Global Chickpea Snacks Market Size, Share, And Business Benefits By Product (Roasted Chickpea, Chickpea Chips, Chickpea Puffs, Seasoned Chickpea, Others), By Flavor (Savory, Sweet, Spicy, Others), By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Grocery Stores, Online Retailers, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: September 2025

- Report ID: 158139

- Number of Pages: 398

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

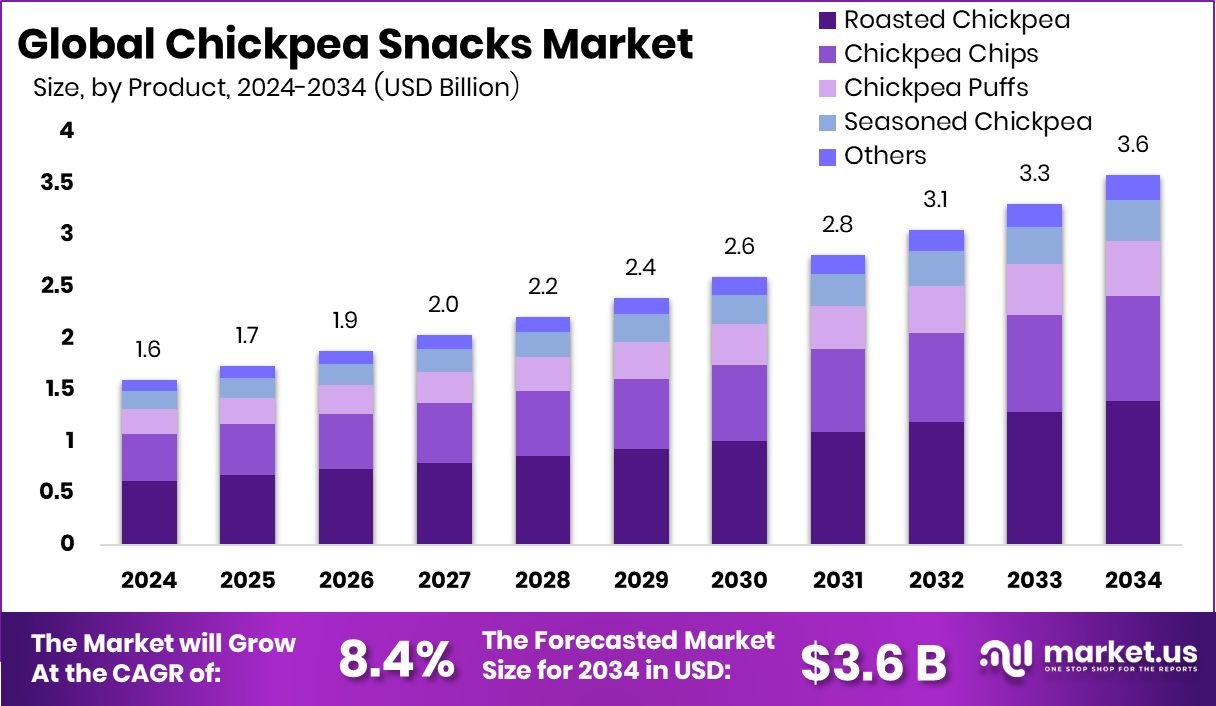

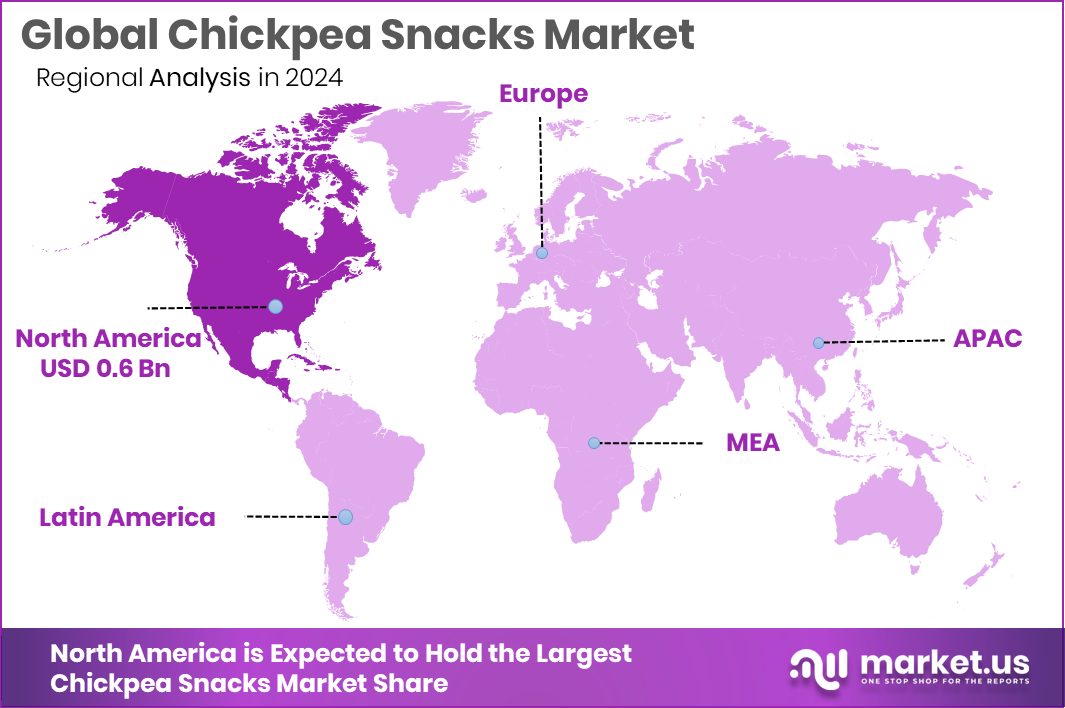

The Global Chickpea Snacks Market is expected to be worth around USD 3.6 billion by 2034, up from USD 1.6 billion in 2024, and is projected to grow at a CAGR of 8.4% from 2025 to 2034. Strong retail presence in North America drove a 39.40% share, generating USD 0.6 Bn revenue.

The chickpea snacks market is expanding rapidly as consumers seek healthier, plant-based, and convenient snack options. These snacks, made from roasted, puffed, or processed chickpeas, are rich in protein and fiber, often gluten-free, and viewed as better alternatives to traditional chips. One of the biggest drivers is rising health and nutrition awareness, especially concerns over diabetes, obesity, and heart disease.

