Global Coating Pretreatment Market Size, Share, And Business Benefits By Type (Phosphate, Chromate, Chromate Free, Blast Clean, Others), By Metal Substrate (Steel, Aluminum, Others), By Application (Building and Construction, Automotive and Transportation, Appliances, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153825

- Number of Pages: 247

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

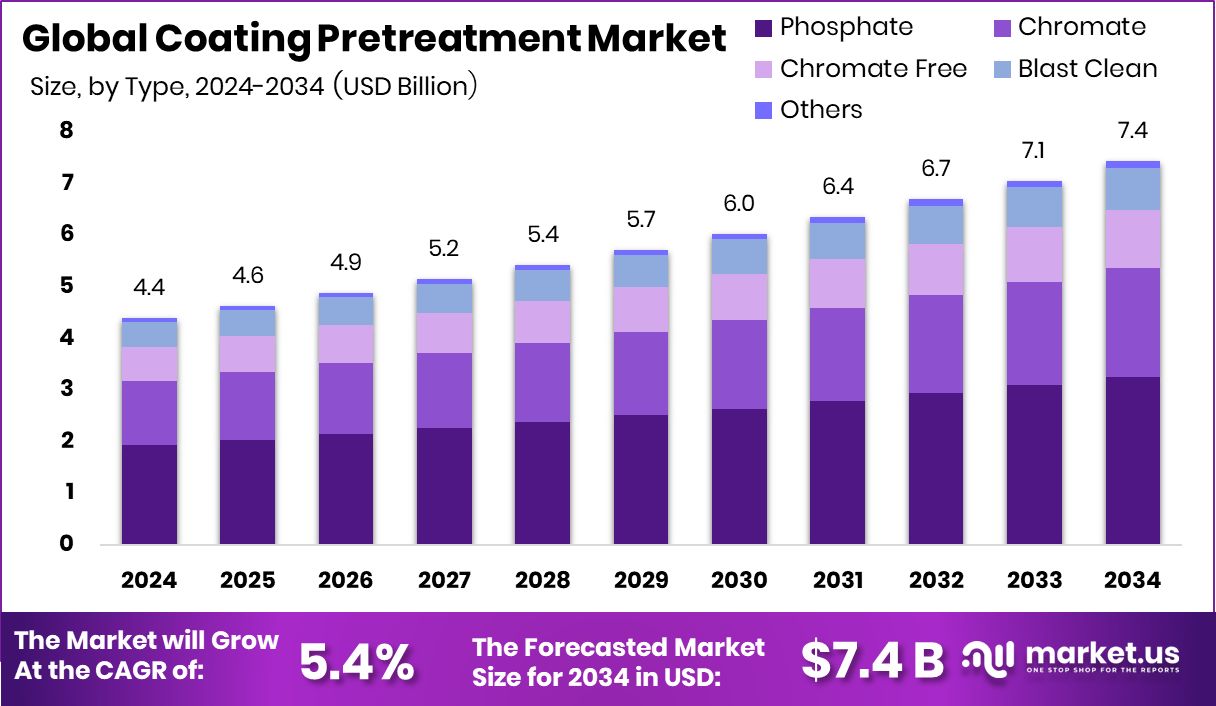

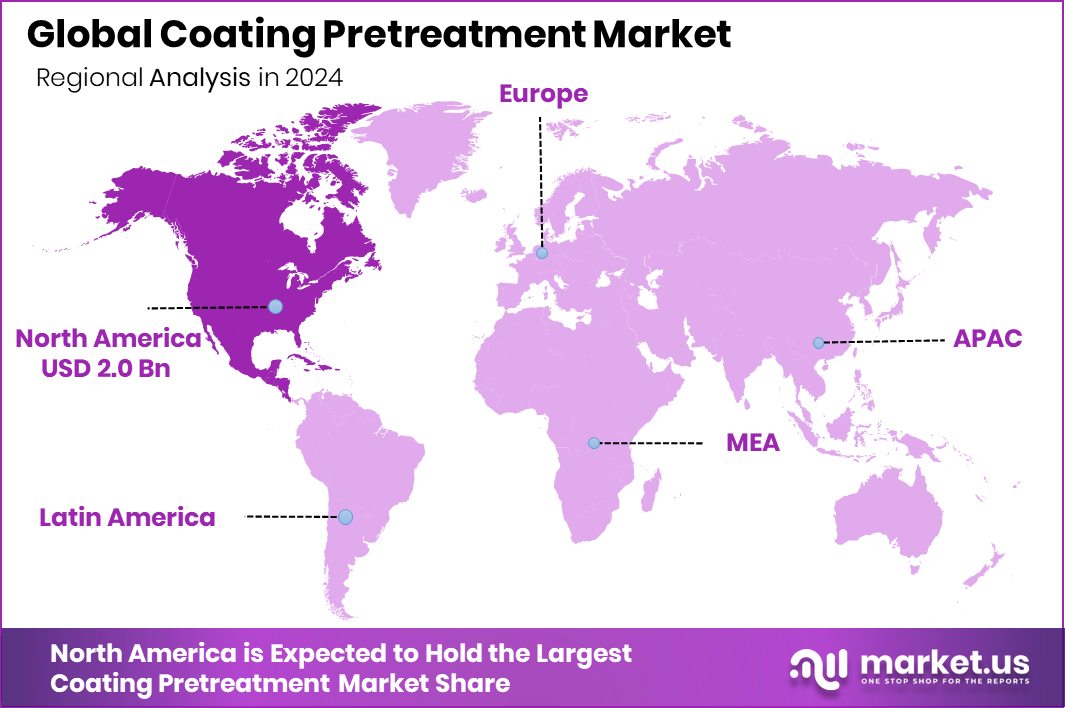

The Global Coating Pretreatment Market is expected to be worth around USD 7.4 billion by 2034, up from USD 4.4 billion in 2024, and is projected to grow at a CAGR of 5.4% from 2025 to 2034. With USD 2.0 billion in revenue, North America dominated the coating pretreatment market in 2024.

Coating pretreatment is a critical surface preparation process carried out before applying any type of coating—such as paint, powder, or plating—on a metal or non-metal surface. The main purpose of pretreatment is to clean the substrate, remove contaminants like oils, rust, and dirt, and create a chemically active surface that allows for better adhesion of the coating. Common methods include chemical cleaning, phosphating, chromating, and anodizing, depending on the substrate material and application.

The coating pretreatment market refers to the global industry involved in the production, distribution, and use of chemicals, equipment, and technologies used for surface preparation. It caters to various end-use sectors such as automotive, construction, appliances, aerospace, and general manufacturing. Demand in this market is largely driven by the need for high-performance coatings that can withstand harsh conditions while offering aesthetic and protective properties.

The growth of the coating pretreatment market can be attributed to the expansion of industrial manufacturing and infrastructure development worldwide. As governments invest in smart cities, renewable energy, and transport projects, the need for long-lasting coated materials rises, boosting demand for effective pretreatment processes.

There is consistent demand for coating pretreatment in automotive, appliances, and construction sectors where components must resist corrosion and maintain finish quality over time. The rise of electric vehicles and lightweight components made from aluminum and alloys further increases the use of specialized pretreatment processes.

Key Takeaways

- The Global Coating Pretreatment Market is expected to be worth around USD 7.4 billion by 2034, up from USD 4.4 billion in 2024, and is projected to grow at a CAGR of 5.4% from 2025 to 2034.

- In 2024, phosphate type led the coating pretreatment market with a 43.8% dominant share globally.

- Steel substrates accounted for 57.1% in the coating pretreatment market due to their widespread industrial usage.

