Global Chlorine Market, By Application (EDC/PVC, Inorganic Chemicals, Chloromethanes, Organic Chemicals, Bleaching, Solvents & Epichlorohydrin, Isocyanates, and Other Applications), By End User (Government, Pharmaceutical, Chemicals, Paper and Pulp, Plastic, Pesticides, Water Treatment, Other End-Users), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Oct 2023

- Report ID: 53958

- Number of Pages: 378

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

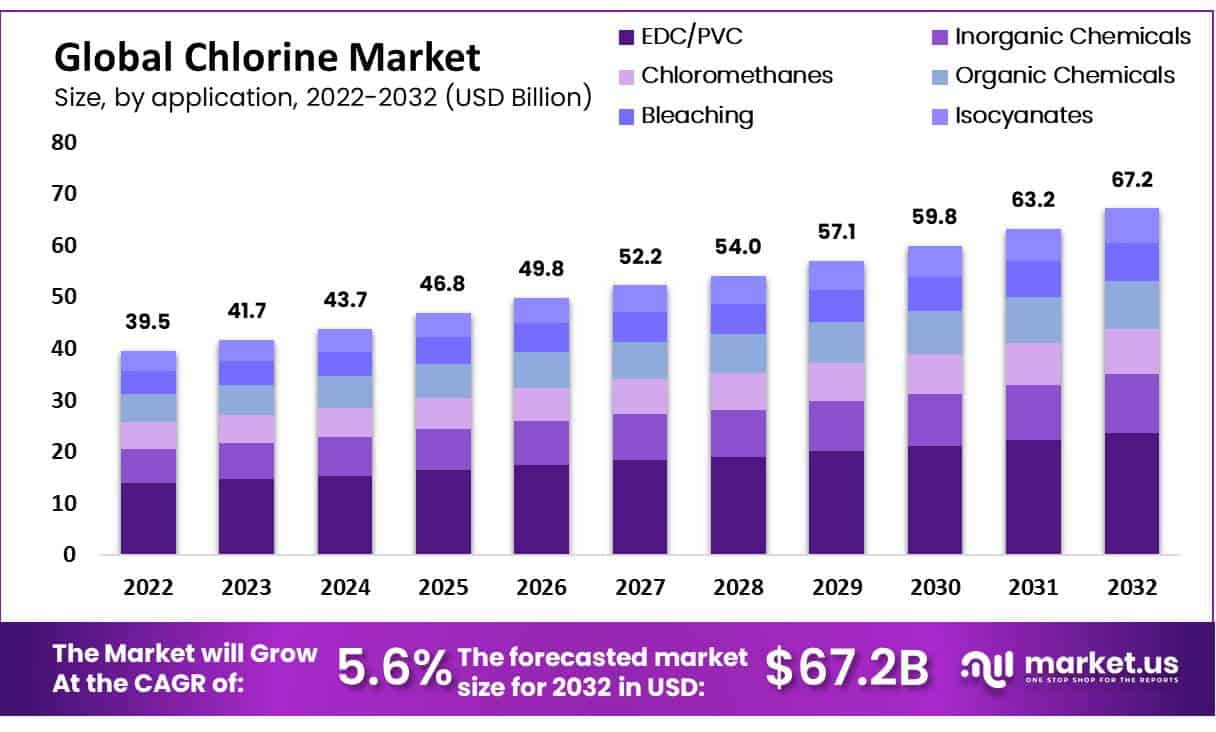

The global chlorine market was valued at USD 39.5 billion in 2022 and is expected to grow to USD 67.2 Billion in 2032. Between 2023 and 2032, this market is estimated to register a CAGR of 5.6%.

The global chlorine market refers to the industry that involves the production, distribution, and sale of chlorine and its derivatives. Chlorine is a chemical element with the symbol Cl & atomic number 17. It is a highly reactive, yellow-green gas, that is commonly used in industries, such as water treatment, chemical manufacturing, pharmaceuticals, and plastics production.

Chlorine is also used in the production of a range of chemicals such as chloromethanes, polyvinyl chloride (PVC), and other organic and inorganic compounds.

