Global Clinical Workflow Solutions Market By Type (Data Integration Solutions, Real-time Communication Solutions, and Others); By End-Use (Hospitals, Long-Term Care Facilities, Ambulatory Care Centers); By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast: 2022-2032

- Published date: Nov 2023

- Report ID: 83190

- Number of Pages: 267

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

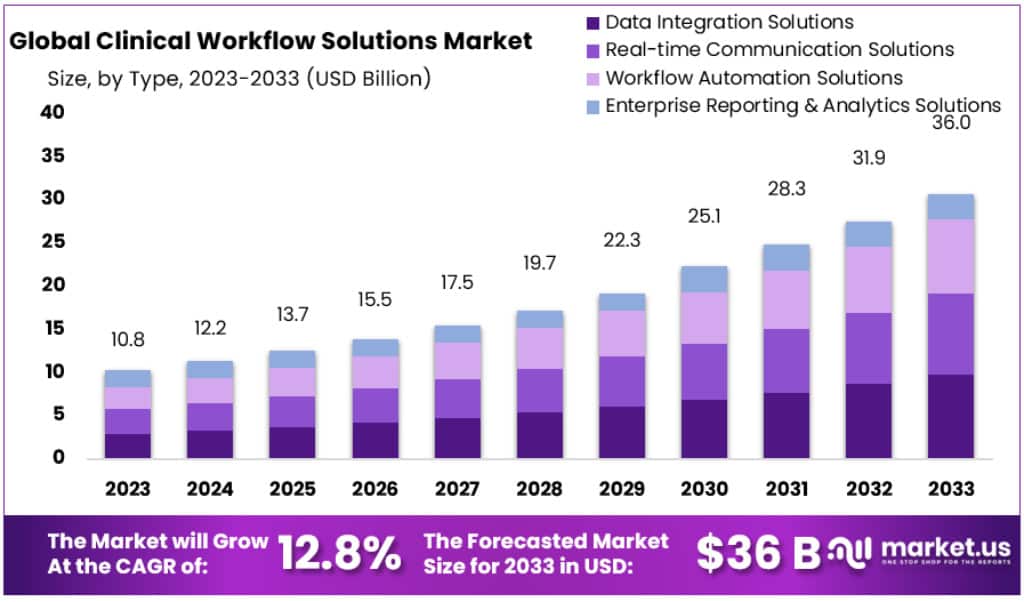

The Global Clinical Workflow Solutions Market size is expected to be worth around USD 36.0 Billion by 2033, from USD 10.8 Billion in 2023, growing at a CAGR of 12.8% during the forecast period from 2023 to 2033.

Healthcare is constantly challenged to deliver high-quality care. There are many factors driving the demand for quality healthcare. These include aging populations, decreasing resources, budget restraints, as well as the absence of standard-designed clinical SOPs and treatment protocols. To cater to this need, hospitals are transitioning more readily towards the adoption of technology-driven systems.

Hospitals and medical environments are currently integrating workflows in order to streamline documentation, for medical staff management, and to provide easy access for patients’ administrative and clinical data.

Multi-modal hospitals will need to share data with their branch offices in order to make it easier for interoperable quality solutions. The demand for clinical workflow solutions market is increasing due to a spike in clinician productivity and patient-centered healthcare delivery from caregivers.

Software solutions for clinical workflows are software solutions that enhance diagnostic confidence by combining imaging silos, enabling collaboration and streamlining workflows.

Key Takeaways

- The Global Clinical Workflow Solutions Market is predicted to reach approximately USD 36.0 billion by 2033, up from USD 10.8 billion in 2023.

- This growth represents a Compound Annual Growth Rate (CAGR) of 12.8% during the period from 2023 to 2033.

- Data Integration Solutions account for over 27.2% of the market share in 2023, driven by increasing data volumes and regulatory reforms.

