Global CGRP Inhibitors Market Analysis By Molecules (Small Molecules, Big Molecules), By Treatment (Preventive Migraine Treatment, Acute Migraine Treatment), By Route of Administration (Oral, Nasal, Injectables), By End User (Hospitals, Specialty Clinics, Mail Order Pharmacies, Retail Pharmacies) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: March 2025

- Report ID: 143861

- Number of Pages: 237

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

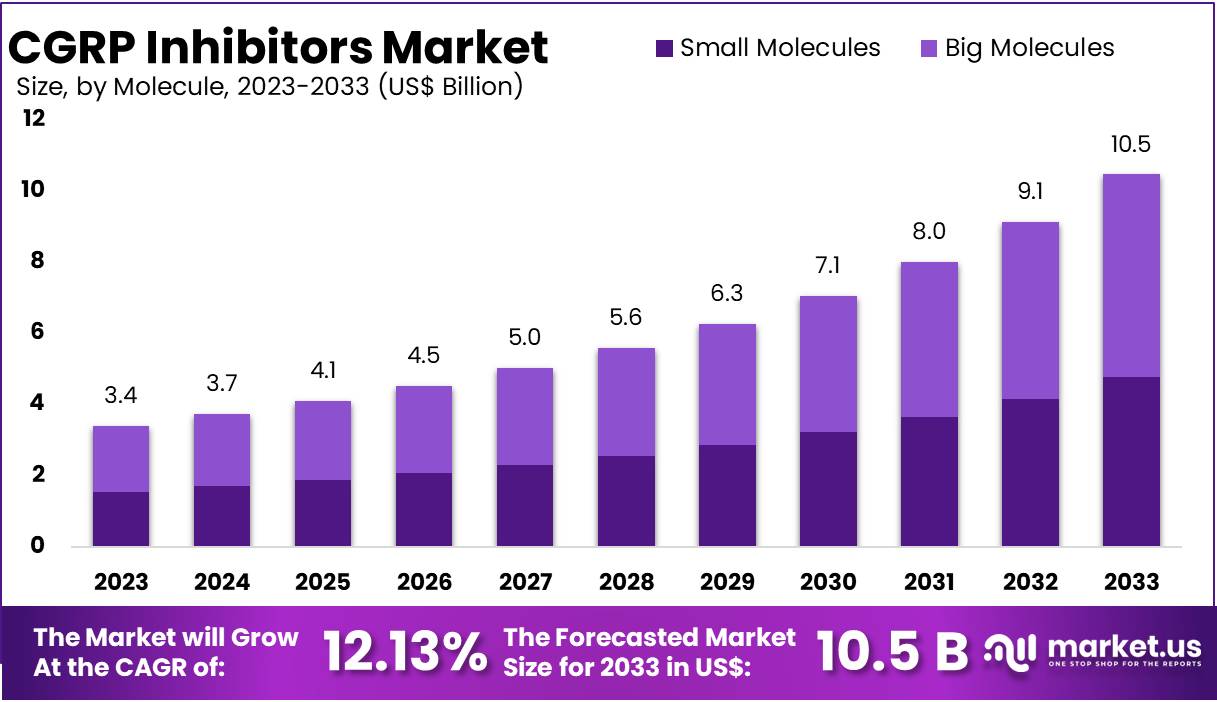

The Global CGRP Inhibitors Market Size is expected to be worth around US$ 10.5 Billion by 2034, from US$ 3.4 Billion in 2024, growing at a CAGR of 12.13% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 38.11% share and holds US$ 1.30 Billion market value for the year.

The market for Calcitonin Gene-Related Peptide (CGRP) inhibitors has witnessed significant growth in recent years. These inhibitors are a class of medications designed to prevent and treat migraines by blocking CGRP or its receptors. CGRP is a neuropeptide involved in migraine pathophysiology, contributing to inflammation and vasodilation in the brain. By targeting this pathway, CGRP inhibitors help reduce the frequency and severity of migraine attacks, making them a crucial advancement in migraine treatment.

According to the World Health Organization (WHO), migraines affect approximately 14% of the global population. Headache disorders, including migraines, impact an estimated 3.1 billion people worldwide. The high prevalence of migraines highlights the substantial demand for effective treatments. As a result, CGRP inhibitors have gained widespread adoption among healthcare providers and patients seeking better therapeutic options to manage migraine symptoms effectively.

