Global Cloud Security Posture Management Market By Component (Solutions, Services), By Cloud Model (IaaS, SaaS), Enterprise Size (SME and Large Enterprise), By Industry Vertical(BFSI, Healthcare, IT & Telecommunication, Government and Defense, Retail & Trade, Other Industry Verticals), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2033

- Published date: Nov. 2023

- Report ID: 73690

- Number of Pages: 266

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

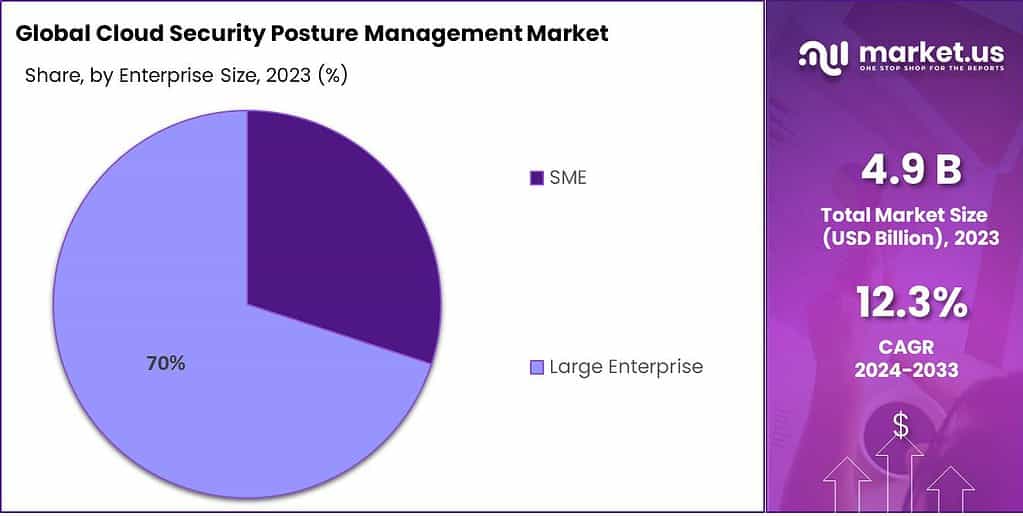

The Global Cloud Security Posture Management (CSPM) Market is anticipated to be USD 15.6 billion by 2033. It is estimated to record a steady CAGR of 12.3% in the Forecast period 2023 to 2033. It is likely to total USD 4.9 billion in 2023.

Cloud Security Posture Management (CSPM) refers to a set of software tools and services that help organizations assess and increase the security of their cloud environments. As more businesses move data and applications onto the cloud, visibility into potential security risks or configuration issues arise with their cloud resources is required in order to keep an optimal security posture.

Note: Actual Numbers Might Vary In Final Report

CSPM tools continuously monitor cloud accounts, resources, and services to identify misconfigurations, vulnerable systems, suspicious activity, and policy violations. For example, a CSPM tool could detect if a cloud storage bucket was left publicly accessible when it should only be internally available within the organization. The tools provide recommendations on how to remediate or fix the issues to strengthen security.

The CSPM market refers to the industry that provides CSPM solutions and services to organizations. It has been experiencing significant growth due to the increasing adoption of cloud computing and the need to ensure robust security measures in cloud environments. The market encompasses various vendors and service providers offering CSPM products, including software tools, platforms, and managed services.

The demand for CSPM solutions has been driven by several factors. First, the rapid migration of workloads and data to cloud platforms has created a need to address the unique security challenges associated with cloud environments. Second, regulatory compliance requirements, industry standards, and data protection laws necessitate maintaining a secure posture in the cloud. Third, the dynamic nature of cloud infrastructure and the frequent changes in configurations require continuous monitoring and management to ensure security.

Organizations across industries, including healthcare, finance, e-commerce, and government sectors, are investing in CSPM solutions to strengthen their cloud security strategies. These solutions help organizations prevent data breaches, unauthorized access, and compliance violations, thereby safeguarding sensitive information and maintaining the trust of their customers.

