Global Clinical Reference Laboratory Market By Test Type (Clinical Diagnostic Services and Clinical Trial & Research Testing), By Service Provider Type (Independent/Standalone Clinical Reference Laboratories, Hospital-Based Reference Laboratories and Public Health Reference Laboratories), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 171515

- Number of Pages: 377

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

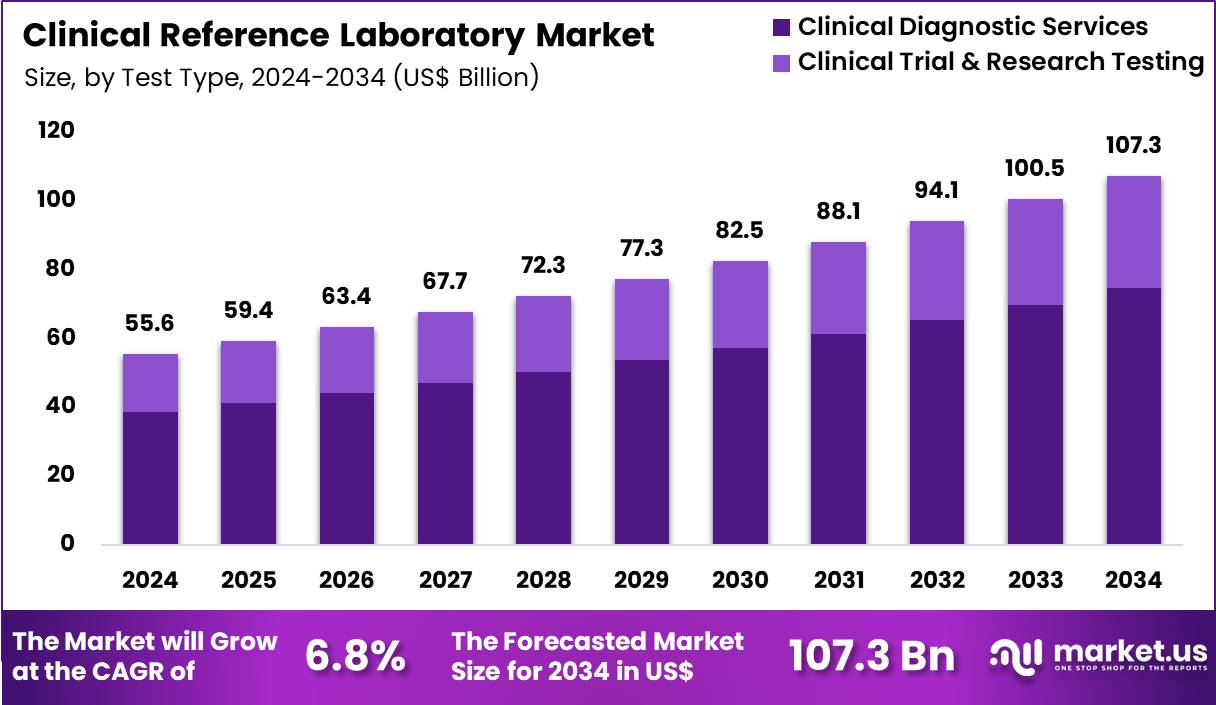

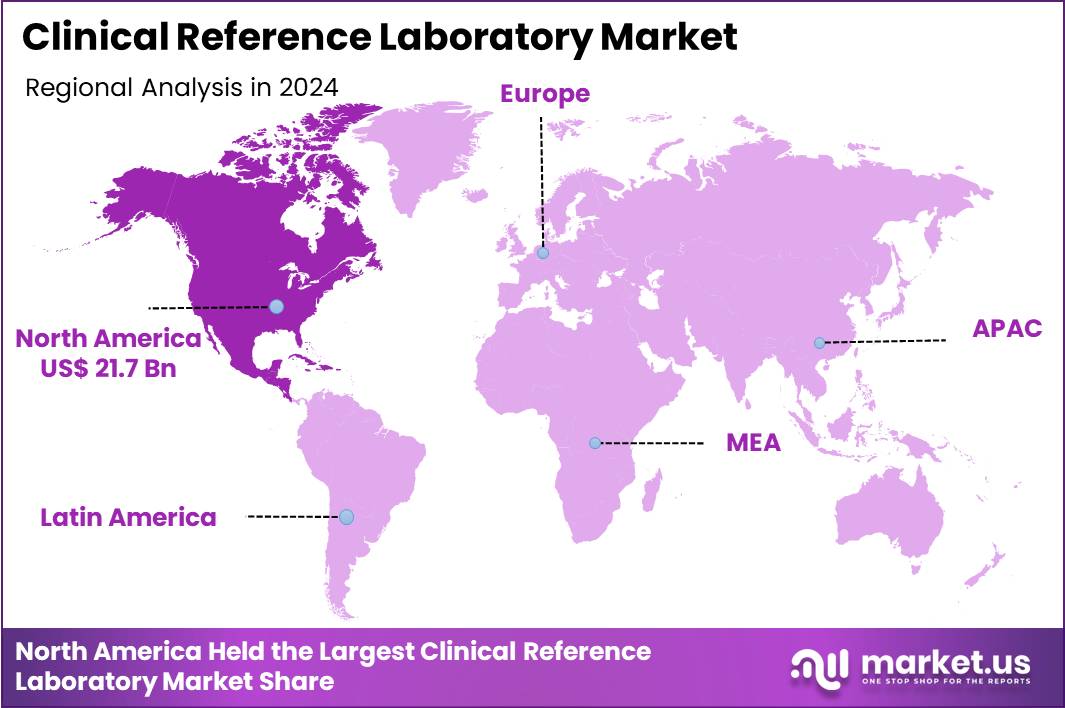

The Global Clinical Reference Laboratory Market size is expected to be worth around US$ 107.3 Billion by 2034 from US$ 55.6 Billion in 2024, growing at a CAGR of 6.8% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 39.1% share with a revenue of US$ 21.7 Billion.

Growing demand for precise diagnostic services fuels expansion in clinical reference laboratories that deliver specialized testing beyond routine hospital capabilities. Healthcare providers increasingly outsource complex assays to these facilities, ensuring access to advanced clinical chemistry analyses for monitoring chronic conditions like diabetes and cardiovascular disorders.

Laboratories perform hematology evaluations to detect blood disorders and guide treatment decisions in oncology patients. These entities conduct microbiology and cytology tests to identify infectious pathogens and cellular abnormalities accurately. Providers utilize genetic testing services for hereditary disease screening and pharmacogenomic profiling to optimize medication regimens.

In July 2025, Roche Diagnostics launched an AI-enabled laboratory platform designed to improve operational efficiency and analytical consistency in high-throughput lab environments. The adoption of automation and artificial intelligence reduces turnaround times and error rates, enabling reference laboratories to handle rising test volumes more efficiently. This advancement strengthens the scalability and competitiveness of centralized diagnostic labs in an increasingly data-intensive market.

Laboratory operators explore opportunities to incorporate next-generation sequencing into routine workflows, enhancing detection of rare genetic variants in precision oncology programs. Service providers expand esoteric testing menus to support companion diagnostic development for targeted therapies in autoimmune diseases.

These facilities enable toxicology screening for substance abuse monitoring and therapeutic drug level assessments in pain management protocols. Opportunities arise in immunology testing to evaluate immune responses and autoimmune markers for rheumatoid arthritis and lupus management.

Companies integrate biomarker discovery services to facilitate early detection of neurodegenerative disorders through cerebrospinal fluid analysis. Firms pursue partnerships to validate novel assays for endocrine function testing, aiding management of thyroid and adrenal conditions.

