Global CBD Water Market By Type (Industrial Hemp-Derived and Medical Marijuana-Derived), By Source (Marijuana, Hemp, and Others), By Grade (Pharmaceutical Grade, and Food Grade), By Distribution Channel (Online and Offline), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Aug 2024

- Report ID: 73729

- Number of Pages: 366

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

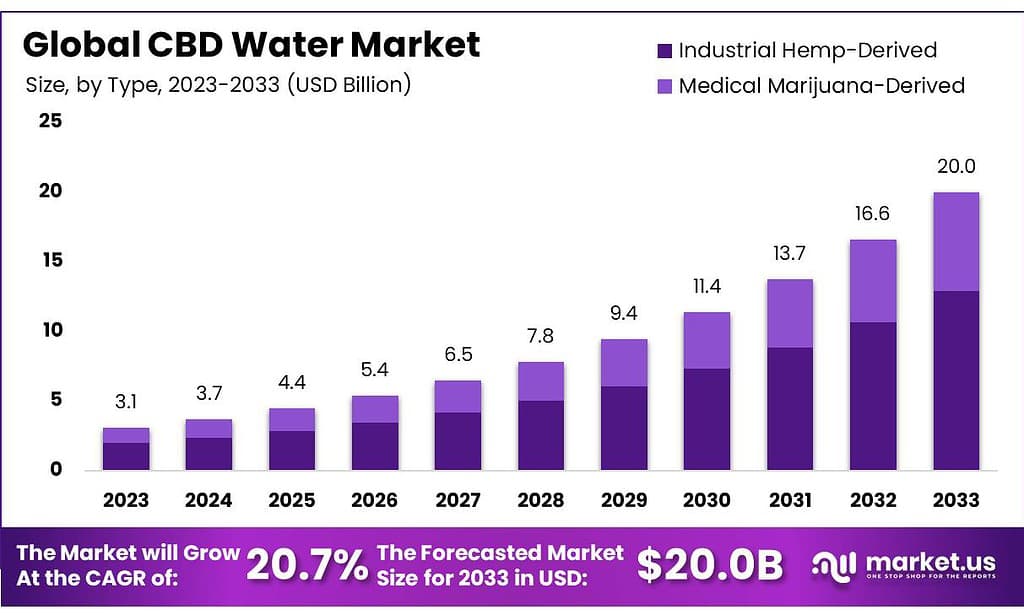

The Global CBD Water Market size is expected to be worth around USD 20.02 billion by 2033 from USD 3.05 billion in 2023, growing at a CAGR of 20.7% during the forecast period 2024 to 2033.

CBD water is a drinking water, infused with a non-psychoactive compound called cannabidiol (CBD). It is a versatile compound extracted from hemp flowers. It is extracted from cannabis or hemp buds. CBD-infused water has several health benefits.

It reduces gut inflammation and improves hunger and digestion. It naturally triggers relaxation by activating the parasympathetic nervous system which is responsible for naturally improving relaxation in our body. Therefore, CBD water effectively treats mental health issues such as anxiety, stress, and depression. It also improves sleep quality and helps deal with insomnia naturally.

The increasing consumer interest in functional food & beverages and the growing consumer shift toward health & well-being is expected to drive the global CBD water market during the forecast period. CBD water has multifaceted benefits in targeting different areas of our health. It has medicinal properties that help regulate mood, increase appetite, and relieve pain in muscles.

It is hence finding its applications in food & beverages, healthcare, pharmaceuticals, and cosmetics industries. To increase product sales, manufacturers are using several strategies to make maximum customers aware of the product. Some of the significant advantages of CBD water consumption include deep hydration and that it promotes overall well-being among consumers.

Consuming CBD in water is more effective than consuming it in the form of pills, vapes, or oils, as water is quickly absorbed by our bodies. The growing awareness regarding therapeutic uses of CBD is projected to create immense opportunities for the market.

