Global Coffee Trade Analysis Market By Coffee Type (Arabica, Robusta, Liberica, Excelsa), By Processing Method (Washed, Natural, Honey-Processed, Others), By Grade (Specialty Coffee, Commercial Coffee, Premium Coffee, Others), By Form (Whole Bean, Ground Coffee, Instant Coffee, Coffee Pods, Others), By End-Use (Foodservice, Retail Consumers), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

- Published date: November 2024

- Report ID: 133432

- Number of Pages: 333

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

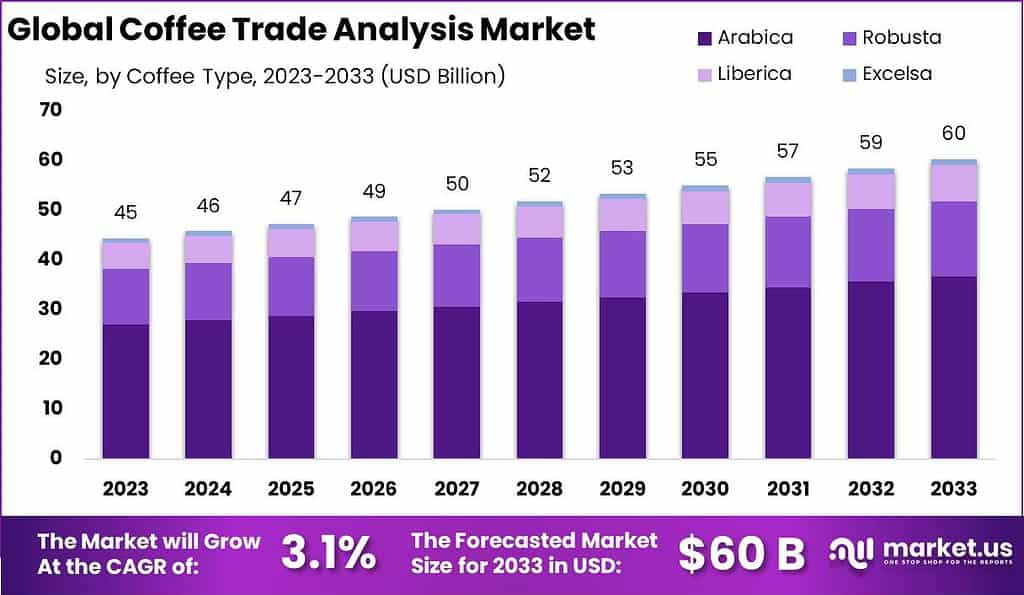

The Global Coffee Trade Analysis Market size is expected to be worth around USD 60.0 Billion by 2033, from USD 44.5 Billion in 2023, growing at a CAGR of 3.1% during the forecast period from 2024 to 2033.

A Coffee Trade Analysis Market typically refers to the assessment and evaluation of the coffee industry’s trading patterns, including the import, export, consumption, and production of coffee on a global scale. This analysis helps stakeholders understand the market dynamics, pricing trends, and the economic factors influencing coffee trading.

The market demand for Coffee Trade Analysis is robust, driven by the global importance of coffee as a commodity and the complex supply chains it navigates. Recent data indicates a growing interest among companies to understand deeper market trends, particularly in regions like North America and Europe, where consumer preferences rapidly evolve towards specialty and sustainable coffee products.

The market popularity for Coffee Trade Analysis is increasingly high, reflecting the global coffee industry’s complex and lucrative nature. This analysis is sought after by stakeholders ranging from multinational corporations to small-scale producers who need to stay informed about global trends and price fluctuations. In recent years, there has been a noticeable surge in demand for these insights, driven by the coffee sector’s volatility and the need for sustainable sourcing practices.

The coffee industry involves over 50 countries, generating an annual income exceeding $200 billion. Globally, more than 3 billion cups of coffee are consumed daily, which highlights the extensive market and its substantial economic impact.

