Global Broadcasting Equipment Market Size, Share, Industry Analysis Report By Type (Dish Antennas, Amplifiers, Switches, Encoders, Video Servers, Transmitters /Repeaters, Modulators, Others), By Technology (Analog, Digital), By Application (Radio (Amplitude Modulation, Frequency Modulation), Television (Direct Broadcasting Satellite (DBS, Terrestrial Television, Cable Television, Others), By Region, Global Opportunity Analysis, Future Outlook and Industry Trends Forecast 2025-2034

- Published date: Sept. 2025

- Report ID: 158874

- Number of Pages: 368

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

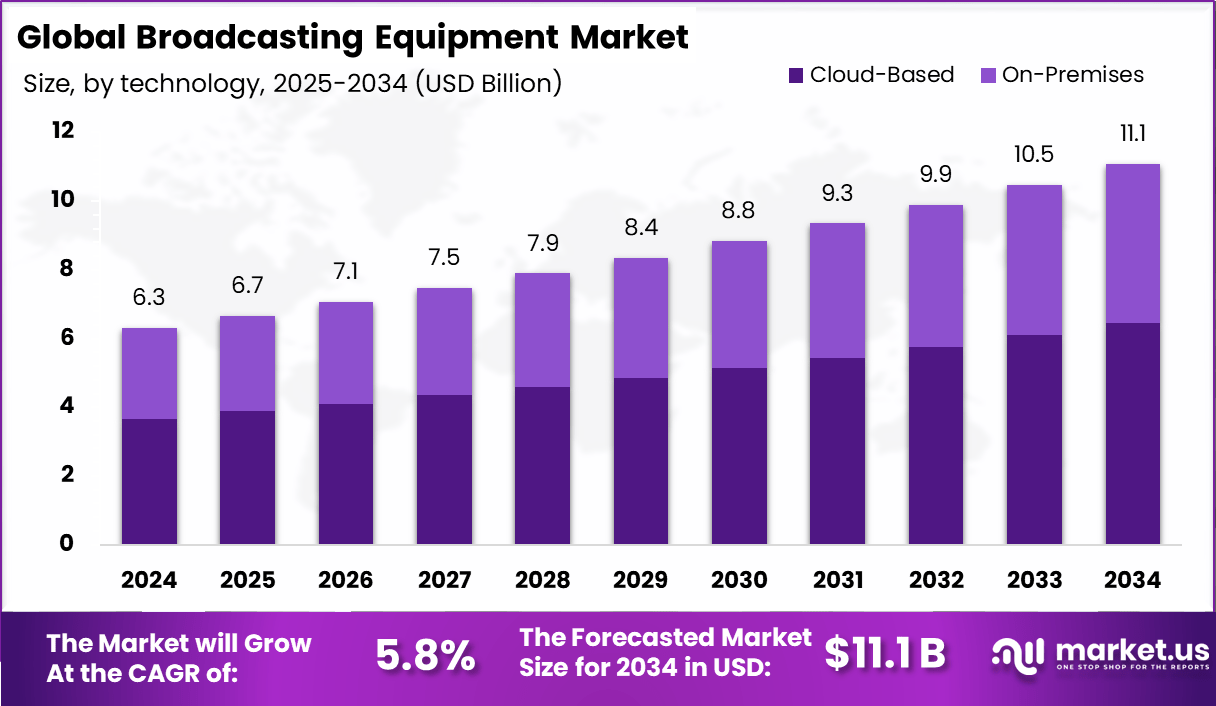

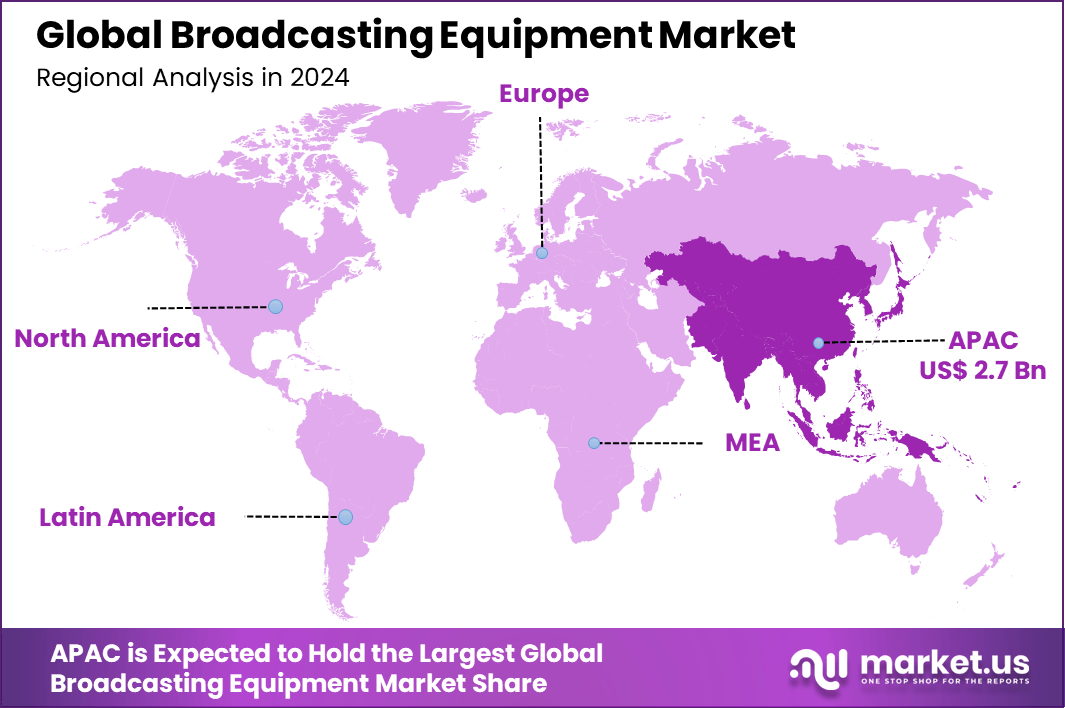

The Global Broadcasting Equipment Market size is expected to be worth around USD 11.1 Billion by 2034, from USD 6.3 billion in 2024, growing at a CAGR of 5.8% during the forecast period from 2025 to 2034. In 2024, Asia Pacific held a dominan market position, capturing more than a 42.5% share, holding USD 2.7 Billion revenue.

The Broadcasting Equipment Market is focused on the tools and devices used to create, process, transmit, and distribute audio-visual content for TV, radio, and internet broadcasting. This includes cameras, microphones, transmitters, encoders, antennas, and servers. The market has been shifting from traditional analog systems to digital and IP-based technologies, driven by increasing demand for high-quality content delivery and growing consumption of streaming services like OTT platforms.

Top driving factors behind this market include the exponential growth of OTT streaming services and live digital broadcasts, the rise of 4K and 8K ultra-high-definition content, and the implementation of 5G networks enabling smooth internet streaming. Digital broadcasting dominates with over 70% market share in technology segments, fueled by the adoption of smart TVs and set-top boxes.

Demand is strong among television and radio broadcasters upgrading to digital and high-definition infrastructure. OTT providers are investing heavily in broadcasting equipment to deliver high-quality streaming experiences. Sports broadcasting companies represent a significant share of demand due to the need for real-time, high-quality transmission. Corporate and educational institutions are adopting broadcasting equipment for webinars, online training, and hybrid events.

Key Takeaways

- By type, Dish Antennas led the market in 2024, holding 26.7% share, highlighting their critical role in broadcasting infrastructure.

- By technology, Analog systems dominated with 58.2% share, reflecting continued reliance on traditional broadcasting despite digital expansion.

