Global Complementary and Alternative Medicine for Anti Aging & Longetivity Market By Therapy Type (Traditional Alternative Medicine/Botanicals, Body Healing, Mind Healing, External Energy Healing, Sensory Healing (Aromatherapy and Sound Healing)), By Age-Group (36-50 Years and 51 Years and Above), By End-User (Fitness, Yoga & Wellness Centers, Integrative & Alternative Medicine Hospitals, Homecare Settings, Natural Skincare Clinics, Corporate Wellness Programs and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 171458

- Number of Pages: 361

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

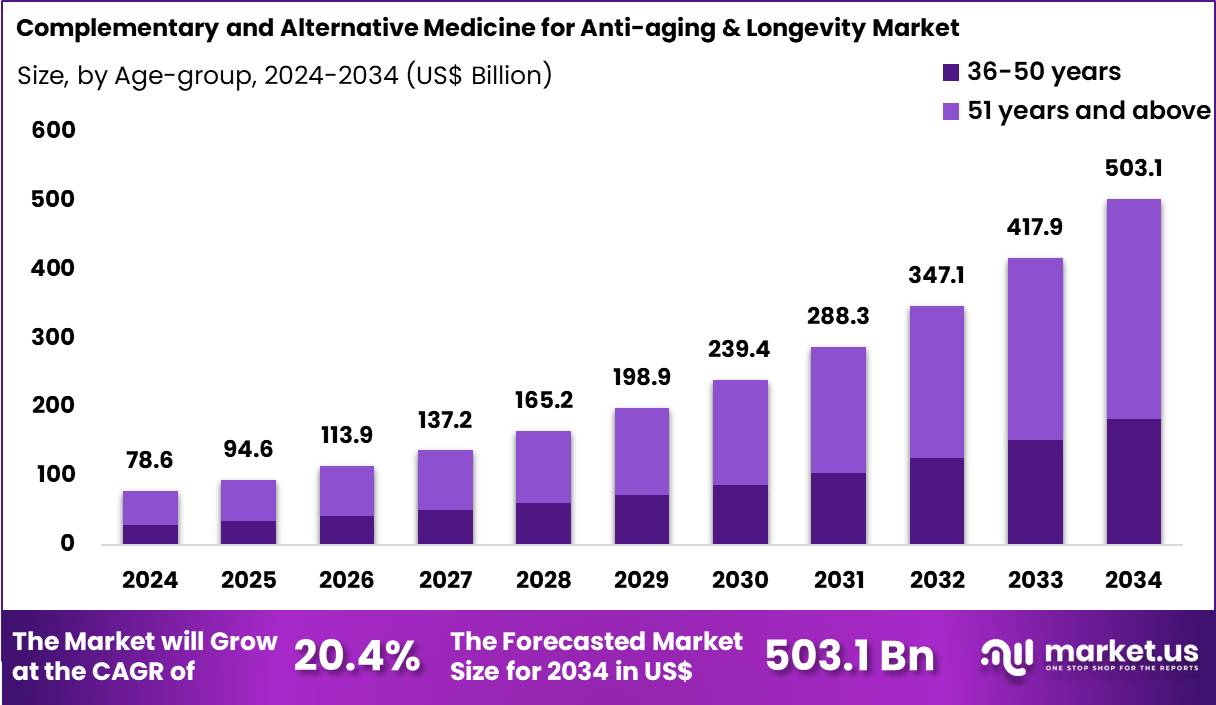

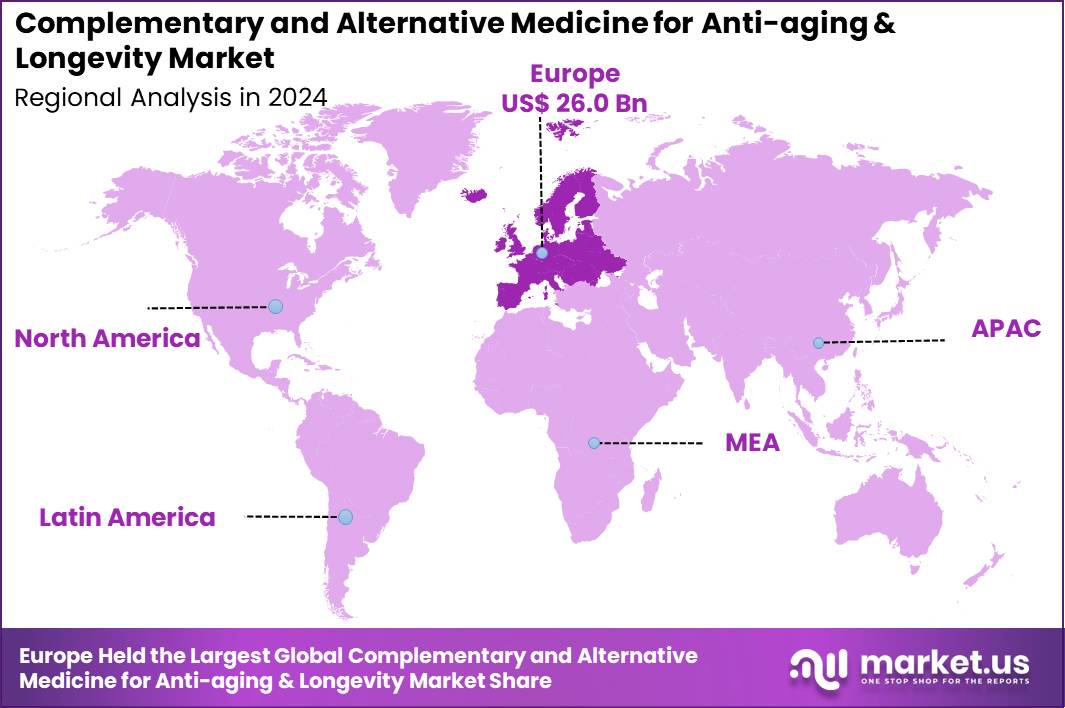

The Global Complementary and Alternative Medicine for Anti Aging & Longetivity Market size is expected to be worth around US$ 503.1 Billion by 2034 from US$ 78.6 Billion in 2024, growing at a CAGR of 20.4% during the forecast period 2025 to 2034. In 2024, Europe led the market, achieving over 33.1% share with a revenue of US$ 26.0 Billion.

Growing consumer preference for holistic wellness strategies accelerates demand for complementary and alternative medicine approaches that promote graceful aging and extended vitality through natural interventions. Individuals increasingly incorporate herbal formulations to support skin elasticity and reduce visible wrinkles, leveraging plant-derived antioxidants for dermal repair and hydration.

Practitioners apply acupuncture techniques to enhance energy flow and alleviate age-related joint stiffness, fostering improved mobility and pain management. These therapies address hormonal imbalances via tailored botanical regimens that stabilize endocrine function and mitigate menopausal symptoms. Consumers adopt mindfulness practices to combat cognitive fog, strengthening neural resilience and memory retention over time.