The National Coffee Association (NCA) plays a significant role in the U.S. by interfacing with government bodies to ensure favorable policies for the coffee sector. The NCA advocates for policies that facilitate production, trade, and consumption, underlining coffee’s substantial contribution to the U.S. economy supporting nearly 1.7 million jobs and generating over $225 billion annually.

The ICO provides comprehensive statistics on coffee trade, prices, production, and consumption. Their data cover several decades and offer insights into monthly and annual trends affecting the global coffee market. This includes detailed export data on Arabica and Robusta beans, consumption per capita, and market dynamics in various regions.

Through programs like Alliances for Action, various international organizations are pushing for a more ethical, sustainable, and inclusive coffee trade system. These programs focus on empowering local communities, promoting sustainable agricultural practices, and enhancing global market access, particularly in developing regions such as Africa and Asia.

The coffee market’s specifics, such as export values and trade balances, provide insights into the scale of global operations. For example, Brazil leads with the highest coffee exports valued at approximately $8.75 billion in 2022, followed by Colombia and Vietnam. Such figures underscore the economic significance of coffee as a key agricultural commodity.

Key Takeaways

- The Global Coffee Trade Analysis Market size is expected to be worth around USD 60.0 Billion by 2033, from USD 44.5 Billion in 2023, growing at a CAGR of 3.1% during the forecast period from 2024 to 2033.

- Arabica dominated the Coffee Trade Analysis Market with a 61.3% share.

- Washed coffee dominated the market with a 51% share in processing methods.

- Commercial Coffee dominated the market with a 62.3% share by grade.

- Ground Coffee dominated the market by form with a 43.3% share.

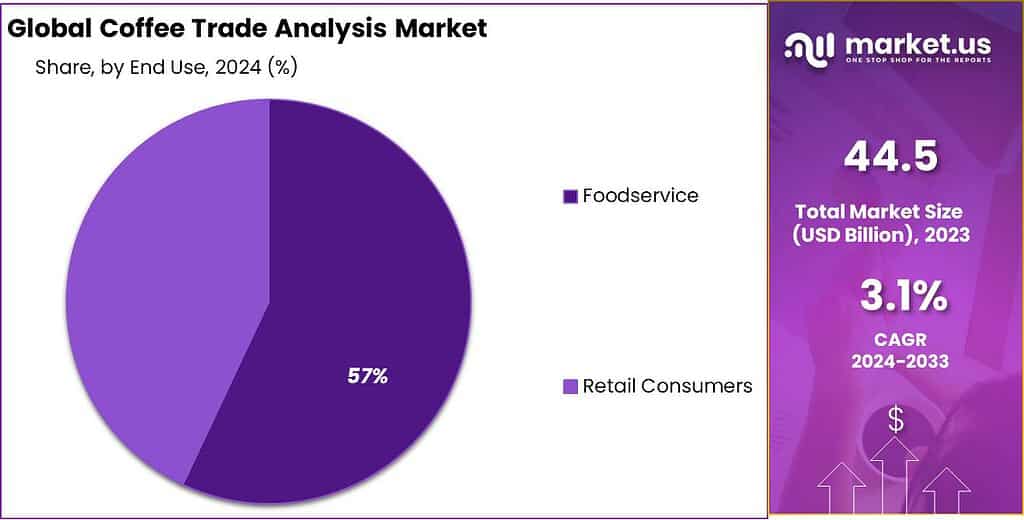

- Foodservice led the Coffee Trade Analysis Market with a 57.3% share by end-use.

