Global Cloud Managed Services Market By Service Type (Managed Mobility Services, Managed Security Services, Managed Communication and Collaboration Services, Managed Network Services, Managed Business Services, Managed Infrastructure Services), By Deployment Mode (Public Cloud, Private Cloud), By Organization Size (Small and Medium-Sized Enterprises, Large Enterprises), By Industry Vertical (IT and Telecommunications, BFSI, Retail, Healthcare, Manufacturing, Government and Public Sector, Other Industry Verticals), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: August 2024

- Report ID: 127420

- Number of Pages: 383

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

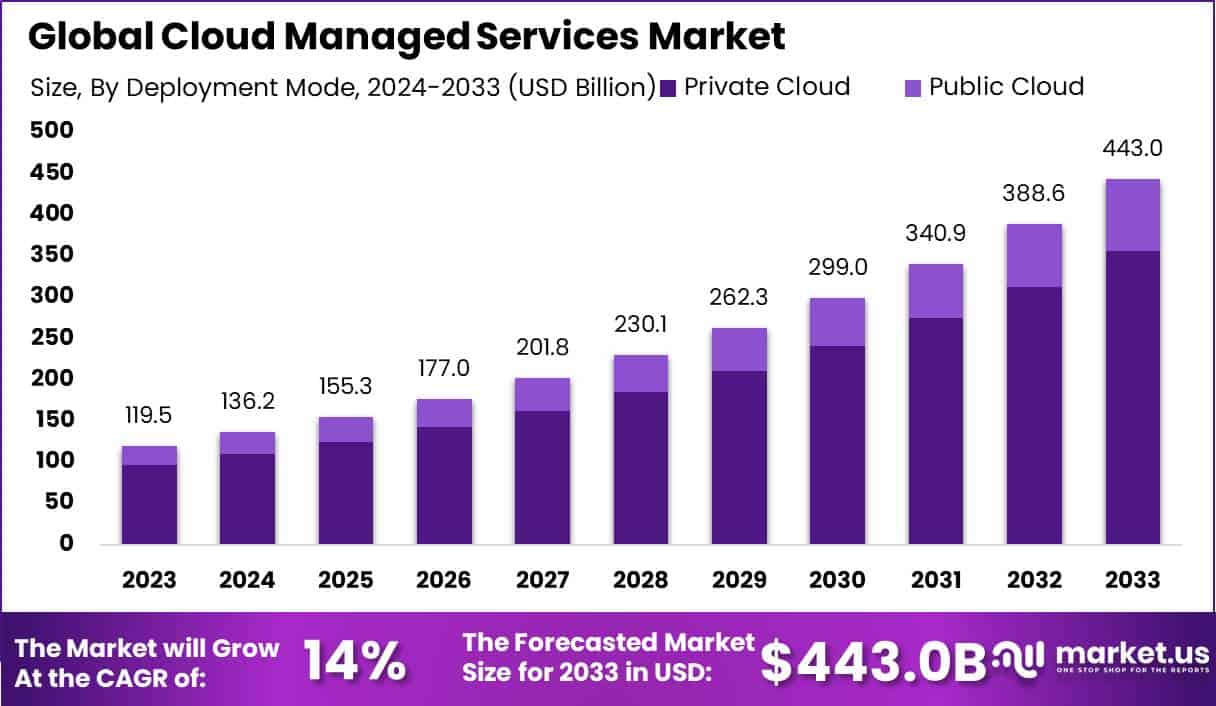

The Global Cloud Managed Services Market size is expected to be worth around USD 443.0 Billion By 2033, from USD 119.0 Billion in 2023, growing at a CAGR of 14% during the forecast period from 2024 to 2033.

Cloud Managed Services refer to the outsourcing of daily IT management for cloud-based services and technical support to automate and enhance business operations. These services are typically utilized by organizations looking to offload general IT operational tasks, allowing them to focus more on strategic business activities. The key offerings under cloud managed services include network management, security management, systems management, and data management, all conducted under the umbrella of cloud environments.

The Cloud Managed Services Market is experiencing significant growth due to the increasing adoption of cloud-based solutions across various industries. Businesses are increasingly turning to cloud managed services to manage complex cloud environments efficiently, ensure security compliance, and optimize operational costs. This market expansion is also driven by the growing need for expertise in managing cloud resources and the desire to reduce the burden on internal IT teams.

