Global Cladding Market By Product (Composite Materials, Terracotta, Steel, and Other Products), By Application (Offices, Commercial, Residential, Industrial, Institutional, and Other Applications), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Dec 2023

- Report ID: 64087

- Number of Pages: 199

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

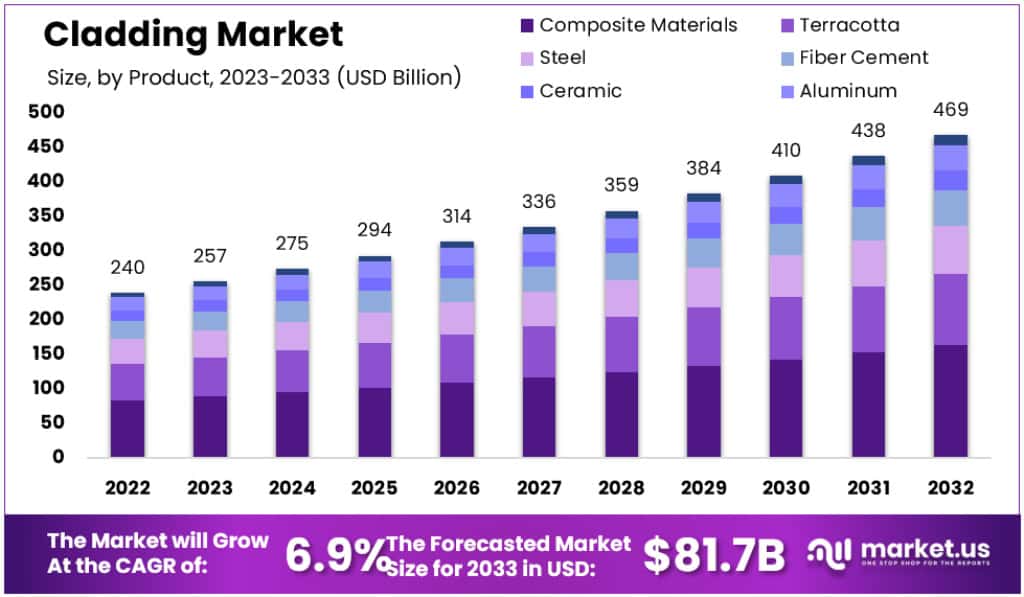

The Global Cladding Market size is expected to be worth around USD 469 Billion by 2032, from USD 257 Billion in 2023, growing at a CAGR of 6.9% during the forecast period from 2023 to 2033.

Cladding is a construction technique that involves applying one material over another to provide a skin or layer for a building. It serves several purposes, including:

- Providing a degree of thermal insulation and weather resistance.

- Improving the appearance of buildings.

- Protecting the structure from the elements.

Some common types of cladding include:

- Rainscreen Cladding: This form of weather cladding is designed to protect against the elements while offering thermal insulation. It does not need to be waterproof, but it may serve as a control element to direct water or wind safely away to prevent run-off and prevent damage.

- External Foam Cladding: This type of cladding is created from a foam similar to polystyrene, with a fiberglass mesh coating and a toughened core.

- Cladding Panels: These prefabricated panels come in various shapes, sizes, and finishes, making them popular for commercial projects. They offer design flexibility while ensuring smooth and streamlined construction.

Cladding not only enhances the visual appeal of a structure but also shields it from external UV rays and temperature fluctuations. It is a fundamental technique used in modern construction to create stunning and functional buildings.

Key Takeaways

- The Global Cladding Market is predicted to reach approximately USD 469 billion by 2032, up from USD 257 billion in 2023.

- This growth represents a Compound Annual Growth Rate (CAGR) of 6.9% during the forecast period from 2023 to 2033.

- In 2023, the Terracotta segment led the market, capturing over 35.5% of global revenue.

