Global Composite Panels Market By Product Type (Aluminium Composite Panel, Steel Composite Panel, Copper Composite Panel, Zinc Composite Panel, Others), By Coating Type (Polyester, Polyvinylidene Fluoride, Polyethylene, Others), By Category (Fire Retardant, Anti-static, Anti-Bacterial), By Thickness (3mm, 4mm, 6mm, Others), By Core Material (Polystyrene, Polyurethane, Phenolic, Polyisocyanurate, Mineral Fibre/Glass Wool, Others), By Application (Interior, Exterior, Signage and Display, Autobody, Others), By End-use (Building And Construction, Automotive, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 151448

- Number of Pages: 367

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

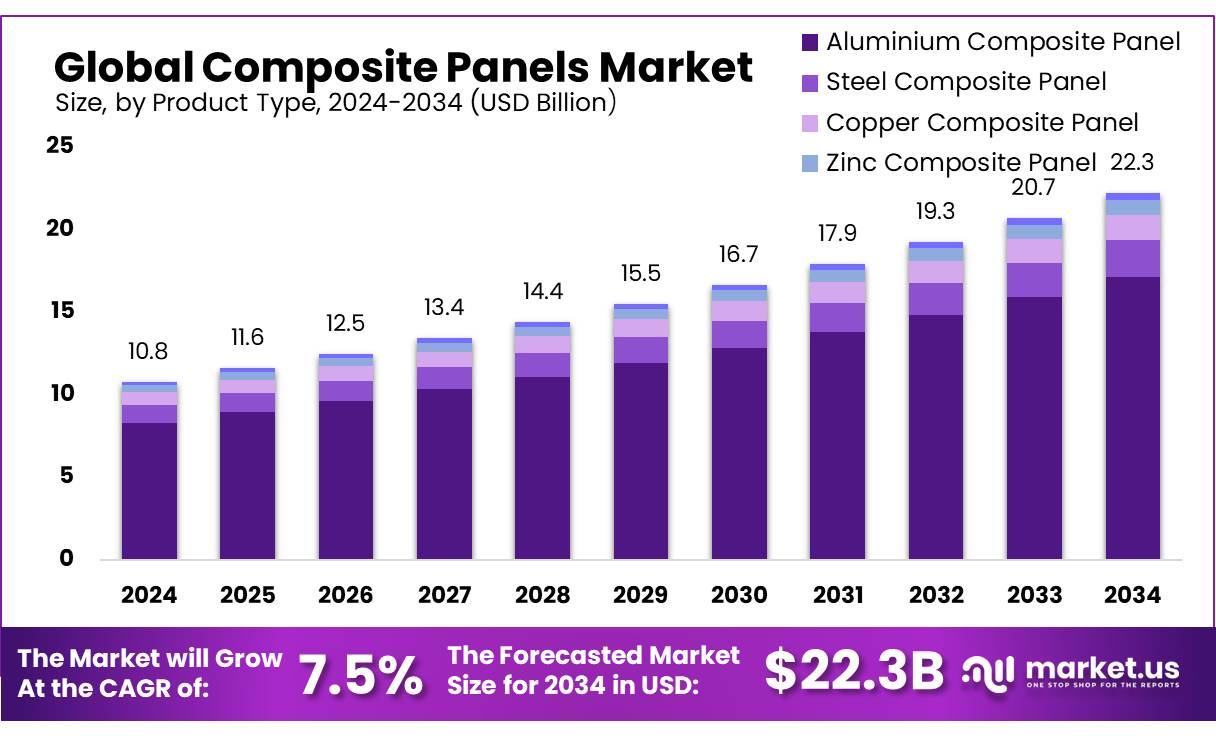

The Global Composite Panels Market size is expected to be worth around USD 22.3 Billion by 2034, from USD 10.8 Billion in 2024, growing at a CAGR of 7.5% during the forecast period from 2025 to 2034.

Composite panel concentrates—comprising thermoset or thermoplastic matrices reinforced with fibers (e.g., glass, carbon)—are fundamental components in sandwich panels widely utilized across building façades, transportation, aerospace, and renewable energy sectors. Thermoset polymers remain dominant (≈80% of the reinforced polymer composites market) due to their favorable viscosity during processing.