Key Takeaways

- Market Size: The Global CSPM market is expected to reach a high of USD 15.6 billion by 2032, with a steady CAGR of 12.3%. In 2023, it is projected to be worth USD 4.9 billion.

- Definition of CSPM: CSPM involves the use of software tools and services to assess and enhance the security of cloud environments. It’s essential as more businesses migrate to the cloud, facing potential security risks.

- Continuous Monitoring and Detection: CSPM tools continuously monitor cloud accounts, resources, and services. They identify misconfigurations, vulnerable systems, suspicious activities, and policy violations, providing recommendations for remediation.

- Market Growth Drivers: Increasing adoption of cloud services across industries and Frequent changes in configurations demand continuous security monitoring.

- Based on Component: Solutions hold the majority of the market share (over 68%) in 2023, driven by the demand for integrated security solutions. Services, though smaller in share, play a vital role in consulting and support.

- Based on Cloud Model: SaaS dominates with a market share of nearly 41%, while IaaS maintains relevance due to its customization for specific business requirements.

- Enterprise Size: Large enterprises (over 70% market share in 2023) prioritize robust cloud security, while SMEs are increasingly aware of cybersecurity risks.

- Based on Industry Vertical: Government and Defense lead with a market share of over 30%, followed by BFSI, Healthcare, IT & Telecommunication, and Retail & Trade.

- Driving Factors: Increasing Cybersecurity Threats and Cloud Adoption.

- Restraining Factors: Complexity of Cloud Environments and Budget Constraints

- Growth Opportunities: Emerging Markets, Integration with DevOps, AI and ML-driven Solutions

- Key Market Trends: Zero Trust Security, Container Security, Continuous Compliance Monitoring and Ecosystem Integration.

- Top Key Players: Microsoft, CrowdStrike, NetApp, Palo Alto Networks, Check Point Software Technologies Ltd.

Based on Component

In 2023, within the Cloud Security Posture Management market, the Solutions Segment emerged as the frontrunner, asserting its dominance by securing a substantial market share of over 68%. This remarkable position can be attributed to the escalating demand for comprehensive and integrated security solutions across various industries. Companies are becoming more aware of the importance of securing their cloud infrastructure to protect against security breaches and cyber-attacks and resulting in the widespread adoption of Cloud Security Posture Management (CSPM) solutions.

These solutions cover a broad range of capabilities, including real-time monitoring, enforcement of policies, and risk assessment, taking care of the ever-changing and complex security requirements of companies in the modern age. As the business landscape continues to evolve, the Solutions Segment is poised to maintain its stronghold, driven by the imperative need for robust cloud security measures.

The Services Segment, on the other hand, also plays a pivotal role in the Cloud Security Posture Management ecosystem. While it may not command the same market share as its counterpart, it remains a vital component of the CSPM landscape. In 2023, the Services Segment contributed significantly to the market, offering consulting, implementation, and support services to organizations seeking to enhance their cloud security posture.

These services facilitate seamless integration of CSPM solutions into existing infrastructure, ensuring optimal performance and efficacy. Furthermore, they provide invaluable expertise and guidance to organizations navigating the complex realm of cloud security, bolstering their overall resilience against cyber threats. As the adoption of CSPM solutions continues to grow, the Services Segment is expected to expand steadily, serving as an indispensable companion to the dominant Solutions Segment, and together, they will contribute to the holistic fortification of cloud security across industries.

Based on Cloud Model

Notably, in the SaaS (Software as a Service) segment has emerged as the leader and capturing a significant market share of nearly 41% This is due to the increasing use of cloud-based SaaS models across all industries. SaaS services provide companies with a simple and flexible method of accessing cloud security solutions, which eliminates the requirement for large infrastructure investment.

Additionally SaaS-based CSPM solutions provide flexibility and easy deployment which makes them a desirable option for companies of different size. With the increasing emphasis placed on the security of cloud environments, SaaS is expected to be able to keep its position. SaaS segment is likely to continue to be a leader and play a pivotal role to strengthen the security of cloud-based services.

However it is it is the IaaS (Infrastructure as a service) segment, despite being challenged by SaaS is still able to maintain an impressive market share until 2023. IaaS-based CSPM solutions cater to organizations that require more control and customization over their cloud infrastructure security. Large enterprises, in particular, often opt for IaaS models to align their cloud security strategies with specific business requirements.

