Global Construction Repair Composites Market Size, Share, And Business Benefits By Fiber Type (Glass Fiber, Carbon Fiber, Others), By Resin Type (Vinyl Easter, Ероху, Others), By Product Type (Textile/ Fabric, Plate, Rebar, Mesh, Adhesive), By Application (Infrastructure, Commercial Buildings, Residential Buildings, Industrial Facilities), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: May 2025

- Report ID: 148382

- Number of Pages: 321

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

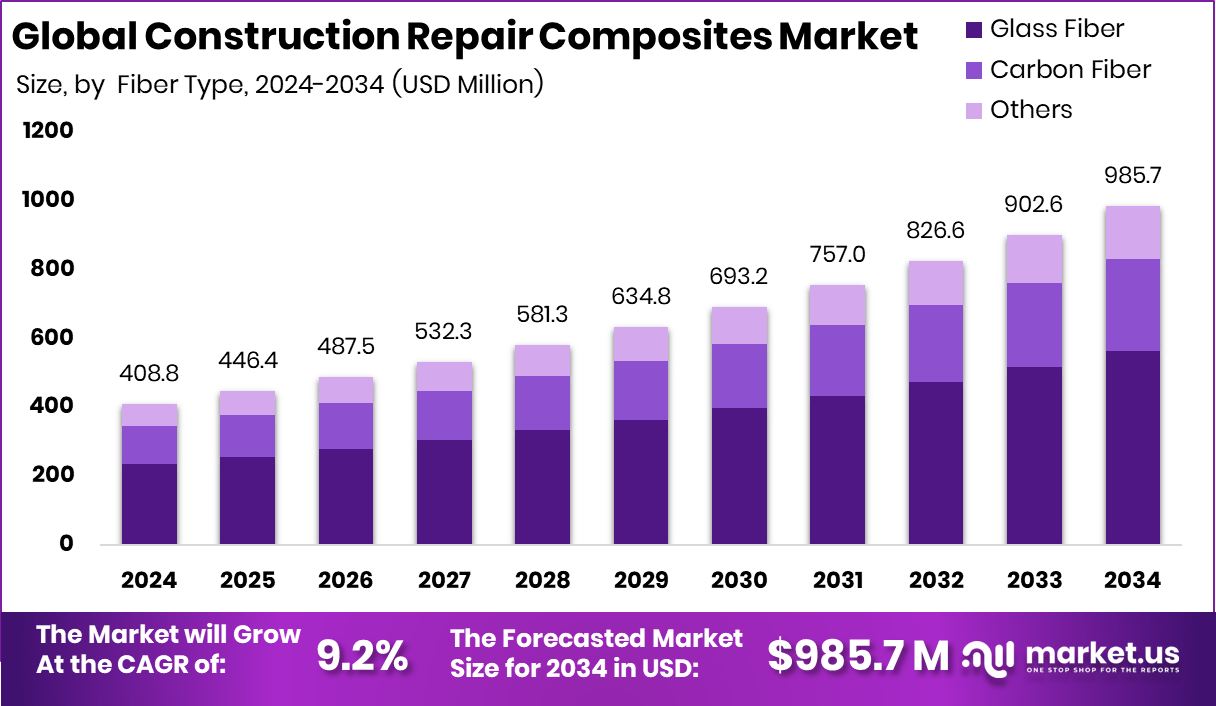

Global Construction Repair Composites Market is expected to be worth around USD 985.7 Million by 2034, up from USD 408.8 Million in 2024, and grow at a CAGR of 9.2% from 2025 to 2034. Construction repair composites hold a commanding 35.8% share in the North American market.

Construction repair composites are advanced materials utilized to restore, reinforce, and protect structural components in buildings, bridges, and infrastructure. These composites consist of fiber-reinforced polymers, carbon fibers, and resins, providing exceptional strength, durability, and corrosion resistance. They are widely employed to mend cracks, strengthen beams, and retrofit aging structures without the need for extensive demolition.

The construction repair composites market encompasses the supply and demand for advanced materials used in structural rehabilitation and reinforcement applications. It includes a range of products such as carbon fiber-reinforced polymers (CFRP), glass fiber-reinforced polymers (GFRP), and epoxy resins. These materials are gaining traction in the construction sector due to their superior mechanical properties, lightweight nature, and ease of installation.

