Global Cold Milling Machine Market Size, Share, Growth Analysis By Machine Type (Small Cold Milling Machines, Large Cold Milling Machines), By Application (Road Construction, Pavement Maintenance, Soil Stabilization, Others), By End-Use Industry (Construction and Infrastructure, Mining, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 141218

- Number of Pages: 278

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

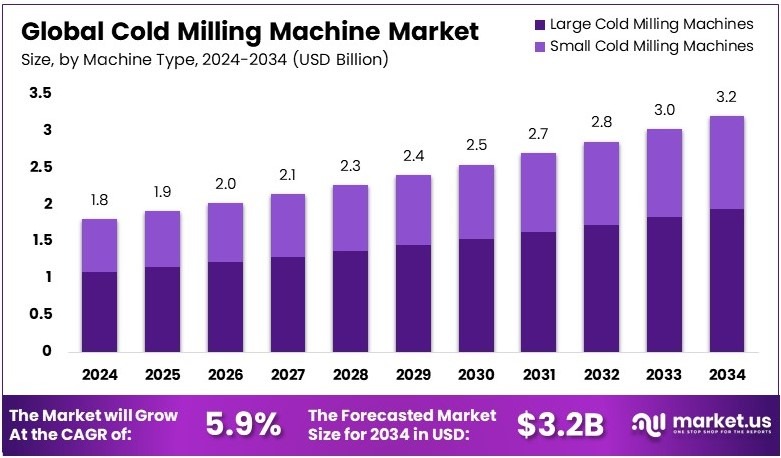

The Global Cold Milling Machine Market size is expected to be worth around USD 3.2 Billion by 2034, from USD 1.8 Billion in 2024, growing at a CAGR of 5.9% during the forecast period from 2025 to 2034.

A cold milling machine is a type of construction equipment used to remove the surface layer of roads, highways, and other paved areas. It uses a rotating drum with sharp teeth to grind and collect the material. This machine is essential for road maintenance and resurfacing projects, offering precise material removal.

The cold milling machine market refers to the demand for these machines across various industries. It includes manufacturers, suppliers, and distributors of cold milling equipment. The market serves sectors such as road construction and infrastructure development, driven by the need to maintain and improve roadways globally.

According to the Federal Highway Administration (FHWA), the U.S. alone has over 4 million miles of paved roads that require continuous maintenance. This large infrastructure base ensures a steady demand for cold milling machines, as these machines are essential for resurfacing roads. Additionally, cold milling helps improve road quality and durability, especially in regions with heavy traffic.

The cold milling machine market benefits from ongoing road maintenance and infrastructure improvement projects. For example, road authorities globally are focusing on resurfacing and reconstruction, creating a constant need for cold milling equipment. Furthermore, as urban areas expand, the demand for efficient road maintenance equipment will continue to grow, leading to increased opportunities for manufacturers.

The market remains competitive, with both established players and new entrants vying for market share. The demand for more efficient, environmentally friendly machines is driving innovation. However, the market is also saturated in some regions, especially where road infrastructure is already highly developed. Manufacturers must innovate to maintain competitive advantage.

Governments play a significant role in the cold milling machine market by funding road maintenance and infrastructure projects. For instance, many countries allocate large portions of their budgets for infrastructure improvements, directly impacting the demand for cold milling machines. Regulations related to environmental sustainability are also shaping the market, encouraging more efficient machinery designs.

Key Takeaways

- The Cold Milling Machine Market was valued at USD 1.8 Billion in 2024 and is expected to reach USD 3.2 Billion by 2034, with a CAGR of 5.9%.

- In 2024, Large Cold Milling Machines dominated the machine type segment with 60.5%, driven by demand for high-capacity road rehabilitation.

- In 2024, Road Construction accounted for 58.2%, as governments worldwide invest in infrastructure modernization and road maintenance.

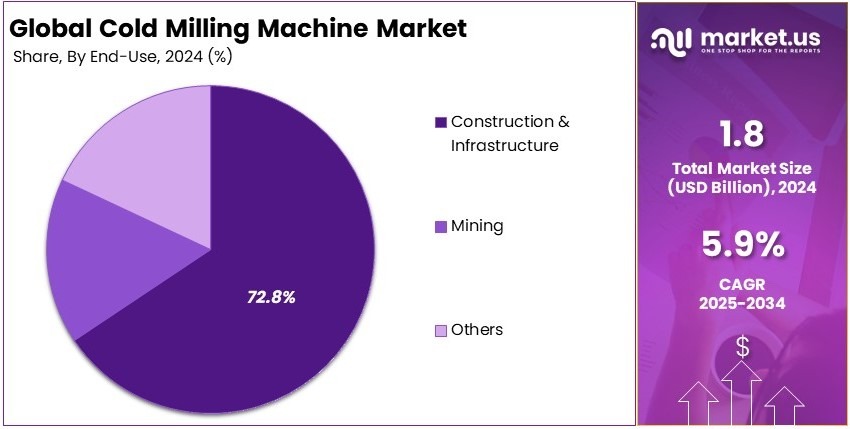

- In 2024, Construction & Infrastructure led the end-use industry with 72.8%, due to increasing urbanization and transportation projects.