Key driving factors for composite panels concentrates include structural advantages such as decreased wall load due to lower panel thickness, enhanced insulation properties, and aesthetic flexibility. These characteristics align with the growing global emphasis on sustainable and green-building certifications. Furthermore, government policies incentivising efficiency and renewable energy contribute indirectly to demand. For example, India’s National Solar Mission aims to achieve 500 GW of renewable capacity by 2030—250 GW from solar—prompting a rise in solar-ready façade materials including composite panels. Such large-scale renewable targets help stimulate associated industries, including panel manufacturing.

The National Mission on Enhanced Energy Efficiency (NMEEE), buildings and appliances are being regulated to improve energy intensity; energy-intensive industries are expected to avoid 19,598 MW capacity additions and save roughly 23 million tonnes of fuel annually. Additionally, India’s National Mission on Sustainable Habitat under the National Action Plan for Climate Change supports use of energy-efficient facades and insulation. The European Union’s circular economy and biotechnology initiatives are encouraging adoption of bio-based composite panels, with studies demonstrating that such bio-materials can reduce embodied carbon by approximately 20%, potentially sequestering over 320,000 tons of CO2 by 2050

Governmental agencies emphasise reducing lifecycle energy consumption. For instance, in the U.S., the 2021 International Energy Conservation Code (IECC) has promoted a 12.1% reduction in site energy use and 10.6% cost savings, compared to its 2018 version. Adoption of composite panels in building envelopes plays a critical role in achieving these efficiencies.

Key Takeaways

- Composite Panels Market size is expected to be worth around USD 22.3 Billion by 2034, from USD 10.8 Billion in 2024, growing at a CAGR of 7.5%.

- Aluminium Composite Panel held a dominant market position, capturing more than a 77.40% share of the overall composite panels market.

- Polyester held a dominant market position, capturing more than a 51.40% share in the composite panels market.

- Fire Retardant held a dominant market position, capturing more than a 63.40% share in the composite panels market.

- 4mm held a dominant market position, capturing more than a 47.50% share in the composite panels market.

- Polystyrene held a dominant market position, capturing more than a 28.40% share in the composite panels market.

- Exterior held a dominant market position, capturing more than a 43.10% share in the composite panels market.

