Global CBD Nutraceuticals Market Size, Share Analysis Report By Product (CBD Tinctures, Capsules And Softgels, CBD Gummie, Others), By Application (Pain Management, Stress And Anxiety Relief, Sleep Support, Skin Health And Beauty, Others), By Distribution Channel (Retail Stores, Online, Pharmacies, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 174292

- Number of Pages: 395

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

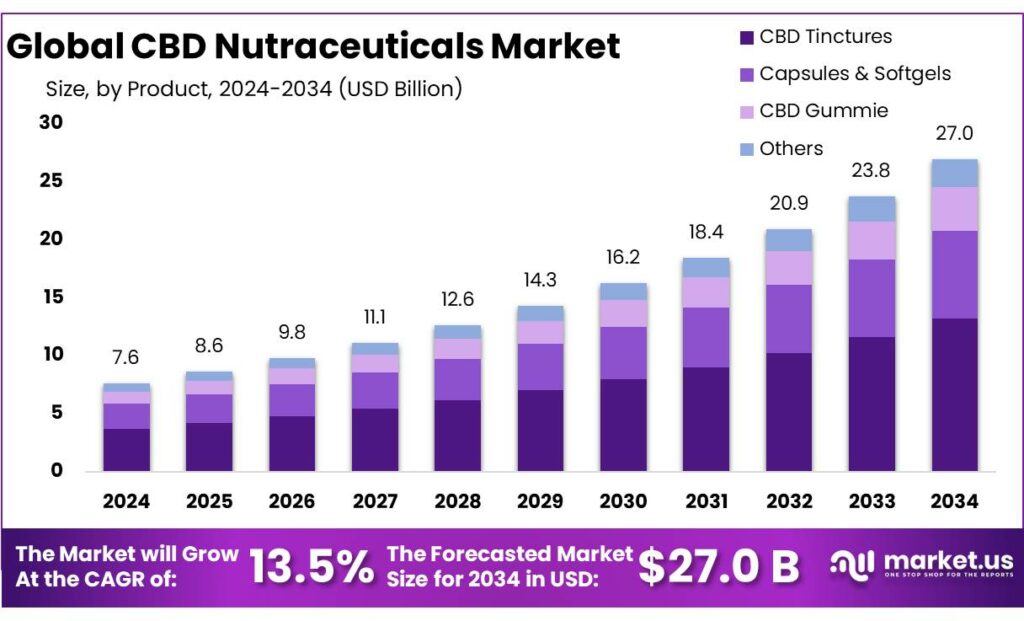

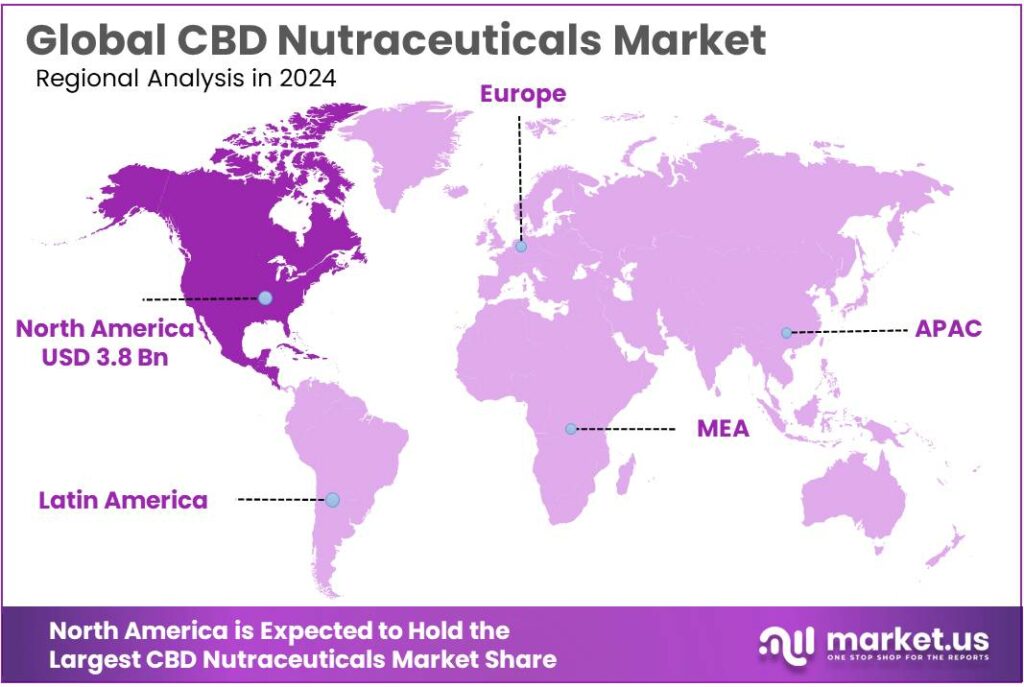

Global CBD Nutraceuticals Market size is expected to be worth around USD 27.0 Billion by 2034, from USD 7.6 Billion in 2024, growing at a CAGR of 13.5% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 51.3% share, holding USD 3.8 Billion in revenue.

CBD nutraceuticals sit at the intersection of functional wellness products and a fast-evolving hemp-derived ingredient supply chain. In simple terms, they include consumer products—most commonly tinctures, capsules, gummies, and drink mixes—positioned around everyday benefits like stress support, sleep, and recovery. In many markets, the industrial foundation is “legal hemp” as defined in the U.S. framework: hemp is cannabis containing no more than 0.3% delta-9 THC on a dry-weight basis, which enabled mainstream cultivation and ingredient commercialization.

Industrially, the CBD nutraceutical supply base is anchored in agricultural hemp output and downstream extraction/refinement. In the United States, USDA data show the 2024 value of industrial hemp production at about USD 445 million, with floral hemp in the open valued at USD 386 million, harvested across 11,827 acres and producing 20.8 million pounds. This matters for nutraceuticals because floral biomass remains a major feedstock for cannabinoid extraction, and swings in acreage, yields, and pricing can quickly change input economics for brands and contract manufacturers.

On the demand side, consumer adoption has moved beyond early adopters into broader wellness purchasing behavior. A peer-reviewed analysis reported that in 2022, 20.6% of U.S. adults used CBD in the prior 12 months, indicating a sizable addressable base for regulated, accurately labeled products. At the same time, mainstream supplement behavior is already normalized: CRN’s consumer survey reported 75% of Americans use dietary supplements, which creates a familiar retail pathway—provided CBD products can meet safety and compliance expectations.