Market participants implement digital pathology solutions combined with machine learning to accelerate interpretation of tissue samples in cancer diagnostics. Providers adopt high-throughput automation systems that streamline workflow integration across clinical chemistry and molecular testing platforms. Laboratories advance multiplex assay development for simultaneous detection of multiple respiratory pathogens in infectious disease panels.

Innovators refine point-of-care connectivity features to aggregate data from decentralized testing sites into centralized reference systems. Companies enhance data analytics capabilities to provide predictive insights from large-scale genomic datasets in hereditary cancer screening. Ongoing efforts prioritize assay standardization initiatives that improve reproducibility in human tumor genetics evaluations across diverse patient cohorts.

Key Takeaways

- In 2024, the market generated a revenue of US$ 55.6 Billion, with a CAGR of 6.8%, and is expected to reach US$ 107.3 Billion by the year 2034.

- The test type segment is divided into clinical diagnostic services and clinical trial & research testing, with clinical diagnostic services taking the lead in 2024 with a market share of 69.5%.

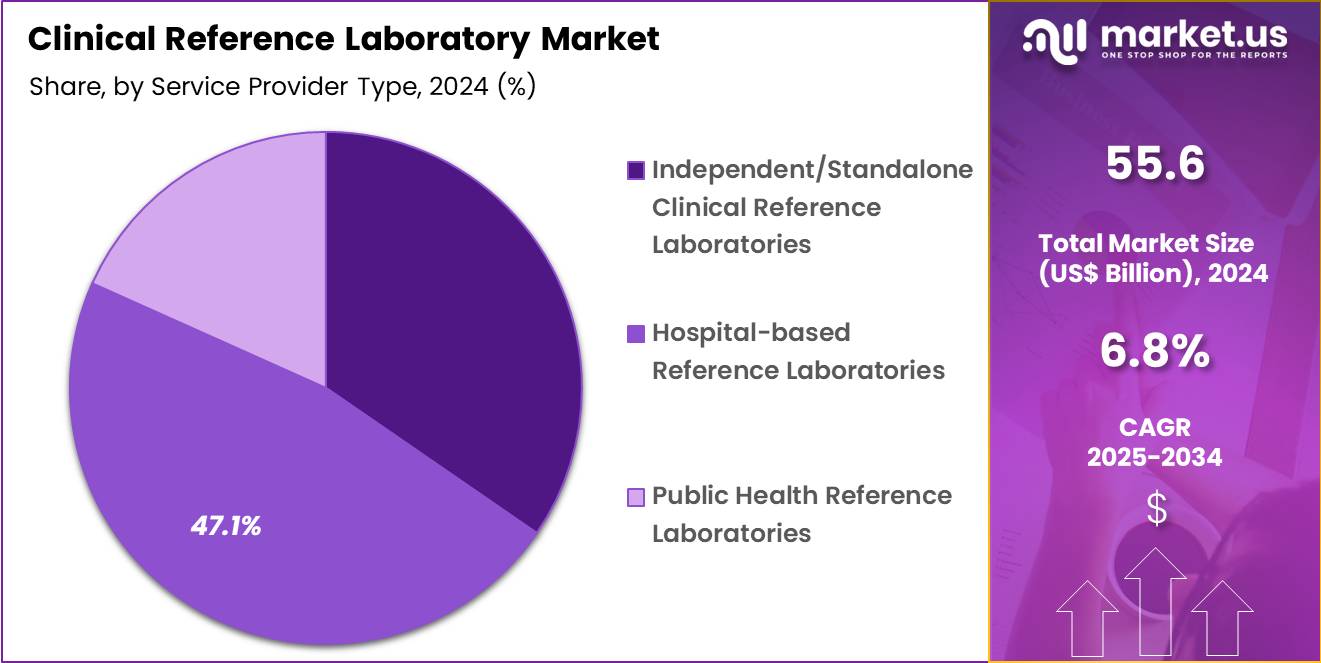

- Considering service provider type, the market is divided into independent/standalone clinical reference laboratories, hospital-based reference laboratories and public health reference laboratories. Among these, hospital-based reference laboratories held a significant share of 47.1%.