Demand for cloud managed services is rising sharply, primarily fueled by the ongoing digital transformation initiatives across industries. As companies migrate more critical applications and data to the cloud, the complexity of managing these resources increases. This complexity often requires specialized skills and tools that can be efficiently provided by cloud managed services providers.

Several growth factors contribute to the expansion of the cloud managed services market. Firstly, the increasing complexity of IT infrastructure necessitates specialized management that can scale with growing business needs. Additionally, the rising awareness of cybersecurity threats pushes companies to adopt managed cloud services that offer robust security measures. The rapid adoption of IoT and big data technologies also requires extensive support, driving further reliance on managed services for efficient and secure operations.

The opportunities within the cloud managed services market are vast. There is a significant potential for providers to innovate in automation and predictive analytics to offer even more effective management solutions. As businesses increasingly prioritize cost efficiency and strategic IT alignment, managed services that can provide comprehensive, customizable, and proactive management solutions are likely to see substantial growth.

For instance, In November 2023, Google Cloud announced the launch of a new cloud region in Dammam, marking a significant expansion in Saudi Arabia. This strategic move is expected to contribute approximately $109 billion to the country’s GDP by 2030. The new region will enhance Google Cloud’s high-performance, low-latency services, providing a robust infrastructure for a diverse range of customers across Saudi Arabia and the broader Middle East region.

Key Takeaways

- The Cloud Managed Services Market is projected to reach approximately USD 443.0 Billion by 2033, up from USD 119.0 Billion in 2023, demonstrating a Compound Annual Growth Rate (CAGR) of 14% during the forecast period from 2024 to 2033.

- In 2023, the Managed Mobility Services segment commanded a significant market share, holding more than 35.8% of the Cloud Managed Services market.

- The Private Cloud deployment model maintained a leading position in 2023, securing over 80.5% of the market’s share within Cloud Managed Services.

- Large Enterprises prominently dominated the market landscape, capturing more than 77.3% of the market share within Cloud Managed Services in 2023.

- Within the industry segmentation, the IT and Telecommunications sector held the largest market share, accounting for over 21.4% in 2023.

- Geographically, North America led the Cloud Managed Services sector, holding a substantial share of more than 35.1% and generating revenues around USD 41.9 billion in 2023.

Service Type Analysis

In 2023, the Managed Mobility Services segment held a dominant market position within the Cloud Managed Services market, capturing more than a 35.8% share.

This leadership can be attributed to several key factors that underscore the growing reliance on mobile solutions in business operations. Firstly, the proliferation of mobile devices and the accompanying demand for seamless integration into corporate networks have driven enterprises to adopt managed mobility services. These services offer comprehensive management of mobile devices, applications, and content that are critical for maintaining business continuity and enhancing workforce productivity.

Furthermore, the rise of remote working models and the expansion of the digital workspace have amplified the need for robust mobile management solutions. Managed Mobility Services ensure that organizations can oversee their mobile ecosystems effectively, enforcing security policies and supporting a wide array of mobile devices.

This is particularly crucial as businesses increasingly depend on mobile technology to perform daily operations, making effective management a key component in safeguarding sensitive corporate data against potential cyber threats. Additionally, the evolution of technologies such as 5G, IoT, and edge computing has further propelled the Managed Mobility Services segment to the forefront.

These technologies enhance mobile connectivity and capabilities, requiring sophisticated management tools that can handle increased data volumes and the need for faster processing speeds. Managed Mobility Services providers have responded by developing advanced solutions that not only support current technological needs but are also scalable and adaptable to future advancements, ensuring their continued dominance in the Cloud Managed Services market.

Deployment Mode Analysis

In 2023, the Private Cloud segment held a dominant market position, capturing more than an 80.5% share of the Cloud Managed Services market. This significant market share is primarily due to the heightened control and security features that private clouds offer, which are particularly appealing to enterprises handling sensitive data or operating under stringent regulatory frameworks.

Organizations in sectors such as finance, healthcare, and government largely prefer private clouds because they provide enhanced security measures, including dedicated firewalls and internal hosting, which significantly reduce the risk of data breaches and external attacks. Additionally, private clouds offer organizations the ability to customize and configure their environments according to specific needs, a factor that is especially valuable for businesses with complex or unique requirements.

