Global Car Bumper Guard Market Size, Share, Growth Analysis By Product (Front Bumper Guards, Rear Bumper Guards, Corner Bumper Guards, Vehicle-Specific Guards), By Material (Plastic, Rubber, Metal, Fiber, Composite Material, Others), By Vehicle Type (Passenger Vehicles, Commercial Vehicles), By Distribution Channel (Aftermarket, OEM), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 156925

- Number of Pages: 364

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

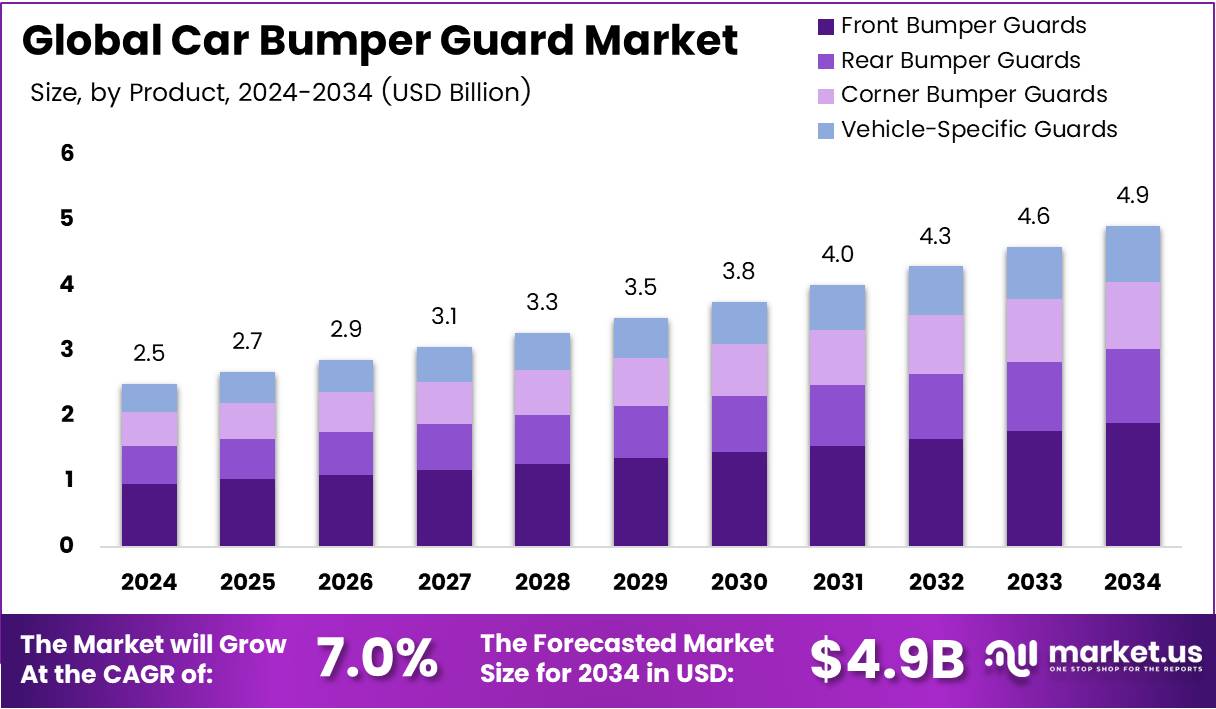

The Global Car Bumper Guard Market size is expected to be worth around USD 4.9 Billion by 2034, from USD 2.5 Billion in 2024, growing at a CAGR of 7% during the forecast period from 2025 to 2034.

The Car Bumper Guard Market refers to the industry focused on protective accessories designed to shield vehicle bumpers from scratches, dents, and minor collisions. These products enhance vehicle aesthetics while reducing repair costs. Growing urbanization, increasing vehicle ownership, and rising consumer awareness about vehicle protection are pushing demand for bumper guards across developed and emerging markets.

In recent years, the Car Bumper Guard Market has witnessed steady growth, supported by rising disposable income and an expanding middle-class population. Consumers are investing in car accessories that ensure both safety and style. Moreover, manufacturers are introducing innovative designs, lightweight materials, and customizable solutions to meet evolving consumer preferences, thereby creating fresh demand.