- North America led the market by securing a market share of 39.1% in 2024.

Test Type Analysis

Clinical diagnostic services, holding 69.5%, are expected to dominate because rising chronic disease prevalence continues to increase routine testing volumes across hematology, biochemistry, immunology, and molecular diagnostics. Physicians rely heavily on diagnostic laboratories for early disease detection, therapy monitoring, and preventive health screening, which strengthens recurring demand.

Aging populations and lifestyle-related disorders expand the frequency of diagnostic evaluations, especially for diabetes, cardiovascular diseases, and oncology markers. Advancements in automation and high-throughput platforms improve turnaround times and test accuracy, encouraging broader clinical adoption. Preventive healthcare awareness drives higher utilization of annual and periodic testing panels.

Expansion of insurance coverage and reimbursement for diagnostics improves patient access to laboratory services. Integration of digital health records enhances test ordering efficiency and result utilization. Growing outpatient care models increase reliance on centralized diagnostic testing. These factors keep clinical diagnostic services anticipated to remain the dominant test type within clinical reference laboratories.

Service Provider Type Analysis

Hospital-based reference laboratories, holding 47.1%, are projected to dominate because hospitals serve as primary hubs for complex diagnostic workflows and inpatient testing needs. These laboratories support emergency departments, intensive care units, and specialized clinical departments that require rapid and reliable results.

Hospitals increasingly centralize testing operations to improve care coordination and reduce outsourcing dependency. Rising hospital admissions and surgical procedures drive continuous demand for comprehensive laboratory services. Access to advanced diagnostic infrastructure enables hospital-based labs to handle high-complexity and esoteric tests. Integration with clinical teams allows faster interpretation and clinical decision-making.

Teaching hospitals and tertiary care centers expand reference lab capabilities to support research and specialized diagnostics. Investment in hospital laboratory modernization strengthens operational efficiency. These dynamics keep hospital-based reference laboratories expected to remain the leading service provider type in this market.

Key Market Segments

Test Type

- Clinical Diagnostic Services

- Routine & Preventive Laboratory Tests

- Infectious Disease & Microbiology Tests

- Cancer Diagnostics

- Endocrinology, Hormonal & Reproductive Tests

- Genetic & Genomic Tests

- Immunology & Autoimmune Diagnostics

- Toxicology & Therapeutic Drug Monitoring (TDM)

- Public Health Surveillance & Epidemiology

- Others

- Clinical Trial & Research Testing

Service Provider Type

- Independent/Standalone Clinical Reference Laboratories

- Hospital-based Reference Laboratories

- Public Health Reference Laboratories

Drivers

Rising incidence of cancer is driving the market

The clinical reference laboratory market is substantially driven by the escalating incidence of cancer, which necessitates extensive diagnostic, prognostic, and monitoring testing services. Cancer diagnosis often requires specialized pathology evaluations, molecular profiling, and biomarker assessments that are frequently outsourced to reference laboratories equipped for high-complexity analyses. These facilities provide advanced capabilities in immunohistochemistry, flow cytometry, and next-generation sequencing to support precise oncology care.

The growing number of cases amplifies demand for confirmatory testing following initial screenings in hospitals or clinics. Therapeutic decision-making increasingly relies on detailed genomic and proteomic data obtainable through reference laboratory platforms. Early detection initiatives and screening programs further contribute to higher testing volumes referred to specialized centers. Population-level risk factors, including lifestyle changes and environmental exposures, sustain this upward trajectory in cancer diagnoses.

Multidisciplinary oncology teams depend on timely and accurate results from reference laboratories to guide treatment protocols. According to the American Cancer Society, an estimated 2,001,140 new cancer cases were projected in the United States for 2024. This figure underscores the persistent burden that fuels investment in laboratory infrastructure.