Key Takeaways

- In 2023, the global CBD water market generated a revenue of USD 05 billion, with a CAGR of 20.7%, and is expected to reach USD 20.02 billion by the year 2033.

- The type segment held a major share of the market, with the industrial hemp-derived segment taking the lead in 2023 with a market share of 3%.

- By source, the hemp segment accounted for a significant share of 4%.

- By grade, the food grade segment among the other sub-segments held a significant revenue share of the market with 4% of the global CBD water market.

- By distribution channel, the online segment accounted for the dominant share of 6%.

- North America led the market by securing a market share of 5% in 2023.

By Type Analysis

Based on type, the market is divided into industrial hemp-derived and medical marijuana-derived. The industrial hemp-derived segment held a dominant share of 64.3% in 2023, owing to the increasing applications of industrial hemp-derived CBD water in several end-user industries. The product is used in personal care products, functional beverages, textiles, construction materials, and other pharmaceutical applications.

It is also used in various agricultural applications and to improve soil quality. The hemp-derived CBD water benefits the environment by enriching the agricultural soil with essential nutrition, soil remediation, and carbon sequestration which significantly improves overall soil health. Research and development studies are being conducted on industrial hemp to identify its gene sequences to eliminate unwanted characteristics of the plant.

Genetic modification can make this plant grow in weather conditions, dissimilar to subtropical and tropical climates. This is expected to help manufacturers all over the world gain considerable yield keeping higher profit margins.

Additionally, the research studies being conducted for extracting CBD with the absence of non-psychoactive stimulants such as THC are projected to drive the segment in the coming years. For instance, according to the data published by Cornell University on February 17, 2022, the production of floral hemp in the US grew in 2021, with about 1,235 pounds per acre yield taken with about 19.7 million pounds of profit.

By Source Analysis

Based on the source, the market is segmented into marijuana, hemp, and others. Among these, the hemp segment held a significant share of 65.4% due to the surging awareness regarding CBD beverages. Consumers are increasingly becoming aware of the health benefits of moderate consumption of CBD.

CBD-infused water is considered the healthiest form of CBD-infused beverages. Hemp-based products have been recently getting traction owing to the growing popularity of hemp as a versatile ingredient.

Hemp-derived products such as textiles, accessories, footwear, and food & beverages are eco-friendly, biodegradable, and sustainable. The increasing global shift toward environment-friendly consumer goods and consumables is fuelling the segment.

The players in the market are constantly focused on producing high-quality CBD water which is derived from organically and naturally grown hemp produce. They use advanced farming techniques such as hydroponics, vertical farming, and others to get maximum yield in a limited area.

They also provide these plants with high-quality natural fertilizers and nutrition which helps them retain the highest nutritional value in the hemp crops, which in turn drives the segment.

By Grade Analysis

The global CBD water market is segmented based on food grade into pharmaceutical grade and food grade. The food-grade segment held the largest share of the market at 65.4%, owing to the growing demand for functional beverages, worldwide. Functional beverages are non-alcoholic drinks that provide additional nutritional benefits to the consumer.

These drinks are infused with bioactive ingredients sourced from different sources. The rising convenience of gaining regulatory approval for CBD products is also expected to contribute to the growth of this segment.

The world food regulatory bodies encourage manufacturers to accurately label the products to let consumers be aware of the product ingredients. CBD is permitted to be infused below a certain percentage in the water so it is only used for its medicinal benefits.

For instance, on January 8, 2021, the US FDA suggested mindful purchase and regulated manufacture of cannabis products, as about 40% of adverse event reports have registered the consumers’ unintentional exposure to delta-8 THC, and about 82% of these unintentional exposures affected pediatric patients. The increasing transparency from CBD water manufacturers regarding the CBD water contents is expected to further bolster the segment during the forecast period.

By Distribution Channel Analysis

Based on the distribution channel, the market is segmented into online and offline. Among these, the online segment held a significant share of 58.6% due to the rapid expansion of the e-commerce sector in the food & beverages sector. This is mainly attributed to the increasing consumer trust in online shopping and the rising influence of social media.

