Global Cell Therapy Market By Therapy Type (Autologous Therapies and Allogeneic Therapies), By Therapeutic Area (Oncology Cardiovascular Disease (CVD), Musculoskeletal Disorders, Dermatology, and Others), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 37308

- Number of Pages: 250

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

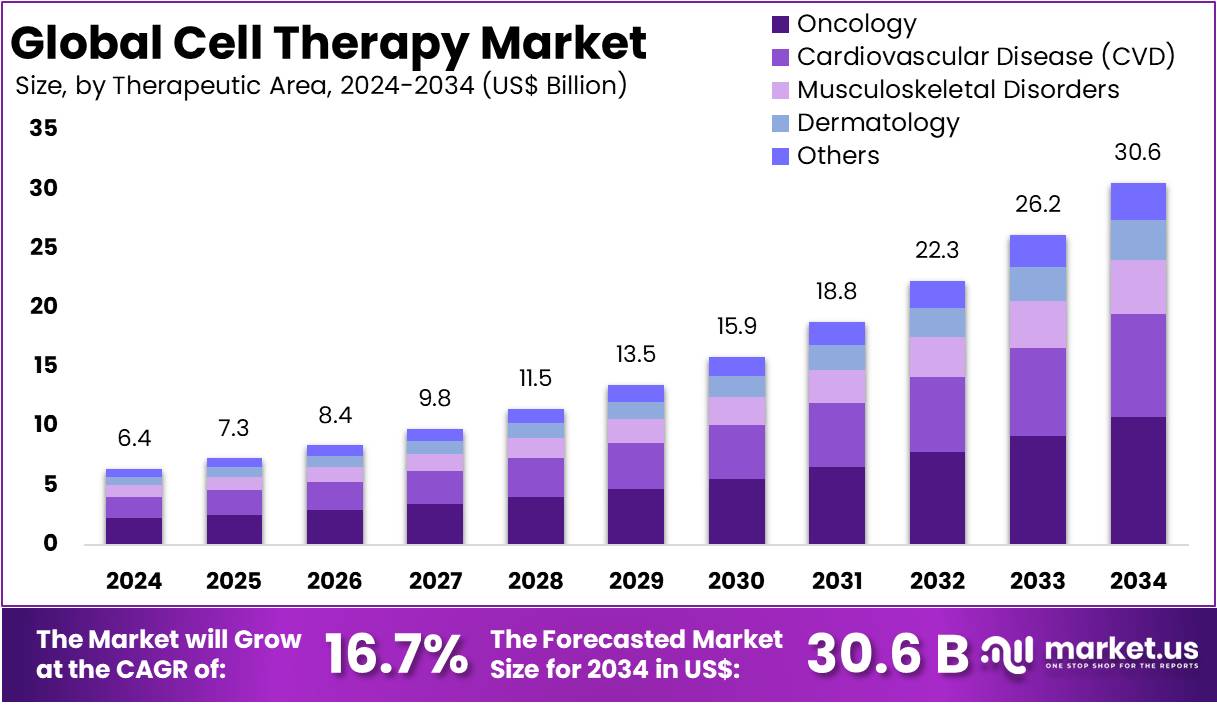

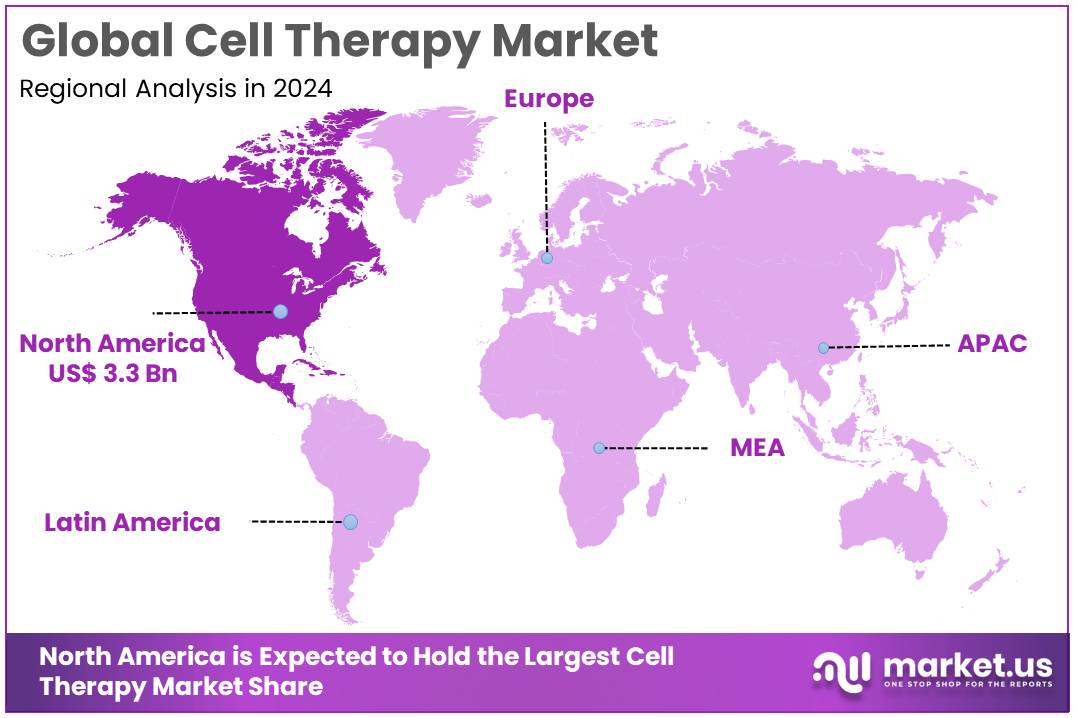

The Global Cell Therapy Market size is expected to be worth around US$ 30.6 Billion by 2034, from US$ 6.4 Billion in 2024, growing at a CAGR of 16.7% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 53.1% share and holds US$ 3.3 Billion market value for the year.

The global cell therapy market is witnessing a remarkable growth phase, fueled by a surge in demand for regenerative medicine. Cell therapy makes use of health cells to treat various medical conditions. It typically involves transplanting healthy cells to repair damaged cells in the human body. Cell therapy can be used to treat various diseases and medical conditions including oncology, cardiovascular disease, musculoskeletal disorders, and skin treatment.

The concept dates back to the 19th century, but significant advances have been made in recent years, particularly with the advent of stem cell research and biotechnology. The cells used in these therapies can be from the patient (autologous cells) or from a donor (allogeneic cells). They can be derived from various sources, such as bone marrow, blood, or even embryonic tissue. Cell therapy aims to replace, repair, regenerate, or enhance the biological function of damaged tissues or organs.

- The therapeutic approach encompasses a variety of treatments using either stem cells or other types of cells, which can be either single or multiple cell-based. These therapies may involve genetic modifications or specific formulations, and can be applied in various ways including topical applications, injections, infusions, or through the use of bioscaffolds and scaffold-free methods. Cell therapy is being explored across numerous medical fields, including regenerative medicine, immunotherapy, and cancer treatment. While many cell therapies are still in the initial phases of development (primarily phase 1/2 trials), there are notable exceptions. These include established treatments like bone marrow/stem cell transplants and hepatocyte transplantation, as well as FDA-approved therapies such as sipuleucel-T (PROVENGE), azficel-T (LAVIV), autologous cultured chondrocytes on porcine collagen (MACI), and tisagenlecleucel (KYMRIAH).

Cell Therapy Market, Global Analysis, 2020-2024 (US$ Billion)

Global 2020 2021 2022 2023 2024 CAGR Revenue 4.4 4.7 5.1 5.6 6.4 16.7% Key Takeaways

- The global cell therapy market was valued at USD 6.4 billion in 2024 and is anticipated to register substantial growth of USD 30.6 billion by 2034, with 16.7% CAGR.

