Global Commercial Energy As A Service (Eaas) Market Size, Share Analysis Report By Type (Energy Supply Service, Operational and Maintenance Services, Energy Efficiency and Optimization Services), By Service-Delivery Model (Pay-for-Service, Performance-based Contracting (ESCO/EPC), Build-Own-Operate-Transfer (BOOT), Leasing and Rental Models), By Technology (Distributed Generation, Energy Storage, Smart Energy Management And Analytics, EV-Charging Infrastructure) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 171632

- Number of Pages: 297

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

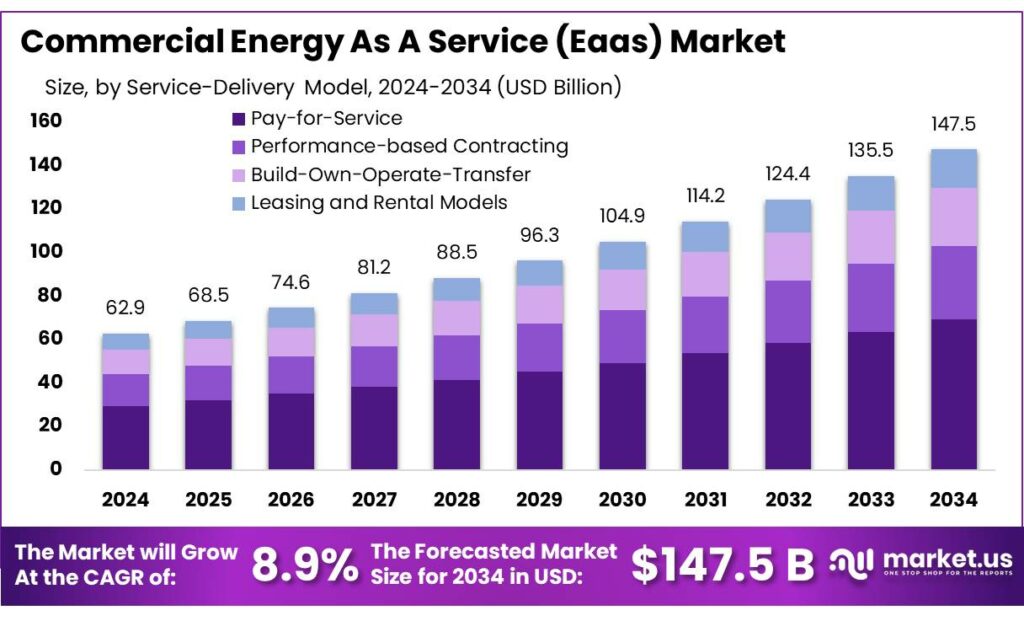

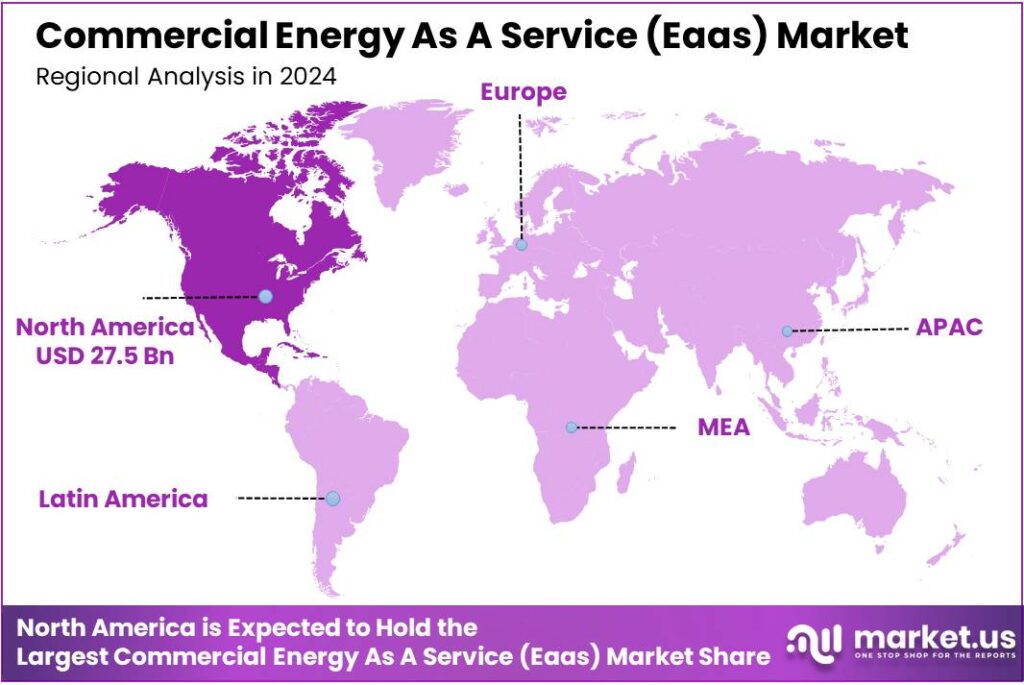

The Global Commercial Energy As A Service (Eaas) Market size is expected to be worth around USD 147.5 Billion by 2034, from USD 62.9 Billion in 2024, growing at a CAGR of 8.9% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 36.8% share, holding USD 24.3 Billion in revenue.

Commercial Energy as a Service (EaaS) is an outcome-based contracting model where a provider finances, installs, operates, and maintains energy assets and software on a customer site, and the customer pays through a subscription / usage fee or “pay-for-performance” structure instead of upfront capex. In practice, EaaS bundles energy efficiency retrofits (HVAC, lighting, controls), on-site generation (often solar), storage, monitoring/analytics, and sometimes EV charging or microgrid resiliency into a single service-level agreement designed around measurable results.

The industrial backdrop for EaaS is shaped by a global push to reduce energy costs, volatility, and emissions while improving resilience. Energy efficiency remains the quickest lever because it reduces demand before new supply is added. The International Energy Agency (IEA) highlights that on a net-zero pathway, annual investment in efficiency across buildings, transport, and industry would need to rise from about USD 660 billion “today” to around USD 1.9 trillion by 2030, underscoring the scale of deployable projects that fit naturally into EaaS contracting.

- Government and institutional programs reinforce this direction by mainstreaming performance contracting and validated savings. In the U.S., DOE’s Better Buildings partners have reported nearly USD 22 billion in energy savings, which helps normalize the “measured results” mindset that EaaS contracts rely on. In Europe, the revised Energy Efficiency Directive sets a binding goal to reduce EU final energy consumption by 11.7% by 2030, strengthening compliance pressure for energy management, audits, and retrofit delivery that EaaS can operationalize at scale.