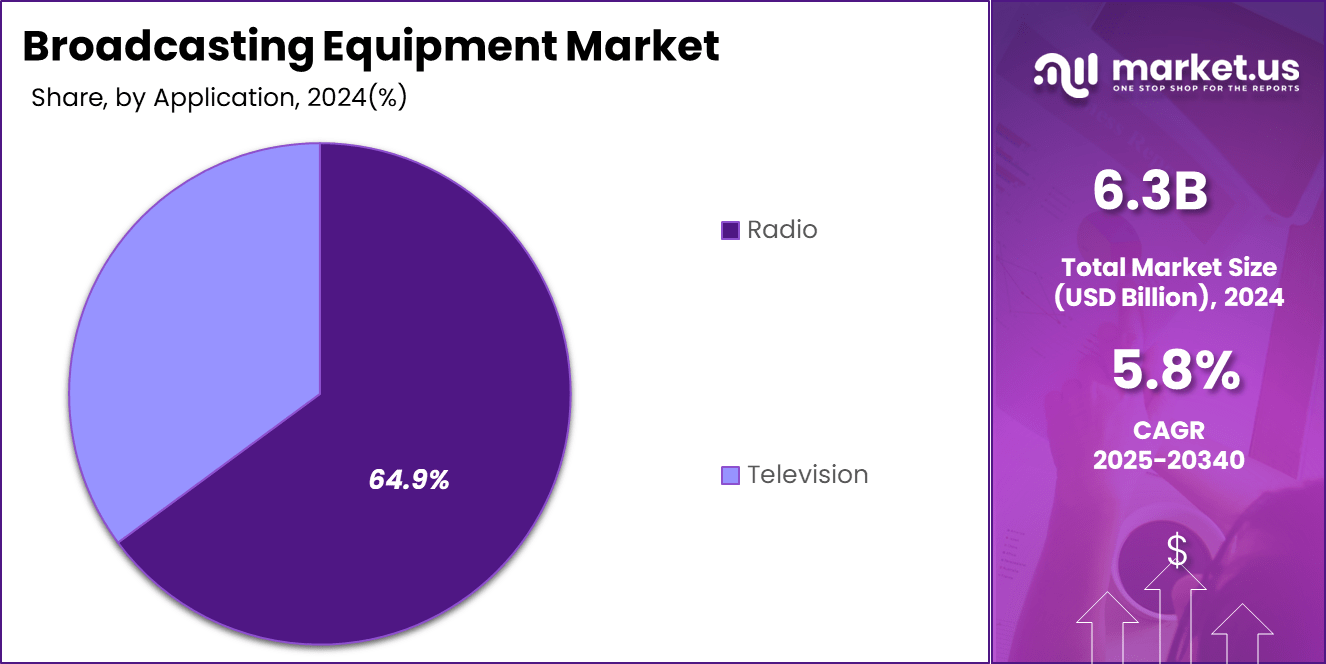

- By application, Radio broadcasting accounted for 64.9% share, showing the medium’s strong global presence and audience reach.

