Global Food Allergy Treatment Market By Allergen Type (Dairy Products, Poultry Product, Tree Nuts, Peanut, Shellfish & Fish, Wheat, Soy, Others), By Drug Type (Antihistamines, Epinephrine, Immunotherapy- Xolair, PALFORZIA, Others), By Rout of Administration (Parenteral, Oral, Others), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Online Pharmacies) By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: May 2025

- Report ID: 147637

- Number of Pages: 377

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Allergen Type Analysis

- Drug Type Analysis

- Route of Administration Analysis

- Distribution Channel Analysis

- Key Segments Analysis

- Driver

- Market Restraints

- Market Opportunities

- Impact of macroeconomic factors / Geopolitical factors

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

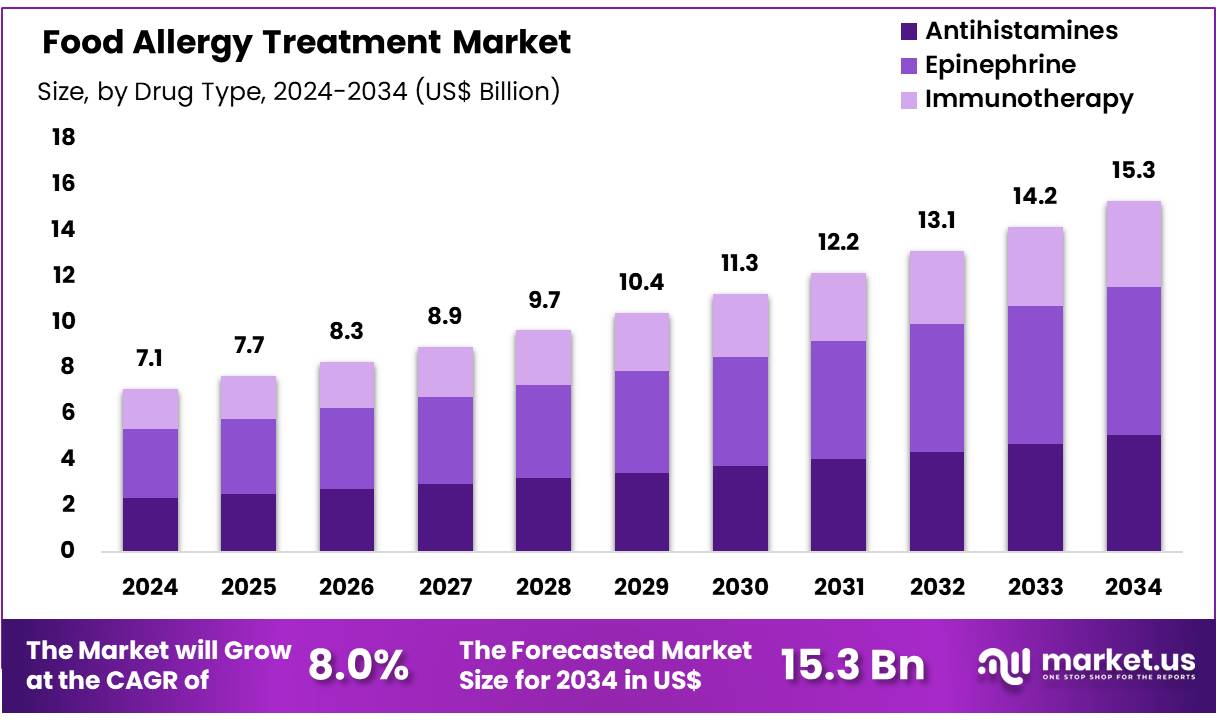

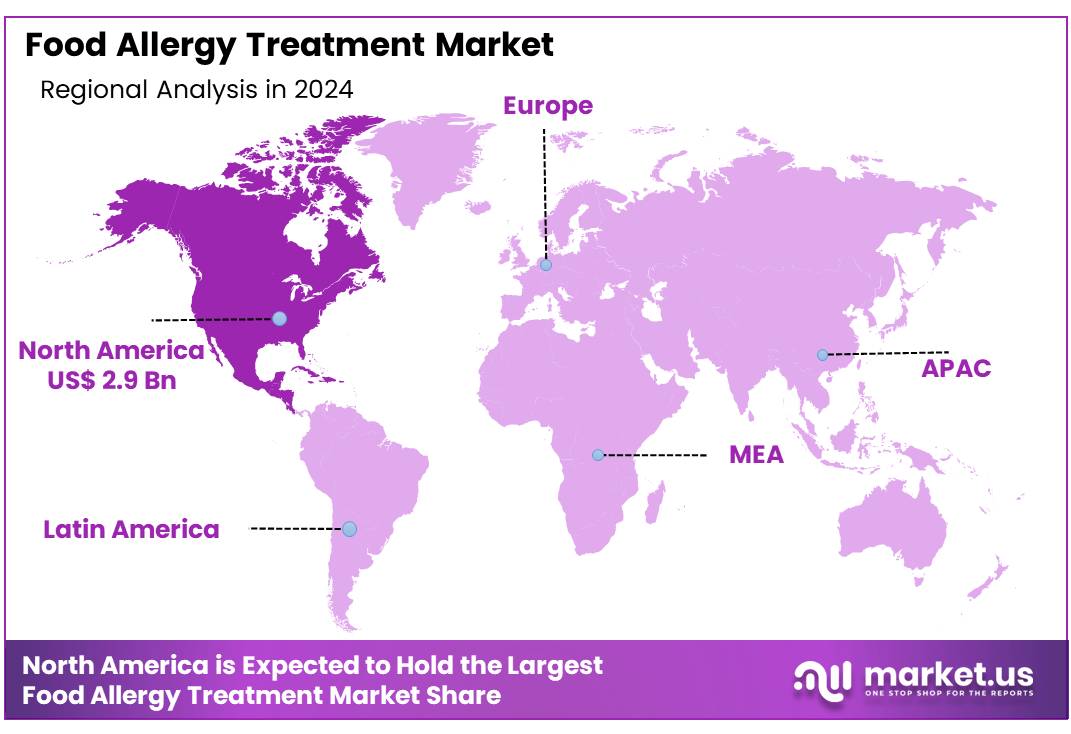

Global Food Allergy Treatment Market size is expected to be worth around US$ 15.3 Billion by 2034 from US$ 7.1 Billion in 2024, growing at a CAGR of 8.0% during the forecast period from 2025 to 2034. In 2024, North America led the market, achieving over 40.5% share with a revenue of US$ 2.9 Billion.

This market is primarily driven by the rising global prevalence of food allergies, prompting increased demand for more precise and effective treatment strategies. Immunotherapy approaches such as oral immunotherapy (OIT) and biologics, which offer targeted desensitization while minimizing adverse reactions, are becoming the preferred options in modern allergy care.