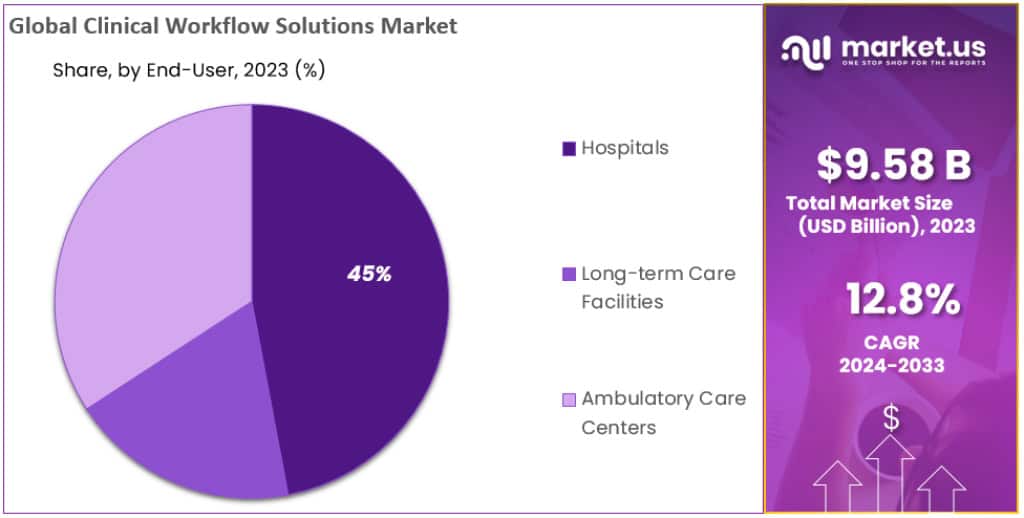

- The ‘Hospital‘ segment dominates the end-use category, with a revenue share exceeding 45.4% in 2023.

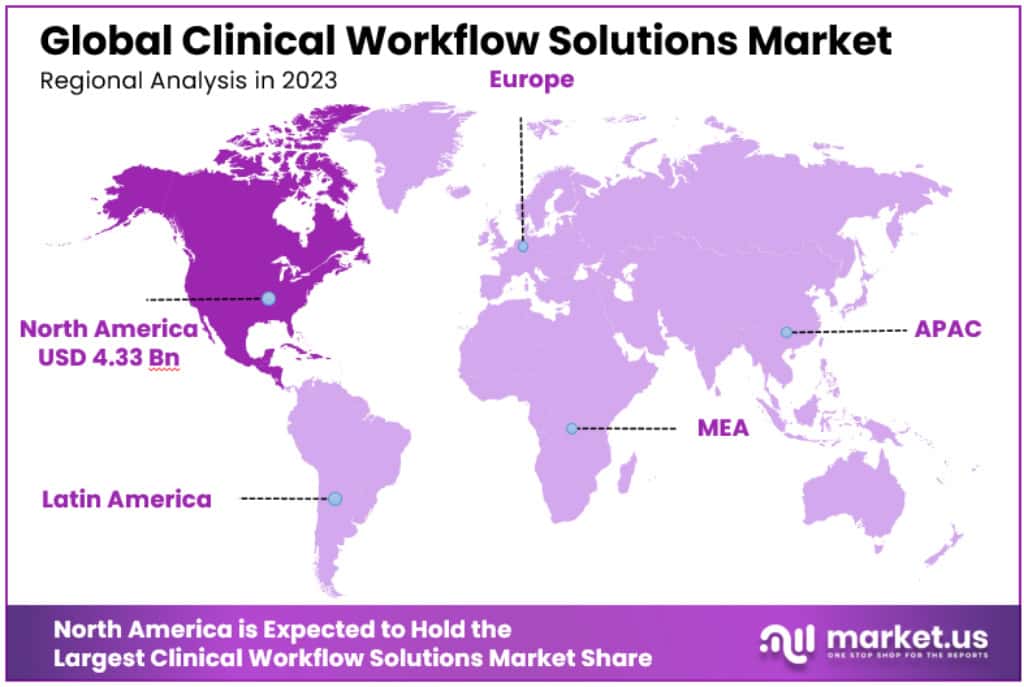

- North America holds the largest market share of over 42.1% in 2023, while the Asia Pacific is expected to register the fastest CAGR of 13.8% due to increasing investments.