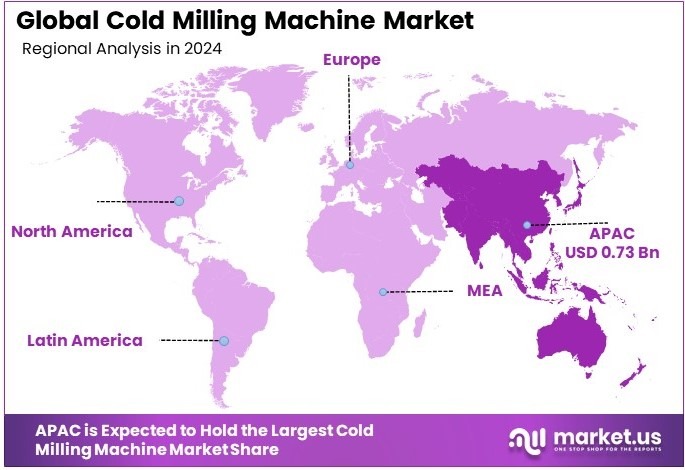

- In 2024, APAC dominated with 40.7% + USD 0.73 Bn, supported by rapid infrastructure expansion and highway development.

Machine Type Analysis

Large Cold Milling Machines dominate with 60.5% due to their high productivity and suitability for large-scale projects.

Large cold milling machines dominate the market with a 60.5% share. These machines are preferred for large-scale construction projects such as road resurfacing and major pavement repairs. Their higher working width and power capacity allow them to cover larger areas more quickly, which significantly increases productivity.

Large cold milling machines are essential for projects that demand high efficiency and superior performance. Their ability to handle deep milling and heavy-duty tasks makes them ideal for busy roads, highways, and infrastructure upgrades. As urbanization increases, the demand for large machines continues to grow, especially in emerging markets where road development is a priority.

On the other hand, small cold milling machines, though holding a smaller share of the market, play a key role in specific applications. These machines are often used for smaller-scale road repairs, patchwork, or projects in areas with limited space.

They are more maneuverable and cost-effective for smaller tasks, though their production rate is lower compared to large machines. While their market share is smaller, small cold milling machines are essential in urban maintenance and for localized milling jobs where large machines are impractical. The increasing focus on road maintenance in urban areas supports steady growth in this sub-segment.

Application Analysis

Road Construction dominates with 58.2% due to the growing demand for new infrastructure.

The road construction application leads the cold milling machine market, holding 58.2% of the share. This segment is driven by the continuous need for new roads and highways, especially in developing regions. Cold milling machines are used to remove old layers of asphalt and prepare the surface for new road construction.

The growing global focus on enhancing infrastructure, particularly in rapidly developing countries, supports strong demand for these machines. In addition, the trend towards rebuilding and expanding road networks in developed countries ensures that road construction remains a dominant application for cold milling machines.

In contrast, pavement maintenance is also a key application, although it commands a smaller share of the market. This segment holds significant potential as older roads require continuous maintenance and resurfacing. The growing awareness of the importance of maintaining road conditions, coupled with the adoption of technology in maintenance practices, supports the growth of this sub-segment.

Similarly, soil stabilization, while a smaller niche, contributes to the market by ensuring the durability and strength of roads and other infrastructure. These machines are used to treat the soil before the construction phase, particularly in areas with poor soil conditions. Though less dominant, soil stabilization plays a vital role in ensuring long-lasting infrastructure.

End-Use Industry Analysis

Construction & Infrastructure dominates with 72.8% due to high demand for roadworks and urban development.

The construction and infrastructure industry is the dominant player in the end-use industry segment, commanding 72.8% of the market share. Cold milling machines are essential for both new construction and the maintenance of existing infrastructure. Urbanization and rapid development of transportation networks, particularly in countries like China and India, have boosted the demand for cold milling machines.

As cities expand and transportation needs increase, construction and infrastructure projects require efficient machinery to remove old road surfaces and prepare for new layers. This ensures the continued growth of this sub-segment, making it the largest end-use category in the cold milling machine market.

The mining industry, while important, holds a smaller share of the market at 18.6%. Mining projects often require cold milling machines for road maintenance in remote areas, as well as for soil and rock stabilization. The role of cold milling machines in mining is expected to grow as mining activities expand globally.

