Global Cooking Wine Market Size, Share, Growth Analysis By Product (Dessert Wine, White Wine, Red Wine, Others), By Application (Food Processing Industry, Food Service, Households), By Distribution Channel (B2B, B2C) - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 157488

- Number of Pages: 327

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

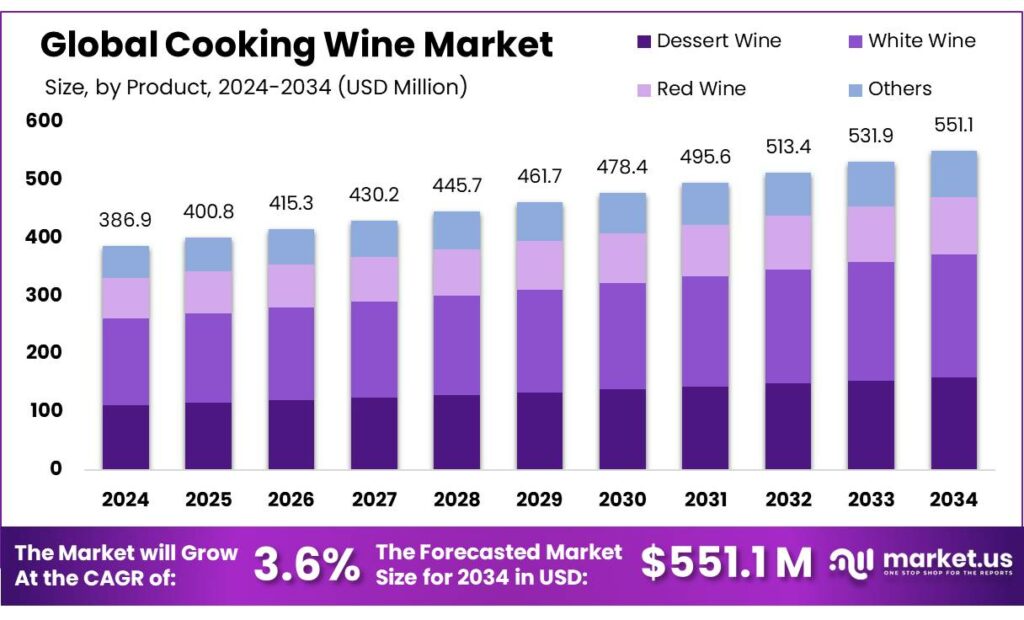

The Global Cooking Wine Market size is expected to be worth around USD 551.1 Million by 2034, from USD 386.9 Million in 2024, growing at a CAGR of 3.6% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 42.9% share, holding USD 45.7 Million in revenue.

The cooking wine industry in India is experiencing a notable transformation, driven by evolving consumer preferences, government initiatives, and an expanding culinary landscape. Traditionally, wine consumption in India has been modest, with per capita consumption at approximately 9 milliliters, a stark contrast to countries like France. However, this trend is shifting, particularly among urban millennials and the growing middle class, who are increasingly incorporating wine into their culinary practices.

Maharashtra, especially the Nashik region, plays a pivotal role in India’s wine production, accounting for nearly 90% of the country’s output. The state’s Wine Industrial Promotion Scheme (WIPS), reintroduced in 2023, offers tax refunds to wineries, enhancing their competitiveness and promoting sustainable growth. Additionally, the establishment of Agri Export Zones in Nashik, Pune, Sangli, and Solapur has bolstered the export potential of Indian wines.

Government support plays a pivotal role in this transformation. The Ministry of Food Processing Industries (MOFPI) has been instrumental in promoting the wine industry by declaring wineries as part of the horticulture and food processing sectors, thereby facilitating easier licensing and providing capital investment subsidies.

Key Takeaways

- Cooking Wine Market size is expected to be worth around USD 551.1 Million by 2034, from USD 386.9 Million in 2024, growing at a CAGR of 3.6%.

- White Wine held a dominant market position, capturing more than a 38.5% share of the cooking wine market.