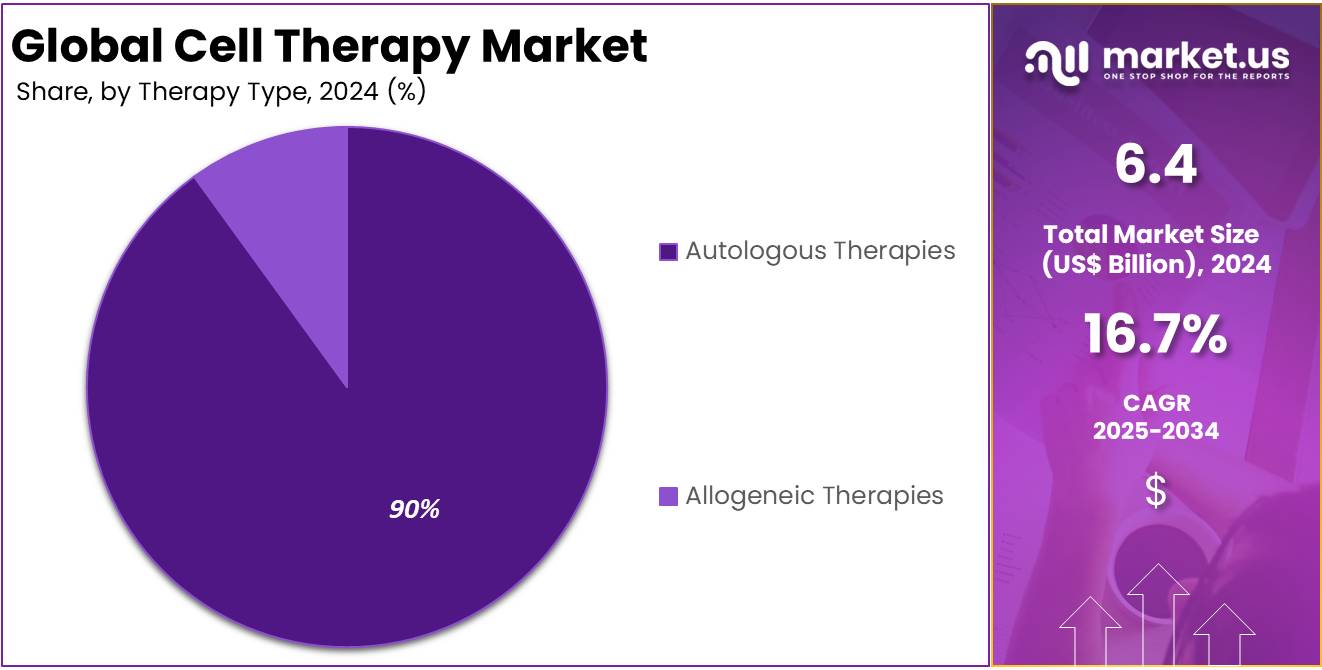

- In 2024, the autologous therapies segment took the lead in the global market, securing 90.0% of the total revenue share.

- The oncology segment took the lead in the global market, securing 38.2% of the total revenue share.

- North America maintained its leading position in the global market with a share of over 53.1% of the total revenue.

Therapy Type Analysis

Based on therapy type the market is fragmented into autologous therapies and allogeneic therapies. Amongst these, autologous therapies segment dominated the global cell therapy market capturing a significant market share of 90.0% in 2024. Allogeneic cell therapies involve using cells from a donor to treat a recipient, a method that has the potential to revolutionize the treatment of a variety of diseases.

These therapies utilize the cells’ natural abilities to perform functions such as regeneration, immune modulation, and the replacement of defective or diseased cells. One of the most common forms of allogeneic cell therapy is bone marrow transplantation, which is widely used to treat hematological conditions like leukemia. The advantage of allogeneic therapies is the ability to create a bank of cells that can be used for multiple patients, making it more scalable than autologous therapies, which require a patient’s own cells.

However, challenges include the risk of immune rejection and the need for immunosuppression in the recipient to prevent graft-versus-host disease. Allogeneic cell therapies are further classified in to stem cell-based therapies and non-stem cell-based therapies. Stem cell based allogeneic cell therapies include hematopoietic stem cell transplantation (HSCT) and mesenchymal stem cell (MSC) therapy.

While non-stem cell-based allogeneic cell therapies include keratinocytes & fibroblast-based therapies and other types of therapies like tumor-infiltrating lymphocytes (TIL) therapy, chimeric antigen receptor t-cell (CAR-T) therapy, regulatory t-cell (Treg) therapy, natural killer (NK) cell therapy, and dendritic cell (DC) therapy.

- The U.S. Food and Drug Administration (FDA) has approved a cell based product named Gintuit which is made from bovine collagen and allogeneic human cells. This product is used for the treatment of mucogingival conditions.