The increasing focus on infrastructure development and modernization is a significant growth driver in the construction repair composites market. Governments worldwide are investing heavily in bridge repairs, road upgrades, and building renovations to maintain structural integrity. Additionally, the rising adoption of composite materials in seismic retrofitting projects further propels market expansion.

The demand for construction repair composites is fueled by the growing incidence of structural deterioration in aging buildings and infrastructure. With infrastructure in many developed and emerging economies reaching the end of its service life, there is a pressing need for effective repair solutions.

A former leader from the Gates Foundation has secured $1.8 million in funding to advance a startup specializing in engineered bamboo building materials. Meanwhile, the National Renewable Energy Laboratory (NREL) is poised to receive $5.4 million to explore the potential of transforming buildings into carbon storage systems. Additionally, Mighty Buildings has successfully raised $40 million in a Series B funding round, aiming to scale its 3D-printed construction solutions and expand its sustainable housing projects.

Key Takeaways

- Global Construction Repair Composites Market is expected to be worth around USD 985.7 Million by 2034, up from USD 408.8 Million in 2024, and grow at a CAGR of 9.2% from 2025 to 2034.

- Glass Fiber dominates the Construction Repair Composites Market, holding a substantial 57.3% share.

- Vinyl Ester resins lead the market with 52.8% share, favored for their exceptional durability.

- Textile/Fabric products capture 35.2% market share, driven by lightweight and flexible composite solutions.

- Infrastructure applications account for 42.9% of the market, emphasizing extensive structural repair projects globally.

- The USD 146.3 Mn market in North America signifies substantial infrastructure repair investments.

By Fiber Type Analysis

Glass Fiber leads with 57.3%, offering exceptional strength in structural repairs.

In 2024, Glass Fiber held a dominant market position in the By Fiber Type segment of the Construction Repair Composites Market, with a 57.3% share. The significant usage of glass fiber in construction repair applications is attributed to its exceptional strength-to-weight ratio and corrosion-resistant properties, making it an ideal choice for reinforcing concrete structures, bridges, and other infrastructure.

The growing focus on structural integrity and long-term durability has propelled the demand for glass fiber composites, particularly in regions prone to adverse weather conditions. Additionally, the increasing adoption of sustainable construction practices further amplifies the use of glass fiber composites due to their recyclability and lower carbon footprint.

As construction projects prioritize material strength, longevity, and cost-effectiveness, glass fiber continues to solidify its position as a preferred material in the repair and reinforcement of structural components, driving its sustained dominance in the market.

By Resin Type Analysis

Vinyl Ester resin dominates at 52.8%, ensuring superior corrosion resistance and durability.

In 2024, Vinyl Easter held a dominant market position in the By Resin Type segment of the Construction Repair Composites Market, with a 52.8% share. The extensive adoption of vinyl ester resin in construction repair applications is primarily driven by its superior corrosion resistance, high impact strength, and thermal stability, making it a preferred choice for reinforcing structural elements in harsh environments.

The growing demand for durable and chemically resistant materials in infrastructure repair, particularly in industrial and marine sectors, has further fueled the uptake of vinyl ester resin composites. Additionally, its ability to provide enhanced adhesion and resistance to cracking under stress positions it as a key material in structural repair projects, ensuring long-term stability and reducing maintenance costs.

As infrastructure repair activities surge to address aging structures and increase structural integrity, vinyl ester resin continues to play a critical role in reinforcing concrete and steel components, maintaining its leadership position in the resin type segment.

By Product Type Analysis

Textile/Fabric products account for 35.2%, gaining traction in construction reinforcement projects.

In 2024, Textile/Fabric held a dominant market position in the By Product Type segment of the Construction Repair Composites Market, with a 35.2% share. The extensive application of textile and fabric composites in construction repair is attributed to their lightweight nature, high tensile strength, and versatility in reinforcing concrete structures.

These composites are widely employed in repairing bridges, columns, and beams, providing structural reinforcement without adding excessive weight to the structure. Additionally, the increasing emphasis on seismic retrofitting and rehabilitation of aging infrastructure has further propelled the demand for textile/fabric composites, as they can be easily molded to conform to complex geometries while maintaining structural integrity.

The growing focus on sustainable construction practices has also driven the adoption of fabric composites due to their recyclable nature and minimal environmental impact. As the construction sector continues to prioritize structural reinforcement and damage prevention, textile/fabric composites remain a preferred choice, reinforcing their leadership position in the product type segment.