However, the demand remains more limited compared to the large-scale road construction projects driven by infrastructure development. Other industries, such as agriculture and forestry, also utilize cold milling machines for land clearing and soil preparation. While these segments contribute to the overall market, their impact remains minor in comparison to construction and infrastructure projects.

Key Market Segments

By Machine Type

- Small Cold Milling Machines

- Large Cold Milling Machines

By Application

- Road Construction

- Pavement Maintenance

- Soil Stabilization

- Others

By End-Use Industry

- Construction & Infrastructure

- Mining

- Others

Driving Factors

Growing Demand for Road Maintenance Drives Market Expansion

The increasing demand for road maintenance and rehabilitation is a key driver for the growth of the Cold Milling Machine market. As roads deteriorate over time, there is a growing need for efficient and cost-effective resurfacing solutions, which cold milling machines provide. These machines are essential for removing worn-out pavement layers, enabling the application of new materials, and ensuring smooth road surfaces.

Additionally, the rise in investments in infrastructure development projects further fuels this demand. Governments and private sectors are focusing on improving road quality, which has led to a surge in cold milling machine adoption to meet these needs.

Technological advancements in milling efficiency and precision also contribute to market growth. Modern cold milling machines offer enhanced performance and accuracy, reducing road repair time and increasing productivity. This allows for faster, more efficient operations, which are vital for large-scale infrastructure projects.

Furthermore, the rising adoption of cold milling machines in paving operations supports the market’s expansion. These machines provide critical advantages in creating smooth and uniform surfaces, making them a preferred choice for paving contractors.

Restraining Factors

Financial and Operational Challenges Restrict Market Growth

One of the primary restraints is the high operational and maintenance costs associated with milling equipment. These machines require significant investment not only for initial purchase but also for upkeep and repairs, which can be a financial burden for companies operating on tight budgets.

Fluctuating prices of raw materials and spare parts further impact the industry, making it difficult for manufacturers to maintain price stability. These fluctuations can lead to unexpected costs, affecting the overall profitability of milling operations.

In addition, the limited availability of skilled operators presents another challenge. Operating cold milling machines requires expertise, and the shortage of qualified workers can hinder productivity and increase training costs for companies.

Lastly, environmental regulations concerning emissions from milling equipment are placing additional pressure on manufacturers. Stricter emissions standards are leading to increased costs for companies as they invest in cleaner technologies to comply with these regulations.

Growth Opportunities

Emerging Technologies and Sustainable Practices Offer Opportunities

The integration of GPS and machine control technologies presents a significant growth opportunity in the Cold Milling Machine market. These technologies allow for enhanced precision and automation during milling operations, improving overall efficiency and reducing material waste.

Additionally, there is an increasing expansion of cold milling applications beyond traditional highway sectors. Industries such as mining, airport construction, and urban development are beginning to adopt these machines for non-highway projects, which broadens the market’s scope.

There is also a rising focus on eco-friendly and low-emission machinery, which presents opportunities for manufacturers to develop more sustainable milling solutions. With governments and organizations pushing for reduced carbon footprints, there is growing demand for machines that offer energy-efficient features and lower emissions.

Furthermore, the growth in public-private partnerships for infrastructure projects is opening new doors for the cold milling machine market. These collaborations provide funding and support for large-scale infrastructure projects, driving the demand for efficient milling technologies.

Emerging Trends

Industry Trends Are Shaping the Future of Milling Machines

Several emerging trends are transforming the Cold Milling Machine market. The shift toward autonomous and semi-autonomous milling machines is one of the most significant changes. These machines offer increased operational efficiency and reduced dependence on skilled operators, driving the market toward automation.

There is also an increasing demand for multi-functional machines with versatile capabilities. These machines are capable of performing various tasks, such as milling, paving, and recycling, making them more attractive to contractors looking for equipment that can handle multiple roles.

Moreover, the adoption of remote monitoring systems for fleet management is on the rise. These systems enable operators to track machine performance in real time, providing valuable data for maintenance and operational optimization.

Lastly, innovations in sustainable and energy-efficient milling technologies are gaining momentum. Manufacturers are developing machines that consume less fuel and reduce emissions, aligning with the growing global emphasis on sustainability and environmental responsibility in industrial operations.

Regional Analysis

Asia Pacific Dominates with 40.7% Market Share

Asia Pacific dominates the Cold Milling Machine Market with a 40.7% share, valued at USD 0.73 billion. This significant market share can be attributed to the region’s fast-paced industrial growth, particularly in countries like China, India, and Japan. The region’s booming construction and infrastructure projects, coupled with the demand for road maintenance and expansion, fuel the demand for cold milling machines.

Key factors include the large-scale urbanization in Asia Pacific, which drives the need for improved road infrastructure. Additionally, government investments in highways, roads, and public transportation systems are major contributors.