The global chlorine market includes the production and sale of these derivatives as well. The market is driven by factors such as increasing demand for water treatment, growth in the chemical industry, and rising use of PVC in various applications such as construction, automotive, and packaging.

The market is highly competitive with several large players such as BASF SE, Dow Chemical Company, Occidental Petroleum Corporation, and Ineos Group Limited among others.

Key Takeaways

Market Size: It is predicted that the global chlorine market size is anticipated to experience a compound annual growth rate between 2023-2032 at a CAGR of 5.6% between 2023-2032.

Market Trend: Chlorine use for water treatment and disinfection processes has seen significant expansion, due to increasing awareness about public health and sanitation concerns.

Application Analysis: Within these categories, EDC/PVC chlorine stands out as being the most profitable in terms of global chlorine market profits and is expected to experience a compound annual growth rate projected at 5.6% from 2017-2022. EDC/PVC chlorine represented 35.1% of revenue contribution worldwide as per 2022 revenue estimates.

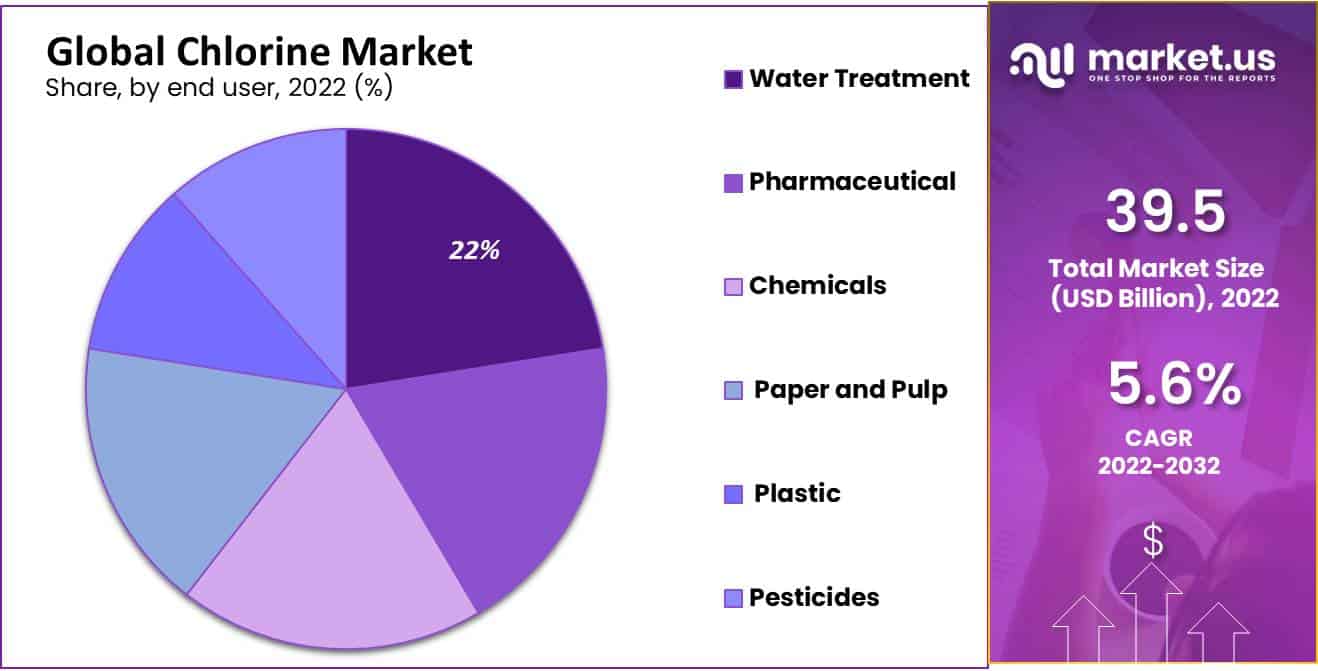

End User Analysis: Within these end-user segments, water treatment stands out as one of the most lucrative for global chlorine market growth, holding 22.5% in revenue share with an expected compound annual growth rate of 5.6% over its forecast period.

Drivers: Rising demand for clean drinking water supplies as well as expanding applications of chlorine across various industries is fuelling growth in the chlorine market.

