Global Aquaculture Healthcare Market By Product Type (Vaccines, Antibiotics, Antifungals, Anti-Viral Drugs, and Others), By Species (Fishes (Freshwater (Tilapia, Carp, and Others), Marine Species (Seabass Seabream, Turbot, and Others), Diadromous Species (Salmon, Trout, and Others)), Crustaceans (Prawns, Shrimps, and Others), and Others), By Route of Administration (Topical, Spray, Parenteral, Oral, and Immersion), By Distribution Channel (Veterinary Hospitals, Veterinary Pharmacies, Retail/Aqua Stores, and Online Pharmacies), By Infection (Bacterial Infection, Viral Infection, Parasitic Infection, and Fungal Infection), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 147144

- Number of Pages: 363

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Product Type Analysis

- Species Analysis

- Route of Administration Analysis

- Distribution Channel Analysis

- Infection Analysis

- Key Market Segments

- Drivers

- Restraints

- Opportunities

- Impact of Macroeconomic / Geopolitical Factors

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

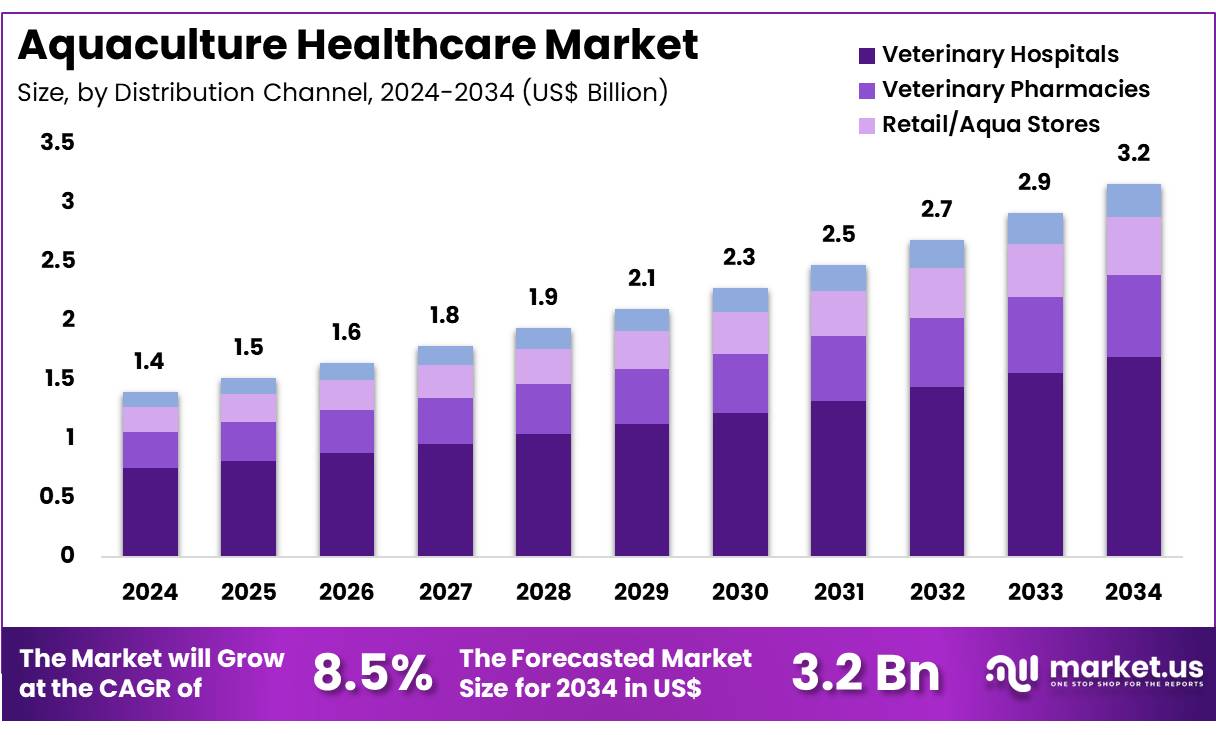

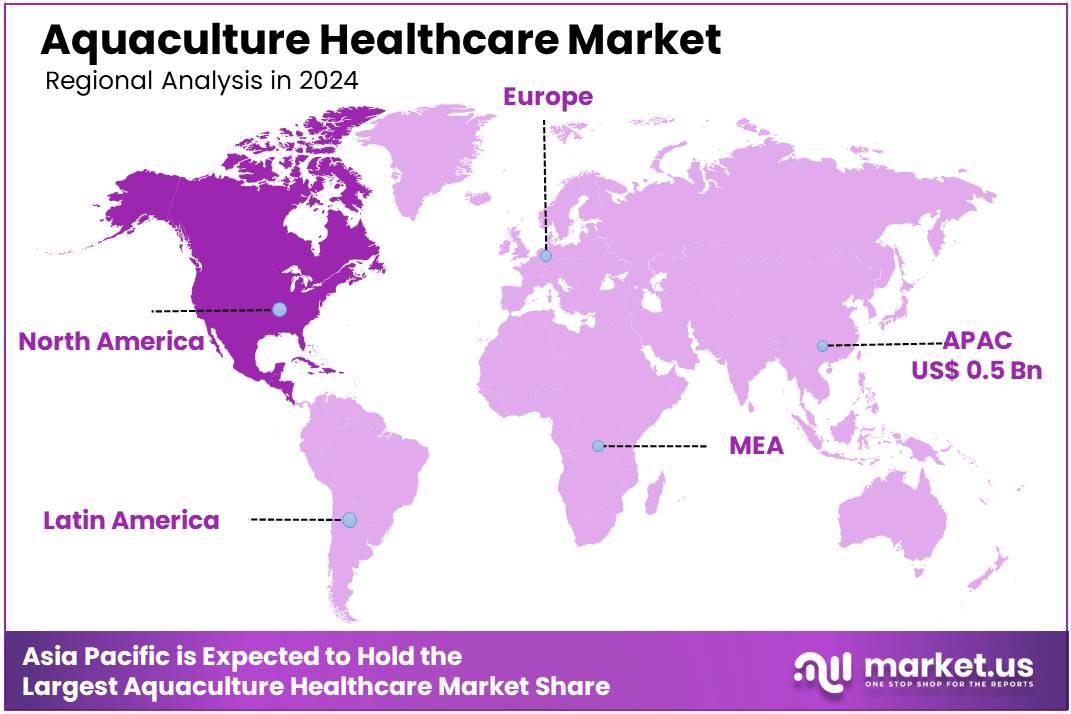

Global Aquaculture Healthcare Market size is expected to be worth around US$ 3.2 billion by 2034 from US$ 1.4 billion in 2024, growing at a CAGR of 8.5% during the forecast period 2025 to 2034. In 2024, Asia Pacific led the market, achieving over 36.9% share with a revenue of US$ 0.5 billion.

The market is experiencing significant expansion driven by the increasing global demand for seafood and the intensification of aquaculture practices. As aquaculture production rises to meet the needs of a growing population, the susceptibility of farmed aquatic animals to various diseases becomes a critical concern. This necessitates the growing adoption of healthcare products to maintain the health and productivity of aquaculture operations.