Furthermore, technological advancements including AI-powered diagnostics, molecular allergology, and gut microbiome research are accelerating market adoption. The growing awareness of early allergy detection and significant investments in allergy treatment infrastructure particularly in emerging markets—are also fueling market expansion.

However, challenges such as the high costs of immunotherapy and biologic treatments, as well as a shortage of allergy specialists, especially in low- and middle-income countries, continue to impede growth. Regulatory hurdles and uneven access to advanced healthcare technologies in certain regions also limit market progress. Despite these challenges, opportunities exist in the development of more affordable and accessible immunotherapy solutions, the expansion of allergy clinics, and innovation in non-invasive diagnostic tools.

Trends such as AI-driven personalized treatment plans, rising demand for allergen-free food products, and collaborations between biotech firms and healthcare providers are also shaping the market. On the other hand, food adulteration has become a growing concern, as it inadvertently introduces allergens into food products, driving the demand for robust allergy management solutions. Policies like the National Food Allergy Action Plan are expected to shape future regulations aimed at reducing the impact of food allergies and improving the quality of life for affected individuals.

The food allergy treatment market is poised for sustained growth, fueled by the increasing incidence of food allergies, advancements in innovative therapies, and the global standardization of diagnostic and treatment approaches. However, challenges remain, including restricted access to specialized treatments in certain regions and the growing shift toward biosimilars, which could influence the adoption of emerging therapies.