Collaborative efforts between healthcare providers and reference laboratories enhance testing accessibility. Regulatory emphasis on evidence-based diagnostics reinforces market growth aligned with cancer management needs. Continued epidemiological trends ensure sustained demand for these essential services. Overall, this driver maintains momentum in the expansion of clinical reference laboratory operations.

Restraints

Reimbursement pressures and spending declines are restraining the market

The clinical reference laboratory market faces notable restraints from evolving reimbursement policies and recent declines in public payer expenditures on diagnostic testing. Medicare Part B, a primary payer for many laboratory services, has experienced fluctuations influenced by policy adjustments and post-pandemic normalization.

Reductions in high-volume testing, particularly for infectious diseases, have contributed to lower overall payments. Clinical laboratories must navigate complex fee schedules that periodically undergo revisions based on cost data reporting requirements. Delays or limitations in coverage for emerging tests can hinder adoption of innovative assays. Independent laboratories often bear administrative burdens associated with claims processing and appeals.

Economic pressures on healthcare systems may lead to consolidated ordering practices that favor in-house testing. Variability in private insurer policies adds uncertainty to revenue streams. In 2022, Medicare spending on laboratory services totaled $10.0 billion. Spending on clinical diagnostic laboratory tests decreased by 10% in 2022 from the prior year and by an additional 5.4% in 2023.

These trends reflect challenges in maintaining financial viability amid volume shifts. Compliance with data submission mandates under payment reforms imposes operational costs. Geographic disparities in reimbursement rates affect service availability in certain regions. Such factors collectively constrain market growth and innovation deployment in clinical reference laboratories.

Opportunities

Increasing authorizations of companion diagnostic devices is creating growth opportunities

The clinical reference laboratory market presents significant growth opportunities through the expanding landscape of companion diagnostics, which enable targeted therapy selection and personalized treatment approaches. These devices identify specific biomarkers to predict patient responses to particular drugs, particularly in oncology and rare diseases.

Reference laboratories are ideally positioned to perform these complex, regulated assays that require validated platforms and expertise. Integration of companion diagnostics into clinical guidelines broadens testing indications and referral volumes. Pharmaceutical development pipelines increasingly incorporate co-approval strategies for therapeutics and diagnostics. Regulatory pathways facilitate clearance of novel in vitro devices that support precision medicine initiatives.

Partnerships between device manufacturers and laboratory providers streamline test commercialization and distribution. Adoption in community oncology settings drives outsourcing to centralized reference facilities. The U.S. Food and Drug Administration listed a total of 197 cleared or approved companion diagnostic devices as of recent updates.

Notably, three such devices received approval in 2024, indicating continued momentum. This progression opens avenues for laboratories to offer differentiated, high-value services. Expansion into theranostic applications further enhances therapeutic monitoring capabilities. Global harmonization efforts may extend opportunities beyond domestic markets. These developments position clinical reference laboratories to capitalize on the shift toward individualized healthcare delivery.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic dynamics bolster the clinical reference laboratory market as surging healthcare investments and escalating demand for advanced diagnostics compel providers to expand molecular testing and automation capabilities for efficient patient care. Executives at top firms strategically deploy AI-driven platforms and genomic services, seizing momentum from post-pandemic recovery trends to penetrate high-growth segments in emerging and mature economies.

Lingering inflation and global economic headwinds, however, inflate costs for reagents, equipment, and skilled labor, prompting laboratories to streamline operations and defer capital upgrades amid budget constraints. Geopolitical frictions, notably U.S.-China trade disputes and regional instabilities, routinely sever supply lines for critical consumables and instruments, generating delays and operational uncertainties for globally reliant providers.

Current U.S. tariffs impose elevated duties on imported medical devices and laboratory reagents, especially from Asian sources, driving up procurement expenses for American distributors and eroding competitive pricing in domestic channels. These tariffs also incite reciprocal barriers from key trading partners that restrict U.S. exports of specialized testing services and impede multinational R&D alliances.

Still, the tariff pressures galvanize substantial commitments to North American production facilities and diversified sourcing models, cultivating fortified infrastructures that promise accelerated technological advancements and steadfast market progression for the foreseeable future.