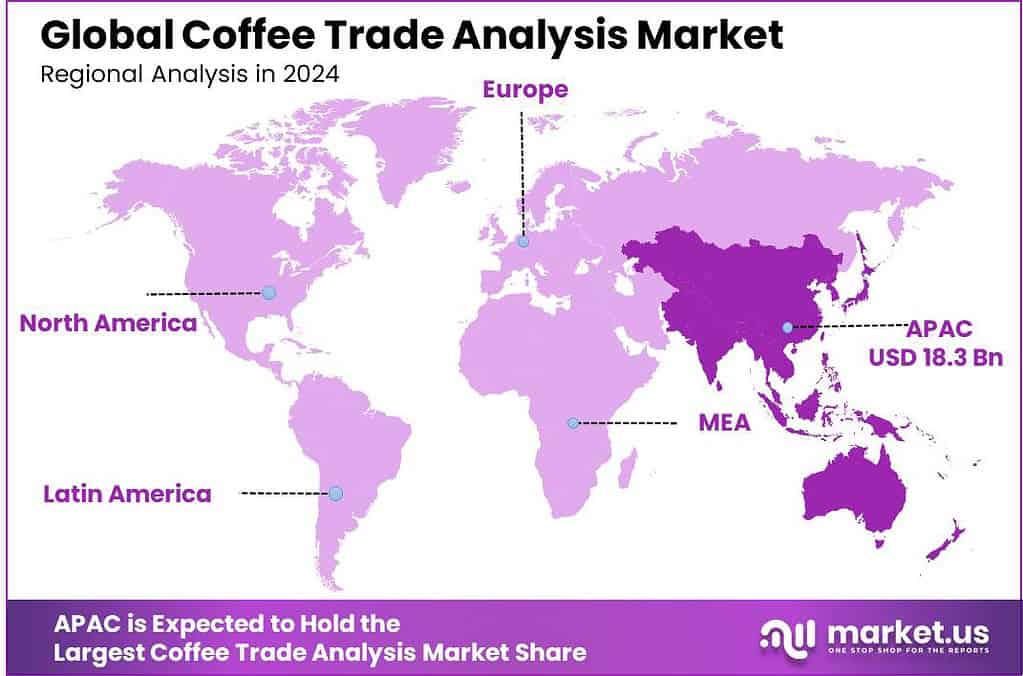

- APAC dominates the Coffee Trade Analysis Market with 43.8%, valued at $18.3 billion.

By Coffee Type Analysis

In 2023, Arabica dominated the Coffee Trade Analysis Market with a 61.3% share.

In 2023, Arabica held a dominant market position in the By Coffee Type segment of the Coffee Trade Analysis Market, capturing more than a 61.3% share. Renowned for its smooth, complex flavor profiles, Arabica coffee is preferred by consumers and baristas alike, contributing significantly to its substantial market share. This preference is reflected in its higher pricing and widespread cultivation in countries known for coffee quality, such as Colombia and Ethiopia.

Robusta, constituting a smaller portion of the market, is valued for its robustness and higher caffeine content, making it ideal for blends and instant coffee products. Although it holds a smaller market share, its cultivation in regions like Vietnam and Brazil supports its strong position in global markets that favor more economical and higher-caffeine options.

Liberica and Excelsa, although less common, offer unique flavors and are primarily grown in specific regions of the world. Liberica, with its distinct fruity and floral notes, caters to a niche market, particularly in the Philippines and Malaysia. Excelsa, known for its tart and fruity characteristics, is often used to enhance the complexity of gourmet coffee blends. Despite their smaller market shares, both varieties contribute to the biodiversity and specialty segments of the coffee industry, appealing to connoisseurs and those seeking variety in their coffee experiences.

By Processing Method Analysis

Washed coffee dominated the market with a 51% share in processing methods.

In 2023, Washed Coffee held a dominant market position in the By Processing Method segment of the Coffee Trade Analysis Market, capturing more than a 51% share. This method, involving the removal of the coffee cherry’s pulp before the beans are dried, is favored for producing a cleaner, more flavorful cup of coffee. Predominantly used in countries like Colombia and Ethiopia, washed coffee is highly regarded for its ability to highlight the true character and acidity of the coffee bean.

Natural processing, which involves drying coffee cherries in the sun to let the bean absorb sugars from the fruit, accounts for a significant market share as well. This method is popular in regions like Brazil and Ethiopia, where the climate favors slow, natural drying, contributing rich, fruity flavors to the coffee.

Honey-processed coffee, a method where some of the cherry’s mucilage is left on the bean during drying, offers a balance between washed and natural processing flavors, resulting in sweet, complex coffee profiles. Although less common, it has been gaining popularity, especially in Central America.