Growth opportunities in this market are significant, particularly in Asia Pacific where rapid urbanization and a growing vehicle fleet increase the likelihood of minor accidents and scratches. In addition, online sales platforms are offering affordable and varied bumper guard options, driving higher penetration across diverse consumer groups. This trend strengthens aftermarket sales channels globally.

Government investment and regulations are also influencing the Car Bumper Guard Market. Several governments enforce strict safety regulations that indirectly encourage the adoption of protective accessories. For instance, initiatives promoting road safety and vehicle durability create a favorable business environment for bumper guard manufacturers, especially in regions emphasizing vehicular safety compliance.

Furthermore, the increasing penetration of electric vehicles provides new growth avenues for bumper guard manufacturers. EV buyers are highly conscious of vehicle appearance and maintenance, leading to strong adoption of premium bumper guards. This demand aligns with the overall market shift toward sustainability, where eco-friendly materials and recyclable products are gaining traction.

Key Takeaways

- The Global Car Bumper Guard Market is projected to reach USD 4.9 Billion by 2034, up from USD 2.5 Billion in 2024, growing at a CAGR of 7%.

- In 2024, Front Bumper Guards dominated with a 38.6% share, supported by rising road accidents and vehicle safety focus.

- Plastic materials led the market with a 31.8% share in 2024, favored for durability, lightweight nature, and cost efficiency.

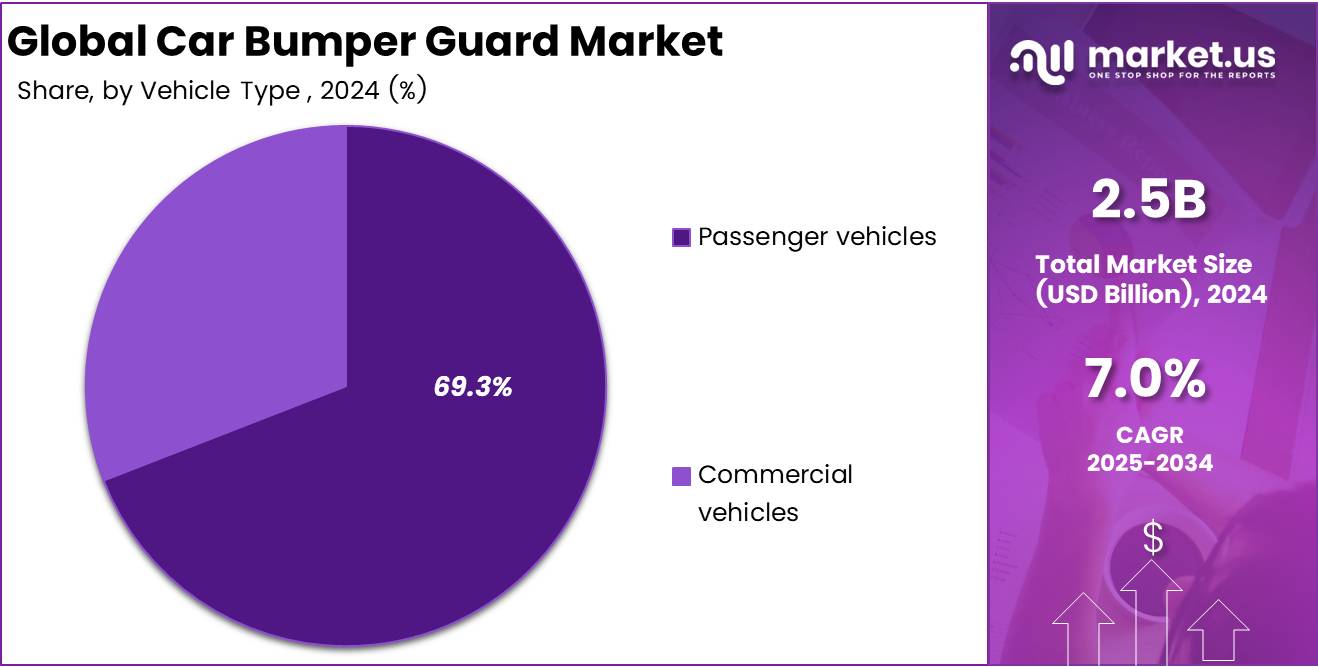

- Passenger Vehicles accounted for a commanding 69.3% share in 2024, driven by high car production and safety customization trends.

