Global Cord Blood Banking Products & Services Market By Products & Services (Products (Cord Blood-Derived Growth Factors, Cell Therapy Products and Cord Blood Units) and Services (Storage, Collection & Transportation and Processing, Analysis)), By Storage Status (Frozen/Cryopreserved and Fresh), By Application (Hematopoietic Stem Cell Transplantation (HSCT), Genetic and Inherited Disorders and Regenerative Medicine), By Bank Type (Private, Public and Hybrid (Emerging Model)), By End-User (Hospitals and Transplant Centers, Academic & Research Institutes and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 173355

- Number of Pages: 312

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Product & Services Analysis

- Storage Status Analysis

- Application Analysis

- Bank Type Analysis

- End-User Analysis

- Key Market Segments

- Drivers

- Restraints

- Opportunities

- Impact of Macroeconomic / Geopolitical Factors

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

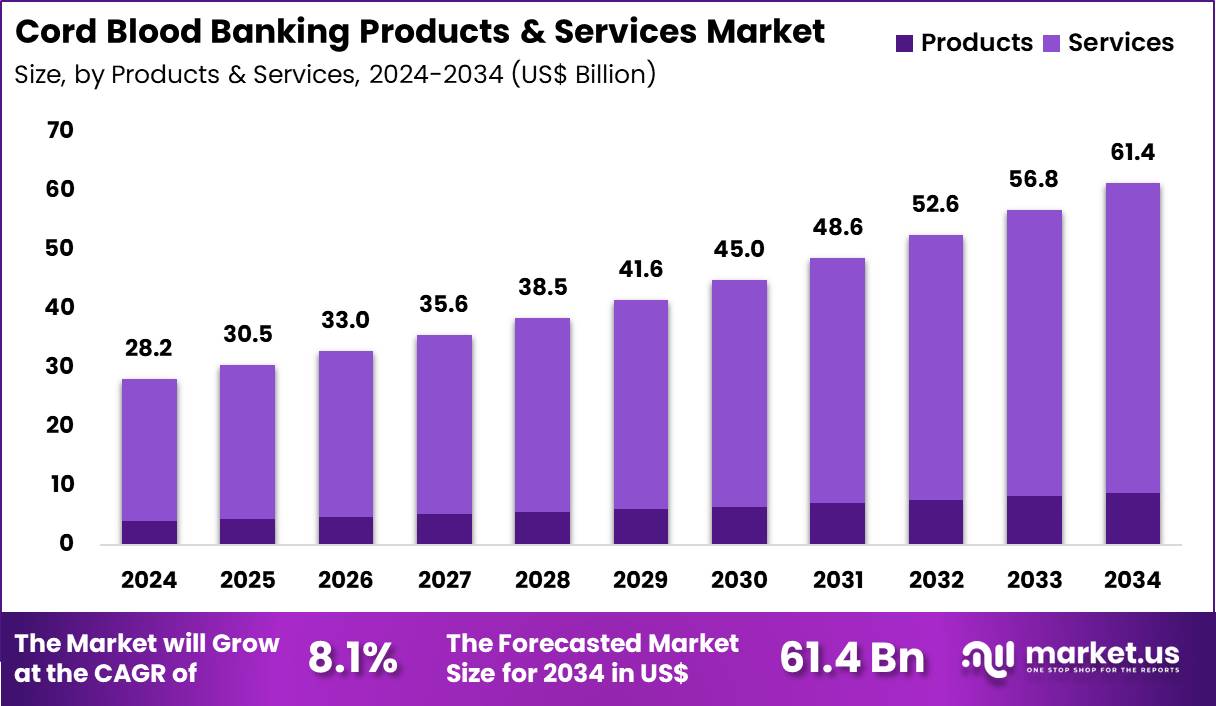

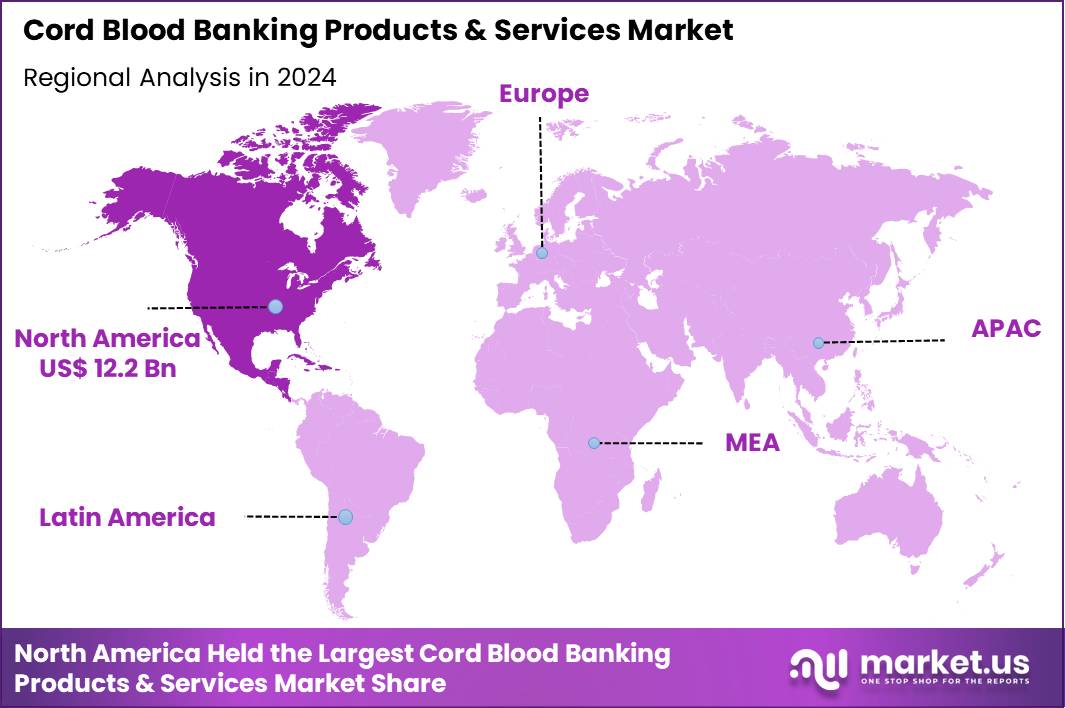

The Global Cord Blood Banking Products & Services Market size is expected to be worth around US$ 61.4 Billion by 2034 from US$ 28.2 Billion in 2024, growing at a CAGR of 8.1% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 43.2% share with a revenue of US$ 12.2 Billion.