By Application Analysis

Infrastructure applications hold 42.9%, driven by aging bridges and public facilities upgrades.

In 2024, Infrastructure held a dominant market position in the By Application segment of the Construction Repair Composites Market, with a 42.9% share. The extensive utilization of construction repair composites in infrastructure applications is driven by the urgent need to rehabilitate aging bridges, highways, and tunnels, ensuring structural integrity and prolonging lifespan.

The rising investments in infrastructure modernization and repair initiatives, particularly in regions prone to severe weather conditions, have further amplified the demand for advanced composite materials. Additionally, infrastructure repair projects increasingly incorporate composites due to their exceptional corrosion resistance, lightweight nature, and ability to restore structural strength without extensive demolition or replacement.

The application of repair composites in infrastructure not only reduces maintenance costs but also enhances the durability of key structural components, mitigating risks associated with material degradation. As governments and construction firms continue prioritizing infrastructure rehabilitation and upgrading projects, the infrastructure segment remains the primary application area for repair composites, solidifying its position as the leading segment in the market.

Key Market Segments

By Fiber Type

- Glass Fiber

- Carbon Fiber

- Others

By Resin Type

- Vinyl Easter

- Ероху

- Others

By Product Type

- Textile/ Fabric

- Plate

- Rebar

- Mesh

- Adhesive

By Application

- Infrastructure

- Commercial Buildings

- Residential Buildings

- Industrial Facilities

Driving Factors

Infrastructure Modernization Spurs Construction, Repair Composites Demand

The ongoing focus on infrastructure modernization is significantly boosting the demand for construction repair composites. Governments globally are investing heavily in rehabilitating aging bridges, highways, and tunnels to ensure structural integrity and public safety. Composite materials, known for their superior strength-to-weight ratio, corrosion resistance, and durability, are increasingly being used to repair and reinforce these structures.

Additionally, climate resilience initiatives are further propelling the use of advanced composites, as they can withstand extreme weather conditions and reduce long-term maintenance costs. With infrastructure spending projected to rise, particularly in developing regions, the market for construction repair composites is set to experience substantial growth, driven by their proven effectiveness in extending the lifespan of critical infrastructure.

Restraining Factors

High Material Costs Limit Composite Adoption Potential

Despite the growing demand for construction repair composites, their high material costs remain a significant restraining factor. Advanced composites such as carbon fiber and glass fiber, while offering superior strength and corrosion resistance, come with substantial price tags compared to traditional construction materials. Small and mid-sized construction firms, particularly in cost-sensitive markets, often find it challenging to justify the upfront investment in composite materials for repair projects.

Additionally, the lack of widespread awareness about the long-term cost savings associated with composites further hampers their adoption. As a result, the high initial costs continue to act as a barrier, slowing the market penetration of construction repair composites, especially in developing economies with budget constraints.

Growth Opportunity

Emerging Applications Expand Composite Repair Market Horizons

The construction repair composites market is experiencing significant growth due to the emergence of new applications beyond traditional concrete repairs. Notably, there is a rising demand for composites in repairing offshore structures and pipelines. These materials offer superior strength, corrosion resistance, and durability, making them ideal for harsh marine environments.

Additionally, the versatility of construction repair composites allows for their use in various structural applications, including bridges, buildings, and roads. As industries seek cost-effective and long-lasting solutions, the adoption of advanced composite materials in diverse repair scenarios presents a substantial growth opportunity for the market.

Latest Trends

Sustainable Composites Drive Market Transformation

A significant trend in the construction repair composites market is the shift towards sustainable materials. Manufacturers are increasingly adopting eco-friendly composites made from natural fibers, recycled plastics, and bio-based resins.

These sustainable alternatives offer comparable performance to traditional materials while reducing environmental impact. For instance, composites utilizing natural fibers like hemp or flax, combined with bio-resins, provide high strength-to-weight ratios and enhanced durability.

This trend aligns with the global emphasis on green building practices and carbon footprint reduction. As regulatory bodies and consumers prioritize sustainability, the demand for environmentally friendly construction repair composites is expected to rise, fostering innovation and growth in the market.

Regional Analysis

North America dominates the Construction Repair Composites Market with 35.8%, generating USD 146.3 Mn.