Type Analysis

On the basis of ‘Type’, this clinical workflow solutions market was dominated by the ‘Data Integration Solutions’ segment, accounting for a revenue share exceeding 27.2% in 2023. Due to increasing data volumes and rising costs, healthcare providers favor the use of data integration systems. Caregivers want an integrated system that allows users to access patient data across the entire continuum. This segment continues to grow due to factors like the adoption of electronic medical records, interoperability solutions, regulatory reforms, as well as the shift towards value-based services.

Because of the greater emphasis being placed on patient-centric service, the ‘Care Collaboration Solution’ segment is expected to grow in value over the forecast period. Integrated solutions are becoming more popular among payers, government agencies, and employer groups to meet their management needs. Care management solutions can be used to improve patient care and streamline workflows. They are also cost-effective and efficient.

Medical technology is driven by technological advancements in wireless technology and computing power. This has led to the creation of connected health devices which can collect, analyze, and transfer data. Providers can streamline their workflow and improve patient care by connecting devices and sensors. Forecasts predict that there will be a surge in the demand for workflow solutions due to the increasing need for efficient workflow management in medical facilities.

End-Use Analysis

Due to its applicability and the growing number of hospitals, the ‘Hospital’ segment dominated the ‘End-Use’ aspect of this clinical workflow solutions market, with a revenue share exceeding 45.4% in 2023. Clinical Workflow Solutions Market growth is expected to be further driven by government initiatives that support the healthcare sector, simplify complex data management in hospitals, and provide additional support for this industry.

This segment is expected to be driven by growing demand for workflows as well as the trend toward connected hospitals. It also continues to expand due to the demand for integrated and collaborative care delivery, unified clinical communications, and streamlining call scheduling.

The surge in outpatient admissions is expected to lead to a boom in the revenue potential of ambulatory care centers. Ambulatory care centers can use IT solutions to reduce medical errors and enhance communication between individuals, such as doctors, nurses, pharmacists, families, and other healthcare providers. The high adoption rates of these technologically advanced systems in outpatient care centers tend to speed-up the treatment process and provide cost-effective results.

To meet the growing demand for home-based healthcare providers are using new technologies and software to increase the quality of the services they provide. The adoption of clinical workflow management systems for long-term healthcare facilities is expected to increase due to a greater demand for value-based services and better collaboration between payers, providers, and payers.

Key Market Segments

Type Outlook

- Data Integration Solutions

- EMR Integration Solutions

- Medical Image Integration Solutions

- Real-Time Communication Solutions

- Nurse Call Alert Systems

- Unified Communication Solutions

- Workflow Automation Solutions

- Patient Flow Management Solutions

- Nursing & Staff Scheduling Solutions

- Care Collaboration Solutions

- Medication Administration Solutions

- Perinatal Care Management Solutions

- Rounding Solutions

- Other Care Collaboration Solutions (Specimen Collection Solutions and Blood Products Administration Solutions)

- Enterprise Reporting & Analytics Solutions

End-use

- Hospitals

- Long-Term Care Facilities

- Ambulatory Care Centers

Driver

Improving Patient Care and Safety

Clinical workflow solutions are gaining popularity in healthcare because they help in better patient care. They make it easier for doctors to access real-time health data, leading to better decisions and outcomes. These solutions are known for improving the quality of care, coordination, patient happiness, and reducing medication errors. Their market is growing and was valued at USD ~10 billion in 2022, expected to grow at a 12.8% yearly rate until 2030.

Restraint

Difficulty in Sharing Data

Hospitals face challenges in sharing data between different systems, like electronic health records (EHRs) and medical devices. This problem, known as poor interoperability, can lead to high costs and technical issues. It’s a big reason why some hospitals are slow to adopt these solutions.

Opportunity

Telehealth and Remote Monitoring Growth

The rise of telehealth and remote monitoring offers big chances for clinical workflow solutions. These technologies, like mobile devices and high-definition video conferencing, help patients track important health signs from home. The market for these solutions is expanding rapidly.

