Global Cold Shrink Cable Termination Market Size, Share, Statistics Analysis Report By Product Type (Single-core Cold Shrink Cables, Multi-core Cold Shrink Cables, Cold Shrink Joints, Cold Shrink Terminations), By Application (Power Transmission, Renewable Energy, Telecommunications, Commercial and Industrial Applications), By Material (EPDM (Ethylene Propylene Diene Monomer), Silicone Rubber, EVA (Ethylene Vinyl Acetate), Other Polymer Materials), By Installation Method (Indoor Cold Shrink Cable Terminations, Outdoor Cold Shrink Cable Terminations, Pre-assembled Cold Shrink Systems, Field-assembled Cold Shrink Systems), By End-user Industry (Power Utilities, Telecommunication Operators, Infrastructure and Construction, Manufacturing and Processing, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 144250

- Number of Pages: 205

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Analysts’ Viewpoint

- China Market Leadership

- Product Type Analysis

- Application Analysis

- Material Analysis

- Installation Method Analysis

- End-user Industry Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Latest Market Trends

- Business Benefits

- Key Player Analysis

- Top Opportunities Awaiting for Players

- Recent Developments

- Report Scope

Report Overview

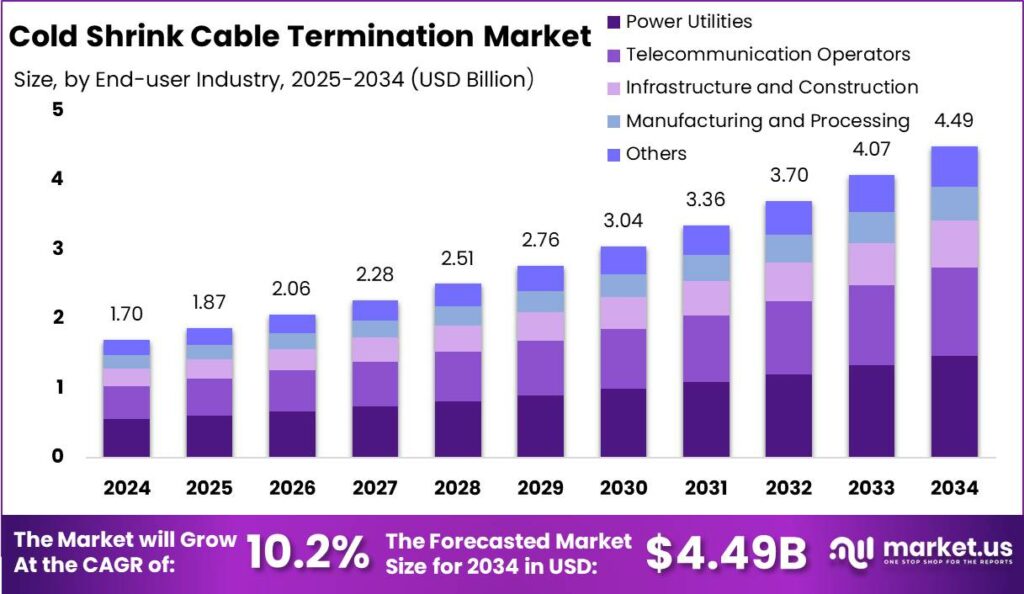

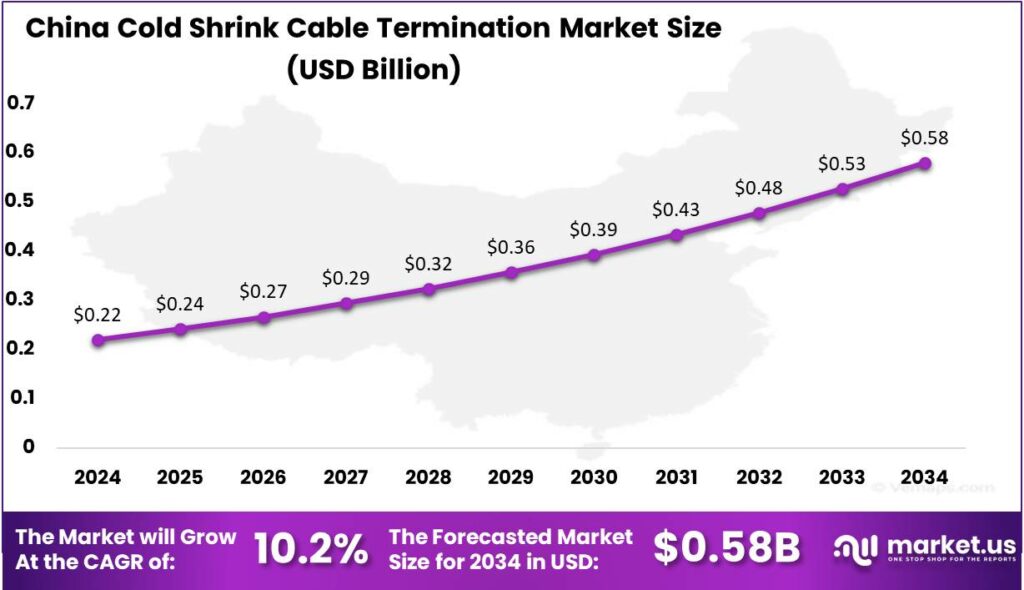

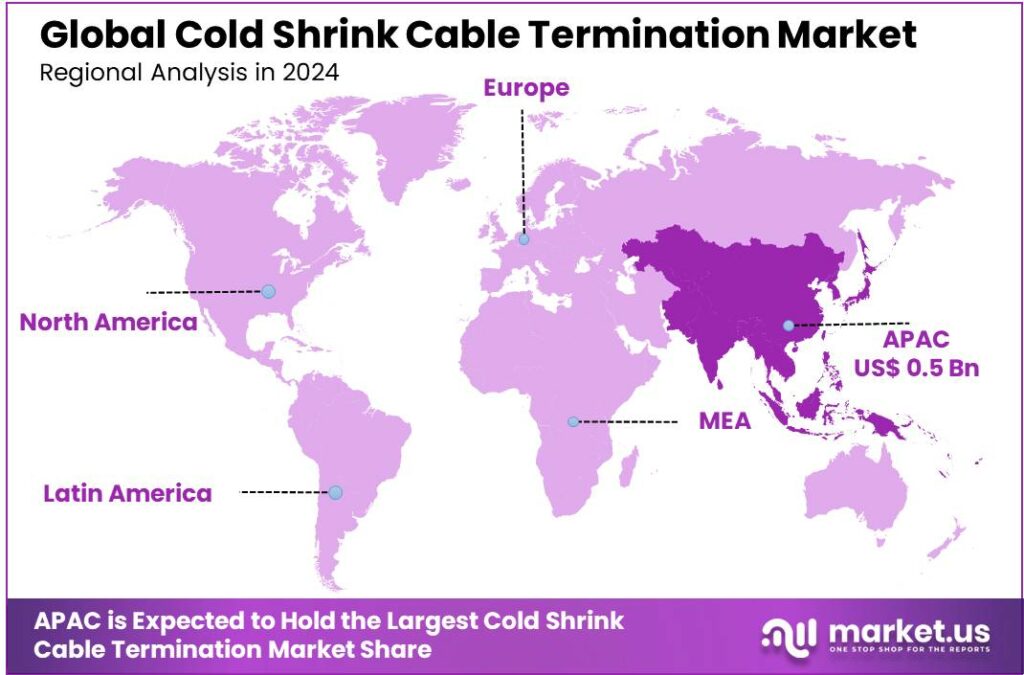

The Global Cold Shrink Cable Termination Market size is expected to be worth around USD 4.49 Billion By 2034, from USD 1.7 Billion in 2024, growing at a CAGR of 10.20% during the forecast period from 2025 to 2034. In 2024, the Asia-Pacific region led the market with 32.9% share and USD 0.5 billion in revenue. The China market was valued at USD 0.22 billion and is projected to grow at a CAGR of 10.2%.