Restraints: Environmental concerns and regulations pertaining to chlorine handling and disposal pose as major roadblocks to market growth, in addition to health and safety risks that hinder its safe handling and disposal.

Opportunities: The rising use of chlorine in emerging economies to treat water for purification and sanitation purposes as well as advances in production methods offer promising growth prospects for the chlorine market.

Challenges: to Chlorine Market Success: Volatile raw material prices and environmental issues associated with traditional production methods present several obstacles for chlorine markets to thrive.

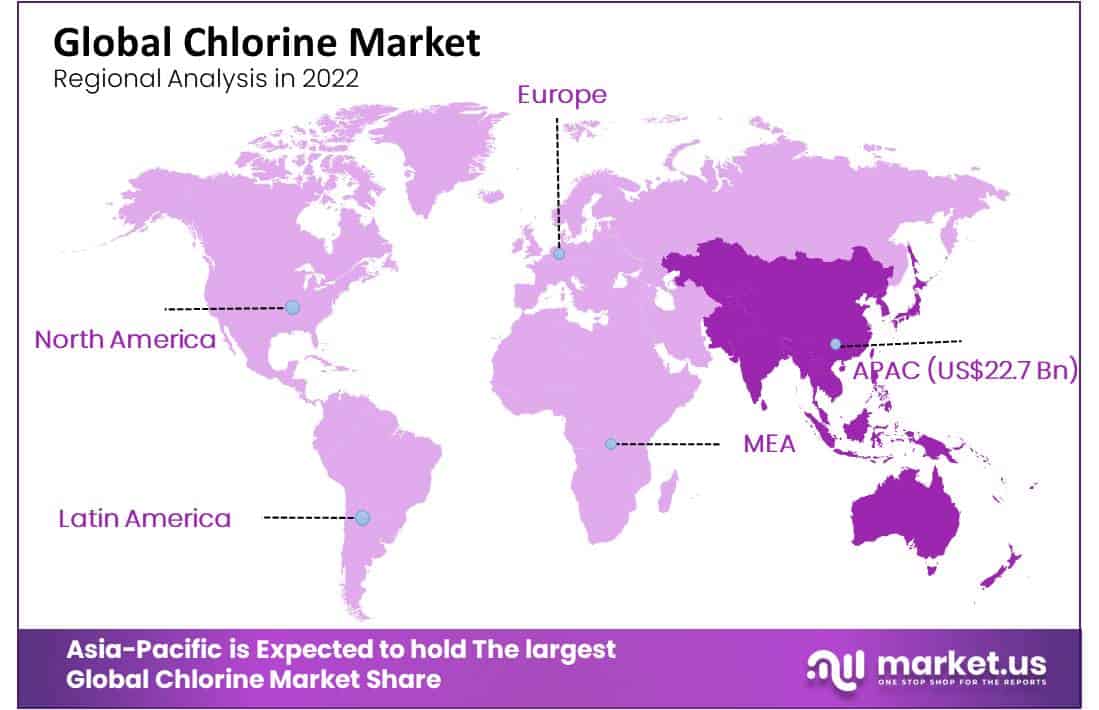

Regional Analysis: Asia-Pacific is predicted to emerge as the most profitable chlorine market globally, boasting a market share of 57.5. The region also projects to experience consistent compound annual growth at an expected compound annual growth rate of 5.6% during its forecasted period.

Key Players Analysis: Major players in the chlorine market include BASF SE Profiled, Olin Corporation, The Dow Chemical Company, Occidental Petroleum Corporation, Ercros, PPG Industries, De Nora, Inovyn, Hanwha Chemical Corporation, Formosa Plastics Corporation, Ineos Group Ltd, Tata Chemicals Limited, Xinjiang Zhongtai Chemicals Co.Ltd, Tosoh Corporation.

Driving Factors

Growing Demand for PVC

The demand for polyvinyl chloride (PVC) is increasing due to its wide range of applications in the construction, automotive, and packaging industries. Since chlorine is a key raw material for the production of PVC, the demand for it is also increasing.

Increasing Water Treatment Activities

Chlorine is widely used as a disinfectant in water treatment, and in plants to kill harmful bacteria and viruses. With increasing concerns about waterborne diseases, the demand for chlorine in water treatment is also increasing.

