Global Canned Mushroom Market Size, Share and Future Trends Analysis Report By Product (Button Mushroom, Shiitake Mushroom, Oyster Mushroom, Morel Mushroom, Others), By Nature (Organic, Conventional), By Form (Whole, Sliced, Chopped, Others), By Application (Household, Restaurants), By Distribution Channel (Supermarkets/Hypermarkets, Departmental Store, Convenience Store, Online, Others) , Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: May 2025

- Report ID: 149100

- Number of Pages: 252

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

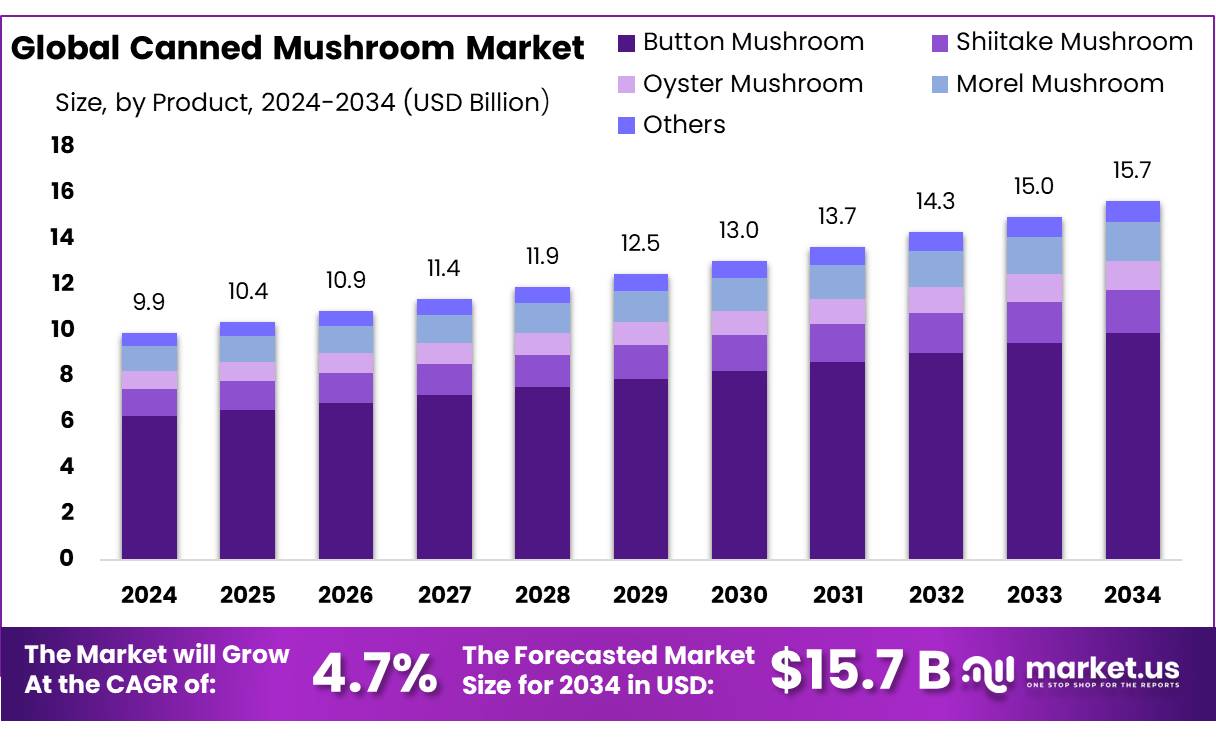

The Global Canned Mushroom Market size is expected to be worth around USD 15.7 Billion by 2034, from USD 9.9 Billion in 2024, growing at a CAGR of 4.7% during the forecast period from 2025 to 2034.

The canned mushroom concentrates industry is an integral segment of the global processed food sector, offering consumers convenient, shelf-stable mushroom products. These concentrates, derived from varieties like button, shiitake, and oyster mushrooms, undergo processes such as washing, blanching, and canning to preserve their nutritional value and extend shelf life. This industry caters to the growing demand for ready-to-eat and easy-to-use ingredients, aligning with modern dietary preferences and lifestyles.

Several factors are propelling the growth of the canned mushroom concentrates industry. Urbanization and changing dietary habits have led to increased consumption of convenient, nutritious foods. Mushrooms, rich in fiber, protein, vitamins, and antioxidants, are gaining popularity as a healthy food choice. The rise in vegetarian and vegan diets, particularly in Europe and North America, has further boosted the demand for mushroom-based products.