Vaccines play a crucial role in disease prevention, while antibiotics, antifungals, and antiviral drugs are essential for treating infections. The market is also influenced by the increasing focus on sustainable aquaculture practices and the need to minimize the environmental impact of disease management. Recent advancements in aquaculture healthcare include the development of more effective vaccines and environmentally friendly therapeutics. The expanding aquaculture industry and the growing awareness of biosecurity measures are expected to continue to drive the growth of this market.

Key Takeaways

- In 2024, the market for aquaculture healthcare generated a revenue of US$ 1.4 billion, with a CAGR of 8.5%, and is expected to reach US$ 3.2 billion by the year 2033.

- The product type segment is divided into vaccines, antibiotics, antifungals, anti-viral drugs, and others, with vaccines taking the lead in 2024 with a market share of 55.5%.

- Considering species, the market is divided into fishes, crustaceans, and others. Among these, fishes held a significant share of 63.8%.

- Furthermore, concerning the route of administration segment, the market is segregated into topical, spray, parenteral, oral, and immersion. The topical sector stands out as the dominant player, holding the largest revenue share of 47.2% in the aquaculture healthcare market.

- The distribution channel segment is segregated into veterinary hospitals, veterinary pharmacies, retail/aqua stores, and online pharmacies, with the veterinary hospitals segment leading the market, holding a revenue share of 53.5%.

