Global Cell Dissociation Market, By Product (Enzymatic Dissociation, Non-Enzymatic Dissociation, and Instruments & Accessories), By Dissociation (Tissue Dissociation and Cell Detachment), By End-User (Biotechnology Companies, Pharmaceutical Companies, Academic Institutes and Research Institutes, and Other End-Users), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: July 2024

- Report ID: 99987

- Number of Pages: 366

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

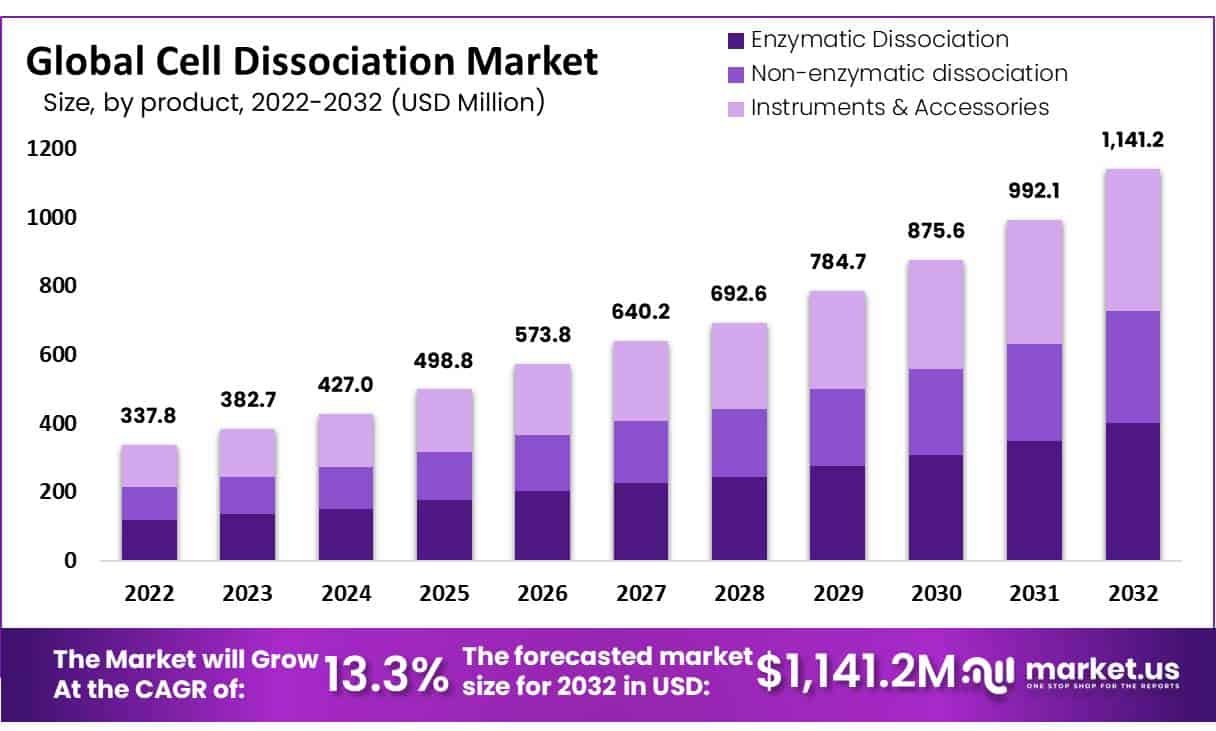

In 2023, the Global Cell Dissociation Market was valued at USD 382.7 Million and is expected to grow to USD 1141.2 Million in 2032. Between 2023 and 2032, this market is estimated to register a CAGR of 13.3%.

Trypsinization is another name for the process of cell dissociation. It involves a proteolytic enzyme to help break down protein to separate adherent cells from the cell culture vessel. For the cells to be further consumed, this breakdown is required. To boost cell viability and isolation effectiveness, cell dissociation reagents can perform collagenolytic and proteolytic activities to release the cell tissues and lines from the container’s glass and plastic surfaces.