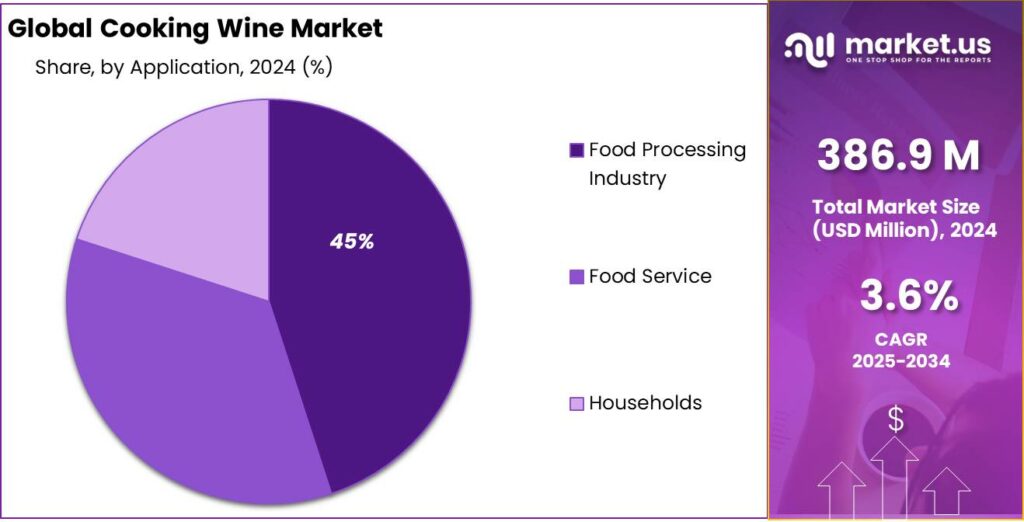

- Food Processing Industry held a dominant market position, capturing more than a 45.8% share of the cooking wine market.

- B2B (Business-to-Business) held a dominant market position, capturing more than a 67.3% share of the cooking wine market.

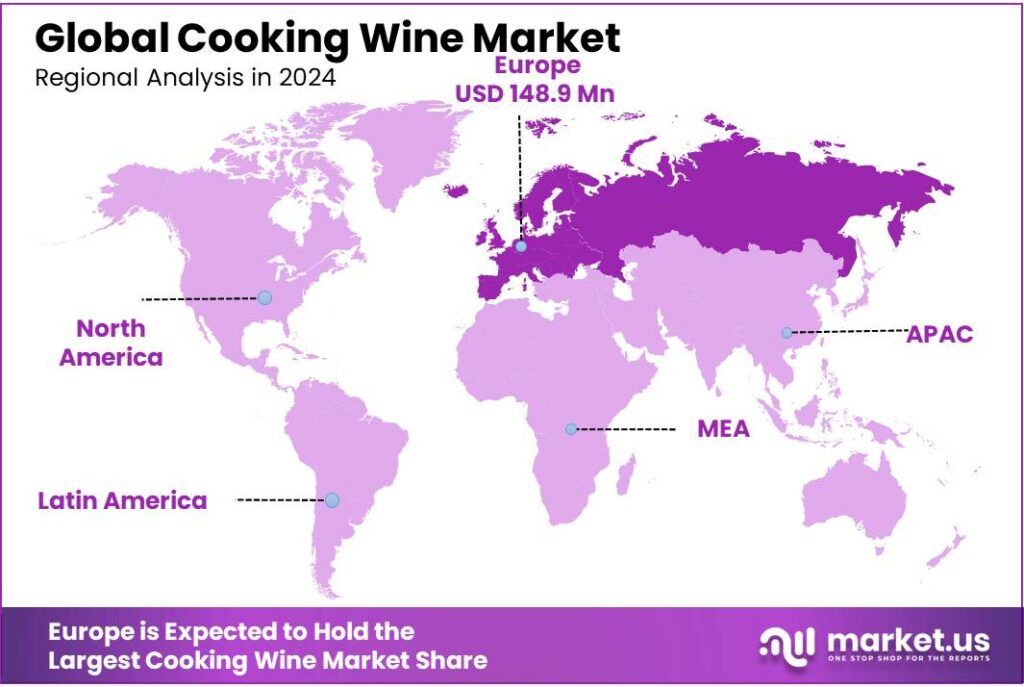

- Europe held a dominant market position in the cooking wine sector, capturing more than a 38.5% share, valued at USD 148.9 million.