Dietary shifts such as vegan, vegetarian, and flexitarian lifestyles further boost demand. In India, government initiatives strengthen supply: the “Mission for Aatmanirbharta in Pulses” has a ₹1,000 crore allocation to support procurement and warehousing, ensuring raw material stability.

Additionally, the Pradhan Mantri Kisan Sampada Yojana (PMKSY) with ₹6,520 crore supports food processing expansion, while the Production Linked Incentive Scheme for Food Processing Industry (PLISFPI) runs with an outlay of ₹10,900 crore over six years, driving investments in value-added chickpea products. Younger consumers and millennials are spurring innovation in new flavors, formats (chips, bars, puffs), and sustainable clean-label variants.

Expanding retail infrastructure, both online and offline, enables deeper market penetration into smaller towns and rural areas. Opportunities also lie in exports, emerging markets in Asia and Africa, and improved processing and packaging to reduce losses and enhance margins.

Key Takeaways

- The Global Chickpea Snacks Market is expected to be worth around USD 3.6 billion by 2034, up from USD 1.6 billion in 2024, and is projected to grow at a CAGR of 8.4% from 2025 to 2034.

- In 2024, roasted chickpeas held a 38.9% share, dominating the Chickpea Snacks Market segment.

- Savory flavors captured 42.3% share, showcasing strong consumer preference in the global Chickpea Snacks Market.