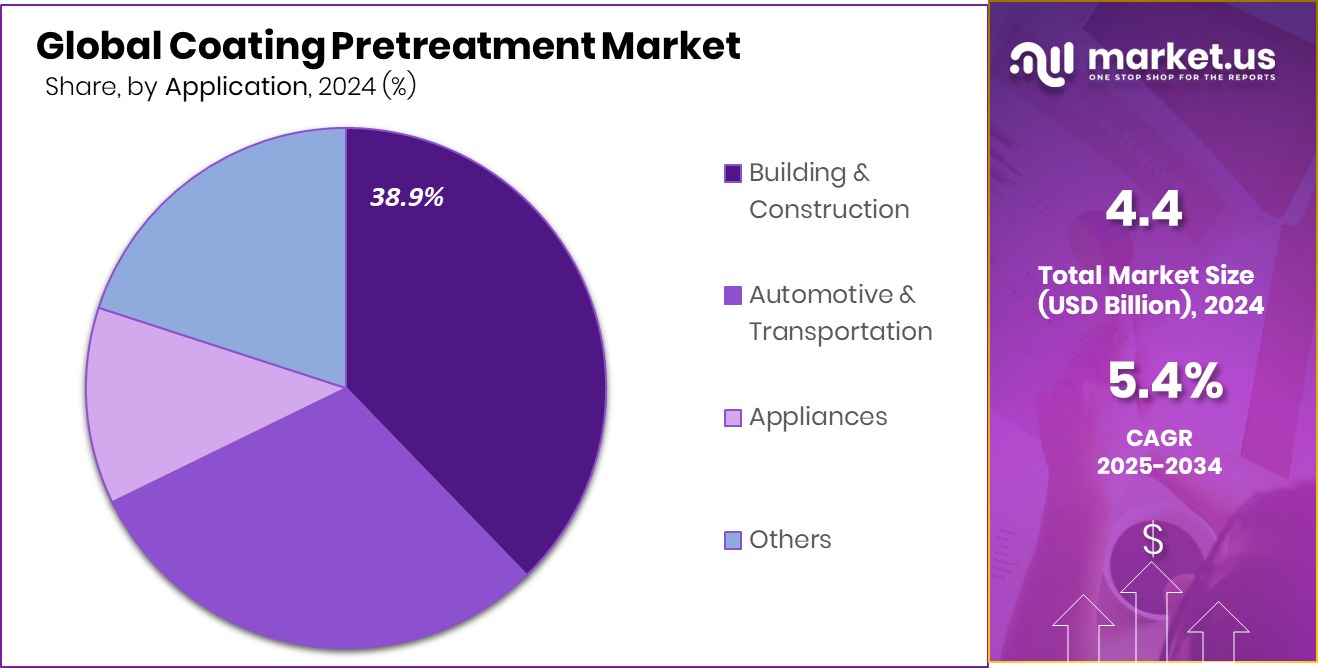

- The building and construction sector captured a 38.9% share in the coating pretreatment market, driven by infrastructure expansion projects.

- Coating pretreatment demand surged in North America, capturing 46.9% market share value.

By Type Analysis

Phosphate dominates the coating pretreatment market with a strong 43.8% share.

In 2024, Phosphate held a dominant market position in the By Type segment of the Coating Pretreatment Market, with a 43.8% share. This dominance is primarily attributed to its widespread application in metal surface treatment across various manufacturing industries.

Phosphate pretreatment processes, particularly zinc and iron phosphating, have long been favored for their effectiveness in improving paint adhesion and providing corrosion resistance. The ability of phosphate coatings to form a uniform, stable layer on ferrous and non-ferrous substrates contributes significantly to their adoption in high-volume production environments.

Industries such as automotive, construction, and heavy machinery have maintained consistent reliance on phosphate-based systems due to their compatibility with a wide range of coatings and substrates. Furthermore, the relatively cost-effective nature of phosphate treatment, along with its proven performance in harsh environmental conditions, has sustained its preference in developing and developed markets alike.

In 2024, the continued demand for durable and high-performance coatings reinforced the use of phosphate pretreatment across both new production lines and maintenance applications. Its dominant share reflects strong industrial confidence in the technology’s reliability and functionality, especially where coating integrity is critical for operational lifespan and aesthetic standards.

By Metal Substrate Analysis

Steel accounts for 57.1% of the coating pretreatment market share.

In 2024, Steel held a dominant market position in the By Metal Substrate segment of the Coating Pretreatment Market, with a 57.1% share. This significant share highlights the widespread use of steel in industrial and commercial applications where corrosion protection and surface durability are essential.

Steel, being a core material in the construction, automotive, infrastructure, and machinery sectors, undergoes coating pretreatment to improve adhesion and extend the life of applied coatings. Pretreatment processes for steel—such as phosphating and cleaning—are well-established and cost-effective, making them a preferred choice across large-scale operations.

The high usage of steel across structural frameworks, automotive components, pipelines, and machinery parts creates a steady demand for coating pretreatment solutions that ensure performance reliability in diverse environmental conditions. In 2024, industries continued to rely heavily on steel due to its strength, availability, and compatibility with various coatings.

The 57.1% market share reflects not only the material’s dominance in downstream manufacturing but also the critical role of pretreatment in enhancing product quality, resistance to corrosion, and lifecycle performance. As industrial output remained strong, especially in emerging economies, the reliance on coated steel products reinforced the demand for efficient and proven pretreatment methods.

By Application Analysis

Building and construction leads with 38.9% application market share.

In 2024, Building and Construction held a dominant market position in the By Application segment of the Coating Pretreatment Market, with a 38.9% share. This strong presence is closely linked to the growing demand for corrosion-resistant and long-lasting coated surfaces in both residential and commercial infrastructure projects.