The cold shrink cable termination market is experiencing growth driven by several key factors. The primary driver is the increased demand for reliable and safe electrical infrastructure, particularly in industries where exposure to hazardous conditions is common, such as oil refineries and chemical plants. Additionally, the market is further supported by the move towards renewable energy sources such as wind and solar power, which demand durable and efficient cable terminations for quick and safe installations.

Technological advancements in materials and design have also enhanced the performance and application range of cold shrink terminations, making them a preferred choice in various sectors. The foremost driving factors for the cold shrink cable termination market include the need for improved safety standards in electrical installations and the global push towards more efficient and sustainable energy practices.

Industries are increasingly adopting these terminations to reduce installation time and labor costs, while also mitigating risks associated with traditional heat shrink methods, such as fire hazards and physical injuries during installation. Technologies in the cold shrink space are being adopted due to their inherent safety features, ease of installation, and lower long-term maintenance requirements.

These terminations eliminate the need for heat, reducing the risk of injuries and simplifying the installation process, which can often be completed by fewer technicians and in less time compared to heat shrink alternatives. This technological shift is primarily driven by the increasing regulatory focus on safety and environmental sustainability in electrical installations.

Demand for cold shrink cable terminations is anticipated to rise significantly due to their robust performance in harsh environmental conditions and their ability to provide a reliable seal that protects against moisture and contaminants. This demand is particularly strong in industries operating in adverse conditions, such as marine, oil and gas, and mining sectors, where equipment reliability is crucial.

Key Takeaways

- The Global Cold Shrink Cable Termination Market size is projected to reach USD 4.49 Billion by 2034, up from USD 1.7 Billion in 2024, growing at a CAGR of 10.20% during the forecast period from 2025 to 2034.

- In 2024, the Multi-core Cold Shrink Cables segment held a dominant market position, accounting for more than 34.8% of the market share.

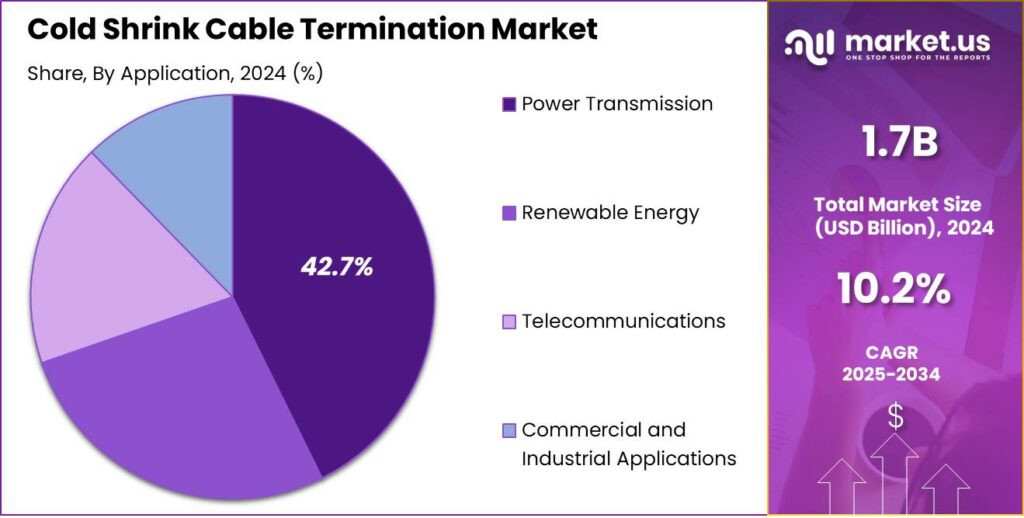

- The Power Transmission segment was the leading segment in 2024, capturing more than 42.7% of the market share in the cold shrink cable termination market.

- The EPDM (Ethylene Propylene Diene Monomer) segment also held a dominant market position in 2024, with a share of more than 38.4%.