By Grade Analysis

Commercial Coffee dominated the market with a 62.3% share by grade.

In 2023, Commercial Coffee held a dominant market position in the By Grade segment of the Coffee Trade Analysis Market, capturing more than a 62.3% share. This segment, characterized by its mass production and broad consumer appeal, caters primarily to the mainstream market. Commercial Coffee is typically produced using robusta beans, known for their strong flavor and higher caffeine content, making it a staple in instant coffee and affordable blends found in supermarkets and standard coffee shops.

Specialty Coffee, although occupying a smaller segment of the market, is distinguished by its exceptional quality and unique flavor profiles, often traced back to specific origins. This type is favored among coffee enthusiasts and high-end cafés, driving a trend towards more ethically sourced and transparently traded coffee.

Premium Coffee stands between commercial and specialty grades, offering higher quality than commercial but without the unique characteristics of specialty coffees. It is often marketed towards consumers looking to step up from regular commercial offerings without venturing into the specialty range, featuring improved flavor and sourcing credentials.

By Form Analysis

Ground Coffee dominated the market by form with a 43.3% share.

In 2023, Ground Coffee held a dominant market position in the By Form segment of the Coffee Trade Analysis Market, capturing more than a 43.3% share. Ground coffee’s widespread popularity is attributed to its convenience and versatility, appealing to a broad range of coffee drinkers from home brewers to large-scale food service operations. It offers a balanced approach between ease of use and the retention of flavor quality, making it a preferred choice for both quick service and traditional coffee-drinking experiences.

Whole Bean Coffee, which allows consumers to grind coffee fresh, thereby preserving the beans’ natural flavors and oils, accounts for a significant portion of the market as well. This segment caters to coffee aficionados and premium cafes that prioritize the freshness and customization of the brewing process.

Instant Coffee, known for its convenience and speed of preparation, holds a substantial market share, especially in markets where brewing equipment is less common or where time is at a premium. Its ease of use drives its popularity among busy professionals and households alike.

Coffee Pods have carved out a niche due to their single-serve convenience and consistent results, appealing particularly to office environments and quick-brew domestic users. Despite environmental concerns, technological advancements in pod recyclability continue to support its market presence.

By End-Use Analysis

Foodservice led the Coffee Trade Analysis Market with a 57.3% share by end-use.

In 2023, Foodservice held a dominant market position in the By End-Use segment of the Coffee Trade Analysis Market, capturing more than a 57.3% share. This sector encompasses restaurants, cafes, hotels, and other hospitality establishments that serve coffee directly to consumers. The prominence of food service is attributed to the global culture of coffee consumption outside the home, where consumers seek not only a beverage but also an experience, often in socially engaging environments. The growth in this segment is driven by the increasing number of coffee shops and the expansion of menu offerings that include coffee as a key component.

Retail Consumers, making up the remainder of the market, are involved in the purchase of coffee products for home use through supermarkets, specialty stores, and online platforms. This segment has seen growth due to rising consumer interest in replicating barista-quality coffee at home, fueled by improvements in home coffee brewing technology and the accessibility of premium and specialty coffee products.

Key Market Segments

By Coffee Type

- Arabica

- Robusta

- Liberica

- Excelsa

By Processing Method

- Washed

- Natural

- Honey-Processed

- Others

By Grade

- Specialty Coffee

- Commercial Coffee

- Premium Coffee

- Others

By Form

- Whole Bean

- Ground Coffee

- Instant Coffee

- Coffee Pods

- Others

By End-Use

- Foodservice

- Retail Consumers

Driving factors

Increasing Global Coffee Consumption

The continual rise in global coffee consumption is a fundamental driver for the growth of the Coffee Trade Analysis Market. Statistics show that worldwide coffee consumption has been increasing steadily, with an annual growth rate of approximately 2% over the past five years. This consistent rise in demand has expanded the market for in-depth trade analysis as businesses seek to understand consumption patterns, forecast future trends, and optimize their supply chains accordingly.

The expanding consumer base, particularly in emerging markets where coffee culture is burgeoning, adds another layer of complexity and opportunity for detailed market analysis.