In July 2024, iHerb expanded its wellness portfolio by introducing Martha Stewart Wellness products, strengthening its position in the complementary and alternative medicine for anti aging and longevity market. This launch drives market growth by improving accessibility to lifestyle oriented supplements that align with preventive health and graceful aging trends.

Leveraging a trusted consumer brand increases confidence in alternative health products and encourages adoption among mainstream consumers. The expansion of curated wellness offerings on global e commerce platforms supports wider penetration of anti aging and longevity focused complementary therapies.

Providers identify opportunities to blend traditional Ayurvedic principles with modern nutraceuticals, creating personalized protocols that optimize metabolic health and sustain energy levels in midlife transitions. Companies develop energy healing modalities to bolster immune surveillance, reducing susceptibility to inflammation-driven degenerative processes. These interventions facilitate cardiovascular reinforcement through yoga-integrated routines that lower blood pressure and enhance vascular flexibility.

Opportunities expand in adaptogenic herb applications for stress adaptation, enabling cellular protection against oxidative damage and premature senescence. Firms pursue integrative fasting guidance combined with herbal support to activate autophagy pathways, promoting tissue renewal and longevity markers. Enterprises invest in biofeedback tools that monitor physiological responses, allowing fine-tuned adjustments for sustained physical performance and recovery.

Industry specialists integrate genomic insights with traditional Chinese medicine diagnostics to craft bespoke regimens that target epigenetic modifiers for prolonged cellular integrity. Practitioners advance sound therapy vibrations to harmonize mitochondrial function, elevating ATP production and combating fatigue in aging populations. Market leaders formulate polyphenol-rich elixirs that fortify gut microbiota diversity, underpinning systemic anti-inflammatory effects and extended healthspan.