Cell Therapy Market, Therapy Type Analysis, 2020-2024 (US$ Billion)

Therapy Type 2020 2021 2022 2023 2024 Autologous Therapies 0.42 0.45 0.50 0.55 0.64 Allogeneic Therapies 3.94 4.24 4.61 5.07 5.75 Therapeutic Area Analysis

The market is fragmented by therapeutic area into oncology, cardiovascular disease (CVD), musculoskeletal disorders, dermatology, and others. Oncology dominated the global cell therapy market capturing a significant market share of 38.2% in 2024. Cell therapy, a ground-breaking approach in oncology, involves the modification and reintroduction of cells into the body to fight cancer. One of the most prominent methods is CAR-T cell therapy, where a patient’s T-cells are genetically engineered to express a Chimeric Antigen Receptor (CAR) that targets cancer cells.

This personalized treatment has shown remarkable success, particularly in blood cancers like leukemia and lymphoma, by enabling the immune system to recognize and destroy cancer cells more effectively. Another approach involves tumor-infiltrating lymphocytes (TILs), where immune cells naturally attacking the tumor are extracted, multiplied, and reintroduced into the patient.

Cell therapy represents a significant shift from traditional treatments like chemotherapy and radiation, offering a more targeted and potentially less toxic alternative. Its application is rapidly expanding, with research delving into solid tumors and the development of off-the-shelf allogeneic therapies, which could make this personalized treatment more accessible and cost-effective for a broader range of cancer patients.

Cell Therapy Market, Therapeutic Area Analysis, 2020-2024 (US$ Billion)

Therapeutic Area 2020 2021 2022 2023 2024 Oncology 1.58 1.71 1.88 2.11 2.44 Cardiovascular Disease (CVD) 0.36 0.39 0.42 0.45 0.51 Musculoskeletal Disorders 0.74 0.80 0.88 0.97 1.11 Dermatology 0.45 0.49 0.53 0.58 0.66 Others 1.24 1.31 1.40 1.51 1.66 Key Segments Analysis

By Therapy Type

- Autologous Therapies

- Stem Cell Therapies

- BM, Blood, & Umbilical Cord-derived Stem Cells

- Adipose derived cells

- Others

- Non-Stem Cell Therapies

- T-Cell Therapies

- CAR T Cell Therapy

- T Cell Receptor (TCR)-based

- Others

- Stem Cell Therapies

- Allogeneic Therapies

- Stem Cell Therapies

- Hematopoietic Stem Cell Therapies

- Mesenchymal Stem Cell Therapies

- Non-Stem Cell Therapies

- Keratinocytes & Fibroblast-based Therapies

- Others

- Stem Cell Therapies

By Therapeutic Area

- Oncology

- Cardiovascular Disease (CVD)

- Musculoskeletal Disorders

- Dermatology

- Others

Drivers

Rising Prevalence of Chronic Diseases and Cancer

The global cell therapy market is experiencing significant growth, driven primarily by the rising prevalence of chronic diseases and cancer. Chronic conditions such as cardiovascular diseases, autoimmune disorders, and neurodegenerative diseases are increasing worldwide, necessitating advanced and effective treatment options. Cell therapy, which leverages stem cells and immune cells to regenerate damaged tissues and enhance immune responses, has emerged as a promising solution.

Cancer, in particular, has fueled the demand for CAR-T cell therapy and stem cell-based treatments, offering personalized and targeted approaches. The growing adoption of regenerative medicine, advancements in biotechnology, and increased funding for research have further accelerated market expansion. Additionally, regulatory support and approvals for innovative therapies are enabling faster commercialization. As the global disease burden continues to rise, cell therapy is gaining traction as a transformative treatment option, driving substantial investments and fostering ongoing research and development in the field.

- According to the World Health Organization (WHO), chronic diseases causes the death of 41 billion people worldwide.

- According to the World Cancer Research Fund International, there were approximately 18.1 billion cancer cases globally in 2020. This cases excluded non-melanoma skin cancer.

- According to the Cancer Research Institute, there were 668 active CAR T cell therapy trails around the world in 2021. This comprised 49% of the total active cell therapy trails in 2021.

Restraints

High Treatment Costs

Cell therapies, especially autologous treatments where a patient’s own cells are used, are expensive. This high cost is due to several factors, including the sophisticated technology required, personalized nature of the treatments, and extensive regulatory compliance costs. Moreover, insurance companies and national health services may not cover these therapies due to the lack of long-term data on their efficacy and cost-effectiveness, further limiting patient access.

