Global Commercial Cleaning Products Market Size, Share, Growth Analysis By Product Type (Surface Cleaners, Floor Cleaners, Disinfectants & Sanitizers, Carpet & Upholstery Cleaners, Bathroom Cleaners, Glass & Window Cleaners, Specialty Cleaning Products), By Application (Office Spaces, Hospitality (Hotels, Restaurants), Healthcare Facilities, Educational Institutions, Industrial and Manufacturing Units, Retail Spaces, Transportation (Airports, Public Transport)), By End User (Janitorial Services, Facility Management, Corporate Offices, Hospitals and Clinics, Educational Institutions, Hotels and Restaurants, Manufacturing Facilities), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 144991

- Number of Pages: 352

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

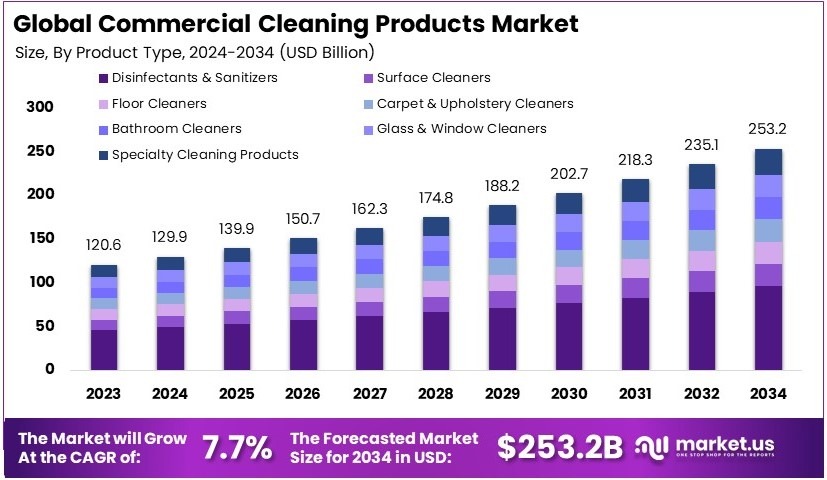

The Global Commercial Cleaning Products Market size is expected to be worth around USD 253.2 Billion by 2034, from USD 120.6 Billion in 2024, growing at a CAGR of 7.7% during the forecast period from 2025 to 2034.

Commercial cleaning products are specialized cleaning solutions used in workplaces, industries, and public spaces. They include disinfectants, detergents, floor cleaners, and sanitizers. These products are formulated for heavy-duty cleaning. They ensure hygiene and safety in high-traffic areas. They are essential in maintaining cleanliness in commercial environments.

The commercial cleaning products market involves the production and distribution of cleaning solutions for businesses. The demand is driven by health regulations and hygiene standards. Sectors like healthcare, hospitality, and offices are key consumers. The market sees innovations in eco-friendly formulations and efficient cleaning technologies.

The commercial cleaning products market is growing steadily. This is driven by the rise in demand for hygiene in public and private spaces. According to the US Bureau of Labor, the U.S. commercial cleaning industry employs over 3.25 million people. Additionally, it is expected to add 236,500 jobs by 2026. This shows the sector’s strength and growth potential.

One key factor driving demand is the increased focus on sanitation. A 2020 report revealed that 38% of healthcare facilities globally lack basic water services. This affects over 896 million people. Moreover, about 20% of these facilities lack sanitation services, impacting 1.5 billion individuals. As such, commercial cleaning products are essential to maintaining hygiene in these spaces.

The rise of two-income households in the U.S. also supports market growth. Nearly 80% of such households are projected to use professional cleaning services in the next 2 years. This trend highlights the demand for reliable, efficient cleaning products. Companies offering multipurpose and eco-friendly solutions are gaining an advantage.

The market is moderately saturated, with large brands holding significant shares. However, smaller companies are emerging with specialized products, such as green cleaning solutions. Consequently, competition is rising, particularly in urban areas where demand is high. To stay competitive, brands invest in innovative and sustainable cleaning technologies.