Innovators refine aromatherapy protocols using essential oils to modulate neuroendocrine axes, curbing cortisol excess and preserving telomere length. Companies emphasize communal meditation frameworks that cultivate social connectivity, countering isolation-induced accelerated decline. Emerging protocols validate pulse electromagnetic fields for bone density preservation, integrating seamlessly with naturopathic bone broth therapies for comprehensive skeletal vitality.

Key Takeaways

- In 2024, the market generated a revenue of US$ 78.6 Billion, with a CAGR of 20.4%, and is expected to reach US$ 503.1 Billion by the year 2034.

- The therapy type segment is divided into traditional alternative medicine/botanicals, body healing, mind healing, external energy healing and sensory healing, with traditional alternative medicine/botanicals taking the lead in 2024 with a market share of 35.3%.

- Considering age-group, the market is divided into 36-50 years and 51 years and above. Among these, 51 years and above held a significant share of 63.7%.

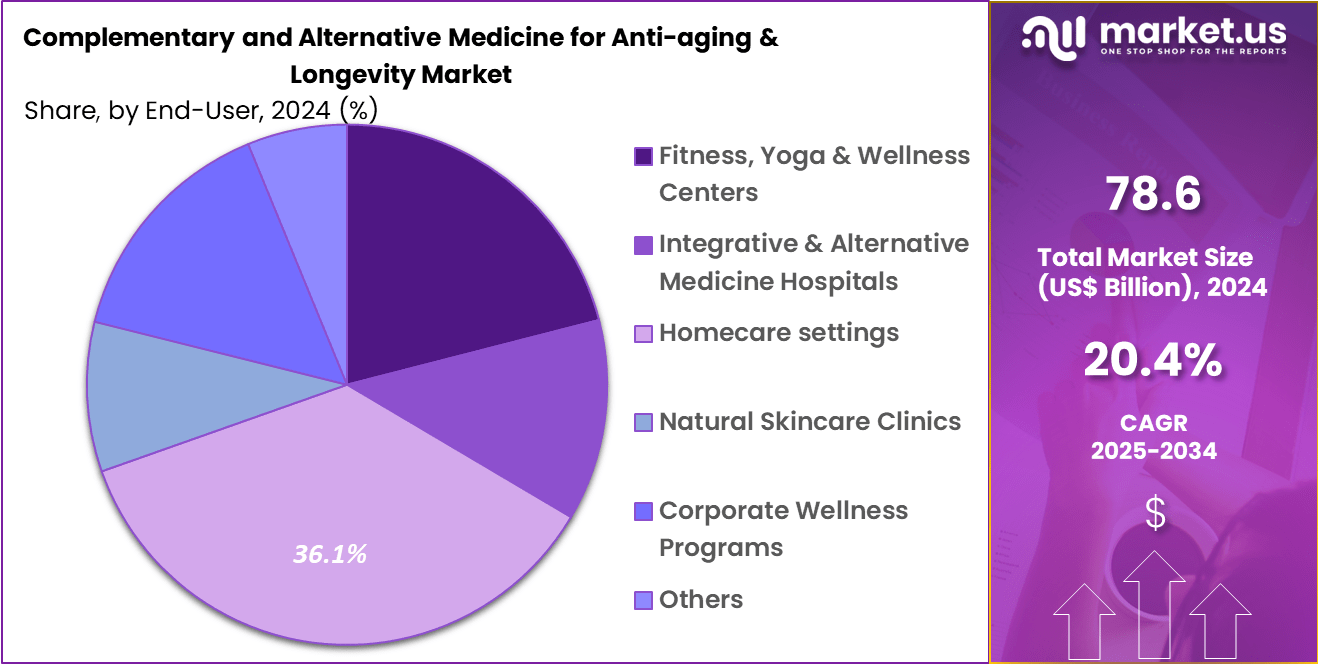

- Furthermore, concerning the end-user segment, the market is segregated into fitness, yoga & wellness centers, integrative & alternative medicine hospitals, homecare settings, natural skincare clinics, corporate wellness programs and others. The homecare settings sector stands out as the dominant player, holding the largest revenue share of 36.1% in the market.

