Global Container Tracking API Market Size, Share, Statistics Analysis Report By Type (In Transit, At Port), By Business Model (Pay-As-You-Go Model, Subscription-Based Model), By Container Type (Dry Storage Containers, Flat Rack Containers, Refrigerated Containers), By Application (Healthcare Supply Chain, Manufacturing Process, Retail Supply Chain, Transportation and Logistics, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 139341

- Number of Pages: 265

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Scope

- Key Takeaways

- Analyst Viewpoint

- Container Tracking API Key Statistics

- By Type

- By Business Model

- By Container Type

- By Application

- Key Market Segments

- Driving Factors

- Restraining Factors

- Growth Opportunities

- Challenging Factors

- Growth Factors

- Emerging Trends

- Business Benefits

- Regional Analysis

- Key Regions and Countries

- Key Player Analysis

- Recent Developments

- Report Scope

Report Scope

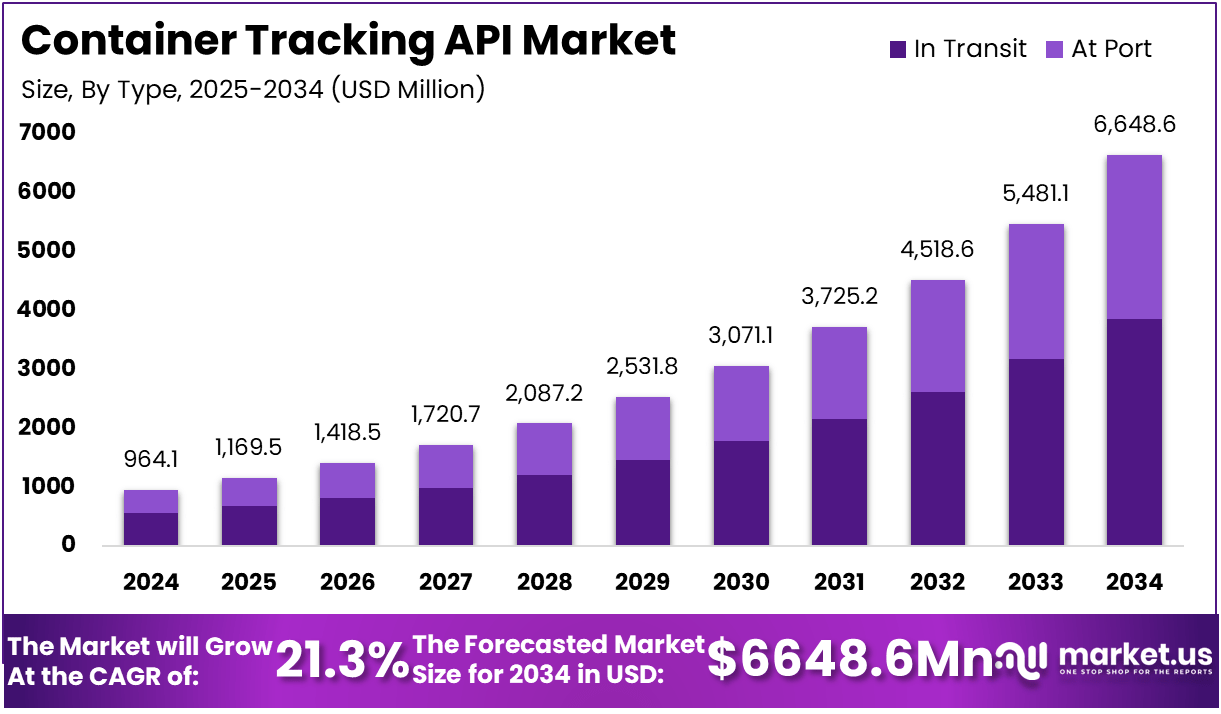

The Global Container Tracking API Market is expected to be worth around USD 6648.6 Million By 2034, up from USD 964.1 million in 2024. It is expected to grow at a CAGR of 21.3% during the forecast period from 2025 to 2034.

