Commercial Seaweed Market Size, Share, And Business Benefits By Product Type (Red Seaweed, Green Seaweed, Brown Seaweed, Others), By Form (Leaf, Powdered, Flakes, Liquid), By End-Uses (Food and Beverage, Agriculture, Animal Feed Additives, Pharmaceuticals, Cosmetics and Personal Care, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: February 2025

- Report ID: 136277

- Number of Pages: 243

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

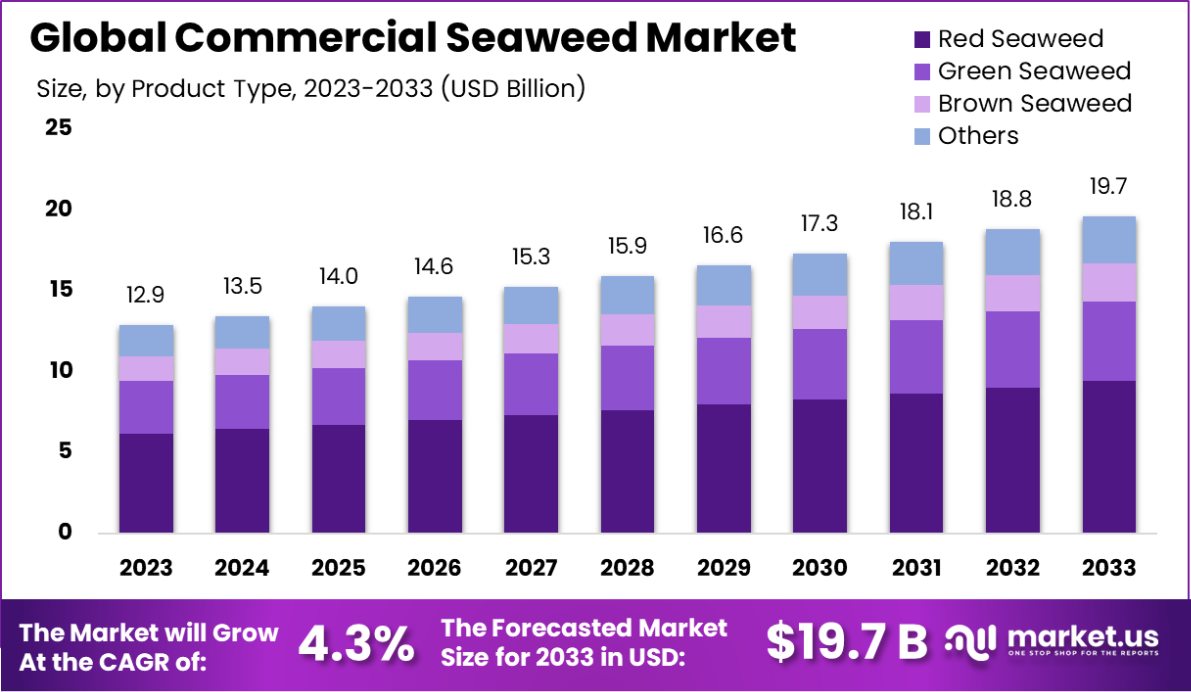

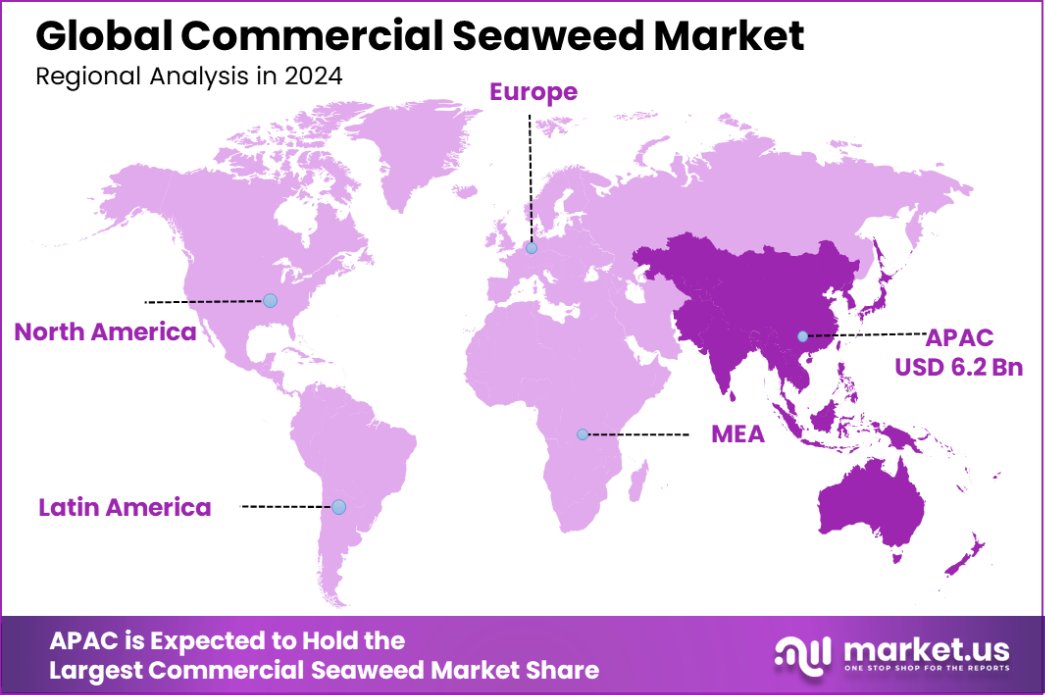

The Global Commercial Seaweed Market is expected to be worth around USD 19.7 Billion by 2033, up from USD 12.9 Billion in 2023, and grow at a CAGR of 4.3% from 2024 to 2033. Asia-Pacific holds 48.2% of, the USD 6.2 billion commercial seaweed market.

Commercial seaweed refers to various species of macroalgae harvested or cultivated for commercial use across diverse industries. These seaweeds are primarily sourced from marine environments and are utilized in food, cosmetics, pharmaceuticals, and biotechnology due to their rich content of vitamins, minerals, and antioxidants. Common types include red, brown, and green seaweed, each differing in their chemical composition and application.

The commercial seaweed market is a sector that involves the production, processing, and distribution of seaweed for various applications. This market has witnessed significant growth due to the increasing awareness of seaweed’s health benefits, sustainability as a resource, and its versatility in use. It is a vital component in industries such as food and beverages, agriculture, and personal care products.

The growth of the commercial seaweed market is propelled by the rising popularity of seaweed-based products among health-conscious consumers and the expanding application of seaweed in the food industry as a natural ingredient and flavor enhancer. The sustainability aspect of seaweed cultivation, which requires no land and minimal resources, also supports market expansion.

Demand for commercial seaweed is driven by its nutritional benefits and its role in weight management and digestive health. Additionally, the growing vegan and vegetarian populations are turning to seaweed as a nutrient-rich, plant-based alternative, further boosting demand across global markets.