Increasing awareness of stem cell therapies propels parents to select cord blood banking products and services that preserve hematopoietic stem cells for potential future medical applications. Families increasingly opt for private banking to secure autologous units for the child’s own use in regenerative treatments targeting conditions like cerebral palsy or acquired neurological disorders. These services support allogeneic transplants through public donation programs, providing matched stem cells for unrelated recipients with hematologic malignancies such as leukemia and lymphoma.

Clinicians apply banked cord blood in hematopoietic stem cell transplantation to restore bone marrow function in patients with inherited metabolic disorders and primary immunodeficiencies. These resources enable ongoing research into expanded applications, including immune cell therapies for autoimmune conditions and tissue repair in developmental anomalies.

In August 2025, Cryo-Cell International implemented automated processing technology from GE Healthcare across its cord blood banking operations. The system was adopted to mechanize several critical handling and preparation steps, allowing the organization to increase throughput, improve consistency, and support future growth in stored stem cell units.

Biobanking providers capitalize on opportunities to develop advanced cryopreservation techniques that enhance post-thaw viability, broadening utility in emerging regenerative protocols for spinal cord injuries and stroke recovery. Developers engineer hybrid storage models that combine cord blood with placental tissue-derived cells, facilitating multi-source stem cell therapies for musculoskeletal regeneration and wound healing.