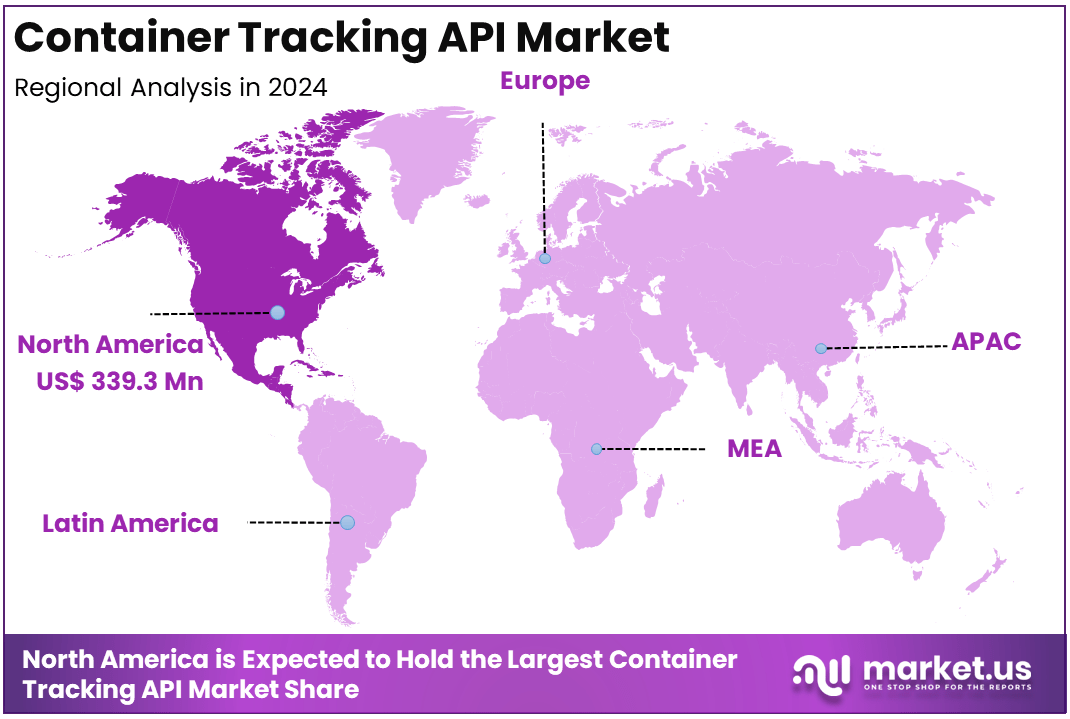

In 2024, North America held a dominant market position, capturing more than a 35.2% share and earning USD 339.3 million in revenue. The United States also had a strong position in North America, with a market size of USD 305.42 million.

The Container Tracking API market revolves around using technology to track shipping containers across their journey, from port to destination. These APIs allow businesses to access real-time data on their containers, such as location, status, and even environmental conditions, helping them manage shipments more efficiently.

With the growing complexity of global trade, container tracking APIs are becoming an essential tool for logistics companies, retailers, and manufacturers who rely on seamless supply chain operations. As the global demand for transparency and speed in logistics rises, the market for container tracking solutions continues to expand, presenting significant opportunities for both businesses and technology providers.

Key Takeaways

- Market Growth: The Container Tracking API market is projected to grow from USD 964.1 million in 2024 to USD 6,648.6 million by 2034, with a CAGR of 21.3%.

- Dominant Type: The In Transit container type holds the largest share at 58.1%, driven by the increasing need for real-time tracking of shipments during transportation.