In the UK, the Food Standards Agency has converged on a low-dose posture: a provisional acceptable daily intake (ADI) of 10 mg/day for adults (also expressed as 0.15 mg/kg body weight/day for a 70-kg adult) and a THC safe upper limit of 0.07 mg THC/day—numbers that are directly shaping serving sizes, label claims, and reformulation programs.

Regulation remains the most decisive swing factor shaping commercialization. In the U.S., the FDA has repeatedly stated that CBD is not permitted in conventional foods or marketed as a dietary supplement under existing frameworks, and it has called for a new regulatory pathway. In Europe, the sector is also constrained by novel-food scrutiny: the European Commission had received more than 150 CBD novel-food applications, with 19 under EFSA assessment as of mid-March 2022, reflecting both industry interest and the depth of the evidence bar.

Key Takeaways

- CBD Nutraceuticals Market size is expected to be worth around USD 27.0 Billion by 2034, from USD 7.6 Billion in 2024, growing at a CAGR of 13.5%.

- CBD Tinctures held a dominant market position, capturing more than a 49.5% share in the CBD Nutraceuticals Market.

- Pain Management held a dominant market position, capturing more than a 39.9% share in the CBD Nutraceuticals Market.

- Retail Stores held a dominant market position, capturing more than a 47.2% share in the CBD Nutraceuticals Market

- North America led the CBD Nutraceuticals Market with a dominant 51.3% share and a value of USD 3.8 Bn.

By Product Analysis

CBD Tinctures dominate the CBD Nutraceuticals Market with 49.5% share in 2024 due to ease of use and flexible dosing.

In 2024, CBD Tinctures held a dominant market position, capturing more than a 49.5% share in the CBD Nutraceuticals Market by Product. This strong position reflects consumer preference for products that are simple to consume and easy to adjust based on personal needs. Tinctures allow users to control intake accurately, which builds trust and repeat usage across regular wellness consumers.

By Application Analysis

Pain Management dominates the CBD Nutraceuticals Market with 39.9% share in 2024 driven by daily relief needs.

In 2024, Pain Management held a dominant market position, capturing more than a 39.9% share in the CBD Nutraceuticals Market by Application. This leadership is closely linked to rising consumer interest in plant-based wellness options for managing routine discomfort. Many users prefer CBD products for pain support because they fit easily into everyday health habits without complex usage steps.

