Global Compounded Topical Drug Market By Product Type (Cream, Ointment, Lotion, and Gel), By Application (Retail Pharmacy, Hospital Pharmacy, Online Pharmacy, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 150821

- Number of Pages: 267

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

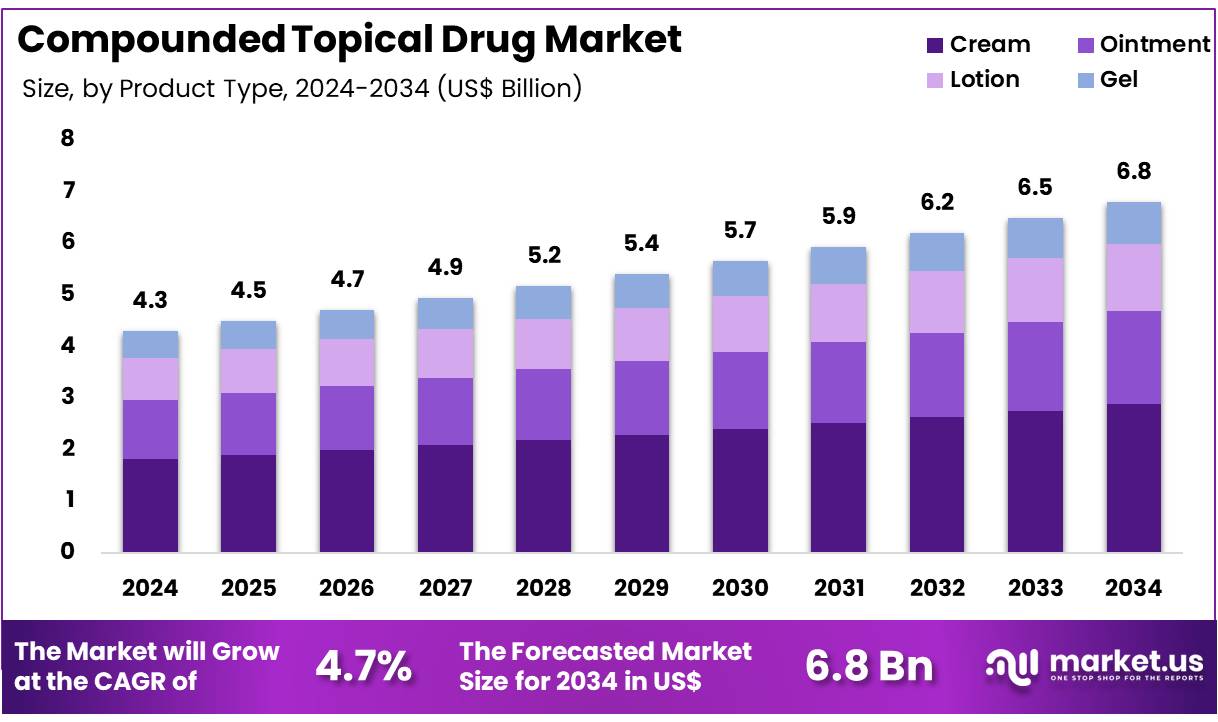

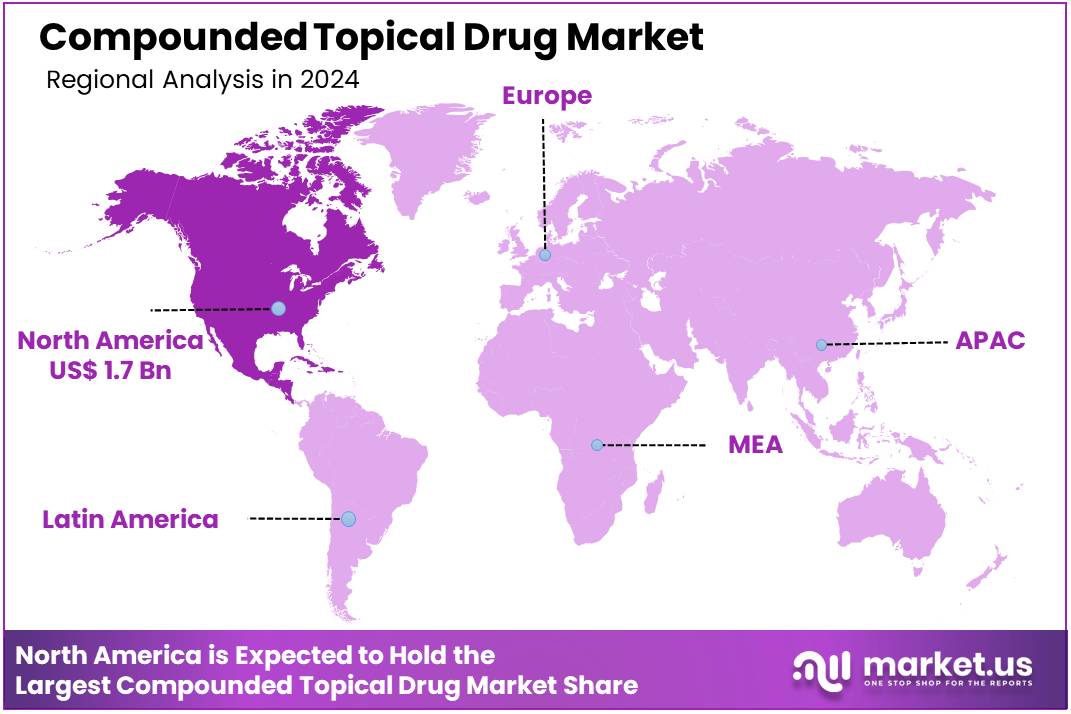

Global Compounded Topical Drug Market size is expected to be worth around US$ 6.8 Billion by 2034 from US$ 4.3 Billion in 2024, growing at a CAGR of 4.7% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 39.8% share with a revenue of US$ 1.7 Billion.

Growing demand for personalized medicine and tailored treatments fuels the compounded topical drug market. These drugs are essential in addressing specific patient needs, offering customized solutions for various dermatological conditions such as acne, eczema, and psoriasis, as well as pain management and hormone replacement therapy.

Recent trends indicate a shift towards the development of more advanced and targeted formulations that enhance therapeutic efficacy and minimize side effects. Companies like Medisca are leading the charge, as seen in their May 2022 acquisition of DIFFUSIMAX and DIFFUSIMAX10 liposomal bases, which are vital for preparing high-quality compounded topical treatments. This acquisition strengthens Medisca’s ability to provide specialized, patient-specific therapies, driving growth in the compounded drug segment.

Moreover, compounding pharmacies continue to capitalize on unmet medical needs, providing solutions that are not commercially available in mass-produced forms. As the trend towards personalized care intensifies, compounded topical drugs offer significant opportunities for addressing complex, chronic conditions that require individualized treatment regimens.

The integration of advanced delivery systems and novel formulations further enhances the market’s growth potential, positioning compounded topical drugs as a vital component of modern healthcare solutions. Additionally, increasing awareness about the benefits of customized treatments and supportive regulatory environments present promising opportunities for continued market expansion.

Key Takeaways

- In 2024, the market for compounded topical drug generated a revenue of US$ 4.3 Billion, with a CAGR of 4.7%, and is expected to reach US$ 6.8 Billion by the year 2034.

- The product type segment is divided into cream, ointment, lotion, and gel, with cream taking the lead in 2024 with a market share of 42.3%.