Challenge

Need for Skilled IT Professionals

There’s a big demand for healthcare IT experts, but not enough skilled people. This shortage is a major barrier to implementing these IT systems in hospitals, especially in major markets like the U.S. and Europe.

Trends

Hospitals Leading the Market

Hospitals are the main users of clinical workflow solutions. They use them to improve care quality and efficiency. The number of hospitals using these solutions is increasing. For example, in the U.S., there were 2,960 non-profit community hospitals in 2022. Also, the admission rates in hospitals are rising, like in Australia where there were 11.8 million admissions in 2020-21, a 6.3% increase from the previous year. This increase in hospital activities boosts the demand for clinical workflow solutions.

Regional Analysis

North America accounted for the largest market share of over 42.1% in 2023, with value 4.3 billion. The regional market continues to grow due to factors like the increasing R&D activities, patient admissions, and government initiatives to ensure interoperability, EHRs, and other solutions. Additionally, this market is being driven by a greater focus on patient care and increased healthcare spending on digitization to secure data exchange within organizations.

The Asia Pacific is expected to register the fastest CAGR of 13.8% over the forecast period due to spike in investments from emerging countries. A significant rise in demand for healthcare information technology solutions is being observed. Key factors driving this regional market include, government support for eHealth implementation, improved healthcare infrastructure, increased medical tourism. and a greater need for high quality healthcare solutions.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

The clinical workflow solutions market is highly competitive and consists of a number of large, established players. The top 10 players in the market account for approximately 60% of the total market share. The remaining 40% of the market share is held by a number of smaller, niche players.

Market growth can be attributed to the growing investments of key market players in advanced systems for healthcare management. Additionally, market growth is expected to be boosted by the fact that leading hospitals and healthcare providers have renewed licensing agreements or entered into new deals to allow them to sell their products to the public.

Promoting activities, partnerships agreements and mergers are key to maintaining high levels of competition. ePlus Inc. was founded in September 2020. Mobile Heartbeat, a partner of ePlusinc., has made MH-CURE available to healthcare administrations looking to enhance clinical workflows as well as patient care. MH-CURE, is a Unified Clinical Communication Platform.

Some Prominent players in the clinical workflow solutions market are Hill-Rom Holdings, Inc., Atenahealth Inc., Hill-Rom Holdings Inc., Koch Industries (Infor Inc.), Koninklijke Philips NV, athenahealth, Inc., Capsule Technologies Inc., Cisco Systems Inc., General Electric Company, NXGN MANAGEMENT LLC, McKesson Corporation, Koninklijke Philips N.V., Hillrom and Othe major playors.

To innovate workflow solutions, major corporations are also collaborating with government agencies. The American Medical Association (AMA), in collaboration with Google, launched the AMA Health Care Interoperability and Innovation Challenge in September 2018.

This challenge seeks to stimulate innovative examples of mobile technology in healthcare such as wearables and apps that can effectively share medical information between doctors and patients. It also aims to improve chronic illness management. Over the forecast period, such initiatives will encourage the adoption of clinical workflow solutions. Listed below are the key players in global clinical workflow solutions market:

Key Market Players

- Veradigm Inc.

- Oracle Corporation

- NXGN Management, LLC

- McKesson Corporation

- Koninklijke Philips N.V.

- Cisco Systems, Inc.

- Getinge AB

- Vocera Communications, Inc.

- Spok Inc.

- AMETEK, Inc.

- Allscripts Healthcare Solutions Inc.

- Cerner Corporation

- Hill-Rom Services Inc.

- Atenahealth Inc.

- ePlus Inc.

- Capsule Technologies Inc.

- AZURE HEALTHCARE

- STANLEY Healthcare

- Ascom Holding AG

- Infor, Inc.

- Other Key Players

Recent Developments

- October 2023: Cerner Corporation is making waves with its latest creation, the Cerner Cloud platform. This new tech is a game-changer for healthcare providers, aiming to make clinical workflows smoother and patient care better.

- October 2023: Epic Systems is joining forces with Microsoft. They’re planning to blend Epic’s electronic health records (EHR) system with Microsoft’s Azure cloud service. It’s a big move to bring tech and healthcare closer together.