In the global Construction Repair Composites Market, North America emerged as the leading region in 2024, capturing a 35.8% market share valued at USD 146.3 million. The region’s dominance is driven by increasing infrastructure repair activities and the adoption of advanced composite materials for structural reinforcement. The demand for durable and corrosion-resistant composites continues to rise as government initiatives prioritize the rehabilitation of aging bridges, tunnels, and roadways.

In contrast, Europe exhibits a steady market presence, supported by stringent regulatory frameworks that promote the use of sustainable construction materials in repair projects. The Asia Pacific region is witnessing growing investment in construction repair composites due to rapid urbanization and industrialization, creating significant opportunities for manufacturers.

Meanwhile, the Middle East & Africa region is gradually adopting composite materials for infrastructure projects, particularly in coastal and industrial areas where corrosion resistance is crucial. Latin America, although smaller in market share, is anticipated to expand as infrastructure development initiatives gain traction, particularly in Brazil and Argentina.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Sika AG, BASF SE, and Arkema SA emerged as prominent players in the global Construction Repair Composites Market, leveraging their extensive portfolios of advanced composite materials tailored for structural reinforcement and repair applications.

Sika AG continues to expand its footprint in the market by focusing on innovative composite systems that enhance structural integrity, especially in aging infrastructure. The company’s expertise in resin-based systems, combined with its strong global distribution network, positions it as a key supplier of high-performance repair composites.

BASF SE, renowned for its extensive chemical expertise, has strategically advanced its construction repair composites range, focusing on sustainable and high-durability materials. The company is investing in product innovations aimed at reducing carbon emissions and extending the lifespan of repaired structures. This approach not only aligns with global sustainability goals but also strengthens BASF SE’s position as a leader in the repair composites sector.

Arkema SA continues to emphasize its advanced resin formulations, catering to the growing demand for lightweight, corrosion-resistant composites. The company’s focus on developing eco-friendly solutions underscores its commitment to sustainable construction practices, enhancing its brand reputation in the global market.

Top Key Players in the Market

- Sika AG

- BASF SE

- Arkema SA

- Owens Corning

- Saint-Gobain S.A.

- S&P Inc.

- DuPont de Nemours Inc.

- Ashland Holdings Inc.

- Henkel AG & Co.

- Mapei S.p.A.

- 3M Company

- Fosroc International Limited

- Dow Inc.

- GCP Applied Technologies Inc.

- Simpson Strong-Tie Company Inc.

Recent Developments

- In January 2025, BASF signed an agreement to sell its Styrodur® business, which produces extruded polystyrene (XPS) insulation materials, to Karl Bachl Kunststoffverarbeitung GmbH & Co. KG (BACHL). BACHL is a leading manufacturer of insulation materials in Germany and has been a long-standing distribution partner of BASF.

- In January 2025, Saint-Gobain’s subsidiary, British Gypsum, launched the Gyproc SoundBloc Infinaé 100 plasterboard in the UK. This product is made entirely from recycled materials, marking a significant step towards sustainable construction practices and supporting the circular economy.

Report Scope

Report Features Description Market Value (2024) USD 408.8 Million Forecast Revenue (2034) USD 985.7 Million CAGR (2025-2034) 9.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Fiber Type (Glass Fiber, Carbon Fiber, Others), By Resin Type (Vinyl Easter, Ероху, Others), By Product Type (Textile/ Fabric, Plate, Rebar, Mesh, Adhesive), By Application (Infrastructure, Commercial Buildings, Residential Buildings, Industrial Facilities) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Sika AG, BASF SE, Arkema SA, Owens Corning, Saint-Gobain S.A., S&P Inc., DuPont de Nemours Inc., Ashland Holdings Inc., Henkel AG & Co., Mapei S.p.A., 3M Company, Fosroc International Limited, Dow Inc., GCP Applied Technologies Inc., Simpson Strong-Tie Company Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Construction Repair Composites MarketPublished date: May 2025add_shopping_cartBuy Now get_appDownload Sample

Construction Repair Composites MarketPublished date: May 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Sika AG

- BASF SE

- Arkema SA

- Owens Corning

- Saint-Gobain S.A.

- S&P Inc.

- DuPont de Nemours Inc.

- Ashland Holdings Inc.

- Henkel AG & Co.

- Mapei S.p.A.

- 3M Company

- Fosroc International Limited

- Dow Inc.

- GCP Applied Technologies Inc.

- Simpson Strong-Tie Company Inc.