The market holds substantial opportunities in the development of innovative and sustainable seaweed-derived products. Advances in cultivation techniques and extraction processes are expected to enhance yield and quality, opening new avenues in pharmaceuticals and nutraceuticals.

Moreover, increasing environmental concerns and the need for sustainable agricultural practices are fostering the use of seaweed in biofertilizers and biostimulants, presenting further growth prospects.

The commercial seaweed market is experiencing a significant transformation, driven by a surge in sustainable agricultural practices and increasing diversification of seaweed applications. Recognized for its ecological benefits, such as carbon sequestration and water purification, seaweed is becoming a cornerstone of modern aquaculture.

The potential for scalable operations is exemplified in India, where the National Institution for Transforming India has identified 24,707 hectares suitable for seaweed farming, projecting potential revenues exceeding Rs. 5000 crores (approximately USD 602 million). This initiative underscores the vast economic opportunity within the sector and the government’s role in fostering growth through supportive policies.

In the United States, the industry’s evolution is evident through significant investments in innovation. For example, Springtide Seaweed, a pioneering small business based in Maine, was awarded $650,000 in SBIR funding in 2022. This grant is earmarked for refining nursery and farm systems specifically for seaweed cultivation. The focus extends beyond the traditional low-value brown kelp, aiming to include higher-value varieties such as nori and dulse.

This shift towards premium seaweed crops illustrates a strategic move to enhance the economic viability of the seaweed industry in the U.S. and reflects broader trends toward diversification and sophistication in global seaweed markets.

These developments are indicative of a broader industry trend towards sustainable and economically significant aquaculture practices that not only support ecological health but also offer substantial financial returns.