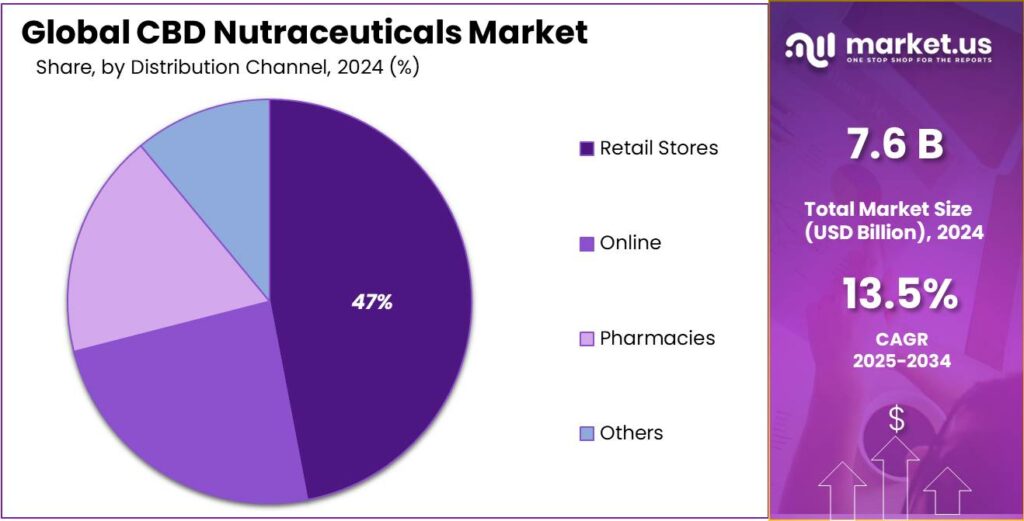

By Distribution Channel Analysis

Retail Stores dominate the CBD Nutraceuticals Market with 47.2% share in 2024 due to in-person buying confidence.

In 2024, Retail Stores held a dominant market position, capturing more than a 47.2% share in the CBD Nutraceuticals Market by Distribution Channel. This dominance reflects consumer preference for purchasing wellness products in physical outlets where product labels can be reviewed and staff guidance is available. Many buyers value face-to-face interaction when selecting CBD products, especially for first-time use.

Key Market Segments

By Product

- CBD Tinctures

- Capsules & Softgels

- CBD Gummie

- Others

By Application

- Pain Management

- Stress & Anxiety Relief

- Sleep Support

- Skin Health & Beauty

- Others

By Distribution Channel

- Retail Stores

- Online

- Pharmacies

- Others

Emerging Trends

Quality-first CBD is trending: third-party testing, cleaner labels, and “trust signals” are becoming the real differentiator

A major latest trend in CBD nutraceuticals in 2024–2025 is a shift from “new product hype” to quality and trust—because shoppers are no longer impressed by CBD alone. They want to know what’s inside the bottle, whether the dose is real, and whether the product is free from contaminants. This trend is showing up across tinctures, gummies, capsules, and even drink mixes: brands are putting more emphasis on batch testing, QR codes, clearer ingredient lists, and stricter claim language. The reason is simple—CBD is now a repeat-buy category, and repeat buying only happens when people feel safe and confident.

The supplement industry context makes this trend stronger. In its 2024 Consumer Survey, the Council for Responsible Nutrition (CRN) reported that 75% of Americans use dietary supplements. When three out of four adults already take supplements, they expect CBD nutraceuticals to behave like supplements too: predictable dosing, clean manufacturing, and transparent labels. This is why “trust signals” are growing in value—customers are comparing CBD products the same way they compare multivitamins or probiotics, and they are quicker to drop brands that feel unclear or inconsistent.

Regulation is pushing the same direction. The U.S. FDA reiterated in a July 16, 2024 update that, based on available evidence, CBD and THC products are excluded from the dietary supplement definition under the FD&C Act. That statement affects how brands communicate benefits, how retailers manage risk, and how cautious consumers interpret “supplement-like” CBD products. At the same time, the FDA maintains a public page listing warning letters issued to firms marketing cannabis-derived products, including CBD. Even if most brands never receive a letter, the existence of an active enforcement record nudges the market toward cleaner marketing and stronger quality documentation.