This segment’s resilience can also be attributed to the fact that certain industries, such as finance and healthcare, prioritize stringent control and compliance measures in their cloud environments, favoring IaaS-based CSPM solutions. As the cloud landscape continues to evolve, the IaaS segment is expected to adapt and innovate, ensuring its relevance in a dynamic market.

Enterprise Size

Shifting our focus to the Enterprise Size segment of the CSPM market, it becomes evident that in 2023, the Large Enterprise segment held a commanding position, securing a market share exceeding 70%. This dominance reflects the intricate and extensive security needs of large organizations, which often operate on a global scale and handle vast volumes of sensitive data. Large enterprises recognize the imperative nature of robust cloud security measures to protect their digital assets and maintain regulatory compliance.

Consequently, they invest significantly in CSPM solutions tailored to their intricate requirements, including advanced threat detection, compliance monitoring, and real-time security posture assessment. As the digital landscape continues to evolve, the Large Enterprise segment is poised to maintain its prominence, ensuring that the cloud security posture of sizable organizations remains steadfast in the face of emerging threats.

On the other hand, Small and Medium-sized Enterprises (SMEs), while constituting a significant portion of the CSPM market, face distinct challenges and opportunities. In 2023, SMEs increasingly recognized the importance of cloud security, albeit with varying budget constraints and resource limitations. As a result, the SME segment witnessed steady growth, driven by a burgeoning awareness of cybersecurity risks. CSPM solutions tailored to the needs and affordability of SMEs gained traction, offering cost-effective options without compromising on essential security features. This segment’s trajectory is expected to remain positive, as SMEs continue to embrace the cloud and prioritize the safeguarding of their digital assets, ultimately contributing to the broader landscape of cloud security posture management.

Note: Actual Numbers Might Vary In The Final Report

Based on Industry Vertical

In 2023, the Cloud Security Posture Management (CSPM) market exhibited notable dynamics in its Industry Vertical segments. Remarkably, the Government and Defense segment emerged as the dominant force, securing a substantial market share of over 30%. This commanding position underscores the paramount importance of cloud security in the public sector, where sensitive data protection and national security concerns are paramount. Government agencies and defense organizations are increasingly adopting CSPM solutions to fortify their cloud environments against cyber threats and data breaches. With stringent compliance requirements and the need for robust security measures, this segment is expected to maintain its prominence, further solidifying its role in safeguarding critical digital assets.

Concurrently, the BFSI (Banking, Financial Services, and Insurance) sector, a perennially critical player in the CSPM market, retained a strong foothold in 2023. With cyberattacks targeting financial institutions on the rise, the BFSI segment continued to prioritize cloud security posture management. It held a significant market share, driven by the imperative need for real-time threat detection, compliance adherence, and data protection. The segment’s resilience in the face of evolving cybersecurity challenges is a testament to the industry’s unwavering commitment to safeguarding financial assets and customer data.

In the Healthcare domain, the adoption of CSPM solutions also gained momentum in 2023. As the industry digitized patient records and embraced cloud-based applications, the need for robust security measures became increasingly evident. Healthcare organizations recognized the critical role of CSPM in maintaining patient confidentiality and complying with stringent data protection regulations. This segment experienced notable growth, contributing to the overall expansion of the CSPM market.

Furthermore, the IT & Telecommunication sector, a trailblazer in technological innovation, continued to be a substantial player in the CSPM market. In an era of digital transformation and remote work, these organizations prioritized cloud security to protect their networks and customer data. The Retail & Trade segment also made strides in adopting CSPM solutions, reflecting the industry’s awareness of the risks associated with online transactions and customer information.

Beyond these key segments, other industry verticals, while collectively contributing to the CSPM market, are characterized by diverse security needs and adoption rates. These segments are expected to evolve at their own pace, driven by unique market dynamics and cybersecurity considerations. In sum, the CSPM market’s segmentation by industry verticals reflects a nuanced landscape, with each sector responding to the imperative of cloud security in its own distinct manner.