The presence of several leading manufacturers in countries like China and South Korea further boosts production capacities and technological innovations in the cold milling machine sector. This has made the region a manufacturing hub for machinery and construction equipment, leading to a growing market share.

Regional Mentions:

- North America: North America holds a steady position in the Cold Milling Machine Market, driven by high infrastructure investments and road maintenance projects in the U.S. and Canada. The region is also witnessing an increase in the use of advanced, precision machinery for road construction and rehabilitation.

- Europe: Europe’s cold milling machine market is propelled by regulations that emphasize road quality and sustainability. Countries like Germany and France focus on innovation and long-term investments in road systems, boosting demand for high-efficiency milling machines to meet industry standards.

- Middle East & Africa: The Middle East and Africa are experiencing growth in the cold milling machine market due to large-scale infrastructure projects, particularly in the UAE and Saudi Arabia. Investments in road construction and urban development drive the demand for milling solutions in the region.

- Latin America: Latin America’s cold milling machine market is expanding, mainly in Brazil and Mexico, due to increased road construction and maintenance needs. The demand for advanced milling equipment in both public and private sectors is growing, supported by infrastructure improvements across the region.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

The Cold Milling Machine Market is highly competitive, with several key players driving innovation and market growth. The top four players are Caterpillar Inc., Volvo Construction Equipment, Wirtgen Group, and SANY Group.

Caterpillar Inc. is a global leader in heavy construction equipment, including cold milling machines. The company’s machines are known for their robust performance, efficiency, and advanced technology. Caterpillar’s global reach, strong distribution network, and commitment to sustainable practices give it a competitive advantage. The company’s focus on innovation, especially in terms of energy-efficient machines and automation, makes it a dominant player in the cold milling market.

Volvo Construction Equipment offers a comprehensive range of cold milling machines that are known for their efficiency and operator safety. Volvo’s machines are equipped with advanced control systems and energy-efficient engines, allowing them to meet the growing demand for environmentally-friendly equipment. The company’s strong presence in North America and Europe, combined with its focus on improving operator comfort and safety, contributes significantly to its market share.

Wirtgen Group, a part of John Deere, is a leading manufacturer of cold milling machines. The company is recognized for its innovative and high-quality milling machines, which offer exceptional precision and versatility. Wirtgen’s machines are widely used in road rehabilitation, maintenance, and construction projects. The company’s commitment to research and development ensures that its machines continue to meet the demands of the industry, keeping it at the forefront of the cold milling machine market.

SANY Group is a major player in the cold milling machine market, particularly in Asia. The company has been expanding its presence globally, offering cost-effective and reliable milling machines. SANY’s focus on producing high-performance machines at competitive prices has made it a popular choice in emerging markets. The company’s strong manufacturing capabilities and growing international footprint contribute to its rising market share.

These top players are driving the Cold Milling Machine Market through technological advancements, operational efficiency, and a focus on sustainability. Their continued investment in R&D, strong customer bases, and global reach position them for sustained growth and leadership in the market.

Major Companies in the Market

- Caterpillar Inc.

- Volvo Construction Equipment

- Wirtgen Group

- SANY Group

- XCMG Group

- LiuGong Machinery

- Zoomlion Heavy Industry

- JCB

- CASE Construction Equipment

- Doosan Infracore

- Terex Corporation

- Hyundai Construction Equipment

- Komatsu Ltd.

Recent Developments

Wirtgen: As of February 2025, Wirtgen cold milling machines successfully tackled a challenging project at the Oroville Dam, the highest dam in the USA, north of Sacramento. Two machines, a W 210i and W 2100, precisely milled the spillway chute, showcasing Wirtgen’s expertise in steep gradient milling. The project was part of a larger rehabilitation effort costing 1.1 billion US dollars, which was completed on schedule after about two years.

Report Scope

Report Features Description Market Value (2024) USD 1.8 Billion Forecast Revenue (2034) USD 3.2 Billion CAGR (2025-2034) 5.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Machine Type (Small Cold Milling Machines, Large Cold Milling Machines), By Application (Road Construction, Pavement Maintenance, Soil Stabilization, Others), By End-Use Industry (Construction and Infrastructure, Mining, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Caterpillar Inc., Volvo Construction Equipment, Wirtgen Group, SANY Group, XCMG Group, LiuGong Machinery, Zoomlion Heavy Industry, JCB, CASE Construction Equipment, Doosan Infracore, Terex Corporation, Hyundai Construction Equipment, Komatsu Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Cold Milling Machine MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample

Cold Milling Machine MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Caterpillar Inc.

- Volvo Construction Equipment

- Wirtgen Group

- SANY Group

- XCMG Group

- LiuGong Machinery

- Zoomlion Heavy Industry

- JCB

- CASE Construction Equipment

- Doosan Infracore

- Terex Corporation

- Hyundai Construction Equipment

- Komatsu Ltd.