In India, government initiatives are playing a pivotal role; for instance, the Ministry of Agriculture allocated ₹500 million in 2024 to support mushroom farming projects, encouraging farmers to adopt mushroom cultivation. Additionally, the National Horticulture Board provides financial assistance for mushroom production units, promoting the sector’s growth.

Globally, the canned mushroom market was valued at USD 7.3 billion in 2018, with expectations of continued growth driven by urbanization, changing dietary habits, and increased demand for plant-based foods. In India, mushroom production has seen a significant rise, from 17,100 metric tonnes in 2013-14 to 487,000 metric tonnes in 2018, indicating a growing domestic market and potential for export expansion . However, India currently accounts for only about 2% of the global mushroom market, suggesting substantial room for growth.

Key Takeaways

- Canned Mushroom Market size is expected to be worth around USD 15.7 Billion by 2034, from USD 9.9 Billion in 2024, growing at a CAGR of 4.7%.

- Button Mushroom held a dominant market position, capturing more than a 63.2% share.

- Conventional held a dominant market position, capturing more than a 67.1% share of the global canned mushroom market

- Whole held a dominant market position, capturing more than a 39.6% share in the global canned mushroom market.

- Restaurants held a dominant market position, capturing more than a 64.8% share of the global canned mushroom market.

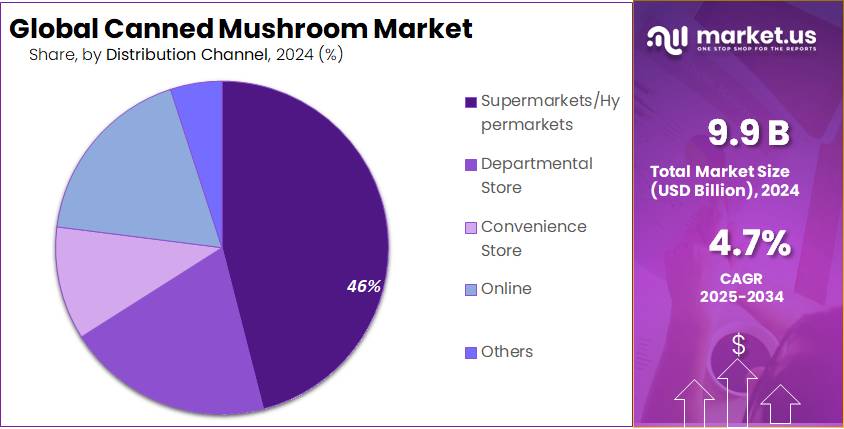

- Supermarkets/Hypermarkets held a dominant market position, capturing more than a 46.9% share.