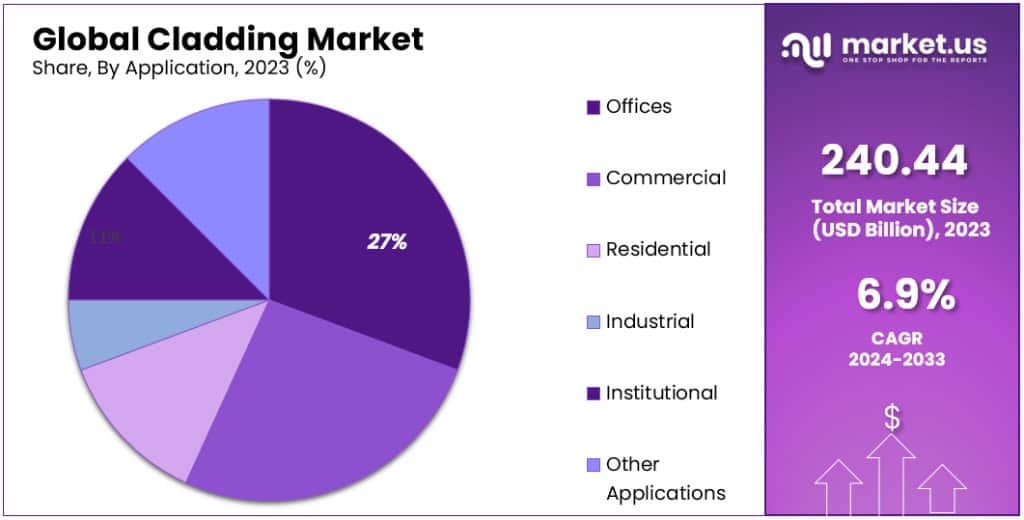

- Office construction was the leading segment, securing over 35.6% of global revenue in 2023.

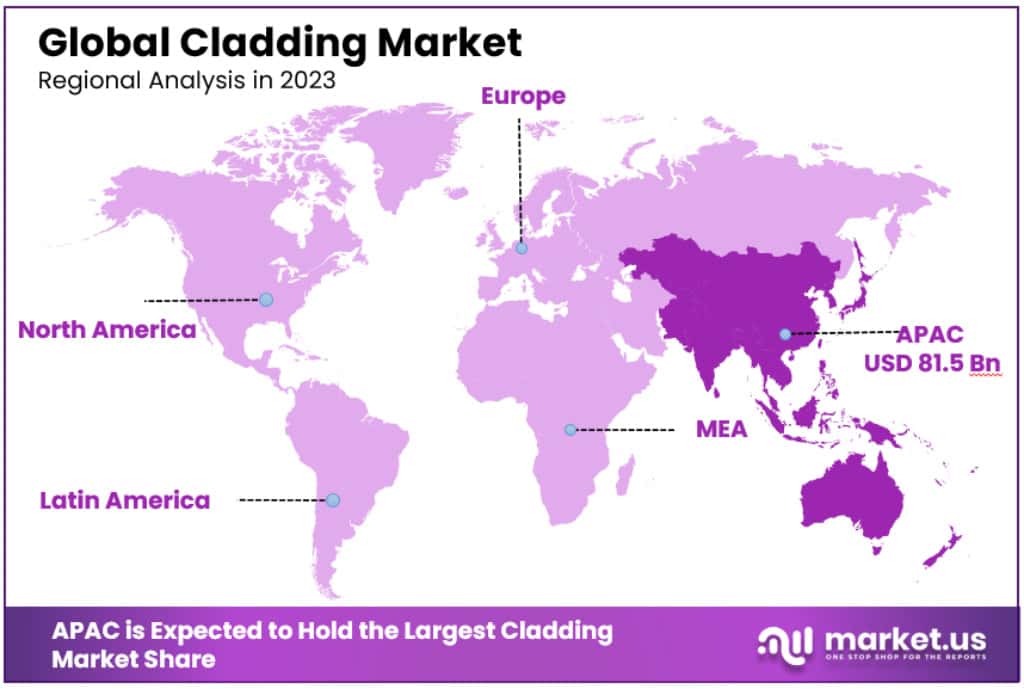

- The Asia Pacific region dominates the Cladding Market, with a 35% share in 2023, driven by urbanization and construction in countries like China and India.