Drivers

Everyday wellness demand, especially for pain support, is the strongest driver for CBD nutraceuticals

A major driving factor for CBD nutraceuticals is the steady rise of “daily wellness” buying—people adding supplements into routines for comfort, sleep, stress balance, and general wellbeing. This matters because CBD products are typically purchased like a wellness supplement, not like a one-time medicine. Industry tracking from the Council for Responsible Nutrition (CRN) shows how large the supplement habit already is: its 2024 consumer survey reported that 75% of Americans use dietary supplements.

Pain-related wellness needs add a strong pull behind that habit. The U.S. CDC reported that in 2023, 24.3% of adults had chronic pain and 8.5% had high-impact chronic pain. That is a very large consumer base actively looking for relief solutions, and many people start with non-invasive options they can control day by day. In practical terms, this is why CBD nutraceuticals keep showing up in “pain management” shopping baskets: consumers can adjust serving size, choose a format that suits them, and decide whether it becomes a daily habit. Even when shoppers do not call it “treatment,” the intention is clear—better comfort and better function.

Regulation and legal access are also shaping the market in a way that supports demand, even if the rules are not uniform. In the U.S., the National Conference of State Legislatures (NCSL) notes that as of June 26, 2025, 40 states allow medical cannabis programs and 24 states allow adult-use cannabis. This wider legal footprint helps normalize cannabinoid-based wellness products in retail environments, increases consumer awareness, and encourages more product choice. At the same time, the U.S. FDA continues to signal that CBD and THC are excluded from the dietary supplement definition under federal law.

On the supply side, the hemp industry’s production base is still expanding and professionalizing, which supports product availability. The USDA’s National Hemp Report (released April 17, 2024) estimated the value of U.S. hemp production totaled $291 million in 2023 (all utilization), and noted “industrial hemp in the open” production value of $258 million in 2023. These numbers matter because stable farm output and processing capacity make it easier for nutraceutical brands to secure consistent inputs and manage pricing.

Restraints

Regulatory uncertainty and uneven product quality are holding back trust in CBD nutraceuticals

One major restraining factor for CBD nutraceuticals is that the rules still do not match how consumers actually shop. Many people buy CBD like a normal supplement—gummies, tinctures, capsules—yet the U.S. FDA continues to state that CBD and THC are excluded from the dietary supplement definition under the FD&C Act. For brands, this creates a difficult reality: they must build a “nutraceutical-style” business while operating in a grey area where product positioning, claims, and even distribution decisions can be questioned.

Enforcement risk adds to the hesitation. The FDA maintains a dedicated public list of warning letters for cannabis-derived products, which is a direct reminder that the agency is actively monitoring firms that market CBD products with improper claims or compliance gaps. Even when only a small portion of brands receive letters, the headlines tend to spill over to the whole category. That makes cautious retailers tighten their acceptance standards and pushes some consumers to pause or switch back to traditional vitamins, minerals, or herbals that feel “cleaner” from a regulatory standpoint.

The second part of the restraint is quality consistency—mainly labeling accuracy and contamination concerns. A well-known peer-reviewed study (JAMA, 2017) found CBD labeling problems in online products, including 26% containing less CBD than labeled (under-labeling). Johns Hopkins researchers later tested 105 topical CBD products (2022) and found that only 24% were accurately labeled; among products that listed CBD content in milligrams, 18% contained less CBD than advertised and 58% contained more than advertised.

Trusted quality organizations are openly pushing for stronger oversight in supplements broadly, which also reflects the pressure CBD nutraceuticals face. For example, USP’s 2024 policy position calls for regulatory reform to protect consumers from unsafe or poor-quality dietary supplement products, highlighting contamination and quality gaps as real public concerns. Until CBD has clearer rules and more uniform quality expectations, brands will keep spending heavily on self-policing—third-party testing, traceability, conservative claims, and retailer compliance packages—while still facing uncertainty.

Opportunity

Sleep and stress support is the biggest growth opportunity for CBD nutraceuticals in 2024–2025

A major growth opportunity for CBD nutraceuticals is the sleep-and-stress wellness lane, because it matches how consumers already shop: they want something simple, repeatable, and easy to fit into a nightly routine. The base market is already huge. In its 2024 consumer survey, the Council for Responsible Nutrition (CRN) reported that 75% of Americans use dietary supplements. That matters because CBD tinctures, gummies, and capsules are bought and used like supplements, not like a one-time product. When most adults already accept “daily supplement” behavior, it lowers the barrier for CBD brands to scale—especially if they focus on clear dosing, consistent batches, and simple benefit messaging like relaxation and wind-down support.