By Product Analysis

White Wine dominates with 38.5% market share in 2024 due to its versatility and widespread usage.

In 2024, White Wine held a dominant market position, capturing more than a 38.5% share of the cooking wine market. This segment continues to be favored due to its versatility and wide use in both cooking and culinary practices. White wine, with its light, crisp, and often slightly fruity flavor, pairs well with a range of dishes, from seafood and chicken to pasta sauces and risottos. The trend towards healthier and lighter cooking options has driven its demand, as consumers and chefs alike appreciate the delicate flavor profile it imparts to food without overpowering it.

The consistent growth of white wine in the cooking wine market is also driven by its accessibility and affordability. White wine’s role in various cuisines, including Mediterranean and French, further solidifies its position as a staple in kitchens worldwide. As culinary trends shift towards more global influences, white wine continues to maintain its prominence in cooking recipes, especially in fine dining and gourmet food preparations.

By Application Analysis

Food Processing Industry dominates with 45.8% market share in 2024 due to its high demand for versatile cooking wines.

In 2024, the Food Processing Industry held a dominant market position, capturing more than a 45.8% share of the cooking wine market. This significant share is driven by the increasing use of cooking wines in the production of ready-to-eat meals, sauces, and other processed food products. Cooking wines, particularly those with mild flavors like white wine, are widely used to enhance the taste of food while maintaining consistency and quality in mass production. The Food Processing Industry benefits from the long shelf life of cooking wines, which makes them an ideal ingredient in processed and packaged foods.

As demand for convenience food grows, particularly in emerging markets, the food processing sector is increasingly relying on cooking wines to add depth and richness to flavors without adding excessive fat or calories. In the coming years, the sector’s share of the cooking wine market is expected to remain robust, as processed foods with more sophisticated and varied flavor profiles continue to appeal to consumers. The sector’s growth is supported by the rising demand for ready-to-eat meals, driven by busy lifestyles and the desire for quick, flavorful food options.

By Distribution Channel Analysis

B2B dominates with 67.3% market share in 2024 due to strong demand from the food service and wholesale sectors.

In 2024, B2B (Business-to-Business) held a dominant market position, capturing more than a 67.3% share of the cooking wine market. This dominance is largely driven by the strong demand from the foodservice industry, including restaurants, catering companies, and wholesale distributors. B2B transactions play a crucial role in the supply chain, where large quantities of cooking wine are purchased to meet the needs of commercial kitchens and food manufacturers. The convenience and bulk pricing offered in B2B sales allow businesses to secure the necessary ingredients for their operations at competitive rates.

Restaurants and catering services are incorporating a variety of cooking wines to elevate their menus and provide customers with more refined, restaurant-style flavors at home. As consumer preference for restaurant-quality meals continues to rise, the B2B market for cooking wine is poised to maintain its dominance, driven by the growing need for bulk purchasing in the foodservice and wholesale sectors.

Key Market Segments

By Product

- Dessert Wine

- White Wine

- Red Wine

- Others

By Application

- Food Processing Industry

- Food Service

- Households

By Distribution Channel

- B2B

- B2C

Emerging Trends

Rise of Wine Tourism: A Gateway to Cooking Wine Popularization in India

A significant trend influencing the growth of cooking wine in India is the burgeoning wine tourism sector, particularly in regions like Nashik, Maharashtra. Wine tourism not only promotes local wine culture but also introduces consumers to the culinary uses of wine, thereby expanding the market for cooking wines.