The high cost of cell therapies not only affects individual access but also has broader implications for healthcare systems and their ability to adopt and integrate these innovative treatments into standard care practices.

- As per industry players, stem cell therapy costs range between US$ 5,000 – 50,000.

Opportunities

Technological Innovations in Manufacturing and Scaling

The global cell therapy market is witnessing rapid expansion, fueled by continuous technological advancements in manufacturing and scaling. Traditional cell therapy production faced challenges such as high costs, complex logistics, and scalability issues. However, innovations in automation, bioprocessing, and cryopreservation techniques are significantly enhancing efficiency, reducing costs, and making therapies more accessible.

One of the key breakthroughs is the development of automated and closed-system bioreactors, which streamline cell culture processes, minimize contamination risks, and ensure consistent product quality. 3D bioprinting and gene-editing technologies like CRISPR are further revolutionizing cell therapy by enabling precise genetic modifications and large-scale production of customized cell-based treatments.

Additionally, advances in allogeneic (off-the-shelf) cell therapies are reducing dependency on patient-derived cells, enhancing manufacturing scalability, and accelerating treatment delivery. AI-driven analytics and digital biomanufacturing are also optimizing cell expansion, potency, and viability, ensuring compliance with regulatory standards.

- In October 2022, Thermo Fisher Scientific Inc. launched a new product named ‘Gibco CTS DynaCellect Magnetic Separation System’ which is automated and closed cell isolation and bead removal system.

Impact of macroeconomic factors / Geopolitical factors

The global cell therapy market is highly influenced by macroeconomic conditions and geopolitical factors, which can either accelerate or hinder growth. Economic stability and healthcare spending play a crucial role, as strong economies enable higher investments in biotechnology research, clinical trials, and infrastructure for cell therapy production. However, during economic downturns or recessions, reduced funding and healthcare budget constraints can slow down innovation and market expansion.

Geopolitical factors such as trade wars, international sanctions, and regional conflicts disrupt global supply chains, impacting the availability of raw materials, bioprocessing equipment, and critical reagents used in cell therapy manufacturing. Dependence on specific regions for cell therapy components makes the industry vulnerable to disruptions in cross-border trade and political instability. For example, restrictions on biopharmaceutical exports or changes in regulatory policies can delay product approvals and market entry.

Additionally, government regulations and international collaborations significantly impact the market. Favorable policies, funding initiatives, and streamlined approval processes drive innovation, while restrictive regulations or inconsistent policies across regions may hinder progress.

Trends

The global cell therapy market is evolving rapidly, driven by advancements in CAR-T cell therapy, regenerative medicine, and gene editing technologies. CAR-T therapies, initially focused on cancer, are now being explored for autoimmune diseases like lupus, showcasing their potential in broader medical applications. Automation and AI-driven bioprocessing are enhancing scalability and reducing production costs, making cell therapies more accessible.

Additionally, the shift toward allogeneic (off-the-shelf) cell therapies is reducing dependence on patient-derived cells, improving treatment availability. Strategic collaborations between biotech firms and pharmaceutical giants, such as acquisitions and partnerships, are accelerating research and commercialization. Regulatory advancements are also streamlining approvals, supporting faster market entry for innovative therapies.

Furthermore, 3D bioprinting and CRISPR gene editing are driving the development of next-generation cell therapies with enhanced precision and effectiveness. These trends collectively indicate a dynamic market focused on personalized, efficient, and scalable treatment solutions for chronic diseases and cancer.

Regional Analysis

North America cell therapy market is experiencing significant growth, driven by advancements in medical research, increased prevalence of chronic diseases, and supportive regulatory environments. The United States, being the largest market in the region, plays a pivotal role, with Canada also contributing notably. The market is expanding due to factors such as favorable government policies, high healthcare spending, and a strong presence of leading pharmaceutical and biotech companies.

The U.S., in particular, is a global leader in biopharmaceutical research, playing a pivotal role in the development and commercialization of cell therapies. Cell therapies targeted to oncology are a major area of focus, with numerous companies investing in the development of CAR-T cell therapies, a ground-breaking approach in cancer treatment in the region.

Additionally, there’s increasing interest in regenerative medicine for conditions such as cardiovascular diseases and neurological disorders. The growing number of cancer cases in the region are expected to rise the demand for cell therapies especially in the field of oncology.