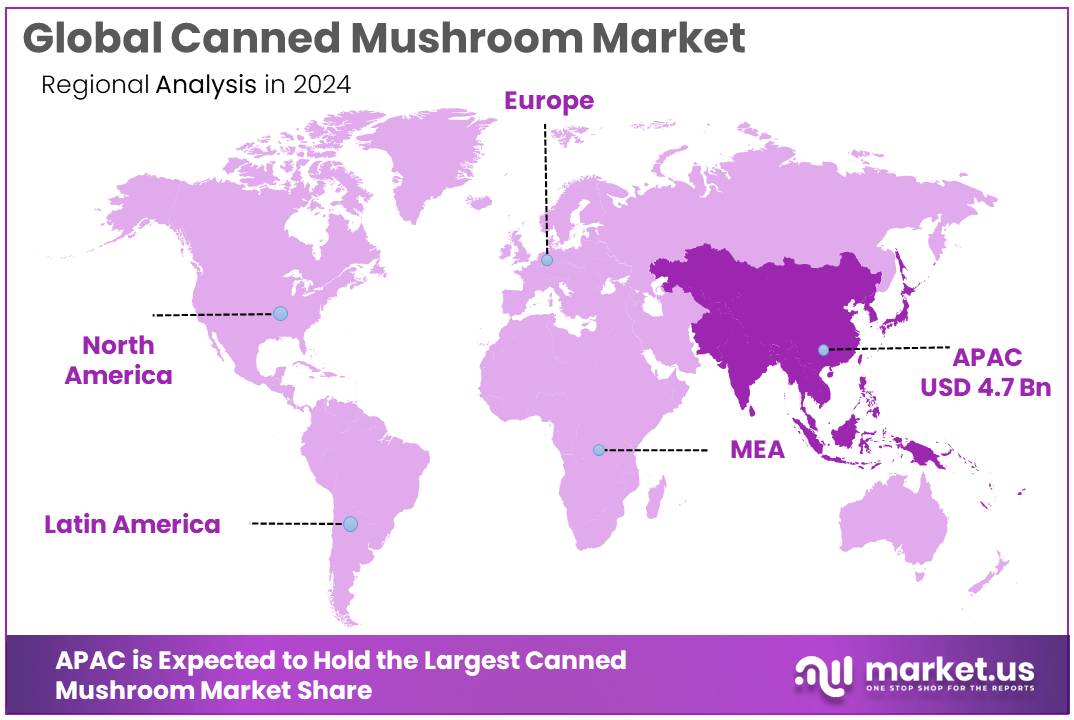

- Asia-Pacific (APAC) region solidified its position as the leading market for canned mushrooms, commanding a substantial 47.9% share, which translates to approximately USD 4.7 billion.

By Product

Button Mushroom dominates with 63.2% share in 2024, driven by its wide culinary use and shelf stability.

In 2024, Button Mushroom held a dominant market position, capturing more than a 63.2% share of the global canned mushroom market. Its popularity comes from its mild flavor, firm texture, and compatibility with a wide range of cuisines — especially in soups, sauces, pizzas, and ready-to-eat meals. Button mushrooms are easy to process and preserve, making them highly suitable for canning. Their long shelf life and affordability have made them the first choice among both manufacturers and consumers.

By Nature

Conventional Canned Mushroom leads with 67.1% share in 2024, supported by mass production and affordability.

In 2024, Conventional held a dominant market position, capturing more than a 67.1% share of the global canned mushroom market by nature. The high share is largely due to the cost-effective farming methods used in conventional mushroom cultivation, allowing producers to offer lower prices in both domestic and international markets. These mushrooms are widely used in commercial food processing, restaurants, and household kitchens where bulk purchasing and extended shelf life are prioritized over organic certification.

By Form

Whole Canned Mushroom leads with 39.6% share in 2024, favored for its natural look and texture in recipes.

In 2024, Whole held a dominant market position, capturing more than a 39.6% share in the global canned mushroom market by form. Consumers and foodservice operators often prefer whole mushrooms because they maintain their shape, size, and texture, offering a more premium feel in dishes. They are especially popular in stir-fries, gourmet salads, pasta, and baked meals where visual appeal matters. The demand is strong from restaurants and catering services that prioritize presentation along with taste.

By Application

Restaurants take the lead with 64.8% share in 2024, driven by bulk demand for quick, ready-to-use ingredients.

In 2024, Restaurants held a dominant market position, capturing more than a 64.8% share of the global canned mushroom market by application. The foodservice industry relies heavily on canned mushrooms due to their convenience, consistent quality, and extended shelf life. Restaurants, especially quick-service chains and mid-range dining outlets, use canned mushrooms in pizzas, pastas, curries, and salads, helping save prep time without compromising flavor or texture.

By Distribution Channel

Supermarkets/Hypermarkets lead with 46.9% share in 2024, thanks to easy access and wide product variety.

In 2024, Supermarkets/Hypermarkets held a dominant market position, capturing more than a 46.9% share in the global canned mushroom market by distribution channel. These large retail outlets continue to be the most preferred point of purchase for canned mushrooms due to their wide product assortment, in-store promotions, and bulk availability. Shoppers find it convenient to compare brands, sizes, and prices under one roof, making these stores a top choice for household and bulk buyers alike.

Key Market Segments

By Product

- Button Mushroom

- Shiitake Mushroom

- Oyster Mushroom

- Morel Mushroom

- Others

By Nature

- Organic

- Conventional

By Form

- Whole

- Sliced

- Chopped

- Others

By Application

- Household

- Restaurants

By Distribution Channel

- Supermarkets/Hypermarkets

- Departmental Store

- Convenience Store

- Online

- Others

Drivers

Government Support Fuels Mushroom Production Growth

One of the key drivers behind the growth of the canned mushroom market is the significant increase in global mushroom production, bolstered by government initiatives and support. According to the Food and Agriculture Organization (FAO), global mushroom production has seen a substantial rise over the years. In 1961, production was approximately 0.5 million tonnes, which increased to 10.24 million tonnes by 2017. This upward trend has continued, with estimates suggesting that production exceeded 40 million tonnes in recent years .

Governments worldwide have recognized the potential of mushroom cultivation as a means to enhance food security, provide employment, and promote sustainable agriculture. For instance, in India, various state governments have launched training programs and offered financial assistance to encourage mushroom farming among rural communities. These initiatives aim to empower farmers, especially women and youth, by providing them with the necessary skills and resources to start mushroom cultivation.