Steel structures, metal roofing, panels, and architectural elements require reliable pretreatment to ensure durability, paint adhesion, and aesthetic quality. Coating pretreatment processes play a vital role in enhancing the performance of these materials, especially when exposed to varying weather conditions, moisture, and pollutants.

The dominance of the building and construction sector in the pretreatment market also stems from the ongoing global focus on urban development and infrastructure expansion. In 2024, increased investments in real estate, public utilities, and smart city projects continued to drive the use of coated metal components in construction.

Pretreated materials not only extend service life but also reduce long-term maintenance costs, making them a practical choice for developers and contractors. The 38.9% market share held by this segment reflects the sector’s consistent and large-scale consumption of treated surfaces, especially where structural integrity and surface performance are non-negotiable requirements.

Key Market Segments

By Type

- Phosphate

- Chromate

- Chromate Free

- Blast Clean

- Others

By Metal Substrate

- Steel

- Aluminum

- Others

By Application

- Building and Construction

- Automotive and Transportation

- Appliances

- Others

Driving Factors

Growing Demand for Corrosion-Resistant Metal Surfaces

One of the main driving factors for the coating pretreatment market is the increasing demand for corrosion-resistant metal surfaces across various industries. Metals used in construction, automotive, and industrial equipment are constantly exposed to harsh environments, moisture, chemicals, and temperature fluctuations. Without proper surface treatment, these metals are prone to rust, weakening, and premature failure.

Coating pretreatment helps by creating a strong bond between the base metal and the final coating, improving durability and extending the life of the product. In 2024, this need for protection and longer service life continues to push manufacturers and industries to adopt advanced pretreatment processes, especially as they aim to reduce maintenance costs and meet higher performance standards.

Restraining Factors

Environmental Concerns Over Hazardous Chemical Usage

A major restraining factor in the coating pretreatment market is the increasing concern over the use of hazardous chemicals in traditional surface treatment processes. Many commonly used pretreatment methods, such as chromating and phosphating, involve toxic substances that pose risks to both the environment and human health. These chemicals can lead to water and soil contamination if not properly handled or disposed of.

Regulatory bodies in several countries have tightened environmental norms, forcing manufacturers to either invest in costly waste management systems or shift to alternative, eco-friendly solutions. This transition often requires high capital investment and technical changes, creating barriers for small and medium-sized enterprises.

Growth Opportunity

Emerging Demand for Eco-Friendly Pretreatment Solutions

One of the strongest growth opportunities in the coating pretreatment market lies in the rising demand for eco-friendly pretreatment solutions. As environmental regulations tighten globally and organizations prioritize sustainability, there is a clear shift toward non-toxic, water-based, and low-VOC (volatile organic compound) pretreatment options.

These greener alternatives reduce hazardous waste and minimize health risks for workers, making them highly attractive for use in automotive, construction, and manufacturing sectors. Further, eco-conscious customers and industries are increasingly favoring suppliers with green processes and certifications. Manufacturers that develop cost-effective, high-performance biodegradable or non-chromate technologies can gain a competitive edge.

The growing adoption of such sustainable pretreatment options presents significant opportunity for innovation and expansion, especially as global industries work to reduce environmental footprints without compromising coating quality.

Latest Trends

Automation of Surface Cleaning through Robotic Pretreatment

Robotic systems for surface cleaning are emerging as a key trend in the coating pretreatment industry. These automated platforms incorporate sensors, programmable settings, and precise control to deliver consistent cleaning across large production volumes. The integration of robotic sandblasting ensures that every component receives uniform surface treatment, eliminating variations caused by manual labor.

This provides greater process repeatability, enhanced safety for operators, and optimized cleaning efficiency. Industries demanding high precision—such as automotive and aerospace—are increasingly adopting robotic pretreatment to secure reliable adhesion and coating performance. As manufacturers strive to reduce human error and boost throughput, automation in pretreatment processes is set to gain wider acceptance in the coming years.

Regional Analysis

In 2024, North America led with a 46.9% share, reaching USD 2.0 billion.

In 2024, North America held a dominant position in the global coating pretreatment market, accounting for 46.9% of the total share, with a market value of approximately USD 2.0 billion. The region’s leadership is primarily driven by strong industrial infrastructure, particularly in the automotive, aerospace, and construction sectors, where metal surface treatments are critical for durability and performance.