For example, the approval of Palforzia® in July 2024 for use in toddlers with peanut allergies, making it the first and only oral immunotherapy approved by both the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA).

In addition, in February 2024, Novartis received FDA approval for Xolair® (omalizumab) to reduce allergic reactions, including anaphylaxis, in individuals aged 1 year and older with IgE-mediated food allergies. However, while Xolair helps minimize allergic responses to accidental exposure, patients must continue strict allergen avoidance as it is not intended for emergency treatment of allergic reactions or anaphylaxis.

Key Takeaways

- The global food allergy treatment market was valued at US$ 7.1 billion in 2024 and is anticipated to register substantial growth of US$ 15.3 billion by 2034, with 8.0% CAGR.

- By allergen type, the peanut segment took the lead in the global market, securing 21.2% of the total revenue share.

- By drug type, the epinephrine segment lead the global market, securing 42.4% of the total revenue share.

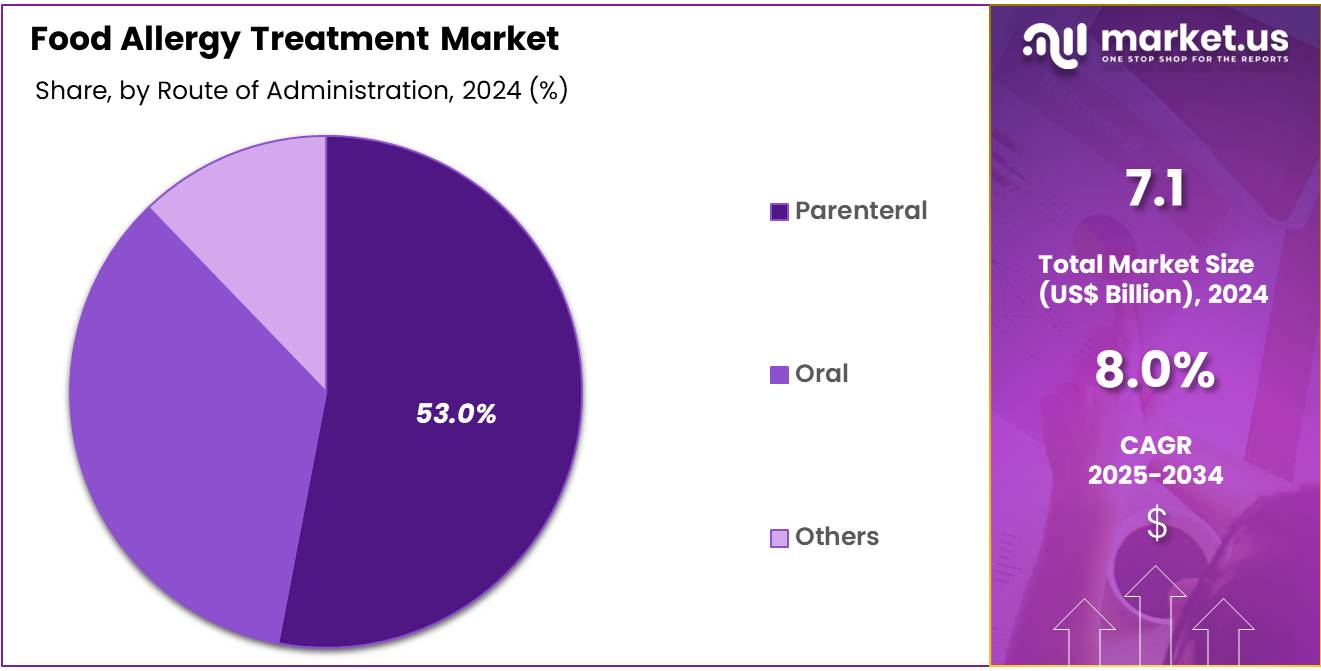

- By route of administration, the parenteral route dominated the global market, securing 53.0% of the total revenue share.

- By end users, hospital pharmacies held the major share of 47.8% the market in 2024.

- North America maintained its leading position in the global market with a share of over 40.5% of the total revenue.

