Global Building Automation Systems Market Size, Share, Statistics Analysis Report By Product Type (Hardware [Sensors, Controllers, Output Devices, User Interface], Software), By Application (HVAC Systems, Safety and Security Systems, Energy Systems, Sanitization Systems, Others (Vents, Pumping Systems)), By End-User (Residential, Commercial [Offices Buildings, Institutional Facilities, Healthcare Facilities, Hotels and Restaurants, Retail Stores,Others (Auditoriums, Museums, Galleries)], Industrial), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Mar 25

- Report ID: 142375

- Number of Pages: 394

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Scope

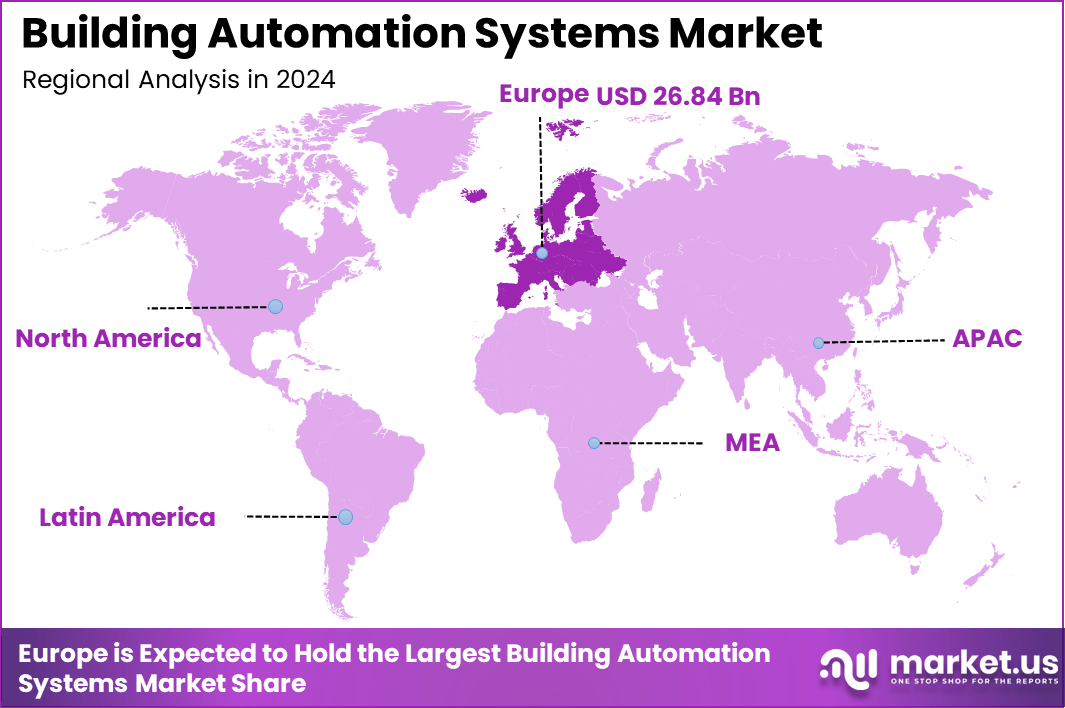

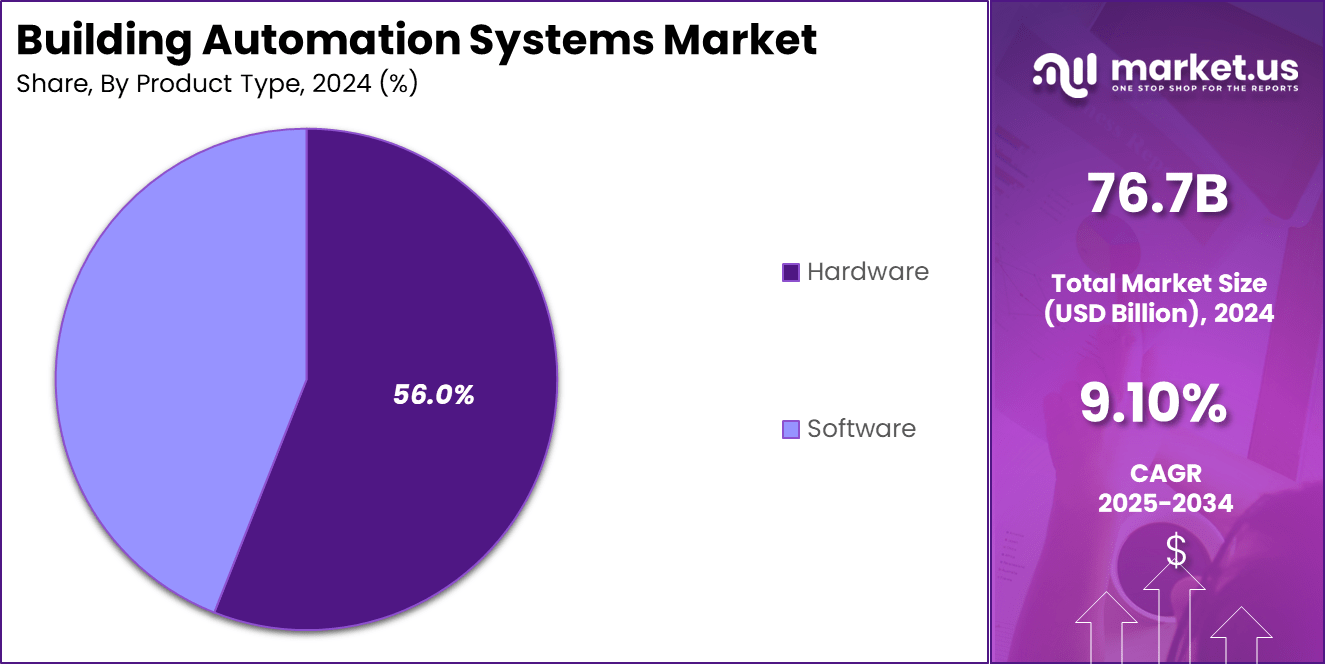

The Global Building Automation Systems Market is expected to be worth around USD 183.2 billion by 2034, up from USD 76.7 billion in 2024. It is expected to grow at a CAGR of 9.10% from 2025 to 2034. In 2024, Europe held a dominant market position, capturing over a 35% share and earning USD 26.84 billion in revenue.

Building Automation Systems (BAS) are centralized networks that monitor and control a building’s various systems, including heating, ventilation, air conditioning (HVAC), lighting, and security. By integrating these functions, BAS enhances occupant comfort, improves operational efficiency, and reduces energy consumption. This integration allows for seamless communication among different systems, ensuring optimal performance and swift response to any issues.

The growing emphasis on energy efficiency and sustainability primarily drives the BAS market. As energy costs rise and environmental concerns become more pressing, building owners and managers are seeking solutions to minimize energy consumption.

BAS provides real-time monitoring and control, enabling significant reductions in energy usage and operational costs. Additionally, government regulations and incentives promoting green building practices further propel the adoption of these systems.

Key Takeaways

- Market Growth: The global Building Automation Systems (BAS) market is projected to grow from USD 76.7 billion in 2024 to USD 183.2 billion by 2034, expanding at a CAGR of 9.10%.

- Dominant Product Type: Hardware accounts for the largest share of the market at 56%, indicating a strong demand for controllers, sensors, and networking devices.

- Leading Application: HVAC Systems dominate the application segment with 35%, showcasing the importance of energy efficiency and climate control in modern buildings.

- Key End-User Segment: The commercial sector leads the market, making up 52% of the total market share, driven by offices, retail spaces, and hospitality industries.

- Regional Insights: Europe holds a significant share of the market at 35%, fueled by stringent energy regulations, smart city initiatives, and high adoption of automation technologies.