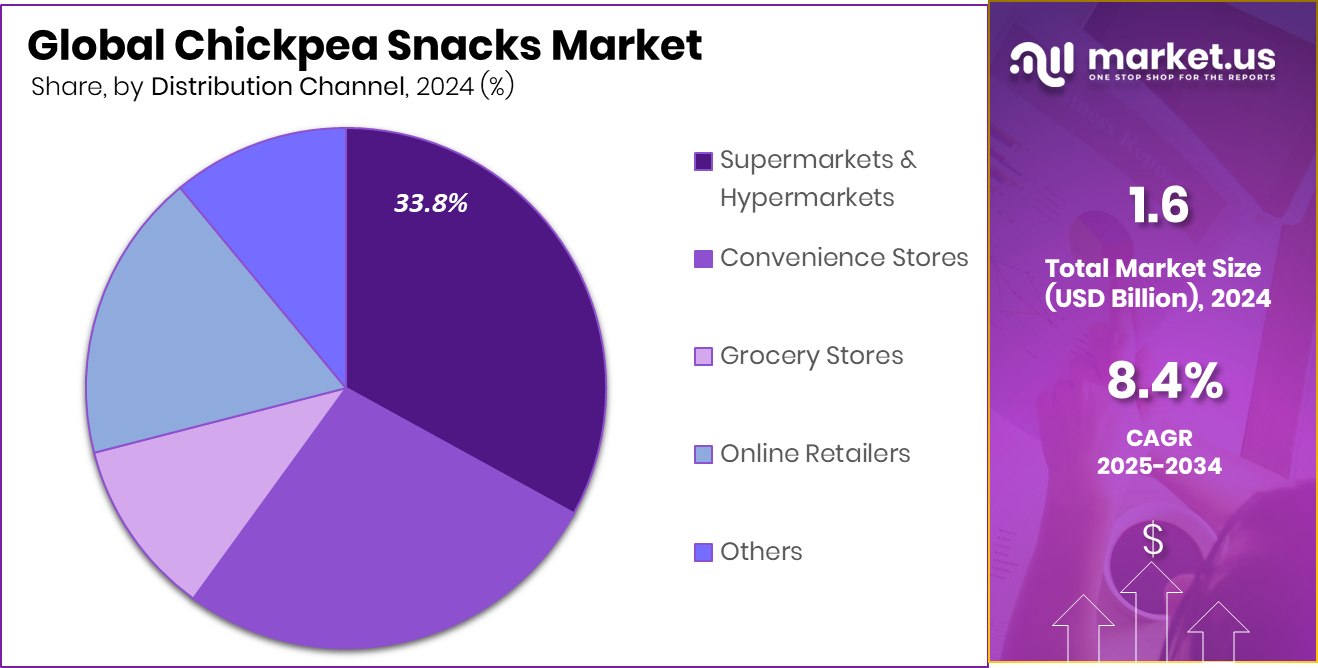

- Supermarkets and hypermarkets accounted for a 33.8% share, driving retail growth within the Chickpea Snacks Market globally.

- Rising health awareness in North America supported its 39.40% market share, valued at USD 0.6 Bn.

By Product Analysis

In 2024, roasted chickpeas led the chickpea snacks market with 38.9%.

In 2024, Roasted Chickpea held a dominant market position in By Product segment of Chickpea Snacks Market, with a 38.9% share. This leadership reflects strong consumer demand for simple, high-protein, and fiber-rich snacks that align with health-conscious lifestyles.

Roasted chickpeas are widely accepted as a guilt-free alternative to fried options, offering a crunchy texture and versatility in flavors ranging from savory spices to sweet coatings. Their appeal is further supported by growing popularity among vegan and gluten-free consumers who prefer natural, minimally processed snacks. The availability of roasted chickpeas through supermarkets, online platforms, and health stores has strengthened accessibility, while innovations in packaging and seasoning continue to drive repeat purchases and expand market penetration.

By Flavor Analysis

Savory flavors captured a 42.3% share in the Chickpea Snacks Market 2024.

In 2024, Savory held a dominant market position in By Flavor segment of the Chickpea Snacks Market, with a 42.3% share. This strong performance is driven by rising consumer preference for bold, spiced, and tangy flavors that match regional taste profiles and offer a satisfying alternative to conventional salty snacks. Savory chickpea snacks appeal to both health-conscious and mainstream consumers by delivering flavor without excessive fat or sugar.

The popularity of seasonings such as chili, garlic, herbs, and masala has widened acceptance across urban and semi-urban markets. With increasing retail penetration and online sales channels, savory chickpea snacks have gained high visibility. Their combination of nutrition and taste ensures repeat consumption, cementing their leading role within this segment.

By Distribution Channel Analysis

Supermarkets and hypermarkets held 33.8% of the chickpea snacks market.