This customization extends to the physical infrastructure and the services layer, allowing companies to optimize their cloud resources for better performance, compliance, and integration with existing systems. Such capabilities are less feasible in public cloud environments, where the infrastructure is designed for broad, multi-tenant use.

The ongoing digital transformation in various industries also fuels the dominance of the Private Cloud segment. As companies continue to modernize their IT infrastructures, the demand for private cloud services that offer scalability similar to public clouds but with greater privacy and security is increasing. This trend is supported by advancements in cloud technologies that are making private cloud solutions more cost-effective and accessible, thereby reinforcing their leading position in the market.

Organization Size Analysis

In 2023, the Large Enterprises segment held a dominant market position within the Cloud Managed Services market, capturing more than a 77.3% share. This considerable market share is largely due to the extensive requirements and complexities associated with managing vast IT infrastructures that are typical of large enterprises. These organizations often operate on a global scale, necessitating robust cloud solutions that can integrate and manage diverse systems and applications efficiently.

Cloud managed services provide the necessary expertise and technology to streamline operations, improve scalability, and enhance the overall IT responsiveness, which are critical factors for large businesses. Moreover, large enterprises frequently face stringent regulatory and compliance requirements, driving the need for managed cloud services that offer tailored security measures.

These services ensure that enterprises not only comply with national and international regulations but also maintain a secure environment for sensitive data across different jurisdictions. The ability to customize cloud environments and security protocols without sacrificing operational efficiency is a key reason why large enterprises heavily invest in managed cloud services.

Additionally, the competitive landscape in which large enterprises operate compels them to continually innovate and optimize their IT operations. Cloud managed services enable these companies to leverage the latest technologies, including artificial intelligence, machine learning, and advanced analytics, without the need for significant upfront capital investment.

This strategic flexibility and operational agility afford large enterprises the ability to adapt quickly to market changes and technological advancements, further cementing their dominance in the Cloud Managed Services market.

Industry Vertical Analysis

In 2023, the IT and Telecommunications segment held a dominant market position in the Cloud Managed Services market, capturing more than a 21.4% share. This segment’s leadership is primarily due to the integral role that cloud services play in managing vast amounts of data and supporting complex network operations across various telecommunication platforms.

As the backbone of digital communication, IT and telecommunications companies require robust, scalable, and highly available service architectures, which cloud managed services readily provide. This need drives sustained demand, particularly as these companies expand their infrastructure to support growing data traffic and evolve with technological advancements.

Moreover, the ongoing digital transformation initiatives within the sector further propel the adoption of cloud managed services. Telecommunication companies are increasingly relying on these services to streamline operations, reduce operational costs, and enhance service delivery. Managed cloud services enable telecom operators to deploy and manage networks efficiently, improve time-to-market for new services, and optimize customer experience through advanced analytics and machine learning capabilities.

This shift is crucial as the industry moves towards more software-defined networking and virtualized network functions. Additionally, the advent of technologies such as 5G, IoT, and edge computing in the IT and telecommunications sector underscores the need for cloud managed services. These technologies demand high-performance computing solutions and extensive data handling capabilities that are cost-effective, flexible, and scalable.

Cloud managed services providers are equipped to handle these requirements, offering specialized services that support the dynamic needs of the sector. The ability to provide tailored solutions that ensure security, compliance, and uninterrupted service delivery positions this segment as a leader in the cloud managed services market.

Key Market Segments

Service Type

- Managed Mobility Services

- Managed Security Services

- Managed Communication and Collaboration Services

- Managed Network Services

- Managed Business Services

- Managed Infrastructure Services

Deployment Mode

- Public Cloud

- Private Cloud

Organization Size

- Small and Medium-Sized Enterprises

- Large Enterprises

Industry Vertical

- IT and Telecommunications

- BFSI

- Retail

- Healthcare

- Manufacturing

- Government and Public Sector

- Other Industry Verticals

Driver

Increasing Adoption of Cloud Technology

A primary driver for the Cloud Managed Services market is the increasing adoption of cloud technology across various sectors, particularly in BFSI and IT & Telecom. This trend is propelled by the need for businesses to manage vast data efficiently and ensure system scalability and flexibility. Managed cloud services facilitate operational excellence and innovation by integrating advanced technologies like AI and machine learning, making business processes more efficient and cost-effective.