Analyst’s Review

Market demand for BAS is also fueled by the increasing need for enhanced security and occupant comfort. Modern buildings require sophisticated systems to manage access control, surveillance, and environmental conditions. BAS offers integrated solutions that address these needs, making it an attractive option for both new constructions and retrofitting existing structures.

Opportunities in the BAS market are expanding with advancements in Internet of Things (IoT) technologies and artificial intelligence (AI). The integration of IoT allows for more connected and responsive building systems, while AI facilitates predictive maintenance and energy optimization. These technological innovations open new avenues for service providers to offer advanced solutions tailored to specific building requirements.

Technological advancements have significantly shaped the BAS landscape. The development of wireless communication protocols and standards has simplified the installation and scalability of these systems. Moreover, the emergence of smart sensors and cloud computing has enhanced data analytics capabilities, enabling more precise control and monitoring of building operations. These innovations contribute to more efficient and user-friendly BAS solutions.

Key Statistics

Technological Integration

- Integration with IoT: 80% of new BAS installations include IoT integration.

- Integration with AI and ML: 60% of new BAS installations include AI/ML for predictive maintenance.

- Software Usage: 90% of BAS systems use software for monitoring and control.

User Statistics

- Number of Users (2022): Estimated 1.2 million commercial and residential users worldwide.

- User Growth Rate: Expected to increase by 15% annually from 2022 to 2025.

- Average System Users per Building: 5 to 10 users per commercial building; 1 to 2 users per residential building.

Quantity and Deployment

- Number of BAS Installations (2022): Approximately 2.5 million installations worldwide.

- Installation Growth Rate: Expected to increase by 12% annually from 2022 to 2025.

- Average Cost per Installation: USD 50,000 to USD 200,000 depending on system complexity.

Regional Analysis

In 2024, Europe held a dominant position in the Building Automation Systems (BAS) market, capturing more than a 35% share, equating to approximately USD 26.84 billion in revenue. This leadership is primarily attributed to the region’s stringent energy efficiency regulations and a strong commitment to sustainability. European Union directives have mandated reductions in energy consumption across various sectors, prompting widespread adoption of BAS to optimize building operations and reduce carbon footprints.

The commercial sector in Europe has been a significant contributor to this market dominance. With a market share of approximately 73% in 2024, the commercial segment has embraced BAS to enhance operational efficiency and comply with regulatory standards. The integration of advanced technologies such as the Internet of Things (IoT) and Artificial Intelligence (AI) has further propelled the adoption of BAS, enabling real-time monitoring and control of building systems.

Germany, in particular, stands out within the European BAS market, commanding approximately 30% of the total market share in 2024. The country’s robust industrial base and commitment to energy-efficient building technologies have fostered innovation and technological advancement in the region. Germany’s focus on developing integrated smart city initiatives has created a robust ecosystem for building automation systems.

The industrial segment is emerging as the fastest-growing sector in the European BAS market, projected to grow at approximately 4% during 2024-2029. This growth is primarily driven by the unprecedented rise in wholesale gas and electricity prices across Europe, compelling industrial facilities to implement more efficient building automation systems. Manufacturing facilities, warehouses, and distribution centers are increasingly recognizing the potential for significant cost savings through automated building management systems.

By Product Type

In 2024, the hardware segment held a dominant position in the Building Automation Systems (BAS) market, capturing more than a 56% share. This segment leads due to the essential role of physical components such as sensors, controllers, output devices, and user interfaces, which form the backbone of any automated system.

Sensors are critical for detecting changes in environmental conditions like temperature, humidity, motion, and occupancy, enabling smart decision-making. Controllers process this data in real-time, optimizing building functions, while output devices execute commands to adjust lighting, HVAC, and security systems accordingly.

Additionally, user interfaces allow facility managers and building operators to monitor and control system performance efficiently. The rising demand for energy-efficient solutions, the integration of IoT and AI-based controllers, and government regulations promoting smart building infrastructure have significantly boosted hardware adoption.