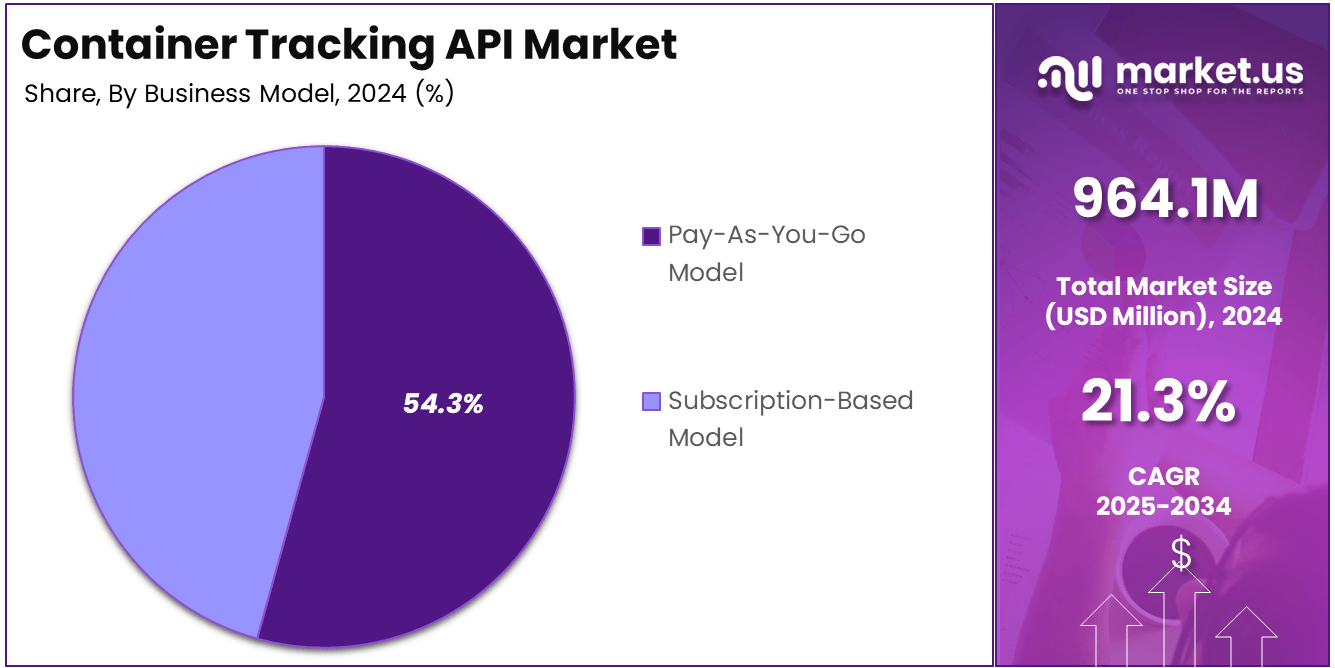

- Leading Business Model: The Pay-As-You-Go business model dominates with a 54.3% market share, offering flexibility and cost-efficiency for users.

- Primary Container Type: Dry Storage Containers make up 41.2% of the market, as they are the most commonly used for shipping a wide range of goods.

- Top Application: The Retail Supply Chain sector leads with a 31.5% market share, reflecting the growing demand for enhanced tracking in e-commerce and retail logistics.

- Regional Dominance: North America accounts for 35.2% of the global market share, with the US contributing USD 305.42 million, making it the largest market region.

Analyst Viewpoint

The growth of global trade is one of the biggest drivers behind the container tracking API market. With millions of containers in transit at any given time, businesses need real-time information to keep their supply chains running smoothly. By offering instant access to container status, location, and estimated delivery times, these APIs minimize risks of delays, reduce operational costs, and increase overall supply chain visibility.

Furthermore, the e-commerce boom has intensified the need for faster, more reliable delivery, leading companies to seek out innovative solutions like container tracking APIs. With increasing regulatory requirements and the need for sustainability in shipping, companies are also adopting these APIs to ensure compliance and reduce environmental impact.

As industries such as retail, manufacturing, and automotive continue to expand, the demand for real-time tracking solutions is higher than ever. With customers expecting faster deliveries and greater transparency about where their shipments are, businesses are turning to container-tracking APIs to meet these demands.