Allergen Type Analysis

The food allergy treatment market is segmented by allergen type, with peanut allergies leading the way with 21.2% share in 2024 due to their high prevalence, particularly among children. The peanut segment is expected to maintain a dominant position, driven by the rising global incidence of peanut allergies, extensive research, and increasing demand for innovative treatment solutions. Peanut allergies are both common and severe, prompting significant awareness and the need for effective therapies.

The growth of this segment is further supported by advancements in biological treatments and emerging approaches like oral immunotherapy (OIT), which are showing promise in desensitizing individuals to peanut allergens. The market for food allergy treatments is driven by improvements in diagnostic tools, immunotherapy, and biologics that enhance treatment precision and streamline allergy management.

Regulatory approvals such as that of Palforzia®, a treatment for peanut allergies, have made structured allergen exposure more widely available, contributing to market growth. Ongoing research and substantial investments in the pharmaceutical sector continue to position peanut allergy treatments at the forefront of allergy management innovation. According to FARE (Food Allergy Research & Education), in the US, approximately 6.1 million people are affected by peanut allergies, making it the most prevalent food allergy in individuals aged 18 years and younger.

Notably, while peanut allergies are widespread, about 20% of children affected may outgrow the condition during their teenage years. In a study of individuals with peanut allergies and at least two other food allergies, two-thirds of those treated with Xolair® (omalizumab), an injectable biologic for managing food allergies in individuals aged one year and older, were able to consume a considerable amount of peanuts after 16 weeks of treatment. In contrast, only 7% of participants in the control group achieved the same outcome.

Drug Type Analysis

In 2024, the epinephrine segment held the largest share of 42.4% in 2024 in the food allergy treatment market. Epinephrine is the leading drug for managing food allergies due to its rapid and life-saving effects in treating severe allergic reactions, including anaphylaxis. It works by quickly reversing the symptoms of an allergic reaction, such as airway constriction, low blood pressure, and swelling, by relaxing airway muscles, increasing blood pressure, and reducing inflammation.

Epinephrine is considered the most effective emergency treatment for severe allergic reactions, making it essential for individuals at high risk of anaphylaxis. This segment’s dominance is driven by the need for immediate intervention during anaphylactic events, and epinephrine auto-injectors, such as EpiPen, have become indispensable in allergy management. The widespread availability of these auto-injectors is ensured by advancements in manufacturing, which streamline production processes and prevent shortages.

Additionally, innovations in device design, such as compact and user-friendly auto-injectors, have improved accessibility and ease of use, promoting greater adoption among patients and healthcare providers. Public health initiatives that raise awareness of anaphylaxis and the critical importance of timely epinephrine administration further strengthen the necessity of keeping this life-saving medication accessible in various environments.

As the global prevalence of food allergies continues to rise, these factors reinforce epinephrine’s position as the leading emergency treatment for severe allergic reactions. In April 2024, ARS Pharmaceuticals announced the completion of a clinical study for Neffy, a nasal epinephrine spray. The trial compared two doses of Neffy with two doses of an epinephrine auto-injector under normal conditions and following a nasal allergen challenge.

The study found that the nasal spray was as effective as or more effective than the auto-injector, with repeat dosing in the same nostril showing greater exposure than dosing once in each nostril or with an injection.

Route of Administration Analysis

In 2024, the parenteral route dominated the global food allergy treatment market with 53.0% share in 2024 and is projected to experience the highest compound annual growth rate (CAGR) during the forecast period. This method is considered the most effective due to its 100% bioavailability, ensuring rapid and complete absorption of medication. The parenteral route, particularly intramuscular (IM) injection of epinephrine, is the preferred approach for treating food allergies, especially in managing severe allergic reactions like anaphylaxis.

This method allows for the quick introduction of the medication into the bloodstream, bypassing the gastrointestinal tract, which can delay absorption in oral administration. Given that anaphylaxis requires swift intervention to prevent life-threatening complications, the IM injection of epinephrine is favored for its fast onset of action, providing immediate relief.

The high bioavailability of medications administered via the parenteral route ensures maximum effectiveness, reinforcing its dominance in emergency allergy treatment. The availability of auto-injectors, such as EpiPen®, has further cemented the parenteral route as the standard approach for managing food-induced anaphylaxis.