As such, stakeholders in the seaweed market—from investors to policymakers—should consider both the ecological and economic impacts of seaweed cultivation to fully capitalize on its growth potential.

Key Takeaways

- The Global Commercial Seaweed Market is expected to be worth around USD 19.7 Billion by 2033, up from USD 12.9 Billion in 2023, and grow at a CAGR of 4.3% from 2024 to 2033.

- Red seaweed dominates the Commercial Seaweed Market, holding a substantial 48.2% share by product type.

- Powdered form leads in usage, capturing 48.2% of the market, preferred for its ease of application.

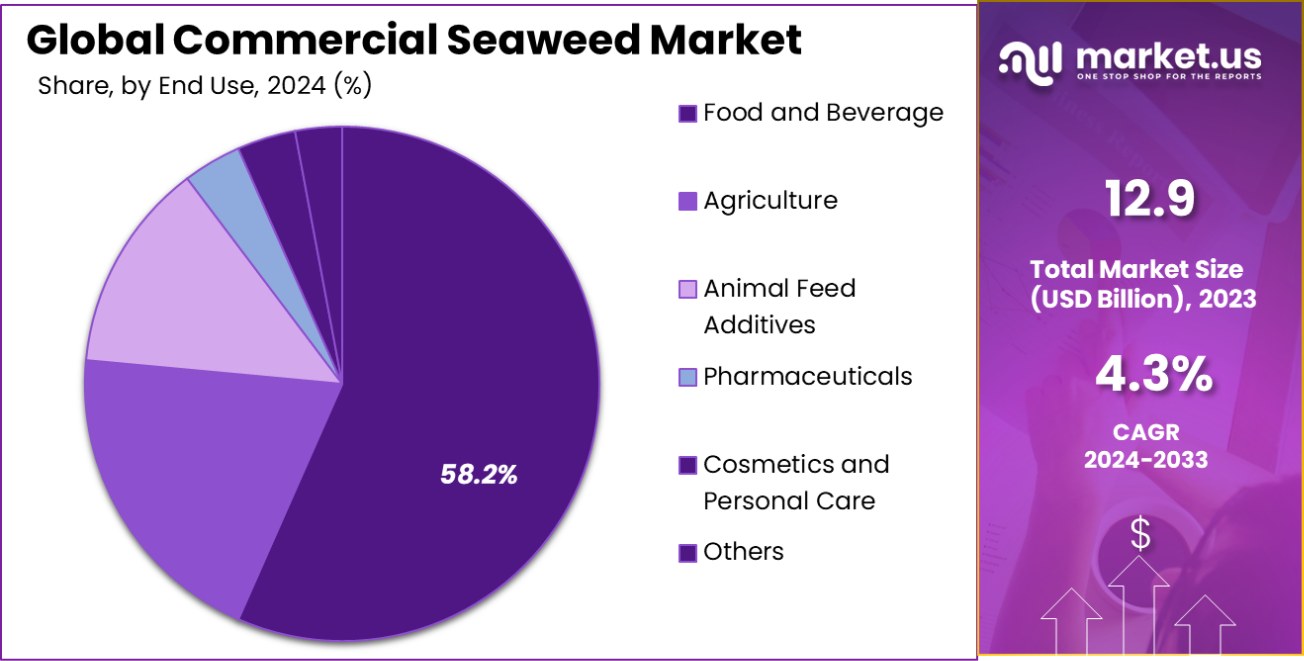

- The food and beverage sector is the largest end-user, accounting for 58.2% of market consumption.

- Asia-Pacific holds a 48.2% share of the commercial seaweed market, worth USD 6.2 billion.

Business Benefits of Commercial Seaweed

Commercial seaweed offers a multitude of business benefits that make it a compelling resource across various industries. Economically, it provides a cost-effective source of raw materials for a wide range of products. The versatility of seaweed allows it to be used in food, cosmetics, pharmaceuticals, and even biofuel production, offering companies the ability to diversify their product lines and penetrate new markets.

From a sustainability perspective, seaweed cultivation is environmentally friendly as it does not require arable land, freshwater, or fertilizers, reducing the ecological footprint of agricultural practices. It also helps in carbon sequestration and improving marine biodiversity, aligning business operations with global sustainability goals and appealing to environmentally conscious consumers.