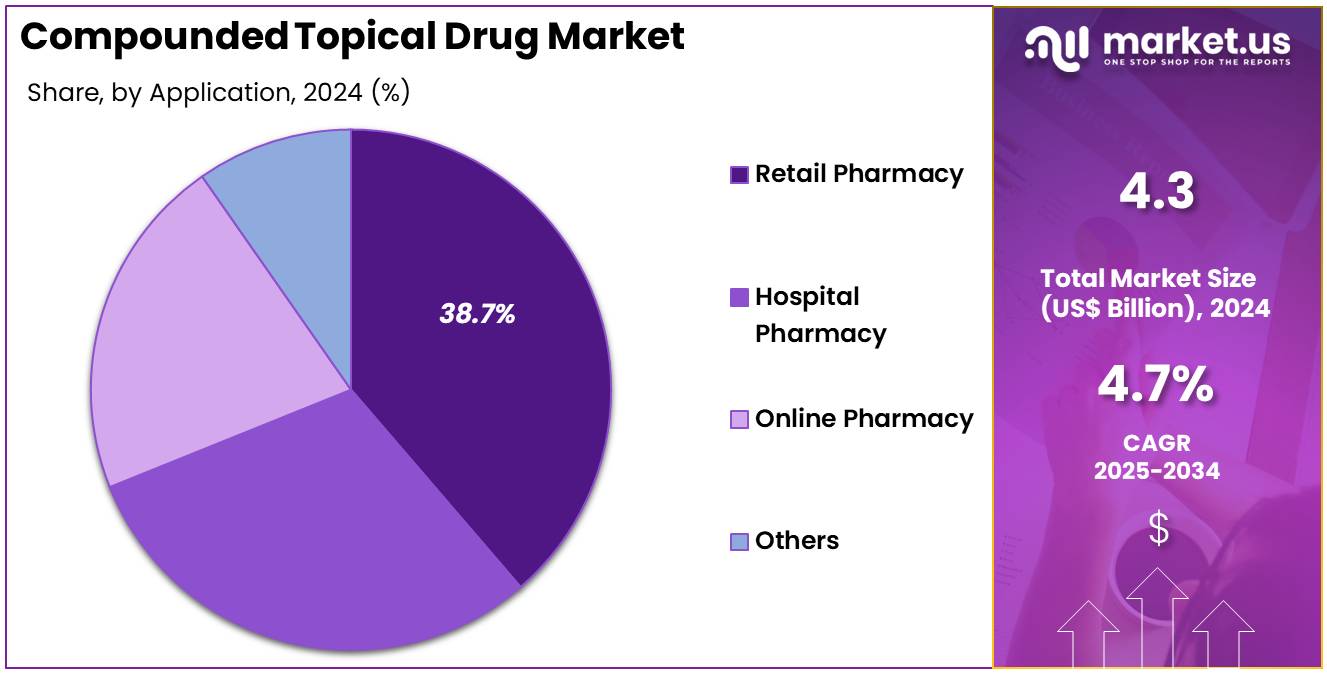

- Considering application, the market is divided into retail pharmacy, hospital pharmacy, online pharmacy, and others. Among these, retail pharmacy held a significant share of 38.7%.

- North America led the market by securing a market share of 39.8% in 2024.

Product Type Analysis

The cream segment claimed a market share of 42.3% owing to its versatility and ease of application. Creams are increasingly favored by patients and healthcare providers because they provide a non-greasy, easy-to-spread consistency that is suitable for a variety of skin types. The demand for compounded topical creams is likely to rise as these formulations can be tailored to address specific dermatological conditions such as eczema, psoriasis, and dermatitis.

Furthermore, creams are anticipated to be in high demand because they offer higher bioavailability, enhancing the efficacy of active ingredients. The increasing preference for personalized medicine and the growing need for skin care solutions that provide both therapeutic and cosmetic benefits are expected to further fuel the growth of this segment in the compounded topical drug market.

Application Analysis

The retail pharmacy held a significant share of 38.7% due to an increasing number of patients seeking customized medications and personalized treatment plans. Retail pharmacies are expected to play a key role in providing patients with convenient access to compounded topical treatments, particularly in communities where specialized services may not be available through hospitals.

The ease of accessing compounded drugs through retail pharmacies is anticipated to be a major factor contributing to the segment’s growth. Additionally, the rise of e-prescriptions and the growing trend toward patient-driven healthcare are expected to further boost demand for compounded products in retail pharmacies. As more patients seek alternatives to over-the-counter solutions, retail pharmacies are likely to become a primary source for custom medications tailored to individual needs, contributing to the segment’s expansion.

Key Market Segments

By Product Type

- Cream

- Ointment

- Lotion

- Gel

By Application

- Retail Pharmacy

- Hospital Pharmacy

- Online Pharmacy

- Others

Drivers

Increasing Demand for Personalized Medicine is Driving the Market

The growing demand for personalized medicine, where treatments are tailored to individual patient needs, is a significant driver for the compounded topical drug market. Compounding pharmacies specialize in customizing formulations by adjusting dosages, combining multiple active ingredients, removing allergens, or preparing drugs in different delivery vehicles like creams, gels, or ointments.

This capability proves crucial for individuals with allergies to standard inactive ingredients, pediatric patients requiring precise micro-doses, or those needing specific combinations of active ingredients not commercially available.

For instance, the National Academies of Sciences, Engineering, and Medicine emphasized in a 2023 report the importance of customized medications for patients with unique clinical needs, highlighting the integral role of compounding. This push for patient-specific healthcare solutions directly fuels the demand for these specialized topical formulations.