The type of tissue in the culture media is taken into consideration while choosing the cell dissociation agent. The global industry is expanding rapidly, with a wide range of products available to help pharmaceutical companies, researchers, and clinicians in their efforts to study, utilize cells, and manipulate them.

The increase in the need for individualized medications, the yearly approval of new production facilities for cell therapies under cGMP standards, and the expanding usage of cell dissociation products in mammalian cell culture to produce recombinant treatments are key market-driving factors.

Key Takeaways

- The cell dissociation market is predicted to reach USD 1,141.2 million by 2032.

- The market was valued at USD 337.8 million in 2022.

- The market is expected to grow at a CAGR of 13.3% from 2023 to 2032.

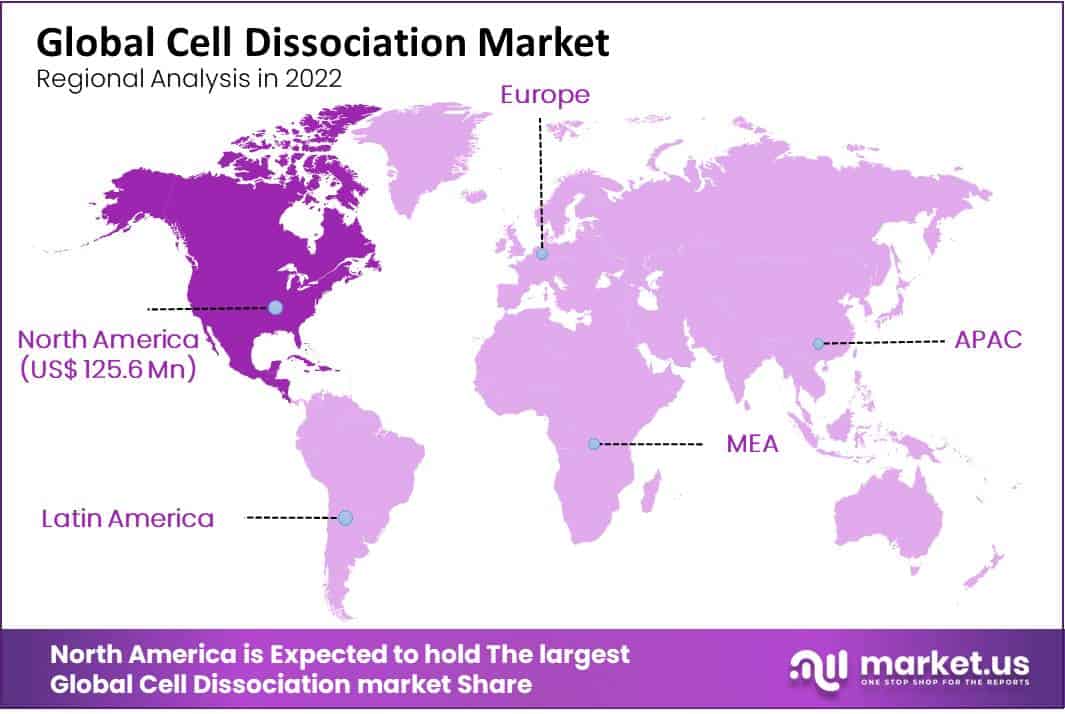

- North America had the highest market share in 2022, with 37.20%.

- The enzymatic dissociation segment dominated the market in 2022 by-products.

- In 2022, tissue dissociation accounted for the largest market share in dissociation type.

- The connective tissues segment held the largest market share by tissue type in 2022.

- Pharmaceutical and biotechnology companies had the highest market share in the end-user segment in 2022.

- Technological advancements are major drivers for market growth.

- The high cost of products can be a restraint to the market.

- Increased government investments and rising medical conditions influenced North America’s market domination in 2022.