Additionally, the health benefits associated with seaweed, such as high vitamins, minerals, and antioxidants, meet the growing consumer demand for healthful food options. This opens up opportunities in the health and wellness sector, where businesses can leverage seaweed’s nutritional profile to market products that support overall health, weight management, and disease prevention.

For coastal communities, seaweed farming can provide economic opportunities without the significant capital investment required for other types of aquaculture, stimulating local economies and creating jobs. This aspect, combined with the rising global demand for natural products, positions businesses to capitalize on both economic and sustainable development benefits through commercial seaweed.

By Product Type Analysis

The Commercial Seaweed Market thrives, with Red Seaweed holding a dominant 48.2% share by product type.

In 2023, Red Seaweed held a dominant market position in the By Product Type segment of the Commercial Seaweed Market, with a 48.2% share. This was followed by Brown Seaweed and Green Seaweed, capturing 35.5% and 16.3% of the market, respectively.

The strong preference for Red Seaweed can be attributed to its widespread applications in the food and beverage industry, where it is prized for its nutritional benefits and gelling properties.

Brown Seaweed, with its significant share, has been extensively utilized in the production of alginate, which is essential in various industrial applications, including textiles and pharmaceuticals. This segment has seen steady growth due to increasing demand for natural and sustainable products.

Green Seaweed, though smaller in market share, is gaining traction in the dietary supplements sector due to its high vitamin and mineral content. The rising awareness of health and wellness, particularly post-pandemic, is likely to boost its demand in upcoming years.

Overall, the distribution of market shares among these segments reflects varying consumer preferences and application fields, indicating a robust and dynamic market landscape for commercial seaweed.

By Form Analysis

Powdered seaweed forms are pivotal, capturing 48.2% of the market, favored for their ease of use and storage.

In 2023, the Commercial Seaweed Market was segmented by form into Leaf, Powdered, Flakes, and Liquid. Among these, Powdered seaweed held a dominant market position, capturing a 48.2% share.

This form’s prevalence is attributed to its versatility and ease of use in various applications ranging from food and beverage to pharmaceuticals, where it serves as a thickening and stabilizing agent. Additionally, the powdered form’s extended shelf life and ease of storage contribute to its widespread preference in both industrial and retail sectors.

Flakes followed, with a significant market share due to their popularity in culinary applications, particularly in the health-conscious consumer segments who appreciate their natural flavor and minimal processing.

Leaf seaweed, typically used in traditional Asian cuisines and modern gastronomy, also maintained a substantial portion of the market. Its appeal lies in its natural form and texture, which is essential for sushi and other regional dishes.

Liquid seaweed, although smaller in market share compared to its counterparts, is increasingly used in agriculture and horticulture for its efficient nutrient delivery system, promoting plant growth and resilience.

The diverse applications and benefits of each form of seaweed highlight the dynamic nature of this market, adapting to varying consumer preferences and industrial requirements.

By End-Uses Analysis

In the realm of end-uses, the Food and Beverage sector leads, consuming 58.2% of all seaweed produced globally.

In 2023, Food and Beverage held a dominant market position in the “By End-Uses” segment of the Commercial Seaweed Market, with a 58.2% share. This significant proportion highlights the growing integration of seaweed as a versatile and sustainable ingredient across a variety of food products, driven by increasing consumer demand for plant-based and nutrient-rich options.

Agriculture followed with a 20.1% share, where seaweed is increasingly used for its natural bio-stimulant properties to enhance crop productivity and soil health. Animal Feed Additives accounted for 10.3%, reflecting seaweed’s role in improving animal health and nutritional quality of feed.

Pharmaceuticals Cosmetics and Personal Care segments captured smaller shares of 6.7% and 4.7% respectively. The use in pharmaceuticals is linked to seaweed’s bioactive compounds, beneficial in developing medications and health supplements.

Meanwhile, the cosmetics sector is tapping into seaweed for its hydrating and anti-aging properties, resonating with the rising trend of natural beauty products. This segmentation underlines the diverse applications of seaweed across various industries, driven by its sustainable and functional attributes.