These innovations open pathways for personalized medicine applications, where banked units support customized cellular treatments in pediatric hematology and oncology. Opportunities expand in integrating cord blood with mesenchymal stem cells for inflammatory disease modulation, offering therapeutic options in conditions resistant to conventional approaches.

Companies pursue scalable processing platforms that accommodate growing demand for high-volume public banks serving diverse transplant needs. Firms invest in quality assurance technologies that verify stem cell potency for long-term storage in gene therapy adjunctive uses.

Industry specialists advance automated systems that streamline volume reduction and cell separation, ensuring higher purity in units destined for clinical-grade applications. Developers refine thawing protocols with controlled-rate warming to preserve cellular integrity during transplantation procedures. Market participants prioritize digital inventory management to facilitate rapid matching for urgent transplant cases in bone marrow failure syndromes.

Innovators incorporate viability testing enhancements that predict engraftment potential, strengthening confidence in cord blood utilization for hemoglobinopathies. Companies emphasize ethical donation frameworks that maximize public access while supporting private family reserves for rare genetic conditions. Ongoing initiatives focus on collaborative research networks that explore cord blood-derived cells in novel indications, including neurodegenerative disorders and tissue engineering.

Key Takeaways

- In 2024, the market generated a revenue of US$ 28.2 Billion, with a CAGR of 8.1%, and is expected to reach US$ 61.4 Billion by the year 2034.

- The products & services segment is divided into products and services, with services taking the lead in 2024 with a market share of 85.6%.