- Europe led the market by securing a market share of 33.1% in 2024.

Therapy Type Analysis

Traditional alternative medicine and botanicals, holding 35.3%, are expected to dominate because consumers increasingly seek natural and plant-based therapies to slow aging and support long-term health. Herbal formulations, Ayurveda, traditional Chinese medicine, and nutraceutical botanicals gain strong acceptance due to their historical use and perceived safety profile. Aging populations prefer therapies that focus on holistic rejuvenation rather than symptom-based pharmaceutical interventions.

Scientific validation of botanical antioxidants, adaptogens, and anti-inflammatory compounds strengthens credibility among healthcare practitioners. Rising concerns over side effects associated with synthetic anti-aging products further encourage botanical adoption. Easy accessibility through supplements, topical formulations, and functional foods expands usage.

Cultural familiarity in emerging economies also supports sustained demand. Personalized wellness approaches increasingly integrate botanicals into daily routines. These factors keep traditional alternative medicine and botanicals anticipated to remain the leading therapy type in this market.

Age-group Analysis

The age group 51 years and above, holding 63.7%, is projected to dominate because individuals in this demographic actively seek longevity-focused solutions to manage age-related physical and cognitive decline. Increased life expectancy encourages proactive investment in therapies that improve quality of life rather than treat isolated conditions. This age group experiences higher prevalence of joint discomfort, metabolic imbalance, skin aging, and immune decline, driving interest in complementary medicine.

Growing awareness of preventive aging strategies motivates consistent use of holistic therapies. Retirement lifestyles allow more time to engage in wellness routines such as herbal supplementation, meditation, and body therapies. Higher healthcare spending capacity supports sustained adoption. Physicians increasingly recommend integrative approaches alongside conventional care for aging patients. These drivers keep the 51 years and above segment expected to remain dominant.

End-User Analysis

Homecare settings, holding 36.1%, are expected to dominate because convenience and comfort strongly influence adoption of anti-aging and longevity therapies. Consumers increasingly prefer self-managed wellness routines that fit seamlessly into daily life. Home-based use of herbal supplements, topical botanicals, mindfulness practices, and digital wellness programs supports sustained engagement.

Technological advancements enable guided meditation, virtual consultations, and personalized wellness tracking from home. Aging individuals prefer familiar environments for long-term therapy adherence and stress reduction. Rising healthcare costs further encourage home-centered preventive approaches. Expansion of e-commerce improves access to alternative medicine products. These dynamics keep homecare settings anticipated to remain the leading end-user segment in this market.

Key Market Segments

By Therapy Type

- Traditional Alternative Medicine/Botanicals

- Ayurveda

- Naturopathy

- Traditional Chinese Medicine

- Zang Fu Theory

- Others

- Body Healing

- Yoga

- Acupuncture & Massage

- Chiropractic

- Qigong & Tai chi

- Kinesiology

- Reflexology

- Eurythmy

- Others

- Mind Healing

- Meditation & Mindfulness

- Stress-Reduction Therapies

- Others

- External Energy Healing

- Magnetic & Electromagnetic therapy

- Chakra healing

- Reiki

- Others

- Sensory Healing

- Aromatherapy

- Sound healing

By Age-group

- 36-50 years

- 51 years and above

By End-User

- Fitness, Yoga & Wellness Centers

- Integrative & Alternative Medicine Hospitals

- Homecare settings

- Natural Skincare Clinics

- Corporate Wellness Programs

- Others

Drivers

Rapidly growing global aging population is driving the market

The complementary and alternative medicine for anti-aging and longevity market is propelled by the rapidly expanding global population of older adults, who increasingly seek non-conventional therapies to promote healthy aging and extend lifespan.

Individuals in this demographic often explore options such as herbal supplements, mind-body practices, and traditional systems like Ayurveda or Traditional Chinese Medicine to address age-related declines in physical and cognitive function. These approaches appeal due to their focus on holistic wellness, prevention, and natural interventions rather than pharmaceutical treatments alone.

Rising life expectancy contributes to prolonged periods where people aim to maintain vitality and independence. Health concerns associated with aging, including chronic conditions and reduced mobility, encourage adoption of alternative modalities for supportive care. Public awareness of lifestyle influences on longevity further stimulates interest in complementary practices. Educational initiatives and media coverage highlight potential benefits of interventions like meditation for stress reduction or antioxidants for cellular health.