Key Market Segments

By Product Type

- Red Seaweed

- Green Seaweed

- Brown Seaweed

- Others

By Form

- Leaf

- Powdered

- Flakes

- Liquid

By End-Uses

- Food and Beverage

- Agriculture

- Animal Feed Additives

- Pharmaceuticals

- Cosmetics and Personal Care

- Others

Driving Factors

Expanding Uses in Food Industries Boost Demand

The commercial seaweed market is primarily driven by its expanding applications within the food sector. Seaweed is increasingly being utilized as a key ingredient in various foods due to its nutritional benefits and unique flavor profile.

From sushi wraps to salads and soups, seaweed’s versatility makes it a popular choice among food manufacturers. Additionally, the rising consumer interest in plant-based and natural products is further propelling the demand for seaweed in food industries across the globe, making it a pivotal factor in the market’s growth.

Growing Health Awareness Amplifies Seaweed Consumption

As more consumers become health-conscious, the demand for seaweed is skyrocketing, given its high mineral, vitamin, and antioxidant content. Seaweed is known for its health benefits, including improved heart health, weight management, and enhanced digestion.

This has led to its increased incorporation into daily diets as a health supplement and functional food. The shift towards healthier lifestyles and the adoption of natural products for wellness purposes are significant trends driving the uptake of seaweed products in various regions, particularly in health-centric markets.

Sustainability Trends Propel Seaweed Farming

Sustainability concerns are playing a crucial role in the commercial seaweed market. Seaweed farming offers a sustainable alternative to terrestrial farming, requiring no fresh water, land, or fertilizers. It also absorbs carbon dioxide, helping combat climate change.

The global push towards more sustainable and eco-friendly production practices has made seaweed farming an attractive agricultural practice. This environmental benefit, coupled with the economic opportunity it presents to coastal communities, is significantly driving the growth of the seaweed market, especially in regions prioritizing sustainability.

Restraining Factors

Environmental Concerns Hinder Seaweed Production

Environmental factors significantly impact the commercial seaweed market. The dependence of seaweed cultivation on pristine marine conditions means that pollution and changing climate conditions pose substantial risks. Issues such as ocean acidification, rising sea temperatures, and water contamination can severely affect seaweed quality and yield.

These environmental challenges not only threaten the sustainability of seaweed farming but also raise concerns among consumers and regulators, potentially restricting market growth as stakeholders seek to balance production with environmental preservation.

Stringent Regulatory Frameworks Limit Market Expansion

The commercial seaweed industry faces rigorous regulatory challenges that can impede its growth. Different countries have diverse and sometimes stringent regulations regarding seaweed harvesting, processing, and its inclusion in food products.

These regulations are intended to ensure sustainable harvesting practices and consumer safety but can also result in increased production costs and delays in market entry for new products. Navigating these complex legal frameworks often requires significant resources, making it difficult for smaller producers to compete and innovate in the global market.

Lack of Standardization Stifles Industry Growth

A major restraint in the commercial seaweed market is the lack of standardization across the industry. Variability in quality, size, and species of seaweed due to differing cultivation and harvesting methods can lead to inconsistent product offerings.

This lack of uniform standards can create challenges for large-scale applications in industries such as food, pharmaceuticals, and cosmetics, where consistency is key. The absence of standardized practices can deter new entrants and limit the ability of companies to scale operations effectively, ultimately restraining market growth.

Growth Opportunity

Innovation in Seaweed Processing Technologies Opens New Markets

Advancements in processing technologies present significant growth opportunities in the commercial seaweed market. By improving methods for extracting valuable compounds from seaweed, companies can develop a wider range of products, from advanced biofuels to pharmaceuticals and nutraceuticals.

These innovations not only enhance the economic value of seaweed but also expand its applicability across diverse industries. As technology evolves, the ability to efficiently process seaweed into high-quality, versatile products will likely attract new investment and drive market expansion, making technology adoption a key opportunity for industry stakeholders.

Expanding Seaweed Applications in Cosmetics and Personal Care

The commercial seaweed market is poised for growth with increasing applications in the cosmetics and personal care industry. Seaweed is rich in antioxidants, minerals, and vitamins, making it an excellent ingredient for skincare products.

As consumer demand for natural and sustainable beauty products continues to rise, seaweed offers a compelling eco-friendly solution. Companies leveraging seaweed’s unique properties to innovate in formulations are likely to capture new customer segments, particularly among environmentally conscious consumers, driving further market growth in this sector.