Restraints

Regulatory Scrutiny and Quality Control Challenges are Restraining the Market

The compounded topical drug market faces significant restraint due to increased regulatory scrutiny and inherent challenges in ensuring consistent quality control. Unlike mass-produced, FDA-approved drugs, compounded medications do not undergo the same rigorous pre-market approval process for safety, efficacy, and quality. This difference in oversight can lead to variability in potency, purity, and stability.

The FDA has heightened its oversight, for instance, by issuing alerts regarding certain bulk drug substances that may present significant safety risks when compounded, such as BPC-157 and Cathelicidin LL-37, which were added to Category 2 in September 2023, advising against their use in compounding.

Furthermore, the FDA publishes inspectional observations (Form 483s) citing deficiencies at compounding pharmacies, reflecting ongoing efforts to enforce quality standards and maintain patient safety. These regulatory concerns, often stemming from past incidents of contamination or incorrect dosing, lead to stricter guidelines and increased compliance costs for compounding pharmacies, thereby moderating market growth.

Opportunities

Addressing Drug Shortages Creates Growth Opportunities

The compounded topical drug market finds a substantial growth opportunity in its ability to address drug shortages of commercially available medications. When manufacturing issues, supply chain disruptions, or sudden increases in demand lead to shortages of essential topical drugs, compounding pharmacies can step in to produce these medications to ensure continued patient access. The American Society of Health-System Pharmacists (ASHP) regularly publishes lists of drug shortages, with 323 active drug shortages reported as of Q3 2023, a significant increase from 287 in Q1 2023.

As of July 31, 2024, the FDA was tracking 102 drug shortages, and more than 40% of these began in 2022 or earlier, highlighting a persistent need for alternative sources. This capability to provide critical medications when commercial alternatives are unavailable positions compounding pharmacies as a vital component of the healthcare system, especially for specialized topical treatments where shortages can severely impact patient care. This role of filling gaps in the pharmaceutical supply chain drives demand and creates opportunities for expansion.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic factors significantly influence the compounded topical drug market, particularly through their impact on healthcare expenditure and consumer spending patterns. During periods of economic prosperity, patients and healthcare systems are generally more willing to invest in customized, often higher-cost, compounded medications.

Conversely, economic downturns or rising inflation can lead to budget constraints, making patients and payers more hesitant to opt for compounded alternatives over standard, more affordable generic drugs. The US pharmaceutical trade deficit reached US$ 139 billion in 2024, out of a total of US$ 1.2 trillion for all goods, according to the U.S. Census Bureau, underscoring the vast economic implications within the broader pharmaceutical sector.

Geopolitical factors, such as trade policies and global supply chain stability for active pharmaceutical ingredients (APIs), are also crucial. Disruptions in the global supply of APIs due to geopolitical tensions can affect the availability and cost of raw materials for compounding pharmacies. However, the fundamental need for personalized treatments, especially for chronic conditions where standard drugs are unsuitable, provides a baseline of demand that often allows this market to demonstrate resilience amidst broader economic and political shifts.

Current US tariff policies can have a direct impact on the compounded topical drug market. Tariffs imposed on imported active pharmaceutical ingredients (APIs) or other raw materials used in compounding can increase the operational costs for compounding pharmacies. For instance, the US increased its reliance on China for medication imports, doubling them between 2020 and 2022, as reported by the US Census Bureau.

The Budget Lab at Yale, in a June 2025 analysis, indicated that all 2025 tariffs could raise the overall US price level by 1.5% in the short run, equivalent to an average per-household consumer loss of US$2,500 in 2024 dollars. This could translate to higher prices for compounded topical drugs, impacting patient affordability and limiting access.

However, these tariffs could also encourage a shift towards domestic sourcing of APIs and other components within the US. This might lead to a more secure and localized supply chain for compounded medications, reducing reliance on foreign suppliers and potentially enhancing the resilience and reliability of the domestic compounding industry in the long term.

Latest Trends

Increased Adoption of Tele-dermatology is a Recent Trend

A prominent recent trend in the compounded topical drug market is the increasing adoption of tele-dermatology services. Tele-dermatology allows patients to consult with dermatologists remotely for skin conditions, and these virtual consultations can often lead to prescriptions for compounded topical medications tailored to their specific needs. This trend has been amplified by the lasting impact of the COVID-19 pandemic, which accelerated the use of virtual healthcare services.