Nashik, often referred to as the “Wine Capital of India,” has become a hub for wine tourism. The region boasts over 50 operational wineries, making it a prominent destination for wine enthusiasts. Events like the India Grape Harvest and SulaFest attract thousands of visitors annually, providing them with opportunities to experience wine tastings, vineyard tours, and culinary pairings. These experiences not only educate consumers about wine but also about its applications in cooking, thereby fostering a culture of using wine in culinary practices.

The government’s support for wine tourism further bolsters this trend. Initiatives such as the establishment of wine parks and the promotion of wine routes have been instrumental in enhancing the infrastructure and accessibility of wine tourism destinations. These efforts have led to increased tourist footfall and greater awareness of wine’s role in gastronomy.

Drivers

Government Initiatives Boosting the Cooking Wine Industry in India

A significant driving factor propelling the growth of the cooking wine industry in India is the proactive support from various state governments through targeted policies and initiatives aimed at promoting viticulture, winemaking, and wine tourism.

In Maharashtra, the state government has established specialized wine parks and provided capital subsidies to encourage the establishment of wineries and grape processing units. These initiatives have led to the development of regions like Nashik, which is now recognized as the “Wine Capital of India,” housing over 50 wineries and producing wines under the protected Geographical Indication (GI) tag of “Nashik Valley Wine.” This recognition ensures that at least 80% of the grapes used for making wine are grown within the Nashik district, preserving the unique characteristics of the region’s terroir.

Similarly, the state of Uttar Pradesh has introduced the UP Wine Policy, which includes provisions for single-window clearances, excise duty exemptions, and incentives for establishing wineries. These measures have attracted significant investments, with the state securing Rs 4,320 crore in investments from new players in the alcoholic beverages sector. The policy aims to boost local production, create employment opportunities, and promote wine tourism, thereby contributing to the state’s economic growth.

Karnataka has also implemented the Grape Processing and Wine Policy, offering capital subsidies, excise duty concessions, and streamlined licensing processes for setting up wineries and grape processing units. The policy’s objectives include promoting grape cultivation for wine production, encouraging the establishment of wineries, boosting wine tourism, generating rural employment, and strengthening grape-wine value chains from farm to bottle.

Restraints

High Taxation and Regulatory Complexities Hindering Cooking Wine Market Growth in India

One of the most significant challenges facing the cooking wine industry in India is the complex and often prohibitive taxation and regulatory framework. While the sector has witnessed growth, especially in regions like Maharashtra, the overarching tax structure remains a substantial barrier to broader adoption and market expansion.

In India, alcohol, including cooking wine, is primarily taxed through state-level excise duties and Value Added Tax (VAT). These taxes vary significantly across states, leading to inconsistencies in pricing and accessibility. For instance, Uttar Pradesh imposes an excise duty of 69% on alcoholic beverages, while states like Goa and Haryana have comparatively lower rates of 22% and 20%, respectively. Such disparities not only affect consumer prices but also complicate distribution and retail strategies for producers.

The regulatory environment further complicates matters. Each state in India has its own set of rules regarding the sale and distribution of alcoholic beverages, including cooking wines. This lack of uniformity leads to challenges in compliance and increases operational costs for producers and retailers. For example, the Food Safety and Standards Authority of India (FSSAI) sets standards for food products, but the enforcement and interpretation of these standards can vary by state, leading to inconsistencies in product quality and safety

Opportunity

Growth Opportunities for Cooking Wine in India

One of the most promising avenues for expanding the cooking wine market in India lies in the burgeoning wine tourism sector. Wine tourism not only enhances consumer engagement but also creates a synergistic relationship between the culinary and viticulture industries, offering substantial growth prospects for cooking wine producers.

Maharashtra, particularly the Nashik region, stands at the forefront of this development. In 2022, Nashik produced approximately 1.4 crore liters of wine, accounting for 90% of India’s total wine production. This output was achieved by crushing 20,000 metric tonnes of grapes, with annual sales typically around 1.3 crore liters. The sector has been experiencing a 20% growth each year, underscoring its expanding footprint.