Restraint

Security Concerns and Inefficiency Perceptions

One significant restraint in the market is the ongoing concern over cloud security. Despite the advancements in technology, apprehensions regarding data breaches and loss of sensitive information continue to hinder the widespread adoption of cloud managed services. Additionally, some businesses perceive managed cloud services as inefficient compared to in-house solutions, stemming from past experiences or lack of tailored solutions that meet specific organizational needs.

Opportunity

Expansion in Developing Markets

There’s a substantial opportunity for growth in developing regions where digital infrastructure is still evolving. Countries like China are heavily investing in new technologies such as cloud computing, AI, and blockchain, which opens up expansive prospects for cloud managed services. These investments are part of broader national strategies to enhance technological capabilities and infrastructure, providing a fertile ground for cloud services expansion.

Challenge

Infrastructure and Regulatory Issues

The cloud managed services market faces challenges related to infrastructure inadequacies in less developed regions. Additionally, varying regulatory environments across different countries can complicate the deployment of cloud services. These issues require service providers to navigate a complex array of laws and regulations while trying to deliver consistent and secure services globally.

Growth Factors

A key growth driver in the Cloud Managed Services market is the increasing emphasis on cost reduction and operational efficiency. Businesses are leveraging cloud managed services to minimize capital expenditures and reduce IT operational costs. This shift is largely motivated by the need for scalability and flexibility in IT resource management, which cloud services provide effectively.

Moreover, the adoption of cloud technology facilitates enhanced collaboration and productivity by allowing remote access and real-time data sharing. This adoption is especially pronounced in regions like North America, where there is high internet penetration and a readiness to integrate advanced technologies such as AI and mobile services into cloud platforms.

Emerging Trends

One of the most notable trends is the integration of advanced technologies like AI and machine learning into cloud managed services, which are becoming essential for businesses seeking to gain a competitive edge. These technologies help in automating operations and providing insightful analytics, leading to more informed decision-making.

Furthermore, the market is seeing a shift towards multi-cloud and hybrid cloud solutions, which allow businesses to optimize their cloud strategies by distributing workloads across various cloud environments, enhancing both performance and security. The growth of the Internet of Things (IoT) and the increasing number of connected devices have also spurred the demand for managed cloud services that can efficiently handle vast amounts of data and complex network environments.

Regional Analysis

In 2023, North America held a dominant market position in the Cloud Managed Services sector, capturing more than a 35.1% share and generating approximately USD 41.9 billion in revenue. This significant market share can be attributed to several key factors that underscore the region’s pioneering role in cloud technology adoption and innovation.

North America’s leadership in this market is driven largely by the presence of major technology firms and early adopters of cloud services. The region benefits from a robust technological infrastructure and a strong emphasis on research and development, factors that foster the rapid deployment of cloud-managed services. The high level of digital literacy among businesses and consumers also accelerates the uptake of cloud solutions, enhancing operational efficiencies and reducing costs across diverse industries.

Moreover, stringent regulatory requirements regarding data privacy and security in North American countries, particularly in the United States and Canada, compel businesses to invest in reliable cloud-managed services. These services not only ensure compliance with regulations but also provide enhanced data security and risk management, making them more attractive to sectors such as finance, healthcare, and government.

In addition to these factors, the North American market benefits from a competitive landscape that pushes continuous innovation in cloud services. This competition results in better service offerings and more comprehensive solutions, which in turn attract more businesses to adopt cloud-managed services. The growth of sectors like e-commerce, telecommunication, and professional services in the region further stimulates market expansion, reinforcing North America’s dominant position in the global cloud managed services landscape.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Cloud Managed Services market is highly competitive with several prominent players driving innovation and growth. Among these, Accenture plc, IBM Corporation, and Deloitte Touche Tohmatsu Limited stand out due to their extensive service portfolios and global reach.

Accenture plc has consistently expanded its cloud services through strategic acquisitions, such as their recent purchase of Imaginea, which enhances their cloud capabilities and consulting services. The company also regularly launches new services, such as their AI-driven cloud management platform, aiming to bolster their comprehensive offerings.