Latest Trends

Rapid growth in authorizations of AI/ML-enabled medical devices is a recent trend

In 2024, the clinical reference laboratory market has seen a prominent trend in the rapid authorization and integration of artificial intelligence and machine learning-enabled medical devices to enhance diagnostic accuracy and efficiency. These technologies support automated analysis in areas such as pathology image interpretation, hematology differentials, and clinical chemistry result validation. Regulatory oversight has accelerated clearances for devices that improve workflow throughput and reduce interpretive variability.

Laboratories adopt these tools to address operational demands for faster turnaround times in high-volume testing. AI algorithms assist in pattern recognition for complex datasets, aiding pathologists in detecting subtle abnormalities. Implementation of predictive models optimizes quality control and flagged result reviews.

Collaborative frameworks between developers and laboratories refine algorithm performance using real-world data. The U.S. Food and Drug Administration authorized over 1,016 AI/ML-enabled medical devices by late 2024, with steady increases throughout the year. This surge reflects broadening applications relevant to laboratory medicine. Training programs prepare staff for effective utilization of these advanced systems.

Cybersecurity considerations accompany deployment to safeguard patient data integrity. Scalability of cloud-based solutions facilitates broader access for reference facilities. Ethical guidelines ensure transparent use in clinical decision support. This trend fundamentally advances diagnostic precision and operational resilience in the sector.

Regional Analysis

North America is leading the Clinical Reference Laboratory Market

In 2024, North America held a 39.1% share of the global clinical reference laboratory market, bolstered by sophisticated health information exchanges and surging requirements for specialized diagnostic panels. Medical networks amplify referrals for pharmacogenomic profiling, guiding individualized dosing regimens in cardiology and psychiatry practices. Research institutions accelerate biomarker validation studies, incorporating mass spectrometry for precise quantification in neurodegenerative disorder assessments.

Preventive health policies promote comprehensive wellness panels, encompassing vitamin deficiencies and hormonal imbalances among working-age adults. Emergency departments rely on rapid toxicology screenings, supporting overdose management protocols with quantitative confirmatory assays. Value-based care models incentivize longitudinal monitoring services, tracking disease progression through serial tumor marker evaluations.

Laboratory consortia invest in robotic automation, elevating throughput for immunology and coagulation testing amid workforce constraints. These dynamics affirm a steadfast dedication to diagnostic precision, empowering evidence-based clinical decision-making. The Centers for Medicare & Medicaid Services indicates that the Clinical Laboratory Improvement Amendments program covers approximately 320,000 laboratory entities.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Governments spearhead vigorous advancement in outsourced clinical testing throughout Asia Pacific over the forecast period, tackling profound epidemiological shifts with strategic infrastructure enhancements. Health agencies establish regional hubs for advanced cytogenetic analyses, aiding prenatal and hematological malignancy diagnostics in expanding maternal care programs.

Clinicians integrate next-generation sequencing workflows, detecting somatic mutations to inform precision oncology in tertiary referral centers. Diagnostic firms customize immunoassay platforms for endemic viral seroprevalence, supporting vaccination impact assessments in densely populated provinces. Economic corridors facilitate joint ventures, deploying capillary electrophoresis systems for hemoglobinopathy screening in thalassemia-prone communities.

Tourism boards collaborate on traveler health packages, incorporating tropical disease antigen detections for inbound cohorts. Educational institutions train specialists in flow cytometry applications, strengthening immunodeficiency evaluations across pediatric networks. These initiatives cultivate comprehensive service ecosystems, ensuring timely and accurate insights amid rising health complexities. The World Health Organization reports that the South-East Asia Region accounted for 34% and the Western Pacific Region for 27% of new global tuberculosis cases in 2024.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Clinical Reference Laboratory market drive growth by expanding high-complexity test menus in genomics, oncology, and rare diseases to capture demand for specialized diagnostics. They scale operations through automation, AI-enabled workflow optimization, and centralized logistics that reduce turnaround times and improve margin efficiency.