The container tracking API market is packed with growth opportunities, particularly in emerging markets where cross-border trade is expanding. For instance, regions like Asia-Pacific are seeing significant growth in trade volume, creating a high demand for effective container tracking.

The evolution of technology is transforming the container tracking industry. Today’s GPS tracking, IoT sensors, and cloud-based solutions enable businesses to gain real-time insights into the location and condition of their containers, no matter where they are in the world.

Container Tracking API Key Statistics

API Performance

- Uptime: Reputable container tracking APIs maintain an average uptime of 99.9%, ensuring continuous data availability.

- Response Time: API response times typically range from 200-500 milliseconds.

- Data Refresh Rate: Data is refreshed every 1-4 hours, depending on the carrier and location.

- Error Rate: The average error rate for API calls is below 0.5%, indicating high accuracy and stability.

- Security Measures: APIs employ encryption protocols (HTTPS) and authentication mechanisms (API keys, OAuth) to safeguard data privacy.

Quantity Statistics

- Containers Tracked: Collectively, these APIs track over 40 million containers annually, representing a substantial portion of global trade.

- Data Volume: API providers process approximately 500 terabytes of container tracking data per year, ensuring accuracy and reliability.

- Carrier Coverage: Leading APIs cover data from 180+ shipping lines.

Number of Events: Each container generates an average of 20-30 event updates throughout its lifecycle.

User Statistics

- User Base: Approximately 4,500 companies globally utilize container tracking APIs as of early 2025, encompassing logistics providers, retailers, manufacturers, and e-commerce businesses.

- API Call Volume: Average daily API calls across all users total 75 million, with peak days reaching up to 90 million calls.

- User Growth Rate: The user base has seen a 20% year-over-year increase in adoption rates since 2023.

- Enterprise vs. SMB: 65% of API users are large enterprises (defined as companies with over 500 employees), while 35% are small-to-medium-sized businesses (SMBs).

- User Satisfaction: 88% of users report increased visibility and control over their supply chains after implementing container tracking APIs.

Usage Statistics

- Frequency of Use: Users typically query the API 5-10 times per container per journey to monitor progress and ensure timely updates.

- Data Points Accessed: On average, each API call retrieves 15-20 data points about the container, including location, status updates, timestamps, and temperature readings (for refrigerated containers).

- Integration Rate: 70% of users have fully integrated the API into their existing TMS or ERP systems within 3 months of adoption.

- Alert Customization: 95% of users customize alert settings, with an average of 3-5 alerts set per container (e.g., departure, arrival, customs clearance).

- Report Generation: Approximately 60% of users generate weekly or monthly reports based on API data for performance analysis and optimization.

By Type

In 2024, the In Transit segment held a dominant market position, capturing more than 58.1% of the Container Tracking API market share. This segment is leading due to the increasing demand for real-time tracking of containers during the transportation phase. As global trade and e-commerce continue to expand, the need for continuous visibility throughout the shipping journey is more critical than ever.

In-transit tracking helps businesses monitor the precise location, estimated arrival times, and any potential disruptions during transit, which ultimately improves supply chain efficiency. Real-time data provided by tracking APIs ensures better decision-making, allowing businesses to adjust delivery schedules, optimize routes, and proactively manage delays.

The need for improved visibility and operational control is driving the widespread adoption of in-transit tracking, particularly in industries like retail and manufacturing, where timely and reliable delivery is crucial. This segment’s growth is further fueled by technological advancements such as GPS tracking, IoT sensors, and cloud-based solutions that offer seamless tracking during transportation across various modes like sea, land, and air.

By Business Model

In 2024, the Pay-As-You-Go Model held a dominant market position, capturing more than 54.3% of the Container Tracking API market share. This business model is leading due to its flexibility and cost-effectiveness, which appeal to a wide range of businesses, particularly small and medium-sized enterprises (SMEs).