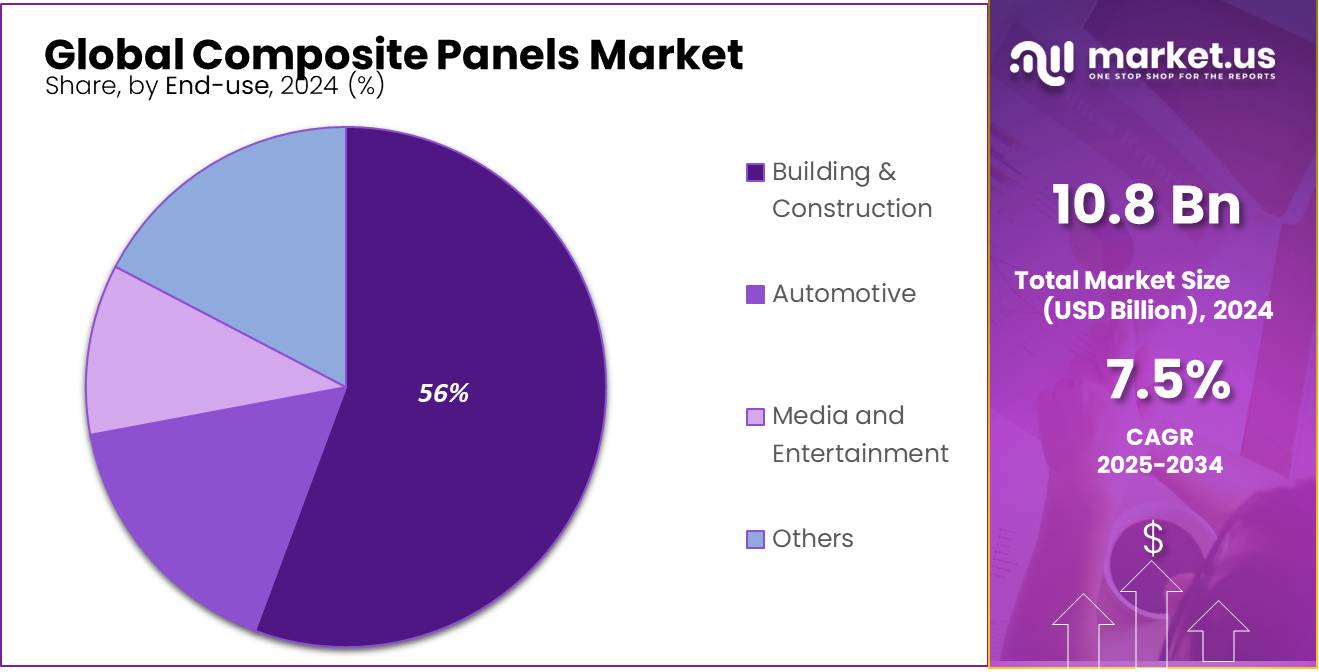

- Building & Construction held a dominant market position, capturing more than a 56.40% share in the composite panels market.

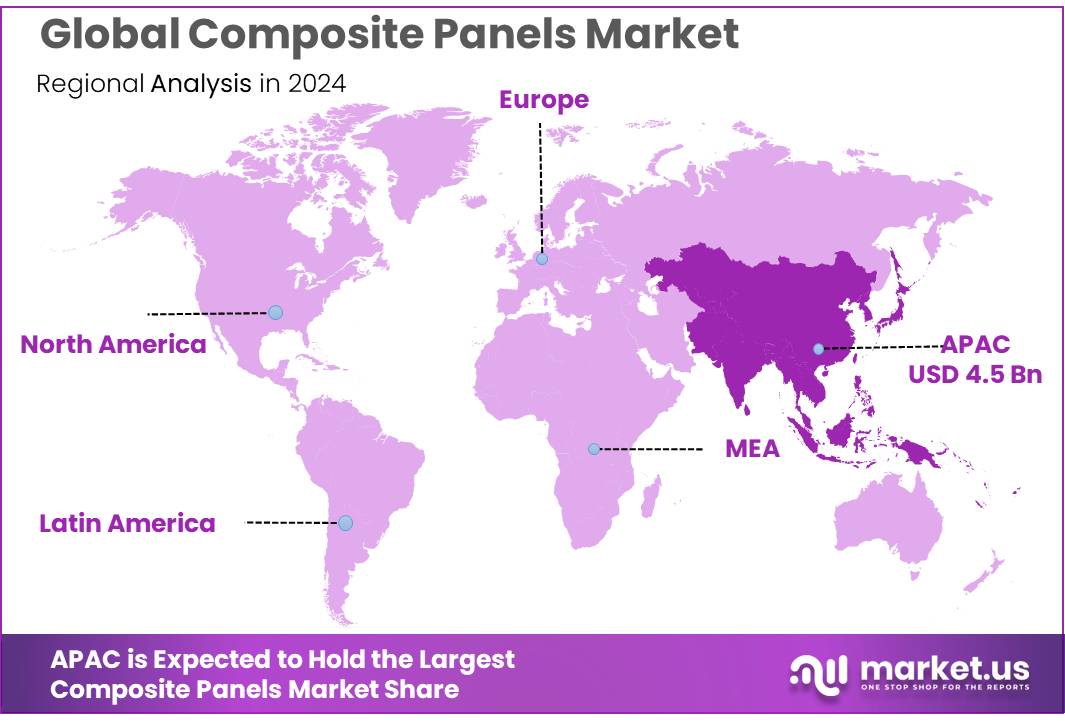

- Asia-Pacific (APAC) region held a dominant position in the global composite panels market, accounting for 42.20% of the total market share, with a valuation of approximately USD 4.5 billion.

By Product Type

Aluminium Composite Panel leads with 77.40% in 2024, driven by strong demand across building façades and signage applications.

In 2024, Aluminium Composite Panel held a dominant market position, capturing more than a 77.40% share of the overall composite panels market. This high share is largely due to its growing use in construction and architecture, especially for exterior cladding, curtain walls, and interior partitions. Aluminium Composite Panels (ACP) are known for being lightweight, corrosion-resistant, and easy to install, which makes them highly preferred for modern infrastructure projects.

Their adaptability in terms of color, design, and surface finish has also increased their popularity in commercial signage and advertising displays. As urban construction activities continue to expand in both developing and developed countries, ACPs have become the go-to solution for cost-effective, durable, and aesthetically appealing paneling. In 2025, this segment is expected to retain its lead, supported by ongoing smart city projects and sustainable building initiatives, particularly in Asia-Pacific and the Middle East.