Commercial teams deepen penetration by integrating services with hospital systems, physician networks, and payers to secure recurring volumes and long-term contracts. Strategic investments in digital ordering, results portals, and data interoperability strengthen clinician engagement and support population-health initiatives.

Geographic expansion and tuck-in acquisitions extend reach into underserved regions while adding niche capabilities. Labcorp exemplifies this strategy as a global diagnostics leader with an extensive reference-testing portfolio, advanced laboratory infrastructure, and strong partnerships across healthcare systems that position it as a preferred provider for complex and high-volume testing services.

Top Key Players

- LabCorp

- Quest Diagnostics

- Sonic Healthcare

- Lancet Laboratories

- ARUP Laboratories

- Biolab

- Eurofins Scientific

- Mayo Clinic Laboratories

- Laboratoires Réunis

- Lifebrain Group

- Al Borg Medical Laboratories

- Synlab Group

- Medsol Diagnostics

- Ampath Laboratories

- Unilabs

- OPKO Health Inc.

- NeoGenomics

Recent Developments

- In August 2025, LabCorp entered a strategic collaboration with a major telehealth provider to strengthen remote diagnostic delivery. This integration enables test ordering, sample coordination, and result reporting to be embedded within virtual care pathways. Such models expand access to reference laboratory services in rural and underserved regions, directly increasing test volumes and reinforcing the role of large reference labs as the backbone of telemedicine-enabled diagnostics.

- In September 2025, Quest Diagnostics expanded its service portfolio with the introduction of advanced genetic testing offerings focused on personalized medicine. By scaling precision diagnostics through centralized reference lab infrastructure, Quest supports growing demand for complex molecular tests that require high analytical expertise. This shift accelerates outsourcing of specialized testing to reference laboratories, driving higher-value revenue streams and long-term market expansion.

- In August 2023, Ampath established a new reference laboratory in Gurgaon, extending its footprint in North India. The facility increased regional access to advanced pathology and laboratory services, allowing hospitals and clinics to outsource complex testing locally rather than sending samples to distant centers. Such capacity expansion directly fuels market growth by improving turnaround times, service coverage, and utilization of reference laboratory networks

Report Scope

Report Features Description Market Value (2024) US$ 55.6 Billion Forecast Revenue (2034) US$ 107.3 Billion CAGR (2025-2034) Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Test Type (Clinical Diagnostic Services (Routine & Preventive Laboratory Tests, Infectious Disease & Microbiology Tests, Cancer Diagnostics, Endocrinology, Hormonal & Reproductive Tests, Genetic & Genomic Tests, Immunology & Autoimmune Diagnostics, Toxicology & Therapeutic Drug Monitoring (TDM), Public Health Surveillance & Epidemiology and Others) and Clinical Trial & Research Testing), By Service Provider Type (Independent/Standalone Clinical Reference Laboratories, Hospital-Based Reference Laboratories and Public Health Reference Laboratories) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape LabCorp, Quest Diagnostics, Sonic Healthcare, Lancet Laboratories, ARUP Laboratories, Biolab, Eurofins Scientific, Mayo Clinic Laboratories, Laboratoires Réunis, Lifebrain Group, Al Borg Medical Laboratories, Synlab Group, Medsol Diagnostics, Ampath Laboratories, Unilabs, OPKO Health Inc., NeoGenomics Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Clinical Reference Laboratory MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Clinical Reference Laboratory MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- LabCorp

- Quest Diagnostics

- Sonic Healthcare

- Lancet Laboratories

- ARUP Laboratories

- Biolab

- Eurofins Scientific

- Mayo Clinic Laboratories

- Laboratoires Réunis

- Lifebrain Group

- Al Borg Medical Laboratories

- Synlab Group

- Medsol Diagnostics

- Ampath Laboratories

- Unilabs

- OPKO Health Inc.

- NeoGenomics