Key Takeaways

- The Commercial Cleaning Products Market was valued at USD 120.6 billion in 2024 and is expected to reach USD 253.2 billion by 2034, with a CAGR of 7.7%.

- In 2024, Disinfectants & Sanitizers dominate the product type segment with 31.7%, driven by heightened hygiene concerns post-pandemic.

- In 2024, Healthcare Facilities lead the application segment with 35.4%, as stringent cleanliness regulations boost product demand.

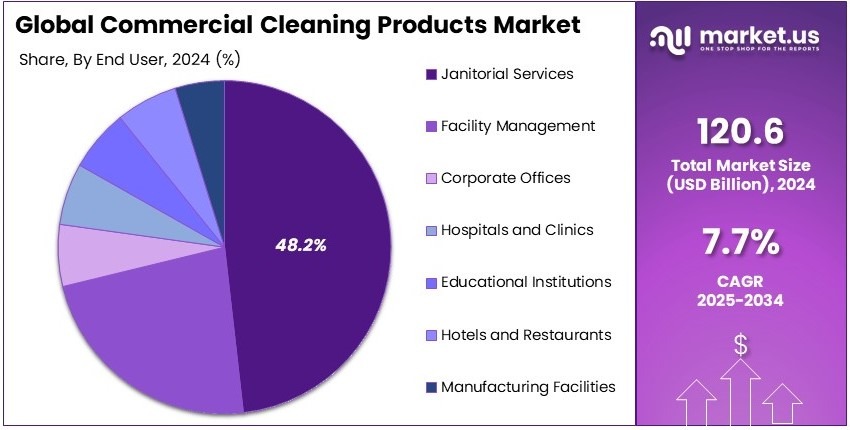

- In 2024, Janitorial Services hold the highest share at 48.2%, relying on bulk procurement for large-scale cleaning operations.

- In 2024, North America dominates with 32.3% and valued at USD 38.95 billion, supported by increasing demand in healthcare and corporate sectors.

Type Analysis

Disinfectants & Sanitizers dominate with 31.7% due to heightened hygiene awareness.

In the Commercial Cleaning Products Market, the types of products include Surface Cleaners, Floor Cleaners, Disinfectants & Sanitizers, Carpet & Upholstery Cleaners, Bathroom Cleaners, Glass & Window Cleaners, and Specialty Cleaning Products. Disinfectants & Sanitizers lead this market with a 31.7% share. This dominance is largely due to the increased emphasis on hygiene and infection control in commercial settings, particularly following health crises.

Surface Cleaners, which make up 22.9% of the market, are essential for daily cleaning operations across all commercial environments, ensuring surfaces are safe and presentable.

Floor Cleaners hold a 19.4% market share. They are crucial for maintaining large areas of commercial spaces, where cleanliness directly impacts the perception of the facility.

Carpet & Upholstery Cleaners and Bathroom Cleaners represent 10.6% and 9.1% of the market, respectively, addressing specific needs within commercial facilities for fabric care and restroom hygiene.

Glass & Window Cleaners and Specialty Cleaning Products, with 3.6% and 2.7% shares respectively, cater to niche market requirements such as streak-free cleaning and tasks requiring particular chemical properties.

Application Analysis

Healthcare Facilities dominate with 35.4% due to stringent sanitation requirements.

Applications of commercial cleaning products are diverse, including Office Spaces, Hospitality, Healthcare Facilities, Educational Institutions, Industrial and Manufacturing Units, Retail Spaces, and Transportation. Healthcare Facilities hold the highest share at 35.4%, driven by the critical need for stringent sanitation protocols to prevent healthcare-associated infections.

Office Spaces and Hospitality, comprising 22.1% and 18.5% of the market, respectively, utilize cleaning products to maintain a clean and welcoming environment for workers and guests.

Educational Institutions, covering 12.0%, focus on creating a safe and hygienic learning environment for students and staff.

