Global Camera Straps Market Size, Share, Growth Analysis By Application (Commercial, Personal), By Material (Nylon, Fabri, Polyester, Cotton, Others), By Distribution Channel (Offline, Online), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 146233

- Number of Pages: 389

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

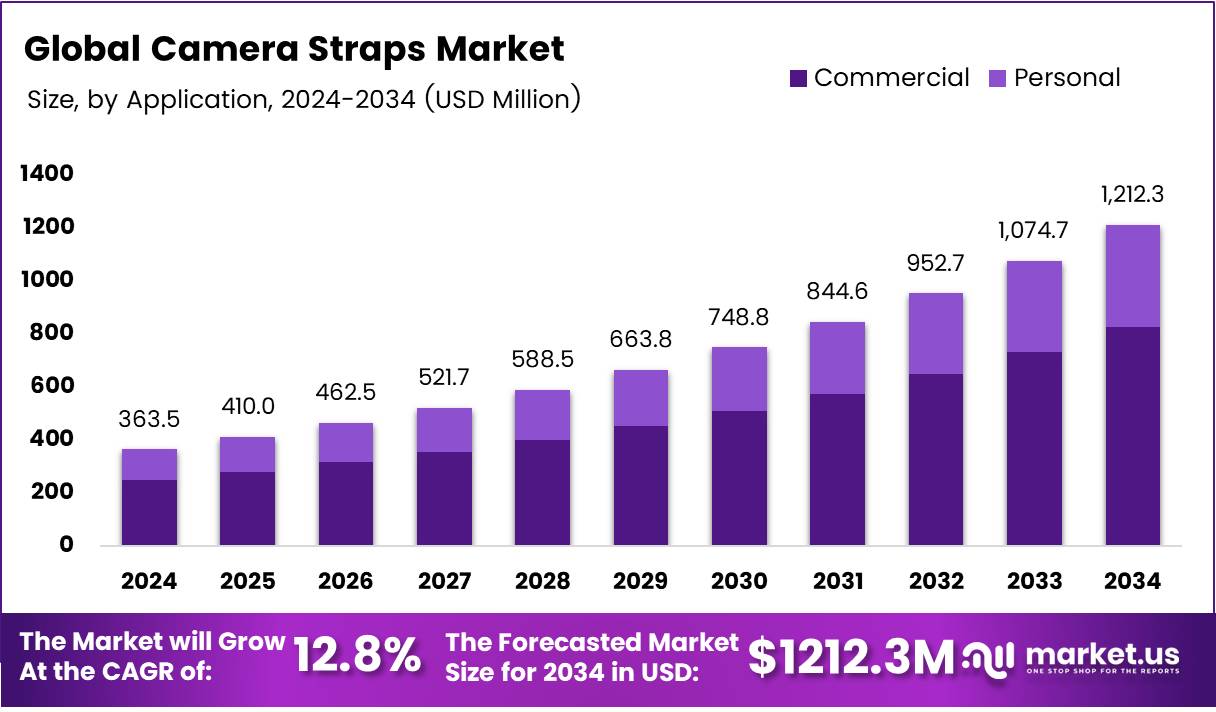

The Global Camera Straps Market size is expected to be worth around USD 1212.3 Million by 2034, from USD 363.5 Million in 2024, growing at a CAGR of 12.8% during the forecast period from 2025 to 2034.

The camera straps market encompasses a diverse range of products designed to enhance the convenience and security of carrying cameras. From basic neck straps to advanced harnesses and sling types, these products cater to both amateur photographers and professional cinematographers. The demand for camera straps is closely tied to the dynamics of the broader camera industry.

According to digitalcameraworld, approximately 750,206 cameras were shipped globally in August 2024, reflecting a stable consumer interest in photography equipment. This statistic underscores the potential market for camera straps as essential accessories for these devices.

Camera straps represent a niche but significant segment within the photography accessories market. The variety in design—from padded straps for comfort to quick-release systems for convenience—suggests a market driven by both functional and aesthetic innovations.

As photography remains a popular hobby and profession, evidenced by the staggering 1.81 trillion photos taken annually worldwide (Pototurial), the need for high-quality camera straps is expected to remain robust. Manufacturers are continually challenged to balance durability with comfort and to innovate in a way that reflects the evolving preferences and technological advancements in camera technology.

The growth prospects for the camera straps market appear promising, driven by both the steady sales of cameras and the increasing enthusiasm for photography across the globe. With governments in various countries recognizing the creative industries as significant contributors to GDP, there may be opportunities for subsidies or reduced tariffs on photography-related products, which can lower costs and stimulate demand.