Public funding and development finance also strengthen the industrial runway by de-risking projects and scaling aggregators. The IEA notes that by end-2023, the U.S. Infrastructure Investment and Jobs Act had allocated nearly USD 75 billion to clean energy, including USD 6.5 billion for energy efficiency. Globally, the World Bank reports its energy efficiency lending portfolio reached USD 6.71 billion between FY15–FY24 across 206 operations, supporting upgrades in buildings, industry, public lighting, and more—exactly the asset base EaaS providers target. In India, the World Bank also approved an USD 300 million Energy Efficiency Scale-Up Program to help scale energy-saving measures, reinforcing the growth of “pay-from-savings” structures.

Key Takeaways

- Commercial Energy As A Service (Eaas) Market size is expected to be worth around USD 147.5 Billion by 2034, from USD 62.9 Billion in 2024, growing at a CAGR of 8.9%.

- Energy Supply Service held a dominant market position, capturing more than a 44.1% share in the Commercial Energy-as-a-Service (EaaS) market.

- Monocrystalline held a dominant market position, capturing more than a 47.3% share in the Commercial Energy-as-a-Service (EaaS) market.

- Distributed Generation held a dominant market position, capturing more than a 51.2% share in the Commercial Energy-as-a-Service (EaaS) market.

- North America emerged as the most influential regional segment, accounting for approximately 43.8% of global revenue with an estimated value of USD 27.5 billion.

By Type Analysis

Energy Supply Service dominates with 44.1% due to its ability to deliver predictable energy costs and reliable power sourcing.

In 2024, Energy Supply Service held a dominant market position, capturing more than a 44.1% share in the Commercial Energy-as-a-Service (EaaS) market by type. This leadership was mainly driven by the growing preference of commercial users to outsource energy procurement and management to specialized service providers. Energy supply service models helped businesses secure stable electricity at contracted rates, reducing exposure to price volatility and operational risks.

In 2025, adoption continued to expand as organizations focused on energy cost control, sustainability targets, and long-term budgeting certainty. The integration of renewable power sourcing and flexible contract structures further improved service appeal, making energy supply service a core offering within the commercial EaaS landscape.

By Service-Delivery Model Analysis

Pay-for-Service dominates with 47.3% as it lowers upfront costs and shifts energy risk away from businesses.