With increasing investments in smart cities and sustainable buildings, the hardware segment continues to dominate, as it remains indispensable for implementing automation solutions. While software plays a crucial role in analytics and remote monitoring, without reliable hardware components, automation cannot function effectively, making this segment the primary driver of market growth.

By Application

In 2024, the HVAC Systems segment held a dominant market position in the Building Automation Systems (BAS) market, capturing more than a 35% share. This leadership is primarily driven by the growing demand for energy efficiency, cost savings, and enhanced indoor air quality in residential, commercial, and industrial buildings. HVAC systems are the largest energy consumers in buildings, accounting for nearly 40-50% of total energy usage, making their automation a critical factor in reducing operational costs and carbon footprints.

The adoption of smart sensors, AI-driven climate control, and IoT-based HVAC automation has significantly improved system efficiency. These technologies enable real-time monitoring and predictive maintenance, ensuring optimal temperature control while minimizing energy waste.

Moreover, stringent environmental regulations and rising awareness of indoor air quality standards have further fueled the demand for intelligent HVAC automation. With the increasing shift toward green buildings and net-zero energy consumption, HVAC automation remains the most essential application within the BAS market, ensuring comfort, efficiency, and sustainability in modern infrastructures.

By End-User

In 2024, the commercial segment held a dominant market position in the Building Automation Systems (BAS) market, capturing more than a 52% share. This leadership is driven by the high demand for energy efficiency, security, and smart building solutions across commercial spaces such as office buildings, institutional facilities, healthcare centers, hotels, restaurants, and retail stores. With businesses increasingly prioritizing cost reduction and operational efficiency, BAS adoption has surged, enabling centralized control over HVAC, lighting, access control, and energy management systems.

Stringent government regulations on energy consumption and carbon emissions have further pushed commercial property owners to invest in automation technologies. Additionally, the rise of smart workplaces, co-working spaces, and digital infrastructure has accelerated the demand for IoT-enabled automation to improve comfort and security.

Healthcare facilities and hotels are also significant adopters, as they require strict environmental controls, safety measures, and seamless building operations. With continued investments in sustainable commercial buildings and smart infrastructure, the commercial segment remains the largest and fastest-growing sector in the BAS market, ensuring long-term market dominance.

Key Market Segments

By Product Type

- Hardware

- Sensors

- Controllers

- Output Devices

- User Interface

- Software

By Application

- HVAC Systems

- Safety and Security Systems

- Energy Systems

- Sanitization Systems

- Others (Vents, Pumping Systems)

By End-User

- Residential

- Commercial

- Offices Buildings

- Institutional Facilities

- Healthcare Facilities

- Hotels and Restaurants

- Retail Stores

- Others (Auditoriums, Museums, Galleries)

- Industrial

Driving Factor

Integration of IoT and Smart Technologies

The integration of the Internet of Things (IoT) and smart technologies is a significant driving force behind the growth of the Building Automation Systems (BAS) market. IoT enables the interconnection of various building systems—such as HVAC, lighting, and security—allowing them to communicate and operate cohesively.

This interconnectedness facilitates real-time monitoring and control, leading to enhanced energy efficiency and occupant comfort. For instance, IoT sensors can detect occupancy levels and adjust lighting and temperature accordingly, optimizing energy usage.

Additionally, the integration of smart technologies allows for predictive maintenance, where data analytics anticipate equipment failures before they occur, reducing downtime and maintenance costs. The seamless integration of these technologies not only improves operational efficiency but also aligns with the growing demand for sustainable and intelligent building solutions.

Restraining Factor

High Initial Installation and Setup Costs

Despite the long-term benefits, the high initial costs associated with installing and setting up Building Automation Systems pose a significant barrier to widespread adoption. These expenses include the procurement of hardware components, software licensing, and the labor required for installation and integration.