Distribution Channel Analysis

The food allergy treatment market is segmented by distribution channel into hospital pharmacies, retail pharmacies, and online pharmacies. In 2024, hospital pharmacies accounted for a significant share of 47.8% in this market, driven by their extensive infrastructure, advanced medical capabilities, and high patient volume. According to NCBI, an internal audit conducted at a hospital in Australia between 2022 and 2023 revealed that approximately 5% to 10% of inpatients had documented food allergies, with many patients reporting multiple allergens.

Hospitals are equipped with cutting-edge diagnostic and treatment technologies, ensuring the efficient management of food allergies, especially severe cases like anaphylaxis. These facilities also provide access to multidisciplinary teams, including allergists, immunologists, and emergency care specialists, enabling integrated patient care from diagnosis through treatment and ongoing management. Their ability to handle complex cases, offer both inpatient and outpatient services, and conduct clinical research further strengthens their leadership in the food allergy treatment space.

Additionally, hospitals often benefit from government support and favorable insurance policies, which make advanced allergy treatments more accessible to patients. With the increasing global prevalence of food allergies, hospitals are expected to maintain their dominant position in the market, meeting the growing demand for specialized allergy care.

Key Segments Analysis

Allergen Type

- Dairy Products

- Poultry Products

- Tree Nuts

- Peanuts

- Shellfish & Fish

- Wheat

- Soy

- Others

Drug Type

- Antihistamines

- Epinephrine

- Immunotherapy

- Xolair

- PALFORZIA

- Others

Route of Administration

- Parenteral

- Oral

- Others

Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

Driver

Rising prevalence of food allergies

The increasing prevalence of food allergies is a multifaceted issue, influenced by environmental factors such as the “hygiene hypothesis,” shifts in the microbiome, and individual genetic predisposition. This rise in food allergies has been particularly prominent in Westernized countries over recent decades. However, while the prevalence is widely acknowledged, strong evidence based on challenge-confirmed diagnoses remains limited due to the high costs and risks associated with conducting food challenge tests on large populations.

Growing awareness about allergy management, coupled with advancements in immunotherapy and biologic drugs, is driving progress in food allergy treatment. The rise in food allergies is further attributed to factors such as changing dietary habits, environmental triggers, and genetic susceptibility. Despite challenges, such as high treatment costs, the limited availability of FDA-approved therapies, and the complexity of developing long-term solutions, the market is poised for expansion.

The introduction of innovative immunotherapies, increased research funding, and broader regulatory approvals are expected to accelerate market growth. Food allergies have become a global public health concern, with the World Health Organization (WHO) reporting that more than 10% of the global population is affected. As per FARE data, around 33 million people in the United States are affected by at least one food allergy.

Nearly 11% of adults aged 18 or older experience food allergies, which accounts for over 27 million adults. The prevalence of food allergies in children has been rising for decades, with approximately 20% of children outgrowing their food allergies by school age.

Furthermore, the growing prevalence of food allergies in children has contributed to an increased demand for professional psychology services, driven by heightened anxiety. A study presented at the American College of Allergy, Asthma, and Immunology (ACAAI) Annual Scientific Meeting in Boston revealed that one center experienced a surge of over 50% in psychology referrals in 2023 compared to annual figures from 2018 to 2022.

Market Restraints

High Cost of Therapies

The high cost of food allergy treatments remains a significant barrier, as it may create financial burdens, limiting access to care and straining healthcare systems. Advanced therapies, such as oral immunotherapy (OIT), which often require months or even years of treatment, contribute to this financial strain. The expense of these therapies is influenced by factors such as the cost of medications, ongoing medical monitoring, and extended treatment regimens.

For instance, monthly costs for food allergy treatments can range from $2,900 for children to $5,000 for adults in the U.S., highlighting the considerable financial impact on individuals and healthcare systems alike. Additionally, diagnostic tests, such as skin prick tests, can cost between $60 and $300, while blood tests may range from $200 to $1,000.