Growth in the Chemical Industry

Chlorine is a key raw material for the production of various chemicals such as chloromethanes, inorganic chemicals, and organic chemicals. With the growth of the chemical industry, the demand for chlorine is also increasing.

Restraining Factors

Environmental Concerns

Chlorine is a highly reactive and corrosive substance that can have harmful effects on the environment if not handled and disposed of properly. This has led to growing concerns about the environmental impact of chlorine production and usage.

Health Concerns

Chlorine can also have negative health effects if ingested, inhaled, or absorbed through the skin. This has led to concerns about the safety of workers involved in the production and handling of chlorine and its derivatives.

Volatility of Prices

The prices of chlorine and its derivatives are subject to fluctuations based on supply and demand, geopolitical events, and other factors. This can create uncertainty and affect the profitability of companies operating in the global chlorine market.

Growth Opportunities

The chlorine demand is growing in emerging markets due to increasing industrialization, urbanization, and population growth. This presents opportunities for companies to expand their presence in these markets. Companies can develop new and innovative products that use chlorine and its derivatives, opening up new markets and applications for these products.

Partnerships and collaborations with other companies, research institutes, and government agencies can help companies expand their knowledge base, develop new technologies and products, and enter new markets. Diversification of product offerings can help companies to mitigate risks and tap into new markets. Companies can explore new applications for chlorine and its derivatives, such as in the pharmaceutical and agrochemical industries.

Trending Factors

The Asia-Pacific region is a major consumer of chlorine due to rapid industrialization, urbanization, and population growth. This is driving the demand for chlorine-based products, such as PVC, in the region. The construction and infrastructure sectors are major consumers of PVC, which is made from chlorine.

As these sectors continue to grow, the demand for PVC and other chlorine-based products is expected to increase. The production and usage of chlorine can have negative environmental impacts. As a result, there is a growing adoption of green technologies for the production and usage of chlorine, such as electrolysis using renewable energy sources.

Application Analysis

The total revenue share of EDC/PVC-type chlorine is 35.1% in 2022

Based on application, the market for global chlorine market is segmented into EDC/PVC, Inorganic Chemicals, Chloromethanes, Organic Chemicals, Bleaching, Solvents and epichlorohydrin, Isocyanates, and Other Applications.

Among these types, the EDC/PVC segment is the most lucrative in the global chlorine market, with a projected CAGR of 5.6 %. The total revenue share of EDC/PVC-type chlorine will be 35.1% in 2022.

Chlorine is also used in the production of various inorganic chemicals such as titanium dioxide, sodium hypochlorite, and magnesium chloride. Chlorine is used in the production of chloromethanes such as methyl chloride, methylene chloride, and chloroform. Chlorine is used in the production of a wide range of organic chemicals such as solvents, glycols, and amines.

Chlorine is used as a bleaching agent in the paper and pulp industry. Chlorine is used in the production of solvents such as trichloroethylene and tetrachloroethylene. Chlorine finds application in several other industries such as food processing, cosmetics, and pharmaceuticals.

End-User Analysis

Based on end-users, the market is segmented into Government, Pharmaceuticals, Chemicals, Paper and Pulp, Plastic, Pesticides, Water Treatment, and Other End-Users. Among these end-users, the water treatment segment is estimated to be the most lucrative segment in the global chlorine market, with the largest revenue share of 22.5% and a projected CAGR of 5.6% during the forecast period.

In water treatment, the Chlorine industry is widely used as a disinfectant, and in plants, to kill harmful bacteria and viruses.

Chlorine is also used in the pulp and paper industry as a bleaching agent to whiten the paper. Then, Chlorine is used in the production of different pharmaceuticals such as antibiotics and painkillers. Chlorine finds applications in several other industries such as cosmetics, agrochemicals, and electronics. It is also used in the production of different consumer products such as household cleaning products and personal care items.