Medical research advancements have significantly enhanced the understanding of migraine pathophysiology, leading to the development of targeted therapies such as CGRP inhibitors. Studies indicate that these inhibitors effectively lower migraine frequency and severity, providing a much-needed alternative to traditional treatments. For instance, several clinical trials have demonstrated the superior efficacy of CGRP inhibitors compared to conventional migraine medications, further boosting their adoption in clinical settings.

Government health agencies and organizations like the WHO actively promote awareness and education about migraine treatments, including CGRP inhibitors. These initiatives aim to improve patient outcomes and enhance quality of life by encouraging the use of innovative therapies. Supportive policies, increased funding for research, and growing acceptance of CGRP inhibitors among medical professionals are expected to drive market growth in the coming years.

The increasing prevalence of migraines and the growing need for effective treatments have positioned CGRP inhibitors as a vital segment within the pharmaceutical industry. The market’s expansion is further supported by ongoing research and development efforts to improve drug efficacy and accessibility. As demand continues to rise, pharmaceutical companies are investing in new formulations and delivery methods, ensuring broader patient access to these advanced migraine therapies.

CGRP inhibitors have emerged as a groundbreaking solution for migraine management. Their effectiveness in reducing migraine symptoms has led to rapid adoption in clinical practice. With strong support from health organizations, continuous medical advancements, and rising awareness, the CGRP inhibitors market is set for continued growth. As research progresses, these inhibitors are likely to play an even greater role in addressing the global burden of migraines and headache disorders.

Key Takeaways

- The global CGRP inhibitors market is anticipated to reach US$ 10.5 billion by 2034, growing from US$ 3.4 billion in 2024 at a 12.13% CAGR.

- In 2023, Big Molecules dominated the molecule segment, securing over 55.1% market share, highlighting their effectiveness in CGRP inhibition therapies.

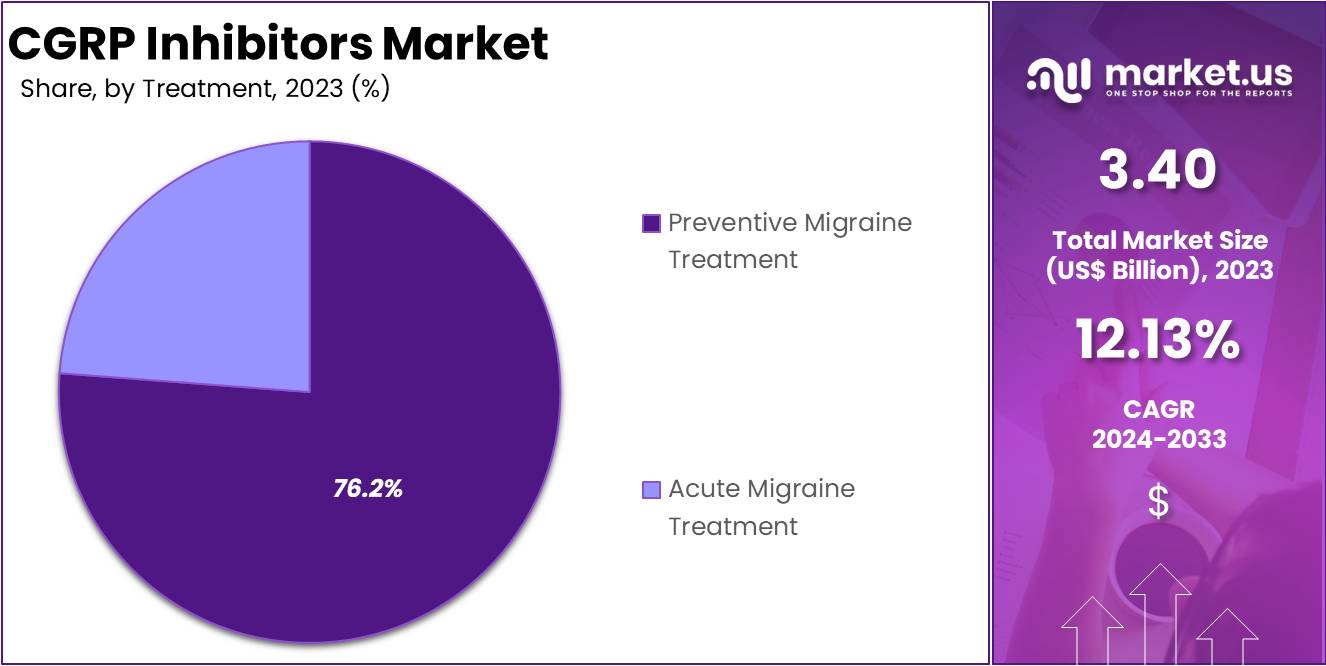

- The preventive migraine treatment segment led the market in 2023, accounting for more than 76.2% share, reflecting increasing demand for proactive migraine management.