By Coating Type

Polyester coating leads with 51.40% in 2024, favored for its cost-efficiency and dependable outdoor durability.

In 2024, Polyester held a dominant market position, capturing more than a 51.40% share in the composite panels market by coating type. This strong performance is largely due to the coating’s balanced mix of affordability, weather resistance, and visual appeal. Polyester-coated composite panels are widely used in construction for both residential and commercial buildings, especially in mid-range applications where durability and color retention are important but cost remains a key consideration. Its ease of application and good adhesion properties also make it a preferred choice among manufacturers. Looking into 2025, the polyester coating segment is expected to maintain its leading share, supported by continued demand from real estate and infrastructure sectors in emerging markets, where cost-effective yet reliable materials are in high demand.

By Category

Fire Retardant panels dominate with 63.40% in 2024, driven by rising safety standards in modern construction.

In 2024, Fire Retardant held a dominant market position, capturing more than a 63.40% share in the composite panels market by category. This strong lead is primarily due to increasing global awareness around fire safety regulations, especially in high-rise buildings, public infrastructure, and commercial complexes. Fire retardant composite panels offer better resistance to flame spread and smoke emission, making them a preferred choice for architects and builders aiming to meet updated building codes and insurance requirements. Their use has grown rapidly in both developed and developing nations as fire safety compliance becomes more strictly enforced. In 2025, the category is expected to maintain its leadership, supported by expanding infrastructure investments and a growing shift toward safer, performance-certified materials in both residential and commercial projects.

By Thickness

4mm panels lead with 47.50% in 2024, favored for their versatility across exterior cladding and signage use.

In 2024, 4mm held a dominant market position, capturing more than a 47.50% share in the composite panels market by thickness. This specific thickness is widely accepted as the standard for a broad range of applications, particularly in exterior building facades, curtain wall systems, and commercial signage. Its balanced profile offers sufficient rigidity and durability while keeping the weight and cost in check, making it a practical choice for both builders and designers. The 4mm panels are especially popular in urban construction projects, where both aesthetic appeal and structural reliability are important. In 2025, this segment is expected to maintain its strong position, supported by steady growth in construction activities across Asia-Pacific, Middle East, and parts of Eastern Europe, where cost-effective and technically compliant materials are in strong demand.

By Core Material

Polystyrene core leads with 28.40% in 2024, driven by its lightweight nature and strong insulation properties.

In 2024, Polystyrene held a dominant market position, capturing more than a 28.40% share in the composite panels market by core material. Its popularity stems from being lightweight, easy to handle, and offering excellent thermal insulation, which makes it especially suitable for temperature-controlled environments such as cold storage, food processing units, and insulated building panels. The cost-effectiveness of polystyrene, combined with its decent structural strength, has made it a reliable option for projects aiming to balance performance and budget. In 2025, polystyrene-based panels are expected to retain steady demand, particularly in industrial and commercial construction sectors across Asia-Pacific and Latin America, where energy efficiency standards and affordability continue to shape material choices.

By Application

Exterior applications lead with 43.10% in 2024, supported by rising use in modern building facades and urban infrastructure.

In 2024, Exterior held a dominant market position, capturing more than a 43.10% share in the composite panels market by application. The demand for composite panels in exterior applications continues to grow due to their durability, weather resistance, and modern aesthetic appeal. These panels are widely used in building facades, wall cladding, curtain walls, and public structures, offering both protective and decorative benefits. As cities invest more in commercial complexes, airports, metro stations, and smart buildings, the need for long-lasting and lightweight panel systems has increased sharply. In 2025, the segment is expected to maintain its leading share, driven by rapid urban development in Asia and the Middle East, as well as stricter energy efficiency regulations pushing builders to adopt high-performance cladding materials.

By End-use

Building & Construction leads with 56.40% in 2024, backed by fast-paced urban development and demand for energy-efficient materials.

In 2024, Building & Construction held a dominant market position, capturing more than a 56.40% share in the composite panels market by end-use. The segment’s leadership is strongly linked to the surge in residential, commercial, and institutional construction activities worldwide. Composite panels are widely used in walls, facades, partitions, ceilings, and insulation systems due to their lightweight nature, ease of installation, and long-term durability.