The second reason this opportunity is strong is that sleep satisfaction is now being discussed as a real quality-of-life issue, not a luxury. The National Sleep Foundation’s Sleep in America® materials show a clear wellbeing gap: 88% of adults with good sleep satisfaction are “flourishing,” compared with 47% of adults with poor sleep satisfaction. This kind of data is powerful for the nutraceutical category because it ties sleep quality to everyday performance and mood—exactly the “why” behind nightly routines.

Supply-side stability also supports the growth path. The USDA’s National Agricultural Statistics Service estimated the value of U.S. industrial hemp production at $291 million in 2023, with $258 million from hemp grown in the open and $32.9 million under protection (reported in the National Hemp Report released April 17, 2024). Those figures help explain why more CBD nutraceutical brands can plan product pipelines and retailer programs: a measurable production base makes it easier to contract for consistent inputs, improve traceability, and invest in quality testing that large retailers expect.

Regional Insights

North America dominates the CBD Nutraceuticals Market with a 51.3% share, valued at USD 3.8 Bn in 2024.

In 2024, North America led the CBD Nutraceuticals Market with a dominant 51.3% share and a value of USD 3.8 Bn. The region’s demand is strongly linked to wellness-led purchasing, especially for formats like tinctures, gummies, capsules, and topicals that fit daily routines.

A big pull comes from pain-related wellness needs: the U.S. CDC reported that in 2023, about 24.3% of adults had chronic pain and 8.5% had high-impact chronic pain (pain that often limits life or work). When that many consumers are looking for relief options, CBD products naturally remain on shopping lists—particularly in channels that make it easy to compare claims, dosage, and ingredients.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

CV Sciences, Inc. — For fiscal 2024, CV Sciences reported revenue of $15.7M and a gross margin of 45.6%, pointing to steady consumer demand and improving product economics. In CBD nutraceuticals, the company is positioned around wellness formats that rely on repeat purchase, clear labeling, and a consistent consumer experience. The same release also cited $3.9M revenue in Q4 2024, showing stable quarterly run-rate performance.

Irwin Naturals — Irwin Naturals’ CBD nutraceutical presence is typically built around mainstream wellness positioning and wide product assortment. Public market profiles indicate revenue around US$86.75M (TTM) and about 111 employees (reported in listings), showing a larger nutraceutical platform than many CBD-only brands. This scale can help with shelf placement and supply continuity, even when CBD demand shifts across channels.

Elixinol — In FY2024, Elixinol reported revenue of about AU$15.0–15.3M, showing a clear step-up versus the prior year. That scale supports its CBD nutraceutical focus—especially oils/tinctures—where repeat quality, batch testing, and consistent supply help win retailer trust. The company also flagged an acquisition contribution of $694,000 to group revenue in 2024.

Top Key Players Outlook

- Elixinol

- Medical Marijuana, Inc.

- CV Sciences, Inc.

- Irwin Naturals

- Diamond CBD.

- Foria Wellness

- Medterra CBD

- Green Roads

Recent Industry Developments

In 2025, MJNA posted USD 2.79 M in revenue, indicating ongoing business activity amid evolving demand trends and state-level legalization shifts in the broader cannabis space.

In 2024, Irwin Naturals stood, a significant shift came when FitLife Brands acquired Irwin’s assets for $42.5M, signaling strategic realignment and new growth under a broader wellness portfolio; this move also suggests Irwin’s CBD and nutraceutical offerings will be integrated into a larger revenue base that had been about $63.9M for FitLife pre-acquisition.

Report Scope

Report Features Description Market Value (2024) USD 7.6 Bn Forecast Revenue (2034) USD 27.0 Bn CAGR (2025-2034) 13.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (CBD Tinctures, Capsules And Softgels, CBD Gummie, Others), By Application (Pain Management, Stress And Anxiety Relief, Sleep Support, Skin Health And Beauty, Others), By Distribution Channel (Retail Stores, Online, Pharmacies, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Elixinol, Medical Marijuana, Inc., CV Sciences, Inc., Irwin Naturals, Diamond CBD., Foria Wellness, Medterra CBD, Green Roads Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Elixinol

- Medical Marijuana, Inc.

- CV Sciences, Inc.

- Irwin Naturals

- Diamond CBD.

- Foria Wellness

- Medterra CBD

- Green Roads