- In 2024, the Indoor Cold Shrink Cable Terminations segment had a dominant position, commanding more than 40.5% of the global market share.

- The Power Utilities segment held a leading market position in 2024, securing more than 32.7% of the market share in the cold shrink cable termination market.

- In 2024, the Asia-Pacific region led the market, holding more than 32.9% of the market share with a revenue of USD 0.5 billion.

- The market for cold shrink cable terminations in China was estimated at USD 0.22 billion in 2024, and it is expected to expand at a CAGR of 10.2%.

Analysts’ Viewpoint

Investment in the cold shrink cable termination market appears promising due to the growing need for safe and efficient cable management solutions across various industries. Investors are particularly interested in companies that are innovating in silicone and rubber technologies, as these materials are key to the effectiveness of cold shrink terminations.

The market is trending towards more environmentally friendly and safer installation practices. There is also a noticeable shift towards customizing solutions to meet specific industry needs, such as adjustable sizes and enhanced resistance to environmental factors like UV radiation and chemicals.

The adoption of cold shrink technology in businesses offers numerous benefits including reduced operational risks, lower installation costs, and improved longevity of electrical systems. These benefits contribute to a more stable and cost-effective operation, particularly in critical infrastructures.

The regulatory landscape for cold shrink cable terminations is increasingly focused on enhancing safety standards and reducing environmental impact. Regulations are becoming stricter in terms of the materials and methods used for cable terminations, driving innovation towards safer and more sustainable practices.

China Market Leadership

In 2024, the market for cold shrink cable terminations in China was estimated at USD 0.22 billion. It is projected to expand at a compound annual growth rate (CAGR) of 10.2%.

Cold shrink cable terminations are crucial in the electrical infrastructure sector, facilitating the secure and efficient termination of medium voltage cables. This technology is particularly favored for its durability and ease of installation, which does not require the use of special tools or heat, thus reducing the risk of installation errors and improving safety.

The market’s growth is driven by factors such as increased investments in renewable energy projects and the modernization of outdated electrical infrastructure. As China focuses on improving energy efficiency and reliability, the demand for advanced electrical components like cold shrink cable terminations is set to rise. Additionally, the Chinese government’s push for renewable energy will likely drive upgrades to existing grid infrastructures, further boosting the demand for these technologies.

In 2024, Asia-Pacific held a dominant position in the cold shrink cable termination market, capturing more than a 32.9% share with revenues amounting to USD 0.5 billion. This significant market share can be attributed to rapid industrialization and urbanization across the region, which have driven the demand for enhanced electrical infrastructure.

The region’s dominance in this market is largely driven by extensive development in countries like China and India, which are investing heavily in upgrading and expanding power distribution networks.Government initiatives to boost renewable energy demand reliable electrical connections, which cold shrink cable terminations can provide.

The Asia-Pacific market benefits from the presence of key players in the electrical components industry, driving technological innovations and product improvements. The competitive landscape fosters ongoing research and development, leading to more efficient and safer cable termination solutions tailored to the region’s high-growth markets.

Additionally, the push towards smart cities and smart grid technologies in countries like South Korea and Japan also supports the expansion of the cold shrink cable termination market. Sophisticated cable management systems are vital for reliability and efficiency, making the Asia-Pacific region a leader in adopting cold shrink cable termination technology.

Product Type Analysis

In 2024, the Multi-core Cold Shrink Cables segment held a dominant market position within the cold shrink cable termination market, capturing more than a 34.8% share. This segment’s leadership is largely due to the increased efficiency and cost-effectiveness that multi-core cables offer in diverse industrial applications.

The demand for multi-core cold shrink cables is high in utilities, telecommunications, and transportation sectors due to their ability to handle high voltage and complex power distributions. Their easy installation, without the need for special tools or flames, makes them ideal for environments where minimizing downtime and labor costs is crucial.

The growth of infrastructure projects, such as renewable energy farms and urban transit systems in developing economies, has driven the demand for multi-core cold shrink cables. These projects require reliable cable networks that perform well under diverse conditions, fueling advancements in cable technology.