- October 2023: Big news from Allscripts Healthcare Solutions – they’ve just bought PatientPoint, a company known for its smart clinical decision support software. This could mean big improvements in how doctors make decisions in clinics.

- September 2023: MEDITECH is stepping up its game with the Expanse EHR system. It’s designed to give healthcare providers a boost in efficiency and productivity – a real helping hand for busy medical professionals.

- September 2023: McKesson Corporation isn’t sitting still – they’ve acquired RelayHealth, a name well-known for its care coordination software. This could mean more streamlined healthcare services down the line.

- September 2023: Athenahealth is teaming up with tech giant IBM. They’re going to combine Athenahealth’s EHR with IBM’s Watson, a smart tool for clinical decisions. It’s like having a high-tech assistant in the healthcare world.

- August 2023: NextGen Healthcare is launching something big – the Enterprise EHR system. It’s all about helping healthcare providers step up their game in patient care and managing the health of entire populations.

- August 2023: eClinicalWorks is expanding its horizons by acquiring assets from IQVIA, known for its clinical research software. This could be a game-changer in the field of medical research and data.

Report Scope

Report Features Description Market Value (2023) USD 10.8 Billion Forecast Revenue (2033) USD 36.0 Billion CAGR (2023-2032) 12.8% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Data Integration Solutions, Real-time Communication Solutions, and Others); By End-Use (Hospitals, Long-Term Care Facilities, Ambulatory Care Centers) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Veradigm Inc, Oracle Corporation, NXGN Management LLC, McKesson Corporation, Koninklijke Philips N.V., Cisco Systems Inc., Getinge AB., Vocera Communications Inc., Spok Inc., AMETEK Inc., Allscripts Healthcare Solutions Inc., Cerner Corporation, Allscripts Healthcare Solutions Inc., Hill-Rom Services Inc., Vocera Communications, Atenahealth Inc., ePlus Inc., Capsule Technologies Inc., AZURE HEALTHCARE, STANLEY Healthcare, Ascom Holding AG, Stanly Healthcare, Cisco Systems Inc, Infor Inc, Allscripts Healthcare LLC and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the clinical workflow solutions market in 2023?The clinical workflow solutions market size is USD 10.8 Billion in 2023.

List the segments encompassed in this report on the clinical workflow solutions marketMarket.US has segmented the clinical workflow solutions market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Outlook, market has been segmented into Data Integration Solutions, EMR Integration Solutions, Medical Image Integration Solutions, Real-Time Communication Solutions, Nurse Call Alert Systems, Unified Communication Solutions, Workflow Automation Solutions, Patient Flow Management Solutions, Nursing & Staff Scheduling Solutions, Care Collaboration Solutions, Medication Administration Solutions, Perinatal Care Management Solutions, Rounding Solutions, Other Care Collaboration Solutions (Specimen Collection Solutions and Blood Products Administration Solutions), Enterprise Reporting & Analytics Solutions. By End-use, the market has been further divided into Hospitals, Long-Term Care Facilities, Ambulatory Care Centers

What is the projected CAGR at which the clinical workflow solutions market is expected to grow at?The clinical workflow solutions market is expected to grow at a CAGR of 12.8% (2023-2033).

Clinical Workflow Solutions MarketPublished date: Nov 2023add_shopping_cartBuy Now get_appDownload Sample

Clinical Workflow Solutions MarketPublished date: Nov 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- Veradigm Inc.

- Oracle Corporation

- NXGN Management, LLC

- McKesson Corporation

- Koninklijke Philips N.V.

- Cisco Systems, Inc.

- Getinge AB

- Vocera Communications, Inc.

- Spok Inc.

- AMETEK, Inc.

- Allscripts Healthcare Solutions Inc.

- Cerner Corporation

- Hill-Rom Services Inc.

- Atenahealth Inc.

- ePlus Inc.

- Capsule Technologies Inc.

- AZURE HEALTHCARE

- STANLEY Healthcare

- Ascom Holding AG

- Infor, Inc.

- Other Key Players