Despite these costs, allergy testing plays a crucial role in managing conditions like allergic asthma, as identifying and avoiding allergens can significantly improve symptom control and quality of life. The combination of high treatment expenses and the broader social and economic implications of food allergies continues to shape the development and growth of the food allergy treatment market, influencing both the availability of therapies and their accessibility.

Market Opportunities

Advancements in oral immunotherapy

Recent advancements in oral immunotherapy (OIT) are transforming food allergy treatment by introducing innovative approaches that enhance patient outcomes and improve quality of life. OIT works by gradually desensitizing individuals to specific allergens, fostering tolerance, and reducing the severity of allergic reactions. Noteworthy progress includes the combination of OIT with biologics like anti-IgE monoclonal antibodies, which increase its effectiveness while minimizing side effects. Research indicates that early intervention, particularly in young children, leads to better long-term results, including sustained tolerance to allergens.

The integration of digital health technologies, such as telemedicine and remote monitoring, further enhances OIT protocols by enabling real-time progress tracking and expanding accessibility. Advances in diagnostics have also resulted in more precise blood and skin prick tests, along with wearable devices to monitor allergic reactions. Additionally, mobile applications facilitate food tracking and emergency response management, while gene-editing technologies like CRISPR hold promise for future breakthroughs in allergy treatment.

These innovations are broadening the range of treatable allergens and paving the way for more personalized and efficient allergy management solutions. Recent progress in food allergy immunotherapy has introduced groundbreaking strategies, such as chimeric antigen receptor (CAR) cell therapy, aimed at achieving true immunologic tolerance. Gene immunotherapy using single-dose adeno-associated virus (AAV) vectors shows promise for reducing allergen-specific antibodies and basophil activation, while also suppressing key drivers of allergic reactions.

In 2024, omalizumab, a drug targeting IgE antibodies, was approved for use alongside OIT or as a standalone treatment to mitigate allergic reactions. Xolair® (omalizumab), an off-label monoclonal antibody, is proving valuable in reducing the risk of anaphylaxis when combined with OIT. Ongoing studies continue to explore its potential to improve the safety and efficacy of OIT.

Similarly, Palforzia, the first FDA-approved immunotherapy for peanut allergies, is designed to reduce allergic reactions caused by accidental peanut exposure. A recent study published in Nature Materials in July 2024 details the development of a novel oral immunotherapy platform by a team of researchers. This platform uses a formulated inulin gel combined with food allergens to deliver dietary antigens directly to intestinal dendritic cells, aiming to modulate the microbiome-metabolites-immune axis in situ and establish long-lasting, allergen-specific oral tolerance.

Impact of macroeconomic factors / Geopolitical factors

Macroeconomic and geopolitical factors have a significant impact on the food allergy treatment market, influencing both supply and demand dynamics. Economic downturns, inflation, and currency fluctuations can restrict healthcare budgets, especially in developing regions, thereby limiting investment in advanced allergy therapies. Geopolitical tensions, trade restrictions, and import-export regulations further disrupt the global supply chain, causing delays in medication availability and driving up costs for manufacturers and healthcare providers.

For example, ongoing conflicts or sanctions in key regions may hinder infrastructure development and access to innovative treatments, while shifting trade policies and regulatory uncertainty could discourage foreign investments in allergy care. Despite the rising prevalence of food allergies, these macroeconomic and geopolitical challenges can slow the adoption of advanced therapies, particularly in markets that depend on international partnerships and imported medical technologies.

Supply chain disruptions, trade regulations, and currency fluctuations can also affect the production and distribution of allergy medications, potentially delaying access to critical treatments. Furthermore, during economic crises, shifting healthcare priorities may result in reduced funding for allergy research and treatment programs. While food allergies are becoming more prevalent globally, these macroeconomic challenges may hinder the widespread adoption of advanced therapies, affecting both patients and healthcare providers worldwide.

Tariff uncertainties, especially those targeting imports from China and Canada, are creating additional financial pressures for organizations involved in food allergy treatment. For instance, healthcare providers in the U.S. face rising costs for essential supplies such as pharmaceuticals and medical devices, which are crucial for diagnosing and managing food allergies.