Technological innovations in the design and material composition of multi-core cold shrink cables have also contributed to their dominant market position. Manufacturers are increasingly focusing on enhancing the performance characteristics of these cables, such as their thermal and chemical resistance, to cater to the stringent requirements of modern electrical systems.

Application Analysis

In 2024, the Power Transmission segment held a dominant market position in the cold shrink cable termination market, capturing more than a 42.7% share. This segment’s leadership can be attributed to the escalating global demand for energy and the consequent expansion of power distribution networks.

The Renewable Energy segment significantly impacts the cold shrink cable termination market, driven by the global shift to sustainable energy. As solar and wind installations increase, the demand for durable, weather-resistant cable terminations grows, highlighting the importance of cold shrink solutions that maintain performance in harsh conditions.

In the realm of Telecommunications, the demand for cold shrink cable terminations is bolstered by the rapid expansion of telecom infrastructure globally. The deployment of high-speed internet networks and the rise of data centers require cable terminations that offer both reliability and ease of installation, which cold shrink technology provides.

The Commercial and Industrial Applications segment uses cold shrink cable terminations to improve the reliability and safety of electrical systems in facilities like factories, offices, and residential complexes. The adoption of this technology is driven by its maintenance-free nature and superior performance, ensuring safety and efficiency in critical environments.

Material Analysis

In 2024, the EPDM (Ethylene Propylene Diene Monomer) segment held a dominant market position within the Cold Shrink Cable Termination market, capturing more than a 38.4% share. This leadership can be attributed to several intrinsic properties of EPDM that are particularly advantageous for cable termination applications.

The preference for EPDM in cold shrink cable terminations stems from its robust performance in extreme weather conditions ranging from severe cold to intense heat. Unlike other materials, EPDM maintains its flexibility and insulating properties over a wide temperature range, making it an ideal choice for outdoor and industrial environments.

EPDM’s excellent resistance to ultraviolet (UV) light and ozone is key to its widespread use, as it prevents degradation over time especially in electrical applications exposed to harsh environments. This stability ensures that electrical connections maintain their integrity, enhancing system safety and reliability.

EPDM-based cold shrink terminations dominate the market due to their manufacturing and installation ease. EPDM’s elastic properties enable a secure fit across various cable sizes, simplifying installation and minimizing errors. This, combined with its performance advantages, makes EPDM the preferred choice for utilities and industries seeking reliable and efficient electrical solutions.

Installation Method Analysis

In 2024, the Indoor Cold Shrink Cable Terminations segment held a dominant market position, capturing more than a 40.5% share of the global market. This segment’s leadership can be attributed to several key factors. First, the growing need for reliable and efficient electrical infrastructure within commercial and residential buildings has driven the demand for indoor terminations.

Outdoor Cold Shrink Cable Terminations also form a significant part of the market, although they hold a slightly smaller share compared to indoor terminations. This segment benefits from the increasing expansion of electrical grids in rural and urban outskirts, where environmental resistance and durability against weather elements are necessary.

Pre-assembled Cold Shrink Systems represent an emerging segment that offers considerable growth potential. These systems are prefabricated, which reduces the time and technical skill required for installation. The convenience of pre-assembled systems is highly valued in fast-paced construction environments and in regions where skilled labor is scarce or costly.

Field-assembled Cold Shrink Systems, though versatile, hold the smallest market share. They offer flexibility for on-site adjustments, especially in bespoke or retrofit applications, but require skilled installation and carry a risk of human error. Innovations to simplify the assembly process could boost their appeal and market share in the future.

End-user Industry Analysis

In 2024, the Power Utilities segment held a dominant market position within the Cold Shrink Cable Termination market, capturing more than a 32.7% share. This prominence is largely due to the critical role of reliable and efficient power distribution and transmission systems in national infrastructures.

Telecommunication Operators also represent a significant portion of the market, driven by the expansion of telecom infrastructure globally. As data transmission demands grow, the need for secure and reliable cable terminations escalates. Cold shrink terminations are favored in this sector for their quick deployment and long-term reliability, essential for maintaining the uptime of critical communication networks.