In Europe, the market showed steady growth, supported by stringent environmental regulations and a rising shift toward sustainable and low-VOC pretreatment chemicals. The focus on quality and compliance across end-use industries sustained regional demand.

Asia Pacific remained a key region due to ongoing industrialization and construction activity, especially in emerging economies. Growth in the transportation and consumer goods sectors continued to support pretreatment usage.

The Middle East & Africa experienced gradual expansion, largely driven by infrastructure development and the need for weather-resistant coated materials in harsh climates.

Meanwhile, Latin America displayed moderate growth, with improvements in industrial output and metal processing capabilities contributing to market expansion. However, North America remained the leading region in 2024, reflecting its high demand and established industrial base.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, the coating pretreatment market reflected steady advancements led by key industry players focused on product performance, surface reliability, and environmentally responsible processes.

Among them, 3M Co. maintained its influence through its expertise in surface preparation technologies that support high-end industrial applications. The company’s emphasis on improving material adhesion and corrosion protection across various sectors continues to resonate with customers seeking long-lasting coating outcomes.

A.D.INTERNATIONAL INDIA demonstrated strong growth by addressing region-specific needs within emerging markets. With a focus on affordable and efficient pretreatment solutions tailored for local industries, the company expanded its reach in sectors such as metal fabrication and construction, reinforcing its reputation for technical flexibility and value-driven service.

AkzoNobel N.V., known for its innovation in surface coatings, maintained a significant role by integrating pretreatment solutions that enhance coating performance. The company’s attention to reducing hazardous chemicals in the pretreatment phase aligned with the global demand for eco-friendly and compliant formulations, especially in Europe and North America. Its consistent focus on sustainability positioned it favorably among environmentally conscious users.

Axalta Coating Systems LLC leveraged its industrial coating background to offer specialized pretreatment systems for automotive and heavy equipment sectors. In 2024, its solutions were especially valued for ensuring coating consistency and corrosion protection in high-volume manufacturing environments. The company’s technical expertise and global distribution channels enabled it to meet diverse client demands, contributing to its continued relevance in the competitive landscape.

Top Key Players in the Market

- 3M Co.

- A.D.INTERNATIONAL INDIA

- AkzoNobel N.V.

- Axalata Coating System LLC

- BASF SE

- Chemetall GmbH

- DuBois Chemicals.

- Henkel AG & Co. KGaA

- NEI Corporation.

- Nippon Paints Co. Ltd

- Plastic Coatings Limited

- PPG Industries

- RPM International Inc.

- The Sherwin-Williams Company

- Valspar

- Vanchem Performance Chemicals

Recent Developments

- In June 2025, A.D.INTERNATIONAL INDIA, via its division AD Coil Coating Technologies, attended the Green Steel Conference held in Kolkata on June 5–6, 2025. Representatives shared insights focusing on sustainable and cost-efficient pretreatment processes for steel in the emerging “green steel” sector.

- In May 2025, 3M resolved legacy PFAS litigation through a judicial consent order involving the state of New Jersey, committing approximately USD 210 million for Chambers Works-related matters and USD 75 million for broader PFAS‑related claims.

Report Scope

Report Features Description Market Value (2024) USD 4.4 Billion Forecast Revenue (2034) USD 7.4 Billion CAGR (2025-2034) 5.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Phosphate, Chromate, Chromate Free, Blast Clean, Others), By Metal Substrate (Steel, Aluminum, Others), By Application (Building and Construction, Automotive and Transportation, Appliances, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape 3M Co., A.D.INTERNATIONAL INDIA, AkzoNobel N.V., Axalata Coating System LLC, BASF SE, Chemetall GmbH, DuBois Chemicals., Henkel AG & Co. KGaA, NEI Corporation., Nippon Paints Co. Ltd, Plastic Coatings Limited, PPG Industries, RPM International Inc., The Sherwin-Williams Company, Valspar, Vanchem Performance Chemicals Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Coating Pretreatment MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Coating Pretreatment MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- 3M Co.

- A.D.INTERNATIONAL INDIA

- AkzoNobel N.V.

- Axalata Coating System LLC

- BASF SE

- Chemetall GmbH

- DuBois Chemicals.

- Henkel AG & Co. KGaA

- NEI Corporation.

- Nippon Paints Co. Ltd

- Plastic Coatings Limited

- PPG Industries

- RPM International Inc.

- The Sherwin-Williams Company

- Valspar

- Vanchem Performance Chemicals