- The Asia Pacific region is predicted to grow rapidly in the coming years.

- Immuneel Therapeutics received USD 15 million for research in June 2022.

- By the end of 2022, pharmaceutical and biotechnology companies had about 71.60% revenue share in the market.

- In 2022, the tissue dissociation type accounted for a 57% revenue share.

Product Analysis

Based on product, the market for cell dissociation is segmented into enzymatic dissociation, non-enzymatic dissociation, and instruments & accessories, in which enzymatic dissociation dominates the market. The collagenase market is primarily responsible for the enzymatic dissociation product domination.

Although there are more than 20 various types of collagenases, only a handful of them are ideal for dissociating tissues using enzymes. For tissue dissociation of the epithelial, liver, adipocyte types, and adrenal collagenase type 1 is commonly advised.

Dissociation Analysis

Based on dissociation, the market for cell dissociation is segmented into Tissue Dissociation and Cell Detachment. In 2022, the tissue dissociation type category led the global market and accounted for the highest revenue share, at 57%. This market is expected to rise as a result of factors like the biopharmaceutical and pharmaceutical industries’ increased focus on the creation of monoclonal antibodies and the individualization of medical care.

Cell detachment type is predicted to develop fastest during the forecast period. One of the main reasons influencing the expansion of this segment is the rising funding for the cell culture development of new products and strategic actions taken by important industry players.

Tissue Analysis

Based on tissue, the market for cell dissociation is segmented into connective tissues, epithelial tissues, and other tissues. In 2022, connective tissues led the global market and accounted for the highest revenue share. The connective tissues support, bind, and shield other tissues and organs in the body.

Connective tissues are composed of various types of cells, including fibroblasts, adipocytes, chondrocytes, osteoblasts, and macrophages. Products for cell dissociation are frequently used to separate and examine cells from connective tissues.

End-User Analysis

Based on end-user, the market for cell dissociation is segmented into biotechnology companies, pharmaceutical companies, academic institutes, and research institutes. In 2022, the pharmaceutical and biotechnology firm’s segment led the market and was responsible for the highest revenue share of more than 71.60%.

Over the forecast period, the sector is anticipated to continue growing at the fastest rate while keeping its dominant position in the worldwide market.

Key Market Segments

Based on Product

- Enzymatic Dissociation

- Trypsin

- Collagenase

- Elastase

- Papain

- Hyaluronidase

- DNase

- Others

- Non-enzymatic dissociation

- Instruments & Accessories

Based on Dissociation

- Tissue Dissociation

- Cell Detachment

Based on Tissue

- Connective Tissues

- Epithelial Tissues

- Other Tissues

Based on End-User

- Biotechnology Companies

- Pharmaceutical Companies

- Academic Institutes

- Research Institutes

- Other End-Users

Driving Factors

Technical developments in dissociation products

The development of new and improved dissociation products, such as enzymes and buffers, is driving the market for cell dissociation products. Better outcomes are obtained in cell-based applications as a result of these products becoming more dependable, efficient, and focused.

Growing demand for cell-based therapies

The rising incidence of chronic diseases like cancer and autoimmune diseases is driving the demand for cell-based therapies. The separation and growth of cells for these therapies involve the crucial stage of cell dissociation.

Technological Advancements

Technological improvements in cell dissociation techniques, such as enzymatic and non-enzymatic approaches, have made the process more efficient and productive. This has led to increased adoption of cell dissociation techniques in research and drug development, further driving the market growth.

Restraining Factors

Dissociation products may be subject to regulatory limitations if they are used in research involving animal or human tissues due to ethical considerations. Certain dissociation procedures can be intricate and time-consuming, requiring a great deal of knowledge and skill to execute effectively. The use of dissociation products in research or therapeutic applications may be constrained due to the scarcity of specific tissues and cell types.

High cost of cell dissociation reagents and equipment

For smaller research institutions and laboratories, the cost of cell dissociation reagents and equipment can be a substantial impediment to the adoption of these technologies.