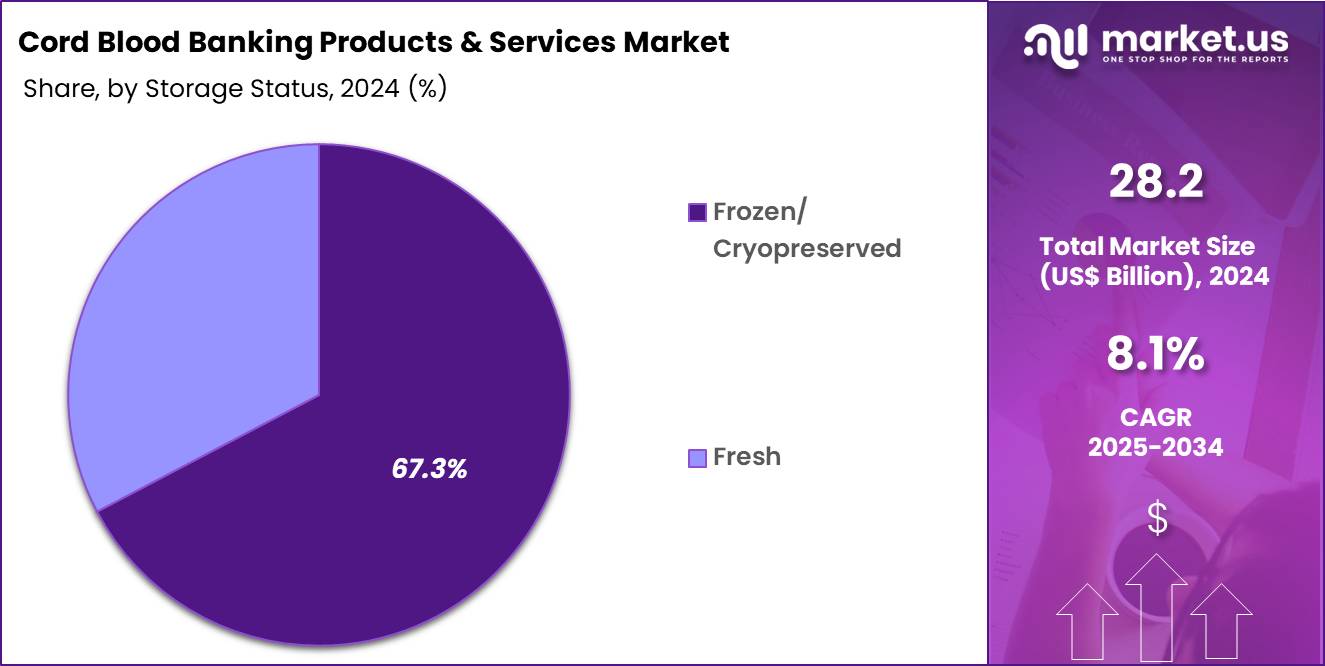

- Considering storage status, the market is divided into frozen/cryopreserved and fresh. Among these, frozen/cryopreserved held a significant share of 67.3%.

- Furthermore, concerning the application segment, the market is segregated into hematopoietic stem cell transplantation (HSCT), genetic and inherited disorders and regenerative medicine. The hematopoietic stem cell transplantation (HSCT)sector stands out as the dominant player, holding the largest revenue share of 58.0% in the market.

- The bank type segment is segregated into private, public and hybrid (emerging model), with the private segment leading the market, holding a revenue share of 44.2%.

- Considering end-user, the market is divided into hospitals and transplant centers, academic & research institutes and others. Among these, hospitals & transplant centers held a significant share of 56.1%.

- North America led the market by securing a market share of 43.2% in 2024.

Product & Services Analysis

Services accounted for 85.6% of the cord blood banking products and services market, reflecting the recurring and long-term nature of banking activities. Parents increasingly opt for comprehensive service packages that include collection, processing, testing, storage, and long-term monitoring. Continuous annual storage fees generate sustained revenue streams for providers.

Rising awareness about future therapeutic potential strengthens enrollment rates. Service-based models align well with private banking strategies that emphasize long-term value. Quality accreditation and compliance requirements increase demand for professional handling services.

Advancements in processing and cryopreservation protocols enhance service differentiation. Customer support, counseling, and digital tracking improve client retention. Expansion of regenerative medicine research reinforces perceived service value. This segment is projected to remain dominant due to its subscription-driven structure and long-term engagement model.

Storage Status Analysis

Frozen or cryopreserved storage accounted for 67.3% of the cord blood banking market, driven by its proven ability to preserve stem cell viability over decades. Cryopreservation supports long-term storage without compromising cellular integrity. Clinical evidence from transplants strengthens confidence in frozen samples. Standardized freezing protocols improve reproducibility and safety.

Regulatory frameworks favor cryopreserved storage for clinical use. Long storage duration aligns with future therapeutic uncertainty. Advances in controlled-rate freezing improve post-thaw recovery rates. Banks invest heavily in cryogenic infrastructure to ensure reliability. Global transplant networks rely on frozen units for rapid availability. This segment is anticipated to sustain leadership due to clinical validation and long-term usability.

Application Analysis

Hematopoietic stem cell transplantation accounted for 58.0% of the cord blood banking market, reflecting its established clinical application. HSCT treats a wide range of hematological malignancies and inherited disorders. Increasing incidence of blood cancers expands transplant demand. Cord blood offers advantages in donor matching and availability compared to bone marrow.

Pediatric transplants particularly benefit from cord blood sources. Ongoing clinical outcomes reinforce physician confidence in HSCT. Improvements in conditioning regimens improve transplant success rates. Expanding transplant centers increase utilization volumes. Government and institutional support strengthen HSCT programs. This application segment is likely to maintain dominance due to its life-saving role and clinical maturity.

Bank Type Analysis

Private cord blood banks held 44.2% of the market, supported by rising parental preference for exclusive access to stored samples. Families increasingly view private banking as a biological insurance option. Marketing efforts emphasize future regenerative medicine potential. Higher disposable incomes in urban populations support private enrollment.

Flexible payment plans improve affordability. Private banks invest in advanced processing technologies to differentiate services. Strong customer engagement models improve retention. Growing awareness campaigns during prenatal care drive uptake. Private banks benefit from recurring storage revenue models. This segment is expected to grow steadily due to personalized ownership and long-term value perception.