Product Analysis

In 2023, the Terracotta segment continued to lead the Cladding Market, capturing over 35.5% of the global revenue. Its dominance is attributed to its robust features, including durability, recyclability, and resistance to ultraviolet radiation, making it weatherproof, fireproof, and favorably easy to install. These panels not only offer continuous insulation outside the primary wall but also significantly enhance a building’s thermal performance, a factor driving its widespread adoption.

The Fiber Cement segment, known for its high durability, cost-effectiveness, and low maintenance, held the significant market share and is anticipated to grow at a CAGR of ~5.5% from 2023 to 2033. Manufactured from cement, water, cellulose fiber, and pulverized limestone, these panels are increasingly favored in the market for their ability to withstand severe weather conditions, including high-pressure winds and rain. The growing industrial investments and a shift toward special-purpose fiber cement indicate a promising expansion for this segment.

On the other hand, Aluminum cladding is gaining momentum due to its lightweight nature, recyclability, resistance to fungi and algae, and ease of installation. Widely utilized for sound and thermal insulation, fire resistance, and enhancing aesthetic appeal, this material is expected to see a surge in demand within the construction industry.

Ceramic cladding is also set to witness growth, driven by its maintenance-free, pollution-resistant nature, and its capability to enhance aesthetic appeal. These panels are made with unalterable colors, offering a weatherproof finish, and are becoming an increasingly popular choice for modern construction projects.

Application Analysis

In 2023, the office construction segment maintained its lead in the Cladding Market, securing over 35.6% of the global revenue. This significant share is primarily due to the segment’s encompassing range of spaces, including both government and private offices. Claddings in these settings are crucial for providing thermal insulation, weather resistance, fire protection, and enhancing the aesthetic appeal of buildings. The continuous rise in employment rates and regional expansion of businesses are driving the demand for new office spaces, subsequently boosting the global construction activity and, by extension, the cladding market.

The residential construction sector is also experiencing a notable uptick in cladding demand, driven by a rising awareness of energy-efficient structures, the need for renovation of older buildings, and increasing over-cladding operations, coupled with government mandates for green buildings. This sector’s focus on enhancing energy efficiency and aesthetic appeal is set to further its growth in the cladding market.

Industrial construction is another key area witnessing growth, propelled by rapid industrial expansion and increased investments from both government and private sectors. The development of new manufacturing plants and processing units by multinational companies is creating a substantial demand for industrial claddings.

The commercial construction segment, encompassing a diverse range of buildings like shopping malls, hospitals, and hotels, is expected to drive cladding demand as well. Increased urbanization and investments in tourism and commercial construction by the government are likely to further this growth.

Key Market Segments

By Product

- Composite Materials

- Terracotta

- Steel

- Fiber Cement

- Ceramic

- Aluminum

- Other Products

By Application

- Offices

- Commercial

- Residential

- Industrial

- Institutional

- Other Applications

Driver

Robust Growth in Construction and Infrastructure Sectors

The cladding systems market is driven by the robust growth of the construction and infrastructure sectors, particularly in developing nations. As per the U.S. Census Bureau, residential construction spending in the U.S. surged from approximately $473.7 billion in 2016 to $546.1 billion in 2018. These systems are essential for providing weather resistance, thermal insulation, and aesthetic enhancements to buildings. With global construction activities on the rise, as indicated by the Global Construction 2030 report, which predicts the industry to more than double in the coming years, the demand for cladding systems is set to soar.

Restraint

High Costs of Raw Materials and Installation

The market faces challenges from high raw material and installation costs. Fluctuations in prices, such as the Brent crude oil price shifting from $52.39/bbl in 2015 to $41.84/bbl in 2020, directly impact the cost of cladding materials. Additionally, complex installation processes requiring skilled labor add to the overall cost, making some projects prohibitive and dampening market growth.

Opportunity

Increasing Urbanization in Emerging Economies

Emerging economies present a significant opportunity, with rapid urbanization and population growth fueling construction activities. Countries like India, China, and Brazil are witnessing substantial investments in residential and commercial construction. For instance, the Brazilian government’s Casa Verde e Amarela housing program aims to assist 1.6 million low-income families by 2024, highlighting the potential for cladding systems in new constructions.