Currently, food bloggers and food explorers on social media sites attract a majority of consumers for businesses. These influencers compel customers to try new food products launched in the market through informative multimedia content. They collaborate with various brands to reach maximum customers, educate them, and offer them discounted prices for special online purchases.

Ever since the advent of the COVID-19 pandemic, customers have started relying heavily on digital platforms to purchase everyday essentials including groceries. The manufacturer’s e-commerce sites and grocery mobile applications have gained consumers’ trust in the past decade. This digitalization of the food and beverages industry has not only simplified the shopping experience for consumers but also has worked in the manufacturer’s favor in terms of profit margins.

The consumers browse through a range of CBD- products at their fingertips, order, and get the product delivered to their doorstep. The online retailers also run various marketing campaigns to convey appropriate product information to consumers. This makes a majority of consumers aware of CBD water, thereby educating them regarding the product’s benefits.

Additionally, efficient supply chain networks, growing consumer access to the product, and convenient way of product purchase are expected to further fuel this segment in the coming years. For instance, according to the Annual Report published by the online retail giant Walmart, on August 16, 2024, registered about 6% growth in overall online sales, with about 16% growth in overall e-commerce revenue in the past 10 quarters.

Key Market Segments

By Type

- Industrial Hemp-Derived

- Medical Marijuana-Derived

By Source

- Marijuana

- Hemp

- Others

By Grade

- Pharmaceutical Grade

- Food Grade

By Distribution Channel

- Online

- Offline

Drivers

The increasing popularity of CBD-infused beverages drives the market.

CBD-infused drinks or CBD water retain the unique taste of its source and appeal to some consumers as a refreshing drink. Consumers are increasingly seeking specialty beverages that are infused with active ingredients, to boost metabolism, improve digestive health, and apatite while fulfilling other nutritional requirements.

Additionally, the rising popularity of healthy packaged drinks is gaining market traction due to the increasing consumer preference toward convenience foods & beverages. This is mainly due to the changing consumer lifestyles and fast-paced work environments.

This encourages the players to package, market, and display their products in unique ways to appeal to the consumers. CBD extracts are also available in different percentages in the CBD water of different brands which is likely to appeal to different sets of consumers.

Furthermore, the players are innovating a newer range of active ingredients of functional ingredients to the CBD water to bring out unique flavors to attract new customers who are looking for functional beverages in diverse flavors. The rising adoption of on-the-go beverage consumption is projected to fuel the segment in the coming years.

Restraints

Challenges to clear several regulatory hurdles hamper the market.

Manufacturers of CBD water require clear guidelines by global governing bodies such as the US FDA and USDA which are yet to arrive. This has created uncertainty among consumers regarding quality determining parameters of the packaged product available in the market.

This is mainly important for substances such as tetrahydrocannabinol (THC) which naturally comes in hemp-derived products in 0.3% concentration. For instance, according to the PubMed report published on March 9, 2023, CBD and THC have similar chemical structures, however, have different effects on our brain as THC is a psychoactive ingredient while CBD is antipsychotic.

This makes it crucial for manufacturers to have precise guidelines to ensure good manufacturing practices (GMP) and quality control of the end product. Every country that produces CBD is subject to have different set of guidelines and regulations to follow and trade the product which complicates the production process.

This also restrains the players from forming their brand identity referring to an individual product. The rising international regulatory differences and traditional stigma around cannabis products are likely to restrain the CBD water market in the coming years.

Opportunities

The wide scope for product innovation creates several opportunities for the market.

CBD-infused water has a wide scope for product innovation especially in deriving various spices, herbs, and flavor blends being infused with CBD water. The increasing demand from adventurous customers, who are willing to try diverse flavors in nutritional drinks is more likely to purchase different flavors of CBD water. Manufacturers can also explore the area of improving the bioavailability, convenience, and taste of CBD water to enhance its mouthfeel.