The state’s wine tourism infrastructure is robust, with over 50 operational wineries, many of which offer vineyard tours, wine tastings, and culinary experiences. These establishments attract a significant number of visitors, with Sula Vineyards alone drawing over 300,000 tourists annually. This influx of tourists not only boosts local economies but also fosters a deeper appreciation for wine, including its culinary applications.

Government initiatives have further bolstered this sector. The Maharashtra government has implemented policies to promote wine tourism, including the establishment of wine parks and providing subsidies for setting up wineries. These measures aim to enhance infrastructure, improve accessibility, and attract both domestic and international tourists.

Regional Insights

Europe dominates the Cooking Wine Market with 38.5% share, valued at 148.9 million in 2024.

In 2024, Europe held a dominant market position in the cooking wine sector, capturing more than a 38.5% share, valued at USD 148.9 million. This strong market presence is primarily driven by the region’s rich culinary heritage, where cooking wines are an integral part of both traditional and modern cooking practices. European countries, particularly France, Italy, and Spain, are renowned for their wine production, which seamlessly translates into a high consumption of cooking wine in both domestic and commercial kitchens.

The European market benefits from a robust foodservice sector, including high-end restaurants, catering services, and food processors, all of which contribute significantly to the demand for cooking wine. As the popularity of gourmet cooking and fine dining continues to grow, the use of wine as a culinary ingredient remains deeply ingrained in the region’s food culture. Moreover, Europe’s inclination towards healthy and natural cooking solutions is driving the preference for wines that enhance flavors without adding unnecessary fats or artificial ingredients.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

AAK AB is a global leader in cooking oils and fats, supplying high-quality vegetable oils for various industries, including the food and beverage sector. With a commitment to sustainability and innovation, AAK provides cooking wines and related products tailored to the needs of the food industry. Their products are known for their superior quality, enhancing the flavors and texture of processed foods. AAK operates in more than 25 countries, maintaining a significant presence in the cooking wine sector.

Palmetto Canning specializes in producing and packaging food products, including cooking wines, for the retail and foodservice industries. Known for its commitment to quality and sustainability, the company provides a range of wine-based products that enhance flavors in a variety of dishes. Palmetto Canning’s products are widely used in food processing, sauces, and marinades. The company is recognized for its efficiency in delivering top-quality cooking wines to meet the evolving demands of the culinary world.

ECOVINAL, S.L.U. is a well-established producer and supplier of organic and conventional cooking wines. The company emphasizes environmental sustainability and natural ingredients in its products, providing a wide selection of wines suitable for the food industry. ECOVINAL works with various food processors and foodservice providers to deliver high-quality wines that support the growing trend towards clean and natural cooking solutions. Their products are known for enhancing the flavor profile of prepared foods while maintaining sustainability standards.

Top Key Players Outlook

- AAK AB

- Batory Foods

- PALMETTO CANNING

- ECOVINAL, S.L.U.

- Iberica Export

- Marina Foods, Inc.

- Stratas Foods

- The Kroger Co.

- Mizkan America Inc.

- Roland Foods, LLC

Recent Industry Developments

In 2024, AAK’s food ingredients segment achieved an operating profit of SEK 767 million, reflecting a 12% increase from the previous year.

In 2024, Batory Foods expanded its facilities to Wilmington, North Carolina, to enhance its distribution capabilities.

Report Scope

Report Features Description Market Value (2024) USD 386.9 Mn Forecast Revenue (2034) USD 551.1 Mn CAGR (2025-2034) 3.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Dessert Wine, White Wine, Red Wine, Others), By Application (Food Processing Industry, Food Service, Households), By Distribution Channel (B2B, B2C) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape AAK AB, Batory Foods, PALMETTO CANNING, ECOVINAL, S.L.U., Iberica Export, Marina Foods, Inc., Stratas Foods, The Kroger Co., Mizkan America Inc., Roland Foods, LLC Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- AAK AB

- Batory Foods

- PALMETTO CANNING

- ECOVINAL, S.L.U.

- Iberica Export

- Marina Foods, Inc.

- Stratas Foods

- The Kroger Co.

- Mizkan America Inc.

- Roland Foods, LLC