IBM Corporation has made significant strides through the acquisition of companies like Red Hat, which has deeply integrated open-source technologies into IBM’s cloud offerings. IBM frequently introduces innovative products, such as its AI-powered cloud security tools, reflecting its commitment to leading in technology-forward managed services.

Deloitte Touche Tohmatsu Limited has broadened its market scope through mergers and acquisitions, including the merger with CloudQuest, which enhances their cloud security offerings. Deloitte also launches innovative solutions tailored to evolving business needs, such as custom cloud strategies that leverage AI and analytics to optimize enterprise operations.

Top Key Players in the Market

- Accenture plc

- IBM Corporation

- Deloitte Touche Tohmatsu Limited

- Infosys Limited

- Veritis Group Inc.

- Wipro Limited

- NTT Ltd.

- Fujitsu Limited

- Capgemini SE

- Cloud4C

- Other Key Players

Recent Developments

- In February 2024, Accenture announced the acquisition of Mindcurv, a cloud-native digital experience and data analytics company. This acquisition strengthens Accenture’s capabilities in composable software, digital engineering, and commerce services for clients globally.

- In 2024, IBM has been active with multiple acquisitions aimed at bolstering its cloud services. Notably, in March 2024, IBM announced the acquisition of HashiCorp Inc. for $6.4 billion to enhance its hybrid cloud capabilities. This acquisition is expected to provide a comprehensive end-to-end hybrid cloud platform

- In 2023, Deloitte was recognized as a leader in Public Cloud IT Transformation Services. This recognition underscores Deloitte’s capabilities in helping organizations manage cloud complexity through its Cloud Managed Services, which offer tailored solutions for cloud deployment and management.

Report Scope

Report Features Description Market Value (2023) USD 119.5 Billion Forecast Revenue (2033) USD 443.0 Billion CAGR (2024-2033) 14% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Service Type (Managed Mobility Services, Managed Security Services, Managed Communication and Collaboration Services, Managed Network Services, Managed Business Services, Managed Infrastructure Services), By Deployment Mode (Public Cloud, Private Cloud), By Organization Size (Small and Medium-Sized Enterprises, Large Enterprises), By Industry Vertical (IT and Telecommunications, BFSI, Retail, Healthcare, Manufacturing, Government and Public Sector, Other Industry Verticals) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Accenture plc, IBM Corporation, Deloitte Touche Tohmatsu Limited, Infosys Limited, Veritis Group Inc., Wipro Limited, NTT Ltd., Fujitsu Limited, Capgemini SE, Cloud4C, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What are Cloud Managed Services?Cloud Managed Services involve outsourcing day-to-day IT management and cloud-based operations to a third-party service provider. These services include network, application, infrastructure, and security management. The goal is to optimize cloud usage, improve efficiency, and ensure continuous operations with minimal downtime.

How big is Cloud Managed Services Market?The Global Cloud Managed Services Market size is expected to be worth around USD 443.0 Billion By 2033, from USD 119.0 Billion in 2023, growing at a CAGR of 14% during the forecast period from 2024 to 2033.

What is driving the growth of the Cloud Managed Services Market?The growth is driven by the increasing adoption of cloud technologies, the need for cost optimization, the demand for enhanced IT agility, and the rise of remote work.

Which industries are the primary adopters of Cloud Managed Services?Key industries include IT and telecom, banking, financial services, and insurance (BFSI), healthcare, retail, manufacturing, and government sectors. These industries require scalable and secure cloud solutions to manage large amounts of data and applications.

What challenges are faced by the Cloud Managed Services Market?Challenges include data security concerns, compliance with regulations, vendor lock-in, the complexity of managing multi-cloud environments, and the need for continuous updates and monitoring.

Cloud Managed Services MarketPublished date: August 2024add_shopping_cartBuy Now get_appDownload Sample

Cloud Managed Services MarketPublished date: August 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Accenture plc

- IBM Corporation

- Deloitte Touche Tohmatsu Limited

- Infosys Limited

- Veritis Group Inc.

- Wipro Limited

- NTT Ltd.

- Fujitsu Limited

- Capgemini SE

- Cloud4C

- Other Key Players