The Infrastructure and Construction sector uses cold shrink cable terminations in both commercial and residential projects, driven by the global construction boom and the growing complexity of electrical systems. Cold shrink technology is valued for its easy installation and low maintenance, though the varying electrical specifications across projects can impact its universal applicability.

The Manufacturing and Processing industry, along with other sectors, increasingly uses cold shrink cable terminations to boost operational reliability. In manufacturing, where downtime can incur financial losses, the quick installation and dependability of cold shrink terminations are vital. However, the segment’s growth is limited by the varied requirements of different processes, which may not always align with standard cold shrink specifications.

Key Market Segments

By Product Type

- Single-core Cold Shrink Cables

- Multi-core Cold Shrink Cables

- Cold Shrink Joints

- Cold Shrink Terminations

By Application

- Power Transmission

- Renewable Energy

- Telecommunications

- Commercial and Industrial Applications

By Material

- EPDM (Ethylene Propylene Diene Monomer)

- Silicone Rubber

- EVA (Ethylene Vinyl Acetate)

- Other Polymer Materials

By Installation Method

- Indoor Cold Shrink Cable Terminations

- Outdoor Cold Shrink Cable Terminations

- Pre-assembled Cold Shrink Systems

- Field-assembled Cold Shrink Systems

By End-user Industry

- Power Utilities

- Telecommunication Operators

- Infrastructure and Construction

- Manufacturing and Processing

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Growing Renewable Energy Initiatives

The global shift towards renewable energy sources has significantly increased the demand for efficient and reliable electrical components, including cold shrink cable terminations. As countries invest heavily in wind, solar, and other renewable energy installations, the need for durable and easy-to-install cable termination solutions becomes paramount.

Cold shrink technology offers superior performance in various environmental conditions, making it ideal for renewable energy applications. For instance, the expansion of renewable energy projects has been identified as a significant opportunity for the cold shrink cable termination market. This trend underscores the critical role of cold shrink terminations in supporting the infrastructure of sustainable energy systems.

Restraint

High upfront costs and specialized expertise needed

Despite the advantages of cold shrink cable terminations, their adoption is hindered by higher initial costs compared to traditional heat shrink solutions. This cost factor can be a significant barrier for budget-conscious projects or regions with limited financial resources.

Additionally, the installation of cold shrink terminations requires specialized technical expertise, which may not be readily available in all markets. The lack of awareness and technical knowledge about cold shrink technology can lead to reluctance in adopting these solutions.

Furthermore, the presence of alternative technologies, such as heat shrink and pre-molded solutions, offers competition that can limit the market penetration of cold shrink terminations. These factors collectively pose challenges to the widespread adoption of cold shrink technology.

Opportunity

Upgrading power grids with smart technology

The modernization of power grids and the adoption of smart grid technologies offer significant opportunities for the cold shrink cable termination market. As utilities upgrade aging infrastructure to improve efficiency and reliability, the demand for advanced cable termination solutions that meet higher performance standards is increasing.

Cold shrink terminations, known for their reliability and ease of installation, are well-suited for these modernized systems. The increasing deployment of smart grids, which require robust and durable components to handle complex electrical networks, further drives the demand for cold shrink technology.

This trend is particularly evident in regions focusing on improving their electrical infrastructure to meet contemporary energy demands. The alignment of cold shrink solutions with the objectives of grid modernization initiatives underscores their potential in this evolving market landscape.

Challenge

Challenge from alternative tech innovations

The cold shrink cable termination market faces significant challenges from alternative technologies, notably heat shrink and pre-molded cable terminations. Competing solutions have a strong market presence and are seen as more cost-effective or familiar. For cold shrink technology to gain traction, it must clearly outperform in terms of performance, ease of installation, and long-term reliability to convince users to switch.