End-User Analysis

Hospitals and transplant centers accounted for 56.1% of the cord blood banking market, reflecting their central role in collection and clinical utilization. These institutions facilitate cord blood collection during delivery under controlled conditions. Direct integration with transplant programs improves sample utilization efficiency. Hospitals manage patient referral pathways for banking decisions. Availability of trained staff ensures protocol adherence.

Transplant centers rely on stored units for timely therapeutic access. Institutional trust strengthens parental confidence in banking services. Clinical trials conducted in hospitals expand application scope. High procedure volumes sustain consistent demand. Consequently, this end-user segment is projected to remain dominant due to clinical integration and treatment concentration.

Key Market Segments

By Products & Services

- Products

- Cord Blood-Derived Growth Factors

- Cell Therapy Products

- Cord Blood Units

- Services

- Storage

- Collection & Transportation

- Processing, Analysis

By Storage Status

- Frozen/Cryopreserved

- Fresh

By Application

- Hematopoietic Stem Cell Transplantation (HSCT)

- Genetic and Inherited Disorders

- Regenerative Medicine

By Bank Type

- Private

- Public

- Hybrid (Emerging model)

By End-User

- Hospitals and transplant centers

- Academic & Research Institutes

- Others

Drivers

Increasing number of cord blood units added to the National Cord Blood Inventory is driving the market

The cord blood banking products and services market is driven by the increasing number of cord blood units added to the National Cord Blood Inventory, which expands the available resources for stem cell transplants and regenerative therapies. Healthcare providers benefit from this growth, as it enhances the probability of finding matches for patients requiring hematopoietic stem cell transplantation.

Regulatory support from government programs encourages cord blood banks to contribute high-quality units to public inventories. Pharmaceutical and biotech firms leverage the expanded inventory for research in genetic and hematologic disorders. Clinical applications in oncology and immunology rely on a robust supply of cord blood for effective treatments. Global health initiatives promote cord blood donation to address shortages in diverse ethnic populations.

Academic collaborations focus on quality assurance to ensure added units meet transplantation standards. Patient outcomes improve with greater access to matched cord blood for life-saving procedures. Economic incentives from funding programs sustain bank operations and inventory expansion. According to the Health Resources and Services Administration, more than 3,700 NCBI units were added in Fiscal Year 2024.

Restraints

Regulatory suspensions and enforcement actions are restraining the market

The cord blood banking products and services market is restrained by regulatory suspensions and enforcement actions, which disrupt operations and erode public confidence in banking services. Banks face temporary halts in processing and storage activities due to non-compliance with quality standards. Healthcare stakeholders hesitate to recommend services from affected banks, impacting new client acquisitions.

Pharmaceutical partnerships are delayed as banks address corrective measures to resume full operations. Clinical trials utilizing cord blood may experience setbacks from supply interruptions. Global regulatory variances complicate compliance for international banks, increasing administrative burdens. Academic research on cord blood viability is hindered by limited access to active banking facilities. Patient decisions on private banking are influenced by concerns over service reliability.

Economic losses from suspensions affect bank revenues and investment in infrastructure. These factors collectively limit market growth by necessitating rigorous internal audits and recovery strategies. According to a GlobeNewswire report, in August 2024, Singapore’s Ministry of Health allowed Cordlife Group Limited to resume cord blood banking services under strict conditions, following a suspension.

Opportunities

FDA approval of expanded cord blood products is creating growth opportunities

The cord blood banking products and services market offers growth opportunities through FDA approvals of expanded cord blood products, which enhance therapeutic applications and attract investment in banking infrastructure. Developers can expand services to include processing for expansion technologies, meeting demands for higher cell doses in transplants. Healthcare providers gain options for treating patients with limited cord blood volumes, broadening eligibility for stem cell therapies.