In 2024, Monocrystalline held a dominant market position, capturing more than a 47.3% share in the Commercial Energy-as-a-Service (EaaS) market by service-delivery model, represented through the Pay-for-Service structure. This model gained strong acceptance as commercial users preferred paying only for energy consumed rather than investing capital in energy infrastructure.

It allowed companies to convert fixed energy costs into predictable operating expenses, improving cash flow and financial planning. In 2025, demand for pay-for-service models continued to rise as organizations focused on flexibility, energy efficiency, and performance-based contracts. The inclusion of maintenance, monitoring, and optimization services within a single payment structure further strengthened adoption, supporting its leading position in the commercial EaaS market.

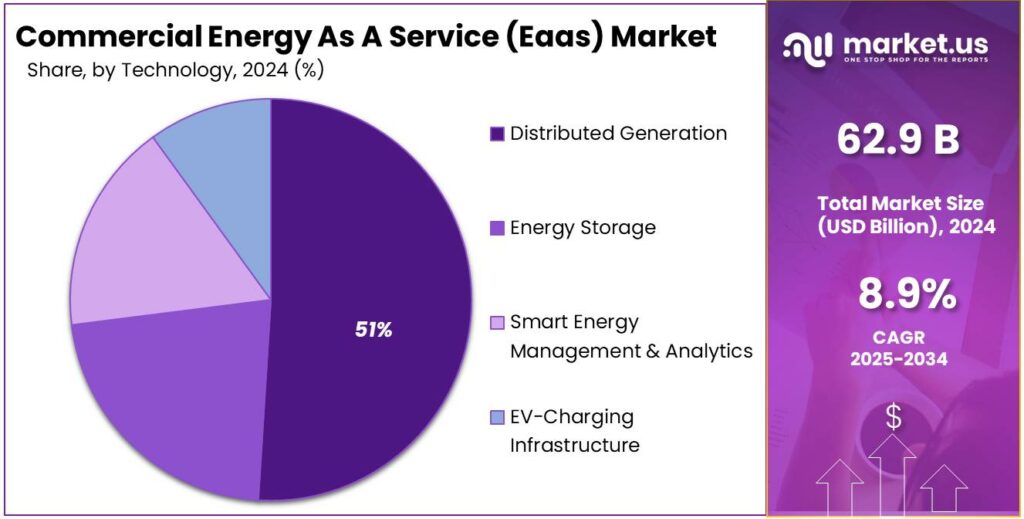

By Technology Analysis

Distributed Generation dominates with 51.2% due to its ability to deliver on-site power and improve energy reliability.

In 2024, Distributed Generation held a dominant market position, capturing more than a 51.2% share in the Commercial Energy-as-a-Service (EaaS) market by technology. This leadership was mainly supported by the rising deployment of on-site energy systems such as solar panels, combined heat and power units, and small-scale generators within commercial facilities.

Distributed generation helped businesses reduce dependence on centralized grids, lower transmission losses, and manage peak demand more effectively. In 2025, adoption continued to increase as energy reliability, resilience, and carbon reduction became key priorities for commercial users. The flexibility to integrate renewable sources and energy management platforms further strengthened the role of distributed generation, reinforcing its leading position in the commercial EaaS technology landscape.

Key Market Segments

By Type

- Energy Supply Service

- Operational and Maintenance Services

- Energy Efficiency and Optimization Services

By Service-Delivery Model

- Pay-for-Service

- Performance-based Contracting (ESCO/EPC)

- Build-Own-Operate-Transfer (BOOT)

- Leasing and Rental Models

By Technology

- Distributed Generation

- Energy Storage

- Smart Energy Management & Analytics

- EV-Charging Infrastructure

Emerging Trends

EaaS Is Shifting from “Savings-Only” to Grid-Flexibility and Virtual Power Plant Participation

A clear latest trend in Commercial Energy as a Service (EaaS) is that providers are no longer selling only “lower energy bills.” More deals are now being designed to make buildings behave like flexible grid assets—so the customer saves money and earns value by shifting load when the grid is stressed. This is showing up through Grid-Interactive Efficient Buildings (GEBs) and Virtual Power Plants (VPPs), where smart controls, storage, and flexible loads are coordinated to reduce peaks or respond to price signals.

The VPP angle is getting more concrete as market rules and programs expand. In DOE’s “Pathways to Commercial Liftoff: Virtual Power Plants 2025 Update,” the report notes that 29 GW of demand response participates in U.S. wholesale markets today, and it highlights that wholesale markets have been a primary way to monetize grid services from distributed flexible loads, especially commercial and industrial loads. The same DOE update also points to FERC Order 2222 as a major policy driver that can unlock broader wholesale participation from distributed energy resources, even though implementation has been slower and uneven across regions.