The increased production has directly impacted the canned mushroom market. With a steady supply of raw mushrooms, processing units can operate more efficiently, ensuring a consistent availability of canned products in the market. This consistency is crucial for meeting the growing consumer demand for convenient and long-lasting food options.

Moreover, the rise in mushroom production has led to advancements in processing and preservation techniques, further enhancing the quality and shelf life of canned mushrooms. As a result, consumers are more inclined to purchase these products, knowing they are both nutritious and readily available.

Restraints

Limited Cold Storage Infrastructure for Mushrooms

One significant hurdle facing India’s canned mushroom industry is the shortage of adequate cold storage facilities. Mushrooms are highly perishable and require immediate cooling after harvest to maintain their quality and extend shelf life. However, the existing cold storage infrastructure in India is insufficient to meet this demand.

According to the National Centre for Cold-chain Development (NCCD), India has an estimated cold storage capacity of about 32 million metric tonnes. However, approximately 70% of this capacity is dedicated solely to storing potatoes, leaving limited space for other perishable commodities like mushrooms. This imbalance leads to significant post-harvest losses, with estimates suggesting that around 28% of total food produce in India is lost due to inadequate storage conditions.

Recognizing this challenge, the Indian government has initiated several schemes to enhance cold storage infrastructure. The Ministry of Food Processing Industries (MoFPI) has been implementing schemes for setting up cold storage facilities for perishable horticultural produce. Additionally, under the Agricultural Infrastructure Fund, the government has allocated ₹500 crore specifically for the promotion of mushroom cultivation, with ₹200 crore earmarked for establishing cold storage facilities.

Despite these efforts, the high cost of setting up and maintaining cold storage units remains a barrier, especially for small and marginal farmers. The average cost of grid-powered micro cold stores in India ranges from ₹1.75 lakh to ₹4 lakh per tonne of refrigeration, which is often unaffordable for small-scale producers. This financial constraint limits the adoption of cold storage solutions, leading to continued post-harvest losses and affecting the overall supply chain efficiency for canned mushrooms.

Opportunity

Government Support and Rising Production in India Open New Avenues for Canned Mushroom Market

India’s mushroom industry is experiencing significant growth, presenting a promising opportunity for the canned mushroom market. According to the Directorate of Mushroom Research, India’s mushroom production reached approximately 0.336 million tonnes in 2023–24, nearly doubling from 0.155 million tonnes in 2019–20.

This surge is largely attributed to robust government initiatives aimed at promoting mushroom cultivation. Programs under the Ministry of Agriculture and the National Horticulture Board provide financial assistance, subsidies, and training to encourage mushroom farming. Additionally, schemes like the Integrated Scheme for Agricultural Marketing (ISAM), Mission for Integrated Development of Horticulture (MIDH), and support from NABARD have played crucial roles in fostering technological advancements and improving market access for mushroom producers.

States like Bihar have emerged as leaders in mushroom production, thanks to targeted government support. Bihar’s government has actively promoted mushroom farming through subsidies, training programs, and workshops, leading to a significant increase in production.

The increased production has created a surplus of raw mushrooms, providing an opportunity for expansion in the canned mushroom sector. With a steady supply of mushrooms, processing units can operate more efficiently, ensuring a consistent availability of canned products in the market. This consistency is crucial for meeting the growing consumer demand for convenient and long-lasting food options.

Trends

Rising Demand for Plant-Based Diets Boosts Canned Mushroom MarketA significant trend shaping the canned mushroom market is the growing consumer shift towards plant-based diets. This movement is fueled by increasing health awareness, environmental concerns, and ethical considerations. Mushrooms, known for their meaty texture and rich umami flavor, have become a popular meat substitute, especially among vegetarians and vegans.This surge is attributed to the rising vegan population and heightened awareness of the health benefits associated with mushroom consumption. Canned mushrooms, in particular, offer convenience and a longer shelf life, making them an attractive option for consumers seeking easy-to-prepare, nutritious meals.In addition to their culinary appeal, mushrooms are rich in essential nutrients, including vitamins, minerals, and antioxidants. This nutritional profile aligns with the growing demand for functional foods that support overall health and wellness. As a result, food manufacturers are increasingly incorporating canned mushrooms into a variety of products, from ready-to-eat meals to plant-based meat alternatives.Government initiatives are also playing a role in promoting mushroom consumption. For instance, the U.S. Department of Agriculture has recognized the potential of mushrooms in contributing to a healthy diet and has included them in various nutritional programs . Such endorsements further validate the importance of mushrooms in contemporary diets and encourage their inclusion in daily meals.Regional Analysis

In 2024, the Asia-Pacific (APAC) region solidified its position as the leading market for canned mushrooms, commanding a substantial 47.9% share, which translates to approximately USD 4.7 billion in revenue. This dominance is fueled by a combination of factors, including rapid urbanization, increasing disposable incomes, and shifting dietary preferences towards convenient and nutritious food options.