Pharmaceutical firms partner with banks to supply units for expansion protocols in clinical trials. Clinical advancements in hematology benefit from approved products enabling faster engraftment and reduced complications. Global collaborations focus on standardizing expansion methods to support international banking networks. Academic institutions explore expanded cord blood in regenerative medicine for diverse indications.

Patient populations with rare diseases access novel treatments facilitated by banking services. Economic models project returns from premium services for expanded unit storage. According to the U.S. Food and Drug Administration, Omisirge (omidubicel-onlv) was approved on April 17, 2023, as an expanded cord blood product for hematopoietic reconstitution.

Impact of Macroeconomic / Geopolitical Factors

Strong global economic upturns channel more capital into stem cell therapies, elevating demand for cord blood banking services among healthcare providers. Enterprises tap into rising consumer awareness and insurance coverage expansions to broaden their client bases in affluent markets. Still, escalating inflation worldwide hikes utility and labor charges, forcing operators to reassess pricing models in competitive landscapes.

Heightened geopolitical strains in Eastern supplier zones stall shipments of essential preservation kits, complicating inventory management for international banks. Executives pivot by cultivating ties with neutral territories, which stabilizes procurement and unlocks cost efficiencies through volume deals. Ongoing US tariffs, applying 10-15% duties on imported blood products and devices from Europe and beyond, intensify financial loads on foreign-dependent entities.

Native suppliers seize the moment to amplify manufacturing capacities, spurring technological refinements and workforce development domestically. Breakthroughs in personalized medicine applications consistently fuel sector vitality, heralding optimistic trajectories for long-term value creation.

Latest Trends

Introduction of machine-learning models for cell count prediction is a recent trend

In 2024, the cord blood banking products and services market has observed a prominent trend toward the introduction of machine-learning models for predicting CD34+ cell counts in cord blood samples, enhancing quality assessment and transplantation success. Banks integrate these models to optimize unit selection for clinical use, improving match efficiency. Healthcare professionals utilize predictions to inform patient-specific treatment plans in stem cell therapies.

Regulatory considerations accommodate AI tools with evidence of predictive accuracy for banking applications. Clinical evaluations demonstrate reduced variability in unit viability assessments through machine learning. Academic studies refine algorithms to incorporate diverse demographic data for global applicability.

Global banking networks adopt these models to standardize processing protocols. Patient therapies benefit from precise cell count estimations enabling better outcomes. Ethical protocols ensure data privacy in model training for cord blood analysis. According to a GlobeNewswire report, in October 2024, scientists at Cordlife Group Limited introduced a machine-learning model designed to predict CD34+ cell counts in cord blood samples.

Regional Analysis

North America is leading the Cord Blood Banking Products & Services Market

North America accounted for 43.2% of the overall market in 2024, and the Cord Blood Banking Products & Services market expanded as expectant parents and healthcare providers increased focus on regenerative medicine and future therapeutic options. Greater awareness of stem cell applications in hematologic disorders, immune deficiencies, and emerging regenerative therapies strengthened private and public banking demand.

Hospitals integrated standardized collection kits and processing services into maternity care pathways, improving enrollment and sample quality. Advancements in cryopreservation, testing, and long-term storage increased confidence in clinical usability. The U.S. Health Resources and Services Administration reported that more than 35,000 cord blood transplants had been performed worldwide by 2022, underscoring validated clinical use and supporting continued banking uptake.

Expanded newborn education programs improved consent rates. Growth in family banking reflected rising interest in personalized medicine. These drivers collectively supported strong market growth across North America in 2024.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to experience sustained expansion during the forecast period as the Cord Blood Banking Products & Services market benefits from rising birth volumes in select countries and expanding stem cell research programs. Governments and academic centers strengthen public banking networks to support transplant access and population diversity.

Private providers broaden service offerings with enhanced processing technologies and flexible storage plans, improving affordability and reach. Increasing clinical trials in regenerative and immunotherapy applications raise perceived value among families. Hospital partnerships streamline collection and logistics in urban maternity centers.