The investment environment is also supporting this shift toward “always-on optimization.” The IEA’s Energy Efficiency 2025 executive summary projects global energy efficiency-related investment will reach almost USD 800 billion in 2025, up 6% versus 2024. As more money flows into efficiency, EaaS providers are packaging upgrades as a managed service with verified performance—then adding grid flexibility as an extra value stream that can improve the business case.

Drivers

Energy Cost Savings & Efficiency Gains Anchored in Rising Food Industry Energy Demand

Commercial EaaS directly addresses this reality. By shifting energy investment from a heavy upfront purchase to an outcome-based service, companies can unlock immediate savings without large capital outlays. The EaaS provider installs and manages efficient energy systems — such as upgraded HVAC, heat recovery units, advanced controls, solar generation, or battery storage — and the food company pays based on actual energy performance. This model aligns incentives: the more energy you save, the more the provider benefits, and the more you benefit. It transforms energy from a cost centre into a managed service that shrinks risk and boosts predictability.

This shift matters because industrial energy use in sectors like food is not just significant, it’s also systemically critical. The industrial sector overall accounted for 37% of global energy use in 2022, underscoring how big the pie is that companies are trying to manage.³ Within that broader industrial pattern, food processors often operate around the clock, meaning even small efficiency improvements directly reduce utility bills and carbon footprints.

Governments and regulators are also nudging this transformation. Many countries have energy efficiency mandates, performance standards, and incentive programs — from building codes to renewable energy credits — that reward measurable reductions in energy use and emissions. This regulatory environment further raises the stakes for businesses that lag behind in energy performance. When efficiency becomes not just smart business but a compliance issue, service models like EaaS grow more compelling and relevant for food companies seeking to reduce risk, lower costs, and meet environmental goals.

The global food industry, for example, is one of the most energy-hungry sectors in manufacturing and supply chains. According to authoritative research, the broader food sector accounts for roughly 30% of total global energy consumption when considering primary energy inputs throughout farming, processing, storage, and transport. In simple terms, this means that nearly one-third of the world’s energy footprint is tied up in getting food from fields to tables — and almost half of that energy is used merely for heating and cooling operations in food factories.

Restraints

Measurement & Verification Burden Can Slow EaaS Adoption

The cost of verification is another friction point. DOE’s federal M&V guidelines note a rule-of-thumb where overall annual M&V costs are about 2% to 5% of typical annual project cost savings. In parallel, industry M&V community guidance often describes typical M&V costs around 3% to 5% of a project’s capital cost. These percentages may look small on paper, but they matter in competitive projects where finance teams scrutinize every basis point of return—especially when sites have limited metering, older controls, or complex utility tariffs that require extra instrumentation and analytics to verify results.

There is also a trust and “savings credibility” challenge that can make buyers cautious. A U.S. Government Accountability Office review of a non-generalizable sample of 20 federal ESPC projects found contractors’ reports overstated cost and energy savings for 14 projects. This doesn’t mean performance contracting fails; it does highlight why some customers insist on stricter baselines, tighter M&V language, and independent review—steps that can stretch sales cycles and legal negotiations before a single upgrade is installed.

Government initiatives do help standardize expectations. The U.S. EPA’s guidance on performance contracting and energy service agreements explains how third-party providers audit energy use, identify measures, and provide upfront funding—supporting the model’s legitimacy for public and commercial decision-makers. Still, the core restraint remains: the more performance-based the contract, the more important (and demanding) the proof becomes—and that proof takes time, data, and disciplined measurement.

Opportunity

Bundled Electrification and Cold-Chain Efficiency Is a Big EaaS Growth Opportunity

One of the clearest growth opportunities for Commercial Energy as a Service (EaaS) is helping energy-intensive businesses—especially food processing and cold-chain operators—upgrade heating, cooling, and controls without waiting for large capex approvals. The reason is simple: heating and cooling is where a huge share of energy sits. IRENA notes that heating and cooling accounts for about half of global final energy consumption and is responsible for more than 40% of global energy-related CO₂ emissions.

The timing is also right because global capital is flowing toward efficiency and electrification. The IEA projects global energy-efficiency-related investment will reach almost USD 800 billion in 2025, up 6% versus 2024. At the same time, the IEA expects investment in the electricity sector to reach USD 1.5 trillion in 2025. These two trends matter for EaaS: efficiency projects are getting funded at scale, and electrification and grid investment make technologies like heat pumps, advanced controls, storage, and smarter tariffs more viable. EaaS providers can use this environment to offer “one contract” upgrades that combine electric heat (where feasible), waste-heat recovery, and optimized refrigeration/HVAC—with performance guarantees that make approval easier for CFOs.