Furthermore, evolving consumer preferences towards personalized and stylish accessories are likely to open new avenues for product differentiation and premiumization in camera straps.

Regulatory frameworks impacting the camera straps market are generally geared towards consumer safety and environmental compliance. For instance, regulations concerning the materials used in these straps can affect manufacturing processes, especially with a growing consumer preference for eco-friendly products.

Government investments in arts and culture, as well as in the digital transformation of creative sectors, could indirectly benefit the market by enhancing the overall sales of cameras and, consequently, camera straps. This governmental support, combined with an understanding of global market trends, positions the camera straps segment for sustained growth and innovation.

Key Takeaways

- The Global Camera Straps Market is projected to reach USD 1212.3 Million by 2034, growing from USD 363.5 Million in 2024 at a CAGR of 12.8%.

- In 2024, the Commercial application segment led with a 57.9% market share, driven by rising demand in professional photography.

- Nylon was the dominant material in 2024 due to its durability, lightweight nature, and moisture resistance.

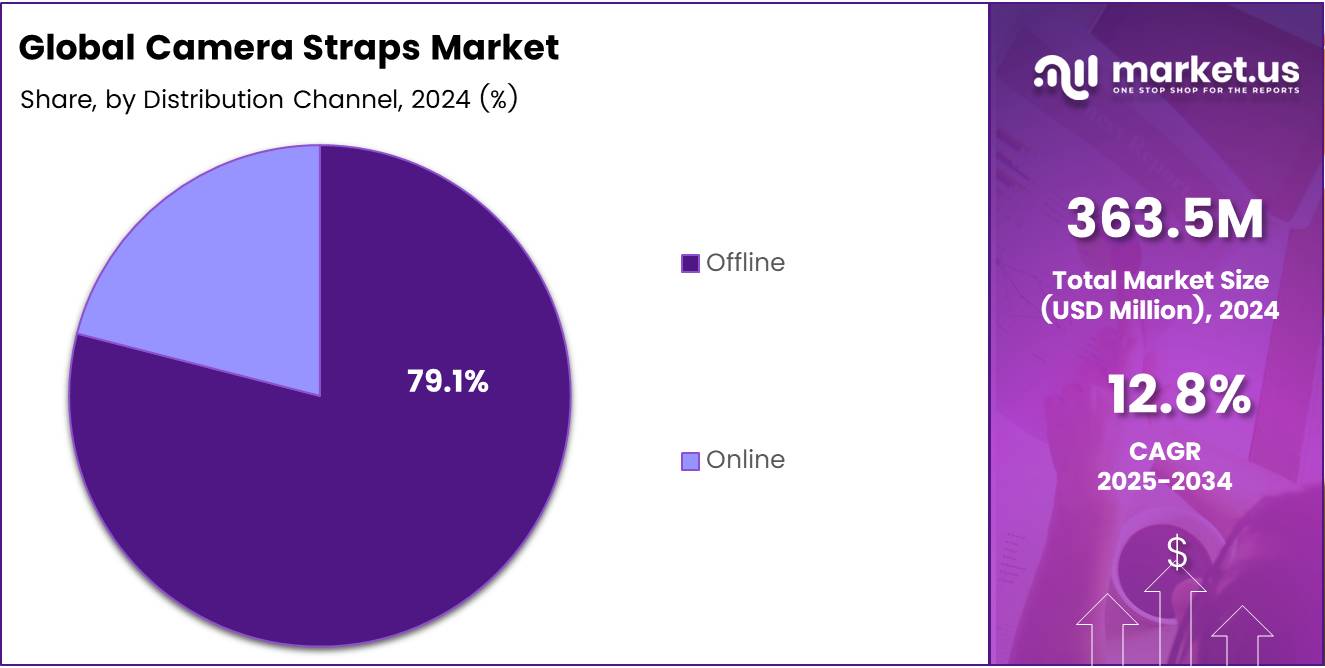

- Offline distribution channels held a commanding 79.1% share in 2024, as consumers prefer to physically evaluate product features.