Premiumization of Coffee Products

The trend towards premiumization of coffee products is significantly shaping the Coffee Trade Analysis Market. Consumers are increasingly willing to pay higher prices for specialty coffees that offer unique flavors and are sourced ethically. This shift has not only increased the value of the coffee market but also the need for sophisticated market analysis tools that can segment consumer preferences, track premium product performances, and assess the impact of premium brands on the overall market dynamics.

As premium and specialty coffees gain market share, detailed trade analysis becomes crucial for companies aiming to capitalize on high-margin opportunities.

Technological Advancements in Coffee Processing and Brewing

Technological advancements in coffee processing and brewing are enhancing the capabilities of the Coffee Trade Analysis Market. Innovations such as blockchain for traceability, IoT for supply chain monitoring, and AI for consumer behavior prediction are transforming how market data is collected and analyzed.

These technologies enable more accurate and timely analysis, facilitating better strategic decisions for coffee businesses. The integration of advanced analytics tools allows for a deeper understanding of the intricate details of coffee trade flows, production efficiencies, and consumer engagement strategies, further driving the market’s growth.

Restraining Factors

Volatility of Coffee Bean Prices

The volatility of coffee bean prices serves as a significant restraining factor in the Coffee Trade Analysis Market. Price fluctuations can be severe due to a variety of factors including geopolitical tensions, trade restrictions, and changes in currency values. These fluctuations make it challenging for businesses to forecast costs and revenues accurately, which can deter investment in detailed market analysis.

However, this volatility also necessitates more sophisticated analytics to manage risk and strategize purchasing, potentially driving demand for advanced trade analysis tools.

Climate Change Impact on Coffee Production

Climate change poses a profound impact on coffee production, directly influencing the Coffee Trade Analysis Market. Changes in temperature and unpredictable weather patterns threaten coffee crops, leading to lower yields and higher production costs.

As regions traditionally suitable for coffee growing become less viable, the industry faces the challenge of sourcing from new areas, which adds complexity to trade dynamics. This uncertainty encourages stakeholders to seek detailed market insights to adapt to changing conditions, potentially increasing reliance on comprehensive trade analyses.

Substitution by Other Beverages

The growing popularity of alternative beverages like tea, energy drinks, and plant-based options directly competes with coffee consumption, posing a restraint on the Coffee Trade Analysis Market. As consumer preferences diversify, coffee’s market share may diminish, reducing the perceived need for in-depth coffee-specific analysis.

However, this trend also prompts coffee companies to innovate and differentiate their offerings, which can spur demand for niche market analyses that focus on competitive positioning and consumer behavior trends.

Growth Opportunity

Development of New Coffee Flavors and Formats

The continuous innovation in coffee flavors and formats presents a significant growth opportunity for the coffee trade analysis market. As consumer preferences evolve, there is a burgeoning demand for novel and diverse coffee experiences, including cold brews, nitrogen-infused options, and health-centric additions like CBD-infused coffee. This trend not only attracts a wider consumer base but also opens new avenues for market research to track emerging preferences and consumption patterns, providing critical insights to coffee producers and retailers aiming to capture market share.

Utilization of AI and Data Analytics

The integration of AI and data analytics into the coffee industry is transforming how businesses understand and predict consumer behavior and market trends. In 2024, these technologies are expected to drive substantial growth in the coffee trade analysis market by enhancing the precision of demand forecasting and optimizing supply chains. AI tools can analyze vast amounts of data from diverse sources, including social media and IoT-enabled devices in coffee machines, offering granular insights that help companies make data-driven decisions to boost profitability and efficiency.

Eco-Friendly Packaging Solutions

Environmental sustainability continues to be a critical concern among consumers, influencing their purchasing decisions. The shift towards eco-friendly packaging solutions in the coffee industry not only responds to consumer demand but also opens up new research areas within the coffee trade analysis market.