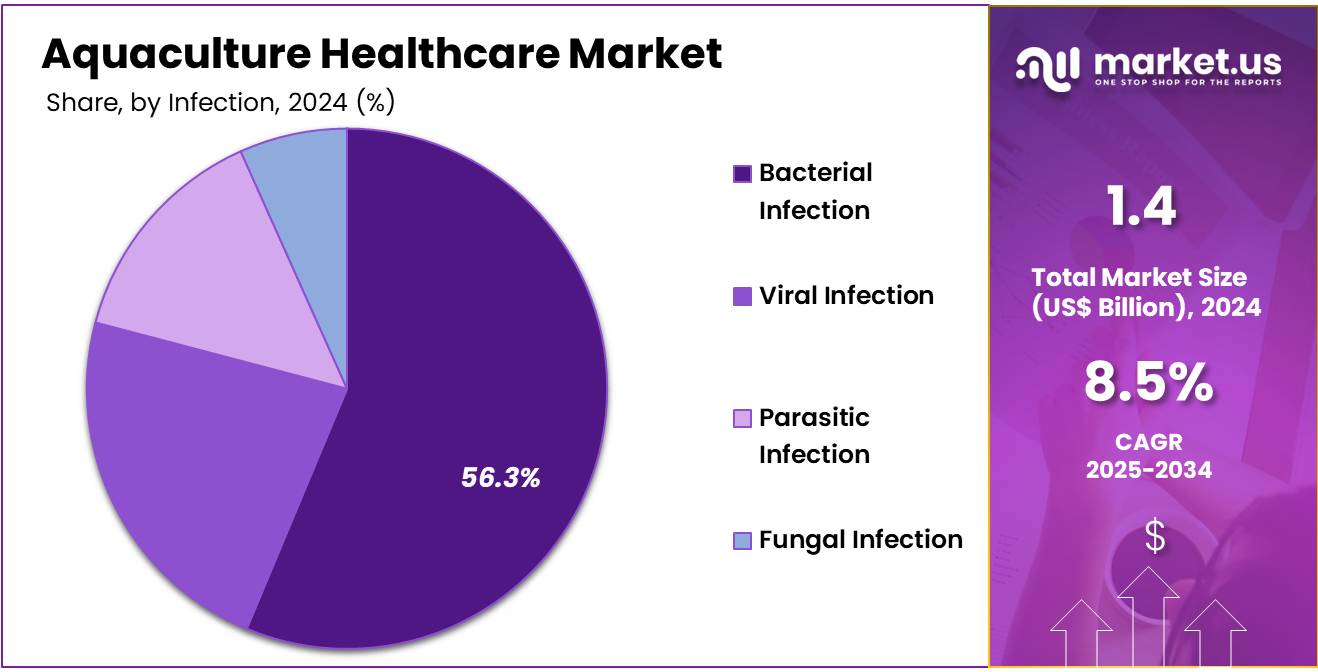

- Considering infection, the market is divided into bacterial infection, viral infection, parasitic infection, and fungal infection. Among these, bacterial infections held a significant share of 56.3%.

- Asia Pacific led the market by securing a market share of 36.9% in 2024.

Product Type Analysis

The vaccines segment led in 2024, claiming a market share of 55.5%. This leading position reflects the increasing global emphasis on prophylactic measures in aquaculture to mitigate the impact of infectious diseases and reduce the reliance on therapeutic treatments like antibiotics. Aquaculture vaccines are designed to stimulate the immune systems of farmed fish and crustaceans, providing protection against specific pathogens such as viral hemorrhagic septicemia (VHS) in salmonids and white spot syndrome virus (WSSV) in shrimp.

The growing investment in research and development activities focused on creating multivalent vaccines that can protect against multiple diseases simultaneously is further propelling this segment’s growth. For instance, studies published since 2021 have highlighted the increasing efficacy and broader protection spectra of newly developed DNA vaccines for various aquaculture species. The economic benefits associated with reduced mortality rates and improved feed conversion ratios resulting from effective vaccination programs are key drivers for their widespread adoption across different aquaculture systems globally.

Species Analysis

The fishes held a significant share of 63.8% due to the significant global production volume of farmed finfish, which includes major species such as salmon, tilapia, carp, and catfish. According to the FAO’s 2021 statistics on aquaculture production, these species collectively represent the majority of the global output.

The intensive farming conditions often associated with finfish aquaculture, including high stocking densities in net pens and ponds, create environments conducive to rapid disease transmission, thereby necessitating the extensive use of healthcare products to maintain the health and viability of these operations. The economic importance of these fish species in global food security and trade further underscores the demand for effective healthcare solutions tailored to their specific disease vulnerabilities, ranging from bacterial infections like Flavobacterium columnare in tilapia to parasitic infestations in carp.