The Pay-As-You-Go model allows companies to pay only for the services they use, making it a scalable option for businesses that don’t want to commit to fixed, long-term subscriptions. This is especially beneficial for businesses with fluctuating tracking needs or seasonal variations in shipping volumes. Furthermore, the model reduces upfront costs, allowing organizations to test the solution before making a larger investment.

As the demand for agile and adaptable business solutions grows, this pricing model provides a clear advantage. Companies can also adjust their usage and costs in real-time, helping them align their spending with actual operational needs. The combination of cost-efficiency, flexibility, and ease of implementation is what drives the Pay-As-You-Go model’s dominance in the market.

By Container Type

In 2024, the Dry Storage Containers segment held a dominant market position, capturing more than 41.2% of the Container Tracking API market share. This segment leads primarily due to the widespread use of dry storage containers in global trade. These containers are versatile, cost-effective, and suitable for transporting a wide variety of goods, making them the most common type of container used in logistics and shipping.

As industries like retail, manufacturing, and consumer goods increasingly rely on these containers to move non-perishable and durable products, the demand for tracking solutions for dry storage containers continues to grow. Real-time tracking provides valuable insights into the container’s location, estimated arrival time, and condition, ensuring the safe and timely delivery of goods.

Additionally, the simplicity of dry storage containers, combined with their high volume in shipping fleets, makes them a priority for container tracking API providers. This high market share reflects the essential role dry storage containers play in supply chain operations, driving the need for reliable, scalable tracking solutions.

By Application

In 2024, the Retail Supply Chain segment held a dominant market position, capturing more than 31.5% of the Container Tracking API market share. This segment is leading due to the rapid growth of e-commerce and the increasing demand for faster, more transparent delivery processes. Retail businesses rely heavily on efficient supply chain management to meet consumer expectations for quick and reliable product deliveries.

Real-time tracking of containers is crucial for retailers to ensure timely shipments, minimize delays, and improve customer satisfaction. The rise of omnichannel retail, where products are sold across both physical and online platforms, further drives the need for seamless tracking solutions across multiple logistics touchpoints.

Container tracking APIs enable retailers to monitor shipments in transit, from warehouse to store or directly to customers, with greater visibility. This increased demand for real-time data and improved operational control is why the retail supply chain continues to dominate the market. As online shopping volumes continue to rise, the need for efficient, transparent logistics will only grow, solidifying this segment’s market leadership.

Key Market Segments

By Type

- In Transit

- At Port

By Business Model

- Pay-As-You-Go Model

- Subscription-Based Model

By Container Type

- Dry Storage Containers

- Flat Rack Containers

- Refrigerated Containers

By Application

- Healthcare Supply Chain

- Manufacturing Process

- Retail Supply Chain

- Transportation and Logistics

- Others

Driving Factors

Increasing Demand for Real-Time Supply Chain Visibility

One of the key driving factors behind the growth of the Container Tracking API market is the increasing demand for real-time supply chain visibility. As global trade expands and supply chains become more complex, businesses are facing higher expectations for transparency, speed, and reliability. With real-time container tracking, companies can monitor the precise location, status, and condition of their shipments, reducing the risk of delays, loss, and damage.

The rise of e-commerce has been a major contributor to this trend. Consumers now expect faster deliveries, sometimes within a day or two, and retailers are under pressure to meet these expectations while maintaining cost efficiency. By leveraging container tracking APIs, businesses can optimize their logistics, streamline inventory management, and enhance overall supply chain performance.

Restraining Factors

High Initial Implementation Costs

Despite the many benefits of container tracking APIs, one significant restraining factor is the high initial implementation cost associated with adopting these systems. The integration of advanced tracking technologies, such as GPS, RFID, and IoT sensors, often requires substantial upfront investment, including the purchase of hardware, software, and infrastructure setups.

For small and medium-sized enterprises (SMEs), the costs can be particularly prohibitive. These businesses may not have the resources to invest in such sophisticated tracking systems, leading to a slower adoption rate in certain market segments. Additionally, the need for specialized IT staff to maintain and manage these systems adds further complexity and cost. For businesses with limited budgets, the return on investment (ROI) might not be immediately clear, making it a harder sell to stakeholders.