Rising Demand for Organic Seaweed Products

There is a growing opportunity in the commercial seaweed market with the rising consumer preference for organic and sustainably sourced products. Organic seaweed, harvested without harmful chemicals and in environmentally sustainable ways, is becoming increasingly popular among health-conscious consumers.

This trend is supported by a broader move towards organic food consumption globally. Capitalizing on this demand by expanding organic seaweed offerings can open new avenues for market players, particularly in Western markets where organic products often command premium pricing and enjoy strong consumer loyalty.

Latest Trends

Surge in Seaweed-Based Snack Popularity

The commercial seaweed market is witnessing a significant trend with the rise in popularity of seaweed-based snacks. Health-conscious consumers are increasingly turning to seaweed snacks as a low-calorie, nutrient-rich alternative to traditional snack options.

These snacks are not only appealing due to their health benefits but also because they cater to the growing demand for vegan and gluten-free products. The innovation in flavors and convenient packaging is further enhancing their appeal, broadening the consumer base and driving growth in this segment of the market.

Integration of Seaweed in Functional Foods

Seaweed is becoming a common ingredient in functional foods due to its health-promoting properties, including being a natural source of vitamins, minerals, and antioxidants. This trend is supported by the increasing consumer interest in foods that offer health benefits beyond basic nutrition.

Seaweed’s potential to improve gut health, enhance immune response, and manage weight makes it a valuable addition to functional foods. As research continues to uncover more benefits, the use of seaweed in functional foods is expected to increase, creating more opportunities for market expansion.

Eco-Friendly Packaging Initiatives in Seaweed Products

Sustainability trends are influencing the commercial seaweed market, particularly through eco-friendly packaging initiatives. As consumers become more environmentally aware, they are demanding sustainable packaging solutions for their products. Seaweed producers are responding by adopting biodegradable and recyclable packaging materials, reducing the environmental impact of their products.

This not only meets consumer expectations but also aligns with global regulatory pressures to minimize plastic waste. Companies that lead in sustainable packaging practices are likely to gain a competitive edge and attract eco-conscious customers, further stimulating market growth.

Regional Analysis

The Asia-Pacific region dominates the commercial seaweed market, accounting for 48.2%, valued at USD 6.2 billion.

The commercial seaweed market is segmented into several key regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America, each displaying unique market dynamics and growth opportunities.

Asia Pacific is the dominant region in the commercial seaweed market, commanding a substantial 48.2% share and valued at USD 6.2 billion. This region’s market leadership is driven by high consumption rates in countries like China, Japan, and South Korea, where seaweed is a staple in local diets. The extensive aquaculture activities and favorable government policies supporting seaweed farming also contribute to its strong market position.

In Europe, the market is growing due to the rising demand for natural and organic food products. Countries such as Norway and Ireland are leading in seaweed production, focusing on sustainable and innovative harvesting techniques. The growing application of seaweed in the pharmaceutical and cosmetic industries further supports European market growth.

North America is experiencing an increase in seaweed demand, fueled by the health and wellness trend. The U.S. and Canada are exploring the nutritional benefits of seaweed, integrating it into various health foods and supplements.

The markets in Latin America and the Middle East & Africa are smaller but gradually expanding. In these regions, the focus is on the potential of seaweed in diverse applications, from agriculture to biofuel production, leveraging local biodiversity and improving economic prospects through sustainable practices.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2023, the global commercial seaweed market is characterized by a diverse array of players, each contributing unique strengths and strategies to this growing industry. Notable among them are companies like Wild Irish Seaweeds, Acadian SeaPlus, and Cargill, Incorporated, which are positioned distinctly across various segments of the market.

Wild Irish Seaweeds and Organic Irish Seaweed-Emerald Isle are significant due to their focus on sustainable, organic seaweed products, catering to the burgeoning demand for natural and environmentally friendly products in Europe and North America. Their traditional harvesting techniques, combined with modern sustainable practices, help maintain biodiversity and ensure a steady supply of high-quality seaweed.

Cascadia Seaweed and Ocean Rainforest are leading in innovation by expanding the applications of seaweed beyond food. These companies are exploring uses in bioplastics, biofuels, and pharmaceuticals, which are expected to be key growth areas. Their forward-thinking approach positions them well for expansion into new markets and sectors.