Industrial and Manufacturing Units and Retail Spaces, holding 7.0% and 4.0% respectively, emphasize maintaining cleanliness to protect products and enhance customer experience.

Transportation, with a smaller share, requires specialized products to address high-traffic public areas prone to quick soiling and frequent touchpoints.

End User Analysis

Janitorial Services dominate with 48.2% due to their integral role in facility maintenance.

End users of commercial cleaning products include Janitorial Services, Facility Management, Corporate Offices, Hospitals and Clinics, Educational Institutions, Hotels and Restaurants, and Manufacturing Facilities. Janitorial Services are the largest segment, with a 48.2% share, due to their comprehensive role in maintaining various types of facilities.

Facility Management and Corporate Offices account for 20.3% and 15.5% of the market, respectively, underscoring the importance of clean environments in operational efficiency and workplace wellness.

Hospitals and Clinics and Educational Institutions, holding 9.0% and 5.0% respectively, focus on high standards of cleanliness to support health and educational outcomes.

Hotels and Restaurants and Manufacturing Facilities, with 2.0% each, rely on these products to meet specific hygiene standards essential for their operations.

Key Market Segments

By Product Type

- Surface Cleaners

- Floor Cleaners

- Disinfectants & Sanitizers

- Carpet & Upholstery Cleaners

- Bathroom Cleaners

- Glass & Window Cleaners

- Specialty Cleaning Products

By Application

- Office Spaces

- Hospitality (Hotels, Restaurants)

- Healthcare Facilities

- Educational Institutions

- Industrial and Manufacturing Units

- Retail Spaces

- Transportation (Airports, Public Transport)

By End User

- Janitorial Services

- Facility Management

- Corporate Offices

- Hospitals and Clinics

- Educational Institutions

- Hotels and Restaurants

- Manufacturing Facilities

Driving Factors

Growing Demand for Hygiene and Green Solutions Drive Market Growth

The commercial cleaning products market is expanding due to an increasing emphasis on hygiene and sanitation across various sectors. Offices, hospitals, and public spaces are prioritizing cleanliness to ensure safety and well-being. This trend has intensified, especially in healthcare settings where maintaining sterile environments is crucial. As a result, there is a growing demand for industrial-grade disinfectants that offer reliable germ-killing efficiency.

Government regulations also play a significant role in driving market growth. Authorities worldwide are implementing stricter hygiene protocols, particularly in public and high-traffic areas. Compliance with these standards requires businesses to invest in high-quality, effective cleaning products, boosting market demand.

Moreover, the rising adoption of multi-purpose cleaning solutions is shaping market dynamics. These products save time and resources by addressing multiple cleaning needs in a single application, which is particularly valuable in large commercial spaces.

The expansion of green and non-toxic cleaning products is another key factor. Businesses are increasingly focusing on workplace safety and environmental sustainability. Non-toxic and biodegradable products reduce chemical exposure and align with corporate social responsibility initiatives. For instance, many companies now prefer eco-friendly cleaners to support a healthier work environment.

Restraining Factors

High Costs and Compatibility Issues Restrain Market Growth

The commercial cleaning products market faces challenges primarily due to the high cost of eco-friendly and certified organic solutions. While businesses recognize the importance of sustainability, the premium pricing of green products limits their adoption, especially among small and budget-conscious companies.

Another restraining factor is the challenge of compatibility between cleaning chemicals and various surfaces. In commercial settings, diverse materials like wood, metal, and fabrics require specific care. Using harsh or incompatible products can lead to damage, which discourages the use of some commercial cleaners.

Market saturation also presents a hurdle. The availability of low-cost, generic cleaning products makes it difficult for premium brands to gain traction. Many businesses opt for these cheaper alternatives, especially when hygiene standards can be met at a lower cost.