Countries like China and India are at the forefront of this growth, with China’s extensive mushroom cultivation infrastructure and India’s expanding middle class driving demand. The rising popularity of Western cuisines, which often incorporate mushrooms, has further amplified consumption in the region. Additionally, the health benefits associated with mushrooms, such as their rich nutrient profile and low-calorie content, have resonated with health-conscious consumers, bolstering their appeal.

This sustained expansion is supported by ongoing investments in food processing technologies, improvements in supply chain logistics, and government initiatives promoting agricultural development. For instance, various state governments in India have launched training programs and offered financial assistance to encourage mushroom farming among rural communities, aiming to empower farmers and enhance production capabilities.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

B&G Foods, Inc., a U.S.-based packaged food manufacturer, includes canned mushrooms under its Green Giant brand, serving retail and foodservice markets. With a strong distribution network across North America, the company leverages consumer demand for convenient and shelf-stable vegetables. Its focus on product consistency and expansion of plant-based food categories supports growth. B&G continues investing in processing capacity and packaging innovations to strengthen its position in the preserved vegetable space, including mushrooms.

Bonduelle Group, headquartered in France, is one of the largest vegetable processors in Europe, offering canned mushrooms across multiple global markets. The company emphasizes sustainable farming, clean-label products, and has invested in local sourcing and production in Europe, Russia, and the U.S. Bonduelle’s canned mushrooms are widely used in ready-to-eat meals and by foodservice providers. Its strong presence in hypermarkets and its shift toward low-sodium, organic offerings continue to support its leadership in the category.

Costa Group, Australia’s leading horticultural company, operates significant mushroom production facilities supplying fresh and processed mushrooms, including canned variants. While primarily known for fresh produce, Costa partners with food processors to support canned mushroom exports, especially into the APAC region. Its vertically integrated farming operations, technology-driven cultivation, and sustainability focus allow consistent, high-quality output that supports global supply chains in the preserved mushroom segment.

Top Key Players in the Market

- B&G Foods, Inc.

- Bonduelle Group

- Costa Group Holdings

- Fujian Yuxing Foods Co.

- Giorgio Fresh Co.

- Greenyard NV

- Monterey Mushrooms, Inc.

- Okechamp SA

- Prochamp B.V.

- Shanghai Finc Food Co., Ltd.

- The Mushroom Company

- Monterey Mushrooms Inc.

Recent Developments

In 2024, B&G Foods, Inc. reported net sales of $1.93 billion, reflecting a 6.3% decline from the previous year, primarily due to the divestiture of its U.S. shelf-stable Green Giant product line in late 2023.

Fujian Yuxing’s commitment to quality is evident in their adherence to international food safety standards, including ISO 20000 and GMP certifications.

Report Scope

Report Features Description Market Value (2024) USD 9.9 Bn Forecast Revenue (2034) USD 15.7 Bn CAGR (2025-2034) 4.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Button Mushroom, Shiitake Mushroom, Oyster Mushroom, Morel Mushroom, Others), By Nature (Organic, Conventional), By Form (Whole, Sliced, Chopped, Others), By Application (Household, Restaurants), By Distribution Channel (Supermarkets/Hypermarkets, Departmental Store, Convenience Store, Online, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape B&G Foods, Inc., Bonduelle Group, Costa Group Holdings, Fujian Yuxing Foods Co., Giorgio Fresh Co., Greenyard NV, Monterey Mushrooms, Inc., Okechamp SA, Prochamp B.V., Shanghai Finc Food Co., Ltd., The Mushroom Company, Monterey Mushrooms Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- B&G Foods, Inc.

- Bonduelle Group

- Costa Group Holdings

- Fujian Yuxing Foods Co.

- Giorgio Fresh Co.

- Greenyard NV

- Monterey Mushrooms, Inc.

- Okechamp SA

- Prochamp B.V.

- Shanghai Finc Food Co., Ltd.

- The Mushroom Company

- Monterey Mushrooms Inc.