Cargill, Incorporated represents the industrial might in the sector, leveraging its vast network and resources to scale production efficiently. Cargill’s focus on integrating seaweed into a variety of food products and its commitment to sustainability through responsible sourcing practices exemplify its role as a market leader.

In regions like Asia-Pacific, which dominates the market, companies such as KwangcheonKlm and Kai Ho “Ocean’s Treasure” are essential for their volume-driven strategies, catering to local and international markets with a broad range of products.

Emerging companies like BLUE EVOLUTION and Seaweed Solutions AS are tapping into niche markets, including seaweed-based health supplements and gourmet food products. These players are likely to drive the next wave of market growth by targeting health-conscious consumers and luxury markets.

Overall, the commercial seaweed market in 2023 shows a robust competitive landscape with each key player focusing on sustainability, market expansion through product diversification, and innovative applications, setting the stage for dynamic growth in the years to come.

Top Key Players in the Market

- Wild Irish Seaweeds

- Acadian SeaPlus

- Organic Irish Seaweed-Emerald Isle

- KwangcheonKlm

- Cascadia Seaweed

- Ocean Rainforest

- Springtide Seaweed, LLC

- BLUE EVOLUTION

- Earaybio

- Kai Ho “”Oceans Treasure””

- Aushadh Limited.

- BY VIET DELTA

- Shore Seaweed

- ALGOLESKO

- Raw Seaweeds

- Cargill, Incorporated

- AtSeaNova

- Kelp Industries Pty, Ltd.

- Maine Coast Sea Vegetables

- MARA SEAWEED

- Marcel Carrageenan

- Pacific Harvest

- Seaweed Solutions AS

- The Seaweed Company

- Irish Seaweeds

Recent Developments

- In 2024, Blue Evolution, a commercial seaweed innovator, focuses on sustainable, regenerative seaweed products. Their 2024 partnership with Te Huata aims to enhance seaweed farming in New Zealand, integrating traditional knowledge with modern technology for global market impact.

- In 2023, KwangcheonKlm has continued to enhance its presence in the commercial seaweed sector. The company is renowned for its expertise in producing a variety of seaweed-based products, maintaining a significant role in this rapidly growing market. As the commercial seaweed market expands, driven by increasing demand from various industries, KwangcheonKlm remains a key player among global competitors.

Report Scope

Report Features Description Market Value (2023) USD 12.9 Billion Forecast Revenue (2033) USD 19.7 Billion CAGR (2024-2033) 4.3% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Red Seaweed, Green Seaweed, Brown Seaweed, Others), By Form (Leaf, Powdered, Flakes, Liquid), By End-Uses (Food and Beverage, Agriculture, Animal Feed Additives, Pharmaceuticals, Cosmetics and Personal Care, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Wild Irish Seaweeds, Acadian SeaPlus, Organic Irish Seaweed-Emerald Isle, KwangcheonKlm, Cascadia Seaweed, Ocean Rainforest, Springtide Seaweed, LLC, BLUE EVOLUTION, Earaybio, Kai Ho “”Oceans Treasure””, Aushadh Limited., BY VIET DELTA, Shore Seaweed, ALGOLESKO, Raw Seaweeds, Cargill, Incorporated, AtSeaNova, Kelp Industries Pty, Ltd., Maine Coast Sea Vegetables, MARA SEAWEED, Marcel Carrageenan, Pacific Harvest, Seaweed Solutions AS, The Seaweed Company, Irish Seaweeds Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Commercial Seaweed MarketPublished date: February 2025add_shopping_cartBuy Now get_appDownload Sample

Commercial Seaweed MarketPublished date: February 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Wild Irish Seaweeds

- Acadian SeaPlus

- Organic Irish Seaweed-Emerald Isle

- KwangcheonKlm

- Cascadia Seaweed

- Ocean Rainforest

- Springtide Seaweed, LLC

- BLUE EVOLUTION

- Earaybio

- Kai Ho ""Oceans Treasure""

- Aushadh Limited.

- BY VIET DELTA

- Shore Seaweed

- ALGOLESKO

- Raw Seaweeds

- Cargill, Incorporated

- AtSeaNova

- Kelp Industries Pty, Ltd.

- Maine Coast Sea Vegetables

- MARA SEAWEED

- Marcel Carrageenan

- Pacific Harvest

- Seaweed Solutions AS

- The Seaweed Company

- Irish Seaweeds