- According to the U.S. Centers for Disease Control and Prevention, In the United States 1,603,844 new cases of cancer were reported in 2020.

Cell Therapy Market, Region Analysis, 2020-2024 (US$ Billion)

Region 2020 2021 2022 2023 2024 North America 2.34 2.52 2.74 3.00 3.39 Europe 0.85 0.92 1.01 1.12 1.29 Asia-Pacific 0.72 0.78 0.86 0.96 1.11 Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The cell therapy market is highly competitive, with a mix of established pharmaceutical companies, biotechnology firms, and emerging start-ups driving innovation. The industry is witnessing a surge in strategic collaborations, mergers, and acquisitions as companies aim to strengthen their pipelines and expand global reach.

Research and development investments are accelerating, with a strong focus on next-generation therapies such as CAR-T, TCR-T, and stem cell-based treatments. Many companies are shifting towards allogeneic (off-the-shelf) cell therapies, reducing reliance on patient-derived cells and improving scalability. Automation, AI-driven bioprocessing, and advanced gene-editing techniques are further optimizing production and reducing costs.

Additionally, partnerships between biotech firms and academic institutions are fostering innovation in regenerative medicine and immunotherapy. Regulatory agencies are also playing a crucial role by streamlining approval pathways, enabling faster commercialization of novel therapies. The market landscape is evolving rapidly, with increasing competition and technological advancements shaping its future.

Johnson & Johnson is a global healthcare company engaged in pharmaceuticals, medical devices, and consumer health products. With a strong presence in the cell therapy market, the company focuses on regenerative medicine, immunotherapy, and oncology treatments. In addition, Novartis AG is a Swiss-based multinational pharmaceutical company known for its leadership in oncology, gene therapy, and regenerative medicine. A pioneer in CAR-T cell therapy, Novartis has been instrumental in developing groundbreaking immunotherapies for cancer treatment.

Top Key Players in the Cell Therapy Market

- CORESTEMCHEMON Inc.

- Dendreon Corp.

- Johnson & Johnson

- Novartis AG

- Bristol-Myers Squibb Company

- Takeda Pharmaceutical Company

- Gilead Sciences Inc.

- JCR Pharmaceuticals Co. Ltd.

- Atara Biotherapeutics

- Tego Science

Recent Developments

- In February 2023, Pierre Fabre and Atara Biotherapeutics, Inc. announced the transfer of the European Commission (EC) marketing authorization (MA) for EBVALLO™ (tabelecleucel) for patients with relapsed or refractory Epstein‑Barr virus positive post‑transplant lymphoproliferative disease (EBV+ PTLD) from Atara to Pierre Fabre. Pierre Fabre will lead all commercialization, distribution, medical and regulatory activities in Europe, Middle East, Africa and other selected markets.

- In November 2023, Tego Science has successfully demonstrated efficacy in a phase 3 clinical trial of its cell therapy for under-eye wrinkles, fulfilling the conditions for a full license. Rosmir is a self-derived cell therapy indicated for moderate to severe nasojugal grooves.

- In June 2021, Dendreon Pharmaceuticals has established and invested in its new contract manufacturing and services division to bring late-stage clinical assets through to commercialization. Leveraging its extensive manufacturing, process development and logistics expertise, Dendreon now offers end-to-end manufacturing of complex cell therapies and patient logistics for partner programs.

Report Scope

Report Features Description Market Value (2024) US$ 6.4 billion Forecast Revenue (2034) US$ 30.6 billion CAGR (2025-2034) 16.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Therapy Type (Autologous Therapies and Allogeneic Therapies), By Therapeutic Area (Oncology Cardiovascular Disease (CVD), Musculoskeletal Disorders, Dermatology, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape CORESTEMCHEMON Inc., Dendreon Corp., Johnson & Johnson, Novartis AG, Bristol-Myers Squibb Company, Takeda Pharmaceutical Company, Gilead Sciences, Inc., JCR Pharmaceuticals Co., Ltd., Atara Biotherapeutics, and Tego Science Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- CORESTEMCHEMON Inc.

- Dendreon Corp.

- Johnson & Johnson

- Novartis AG

- Bristol-Myers Squibb Company

- Takeda Pharmaceutical Company

- Gilead Sciences Inc.

- JCR Pharmaceuticals Co. Ltd.

- Atara Biotherapeutics

- Tego Science