Accessibility through wellness centers and online resources broadens participation among seniors. According to the World Health Organization, by 2030, 1 in 6 people in the world will be aged 60 years or over. This demographic shift amplifies demand for therapies perceived as enhancing quality of life in later years.

Economic empowerment among older populations enables expenditure on such services. Governments and organizations promote healthy aging strategies that align with complementary methods. Overall, this driver fosters sustained market growth by addressing evolving needs in an aging society.

Restraints

Limited insurance coverage and reimbursement policies are restraining the market

The complementary and alternative medicine for anti-aging and longevity market encounters restrictions due to limited insurance coverage and reimbursement policies for most therapies, placing financial burden primarily on consumers. Many health plans, including public programs, cover only conventional treatments, excluding popular options like acupuncture, herbal consultations, or yoga therapy unless for specific approved conditions. This out-of-pocket requirement can deter widespread adoption, particularly among fixed-income retirees interested in longevity interventions.

Variability in private insurer policies creates inconsistency in access across regions and populations. Lack of standardized billing codes for certain practices complicates claims processing. Legislative frameworks prioritize evidence-based medicine, often sidelining alternative approaches in reimbursement decisions. High costs of ongoing therapies, such as supplement regimens or wellness programs, accumulate over time without support.

Economic downturns exacerbate sensitivity to non-essential expenditures perceived as elective. Providers face challenges in sustaining practices reliant on direct payments. Integration efforts into mainstream healthcare remain slow due to payer hesitancy. These constraints hinder market expansion by limiting affordability and scalability. Professional advocacy continues to push for broader inclusion in benefit packages.

Opportunities

Increased government funding for aging research is creating growth opportunities

The complementary and alternative medicine for anti-aging and longevity market gains opportunities from heightened government funding dedicated to aging research, which explores integrative approaches to extend healthspan. National institutes support studies examining mechanisms of aging and potential interventions, including dietary supplements, mind-body techniques, and traditional remedies. This funding validates scientific inquiry into complementary modalities, potentially leading to evidence-based applications.

Grants facilitate clinical trials assessing efficacy in promoting longevity markers like reduced inflammation or improved metabolic function. Collaborations between researchers and practitioners bridge traditional knowledge with modern science. Expanded budgets enable multidisciplinary projects incorporating alternative therapies. In fiscal year 2024, the National Institute on Aging allocated an additional $39.0 million for research centers, bringing the total to $304.3 million.

Such investments attract talent and resources to the field. Translational research outcomes may inform guideline development favoring integrative care. Public-private partnerships amplify impact on longevity-focused innovations. Regulatory bodies may consider funded evidence in policy updates. Global initiatives align with national efforts to address aging challenges. These opportunities enhance credibility and market potential for complementary anti-aging solutions.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic dynamics energize the complementary and alternative medicine for anti-aging and longevity market as rising disposable incomes and heightened consumer focus on preventive wellness propel demand for herbal extracts, acupuncture services, and mindfulness-based therapies worldwide. Leading companies strategically broaden portfolios with science-supported nutraceuticals and holistic protocols, seizing opportunities from aging demographics eager to enhance vitality and extend healthy lifespans across developed and emerging regions.

Lingering inflation and economic fluctuations, however, escalate sourcing costs for rare botanicals and clinical validation, prompting price-sensitive consumers to reduce spending on non-essential supplements and treatments. Geopolitical frictions, especially U.S.-China trade disputes and restrictions on traditional remedy exports, routinely interrupt supplies of premium ingredients like adaptogens and antioxidants, fostering shortages and operational challenges for globally oriented suppliers.

Current U.S. tariffs substantially increase landed costs on imported alternative medicine products and raw materials, compressing margins for American importers and limiting affordability for mainstream adoption. These measures also trigger reciprocal barriers overseas that constrain U.S. exports of innovative wellness solutions and disrupt international research collaborations.

Still, the evolving pressures catalyze meaningful investments in domestic herb cultivation, regional manufacturing hubs, and breakthrough local formulations, establishing resilient frameworks that will drive innovation and secure robust market expansion moving forward.