The Centers for Disease Control and Prevention (CDC) reported in June 2022 that telehealth visits increased by 37.0% among adults in the US during the past 12 months, indicating a broad embrace of remote care.

A study published in JAMA Network Open in October 2023 (analyzing data up to 2022) found a substantial increase in outpatient mental health visits via telehealth, demonstrating widespread integration of virtual care in specialties that can also prescribe compounded medications. This ease of access for dermatological consultations, especially for chronic or sensitive skin conditions, makes it more convenient for patients to receive personalized compounded formulations, thereby driving the demand for these specialized topical drugs.

Regional Analysis

North America is leading the Compounded Topical Drug Market

North America dominated the market with the highest revenue share of 39.8% owing to the increasing demand for highly personalized medicine solutions. Physicians and patients often seek customized formulations to address specific medical needs that are not met by commercially available products.

This includes adjusting dosages for pediatric or geriatric patients, creating allergen-free preparations for sensitive individuals, or combining multiple active ingredients into a single topical application for enhanced convenience. The flexibility offered by compounding pharmacies allows for tailored therapeutic approaches, particularly for dermatological conditions, pain management, and hormone replacement therapies. This responsiveness to individual patient requirements is a key factor supporting the market’s expansion across the region.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to the region’s expanding healthcare infrastructure and a rising awareness of personalized treatment options among both healthcare providers and patients. As the prevalence of various dermatological conditions increases, so does the demand for customized topical preparations that can address unique patient sensitivities or specific therapeutic needs.

The growing adoption of advanced pharmaceutical techniques and the increasing number of skilled compounding pharmacists in countries across Asia Pacific will also facilitate market expansion. This growing emphasis on patient-centric care and the ability to provide tailored medications will likely drive the demand for these specialized topical formulations.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the compounded topical drug market employ strategies such as expanding their product offerings, focusing on personalized formulations, and forming partnerships with healthcare providers to enhance patient outcomes. Companies leverage advancements in technology and formulation science to improve the precision and efficacy of their products.

They also invest in regulatory approvals and compliance to ensure market access. Additionally, key players strengthen their market position by increasing their distribution networks and targeting emerging markets where the demand for customized topical therapies is growing.

ImprimisRx is a leading provider of compounded pharmaceutical products, including topical treatments for various conditions such as pain management and dermatological disorders. The company specializes in creating customized, patient-specific formulations that are tailored to individual needs. ImprimisRx focuses on expanding its reach through strategic partnerships with physicians and pharmacies, aiming to provide affordable, high-quality compounded drugs while adhering to strict regulatory standards.

Top Key Players

- Medisca

- Hello Cake

- Eucalyptus

- Epiq Scripts

- Calgary Co-op

- B Braun Melsungen AG

- Aurora Health Care

- Apollo Clinical Pharmacy

Recent Developments

- In July 2024, Hello Cake, a startup in sexual health, introduced two new prescription medications: Libido Lift Rx, a dissolvable tablet, and O-Cream, a topical sildenafil treatment to be applied directly to the vagina. Both products are compounded by Epiq Scripts, a digital pharmacy company. This launch is expected to expand the sexual health market by offering convenient, personalized treatment options, enhancing libido, and improving sexual wellness for individuals seeking specialized solutions.

- In September 2023, Medisca unveiled the Medisca MAZ Mixer, an innovative compounding technology aimed at delivering efficient, uniform, and high-quality solutions for a broad range of formulations. This advancement is expected to drive the pharmaceutical compounding market by improving the precision and consistency of compounded medications, ultimately enhancing the quality of customized treatments available to patients.

Report Scope

Report Features Description Market Value (2024) US$ 4.3 Billion Forecast Revenue (2034) US$ 6.8 Billion CAGR (2025-2034) 4.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Cream, Ointment, Lotion, and Gel), By Application (Retail Pharmacy, Hospital Pharmacy, Online Pharmacy, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Medisca, Hello Cake, Eucalyptus, Epiq Scripts, Calgary Co-op, B Braun Melsungen AG, Aurora Health Care, Apollo Clinical Pharmacy. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Compounded Topical Drug MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Compounded Topical Drug MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Medisca

- Hello Cake

- Eucalyptus

- Epiq Scripts

- Calgary Co-op

- B Braun Melsungen AG

- Aurora Health Care

- Apollo Clinical Pharmacy