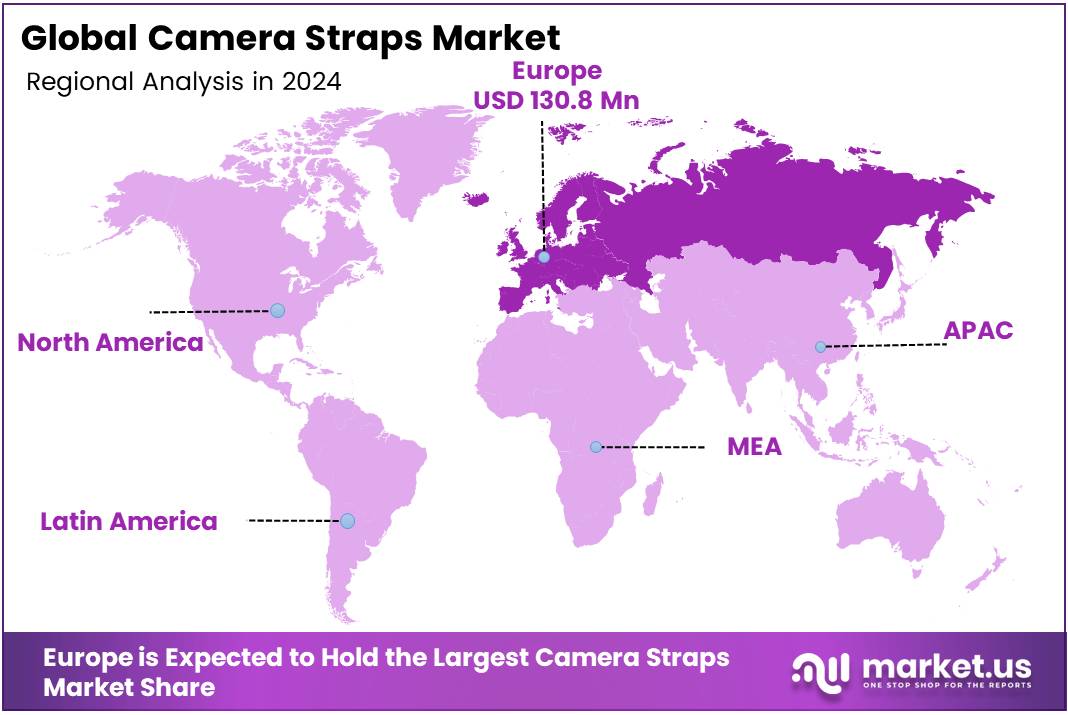

- Europe led the regional market with a 36.2% share, valued at USD 130.8 Million, supported by a strong base of professional photographers and content creators.

Application Analysis

Commercial dominates with 57.9% share due to its extensive adoption by professionals

In 2024, Commercial held a dominant market position in the By Application Analysis segment of the Camera Straps Market, with a 57.9% share.

The commercial application segment has significantly benefited from the surge in professional photography, including events, fashion, wildlife, and media. Brands and organizations increasingly demand high-performance camera straps that provide durability, ergonomic comfort, and reliability during extended usage. These needs have driven consistent investment in commercial-grade products.

In contrast, the personal application segment is growing, driven by hobbyist photographers and social media influencers. While not as dominant as commercial, this segment is gaining traction with the rise of compact and mirrorless cameras for travel and casual photography. Consumers in this space often seek stylish and customizable strap options.

However, commercial users continue to demand premium materials and performance features that ensure safety and support in challenging shooting conditions. This ongoing requirement sustains the commercial sector’s leadership in the segment.

Material Analysis

Nylon dominates due to its strength, flexibility, and moisture resistance

In 2024, Nylon held a dominant market position in the By Material Analysis segment of the Camera Straps Market.

Nylon continues to be the material of choice for camera straps due to its durability, lightweight characteristics, and resistance to moisture. Its high tensile strength and low elasticity offer photographers the security and stability required during shoots, especially in demanding environments.

Fabric materials are appealing to consumers looking for texture and aesthetics. These straps are often chosen for their trendy appearance, though they may fall short in terms of heavy-duty performance.

Polyester is another widely used material, offering a balance between cost and functionality. It provides decent durability and weather resistance but lacks the premium feel of nylon.

Cotton-based straps appeal to niche markets that prioritize sustainability and comfort. While they are not as rugged, they serve well in lifestyle and casual photography settings.

The Others category includes leather, faux leather, and recycled materials that cater to design-conscious and eco-aware consumers. These options are often selected for fashion-forward applications rather than rugged use.

Distribution Channel Analysis

Offline dominates with 79.1% share due to tactile buying experience and immediate availability

In 2024, Offline held a dominant market position in the By Distribution Channel Analysis segment of the Camera Straps Market, with a 79.1% share.