Their ability to meet fire safety norms and energy efficiency standards has further increased their use in both public infrastructure and private developments. In 2025, demand from this sector is expected to stay strong, especially in fast-growing regions like Asia-Pacific and the Middle East, where smart cities, industrial parks, and green building initiatives are gaining pace.

Key Market Segments

By Product Type

- Aluminium Composite Panel

- Steel Composite Panel

- Copper Composite Panel

- Zinc Composite Panel

- Others

By Coating Type

- Polyester

- Polyvinylidene Fluoride

- Polyethylene

- Others

By Category

- Fire Retardant

- Anti-static

- Anti-Bacterial

By Thickness

- 3mm

- 4mm

- 6mm

- Others

By Core Material

- Polystyrene

- Polyurethane

- Phenolic

- Polyisocyanurate

- Mineral Fibre/Glass Wool

- Others

By Application

- Interior

- Exterior

- Signage and Display

- Autobody

- Others

By End-use

- Building & Construction

- Residential

- Commercial

- Industrial

- Automotive

- Passenger Cars

- Light Commercial Vehicles

- Media and Entertainment

- Others

Drivers

Increasing Demand for Sustainable Packaging Solutions

One of the key driving factors for the growth of the composite panels market is the rising demand for sustainable packaging solutions across industries, including the food sector. Food manufacturers and packaging companies are increasingly looking for alternatives to traditional materials such as plastic and metal. This shift is driven by both environmental concerns and the growing preference for eco-friendly products among consumers.

A prime example of this trend is evident in the food packaging sector. In recent years, organizations like Nestlé and PepsiCo have committed to making their packaging more sustainable. Nestlé, for instance, has pledged to make all of its packaging recyclable or reusable by 2025. By doing so, they aim to reduce their environmental footprint, especially regarding single-use plastics. This initiative is part of a broader effort by the food industry to reduce waste and improve resource efficiency.

Governments worldwide are also supporting this shift with regulatory policies aimed at reducing packaging waste. For example, the European Union has introduced regulations requiring packaging to be recyclable and to contain a minimum amount of recycled content. These initiatives have made it clear that sustainable packaging is not only desirable but necessary for companies to comply with regulatory standards and consumer expectations. This is pushing companies in the food industry to explore materials like composite panels, which offer a strong yet lightweight alternative to traditional packaging materials.

Restraints

High Production Costs and Limited Availability of Raw Materials

One of the significant challenges facing the composite panels market is the high production costs and limited availability of raw materials. While composite panels offer several advantages, such as being lightweight, durable, and sustainable, the cost of manufacturing them remains a significant barrier. The production of composite panels often requires specialized raw materials such as advanced polymers, fiberglass, or bio-based fibers, which can be expensive compared to traditional materials like wood, metal, or plastic.

In the food industry, companies like Unilever and Coca-Cola are committed to using sustainable materials in their packaging. However, the cost of sourcing these materials can be prohibitive. Unilever, for example, has set a target to make 100% of its plastic packaging recyclable, reusable, or compostable by 2025. While this is an admirable goal, it has highlighted the economic challenges of transitioning to sustainable packaging materials. The cost of raw materials like biodegradable composites or recycled fibers can sometimes exceed that of conventional plastic packaging, leading to higher production costs for manufacturers.

Moreover, the limited availability of raw materials for composite panels can also affect production scalability. While there is a growing demand for sustainable packaging, the supply chain for bio-based materials is not as robust as for traditional materials. This can lead to delays and price fluctuations, making it difficult for manufacturers to secure consistent supplies of the necessary raw materials at competitive prices.

Governments and regulatory bodies are making efforts to support sustainable packaging initiatives. For instance, the European Union’s Circular Economy Action Plan encourages the use of recycled materials in packaging, but the economic reality of raw material availability and production costs remains a significant challenge. Until the cost of production decreases and supply chains for bio-based raw materials become more stable, the widespread adoption of composite panels will continue to be constrained.