Growth Opportunities

Expansion in Emerging Markets

A promising growth opportunity for the Container Tracking API market lies in the expansion into emerging markets. Regions like Asia-Pacific, Latin America, and the Middle East are experiencing rapid industrialization and urbanization, driving significant growth in trade and logistics. These markets are investing heavily in modernizing their supply chain infrastructure, making them ideal for the adoption of advanced technologies like container tracking APIs.

As these regions continue to grow, the demand for real-time tracking solutions will increase. In particular, China, India, and Brazil are emerging as key players in global trade, contributing to the growth of international logistics. The expansion of e-commerce in these regions is also spurring demand for efficient and transparent supply chains, where container tracking plays a critical role.

Challenging Factors

Data Security and Privacy Concerns

A major challenging factor facing the Container Tracking API market is data security and privacy concerns. As container tracking systems rely heavily on cloud computing and internet-based technologies, the vast amounts of data being transmitted and stored become susceptible to cyber threats. This includes risks of hacking, data breaches, and unauthorized access to sensitive logistics information.

For companies that handle high-value goods or operate in industries with strict regulatory requirements—such as pharmaceuticals or electronics—the threat of data compromise can be particularly alarming. Any breach of confidential shipment details or real-time tracking data can lead to financial losses, reputational damage, and potential legal consequences.

Additionally, the complexity of complying with various regional data protection regulations, such as the GDPR in Europe or CCPA in California, adds another layer of challenge for companies looking to implement container tracking APIs.

Growth Factors

The growth of the Container Tracking API market is being propelled by several key factors, with e-commerce and global trade expansion standing out as major contributors. In 2024, the global e-commerce market is expected to surpass USD 5 trillion and continue growing at a compound annual growth rate (CAGR) of 11.6%.

As more consumers demand faster deliveries, retailers, and logistics companies are under pressure to enhance operational efficiency and offer real-time visibility into shipments. Container tracking APIs offer an effective solution by providing continuous updates on the location and condition of goods in transit.

Emerging Trends

Several emerging trends are shaping the future of the Container Tracking API market. One of the most prominent is the integration of IoT (Internet of Things) sensors, which enable enhanced tracking capabilities, such as monitoring temperature, humidity, and shock during transit.

Another notable trend is the growing role of blockchain technology in container tracking. Blockchain offers a decentralized and secure method for tracking the provenance and movement of goods, enhancing transparency and reducing fraud. Blockchain’s integration with container tracking APIs is anticipated to significantly improve the accuracy and security of data transmission.

Business Benefits

Container Tracking APIs provide a range of business benefits that directly contribute to operational efficiency, cost savings, and enhanced customer satisfaction. One of the most significant advantages is improved supply chain visibility. With real-time updates on the location and status of containers, companies can proactively manage delays, optimize routes, and avoid costly disruptions. This capability not only reduces inventory holding costs but also minimizes the need for last-minute adjustments or rush shipments.

Moreover, container tracking APIs enable businesses to ensure the security and integrity of goods. For industries such as pharmaceuticals, where the condition of products is crucial, sensors integrated into the tracking system can monitor factors like temperature and humidity, ensuring that shipments remain within safe conditions. This reduces the risk of product spoilage or damage, helping companies maintain compliance with regulations.

Regional Analysis

In 2024, North America held a dominant market position, capturing more than 35.2% of the Container Tracking API market share, with a revenue of USD 339.3 million. This strong market position is driven by the region’s well-established and technologically advanced logistics and transportation infrastructure.

North America has been at the forefront of adopting cutting-edge technologies, including container tracking solutions, to streamline its robust supply chain operations. The increasing demand for real-time visibility in logistics, coupled with growing e-commerce activities, has significantly contributed to the widespread adoption of container tracking APIs across industries such as retail, automotive, and manufacturing.