The Japan Cord Blood Bank Network reported that stored cord blood units exceeded 130,000 by 2022, highlighting scale and momentum in regional infrastructure. Medical tourism and cross-border collaborations further stimulate demand. These dynamics position Asia Pacific for continued growth over the coming years.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Cord Blood Banking Products & Services market drive growth by expanding collection kits, cryopreservation technologies, and long-term storage solutions that improve cell viability and retrieval confidence. Companies strengthen demand through educational outreach to expectant parents and partnerships with maternity hospitals to integrate banking decisions into prenatal care pathways.

Commercial strategies focus on tiered service offerings, subscription-based storage plans, and bundled newborn stem cell services that increase lifetime customer value. Innovation priorities include automated processing, advanced freezing media, and digital tracking systems that enhance transparency and regulatory compliance.

Market expansion targets regions with rising birth rates, growing awareness of regenerative medicine, and supportive stem cell regulations. Cryo-Cell International operates as a leading provider by delivering end-to-end cord blood and tissue banking services, supported by decades of clinical experience, scalable storage infrastructure, and a strong consumer-facing service model.

Top Key Players

- CBR Systems, Inc. (Part of CooperCompanies)

- ViaCord (Revvity)

- Cryo-Cell International

- LifeCell International

- Cordlife Group

- StemCyte

- CordVida

- Americord

- FamiCord Group

- Cryo-Save

- Cells4Life

- NeoStem, Inc.

- Precision Cellular Storage

- Lifeforce Cryobanks

- Virgin Health Bank

- CORD BLOOD AMERICA, INC.

- CryoHoldco

Recent Developments

- In August 2025, CytoMed Therapeutics Limited established a new cord blood storage operation under the name LongevityBank to support its long-term cell therapy strategy. The company outlined plans to allocate up to US$500,000 toward improving the collection and long-term preservation of cord-blood-derived natural killer cells at a scale suitable for clinical development. This effort is intended to strengthen the company’s ability to advance immune-based therapies derived from cord blood.

- In April 2025, legislation was introduced in the U.S. House of Representatives that would allow private cord blood and tissue banking expenses to qualify as medical costs under federal tax rules. The proposal aims to lower the financial burden on families by recognizing cord blood preservation as part of eligible healthcare spending, which could encourage broader participation in private banking programs.

Report Scope

Report Features Description Market Value (2024) US$ 28.2 Billion Forecast Revenue (2034) US$ 61.4 Billion CAGR (2025-2034) 8.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Products & Services (Products (Cord Blood-Derived Growth Factors, Cell Therapy Products and Cord Blood Units) and Services (Storage, Collection & Transportation and Processing, Analysis)), By Storage Status (Frozen/Cryopreserved and Fresh), By Application (Hematopoietic Stem Cell Transplantation (HSCT), Genetic and Inherited Disorders and Regenerative Medicine), By Bank Type (Private, Public and Hybrid (Emerging Model)), By End-User (Hospitals and Transplant Centers, Academic & Research Institutes and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape CBR Systems, Inc., ViaCord, Cryo-Cell International, LifeCell International, Cordlife Group, StemCyte, CordVida, Americord, FamiCord Group, Cryo-Save, Cells4Life, NeoStem, Inc., Precision Cellular Storage, Lifeforce Cryobanks, Virgin Health Bank, CORD BLOOD AMERICA, INC., CryoHoldco Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Cord Blood Banking Products & Services MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

Cord Blood Banking Products & Services MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- CBR Systems, Inc. (Part of CooperCompanies)

- ViaCord (Revvity)

- Cryo-Cell International

- LifeCell International

- Cordlife Group

- StemCyte

- CordVida

- Americord

- FamiCord Group

- Cryo-Save

- Cells4Life

- NeoStem, Inc.

- Precision Cellular Storage

- Lifeforce Cryobanks

- Virgin Health Bank

- CORD BLOOD AMERICA, INC.

- CryoHoldco