For many building owners, especially those managing smaller or older properties, these upfront investments can be prohibitive. Additionally, the complexity of retrofitting existing structures with modern BAS technology can further escalate costs, making stakeholders hesitant to implement such systems. This financial hurdle often leads to a slower adoption rate, particularly in markets sensitive to capital expenditures.

Growth Opportunity

Expansion in Emerging Markets

Emerging markets present a substantial growth opportunity for the Building Automation Systems industry. Rapid urbanization and industrialization in regions such as Asia-Pacific and Latin America have led to increased construction activities, creating a demand for efficient building management solutions.

Governments in these areas are also implementing regulations and incentives to promote energy efficiency and sustainable building practices, further driving the adoption of BAS. Moreover, the rising awareness of the benefits associated with building automation, such as reduced operational costs and improved occupant comfort, is encouraging stakeholders to invest in these technologies. As these markets continue to develop, the demand for advanced building automation solutions is expected to grow, offering lucrative opportunities for industry players.

Challenging Factor

Interoperability Issues with Legacy Systems

A significant challenge in the Building Automation Systems market is the interoperability issues with legacy systems. Many existing buildings operate on outdated automation technologies that lack standardized communication protocols, making integration with modern BAS solutions difficult. This incompatibility can lead to increased complexity and costs during system upgrades or expansions.

Building owners may face challenges in achieving seamless communication between new and old systems, resulting in operational inefficiencies. Addressing these interoperability issues requires the development of adaptable solutions and industry-wide standards to ensure smooth integration and functionality across diverse systems.

Growth Factors

Integration of IoT and Smart Technologies

The integration of the Internet of Things (IoT) and smart technologies is a significant growth driver in the Building Automation Systems (BAS) market. IoT enables seamless communication between various building systems—such as HVAC, lighting, and security—allowing for centralized and efficient management. This interconnectedness leads to enhanced energy efficiency and operational performance.

This growth is largely attributed to the adoption of IoT-based solutions that facilitate real-time monitoring and control, reducing energy consumption and operational costs. For instance, smart sensors can adjust lighting and temperature based on occupancy, optimizing energy usage.

Moreover, the integration of artificial intelligence (AI) with BAS allows for predictive maintenance, identifying potential equipment failures before they occur, thereby minimizing downtime and maintenance expenses. As buildings become smarter and more connected, the demand for advanced BAS is expected to rise, driving market growth.

Emerging Trends

Emphasis on Sustainability and Green Buildings

A notable emerging trend in the BAS market is the increasing emphasis on sustainability and the development of green buildings. Governments and organizations worldwide are implementing stringent regulations and standards to reduce carbon footprints and promote environmental responsibility.

Building automation systems play a crucial role in achieving these sustainability goals by optimizing energy usage and enhancing operational efficiency. This growth is driven by the increasing adoption of BAS in green building projects, as these systems help in monitoring and controlling energy consumption, thereby reducing greenhouse gas emissions.

For example, automated lighting systems can significantly decrease electricity usage by adjusting brightness based on natural light availability. As the focus on environmental sustainability intensifies, the integration of BAS in building designs is expected to become more prevalent, aligning with global green initiatives.

Business Benefits

Enhanced Operational Efficiency and Cost Savings

Implementing building automation systems offers substantial business benefits, including enhanced operational efficiency and significant cost savings. By automating the control of various building systems, such as heating, ventilation, air conditioning, and lighting, organizations can achieve optimal performance with minimal manual intervention.

This automation leads to reduced energy consumption and lower utility bills. The cost savings associated with reduced energy usage contribute to this market expansion. Additionally, BAS enables predictive maintenance by monitoring equipment performance in real-time, identifying potential issues before they escalate into costly repairs.