Key Market Segments

Based on Application

- EDC/PVC

- Inorganic Chemicals

- Chloromethanes

- Organic Chemicals

- Bleaching

- Solvents and Epichlorohydrin

- Isocyanates

- Others

Based on End-User

- Government

- Pharmaceutical

- Chemicals

- Paper and Pulp

- Plastic

- Pesticides

- Water Treatment

- Other End Users

Regional Analysis

Asia-Pacific Generated Highest Revenue Globally and dominated the Global Chlorine Market

Asia-Pacific is estimated to be the most lucrative market in the global chlorine market, with the largest market share of 57.5%, and is expected to register a CAGR of 5.6% during the forecasted period. The Asia-Pacific region is rapidly growing in the market for chlorine, driven by the fast-growing economies of China and India.

The demand for chlorine in the region is driven by several industries, including construction, chemicals, and pharmaceuticals. The Asia-Pacific region is a rapidly growing market for chlorine, driven by the fast-growing economies of China and India.

The demand for chlorine in the region is driven by several industries, including construction, chemicals, and pharmaceuticals. The Middle East and Africa region is a significant market for chlorine, driven by several industries, including water treatment, construction, and chemicals. The region is also a major exporter of chlorine and its derivatives.

Overall, the global chlorine market is driven by several industries and regions, with demand and supply dynamics varying by region. The Asia-Pacific region is expected to be a major growth market for chlorine in the coming years, driven by the rapid growth of the region’s economies and industries.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

These key players are focused on collaborations, strategic partnerships, & mergers and acquisitions to strengthen their market position and expand their product portfolio. The key players are also investing in research and development activities to introduce new and innovative chlorine products to meet the changing market demands.

In terms of market share, Occidental Petroleum Corporation, The Dow Chemical Company, and Ineos Group Holdings S.A. are among the major players with a significant share in the global chlorine market. However, the market share is subject to change with the entry of new players & changing market dynamics.

Market Key Players

- BASF SE Profiled

- Olin Corporation

- The Dow Chemical Company

- Occidental Petroleum Corporation

- Ercros

- PPG Industries

- De Nora

- Inovyn

- Hanwha Chemical Corporation

- Formosa Plastics Corporation

- Ineos Group Ltd

- Tata Chemicals Limited

- Xinjiang Zhongtai Chemicals Co.Ltd

- Tosoh Corporation

Recent Developments

- In May 2021, the chlorine market experienced a significant increase in demand due to the COVID-19 pandemic, as it is used in disinfectants and water treatment facilities.

- In August 2021, Tata Chemicals Ltd. announced the expansion of its chlor-alkali and soda ash plant in Tanzania to meet the growing demand for chlorine in Africa.

- In September 2021, Ineos Group Holdings S.A. announced plans to invest €1 billion in the construction of a new chlorine plant in Antwerp, Belgium, which is expected to become operational by 2025.

Report Scope

Report Features Description Market Value (2022) US$ 39.5 Bn Forecast Revenue (2032) US$ 67.2 Bn CAGR (2023-2032) 5.6% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Application -EDC/PVC, Inorganic Chemicals, Chloromethanes, Organic Chemicals, Bleaching, Solvents & Epichlorohydrin, Isocyanates, and Other Applications; By End User -Government, Pharmaceutical, Chemicals, Paper and Pulp, Plastic, Pesticides, Water Treatment, Other End Users Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape BASF SE Profiled, Olin Corporation, The Dow Chemical Company, Occidental Petroleum Corporation, Ercros, PPG Industries, De Nora, Inovyn, Hanwha Chemical Corporation, Formosa Plastics Corporation, Ineos Group Ltd, Tata Chemicals Limited, Xinjiang Zhongtai Chemicals Co.Ltd, Tosoh Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the projected market size of the Chlorine Market?projected market size of the Chlorine Market is USD 67.2 billion

What is the projected growth rate of the Chlorine Market?Between 2023 and 2032, this market is estimated to register a CAGR of 5.6%.

What was the global chlorine market size in 2022?In 2022, the global chlorine market was valued at US$ 39.5 billion.

-

-

- BASF SE Profiled

- Olin Corporation

- The Dow Chemical Company

- Occidental Petroleum Corporation

- Ercros

- PPG Industries

- De Nora

- Inovyn

- Hanwha Chemical Corporation

- Formosa Plastics Corporation

- Ineos Group Ltd

- Tata Chemicals Limited

- Xinjiang Zhongtai Chemicals Co.Ltd

- Tosoh Corporation