Additionally, overcoming the inertia of existing preferences and the investment in current technologies requires substantial marketing efforts and evidence-based demonstrations of cold shrink benefits. The competitive landscape requires ongoing innovation and education to emphasize the unique benefits of cold shrink terminations. Overcoming these challenges is key to expanding market share and driving wider adoption of cold shrink solutions.

Latest Market Trends

One significant trend is the increasing adoption of cold shrink solutions in renewable energy projects, such as wind and solar power installations. These environments demand robust and durable cable terminations that can withstand harsh conditions, making cold shrink technology a preferred choice due to its superior environmental sealing and insulation properties.

Another emerging trend is the expansion of cold shrink applications into high-voltage systems. Traditionally utilized in medium-voltage scenarios, recent developments have enabled the use of cold shrink joints and terminations in high-voltage applications, offering simplified installation processes and enhanced performance.

Geographically, regions such as Asia-Pacific, North America, and Europe are experiencing significant growth in the cold shrink cable termination market. This expansion is fueled by infrastructure development, technological advancements, and the increasing demand for reliable power distribution networks.

Business Benefits

- Simplified Installation: Cold shrink terminations are pre-stretched and placed on a removable core, allowing for easy installation without the need for heat or specialized tools. This reduces labor time and minimizes the risk of installation errors.

- Enhanced Safety: The absence of heat application eliminates the need for open flames or heat guns, reducing the risk of fire hazards and making them suitable for hazardous environments where flammable gases may be present.

- Reliable Performance: Cold shrink terminations provide a consistent and dependable seal that adapts to cable expansions and contractions due to temperature changes, maintaining a secure connection over time.

- Cost Efficiency: The ease of installation and reduced need for specialized tools or permits lead to lower labor costs. Additionally, the long-term reliability decreases maintenance expenses and potential downtime.

- Versatility: Cold shrink technology is adaptable to various cable sizes and types, making it suitable for a wide range of applications, including tight spaces and challenging environmental conditions.

Key Player Analysis

The market is dominated by several key players that offer innovative products and solutions to meet the diverse needs of customers.

3M Company is a global leader in the cold shrink cable termination market. Known for its cutting-edge technology and high-performance materials, 3M offers a wide range of cold shrink products designed for both low and high voltage applications. 3M is known for its innovation and customer satisfaction, consistently launching products that improve durability and installation. Its global reach and strong industry presence make it a market leader.

ABB Ltd. is another key player in the cold shrink cable termination market. The company is known for its broad portfolio of electrical products, including its reliable and efficient cold shrink cable terminations. ABB’s solutions are widely used in the power and utilities sector, where high-quality cable termination is crucial for ensuring system reliability and safety.

TE Connectivity Ltd. is a prominent player in the cold shrink cable termination space, offering advanced solutions for both medium and high voltage systems. The company’s cold shrink products are known for their ease of installation and ability to perform in challenging environments. TE Connectivity delivers high-performance, durable, and cost-effective solutions across industries such as telecommunications, energy, and transportation.

Top Key Players in the Market

- 3M Company

- ABB Ltd.

- TE Connectivity Ltd.

- Raychem RPG Pvt. Ltd.

- Nexans S.A.

- Prysmian Group

- Hubbell Power Systems, Inc.

- Sumitomo Electric Industries, Ltd.

- Eaton Corporation plc

- General Cable Technologies Corporation

- Legrand S.A.

- Schneider Electric SE

- Siemens AG

- Brugg Kabel AG

- NKT A/S

- Southwire Company, LLC

- LS Cable & System Ltd.

- Elsewedy Electric S.A.E.

- Ensto Group

- Hellenic Cables S.A.

- Others

Top Opportunities Awaiting for Players

In the rapidly evolving Cold Shrink Cable Termination market, several opportunities are emerging that could be leveraged by players to enhance their market position.

- Technological Innovations: The market is seeing significant advancements in product design and materials, which include the development of cold shrink terminations with integrated surge arresters and self-healing capabilities. These innovations not only improve the functionality and reliability of the terminations but also open new application avenues in harsh environmental conditions.