Route of Administration Analysis

The topical segment had a tremendous growth rate, with a revenue share of 47.2%. Topical applications in aquaculture healthcare involve the direct treatment of aquatic animals through methods such as medicated baths, immersion treatments, and surface sprays. These methods are particularly effective for addressing external parasitic infestations, such as sea lice in salmon farming, and superficial fungal or bacterial infections affecting the skin and gills of various fish species.

The relative ease of administering topical treatments in certain aquaculture systems, especially in pond-based and recirculating aquaculture systems (RAS), contributes to their widespread use. Furthermore, the growing emphasis on minimizing the internal use of pharmaceuticals in aquaculture to address concerns about residues in seafood is also driving the adoption of topical solutions for localized health issues. Research into more efficient and environmentally benign topical treatment formulations is an ongoing area of development within this segment.

Distribution Channel Analysis

The veterinary hospitals segment grew at a substantial rate, generating a revenue portion of 53.5% as aquaculture veterinarians play a critical role in diagnosing diseases, prescribing appropriate treatments, and providing expert advice on disease prevention and biosecurity measures to aquaculture farmers. The diagnostic capabilities and specialized knowledge offered by veterinary professionals make veterinary hospitals a primary point of access for more complex healthcare interventions and prescription medications.

The increasing professionalization of aquaculture health management and the growing recognition of the economic benefits of proactive veterinary care are contributing to the prominence of this distribution channel. Furthermore, veterinary hospitals often serve as key points for disseminating information on best practices and the latest advancements in aquaculture healthcare to farmers.

Infection Analysis

The bacterial infections held a significant share of 56.3%. Bacterial diseases are a pervasive challenge in aquaculture due to factors such as high stocking densities, fluctuating environmental conditions, and stress in farmed populations, which can compromise the immune systems of aquatic animals. Common bacterial pathogens, including species of Vibrio in shrimp and Aeromonas in freshwater fish, can cause significant mortality and morbidity, leading to substantial economic losses for aquaculture producers.

The demand for antibiotics and other antibacterial treatments remains high in many regions to manage these outbreaks. However, the increasing regulatory scrutiny on antibiotic use is driving research into alternative antibacterial strategies and preventative measures to reduce the reliance on these drugs. The economic impact of bacterial diseases continues to make this the largest segment within the aquaculture healthcare market.

Key Market Segments

Product Type

- Vaccines

- Antibiotics

- Antifungals

- Anti-Viral Drugs

- Others

Species

- Fishes

- Freshwater

- Tilapia

- Carp

- Others

- Marine Species

- Seabass Seabream

- Turbot

- Others

- Diadromous Species

- Salmon

- Trout

- Others

- Freshwater

- Crustaceans

- Prawns

- Shrimps

- Others

- Others

Route of Administration

- Topical

- Spray

- Parenteral

- Oral

- Immersion

Distribution Channel

- Veterinary Hospitals

- Veterinary Pharmacies

- Retail /Aqua Stores

- Online Pharmacies

Infection

- Bacterial Infection

- Viral Infection

- Parasitic Infection

- Fungal Infection

Drivers

Increasing Global Aquaculture Production is Driving the Market

The escalating global demand for seafood is a primary driver propelling the Aquaculture Healthcare Market forward. As per the Organisation for Economic Co-operation and Development (OECD) and FAO’s Agricultural Outlook 2021-2030, aquaculture is projected to account for an increasing share of global fish production, estimated to reach 53% by 2030. This intensification of aquaculture practices, aimed at meeting the nutritional needs of a growing global population, inherently elevates the susceptibility of farmed aquatic animals to various infectious diseases and parasitic infestations.

Consequently, there is a burgeoning need for effective healthcare interventions to safeguard the health and productivity of these aquaculture operations. The increasing awareness among aquaculture farmers regarding the significant economic losses that can result from disease outbreaks is also contributing to the greater adoption of preventative and therapeutic healthcare products. Furthermore, the advancements in aquaculture technologies, leading to higher stocking densities in farms, further exacerbate the risk of disease transmission, thereby amplifying the demand for robust healthcare solutions.