Government initiatives strengthen the runway by pushing measurable efficiency into national plans. The IEA notes that for COP30, over 110 countries updated their Nationally Determined Contributions (NDCs), with over 50 of them setting efficiency-related targets. In the U.S., USDA analysis has shown the scale and importance of energy in the food economy: in 2007, the U.S. food system accounted for almost 16% of the nation’s energy budget. Those kinds of numbers make it easier for policymakers and corporate sustainability teams to justify programs that reward verified savings—exactly what EaaS is designed to deliver.

Regional Insights

North America leads strongly with 43.8% share and USD 27.5 Bn, driven by high commercial EaaS uptake and supportive energy frameworks.

In 2024, the Commercial Energy-as-a-Service (EaaS) Market in North America emerged as the most influential regional segment, accounting for approximately 43.8% of global revenue with an estimated value of USD 27.5 billion. This leadership reflected the region’s early adoption of advanced energy service models, strong regulatory support for energy efficiency, and a mature ecosystem of service providers catering to commercial clients seeking predictable energy costs and operational resilience.

A significant portion of demand originated from the United States, where businesses embraced energy supply outsourcing, on-site generation integration, and performance-based service contracts to support sustainability commitments and cost control. Canada contributed through growing EaaS deployments tied to provincial renewable mandates and corporate decarbonization strategies. The availability of smart grid infrastructure, incentives for energy management solutions, and an established capital market to finance EaaS transitions underpinned consistent growth throughout 2024.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Budderfly is a rapidly growing U.S. EaaS company offering capital-free energy management and efficiency services tailored to commercial customers such as retail franchises and hospitality chains. In 2024, Budderfly secured a USD 400 million growth debt facility to accelerate technology deployment and expand its EaaS footprint, delivering simplified billing, continuous monitoring, and energy cost savings with minimal upfront cost for clients.

Centrica Business Solutions provides commercial EaaS through pay-for-performance energy service agreements that fund efficiency upgrades without upfront capital. Its approach enables public and private organizations to implement infrastructure projects, reduce consumption, and improve operational income by paying from measured savings and clean energy output, reflecting a tailored, outcome-based solution model.

Bernhard Energy Solutions, rebranded as ENFRA in 2025, has more than 100 years of energy infrastructure experience and provides turnkey EaaS solutions to sectors including healthcare, education, and commercial buildings. The firm executes long-term performance-based energy infrastructure projects such as a notable USD 418 million EaaS partnership with Adventist Health, enhancing operational resilience and energy system efficiency.

Top Key Players Outlook

- Ameresco

- Bernhard Energy Solutions

- Budderfly

- Capstone Green Energy Corporation

- Centrica Business Solutions

- Enel X

- ENGIE Impact

- GridX.Inc

- Honeywell

- Jakson Group

Recent Industry Developments

In 2024, Ameresco reported full-year revenue of USD 1,769.9 million with an adjusted EBITDA of USD 225.3 million, driven by solid execution across energy projects, renewable assets placed in service, and growing operations and maintenance contracts.

In 2024 Bernhard Energy Solutions, its EaaS portfolio surpassed USD 2 billion in total financed volume across more than 23 partnerships, closing USD 739 million in new capital partnerships and booking USD 696 million in infrastructure improvements.

Report Scope

Report Features Description Market Value (2024) USD 62.9 Bn Forecast Revenue (2034) USD 147.5 Bn CAGR (2025-2034) 8.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Energy Supply Service, Operational and Maintenance Services, Energy Efficiency and Optimization Services), By Service-Delivery Model (Pay-for-Service, Performance-based Contracting (ESCO/EPC), Build-Own-Operate-Transfer (BOOT), Leasing and Rental Models), By Technology (Distributed Generation, Energy Storage, Smart Energy Management And Analytics, EV-Charging Infrastructure) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Ameresco, Bernhard Energy Solutions, Budderfly, Capstone Green Energy Corporation, Centrica Business Solutions, Enel X, ENGIE Impact, GridX.Inc, Honeywell, Jakson Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Commercial Energy As A Service (Eaas) MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Commercial Energy As A Service (Eaas) MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Ameresco

- Bernhard Energy Solutions

- Budderfly

- Capstone Green Energy Corporation

- Centrica Business Solutions

- Enel X

- ENGIE Impact

- GridX.Inc

- Honeywell

- Jakson Group