Opportunity

Expansion of the Food Packaging Industry Towards Eco-Friendly Solutions

A major growth opportunity for the composite panels market lies in the expanding demand for eco-friendly food packaging solutions. As more food companies are setting sustainability targets, there is a shift away from traditional packaging materials like plastic, which have a significant environmental impact. Food industry giants such as Nestlé and PepsiCo are leading the way in adopting sustainable practices, driving the demand for innovative packaging solutions like composite panels. Nestlé, for instance, has committed to making 100% of its packaging recyclable or reusable by 2025, and PepsiCo aims to achieve similar goals for its plastic packaging.

This focus on sustainability aligns with the growing consumer preference for eco-conscious products. Consumers are increasingly seeking products that align with their values, such as reducing waste and supporting environmental protection. According to a study by the Environmental Protection Agency (EPA), over 60% of consumers in the U.S. express interest in purchasing products that use sustainable packaging. This consumer trend is creating a substantial opportunity for companies in the food packaging sector to adopt composite panels as a viable alternative.

Governments are also playing a role in encouraging this shift. For example, the European Union’s Circular Economy Action Plan sets ambitious recycling targets for packaging materials, pushing companies to explore sustainable alternatives. This initiative is particularly significant for composite panels made from renewable or recycled materials, which fit well within these regulations. As governments continue to tighten regulations on packaging waste and set higher sustainability standards, food companies will increasingly look to composite panels to meet these requirements.

Trends

Shift Towards Mono-Material and Biodegradable Packaging

A prominent trend in the composite panels market is the increasing adoption of mono-material and biodegradable packaging solutions. This shift is driven by consumer demand for sustainable products and stringent regulatory measures aimed at reducing plastic waste.

Leading food companies like Nestlé and PepsiCo are at the forefront of this transformation. Nestlé has committed to making 100% of its plastic packaging recyclable or reusable by 2025 and has already achieved 43.2% renewable or recycled content across all its packaging. Similarly, PepsiCo’s sustainable packaging strategy focuses on reducing plastic use, supporting recycling, and exploring alternative materials such as compostable options.

This trend is also supported by government initiatives. For instance, the European Union’s Circular Economy Action Plan aims to make all packaging recyclable by 2030, promoting the use of sustainable materials . In France, the Anti-Waste and Circular Economy Law encourages the use of recyclable and biodegradable packaging and prohibits the destruction of unsold goods, further incentivizing companies to adopt sustainable practices.

The growing emphasis on mono-material and biodegradable packaging presents a significant growth opportunity for the composite panels market. As food companies strive to meet sustainability goals and comply with regulations, the demand for eco-friendly packaging solutions is expected to rise, driving innovation and investment in this sector.

Regional Analysis

Asia-Pacific dominates with 42.20% share in 2024, valued at USD 4.5 billion, driven by construction growth and manufacturing scale.

In 2024, the Asia-Pacific (APAC) region held a dominant position in the global composite panels market, accounting for 42.20% of the total market share, with a valuation of approximately USD 4.5 billion. This leadership can be attributed to the region’s strong construction activity, rapid urban development, and large-scale infrastructure investments across key economies such as China, India, Japan, South Korea, and Southeast Asian countries. The surge in commercial and residential construction projects—especially in high-rise buildings, airports, metro rail networks, and industrial parks—has significantly boosted the demand for aluminum composite panels, fire-retardant panels, and insulated wall systems.

China remains the largest contributor in APAC, supported by its massive building sector and large-scale public infrastructure plans. According to the Ministry of Housing and Urban-Rural Development of China, urban construction projects are expected to cover over 90 million square meters in 2025, further driving panel demand. India is also witnessing a rise in composite panel usage due to its Smart Cities Mission and increasing preference for energy-efficient building materials. Additionally, the manufacturing capacity for composite panel components, such as aluminum sheets, core materials, and coatings, is more cost-effective in the region, enhancing local production and export capability.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Grossbond, established in 2006 in Moscow, is a recognized manufacturer of aluminium composite panels, including fire-resistant variants under the “Grossbond” and “Grossbond FR” brands. The company provides a versatile range of ACP suitable for building facades, interior partitions, signage, and even vehicle bodies. Products are noted for their weather resistance, light weight, and ease of fabrication. Grossbond’s strategic positioning in Russia and expansion into export markets underscores its regional influence and technical reliability.

ReynoArch India is a full spectrum producer of aluminium composite panels (ACP) and high-pressure laminates (HPL), operating from a modern facility spanning 8 acres in Rajasthan. Since its inception in 2020, it has steadily built a reputation for quality, offering premium and economic ACP lines, including fire-resistant EN-certified panels under its “ReynoArch” brand. The company focuses on innovation, color consistency, and versatility, serving markets demanding both aesthetic appeal and cost-effective performance.