Driving Factors

- Increasing Cybersecurity Threats: The ever-growing sophistication of cyber threats, including data breaches and ransomware attacks, is a significant driver for the CSPM market. Organizations are compelled to invest in CSPM solutions to protect their cloud environments from evolving security risks.

- Cloud Adoption: The rapid adoption of cloud services across industries is a key driver. As businesses migrate their operations to the cloud, the need for robust CSPM solutions to ensure data security and compliance becomes paramount.

- Stringent Data Privacy Regulations: Strict data protection regulations, such as GDPR and CCPA, mandate the secure handling of sensitive information. Compliance with these regulations drives the adoption of CSPM solutions, which assist organizations in achieving and maintaining compliance.

- Remote Work Trends: The shift towards remote work and the use of remote access to cloud resources have intensified the demand for CSPM. Ensuring secure access to cloud-based applications and data for remote employees is a critical driver.

Restraining Factors

- Complexity of Cloud Environments: The complexity of multi-cloud and hybrid cloud environments can pose challenges in implementing CSPM solutions effectively. Managing security across diverse cloud platforms can be resource-intensive and complicated.

- Budget Constraints: Some organizations, particularly smaller ones, may face budget limitations when it comes to investing in CSPM solutions. Cost considerations can restrain adoption, especially in competitive markets.

- Skills Gap: The shortage of skilled cybersecurity professionals proficient in CSPM tools can hinder adoption. Organizations may struggle to find or train personnel to effectively utilize CSPM solutions.

- Resistance to Change: Resistance to change within organizations can be a significant barrier. Some businesses may be hesitant to transition from traditional security measures to CSPM, fearing disruptions or uncertainties.

Growth Opportunities

- Emerging Markets: The CSPM market offers significant growth opportunities in emerging markets where cloud adoption is on the rise. These regions present untapped potential for CSPM vendors to expand their customer base.

- Integration with DevOps: The integration of CSPM into DevOps practices is a burgeoning opportunity. CSPM tools that seamlessly fit into the DevOps pipeline enable organizations to build security into their applications from the outset.

- Artificial Intelligence (AI) and Machine Learning (ML): AI and ML-driven CSPM solutions are gaining traction. These technologies can enhance threat detection and response capabilities, offering a growth avenue for innovative CSPM vendors.

- Vertical-specific Solutions: Tailoring CSPM solutions for specific industries, such as healthcare or finance, presents an opportunity. Industry-specific compliance requirements drive the demand for customized CSPM offerings.

Key Market Trends

- Zero Trust Security: Zero Trust architecture, which assumes no trust within or outside the network, is a prevailing trend. CSPM solutions are aligning with Zero Trust principles to provide granular security controls.

- Container Security: With the rise of containerization and microservices, CSPM is extending its focus to container security. Protecting containerized applications and their orchestration platforms is a key trend.

- Continuous Compliance Monitoring: Continuous compliance monitoring is gaining prominence. CSPM tools are evolving to provide real-time compliance checks and automated remediation to ensure adherence to regulatory requirements.

- Ecosystem Integration: CSPM solutions are increasingly integrating with other security tools and platforms, creating a unified security ecosystem. This trend enhances visibility and coordination in managing cloud security posture.