Latest Trends

Significant rise in utilization of complementary health approaches is a recent trend

In 2024, analyses of recent survey data highlighted a significant rise in the utilization of complementary health approaches among U.S. adults, reflecting growing interest in wellness and pain management strategies relevant to anti-aging and longevity. Practices such as meditation and yoga have gained prominence for their roles in stress mitigation and physical resilience, factors associated with healthier aging. This trend encompasses broader adoption of integrative methods to support overall vitality amid lifestyle pressures.

Population segments experiencing chronic pain, common in aging, increasingly turn to these non-pharmacological options. Educational campaigns and digital platforms facilitate awareness and access to such practices. Healthcare providers incorporate referrals to complementary services in patient care plans. Community programs expand offerings tailored to older adults seeking preventive health. An NIH analysis released in 2024 revealed that the percentage of individuals using at least one of seven complementary approaches increased from 19.2% in 2002 to 36.7% in 2022.

Particular growth occurred in meditation and yoga usage. This upward trajectory aligns with demands for sustainable health maintenance. Research emphasis on mind-body benefits reinforces practical application. Cultural shifts toward proactive wellness sustain momentum. The trend positions complementary approaches as integral to contemporary longevity strategies.

Regional Analysis

Europe is leading the Complementary and Alternative Medicine for Anti Aging & Longetivity Market

Europe accounted for 33.1% of the overall market in 2024, and the region experienced steady growth as aging populations increasingly adopted holistic approaches to support longevity, wellness, and age-related disease prevention. Strong cultural acceptance of herbal medicine, homeopathy, nutraceuticals, and mind-body therapies supported wider consumer adoption across Western and Northern Europe. Preventive healthcare policies and rising interest in non-pharmacological interventions encouraged integration of alternative practices into wellness routines.

Medical spas and longevity clinics expanded offerings that combine nutrition therapy, botanical supplements, and traditional practices. The European Commission reported that 21.1% of the EU population was aged 65 and above in 2023, reflecting a large demographic actively seeking anti-aging solutions. Growing concerns around chronic disease management further strengthened demand. Increased research into plant-based and traditional remedies improved credibility. These factors collectively drove market growth across Europe in 2024.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to experience strong expansion during the forecast period as traditional medicine systems gain renewed relevance in modern longevity and wellness strategies. Consumers increasingly combine Ayurveda, Traditional Chinese Medicine, Kampo, and herbal supplementation with contemporary preventive health practices. Rapid population aging and urban stress levels accelerate demand for natural therapies that support vitality and long-term health.

Governments promote integration of traditional medicine into national healthcare frameworks, increasing accessibility and trust. Wellness tourism growth in countries such as Thailand, India, Japan, and China further boosts adoption. The United Nations reported that Asia Pacific had over 414 million people aged 65 and above in 2023, highlighting a rapidly expanding longevity-focused population. Digital platforms improve access to alternative health services and products. These dynamics position the region for sustained and accelerated market growth.

Key Regions and Countries

Europe

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Complementary and Alternative Medicine for Anti Aging & Longetivity market drive growth by integrating evidence-informed natural therapies, nutraceuticals, and lifestyle-based interventions that appeal to consumers seeking preventive and holistic health solutions. Companies active in the Complementary and Alternative Medicine for Anti Aging & Longetivity market expand demand through personalized wellness programs that combine supplements, diagnostics, and coaching to support long-term vitality outcomes.

Strategic emphasis within the Complementary and Alternative Medicine for Anti Aging & Longetivity market includes partnerships with wellness clinics, digital health platforms, and hospitality-based health retreats to broaden consumer access. Product innovation focuses on botanicals, functional formulations, and bioavailability enhancement while aligning offerings with clean-label and sustainability expectations.

Geographic expansion targets regions with rising disposable income and growing acceptance of integrative medicine approaches. iHerb represents a prominent participant in the Complementary and Alternative Medicine for Anti Aging & Longetivity market, leveraging its global e-commerce platform, extensive portfolio of natural health products, and strong supplier ecosystem to deliver accessible longevity-focused solutions to consumers worldwide.