Concerns over chemical residue also impact consumer preferences. Some commercial cleaning agents leave residues that can affect indoor air quality, particularly in enclosed environments like offices. This has raised health concerns, particularly regarding respiratory issues and long-term exposure to volatile organic compounds (VOCs).

Growth Opportunities

Smart Cleaning Devices and Sustainable Products Provide Opportunities

The commercial cleaning products market holds promising opportunities driven by technological advancements and sustainability trends. One of the most significant growth areas is the development of AI-powered and autonomous cleaning devices. These machines use smart disinfectants and can operate without constant human supervision, making them ideal for large commercial facilities. Their ability to adapt cleaning intensity based on real-time data enhances efficiency and reduces human error.

Subscription-based supply services are also gaining traction. Businesses are increasingly opting for regular delivery of cleaning products, ensuring uninterrupted hygiene maintenance. This model offers cost savings and convenience, particularly for large enterprises with consistent cleaning needs.

There is also growing interest in waterless and low-waste cleaning solutions. Such products support sustainable operations by minimizing water usage and packaging waste. For example, concentrated cleaning formulas that require less plastic packaging are becoming popular among environmentally conscious businesses.

Another major opportunity lies in hospital-grade and antimicrobial cleaning products. With heightened awareness of infection control, healthcare and related sectors demand products that offer reliable disinfection. Incorporating antimicrobial technology ensures prolonged protection against pathogens, making these products essential in medical and high-risk environments.

Emerging Trends

Smart Cleaning Technologies and Sustainable Practices Are Latest Trending Factor

The commercial cleaning products market is witnessing a shift towards smart technologies and sustainable practices. One of the most notable trends is the adoption of electrostatic sprayers and UV-light sanitization devices. These technologies ensure thorough and even distribution of disinfectants, reducing manual effort while increasing efficiency. Such innovations are especially useful in healthcare and educational facilities where hygiene is critical.

There is also a growing preference for fragrance-free and hypoallergenic cleaning products. These formulations cater to environments where sensitivity to strong scents is a concern, such as hospitals, schools, and offices. Companies are recognizing the need to create cleaner indoor air without causing irritation, leading to increased demand for gentle yet effective products.

The integration of IoT-enabled cleaning systems is another emerging trend. These systems offer real-time monitoring of hygiene levels, allowing facility managers to maintain consistent cleanliness. For instance, sensors can track foot traffic and automatically trigger cleaning protocols in high-use areas, optimizing resource allocation.

Additionally, refillable and concentrated cleaning products are gaining popularity. These solutions reduce packaging waste and are more economical for commercial users. Companies adopting such practices align themselves with sustainable business operations while reducing their carbon footprint.

Regional Analysis

North America Dominates with 32.3% Market Share

North America leads the Commercial Cleaning Products Market with a 32.3% share, valued at USD 38.95 billion. This strong market position is bolstered by the region’s comprehensive health regulations and the substantial size of its service industry.

Factors driving this dominance include the high standard of cleanliness expected in public and private sectors, widespread awareness about hygiene due to health safety regulations, and the presence of numerous multinational corporations that demand rigorous cleaning protocols.

Looking forward, North America’s influence in the global market is anticipated to continue growing. The ongoing emphasis on sustainable and effective cleaning solutions, coupled with technological advancements in cleaning products, predicts a steady increase in demand, potentially expanding the region’s market share further.

Regional Mentions:

- Europe: Europe has a substantial market share due to strict cleanliness standards in healthcare and food service sectors. The region’s focus on eco-friendly products and sustainability is driving innovation and adoption in the cleaning industry.

- Asia Pacific: The Asia Pacific region is rapidly growing due to urban development and increasing health awareness. This growth is particularly strong in emerging economies where commercial and industrial activities are expanding.

- Middle East & Africa: Middle East & Africa are experiencing growth driven by development in tourism and hospitality sectors, necessitating higher standards of cleanliness and more extensive use of cleaning products.