Offline channels, including specialty photography stores and retail outlets, continue to dominate the distribution space. Consumers prefer to physically test the feel, length, and build quality of camera straps before making a purchase—especially when it comes to comfort and ergonomics.

Additionally, offline purchases offer the benefit of immediate availability, a key factor for professionals who need equipment on short notice. The ability to seek expert advice in-store further boosts the preference for offline channels among both amateurs and seasoned photographers.

Online channels, while smaller in share, are growing steadily. Platforms like Amazon and brand-owned websites offer convenience, variety, and competitive pricing. Digital sales are especially strong for trendy, lifestyle-oriented, and lower-priced camera straps. Influencer marketing and customer reviews play a critical role in driving online conversions.

Despite the growth of e-commerce, the offline segment remains the go-to channel for most serious photography professionals, sustaining its market leadership.

Key Market Segments

By Application

- Commercial

- Personal

By Material

- Nylon

- Fabric

- Polyester

- Cotton

- Others

By Distribution Channel

- Offline

- Online

Drivers

Rising Popularity of Photography and Videography Boosts Demand for Camera Straps

The camera straps market is experiencing steady growth, mainly driven by the increasing popularity of photography and videography among both professionals and hobbyists. As more people take up photography—either as a career or a creative outlet—there’s a growing need for reliable and comfortable straps to carry their gear.

Camera straps help photographers manage their equipment more safely, especially during long shoots. Moreover, the rise in travel and adventure tourism has also played a big part in this demand. People involved in outdoor photography want durable straps that can handle rugged use during hikes, safaris, or action sports.

Another key driver is the explosion of social media platforms like Instagram, TikTok, and YouTube, where content creation is booming. With more creators investing in cameras to elevate their content, they also look for useful accessories such as straps that improve mobility and ease of use. Overall, a mix of lifestyle trends and creative pursuits is pushing the camera straps market forward.

Restraints

Availability of Alternatives Like Bags and Harnesses Limits Strap Sales

While the demand for camera straps is growing, the market does face some restraints. One major factor is the availability of alternative carrying options like camera bags, backpacks, and wearable harnesses. These products often provide more storage or support, leading some consumers—especially professionals—to prefer them over traditional straps.

In addition, the cost of high-end camera straps can be a barrier for many users. Premium materials such as leather or reinforced synthetic fabrics come at a higher price, which might not appeal to amateur photographers or budget-conscious customers.

This limits widespread adoption, especially in markets where affordability is a key concern. These restraints suggest that while the market is growing, manufacturers need to find a balance between functionality, pricing, and user preferences to expand their customer base.

Growth Factors

Growing Demand in Developing Markets Presents New Growth Potential

The camera straps market has several promising opportunities ahead. One key area is the expansion into emerging markets. As incomes rise and more people gain access to digital cameras in developing countries, the interest in photography is also increasing. This creates a fresh demand for camera accessories, including straps.

Additionally, integrating smart technology into straps could open new doors. Features like GPS trackers, camera remote controls, or health sensors can turn a simple strap into a multifunctional tool, attracting tech-savvy users.

Another big opportunity lies in collaborating with major camera manufacturers. Co-branded or bundled straps with cameras could offer added value to customers and boost brand exposure for strap makers. These growth opportunities suggest that innovation and strategic partnerships could help companies capture untapped segments and broaden their market reach globally.

Emerging Trends

Minimalist and Stylish Strap Designs Are Gaining Popularity

Current trends in the camera straps market show a clear shift toward minimalism and functionality. Many photographers now prefer lightweight and simple designs that don’t add bulk but still offer strong support. These minimalist straps are especially popular among professionals who value efficiency and portability.

There’s also a rising preference for adjustable and ergonomic straps. These help distribute weight evenly, making them more comfortable for long hours of shooting. This is particularly important for travel or event photographers. Additionally, fashion is beginning to play a role. Today’s consumers, especially younger ones, are looking for camera straps that reflect their personal style—featuring vibrant colors, unique patterns, or premium textures.

As camera gear becomes part of everyday carry for influencers and content creators, fashionable and customizable straps are becoming more of a statement accessory than just a practical item. Together, these trends are reshaping how camera straps are designed and marketed.

Regional Analysis

Europe Leads the Global Camera Straps Market with 36.2% Share, Valued at USD 130.8 Million

Europe dominates the global camera straps market, holding a significant 36.2% share, valued at USD 130.8 million. This dominance is largely driven by the region’s strong base of professional photographers and content creators, especially in countries like Germany, the UK, and France.