With fixed reimbursement rates from Medicare and Medicaid, these providers are unable to pass on the increased expenses to patients, potentially leading to service cutbacks or reduced staffing levels, which may ultimately affect the quality of care for individuals with food allergies.

Latest Trends

Integration of Digital Health Technologies

The integration of artificial intelligence (AI) and predictive analytics into digital health technologies is transforming the healthcare landscape, particularly in the treatment of food allergies, by enhancing operational efficiency and improving patient outcomes. AI-powered tools are being increasingly used to analyze large volumes of health data, allowing healthcare providers to anticipate patient needs and implement proactive interventions.

For instance, AI systems can predict the likelihood of a patient experiencing a severe allergic reaction, such as anaphylaxis, enabling timely preventive measures. Predictive analytics also helps optimize resource allocation by forecasting patient admission rates, which improves the management of healthcare staff and facilities and reduces delays in care. Moreover, AI enables the development of personalized treatment plans by analyzing individual health histories, current conditions, and potential allergen triggers. This individualized approach not only boosts clinical effectiveness but also significantly enhances patients’ quality of life.

Furthermore, AI-driven systems can monitor patients in real time, tracking allergen exposures and allowing healthcare providers to adjust care strategies accordingly. In addition to improving patient care, AI also streamlines administrative processes by automating routine tasks such as scheduling and documentation, which reduces the workload on medical staff and allows them to focus more on direct patient care.

AI also enhances patient safety by predicting potential health risks, such as severe allergic reactions, and by supporting medication management through the identification of possible drug-allergen interactions, ensuring accurate and timely care. Growing investments and public-private partnerships are further accelerating market growth, while advancements in technology are driving innovative research and development.

In addition to the development of new treatments, animal models are being designed to evaluate the safety and efficacy of these therapies. These models are integrated with advanced biomarker panels, in vitro platforms, and cutting-edge techniques, such as physiological-like elastic hydrogels and nanotextured 3D systems, to improve the accuracy and reliability of research.

Stallergenes Greer, a global leader in allergy therapeutics, will present positive results from its SPEED survey at the CFA Congress in Paris (April 15-18, 2025). The survey highlights the impact and high patient adoption of the iPUMP® connected assistant for sublingual liquid allergen immunotherapy (SLIT). Developed with Aptar Digital Health, iPUMP® helps patients follow the correct dosing, duration, and frequency for SLIT, supporting adherence through a mobile app that connects to their treatment protocol.

The SPEED survey showed a 15% improvement in adherence for iPUMP® users. Among children aged 5-12, parental involvement in treatment dropped from 50% to 28%, while independent medication use by children increased from 24% to 58%. Additionally, 90% of parents felt reassured by the iPUMP®, with half feeling completely confident in treatment administration, compared to 36% in the non-iPUMP® group.

Regional Analysis

North America held the largest market share of 40.5% in 2024 in the global food allergy treatment industry, driven by its advanced healthcare infrastructure, high prevalence of food allergies, and early adoption of innovative therapies. The region benefits from well-established allergy clinics, a strong presence of leading pharmaceutical companies, and significant investments in research and development. Favorable reimbursement policies, supportive government initiatives, and continuous advancements in treatment options—such as biologics and immunotherapies—have further accelerated market growth.

Additionally, the availability of skilled healthcare professionals and increasing awareness about effective allergy management contribute to the region’s dominance. With a strong focus on improving patient outcomes and quality of life, North America is expected to maintain its leadership in the global food allergy treatment market. Substantial investments in research and development continue to drive innovation, while regulatory bodies like the FDA ensure that safe and effective treatments reach the market.

Awareness campaigns and education initiatives encourage individuals to seek timely treatment, fostering a proactive approach to managing allergies. In the U.S., approximately 5 million children under the age of 18 are diagnosed with food allergies, meaning that one in thirteen children is affected.