Key Market Segments

Based on Component

- Services

- Solutions

Based on Cloud Model

- IaaS

- SaaS

Enterprise Size

- SME

- Large Enterprise

Based on Industry Vertical

- BFSI

- Healthcare

- IT & Telecommunication

- Retail & Trade

- Other Industry Verticals

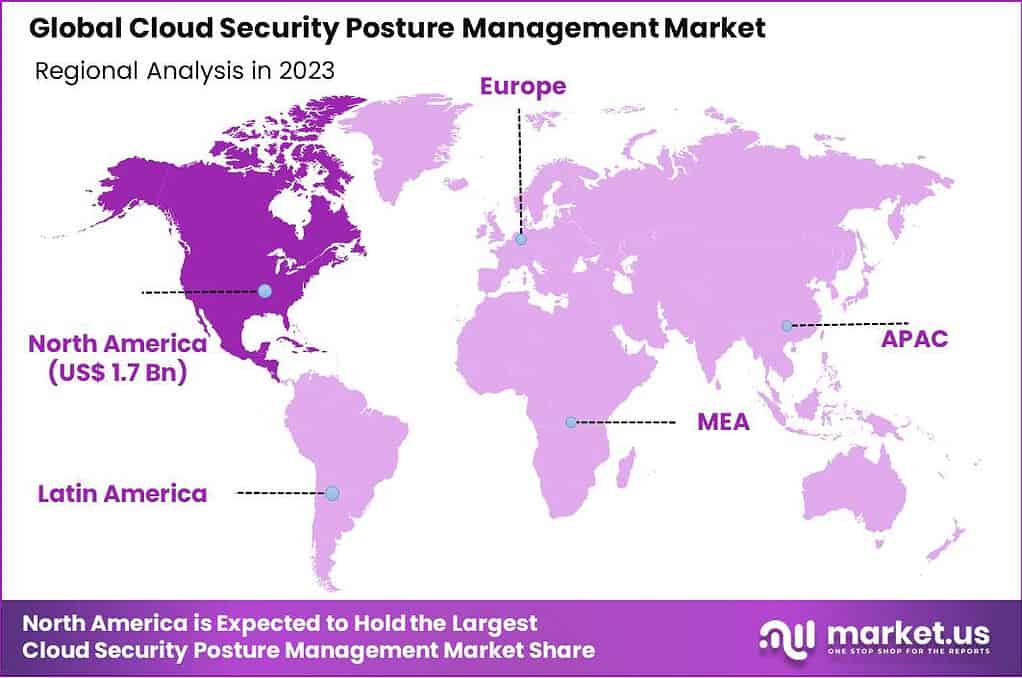

Regional Analysis

In 2023, North America solidified its commanding position in the Cloud Security Posture Management (CSPM) market by capturing over 35% of the market share. The demand for Cloud Security Posture Management Market in North America was valued at USD 1.7 billion in 2023 and is anticipated to grow significantly in the forecast period.

This dominance can be attributed to the region’s early and enthusiastic adoption of cloud technologies, combined with a heightened awareness of cybersecurity risks. North American organizations, spanning various industries, have been at the forefront of embracing CSPM solutions to safeguard their cloud environments comprehensively. The presence of major CSPM vendors and robust regulatory frameworks further propelled the market’s growth in this region.

In contrast, Europe exhibited a competitive landscape, with a notable market share reflecting the region’s commitment to stringent data protection regulations. The European Union’s General Data Protection Regulation (GDPR) and similar legislations have compelled organizations to prioritize cloud security and compliance, driving the adoption of CSPM solutions. The Asia-Pacific (APAC) region experienced rapid market expansion, fueled by the digital transformation endeavors of businesses across diverse sectors. APAC’s burgeoning cloud market and increasing cyber threats contributed to the growing demand for CSPM solutions, with the region poised for continued growth.

Latin America witnessed steady adoption as organizations recognized the significance of securing their cloud assets against emerging threats, albeit at a comparatively slower pace. The Middle East and Africa, while holding a smaller market share, showcased potential for future growth, primarily driven by the increasing awareness of the importance of cloud security in digital transformation initiatives. In summary, the CSPM market’s regional analysis in 2023 reflects a global landscape shaped by diverse factors, where North America’s dominance and each region’s unique dynamics contribute to the market’s overall resilience and expansion.

Note: Actual Numbers Might Vary In The Final Report Key Regions and Countries Covered in this Report

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

Cloud Security Posture Management (CSPM) market is a rapidly growing sector that focuses on ensuring the security and compliance of cloud computing environments. Several key players have emerged in this market, offering CSPM solutions and services to organizations.

Key player analysis involves assessing the market presence, product offerings, industry reputation, and customer base of significant companies in a specific market segment. In the context of the CSPM market, key player analysis helps identify the leading vendors that offer CSPM solutions and services. These key players are often distinguished by their innovative solutions, comprehensive feature sets, customer satisfaction, and market share. Their expertise and capabilities contribute to shaping the CSPM market landscape and driving its growth.