Restraints

Stringent Regulations on Antibiotic Use are Restraining the Market

Stringent regulatory frameworks governing the use of antibiotics in aquaculture present a notable restraint on market growth. Concerns surrounding the rise of antimicrobial resistance (AMR) in both human and animal populations have prompted regulatory bodies worldwide to implement stricter guidelines on antibiotic usage in food production, including aquaculture.

The European Union’s regulations, for instance, have become increasingly restrictive on the types and quantities of antibiotics permitted in aquaculture, as highlighted in the European Medicines Agency’s (EMA) 2022 report on antimicrobial resistance. Similarly, the US Food and Drug Administration (FDA) has also implemented measures to promote the judicious use of antimicrobials in aquaculture.

These regulatory limitations necessitate the development and adoption of alternative disease management strategies, potentially slowing down the market growth for traditional antibiotic-based healthcare products in the short term. The need for effective and safe alternatives that comply with these evolving regulations poses a significant challenge for the industry.

Opportunities

Development of Sustainable and Preventative Healthcare Solutions Presents Growth Opportunities

The increasing emphasis on sustainable aquaculture practices is generating significant growth opportunities within the Aquaculture Healthcare Market. This focus is driving the demand for environmentally friendly and preventative healthcare solutions. The development of innovative vaccines that offer long-lasting protection against key aquaculture diseases is gaining traction, reducing the reliance on chemical treatments.

Furthermore, research into immunostimulants and probiotics that can enhance the natural immune responses of aquatic animals is yielding promising results, as documented in various studies published in aquaculture journals since 2021. The exploration of alternative therapeutic approaches, such as phage therapy and the use of antimicrobial peptides, also presents lucrative opportunities for market expansion. Consumer preferences for sustainably sourced seafood are further encouraging aquaculture farmers to adopt these greener healthcare solutions, creating a positive feedback loop for the market.

Impact of Macroeconomic / Geopolitical Factors

The Aquaculture Healthcare Market in 2025 is influenced by various macroeconomic and geopolitical factors. Economic growth in developing countries is increasing the demand for seafood, further driving the expansion of aquaculture and the need for healthcare products. However, economic downturns in key markets could potentially impact investment in aquaculture and related healthcare. Geopolitical tensions and trade restrictions could affect the supply chain of aquaculture healthcare products, including vaccines and pharmaceuticals.

Fluctuations in commodity prices, particularly for feed ingredients, can also impact the profitability of aquaculture operations, indirectly affecting their ability to invest in healthcare. Furthermore, international collaborations and agreements on food safety and animal health standards can influence the regulatory landscape for aquaculture healthcare products.

Recent US tariff policies implemented in April 2025 could have implications for the Aquaculture Healthcare Market, particularly concerning the import of certain healthcare products and raw materials. If tariffs are imposed on key inputs used in the production of vaccines, antibiotics, or other aquaculture health products sourced from international suppliers, it could lead to increased costs for US aquaculture farmers.

According to data from the US Department of Agriculture (USDA) in 2024, a significant portion of aquaculture health products used in the US are imported. These tariffs could potentially make disease management more expensive and impact the competitiveness of the US aquaculture industry. In response, aquaculture producers might explore alternative sourcing options or advocate for policy adjustments to mitigate these effects.

Latest Trends

Integration of Digital Health and Precision Aquaculture is a Recent Trend

A prominent recent trend in the Aquaculture Healthcare Market is the growing integration of digital health technologies and precision aquaculture methodologies. The implementation of smart sensors and monitoring systems enables real-time data collection on crucial parameters such as water quality, temperature, and dissolved oxygen levels, which are critical indicators of aquatic animal health.

Artificial intelligence (AI) and machine learning algorithms are being employed to analyze this data, facilitating the early detection of disease outbreaks and enabling timely and targeted interventions. Companies are developing sophisticated software platforms that provide aquaculture farmers with actionable insights for optimizing health management practices.

This trend towards data-driven aquaculture healthcare not only improves efficiency and reduces losses but also supports more sustainable and responsible farming practices. The increasing availability and affordability of these digital tools are expected to accelerate their adoption across the aquaculture industry.

Regional Analysis

Asia Pacific is leading the Aquaculture Healthcare Market

Asia Pacific dominated the market with the highest revenue share of 36.9%. According to the Network of Aquaculture Centres in Asia-Pacific (NACA) data from 2022, the region accounts for over 90% of the world’s total aquaculture production by volume. This massive scale of aquaculture operations across countries like China, India, Indonesia, Vietnam, and Bangladesh inherently creates a substantial and sustained demand for a wide range of aquaculture healthcare products, including vaccines, antibiotics, and water treatment solutions.