Companies are increasingly exploring biodegradable and recyclable packaging options to reduce their environmental footprint, a move that requires market analysis to understand consumer responses and willingness to pay a premium for sustainable products. This shift is expected to generate new growth opportunities in market research, as brands seek to navigate the complexities of sustainable practices and consumer expectations.

Latest Trends

Cold Brew and Nitro Coffee Popularity

The rising popularity of cold brew and nitro coffee is expected to significantly influence the Coffee Trade Analysis Market. These brewing methods cater to a growing consumer preference for smoother, sweeter coffee experiences without added sugars or creamers.

The surge in demand for these products, often consumed as premium beverages, provides ample opportunities for market analysts to explore new consumer segments and pricing strategies. This trend is likely to drive further diversification in product offerings from coffee manufacturers seeking to capitalize on the expanding market.

Innovations in Coffee Machinery

Technological advancements in coffee machinery are set to revolutionize the coffee industry. These innovations not only enhance the efficiency and consistency of coffee production but also improve the quality of the final product.

New machines capable of precise grinding, temperature control, and brewing pressure adjustments allow for unprecedented customization of coffee brewing, appealing to both commercial and domestic users. The development of these technologies necessitates detailed market analyses to evaluate consumer acceptance and the potential impact on market growth.

Integration of Blockchain for Traceability

Blockchain technology is increasingly becoming integrated into the coffee industry, primarily for enhancing traceability and transparency. This technology enables all stakeholders in the supply chain from farmers to consumers to access information about the coffee’s origin, processing, and shipping.

Such traceability is becoming a significant factor in consumer purchasing decisions, particularly among those concerned with ethical sourcing and sustainability. Market analysts will find valuable insights in tracking how blockchain implementation affects consumer trust and loyalty, potentially reshaping market dynamics.

Regional Analysis

APAC dominates the Coffee Trade Analysis Market with 43.8%, valued at $18.3 billion.

The Coffee Trade Analysis Market exhibits significant regional diversities, with trends and growth opportunities varying across North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. Dominating the market, Asia Pacific holds a substantial share of 43.8%, valued at $18.3 billion, driven by burgeoning coffee culture and rapid urbanization in countries like China, Japan, and South Korea. This region’s dominance is bolstered by increasing disposable incomes and a growing cafe culture that embraces both traditional and modern coffee experiences.

In North America, the market is characterized by a strong preference for specialty coffees and the proliferation of coffee-serving establishments. The U.S. and Canada continue to see growth in both consumption and the variety of coffee products offered, from cold brews to gourmet blends, fueled by an ever-evolving consumer palette seeking diversity and quality.

Europe’s market is deeply influenced by its rich coffee tradition, with countries like Italy and France leading in terms of consumption per capita. The region focuses heavily on sustainable and ethically sourced coffee, driven by stringent EU regulations and a consumer base that prioritizes environmental and social governance.

The Middle East & Africa region, though smaller in market share, is witnessing growth driven by increased coffee consumption in urban centers and the introduction of Western coffee drinking habits. Countries such as the UAE and South Africa are emerging as significant markets, with a growing number of coffee chains and specialty shops.

Latin America, as a key coffee-producing region, focuses on both export and increasing local consumption. Brazil and Colombia, major coffee producers, are also working to enhance domestic consumption by promoting the quality and heritage of their own coffee products, tapping into both local pride and tourist interest.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

In 2024, the Coffee Trade Analysis Market remains significantly influenced by the strategies and performances of key players such as Nestlé, Starbucks Coffee Company, The J.M. Smucker Company, and UCC Ueshima Coffee Co., Ltd. Each of these companies plays a crucial role in shaping the dynamics of the global coffee market through innovative practices and expansive market reach.

Nestlé continues to lead with its vast portfolio of coffee products, including the popular Nespresso and Nescafé lines. Nestlé’s focus on sustainability and technological advancements in coffee processing and brewing has strengthened its market presence and appeal to environmentally conscious consumers. The company’s global distribution capabilities allow it to tap into emerging markets, further expanding its influence.