- Latin America: Latin America is witnessing moderate growth in the commercial cleaning market. The increase in industrial activities and the growing service sector are main contributors to this development.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

The Commercial Cleaning Products Market is shaped significantly by four major companies: Church & Dwight Co., Inc., BISSELL Inc., Spectrum Brands, Inc. (Nature’s Miracle), and Rocco & Roxie Supply Co.

Church & Dwight Co., Inc. brings a portfolio of powerful cleaning brands that are well-respected in both residential and commercial markets. Their products are known for their efficacy and reliability, making them a preferred choice in commercial settings.

BISSELL Inc. is pivotal in the market due to its innovative cleaning solutions and equipment that cater to a variety of commercial cleaning needs, from floor care to general sanitation, emphasizing durability and performance.

Spectrum Brands’ Nature’s Miracle is specifically recognized in the pet care segment, offering specialized products that effectively remove pet stains and odors, making them indispensable in commercial settings like veterinary clinics and pet-friendly businesses.

Rocco & Roxie Supply Co. offers highly effective stain and odor eliminators that have gained popularity for their strength and safety, becoming a go-to for businesses that require pet-specific cleaning solutions.

Together, these companies drive innovation and set standards in the Commercial Cleaning Products Market, characterized by their strong focus on quality, customer satisfaction, and continuous improvement in product effectiveness and safety.

Major Companies in the Market

- Bi-O-Kleen Industries, Inc.

- Fresh Wave

- Church & Dwight Co., Inc.

- BISSELL Inc.

- Spectrum Brands, Inc. (Nature’s Miracle)

- Rocco & Roxie Supply Co.

- Skouts Honor Pet Supply Co.

- Angry Orange

- Zero Odor

- Compana Pet Brands (Simple Solution)

Recent Developments

- San Francisco Equity Partners (SFEP): February 2025, San Francisco Equity Partners acquired a majority stake in Formula Corp, a leading developer and manufacturer of cleaning products for both consumer and professional use. Formula Corp specializes in custom-blended cleaning products and offers a comprehensive range of services including R&D, formulation, and fulfillment.

- OZONO: November 2024, OZONO introduced its innovative chemical-free cleaning device to the Australian market. The device utilizes aqueous ozone technology, generating a powerful, natural cleaner using air and electricity. This solution effectively cleans, sanitizes, and removes odors without harmful residues, offering hypoallergenic and environmentally friendly benefits.

Report Scope

Report Features Description Market Value (2024) USD 120.6 Billion Forecast Revenue (2034) USD 253.2 Billion CAGR (2025-2034) 7.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Surface Cleaners, Floor Cleaners, Disinfectants & Sanitizers, Carpet & Upholstery Cleaners, Bathroom Cleaners, Glass & Window Cleaners, Specialty Cleaning Products), By Application (Office Spaces, Hospitality (Hotels, Restaurants), Healthcare Facilities, Educational Institutions, Industrial and Manufacturing Units, Retail Spaces, Transportation (Airports, Public Transport)), By End User (Janitorial Services, Facility Management, Corporate Offices, Hospitals and Clinics, Educational Institutions, Hotels and Restaurants, Manufacturing Facilities) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Bi-O-Kleen Industries, Inc., Fresh Wave, Church & Dwight Co., Inc., BISSELL Inc., Spectrum Brands, Inc. (Nature’s Miracle), Rocco & Roxie Supply Co., Skouts Honor Pet Supply Co., SzeKai Co., Ltd?, Sunny & Honey, Angry Orange, Zero Odor, Procter & Gamble (Febreze), Compana Pet Brands (Simple Solution) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Commercial Cleaning Products MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

Commercial Cleaning Products MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Bi-O-Kleen Industries, Inc.

- Fresh Wave

- Church & Dwight Co., Inc.

- BISSELL Inc.

- Spectrum Brands, Inc. (Nature's Miracle)

- Rocco & Roxie Supply Co.

- Skouts Honor Pet Supply Co.

- Angry Orange

- Zero Odor

- Compana Pet Brands (Simple Solution)