Maxmetal, a North American brand, specializes in aluminium composite panels designed for graphics and signage. The product line includes standard 3 mm panels with two 0.15 mm aluminium skins bonded to polyethylene cores, offering UL certification, digital-printing compatibility, and heavy-duty versions like Maxmetal HD with thicker skins. Maxmetal panels are prized for their durability, lightweight characteristics, and excellent coating adhesion, serving design-intensive applications such as signage, display, and electrical housing.

Top Key Players in the Market

- Aludecor

- Kingmets New Material Co., Limited

- ALUMAX Composite Material Co.,Ltd.

- Hunan Huabond Technologies Co., Ltd.

- Grossbond

- ReynoArch India

- Jyi Shyang Industrial Co., Ltd.

- Maxmetal

- Sundream Group

- Zhejiang Geely Decorating Materials Co.,Ltd

- Eurobond

- VMZINC

- Arconic

- Mitsubishi Chemical

- 3A Composites

- Alubond U.S.A.

- Shanghai Huayuan New Composite Materials

- Hyundai Alcomax Co., Ltd

- Fairfield Metal LLC

- Alstrong Enterprises India (Pvt) Ltd

- Qatar National Aluminium Panel Company

- Kendy Cladding

- RMK INDUSTRIES LLC

- Sykon GmbH

- Other Key Players

Recent Developments

In 2024 ReynoArch India, secured India’s first and only ISI certification for Aluminium Composite Panels (ACP) under ISo 17682:2021, solidifying its technical credentials and commitment to meeting rigorous standards.

In 2024, Maxmetal reported supplying standard 3 mm panels with two 0.15 mm aluminum skins bonded to a polyethylene core and introduced a 6 mm heavy-duty variant for extra rigidity.

Report Scope

Report Features Description Market Value (2024) USD 10.8 Bn Forecast Revenue (2034) USD 22.3 Bn CAGR (2025-2034) 7.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Aluminium Composite Panel, Steel Composite Panel, Copper Composite Panel, Zinc Composite Panel, Others), By Coating Type (Polyester, Polyvinylidene Fluoride, Polyethylene, Others), By Category (Fire Retardant, Anti-static, Anti-Bacterial), By Thickness (3mm, 4mm, 6mm, Others), By Core Material (Polystyrene, Polyurethane, Phenolic, Polyisocyanurate, Mineral Fibre/Glass Wool, Others), By Application (Interior, Exterior, Signage and Display, Autobody, Others), By End-use (Building And Construction, Automotive, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Aludecor, Kingmets New Material Co., Limited, ALUMAX Composite Material Co.,Ltd., Hunan Huabond Technologies Co., Ltd., Grossbond, ReynoArch India, Jyi Shyang Industrial Co., Ltd., Maxmetal, Sundream Group, Zhejiang Geely Decorating Materials Co.,Ltd, Eurobond, VMZINC, Arconic, Mitsubishi Chemical, 3A Composites, Alubond U.S.A., Shanghai Huayuan New Composite Materials, Hyundai Alcomax Co., Ltd, Fairfield Metal LLC, Alstrong Enterprises India (Pvt) Ltd, Qatar National Aluminium Panel Company, Kendy Cladding, RMK INDUSTRIES LLC, Sykon GmbH, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Aludecor

- Kingmets New Material Co., Limited

- ALUMAX Composite Material Co.,Ltd.

- Hunan Huabond Technologies Co., Ltd.

- Grossbond

- ReynoArch India

- Jyi Shyang Industrial Co., Ltd.

- Maxmetal

- Sundream Group

- Zhejiang Geely Decorating Materials Co.,Ltd

- Eurobond

- VMZINC

- Arconic

- Mitsubishi Chemical

- 3A Composites

- Alubond U.S.A.

- Shanghai Huayuan New Composite Materials

- Hyundai Alcomax Co., Ltd

- Fairfield Metal LLC

- Alstrong Enterprises India (Pvt) Ltd

- Qatar National Aluminium Panel Company

- Kendy Cladding

- RMK INDUSTRIES LLC

- Sykon GmbH

- Other Key Players