Top Key Players

- Microsoft

- CrowdStrike

- NetApp

- Palo Alto Networks

- Check Point Software Technologies Ltd

- Fortinet

- Qualys

- McAfee Inc.

- Trend Micro Incorporated

- Lacework

- SentinelOne

- Sophos Ltd.

- Aqua Security Software Ltd.

- Armor Defense Inc.

- Cloudflare

- Other Key Players

Recent Developments

- In March 2022, VMware revealed its collaboration with Google Cloud, aiming to assist customers in speeding up the modernization of their applications and the transition to cloud computing.

- In February 2022, Check Point acquired Spectral to enhance CloudGuard. This move was geared towards developing a security platform with a primary focus on developers and expanding the range of security measures for cloud applications.

- In November 2021, Sonrai Security became a part of Microsoft Intelligent Security. The Sonrai Dig platform combines Cloud Security Posture Management (CSPM), Cloud Infrastructure Entitlements Management (CIEM), and data security into a single, unified system, all powered by a cloud identity graph.

Report Scope

Report Features Description Market Value (2023) US$ 4.9 Bn Forecast Revenue (2032) US$ 15.6 Bn CAGR (2023-2032) 12.3% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Solutions, Services), By Cloud Model (IaaS, SaaS), Enterprise Size (SME and Large Enterprise), By Industry Vertical(BFSI, Healthcare, IT & Telecommunication, Government and Defense, Retail & Trade, Other Industry Verticals) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Microsoft, CrowdStrike, NetApp, Palo Alto Networks, Check Point Software Technologies Ltd, Fortinet, Qualys, McAfee Inc., Trend Micro Incorporated, Lacework, SentinelOne, Sophos Ltd., Aqua Security Software Ltd., Armor Defense Inc., Cloudflare, Other Key Players Customization Scope Customization for segments and region/country level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is Cloud Security Posture Management (CSPM)?CSPM is a set of tools and practices designed to ensure the security of cloud environments. It involves monitoring, assessing, and managing the security posture of cloud infrastructure to prevent and respond to potential threats.

How big is the Security Posture Management (CSPM) market?The Global Cloud Security Posture Management (CSPM) Market is anticipated to be USD 15.6 billion by 2033. It is estimated to record a steady CAGR of 12.3% in the Forecast period 2023 to 2033. It is likely to total USD 4.9 billion in 2023.

Who are the leaders in the CSPM market?Notable players in the CSPM market included companies like Microsoft, CrowdStrike, NetApp, Palo Alto Networks, Check Point Software Technologies Ltd, Fortinet, Qualys, McAfee Inc., Trend Micro Incorporated, Lacework, SentinelOne, Sophos Ltd., Aqua Security Software Ltd., Armor Defense Inc., Cloudflare, Other Key Players

What are the trends in CSPM?Trends in CSPM include the integration of artificial intelligence and machine learning for threat detection, the focus on automation for remediation, the incorporation of CSPM into DevOps processes, and the rising importance of multi-cloud security.

How big is the Extended Detection and Response (XDR) market?The XDR market has been expanding rapidly as organizations seek more comprehensive threat detection and response capabilities. The market size can be influenced by factors such as the evolving threat landscape and the adoption of advanced security solutions. Current figures can be obtained from recent market research reports.

What are the key features to look for in a CSPM solution?Effective CSPM solutions should provide continuous monitoring, configuration analysis, threat detection, and automated remediation capabilities. Integration with other security tools and support for multiple cloud platforms are also important considerations.

Cloud Security Posture Management MarketPublished date: Nov. 2023add_shopping_cartBuy Now get_appDownload Sample

Cloud Security Posture Management MarketPublished date: Nov. 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- Microsoft

- CrowdStrike

- NetApp

- Palo Alto Networks

- Check Point Software Technologies Ltd

- Fortinet

- Qualys

- McAfee Inc.

- Trend Micro Incorporated

- Lacework

- SentinelOne

- Sophos Ltd.

- Aqua Security Software Ltd.

- Armor Defense Inc.

- Cloudflare

- Other Key Players