- Oral CGRP inhibitors were the preferred route of administration in 2023, capturing over 48.90% share, driven by convenience and patient adherence benefits.

- Hospitals held the largest share of the end-user segment in 2023, securing over 48.90% share, driven by widespread use in clinical settings.

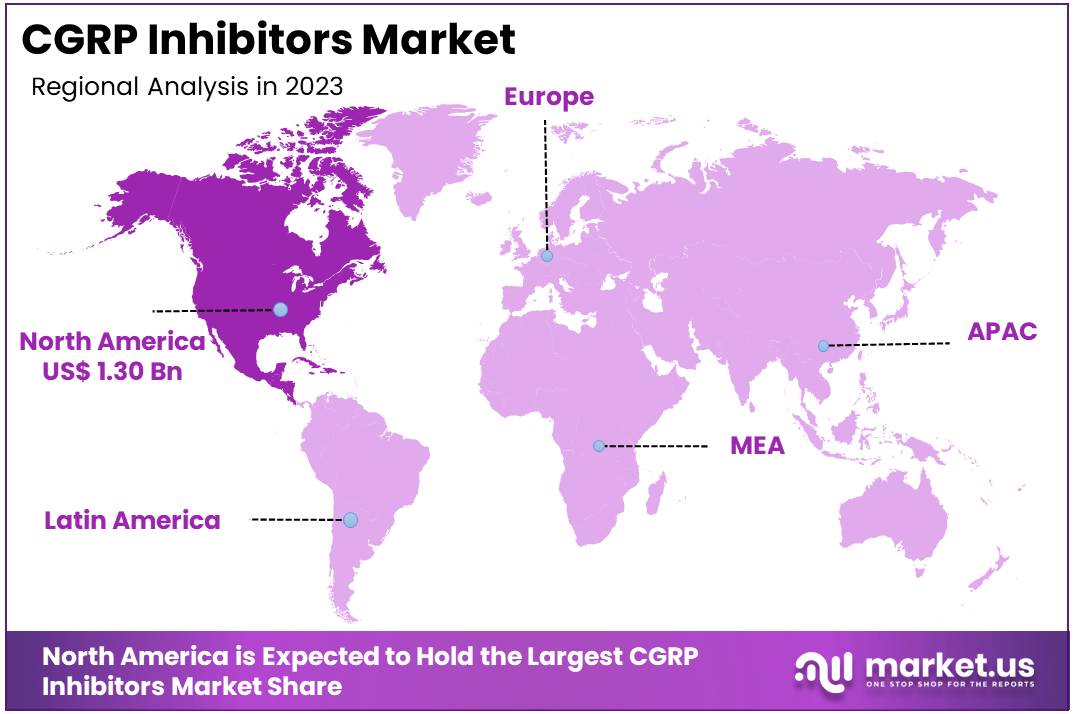

- In 2023, North America dominated the CGRP inhibitors market, holding a 38.11% share and generating US$ 1.30 billion in revenue.

Molecules Analysis

In 2023, Big Molecules held a dominant market position in the Molecules Segment of CGRP Inhibitors, capturing more than a 55.1% share. Their strong presence is due to high efficacy, a longer half-life, and sustained therapeutic effects. These biologics, mainly monoclonal antibodies, offer precise CGRP inhibition, reducing migraine frequency. Physicians prefer them for their long-lasting impact and proven clinical outcomes. As a result, Big Molecules continue to be the leading choice in the CGRP inhibitors market.

Small Molecules are gaining attention due to their oral bioavailability and rapid onset of action. Unlike Big Molecules, they allow for flexible dosing and easier administration. Many patients prefer them for their non-injectable nature and convenience. The increasing demand for user-friendly treatments supports their growth. As more oral CGRP inhibitors gain approval, the market is expected to see a shift. However, they still face challenges in competing with the established dominance of Big Molecules.

Both Big and Small Molecules contribute to the evolving CGRP inhibitors market. Big Molecules remain the preferred option due to strong clinical trust and longer dosing intervals. However, the demand for cost-effective and easy-to-use treatments is driving interest in Small Molecules. With ongoing drug approvals and new developments, the market is expected to grow. While Big Molecules currently lead, Small Molecules are projected to witness faster adoption, shaping the future of CGRP inhibitor therapies.