- The Aftermarket segment captured 59.2% share in Passenger Vehicles, reflecting strong consumer demand for personalization and competitive pricing.

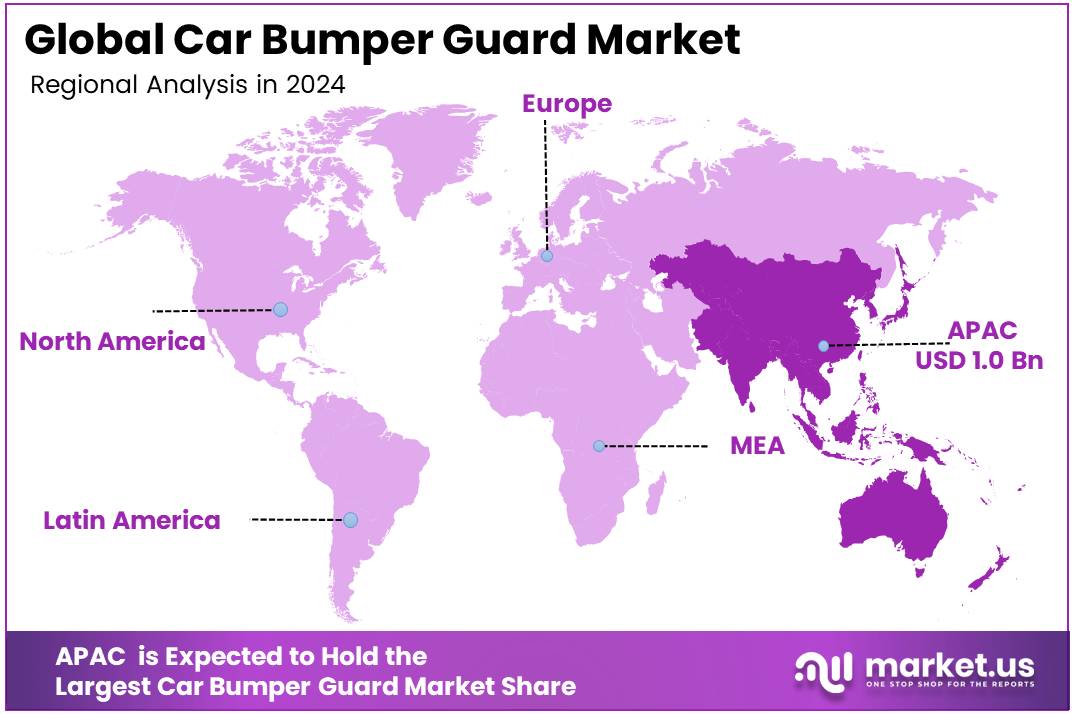

- Asia Pacific led the global market with 41.7% share and a value of USD 1.0 Billion in 2024, fueled by rapid urbanization, rising ownership, and accessory adoption.

Product Analysis

Front Bumper Guards dominate with 38.6% due to their widespread usage in passenger and commercial vehicles.

In 2024, Front Bumper Guards accounted for a dominant 38.6% share in the Car Bumper Guard Market. Their growing adoption is supported by rising road accidents and consumer preference for enhanced vehicle safety. The segment benefits from strong demand in both premium and mid-range passenger vehicles, as automakers increasingly prioritize protection.

Rear Bumper Guards held a notable share, supported by consumer interest in safeguarding vehicles against rear-end collisions. The rising number of urban road accidents and congested traffic conditions are creating consistent demand for these guards, particularly in high-density metropolitan areas.

Corner Bumper Guards are gaining visibility as niche products, designed for comprehensive coverage of vehicle edges. This segment benefits from rising adoption in SUVs and high-end vehicles, where aesthetics and safety combine to create higher demand. Their specialized design supports premium sales growth.

Vehicle-Specific Guards are increasingly adopted by consumers seeking customized safety solutions. This segment is supported by rising OEM collaborations and aftermarket offerings tailored to specific models. Demand is expanding in developed markets, where consumers prioritize brand-fit accessories to ensure seamless vehicle integration.

Material Analysis

Plastic dominates with 31.8% due to cost-effectiveness and wide availability in aftermarket accessories.