In North America, the United States dominates the market, contributing USD 305.42 million to the overall regional revenue. The country’s large consumer market and its status as a global trade hub make it a key driver for the demand for container tracking solutions.

The U.S. logistics sector, which is highly sophisticated, places a premium on technologies that can improve operational efficiency, reduce delays, and provide transparency throughout the supply chain. The U.S. is also home to many large-scale retailers and multinational corporations that rely heavily on effective tracking systems to manage their international and domestic shipments.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

Vizion API, Inc. has positioned itself as a leading player in the Container Tracking API market by focusing on simplifying the supply chain tracking process. One of their key strategies has been product innovation, especially in terms of offering an easy-to-integrate, scalable API solution for container tracking.

Shipsgo Pte. Ltd. is another key player in the Container Tracking API market, known for its focus on smart logistics solutions. Shipsgo’s platform leverages IoT sensors and blockchain technology, making it one of the most secure and reliable solutions for real-time shipment tracking.

Terminal49, Inc. has made a significant impact on the Container Tracking API market through its cutting-edge port management solutions. Known for its cloud-based container tracking platform, Terminal49 enables seamless integration of terminal operations, making it easier for shippers to manage containers at various ports.

Top Key Players in the Market

- Vizion API, Inc.

- Shipsgo Pte. Ltd.

- Terminal49, Inc.

- SeaRates ITF FZCO

- MarineTraffic Maritime Informatics S.A.

- Sinay SAS

- GoFreight Inc.

- VesselFinder Ltd.

- Gnosis Freight, Inc.

- GoComet Solutions Private Limited

- Postman, Inc.

- Safecube SAS

- A.P. Moller – Maersk A/S

- Beacon AI, Inc.

- Windward Ltd.

- JSONCargo, Inc.

- Others

Recent Developments

- In 2024, Vizion API significantly expanded its global reach by forming new strategic partnerships with leading freight carriers and logistics platforms across Europe and Asia.

- In 2024, Shipsgo Pte. Ltd. launched a new predictive analytics tool within its container tracking API platform.

Report Scope

Report Features Description Market Value (2024) USD 964.1 Million Forecast Revenue (2034) USD 6648.6 Million CAGR (2025-2034) 21.3% Largest Market North America Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (In Transit, At Port), By Business Model (Pay-As-You-Go Model, Subscription-Based Model), By Container Type (Dry Storage Containers, Flat Rack Containers, Refrigerated Containers), By Application (Healthcare Supply Chain, Manufacturing Process, Retail Supply Chain, Transportation and Logistics, Others) Regional Analysis North America (US, Canada), Europe (Germany, UK, Spain, Austria, Rest of Europe), Asia-Pacific (China, Japan, South Korea, India, Australia, Thailand, Rest of Asia-Pacific), Latin America (Brazil), Middle East & Africa(South Africa, Saudi Arabia, United Arab Emirates) Competitive Landscape Vizion API, Inc., Shipsgo Pte. Ltd., Terminal49, Inc., SeaRates ITF FZCO, MarineTraffic Maritime Informatics S.A., Sinay SAS, GoFreight Inc., VesselFinder Ltd., Gnosis Freight, Inc., GoComet Solutions Private Limited, Postman, Inc., Safecube SAS, A.P. Moller – Maersk A/S, Beacon AI, Inc., Windward Ltd., JSONCargo, Inc., Others Customization Scope We will provide customization for segments and at the region/country level. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Container Tracking API MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample

Container Tracking API MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Vizion API, Inc.

- Shipsgo Pte. Ltd.

- Terminal49, Inc.

- SeaRates ITF FZCO

- MarineTraffic Maritime Informatics S.A.

- Sinay SAS

- GoFreight Inc.

- VesselFinder Ltd.

- Gnosis Freight, Inc.

- GoComet Solutions Private Limited

- Postman, Inc.

- Safecube SAS

- A.P. Moller - Maersk A/S

- Beacon AI, Inc.

- Windward Ltd.

- JSONCargo, Inc.

- Others