According to data from the CDC’s National Center for Health Statistics, in 2021, nearly one-third of the U.S. adults and over a quarter of the U.S. children reported experiencing seasonal allergies, eczema, or food allergies, with around 6% of both adults and children in the U.S. having a food allergy. Notably, Black, non-Hispanic individuals—both adults and children—are among the most likely to report this condition.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The competitive landscape of the food allergy treatment market is driven by several global players who are focused on enhancing technological advancements, expanding their geographic reach, and strengthening their market positions. Leading pharmaceutical companies and biotechnology firms are investing in the development of immunotherapies, biologics, and precision allergy diagnostics to improve treatment efficacy and patient outcomes.

These companies prioritize research and development to advance food allergy treatments, including novel therapies and personalized medicine approaches. Strategic partnerships, mergers, acquisitions, and collaborations with healthcare providers and research institutions are key strategies for gaining a competitive advantage.

Furthermore, emerging players and regional manufacturers, particularly in the Asia-Pacific region, are intensifying competition by offering cost-effective treatment solutions. As the prevalence of food allergies continues to rise and healthcare providers seek more effective and accessible treatments, competition within the market is expected to intensify, driving ongoing innovation and technological advancements.

Top Key Players in the Market

- F. Hoffman-La Roche Ltd.

- Camallergy

- DBV Technologies

- Inimmune Corporation

- Intrommune Therapeutics

- Prota Therapeutics Pty. Ltd.

- Siolta Therapeutics

- Stallergenes Greer

- Vedanta Biosciences

- Sanofi

- COUR Pharmaceuticals

- Aimmune Therapeutics, Inc.

- Alladapt Immunotherapeutics, Inc.

- Aravax

- Teva Pharmaceutical Industries Ltd.

- Novartis AG

Recent Developments

- In January 2024, Inimmune Corporation and Intrommune Therapeutics, Inc., both clinical-stage companies dedicated to developing innovative immunotherapeutics, announced a significant collaboration. Intrommune is advancing a clinical-stage oral mucosal therapy for food allergies in allergic individuals. This groundbreaking immunotherapy will combine Intrommune’s disease-modifying peanut oral mucosal immunotherapy (OMIT) with Inimmune’s proprietary clinical-stage immunotherapy, designed to provide rapid desensitization to allergens.

- In November 2023, Camallergy and OnDosis, an expert in intelligent dosing of oral solid medications, announced a strategic collaboration. This partnership is poised to revolutionize the treatment of food allergies, including peanut allergies, by combining Camallergy’s groundbreaking therapies with OnDosis’ advanced Dosage Manager device technology. The integration of the drug-device combination aims to overcome the challenges that physicians encounter with oral immunotherapy, making the treatment more accessible to patients.

Report Scope

Report Features Description Market Value (2024) US$ US$ 7.1 billion Forecast Revenue (2034) US$ US$ 15.3 billion CAGR (2025-2034) 8.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Allergen Type (Dairy Products, Poultry Product, Tree Nuts, Peanut, Shellfish & Fish, Wheat, Soy, Others), By Drug Type (Antihistamines, Epinephrine, Immunotherapy- Xolair, PALFORZIA, Others), By Rout of Administration (Parenteral, Oral, Others), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Online Pharmacies) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape F. Hoffman-La Roche Ltd., Camallergy, DBV Technologies, Inimmune Corporation, Intrommune Therapeutics, Prota Therapeutics Pty. Ltd., Siolta Therapeutics, Stallergenes Greer, Vedanta Biosciences, Sanofi, COUR Pharmaceuticals, Aimmune Therapeutics, Inc., Alladapt Immunotherapeutics, Inc., Aravax, Teva Pharmaceutical Industries Ltd., Novartis AG Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Food Allergy Treatment MarketPublished date: May 2025add_shopping_cartBuy Now get_appDownload Sample

Food Allergy Treatment MarketPublished date: May 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- F. Hoffman-La Roche Ltd.

- Camallergy

- DBV Technologies

- Inimmune Corporation

- Intrommune Therapeutics

- Prota Therapeutics Pty. Ltd.

- Siolta Therapeutics

- Stallergenes Greer

- Vedanta Biosciences

- Sanofi

- COUR Pharmaceuticals

- Aimmune Therapeutics, Inc.

- Alladapt Immunotherapeutics, Inc.

- Aravax

- Teva Pharmaceutical Industries Ltd.

- Novartis AG