Furthermore, the increasing demand for convenience foods & beverages drives the market as the world is facing a rapid expansion of the urban population. This has further led to a majority of people working in fast-paced environments which altered their food habits. Consumers are currently shifting toward convenience foods & beverages.

The growing awareness about healthy lifestyles has consequently surged the demand for healthy, ready-to-drink beverages. This is likely to attract more fitness-conscious consumers toward the product which is expected to further boost the market in the coming years.

Latest Trends

Increasing demand for natural and organic beverages.

The increasing demand for organic and natural foods & beverages is mainly attributed to the growing consumer awareness regarding the harmful effects of non-organic beverage consumption. These beverages are loaded with artificial colors, preservatives, and chemical stabilizers which cause harm to several vital organs in the long run. These products are subject to cause kidney damage, fatty liver, obesity, and type 2 diabetes when consumed frequently.

The organic beverages contain high-quality natural and organic source ingredients. As consumers become more health-conscious and environmentally aware, they seek beverages that are not only refreshing but also align with their values. CBD water, being a natural and organic product, is perfectly positioned to capitalize on this trend.

The demand for natural and organic beverages is expected to continue growing with more consumers demanding products that are free from any artificial ingredients and preservatives. This is expected to create profitable projections for the market during the forecast period.

Geopolitical Impact Analysis

Changing geopolitical relations among various nations worldwide exert a significant influence on the global CBD water market. Trade tensions and tariffs increase the costs and hamper the international trade. However, some country’s favorable regulations and support for hemp preparation for hemp growth can create new opportunities.

The 2020 US-China trade war has increased tariffs on Chinese hemp imports, which is benefitting local US CBD water manufacturers. On the other hand, Canada’s legalization of cannabis has created a thriving CBD market with CBD water being a popular product.

The EU’s novel food regulations have created a barrier for CBD products while encouraging innovation within the boundary of compliance. The 2020 Brexit (Britain’s exit from the UK government), caused uncertainty but the UK’s market continues to expand despite that. Overall, the geopolitical factors present both, challenges and opportunities for the market.

Regional Analysis

North America is leading the global CBD water Market

North America dominated the market with the largest revenue of 1.17 billion, commanding a share of 37.5% owing to the growing acknowledgment of the CBD’s potential health benefits, worldwide. CBD-infused beverages are particularly gaining traction among Gen Z and the millennial population.

CBD helps in relaxation and pain relief. The market is projected to expand as more key players enter the space and existing players innovate and expand their product lines. Growing distribution channels including online sales and retailers, are set to make CBD water more accessible to consumers.

Furthermore, favorable regulations and decreasing stigma around CBD are projected to create lucrative prospects for the market. Consumer preferences are shifting toward clean-label food products which is subject to bolster the market. Increasing availability of the product in gyms, yoga studios, fitness centers, and health food stores is another factor contributing to the market growth.

New product developments such as flavored and functional CBD waters are expected to attract a wider consumer base. Additionally, the increasing advancements in marketing gimmicks to educate customers are projected to duel the market in the coming years, in the region.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The major players in the global CBD water market are continuously investing in innovation and expansion. They execute several strategies to dominate the competitive ground. CBD Biotechnology Co. Ltd, Cannabiniers, General Cannabis, K-Zen Beverages Inc., and Canopy Growth Corporation are some of the significant players known for diversified CBD water production and supply chain networks.

These key players along with other industry participants collectively influence the global CBD water market’s growth, supply, and demand dynamics.

Top Key Players

- Alkaline88, LLC

- Aphria Inc.

- Aurora Cannabis

- Cannabiniers

- CANNABIS SATIVA, INC

- Canopy Growth Corporation

- CBD Biotechnology Co. Ltd

- CBD Naturals

- CHARLOTTE’S WEB

- CV Sciences, Inc.

- Daytrip Beverages

- ENDOCA

- G&Juice

- Gaia Botanicals, LLC

- General Cannabis

- HempMeds

- Honeydrop Beverages

- Karma Water

- Koios Beverage Corp.

- K-Zen Beverages Inc.