For instance, sensors can detect anomalies in HVAC systems, prompting timely maintenance and preventing system failures. Moreover, automated systems enhance occupant comfort and productivity by maintaining optimal indoor environments, which can lead to increased employee satisfaction and retention. Overall, the integration of BAS provides businesses with a competitive edge through improved efficiency and reduced operational costs.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

Honeywell has been actively reshaping its business through strategic acquisitions and organizational restructuring. In March 2025, Honeywell announced its intention to acquire Sundyne LLC for approximately $2.2 billion. This acquisition aims to bolster Honeywell’s Energy and Sustainability segment by integrating Sundyne’s advanced pumps and compressors, thereby enhancing its offerings in the petrochemical and renewable fuel markets.

Cisco has been expanding its capabilities through targeted acquisitions. In 2023, Cisco acquired several cybersecurity firms, including Valtix, Lightspin, and Armorblox, to enhance its security offerings. Additionally, Cisco announced its intention to acquire Isovalent, a networking and security startup, reflecting its commitment to strengthening its Full-Stack Observability strategy. In September 2023, Cisco made a significant move by agreeing to acquire Splunk for $28 billion, marking its largest acquisition to date.

Trane Technologies has been focusing on integrating advanced technologies to enhance its product offerings. In December 2024, the company announced a definitive agreement to acquire BrainBox AI, a pioneer in autonomous HVAC controls and generative AI building technology. This acquisition is expected to combine BrainBox AI’s deep learning algorithms with Trane’s building management systems, aiming to reduce energy consumption by up to 25% and greenhouse gas emissions by up to 40%.

Top Key Players in the Market

- Honeywell International Inc.

- Cisco Systems Inc.

- Trane Technologies

- Lutron Electronics Co. Ltd

- Hubbell Inc.

- United Technologies Corporation

- Hitachi Ltd

- Huawei Technologies Corporation

- Emerson Electric Co.

- Mitsubishi Electric Corporation

- Other Key Players

Recent Developments

- In 2024, Siemens raised its mid-term profit margin target for its Smart Infrastructure unit to 16-20%, up from the previous 11-16%, reflecting increased demand for building automation solutions.

- In 2024, Schneider Electric reported higher-than-expected net profit and revenue, driven by strong performance in its energy-management sector, with organic revenue growing by 11.5% to €31.13 billion.

Report Scope

Report Features Description Market Value (2024) USD 76.7 Billion Forecast Revenue (2034) USD 183.2 Billion CAGR (2025-2034) 9.10% Largest Market North America Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Hardware [Sensors, Controllers, Output Devices, User Interface], Software), By Application (HVAC Systems, Safety and Security Systems, Energy Systems, Sanitization Systems, Others (Vents, Pumping Systems)), By End-User (Residential, Commercial [Offices Buildings, Institutional Facilities, Healthcare Facilities, Hotels and Restaurants, Retail Stores, Others (Auditoriums, Museums, Galleries)], Industrial) Regional Analysis North America (US, Canada), Europe (Germany, UK, Spain, Austria, Rest of Europe), Asia-Pacific (China, Japan, South Korea, India, Australia, Thailand, Rest of Asia-Pacific), Latin America (Brazil), Middle East & Africa(South Africa, Saudi Arabia, United Arab Emirates) Competitive Landscape Honeywell International Inc., Cisco Systems Inc., Trane Technologies, Lutron Electronics Co. Ltd, Hubbell Inc., United Technologies Corporation, Hitachi Ltd, Huawei Technologies Corporation, Emerson Electric Co., Mitsubishi Electric Corporation, Other Key Players Customization Scope We will provide customization for segments and at the region/country level. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Building Automation Systems MarketPublished date: Mar 25add_shopping_cartBuy Now get_appDownload Sample

Building Automation Systems MarketPublished date: Mar 25add_shopping_cartBuy Now get_appDownload Sample -

-

- Honeywell International Inc.

- Cisco Systems Inc.

- Trane Technologies

- Lutron Electronics Co. Ltd

- Hubbell Inc.

- United Technologies Corporation

- Hitachi Ltd

- Huawei Technologies Corporation

- Emerson Electric Co.

- Mitsubishi Electric Corporation

- Other Key Players