Challenge

Costly Repairs and Maintenance

The cladding market faces challenges with the high costs associated with repairing and maintaining cladding systems. Specialized materials and skilled labor required for repairs can significantly increase the overall expenses, especially in cases where unique or custom cladding materials are used.

Trends

Diverse and Aesthetic Cladding Options

There’s a growing trend towards offering a wide range of colors and patterns in cladding systems, catering to the aesthetic preferences of customers. Companies like DuPont have expanded their offerings, producing materials like Corian in over 21 different colors since September 2019. This trend aligns with the increasing demand for buildings that are not only functional but also visually appealing.

Regional Analysis

Asia Pacific Dominance

Asia Pacific is dominating the Cladding Market with a substantial 35% share, valuing at approximately USD 81.5 billion in 2023. This region led the market in 2021 with more than 34% of global revenue, driven by rising per capita income, rapid urbanization, and a growing population coupled with burgeoning construction activities in emerging economies like China, India, and Japan. The region is projected to exhibit the highest CAGR during the forecast period, fueled by massive investments in public infrastructure and residential construction sectors. According to the International Trade Administration, China’s construction sector is expected to grow at an average of 8.6% from 2022 to 2030. Additionally, India’s ‘Make in India’ campaign aims for infrastructural investment worth US$965.5 million by 2040, further propelling the demand for Cladding Systems.

North America’s Substantial Growth

North America, particularly the US and Canada, is anticipated to see significant growth due to increasing demand from the residential sector and government initiatives to strengthen social infrastructure. The region is expected to exhibit a CAGR of ~15% over the forecast period, with the US dominating consumption. Policy reforms and a growing international and domestic migration rate, boosting housing demand, are key drivers of this expansion.

Europe’s Steady Expansion

Europe’s cladding market is set to benefit from the recovery in residential and commercial construction sectors, projected to exhibit a CAGR of ~13.5%. The growth in tourism, retail trade, and business turnover in EU states are expected to drive commercial construction, thereby boosting the cladding market. Countries like Italy, Germany, and the UK are significant markets, with innovative claddings being developed for household and healthcare applications, driven by the growing geriatric population.

Middle East & Africa’s Rebound Growth

The construction sector in the Middle East & Africa is expected to observe rebound growth during the forecast period, driven by increased investments, expansion of oil production, and improved weather conditions. Government investment in economies like Saudi Arabia, the UAE, and Qatar is expected to boost economic growth and, subsequently, the demand for cladding.

Latin America’s Emerging Potential

In Latin America, the construction industry is poised for substantial growth due to investments in infrastructure projects by foreign and domestic players. Economies like Argentina, Brazil, Chile, Colombia, Mexico, and Peru are significantly contributing to this growth, with improved economic conditions expected due to investments in infrastructure, commercial, and industrial projects.

Кеу Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

The cladding market is a competitive arena where manufacturers, distributors, and installers are the key players. They supply essential components like metal frameworks, panels, and insulation sheets to meet the construction sector’s demands. Innovation and enhancements in the production process have led to more durable, customizable, and easy-to-maintain components. The introduction of quick installation techniques and interlocking panels has intensified competition globally.

Players in this market range from local to international, with a few having a global presence. Notable companies like Arconic Inc., Tata Steel Ltd., Etex Group, Compagnie de Saint-Gobain SA., and Kingspan Group are among the major participants. These players are continuously innovating to meet diverse market needs. For instance, Saint-Gobain S.A. is making strides in flat glass and high-performance materials, offering solutions for both interiors (like insulation and gypsum products) and exteriors (including pipes and industrial mortars).

The market’s competitive landscape is not just about the range of products offered but also about each company’s global presence, production capabilities, and market strategies. Firms are increasingly leaning towards acquisitions and mergers to consolidate their market share and expand their geographical footprint. For example, Bannipal Steel Limited’s acquisition by Tata Steel is expected to significantly enhance its steel capacity.