In 2024, Plastic held the largest market share at 31.8% in the Car Bumper Guard Market. Lightweight, durable, and cost-efficient, plastic materials are widely favored for both OEM and aftermarket applications. Their adaptability in manufacturing makes them a preferred choice for mass-market vehicles globally.

Rubber bumper guards captured a steady share, supported by their superior shock absorption qualities. These guards are popular in urban driving conditions where low-speed collisions are common, making them attractive to budget-conscious consumers and fleet operators focused on vehicle protection.

Metal bumper guards serve as premium offerings due to their robust design and high durability. The segment is gaining traction in commercial vehicles and SUVs, where stronger structural protection is essential. Increasing demand in emerging markets supports further growth for this material.

Fiber and Composite Material guards are emerging segments, benefiting from rising adoption in premium vehicles. These materials combine lightweight characteristics with superior strength, aligning with modern vehicle design needs. Their market is projected to grow as OEMs integrate advanced materials to meet evolving safety standards.

Vehicle Type Analysis

Passenger Vehicles dominate with 69.3% driven by high production volumes and rising consumer adoption.

In 2024, Passenger Vehicles accounted for a commanding 69.3% share in the Car Bumper Guard Market. The dominance of this segment is attributed to the high production of passenger cars worldwide and growing consumer emphasis on safety and vehicle customization.

The increasing use of bumper guards in sedans, hatchbacks, and SUVs is driving adoption across both OEM and aftermarket channels. Strong demand from urban markets, where minor collisions are frequent, further supports segment growth. Rising disposable incomes enhance consumer spending on accessories.

Commercial Vehicles hold a smaller but important share of the market. Demand is largely driven by fleet operators and logistics companies focused on vehicle protection in high-usage scenarios. Heavy-duty bumper guards in this segment ensure cost efficiency by minimizing damage repair costs.

The adoption of bumper guards in light and medium-duty commercial vehicles is expanding, especially in developing markets with growing transportation and logistics demand. This provides steady opportunities for manufacturers supplying to commercial fleets worldwide.

Passenger Vehicles Analysis

Aftermarket dominates with 59.2% due to rising consumer preference for affordable and customizable solutions.

In 2024, Aftermarket accounted for a dominant 59.2% share in the Passenger Vehicles segment of the Car Bumper Guard Market. High consumer interest in personalization, coupled with competitive pricing, makes aftermarket channels a preferred choice for bumper guard purchases.

This segment thrives on product variety, as consumers seek guards with advanced designs and finishes tailored to their vehicle models. Growing e-commerce sales further support aftermarket dominance, making products widely accessible to customers across geographies.

OEM supply maintains steady growth, supported by integration of bumper guards into premium vehicle designs. Automakers are increasingly offering factory-installed guards to meet consumer demand for comprehensive safety solutions. This strengthens OEM adoption in high-end passenger cars and SUVs.

While aftermarket channels lead in affordability and variety, OEM channels are benefiting from rising brand loyalty and consumer trust in genuine parts. This dual dynamic ensures balanced growth across both channels, with aftermarket remaining the leading contributor in 2024.

Key Market Segments

By Product

- Front Bumper Guards

- Rear Bumper Guards

- Corner Bumper Guards

- Vehicle-Specific Guards

By Material

- Plastic

- Rubber

- Metal

- Fiber

- Composite Material

- Others

By Vehicle Type

- Passenger Vehicles

- Hatchback

- Sedan

- SUV

- Commercial Vehicles

- Light Commercial Vehicles (LCV)

- Heavy Commercial Vehicles (HCV)

By Distribution Channel

- Aftermarket

- OEM

Drivers

Rising Consumer Focus on Vehicle Aesthetics and Customization Drives Market Growth

The car bumper guard market is driven by the growing preference for stylish and customized vehicle accessories. Consumers are no longer buying bumper guards just for protection, but also for enhancing the visual appeal of their vehicles. This trend is especially strong among young buyers in urban areas.

Another major driver is the rising incidence of minor accidents and parking collisions. With congested parking spaces and busy city roads, bumper guards are seen as a practical solution to minimize repair costs. This growing awareness about safety and protection continues to fuel steady demand.

Expanding automotive aftermarket sales channels also contribute to market growth. With easy availability through retail stores, service outlets, and online platforms, customers find it convenient to purchase bumper guards. Attractive product promotions and discount offers further boost sales in both developed and emerging markets.