Consumers in Europe tend to prefer high-end, ergonomic, and visually appealing camera accessories, contributing to the increasing demand for premium-quality straps. The market in the region is also supported by a mature retail infrastructure and a high rate of digital camera adoption, with consistent innovation and design enhancements helping sustain its lead.

Regional Mentions:

North America, the camera straps market is expanding steadily, fueled by a large number of amateur photographers, social media influencers, and content creators. The region has a strong demand for adjustable, padded, and customizable camera straps to suit a wide range of consumer needs. Technological adoption and awareness of camera ergonomics contribute to the market’s growth. The presence of leading camera brands and accessory manufacturers in the U.S. and Canada also supports regional demand.

Asia Pacific is emerging as one of the fastest-growing regions in the camera straps market. Increasing disposable incomes, a young population, and growing interest in photography and vlogging are driving demand across countries such as China, India, and Japan. The availability of affordable yet quality camera accessories, along with widespread e-commerce penetration, has further bolstered market expansion.

The Middle East and Africa are witnessing growing traction, with the market projected to reach USD 42.2 million by 2030. Rising digital engagement, social media influence, and increased camera usage among travelers and hobbyists are contributing to regional growth.

Latin America, although holding a smaller share, is gradually picking up pace. Countries like Brazil and Mexico are seeing growth fueled by a young demographic and expanding online retail platforms, offering increased accessibility to camera accessories.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2024, the global camera straps market is witnessing robust growth, driven by the expanding community of photography enthusiasts, vloggers, and professionals seeking both functionality and style in their gear.

Among the leading players, Peak Design stands out for its cutting-edge, modular strap systems. Products like the Slide and Slide Light are renowned for their durability, comfort, and ease of use, making them a favorite among both professionals and hobbyists. The brand’s design philosophy centers around user experience and adaptability, which has helped build strong brand loyalty.

BlackRapid has maintained a solid position in the market through its innovative sling-style straps, particularly favored by professionals who need quick camera access and ergonomic support during long shoots. Their Sport series is a benchmark for comfort and reliability, offering features like breathable materials and secure fastenings that cater to dynamic shooting environments.

Gordy’s Camera Straps continues to attract niche consumers with its handcrafted leather offerings. Known for their minimalistic design and artisanal quality, these straps are particularly popular with vintage camera users and those looking for a classic, timeless aesthetic. The emphasis on craftsmanship and customization makes Gordy’s a go-to for photographers who value form as much as function.

FUJIFILM Corporation, while primarily a camera manufacturer, plays a significant role in this market by offering branded camera straps that align with their camera systems in both design and quality. These accessories are designed to enhance the user experience by ensuring seamless integration and consistent visual appeal.

These companies represent the diverse trends shaping the camera strap landscape in 2024.

Top Key Players in the Market

- gordy’s camera straps

- FUJIFILM Corporation

- Peak Design

- SAMSUNG

- ORIGINAL FUZZ

- ALTURAPHOTO

- Movo

- COOPH Cooperative of Photography GmbH

- Black Rapid, Inc.

Recent Developments

- In August 2024, Bosch Building Technologies launched its first ‘Made in India’ FLEXIDOME cameras, showcasing a commitment to local manufacturing and innovation. These surveillance cameras are tailored to meet Indian market requirements with advanced features and high-quality imaging.

- In January 2025, Zebra Technologies announced the acquisition of Photoneo, a 3D machine vision and AI technology company. The move aims to strengthen Zebra’s position in intelligent automation and robotics across industrial applications.

- In April 2024, Nikon completed the acquisition of RED.com, LLC, a U.S.-based cinema camera manufacturer renowned for high-end digital cinematography. This acquisition is expected to bolster Nikon’s presence in the professional digital video production market.

Report Scope

Report Features Description Market Value (2024) USD 363.5 Million Forecast Revenue (2034) USD 1212.3 Million CAGR (2025-2034) 12.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Application (Commercial, Personal), By Material (Nylon, Fabri, Polyester, Cotton, Others), By Distribution Channel (Offline, Online) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape gordy’s camera straps, FUJIFILM Corporation, Peak Design, SAMSUNG, ORIGINAL FUZZ, OP//TECH USA, ALTURAPHOTO, Movo, COOPH Cooperative of Photography GmbH, Black Rapid, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- gordy's camera straps

- FUJIFILM Corporation

- Peak Design

- SAMSUNG

- ORIGINAL FUZZ

- ALTURAPHOTO

- Movo

- COOPH Cooperative of Photography GmbH

- Black Rapid, Inc.