Key Market Players

- Kingspan Group

- Carea Group

- GB Architectural Cladding Products Ltd

- Rieger Architectural Products

- OmniMax International, Inc.

- CGL Systems Ltd.

- SFS Group

- Cladding Corp

- Centria

- Trespa International B.V.

- Middle East Insulation LLC

- Shildan, Inc.

- Avenere Cladding LLC

- Other Key Players

Recent Developments

- June 2023: Westlake Corporation acquired Boral’s North American building products businesses. This includes roofing, siding, trim and shutters, decorative stone, and windows, enhancing Westlake’s product range and market reach in North America.

- June 2023: Etex successfully completed the acquisition of Superglass, a UK-based insulation producer. This acquisition broadens Etex’s European reach in sustainable insulation and complements its existing insulation manufacturing capabilities.

- June 2023: Saint-Gobain completed its acquisition of Igland Industrier AS in Norway, expanding its offerings in prefabricated garages and assembly services in the region.

- May 2023: Britten Inc. introduced Tex CladcTM, combining high-strength engineered fabrics with architecture-grade metal. This innovative cladding system offers a cost-effective alternative to traditional metal facades, providing new opportunities for creative architectural designs.

- May 2023: Saint-Gobain acquired Building Products of Canada Corp., a leading Canadian manufacturer of residential roofing shingles and wood fiber insulation panels. This move expands Saint-Gobain’s portfolio and presence in the Canadian market.

- March 2023: Cuppa Pizarras developed Cupa Clad, a natural slate cladding system that combines aesthetic appeal with improved insulation through a ventilated rainscreen application, marking a significant advancement in architectural cladding solutions.

- February 2023: Tata Steel established the Centre for Innovation in Mining and Mineral Beneficiation at the Indian Institute of Technology (Indian School of Mines), Dhanbad. This initiative aims to foster innovation and technological advancements in the mining sector.

- August 2022: Kingspan expanded its Roofing + Waterproofing division by acquiring Ondura Group and Derbigum, diversifying into flat and pitched roof membrane solutions and reinforcing its market position.

- June 2022: Etex enhanced its focus on lightweight and sustainable building solutions by acquiring insulation expert URSA, further strengthening its portfolio in energy-efficient building materials.

- April 2021: Etex acquired Sigmat, a U.K.-based leader in light gauge steel framing, expanding its offsite construction solutions and strengthening its position in the U.K. market.

Report Scope

Report Features Description Market Value (2023) USD 257 Billion Forecast Revenue (2032) USD 469 Billion CAGR (2023-2033) 6.9% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Composite Materials, Terracotta, Steel, Fiber Cement, Ceramic, Aluminum and Other Products) By Application (Offices, Commercial, Residential, Industrial, Institutional and Other Applications) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Kingspan Group, Carea Group, GB Architectural Cladding Products Ltd, Rieger Architectural Products, OmniMax International, Inc., CGL Systems Ltd., SFS Group, Cladding Corp, Centria, Trespa International B.V., Middle East Insulation LLC, Shildan, Inc., Avenere Cladding LLC, Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the Cladding Market size in 2023?The Cladding market size is USD 257 Billion in 2023.

What is the CAGR for the Cladding Market?The Cladding market is expected to grow at a CAGR of 6.9% during 2023-2033.

Who are the key players in the Cladding Market?Kingspan Group, Carea Group, GB Architectural Cladding Products Ltd, Rieger Architectural Products, OmniMax International, Inc., CGL Systems Ltd., SFS Group, Cladding Corp, Centria, Trespa International B.V., Middle East Insulation LLC, Shildan, Inc., Avenere Cladding LLC, Other Key Players.

-

-

- Kingspan Group

- Carea Group

- GB Architectural Cladding Products Ltd

- Rieger Architectural Products

- OmniMax International, Inc.

- CGL Systems Ltd.

- SFS Group

- Cladding Corp

- Centria

- Trespa International B.V.

- Middle East Insulation LLC

- Shildan, Inc.

- Avenere Cladding LLC

- Other Key Players