In 2024, Supermarkets and Hypermarkets held a dominant market position in the By Distribution Channel segment of Chickpea Snacks Market, with a 33.8% share. Their dominance stems from wide product availability, organized shelving, and the ability to showcase multiple brands and flavors under one roof, encouraging impulse purchases. These retail outlets offer consumers the convenience of variety, competitive pricing, and promotional discounts, making them the preferred choice for buying chickpea snacks.

Stronger penetration of supermarkets and hypermarkets in urban areas, coupled with expanding footprints in semi-urban regions, has further boosted sales. Additionally, attractive in-store marketing, sampling activities, and better visibility for new product launches have reinforced consumer trust, cementing their leadership in this distribution channel.

Key Market Segments

By Product

- Roasted Chickpea

- Chickpea Chips

- Chickpea Puffs

- Seasoned Chickpea

- Others

By Flavor

- Savory

- Sweet

- Spicy

- Others

By Distribution Channel

- Supermarkets and Hypermarkets

- Convenience Stores

- Grocery Stores

- Online Retailers

- Others

Driving Factors

Public investment in pulses accelerates snack innovation

A key growth driver is government money flowing into pulse crops—especially chickpeas—which lifts yields, stabilizes supplies, and lowers input risk for snack makers. India’s National Food Security & Nutrition Mission (formerly NFSM) funds pulse seed distribution, demonstrations, and seed hubs; for example, in 2024–25, the Centre sanctioned ₹2,907 lakh to Andhra Pradesh under the NFSNM-Pulses head, showing concrete, state-level support for production.

Beyond direct grants, operational circulars allocate chickpea/pulse seed mini-kits for Kharif/Rabi seasons, which improves varietal access and productivity at scale. As acreage and output rise, processors gain a more consistent, local chickpea supply, enabling steady production of roasted and seasoned SKUs, faster NPD cycles, and tighter cost control—even when imports are volatile.

Restraining Factors

Weak infrastructure funding slows chickpea snacks growth

One big restraint is the lack of strong investment in infrastructure (roads, storage, processing) for pulse crops like chickpeas. Even though governments allocate funds for farmer welfare (input subsidies, credit, MSP), the spending on infrastructure—warehouses, cold storage, value‐addition centers—is comparatively low. This means losses after harvest are high, quality suffers, and processors struggle to scale. For chickpea snack makers, this raises raw material costs and affects consistency, which limits market growth.

For example, India’s Demand for Grants document for 2025-26 shows ~Rs 1,37,757 crore allocated to the Ministry of Agriculture & Farmers’ Welfare. But only a small share goes into research and education and infrastructure schemes under “others.” Also, though the government increased the budget for agriculture, there is still a gap in investment specifically for pulse-crop infrastructure.

Growth Opportunity

Expanding value-addition unlocks the chickpea snacks’ potential.

One big opportunity in the chickpea snacks market is adding value—turning raw chickpeas into roasted, flavored, baked, or puffed snacks rather than selling only unprocessed grains. Value addition captures more profit, meets changing consumer tastes (health, convenience), and lets producers differentiate. The Indian government is supporting this via the PM Formalisation of Micro Food Processing Enterprises (PMFME) scheme: micro food processing units (new and existing) can get financial, technical, and business support.

Also, the Ministry of Food Processing Industries (MoFPI) offers subsidies under its Integrated Cold Chain & Value Addition Infrastructure scheme, grants up to ₹10 crore for setting up such infrastructure.

Latest Trends

Rise of health-first chickpea snacks thanks to government push

One big trend in the chickpea snacks market is that people want healthier, clean-label foods (less oil, no artificial additives), and governments are helping make that happen. For example, India’s Production Linked Incentive Scheme for Food Processing Industry (PLI-SFPI) gives funds and incentives to food processors who upgrade technology, improve processing, and adopt better standards, which helps snack makers produce healthier chickpea snack variants with better nutritional profiles.

Also, under the MoFPI grant schemes, support is given to capacity building, better machinery, packaging, and branding, all of which contribute to delivering higher-quality, health‐focused snacks.

As consumers globally care more about protein, fibre, low sugar, the trend toward baked or roasted rather than fried chickpea snacks is strengthening—and government backing is helping companies overcome cost and technology barriers to ride this wave.

Regional Analysis

In 2024, North America held a 39.40% share of the Chickpea Snacks Market, worth USD 0.6 Bn.