The increasing focus on food security and the continuous investments in expanding and modernizing aquaculture infrastructure across the Asia Pacific region are further bolstering the market for aquaculture healthcare. Furthermore, the rising awareness among aquaculture farmers regarding the economic consequences of disease outbreaks is driving greater adoption of preventative health management practices. The presence of a large number of aquaculture farms and the increasing availability of veterinary services and aquaculture health expertise in this region contribute significantly to its market leadership.

The North America region is expected to experience the highest CAGR during the forecast period

North America is expected to grow with the fastest CAGR during the forecast period. While its production volume is smaller compared to Asia Pacific, the North American aquaculture industry, particularly in the United States and Canada, focuses on high-value species such as salmon, shrimp, and trout. Data from the US Department of Commerce’s National Marine Fisheries Service (NMFS) in 2023 indicated a consistent increase in the value of US aquaculture production.

There is a strong emphasis on sustainable aquaculture practices and the implementation of stringent health and biosecurity regulations in this region, which drives the demand for high-quality and effective aquaculture healthcare products. The presence of advanced veterinary infrastructure and a proactive approach towards disease prevention and management among aquaculture farmers contribute to the market’s growth. Furthermore, increasing consumer demand for sustainably sourced seafood is further incentivizing the adoption of robust healthcare practices in North American aquaculture.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Aquaculture Healthcare Market are focused on developing and providing a comprehensive range of products to address the health needs of farmed aquatic animals. These companies invest in research and development to create innovative vaccines, therapeutics, and diagnostic tools. Strategic partnerships and collaborations with aquaculture farms, research institutions, and regulatory bodies are crucial for market penetration and product development. Expanding their product portfolios to cater to a wider range of aquaculture species and disease challenges is a key strategy for these players.

Merck Animal Health, headquartered in Madison, New Jersey, is a major player in the animal health industry, including the aquaculture sector. The company offers a variety of vaccines and pharmaceutical products for aquaculture species. Their global presence and investment in research and development position them as a significant contributor to the Aquaculture Healthcare Market. Merck Animal Health focuses on providing solutions that enhance the health and productivity of aquaculture operations worldwide.

Top Key Players

- Zoetis

- Virbac

- Indian Immunologicals Ltd

- Elanco

- Bayer Animal Health

- Archer Daniels Midland Company

- Alltech

- Agriculture Insurance Company of India

Recent Developments

- In May 2023, the Agriculture Insurance Company of India (AIC) unveiled plans to offer tailored insurance solutions for the livestock, aquaculture, and sericulture sectors. The initiative follows the company receiving approval from India’s Insurance Regulatory and Development Authority (IRDAI), marking a significant expansion of their product portfolio to include these key agricultural industries.

- In November 2022, Indian Immunologicals Ltd. (IIL) entered into a partnership with the Central Institute of Fisheries Education (CIFE) to create India’s first commercially available fish vaccine. This collaboration aims to address the challenges of disease management in the aquaculture industry, enhancing productivity and sustainability in fish farming.

Report Scope

Report Features Description Market Value (2024) US$ 1.4 billion Forecast Revenue (2034) US$ 3.2 billion CAGR (2025-2034) 8.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Vaccines, Antibiotics, Antifungals, Anti-Viral Drugs, and Others), By Species (Fishes (Freshwater (Tilapia, Carp, and Others), Marine Species (Seabass Seabream, Turbot, and Others), Diadromous Species (Salmon, Trout, and Others)), Crustaceans (Prawns, Shrimps, and Others), and Others), By Route of Administration (Topical, Spray, Parenteral, Oral, and Immersion), By Distribution Channel (Veterinary Hospitals, Veterinary Pharmacies, Retail/Aqua Stores, and Online Pharmacies), By Infection (Bacterial Infection, Viral Infection, Parasitic Infection, and Fungal Infection) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Zoetis, Virbac, Indian Immunologicals Ltd, Elanco, Bayer Animal Health, Archer Daniels Midland Company, Alltech, and Agriculture Insurance Company of India. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Aquaculture Healthcare MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

Aquaculture Healthcare MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Zoetis

- Virbac

- Indian Immunologicals Ltd

- Elanco

- Bayer Animal Health

- Archer Daniels Midland Company

- Alltech

- Agriculture Insurance Company of India