- Expansion in Renewable Energy Sectors: There is a growing demand for cold shrink cable terminations in renewable energy setups, especially in wind power and photovoltaic systems. The expansion of offshore wind farms and submarine cables presents a substantial opportunity for market growth, driven by the global shift towards sustainable energy solutions.

- Geographical Expansion: Market players can look to expand into new geographic regions where the adoption of cold shrink technology is still nascent. For instance, developing regions that are currently underrepresented in market penetration offer a fertile ground for expansion, provided that awareness and distribution challenges are addressed.

- Eco-Friendly Solutions: There is a notable shift toward environmentally friendly materials in manufacturing processes. Players in the cold shrink cable termination market can gain a competitive edge by developing and promoting products that meet these eco-conscious standards, appealing to a broader range of stakeholders concerned with sustainability.

- Strategic Partnerships and Localization: Forming strategic partnerships and localizing supply chains can significantly enhance market reach and serviceability. This approach not only helps in reducing operational costs but also in complying with local regulations and standards, which can vary significantly across different regions.

Recent Developments

- In February 2025, TE Connectivity entered into a definitive agreement to acquire Richards Manufacturing Co. This strategic move aims to strengthen TE’s position in serving electrical utilities in North America by combining complementary product portfolios and leveraging Richards’ expertise in medium voltage cold-shrink cable accessories.

- On March 25, 2025, Prysmian Group agreed to acquire U.S.-based connectivity device manufacturer Channell Commercial Corp for up to $1.15 billion. This acquisition is intended to enhance Prysmian’s footprint in North America, particularly in the digital solution cables sector, which is crucial for the development of data centers and 5G technology.

- In April 2024, MTM Engineering acquired TA Ronan, a leading provider of cable installation and termination services in central London. This acquisition is part of MTM’s strategy to expand its market presence in the UK and enhance its capabilities in the cable accessories sector.

Report Scope

Report Features Description Market Value (2024) USD 1.7 Bn Forecast Revenue (2034) USD 4.49 Bn CAGR (2025-2034) 10.20% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Product Type (Single-core Cold Shrink Cables, Multi-core Cold Shrink Cables, Cold Shrink Joints, Cold Shrink Terminations), By Application (Power Transmission, Renewable Energy, Telecommunications, Commercial and Industrial Applications), By Material (EPDM (Ethylene Propylene Diene Monomer), Silicone Rubber, EVA (Ethylene Vinyl Acetate), Other Polymer Materials), By Installation Method (Indoor Cold Shrink Cable Terminations, Outdoor Cold Shrink Cable Terminations, Pre-assembled Cold Shrink Systems, Field-assembled Cold Shrink Systems), By End-user Industry (Power Utilities, Telecommunication Operators, Infrastructure and Construction, Manufacturing and Processing, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape 3M Company, ABB Ltd., TE Connectivity Ltd., Raychem RPG Pvt. Ltd., Nexans S.A., Prysmian Group, Hubbell Power Systems, Inc., Sumitomo Electric Industries, Ltd., Eaton Corporation plc, General Cable Technologies Corporation, Legrand S.A., Schneider Electric SE, Siemens AG, Brugg Kabel AG, NKT A/S, Southwire Company, LLC, LS Cable & System Ltd., Elsewedy Electric S.A.E., Ensto Group, Hellenic Cables S.A., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Cold Shrink Cable Termination MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Cold Shrink Cable Termination MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- 3M Company

- ABB Ltd.

- TE Connectivity Ltd.

- Raychem RPG Pvt. Ltd.

- Nexans S.A.

- Prysmian Group

- Hubbell Power Systems, Inc.

- Sumitomo Electric Industries, Ltd.

- Eaton Corporation plc

- General Cable Technologies Corporation

- Legrand S.A.

- Schneider Electric SE

- Siemens AG

- Brugg Kabel AG

- NKT A/S

- Southwire Company, LLC

- LS Cable & System Ltd.

- Elsewedy Electric S.A.E.

- Ensto Group

- Hellenic Cables S.A.

- Others