Lack of Awareness and Understanding About Cell Dissociation Techniques

Many researchers may not be aware of the advantages or how to use cell dissociation, which can limit its adoption correctly.

Regulatory barriers

Cell dissociation techniques may be subject to regulatory requirements, particularly if they are utilized in clinical applications. This can increase the time and cost of bringing new products to market.

Growth Opportunities

The cell dissociation market offers considerable potential growth. The expanding demand for cell-based assays and biopharmaceuticals is one of the major drivers of the cell dissociation market. Cell-based assays are commonly applied in drug discovery and development, and their utilization is expected to grow as the focus of specific treatments. The escalating use of automation and robotics in cell culture and tissue engineering applications is also fueling demand for cell dissociation products.

The increasing adoption of stem cell research, tissue engineering, and regenerative medicine is another reason for the rapid expansion of the cell dissociation market. These applications require efficient cell dissociation, so there is a growing demand for high-quality cell dissociation products.

Trending Factors

The market for cell dissociation is expanding quickly as a result of the growing need for cell-based tests and biopharmaceuticals. Enzymes, antibodies, and equipment comprise most of the market-available products for cell dissociation. The increased demand for stem cell research in recent years has led to an increase in the use of cell dissociation products.

Moreover, the growth of personalized medicine and the need for more targeted treatments have increased the need for cell-based assays, which necessitate efficient cell dissociation.

Regional Analysis

In 2022, North America dominated the cell dissociation market, accounting for the highest revenue share of more than 37.20%. The rise in government investment programs and the rise in the prevalence of chronic diseases like cancer can all be credited to the region’s high population density.

The market growth possibilities are expanding due to the rising incidence of chronic and infectious diseases and the growing emphasis on cell-based treatments. The Asia Pacific region is anticipated to grow fastest throughout the forecast period due to the rising need for new therapies.

Rising government R&D spending and expanding infrastructure are a few key factors propelling the regional market’s progress. A number of local businesses are also receiving financing to assist them in finding a cure for a number of chronic ailments, including cancer.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Major players are using various techniques, such as brand-new product releases, partnerships, collaborations, mergers & acquisitions, and geographic expansions, to increase their market presence. S2 Genomics, for instance, introduced the Singulator 100 System in February 2020.

The System automates the conversion of solid tissue samples into high-yielding suspensions of nuclei or single cells from tiny samples for a wide range of single-cell biology and genomic investigations.

The device standardizes the process for separating solid tissues, enabling researchers to generate suspensions of high-quality, highly viable nuclei or cells with minimal variation over time.

Listed below are some of the most prominent cell dissociation industry players.

Market Key Players

- Merck KGaA

- Thermo Fisher Scientific

- Danaher Corp.

- Stemcell Technologies

- Sartorius AG

- BD

- Miltenyi Biotec

- PAN-Biotech

- HiMedia Laboratories

- Hoffmann-La Roche Ltd.

- S2 Genomics, Inc.

- Other Key Players

Recent Developments

- Merck KGaA (January 2024): Merck KGaA acquired Promega Corporation to enhance its cell dissociation portfolio. This acquisition aims to integrate Promega’s advanced enzymatic dissociation technologies with Merck’s existing product line, improving the efficiency and reliability of cell culture processes.

- Thermo Fisher Scientific (March 2024): Thermo Fisher Scientific launched the Gibco TrypLE Express Enzyme, a recombinant enzyme for cell dissociation. This product is designed to provide a safer, more efficient alternative to traditional trypsin, facilitating improved cell culture outcomes.

- Danaher Corp. (February 2024): Danaher Corp. acquired Cytiva in February 2024, aiming to bolster its cell dissociation capabilities. Cytiva’s expertise in cell processing technologies complements Danaher’s existing portfolio, enhancing its offerings in biopharmaceutical manufacturing.