- Lagunitas Brewing Company

- Mary’s Medicinals

- NewAge Inc.

- Phivida Holdings Inc.

- Puration

- Sprig

- TertraLabs

- Tilray

- UbU Sparkling Beverages

- Other Key Players

Recent Developments

- In September 2023, Cape Sativa, a subsidiary of 3Sixty Global Solutions Group, launched eQuivex CBD water, in 5+ unique flavors. The company aims to explore the benefits of CBD consumption and is the first to release 100% water-soluble cannabidiol water.

- On April 6, 2023, SAPPE announced the launch of its new functional drink ‘SAPPE Keaf’, a CBD water brand in two distinct flavors. The two flavors consist of vitamin B complex (B3, B5, B6, and B12), which has been induced to improve brain function.

- On October 4, 2021, Karma Water announced the launch of a wide range of CBD water flavors and revolutionized the Karma Wellness & probiotic waters portfolio. The company is also partnering with Canopy Growth to leverage its premium quality CBD.

Report Scope

Report Features Description Market Value (2023) $ 3.05 billion Forecast Revenue (2033) $ 20.02 billion CAGR (2024-2033) 20.7% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Industrial Hemp-Derived and Medical Marijuana-Derived), By Source (Marijuana, Hemp, and Others), By Grade (Pharmaceutical Grade, and Food Grade), By Distribution Channel (Online and Offline) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Alkaline88, LLC, Aphria Inc., Aurora Cannabis, Cannabiniers, CANNABIS SATIVA, INC., Canopy Growth Corporation, CBD Biotechnology Co. Ltd, CBD Naturals, CHARLOTTE’S WEB, CV Sciences, Inc., Daytrip Beverages, ENDOCA, G&Juice, Gaia Botanicals, LLC, General Cannabis, HempMeds, Honeydrop Beverages, Karma Water, Koios Beverage Corp., K-Zen Beverages Inc., Lagunitas Brewing Company, Mary’s Medicinals, NewAge Inc., Phivida Holdings Inc., Puration, Sprig, TertraLabs, Tilray, UbU Sparkling Beverages, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the Size of CBD Water Market?CBD Water Market size is expected to be worth around USD 20.02 billion by 2033 from USD 3.05 billion in 2023

What is the CAGR for the CBD Water Market?The CBD Water Market is expected to grow at a CAGR of 20.7% during 2024-2033.Name the major industry players in the CBD Water Market?Alkaline88, LLC, Aphria Inc., Aurora Cannabis, Cannabiniers, CANNABIS SATIVA, INC., Canopy Growth Corporation, CBD Biotechnology Co. Ltd, CBD Naturals, CHARLOTTE’S WEB, CV Sciences, Inc., Daytrip Beverages, ENDOCA, G&Juice, Gaia Botanicals, LLC, General Cannabis, HempMeds, Honeydrop Beverages, Karma Water, Koios Beverage Corp., K-Zen Beverages Inc., Lagunitas Brewing Company, Mary's Medicinals, NewAge Inc., Phivida Holdings Inc., Puration, Sprig, TertraLabs, Tilray, UbU Sparkling Beverages, Other Key Players

-

-

- Alkaline88, LLC

- Aphria Inc.

- Aurora Cannabis

- Cannabiniers

- CANNABIS SATIVA, INC

- Canopy Growth Corporation

- CBD Biotechnology Co. Ltd

- CBD Naturals

- CHARLOTTE’S WEB

- CV Sciences, Inc.

- Daytrip Beverages

- ENDOCA

- G&Juice

- Gaia Botanicals, LLC

- General Cannabis

- HempMeds

- Honeydrop Beverages

- Karma Water

- Koios Beverage Corp.

- K-Zen Beverages Inc.

- Lagunitas Brewing Company

- Mary's Medicinals

- NewAge Inc.

- Phivida Holdings Inc.

- Puration

- Sprig

- TertraLabs

- Tilray

- UbU Sparkling Beverages

- Other Key Players