Treatment Analysis

In 2023, Preventive Migraine Treatment held a dominant market position in the treatment segment of CGRP inhibitors, capturing more than a 76.2% share. The strong demand for preventive therapies was driven by their ability to reduce migraine frequency. Many patients with chronic migraines preferred long-term solutions over acute treatments. The introduction of monoclonal antibodies (mAbs) and small-molecule CGRP inhibitors further increased adoption. These therapies provided lasting relief, minimizing the need for emergency medication.

The demand for acute migraine treatment continued to grow but remained lower than preventive options. Acute therapies primarily offered short-term symptom relief, making them less preferred by chronic migraine sufferers. However, advancements in fast-acting CGRP inhibitors expanded treatment choices. Increased awareness among patients and healthcare providers supported this segment’s growth. As more novel drug formulations entered the market, acute treatment options became more accessible, leading to steady adoption rates.

Regulatory approvals and improved insurance coverage further enhanced market accessibility for both preventive and acute therapies. Pharmaceutical companies continued to invest in drug innovation to strengthen their product portfolios. The growing preference for long-term migraine management positioned preventive treatments as the leading segment. However, acute therapies are expected to gain traction with increasing physician recommendations. While the market for acute treatments will expand, preventive therapies will likely maintain dominance due to their superior effectiveness and patient preference.

Route of Administration Analysis

In 2023, Oral held a dominant market position in the Route of Administration segment of CGRP Inhibitors, capturing more than a 48.90% share. The preference for oral CGRP inhibitors remains high due to ease of use and patient convenience. These formulations offer a non-invasive option, making them a popular choice among migraine patients. The growing adoption of oral medications has further strengthened their market position. Increasing regulatory approvals and advancements in drug formulation continue to drive segment growth.

Injectable CGRP inhibitors also hold a significant market share. These formulations are widely used due to their fast action and long-lasting effects. Physicians often recommend injectables for chronic migraine patients who require sustained relief. Longer dosing intervals make them a convenient option despite being invasive. Strong clinical efficacy supports their adoption in both acute and preventive treatments. As a result, the demand for injectable CGRP inhibitors remains steady in the market.

Nasal CGRP inhibitors represent an emerging segment with growth potential. These formulations provide rapid absorption, offering quick relief for patients seeking immediate effects. The nasal route bypasses the digestive system, allowing for direct action on migraine pathways. While currently a niche segment, advancements in drug delivery technologies are expected to drive future adoption. Increasing research and innovation in intranasal drug formulations may enhance their market presence in the coming years.

End User Analysis

In 2023, hospitals held a dominant market position in the route of end-user segment of CGRP inhibitors, capturing more than a 48.90% share. This dominance was largely due to the high patient influx seeking migraine and chronic headache treatments. Hospitals provided access to specialized healthcare professionals and advanced medical infrastructure. The preference for intravenous and injectable therapies in hospital settings further contributed to market growth. As a result, hospitals remained the primary choice for patients requiring immediate and specialized migraine care.

Specialty clinics also accounted for a notable share in the CGRP inhibitors market. These clinics offered targeted treatment options under the supervision of neurologists and pain management specialists. Many patients preferred specialty clinics for personalized care and follow-up consultations. Additionally, the rising adoption of CGRP inhibitors in outpatient settings supported segment growth. With increased awareness of specialized migraine treatments, specialty clinics continued to expand their patient base and strengthen their market presence.

Mail-order and retail pharmacies witnessed steady growth, driven by convenience and affordability. Many patients with chronic migraines opted for mail-order pharmacies for continuous medication access. Insurance collaborations and discount programs further supported this trend. Retail pharmacies, on the other hand, benefited from improved accessibility and expanding pharmacy chains. In some regions, over-the-counter availability of CGRP inhibitors enhanced consumer adoption. The rise of digital health platforms also contributed to the increasing demand for CGRP inhibitors through retail and mail-order pharmacies.

Key Market Segments

By Molecules

- Small Molecules

- Big Molecules

By Treatment

- Preventive Migraine Treatment

- Acute Migraine Treatment

By Route of Administration

- Oral

- Nasal

- Injectables

By End User

- Hospitals

- Specialty Clinics

- Mail Order Pharmacies

- Retail Pharmacies

Drivers

Increasing Prevalence of Migraines

The global burden of migraines has significantly increased, driving demand for more effective treatments. According to PubMed Central, migraine cases surged by 58.15% from 1990 to 2021, reaching 1.16 billion worldwide. The incidence rate also grew by 42.06% during this period. Regionally, medium socio-demographic index (SDI) areas reported the highest absolute cases, while high SDI regions had the most elevated rates. Migraines predominantly affect individuals aged 35–39, with women consistently experiencing higher prevalence than men across all age groups (PubMed Central).