Finally, increasing urban vehicle ownership adds to the demand. As traffic density rises in major cities, the chances of scratches, dents, and low-speed impacts also rise. Bumper guards provide a cost-effective safeguard for vehicle owners, encouraging wider adoption across different vehicle types and price ranges.

Restraints

Availability of Low-Cost Substitutes and DIY Alternatives Hampers Market Growth

The availability of cheap substitutes and do-it-yourself (DIY) alternatives is a major restraint for the car bumper guard market. Many vehicle owners opt for low-priced accessories that may not meet quality standards but provide short-term protection. This puts pressure on premium players to compete on pricing.

Another limitation is the lack of standardization across different vehicle models. Since each car brand and variant has unique dimensions, universal bumper guards often do not fit perfectly. This issue discourages some customers from purchasing aftermarket solutions and limits large-scale adoption.

Durability concerns with low-quality materials further impact growth. Products made from inferior plastics or metals may wear out quickly, lose strength, or damage the vehicle’s paint. Negative consumer experiences with such products weaken trust in the segment, thereby slowing down long-term demand.

Together, these restraints create a challenge for manufacturers who aim to balance affordability, product quality, and compatibility while maintaining customer satisfaction and brand loyalty.

Growth Factors

Integration of Smart Sensors with Bumper Guards Creates Growth Opportunities

The integration of smart sensors with bumper guards presents a strong growth opportunity. With the rise of connected vehicles, bumper guards embedded with parking sensors or cameras enhance both safety and convenience, making them highly attractive to modern buyers.

Expansion of online retail and e-commerce platforms is another key growth avenue. Consumers are increasingly turning to digital marketplaces for automotive accessories, where they can compare prices, check reviews, and get doorstep delivery. This trend expands the reach of manufacturers and increases sales potential.

The rising demand for premium and luxury vehicle accessories further strengthens growth opportunities. High-income consumers are seeking aesthetically advanced and high-quality bumper guards that complement the design of their cars, supporting a premium pricing strategy for manufacturers.

Additionally, growing adoption of bumper guards in fleet and ride-sharing vehicles creates recurring demand. Companies operating large fleets focus on minimizing repair costs, and bumper guards offer an economical solution. This commercial adoption ensures consistent market expansion in the long term.

Emerging Trends

Emergence of Eco-Friendly and Recyclable Materials Shapes Market Trends

Eco-friendly and recyclable materials are becoming a trending factor in the car bumper guard market. Manufacturers are investing in sustainable production to align with environmental regulations and consumer preferences, creating products that are durable yet eco-conscious.

Another trend is the rising popularity of modular and custom-fit bumper guards. Consumers now prefer designs that are tailor-made for their specific vehicle models, ensuring a sleek appearance along with better performance in reducing impact damage.

Lightweight and high-strength designs are also gaining traction. Advanced materials such as reinforced polymers and alloys make bumper guards more durable without adding extra weight to the vehicle, enhancing both fuel efficiency and safety.

The adoption of 3D printing technology is emerging as a game-changer. It allows rapid customization and small-scale production of unique bumper guard designs, catering to individual tastes. This innovation is expected to redefine product development in the aftermarket accessories industry.

Regional Analysis

APAC Dominates the Car Bumper Guard Market with a Market Share of 41.7%, Valued at USD 1.0 Billion

Asia Pacific accounted for the largest share of the car bumper guard market, with 41.7% and a valuation of USD 1.0 Billion in 2024. The growth is driven by rapid urbanization, increasing vehicle ownership, and rising adoption of aftermarket accessories in countries such as China, India, and Japan. Expanding middle-class income levels and heightened focus on vehicle aesthetics further reinforce regional demand.

North America Car Bumper Guard Market Trends

North America shows steady adoption of bumper guards supported by high vehicle penetration and strong aftermarket channels. Consumer preference for advanced protection solutions, combined with the rising rate of road accidents and parking collisions in urban areas, is fueling the need for durable bumper guard installations.

Europe Car Bumper Guard Market Trends

Europe exhibits strong demand for premium and customized bumper guards due to strict vehicle safety regulations and consumer focus on aesthetics. Growing sales of passenger cars and increasing aftermarket customization trends across Germany, UK, and France are reinforcing product adoption in the region.