Starbucks Coffee Company remains a dominant force, not just as a retailer but also as a trendsetter in the coffee industry. With its extensive global network of coffeehouses, Starbucks influences coffee consumption habits and popularizes new coffee trends, such as cold brew and nitro coffee. Their commitment to ethical sourcing and community involvement continues to enhance their brand loyalty and market penetration.

The J.M. Smucker Company, known for its Folgers and Dunkin’ brands, holds a significant share in both the retail and commercial sectors. Smucker’s strategy of diversifying its product offerings to include a range of coffee types and flavors caters to a broad audience, driving growth in its coffee segment.

UCC Ueshima Coffee Co., Ltd. stands out in the Asia-Pacific market with its strong focus on quality and innovation. Known for its premium coffee products and brewing equipment, UCC drives the premiumization trend in Japan and beyond, appealing to consumers’ growing interest in high-quality coffee experiences.

These companies, with their distinct strategies and market approaches, continue to drive innovation and competition in the Coffee Trade Analysis Market, shaping the industry’s future landscape in 2024 and beyond.

Market Key Players

- JAB Holding Company

- JDE Peet’s

- LUIGI LAVAZZA SPA

- Luigi Lavazza SPA

- Massimo Zanetti Beverage USA

- Melitta

- Nestlé

- Nestle SA

- Starbucks Coffee Company

- Strauss Group Ltd

- Tata Global Beverages

- Tchibo Coffee

- The Coca-Cola Company

- The J.M. Smucker Company

- The Kraft Heinz Company

- UCC UESHIMA COFFEE CO., LTD.

Recent Development

- In March 2024, Starbucks launched a new line of ready-to-drink coffee products, focusing on non-dairy alternatives and sustainable packaging. This launch aligns with the growing consumer demand for convenient and eco-friendly coffee options, bolstering Starbucks’ position in the competitive ready-to-drink sector.

- In February 2024, Nestlé introduced a blockchain-based traceability platform for its coffee brands, Nespresso and Nescafé. The new platform allows consumers to track the coffee’s journey from farm to cup, emphasizing transparency and sustainable farming practices. This development enhances consumer trust and supports Nestlé’s commitment to ethical sourcing.

- In January 2024, The J.M. Smucker Company expanded its coffee production facilities in the United States to increase the output of its Dunkin’ and Folgers brands. This expansion aims to meet the rising domestic demand for coffee and improve the supply chain efficiency.

Report Scope

Report Features Description Market Value (2023) USD 44.5 Billion Forecast Revenue (2033) USD 60.0 Billion CAGR (2024-2032) 3.1% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Coffee Type (Arabica, Robusta, Liberica, Excelsa), By Processing Method (Washed, Natural, Honey-Processed, Others), By Grade (Specialty Coffee, Commercial Coffee, Premium Coffee, Others), By Form (Whole Bean, Ground Coffee, Instant Coffee, Coffee Pods, Others), By End-Use (Foodservice, Retail Consumers) Regional Analysis North America – The US, Canada, Rest of North America, Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America – Brazil, Mexico, Rest of Latin America, Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape JAB Holding Company, JDE Peet’s, LUIGI LAVAZZA SPA, Luigi Lavazza SPA, Massimo Zanetti Beverage USA, Melitta, Nestlé, Nestle SA, Starbucks Coffee Company, Strauss Group Ltd, Tata Global Beverages, Tchibo Coffee, The Coca-Cola Company, The J.M. Smucker Company, The Kraft Heinz Company, UCC UESHIMA COFFEE CO., LTD. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Coffee Trade Analysis MarketPublished date: November 2024add_shopping_cartBuy Now get_appDownload Sample

Coffee Trade Analysis MarketPublished date: November 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- JAB Holding Company

- JDE Peet's

- LUIGI LAVAZZA SPA

- Luigi Lavazza SPA

- Massimo Zanetti Beverage USA

- Melitta

- Nestlé

- Nestle SA

- Starbucks Coffee Company

- Strauss Group Ltd

- Tata Global Beverages

- Tchibo Coffee

- The Coca-Cola Company

- The J.M. Smucker Company

- The Kraft Heinz Company

- UCC UESHIMA COFFEE CO., LTD.