Traditional migraine treatments often offer limited relief, increasing the demand for innovative solutions. CGRP inhibitors have gained attention due to their ability to block calcitonin gene-related peptide (CGRP), a key factor in migraine pathophysiology. Unlike conventional therapies, these inhibitors prevent CGRP activity, reducing inflammation and pain transmission. This mechanism provides sustained relief, particularly for chronic sufferers. Studies highlight their effectiveness in lowering migraine frequency and severity, making them a preferred option in the healthcare industry.

The growing adoption of CGRP inhibitors is driven by increased awareness and regulatory approvals. For instance, the American Headache Society reports that the migraine prevalence in the U.S. has remained stable over the past 30 years, affecting 11.7% to 14.7% of the population. Women experience higher rates, ranging from 17.1% to 19.2%, compared to 5.6% to 7.2% in men. These statistics reinforce the necessity for targeted treatments, positioning CGRP inhibitors as a crucial advancement in migraine management.

As research advances, CGRP inhibitors are expected to play a vital role in migraine treatment. Their ability to address the root cause of migraines has contributed to their increasing market growth. The rising prevalence of migraines, coupled with the limitations of traditional therapies, has fueled investment in innovative solutions. Regulatory support and clinical success further enhance their adoption. With ongoing developments, CGRP inhibitors are projected to transform migraine care, providing effective long-term relief and expanding their market potential.

Restraints

Regulatory Hurdles

The regulatory framework for pharmaceuticals, particularly for CGRP inhibitors, is highly complex. Companies must comply with strict approval processes imposed by agencies like the FDA and EMA. These processes involve extensive clinical trials, safety evaluations, and efficacy assessments. Any delay in regulatory approvals can slow down market entry, affecting the availability of innovative therapies. Moreover, evolving regulatory guidelines may create additional compliance challenges. Companies investing in CGRP inhibitors must allocate significant resources to navigate these hurdles, potentially increasing development costs and affecting profitability.

Regulatory delays can limit the market reach of CGRP inhibitors. Lengthy approval timelines may hinder commercialization strategies, delaying revenue generation for manufacturers. Additionally, variations in approval standards across different regions can create inconsistencies in market access. This can affect global expansion plans for pharmaceutical firms. Compliance with post-marketing surveillance requirements further adds to the regulatory burden. As a result, smaller players may struggle to compete, leading to market dominance by established pharmaceutical companies with greater regulatory expertise.

Opportunities

Emerging Markets and New Formulations

Emerging markets present significant opportunities for CGRP inhibitor growth. Regions such as South Asia and the Pacific are experiencing rapid market expansion due to a rising migraine burden. Improved healthcare infrastructure and greater awareness are driving demand. Pharmaceutical companies are increasing their presence in these regions, leveraging unmet medical needs. Government initiatives supporting neurological disorder treatments further enhance market potential. The availability of advanced migraine therapies is expected to improve, making these regions attractive for investment and product launches in the coming years.

New formulations and delivery methods are shaping the future of CGRP inhibitors. Ongoing research and development efforts focus on improving drug efficacy and patient convenience. Innovations such as oral formulations and long-acting injectables are gaining traction. These advancements enhance treatment adherence and expand the patient pool. Pharmaceutical firms are investing in novel technologies to gain a competitive edge. Regulatory approvals for improved formulations will drive market growth. The shift towards personalized medicine is also influencing future CGRP inhibitor advancements.

Trends

Shift to Preventive Treatments

The migraine treatment landscape is shifting toward preventive care, with CGRP inhibitors gaining widespread acceptance. These drugs effectively reduce migraine frequency and severity, making them a preferred choice over traditional pain medications. Their targeted mechanism blocks CGRP, a key protein linked to migraine attacks. This shift is driven by growing patient demand for long-term relief and fewer side effects. Additionally, healthcare providers are recognizing their benefits, leading to increased prescriptions. The preventive approach aims to enhance patients’ quality of life and reduce healthcare costs.