Middle East and Africa Car Bumper Guard Market Trends

The Middle East and Africa market is expanding gradually as vehicle sales rise in urban centers such as UAE and South Africa. Economic growth and rising disposable incomes are encouraging consumers to invest in vehicle protection accessories, although market maturity remains lower compared to developed regions.

Latin America Car Bumper Guard Market Trends

Latin America is witnessing increasing adoption of bumper guards due to rising vehicle fleets in Brazil and Mexico. Growing concerns about road safety and the popularity of aftermarket automotive accessories are supporting demand, although economic fluctuations pose short-term challenges for consistent growth.

U.S. Car Bumper Guard Market Trends

The U.S. market benefits from high consumer awareness regarding vehicle safety and aesthetics. A well-established automotive aftermarket industry and frequent cases of minor accidents in densely populated urban areas continue to push the demand for both standard and customized bumper guards.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Car Bumper Guard Company Insights

In 2024, the global Car Bumper Guard Market reflected active participation from established multinational companies and specialized aftermarket players, each shaping the competitive dynamics in unique ways.

3M Company maintained strong influence through its innovative protective films and adhesive technologies, supporting OEM and aftermarket demand. Its ability to integrate material science expertise into bumper guard solutions strengthened its reputation for durability, safety, and long-term performance in vehicle protection.

Auto Metal Direct LLC contributed significantly by focusing on replacement and restoration parts, catering to automotive enthusiasts and repair workshops. Its range of metal-based bumper guards addressed both functionality and aesthetics, making it a preferred supplier in markets where vintage and restoration vehicles are prominent.

Bumper Badger carved out a niche with consumer-friendly rear bumper protection products, especially in urban areas where parking-related damage is frequent. The brand’s emphasis on easy-to-install, removable, and affordable solutions resonated well with individual car owners seeking added convenience and style.

Ford Motor Company leveraged its global manufacturing footprint to integrate bumper guard solutions across various models, aligning with safety standards and consumer preferences. Its direct involvement as an OEM player ensured consistent demand, while strategic innovations around design compatibility enhanced customer trust and reinforced its leadership in the segment.

Top Key Players in the Market

- 3M Company

- Auto Metal Direct LLC

- Bumper Badger

- Ford Motor Company

- Lund International

- Luv-Tap

- Parking Armor

- Toyota Boshoku Corporation

- Volkswagen AG

- Westin Automotive

Recent Developments

- In Aug 2025, Automotive Fintech Bumper secured $11 million to drive its European expansion and strengthen its B2B platform. This funding aims to accelerate its market penetration and enhance digital payment solutions for auto retailers and workshops.

- In Mar 2025, Hyundai Motor Group announced a massive $21 billion investment in US vehicle production, future tech, and energy infrastructure. The initiative targets a production capacity of 1.2 million units and the creation of 100,000 new jobs by 2028.

- In Sep 2025, Virtuoso committed ₹800 crore to bolster the automotive supply chain, focusing on advanced manufacturing and technology integration. This investment is expected to strengthen supplier networks and support the EV transition.

- In Aug 2025, Bumper raised £8 million in a Series B extension to fuel its expansion and accelerate product rollout. The fresh capital will support innovation and broaden service offerings across its financial technology solutions.

- In Sep 2024, Monroe Capital launched a $1 billion fund to support small auto suppliers navigating the shift to EVs. The fund is designed to provide liquidity and financial stability amid industry transformation.

Report Scope

Report Features Description Market Value (2024) USD 2.5 Billion Forecast Revenue (2034) USD 4.9 Billion CAGR (2025-2034) 7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Front Bumper Guards, Rear Bumper Guards, Corner Bumper Guards, Vehicle-Specific Guards), By Material (Plastic, Rubber, Metal, Fiber, Composite Material, Others), By Vehicle Type (Passenger Vehicles, Commercial Vehicles), By Distribution Channel (Aftermarket, OEM) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape 3M Company, Auto Metal Direct LLC, Bumper Badger, Ford Motor Company, Lund International, Luv-Tap, Parking Armor, Toyota Boshoku Corporation, Volkswagen AG, Westin Automotive Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- 3M Company

- Auto Metal Direct LLC

- Bumper Badger

- Ford Motor Company

- Lund International

- Luv-Tap

- Parking Armor

- Toyota Boshoku Corporation

- Volkswagen AG

- Westin Automotive