North America leads the Chickpea Snacks Market, accounting for 39.40% and USD 0.6 Bn, underpinned by mature grocery retail, strong private-label penetration, and high adoption of protein-rich, gluten-free snacking. The region benefits from widespread availability of roasted and baked chickpea formats, robust e-commerce fulfillment, and clean-label positioning across club stores and natural channels.

Europe shows steady traction driven by front-of-pack labelling standards, retailer sustainability commitments, and a sizable flexitarian base that favors legume-based snacks. Asia Pacific is expanding as urban consumers trade up from traditional pulses toward convenient, ready-to-eat formats; modern trade and quick-commerce listings are improving brand visibility and repeat purchase.

In the Middle East & Africa, chickpea’s cultural familiarity supports product trial, while modern packaging, lighter roasting, and regional flavors help formalize demand beyond wet markets. Latin America’s opportunity is tied to supermarket consolidation and rising interest in plant-forward snacking, with local co-packers enabling agile flavor launches and competitive pricing. Across regions, marketing that emphasizes fibre, plant protein, and minimal processing is key; multichannel strategies—mass retail, specialty, and D2C—improve household penetration.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, PepsiCo, Inc. continues to strengthen its position in the global snacking category by leveraging its diverse product portfolio and strong retail networks. The company’s focus on healthier alternatives has led to the strategic development of chickpea-based snacks under its popular brands. By combining large-scale distribution with growing consumer demand for plant protein, PepsiCo capitalizes on both convenience and nutritional positioning, enhancing its relevance in modern snacking.

Nestlé S.A. has expanded its presence in the chickpea snacks segment by emphasizing research and product innovation. The company’s global footprint enables it to tailor chickpea-based products for diverse regional tastes while aligning with its long-term focus on health, nutrition, and sustainability. Nestlé’s ability to invest in reformulation and clean-label solutions positions it to meet evolving dietary preferences, particularly among health-conscious and urban consumers who prioritize protein-rich and allergen-friendly snack options.

Mondelez International, Inc. has strategically tapped into the better-for-you snacking trend by diversifying its offerings to include chickpea-based formats. Known for its established global snacking brands, Mondelez uses its marketing expertise and scale to drive consumer engagement and trial. Its move toward plant-forward snacking aligns with its strategy of broadening categories beyond traditional confectionery, enhancing competitive advantage in markets where demand for innovative, savory snacks is rising.

Top Key Players in the Market

- PepsiCo, Inc.

- Nestlé S.A.

- Mondelez International, Inc.

- Calbee, Inc.

- Campbell Soup Company

- Conagra Brands, Inc.

- The Hain Celestial Group, Inc.

- Kraft Heinz Company

- Kellogg Company

- Biena Snacks

Recent Developments

- In May 2025, Conagra showcased many new snack offerings at the Sweets & Snacks Expo (sweet, salty, meat snacks, seeds). This portfolio is large (~ US$3.2 billion snacks business), but chickpea is not mentioned as an ingredient in the announcements.

- In October 2024, Nestlé introduced “Maggi Nutri-licious Chatpata Besan Noodles” in India, using locally sourced chickpea flour (besan) as a main ingredient. The aim was to offer more protein and fibre using chickpea flour, while keeping the taste good by reducing bitterness and maintaining texture.

Report Scope

Report Features Description Market Value (2024) USD 1.6 Billion Forecast Revenue (2034) USD 3.6 Billion CAGR (2025-2034) 8.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Roasted Chickpea, Chickpea Chips, Chickpea Puffs, Seasoned Chickpea, Others), By Flavor (Savory, Sweet, Spicy, Others), By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Grocery Stores, Online Retailers, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape PepsiCo, Inc., Nestlé S.A., Mondelez International, Inc., Calbee, Inc., Campbell Soup Company, Conagra Brands, Inc., The Hain Celestial Group, Inc., Kraft Heinz Company, Kellogg Company, Biena Snacks Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Chickpea Snacks MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample

Chickpea Snacks MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- PepsiCo, Inc.

- Nestlé S.A.

- Mondelez International, Inc.

- Calbee, Inc.

- Campbell Soup Company

- Conagra Brands, Inc.

- The Hain Celestial Group, Inc.

- Kraft Heinz Company

- Kellogg Company

- Biena Snacks