- Stemcell Technologies (April 2024): Stemcell Technologies introduced the EasySep Releasable Cell Dissociation Kit in April 2024. This innovative product allows for gentle and efficient cell dissociation, preserving cell viability and functionality, and is ideal for downstream applications.

- Sartorius AG (March 2024): Sartorius AG acquired a majority stake in CellGenix, a provider of high-quality cell dissociation reagents. This strategic move is expected to enhance Sartorius’s product offerings in the cell culture market and expand its global footprint.

- Miltenyi Biotec (January 2024): Miltenyi Biotec announced a merger with SynGen Inc. in January 2024. This merger is expected to combine SynGen’s innovative cell processing technologies with Miltenyi’s expertise in magnetic cell separation, enhancing their cell dissociation and processing capabilities.

Report Scope

Report Features Description Market Value (2023) USD 382.7 Million Forecast Revenue (2033) USD 1,141.2 Million CAGR (2024-2033) 13.3% Base Year for Estimation 2022 Historic Period 2016-2021 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Enzymatic Dissociation, Trypsin, Collagenase, Elastase, Papain, Hyaluronidase, DNase, and Other products; Non-enzymatic dissociation and Instruments and accessories) By Dissociation (Tissue Dissociation and Cell Detachment) By Tissue (Connective Tissues, Epithelial Tissues, and Other Tissues) By End-User (Biotechnology Companies, Pharmaceutical Companies, Academic Institutes, Research Institutes, and Other End-Users) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Merck KGaA, Thermo Fisher Scientific, Danaher Corp., Stemcell Technologies, Sartorius AG, BD, Miltenyi Biotec, PAN-Biotech, HiMedia Laboratories, F. Hoffmann-La Roche Ltd., S2 Genomics, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the cell dissociation market?The cell dissociation market encompasses products and technologies used to separate adherent cells from culture surfaces or from each other. This process is essential for cell analysis, culture, and bioprocessing.

How big is the Cell Dissociation Market?The global Cell Dissociation Market size was estimated at USD 382.7 Million in 2023 and is expected to reach USD 1141.2 Million in 2032.

What is the Cell Dissociation Market growth?The global Cell Dissociation Market is expected to grow at a compound annual growth rate of 13.3%. From 2023 To 2032

Who are the key companies/players in the Cell Dissociation Market?Some of the key players in the Cell Dissociation Markets are Merck KGaA, Thermo Fisher Scientific, Danaher Corp., Stemcell Technologies, Sartorius AG, BD, Miltenyi Biotec, PAN-Biotech, HiMedia Laboratories, F. Hoffmann-La Roche Ltd., S2 Genomics, Inc.

Which industries utilize cell dissociation technologies?Industries such as biotechnology, pharmaceuticals, academic research, and clinical diagnostics utilize cell dissociation technologies for applications in cell culture, regenerative medicine, and drug development.

What recent developments have occurred in the cell dissociation market?Recent developments include acquisitions and new product launches by key companies. For instance, Merck KGaA acquired Promega Corporation in January 2024, and Thermo Fisher Scientific launched the Gibco TrypLE Express Enzyme in March 2024.

What factors drive the growth of the cell dissociation market?Factors driving market growth include increasing research activities in cell biology, advancements in cell culture techniques, and the rising demand for biopharmaceuticals. Additionally, technological innovations and strategic acquisitions enhance market offerings.

What challenges face the cell dissociation market?Challenges include the high cost of advanced dissociation reagents and technologies, variability in cell dissociation outcomes, and the need for skilled personnel to handle complex cell culture processes.

-

-

- Merck KGaA

- Thermo Fisher Scientific

- Danaher Corp.

- Stemcell Technologies

- Sartorius AG

- BD

- Miltenyi Biotec

- PAN-Biotech

- HiMedia Laboratories

- Hoffmann-La Roche Ltd.

- S2 Genomics, Inc.

- Other Key Players