The adoption of CGRP inhibitors is reshaping migraine management strategies. Unlike conventional treatments that address symptoms, these inhibitors prevent migraines from occurring. Clinical studies confirm their efficacy, boosting physician and patient confidence. Pharmaceutical companies are investing in research to expand indications and improve accessibility. The rising prevalence of chronic migraines further fuels market growth. As awareness increases, insurers are gradually covering these treatments, enhancing affordability. This preventive trend is expected to drive market expansion in the coming years.

Regional Analysis

In 2023, North America held a dominant market position, capturing more than a 38.11% share and holding a market value of US$ 1.30 billion. The region’s leadership is driven by high prevalence rates of migraines, a strong healthcare infrastructure, and rapid adoption of innovative therapies.

The United States accounts for the largest share due to rising awareness, increasing healthcare spending, and strong regulatory support. The availability of FDA-approved CGRP inhibitors further strengthens market growth. In addition, the presence of key pharmaceutical companies and ongoing research initiatives contribute to the region’s expansion.

Canada also plays a key role, with growing demand for preventive migraine treatments. Supportive reimbursement policies and expanding neurology-focused healthcare facilities enhance market penetration.

North America benefits from a higher diagnosis rate and a well-established network of neurologists and headache specialists. This ensures faster adoption of CGRP inhibitors compared to other regions. The region’s market is expected to maintain steady growth due to continued advancements in migraine treatments and an increasing patient base.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Amgen and Novartis are leading players in the CGRP inhibitors market. Amgen, with its pioneering drug Aimovig, has established a strong foothold in migraine prevention. Novartis, a co-developer of Aimovig, benefits from its extensive global reach and strong distribution network. Both companies leverage innovation and strategic collaborations to maintain a competitive edge. Their focus on research and development, coupled with significant investments in clinical trials, strengthens their market position. Patent exclusivity and regulatory approvals further enhance their dominance in the CGRP inhibitors segment.

Teva Pharmaceutical Industries Ltd. and Eli Lilly play a crucial role in market expansion. Teva’s Ajovy offers a differentiated dosing schedule, attracting a broad patient base. Eli Lilly’s Emgality stands out due to its efficacy in episodic and chronic migraine management. Both companies emphasize commercial partnerships and patient support programs. Their robust marketing strategies and increasing geographic reach contribute to strong revenue growth. Continuous pipeline advancements and real-world data further reinforce their market presence.

Lundbeck and other key players are expanding their footprint in the CGRP inhibitors market. Lundbeck, after acquiring Alder BioPharmaceuticals, strengthened its position with Vyepti, a leading intravenous CGRP inhibitor. Emerging players focus on novel drug formulations and alternative administration routes. Strategic mergers, acquisitions, and licensing agreements drive market competition. Increasing awareness and favorable reimbursement policies support market penetration. As demand rises, these companies invest in extensive clinical research and regulatory approvals, ensuring sustained market growth in the coming years.

Market Key Players

- Amgen

- Novartis

- Teva Pharmaceutical Industries Ltd.

- Eli Lilly

- Lundbeck

- Abbvie

- Allergan

- Biohaven Pharmaceutical Holding Company Ltd.

- Pfizer

Recent Developments

- In October 2022: Pfizer successfully completed the acquisition of Biohaven Pharmaceuticals in a transaction valued at approximately $11.6 billion. Through this acquisition, Pfizer expanded its portfolio with CGRP inhibitors, including NURTEC ODT (rimegepant) and zavegepant. As part of the agreement, Pfizer acquired all outstanding shares of Biohaven that it did not already own, at a price ranging from $148.50 to $149.50 per share.

- In October 2023: Amgen finalized its acquisition of Horizon Therapeutics for approximately $27.8 billion. While this acquisition does not directly involve CGRP inhibitors, it represents a significant expansion of Amgen’s portfolio in the treatment of rare diseases. The transaction underscores Amgen’s broader strategic growth within the pharmaceutical sector.

Report Scope

Report Features Description Market Value (2023) US$ 3.4 Billion Forecast Revenue (2033) US$ 10.5 Billion CAGR (2024-2033) 12.13% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Molecules (Small Molecules, Big Molecules), By Treatment (Preventive Migraine Treatment, Acute Migraine Treatment), By Route of Administration (Oral, Nasal, Injectables), By End User (Hospitals, Specialty Clinics, Mail Order Pharmacies, Retail Pharmacies) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape horizontal_comapnies Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Amgen

- Novartis

- Teva Pharmaceutical Industries Ltd.

- Eli Lilly

- Lundbeck

- Abbvie

- Allergan

- Biohaven Pharmaceutical Holding Company Ltd.

- Pfizer