Top Key Players

- Centre Chiropractic de la Colonne Vertébrale

- Therme Wien

- Sinomedica

- healthPi

- Acupuncture Enfants

- Anadolu Medical Center

- MayLilacs

- Al Zuhair Holistic Medicine Center

- Ayurmana by Dharma Ayurveda

- Trinicum

- Miskawaan Health Group

- Lama Polyclinic LLC

- Al Manar Ayurvedic Center

- Ayurveda Kuwait

- Maya Reiki School

- First Chiropractic Centre

- American Chiropractic Center

- VIVAMAYR

- Qatar Chiropractic & Physiotherapy Clinic

- Optimal Spine and Joint Center

Recent Developments

- In August 2023, Aviv Clinics introduced an advanced executive health and performance assessment program that evaluates cognitive function and physical health beyond conventional checkups. This initiative drives the complementary and alternative medicine for anti aging and longevity market by increasing consumer awareness of preventive, data driven longevity care. By integrating functional medicine, personalized diagnostics, and lifestyle optimization, such programs encourage demand for non conventional therapies aimed at slowing cognitive decline, improving vitality, and extending health span. The focus on proactive aging management strengthens adoption of holistic and alternative approaches among high income and aging populations.

- In August 2023, SHA Wellness Clinic launched a dedicated sexual health unit designed to optimize hormonal balance and sexual well being as part of overall longevity care. This development supports growth in the complementary and alternative medicine for anti aging and longevity market by broadening the scope of wellness offerings beyond aesthetics and fitness. Addressing hormonal health through integrative therapies, nutrition, and non pharmaceutical interventions reinforces the role of alternative medicine in enhancing quality of life and emotional balance during aging. Such specialized units increase acceptance of holistic longevity solutions among global wellness consumers.

- In February 2023, SEVA Experience partnered with The Standard, Huruvalhi Maldives to deliver a structured wellness program centered on meditation, yoga, and holistic practices. This collaboration contributes to market expansion by promoting mind body therapies as core components of longevity focused wellness tourism. By embedding alternative practices into luxury travel experiences, the partnership exposes a wider audience to complementary medicine approaches for stress reduction, metabolic balance, and healthy aging. The growing popularity of destination based wellness programs accelerates global demand for non clinical, preventive longevity solutions.

Report Scope

Report Features Description Market Value (2024) US$ 78.6 Billion Forecast Revenue (2034) US$ 503.1 Billion CAGR (2025-2034) 20.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Therapy Type (Traditional Alternative Medicine/Botanicals (Ayurveda, Naturopathy, Traditional Chinese Medicine, Zang Fu Theory and Others), Body Healing (Yoga, Acupuncture & Massage, Chiropractic, Qigong & Tai Chi, Kinesiology, Reflexology, Eurythmy and Others), Mind Healing (Meditation & Mindfulness, Stress-Reduction Therapies and Others), External Energy Healing (Magnetic & Electromagnetic Therapy, Chakra Healing, Reiki and Others) and Sensory Healing (Aromatherapy and Sound Healing)), By Age-Group (36-50 Years and 51 Years and Above), By End-User (Fitness, Yoga & Wellness Centers, Integrative & Alternative Medicine Hospitals, Homecare Settings, Natural Skincare Clinics, Corporate Wellness Programs and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Centre Chiropractic de la Colonne Vertébrale, Therme Wien, Sinomedica, healthPi, Acupuncture Enfants, Anadolu Medical Center, MayLilacs, Al Zuhair Holistic Medicine Center, Ayurmana by Dharma Ayurveda, Trinicum, Miskawaan Health Group, Lama Polyclinic LLC, Al Manar Ayurvedic Center, Ayurveda Kuwait, Maya Reiki School, First Chiropractic Centre, American Chiropractic Center, VIVAMAYR, Qatar Chiropractic & Physiotherapy Clinic, Optimal Spine and Joint Center Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Complementary and Alternative Medicine for Anti Aging & Longetivity MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Complementary and Alternative Medicine for Anti Aging & Longetivity MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Centre Chiropractic de la Colonne Vertébrale

- Therme Wien

- Sinomedica

- healthPi

- Acupuncture Enfants

- Anadolu Medical Center

- MayLilacs

- Al Zuhair Holistic Medicine Center

- Ayurmana by Dharma Ayurveda

- Trinicum

- Miskawaan Health Group

- Lama Polyclinic LLC

- Al Manar Ayurvedic Center

- Ayurveda Kuwait

- Maya Reiki School

- First Chiropractic Centre

- American Chiropractic Center

- VIVAMAYR

- Qatar Chiropractic & Physiotherapy Clinic

- Optimal Spine and Joint Center