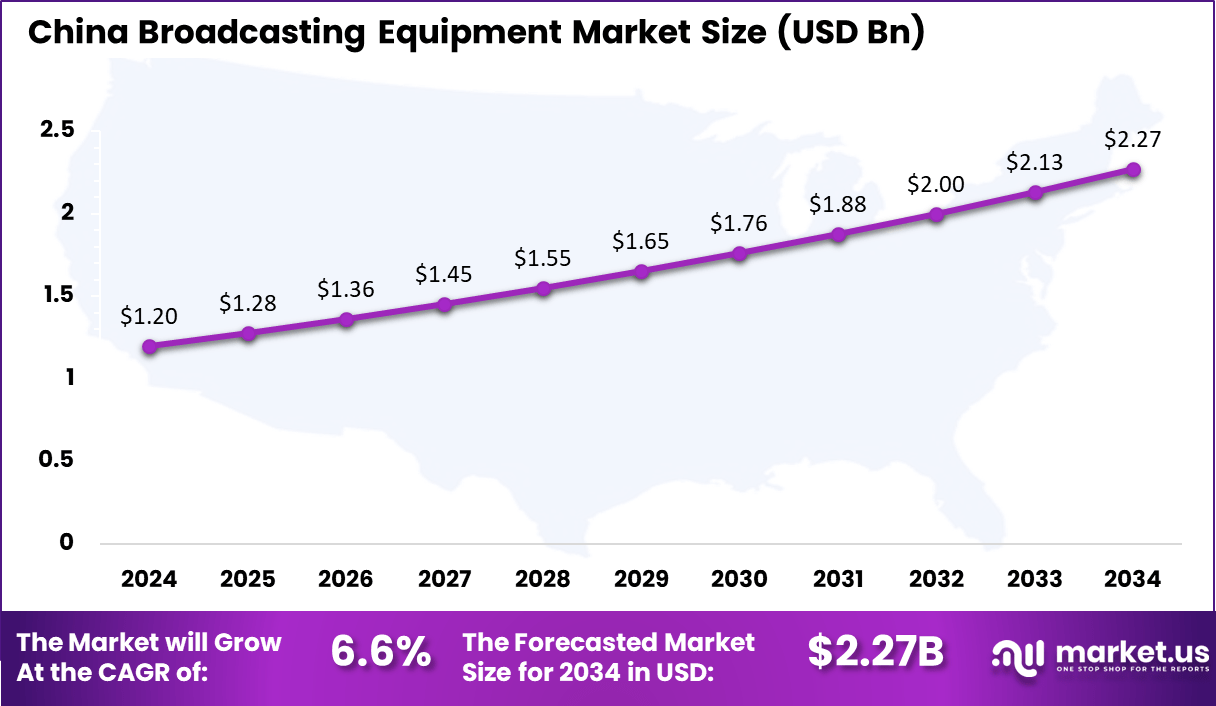

- Regionally, Asia Pacific captured 42.5% share, with China valued at USD 1.20 Billion in 2024 and recording a CAGR of 6.6%.

- According to OEC, global exports of broadcasting equipment rose 20.4%, from USD 474 Billion to USD 571 Billion, representing 2.41% of total world trade.

- According to the CIA, in China, all broadcasting media are state-owned or affiliated with the Chinese Communist Party (CCP) or government agencies, with state-run networks offering over 2,000 channels.

Role of Generative AI

In 2025, generative AI has become an integral part of broadcasting workflows, deeply influencing content creation, editing, and audience engagement. The technology enables broadcasters to automatically generate short-form content, tailor programming dynamically to viewer preferences, and accelerate localization processes, with AI-driven machine translation handling up to 80-90% of content adaptation before finalization.

This significantly reduces time and cost while improving operational efficiency. Moreover, generative AI supports hyper-personalization, allowing broadcasters to offer content and advertising that resonate individually with viewers, leading to enhanced engagement and revenue opportunities. Advances in AI also facilitate real-time metadata generation and smarter content recommendations, making AI a strategic tool rather than just an automation aid in broadcast operations.

Asia Pacific Market Trends

In 2024, The Asia Pacific region commands a leading 42.5% share in the broadcasting equipment market. This strong presence is driven by nations actively expanding their broadcast services, modernization efforts combining traditional and digital technologies, and government support for media infrastructure development. The region’s digital transformation and rising consumption of video and audio content fuel this growth.

China stands out within the region, accounting for a substantial share with a market value reported around USD 1.20 billion and a CAGR near 6.6%. The country’s rapid OTT platform adoption and increasing internet penetration are pushing the need for advanced broadcast equipment. Investments in 5G and UHD broadcasting also support technology upgrades, positioning Asia Pacific as a key market leader.

Europe Market Trends

Europe holds a notable share of the global broadcasting equipment market, with revenue figures indicating steady growth. The market benefits from high adoption of modern broadcast solutions including dish antennas, which lead product segment revenues. Governments in key European countries support digital broadcasting initiatives, such as upgrading traditional infrastructure to digital and IP-based systems.

Sustainability and energy efficiency have become important drivers in Europe, prompting broadcasters to invest in environmentally friendly technologies. The focus on interactive media and immersive content production, along with strong regional sports and media events, creates sustained demand for advanced broadcasting equipment across the continent.

Latin America Market Trends

In Latin America, the broadcasting equipment market is evolving through ongoing digital transformation and infrastructure upgrades. The transition from analog to digital broadcasting drives investment in new equipment that supports high-definition content and streaming services. There is growing interest in mobile broadcasting and OTT platforms to meet changing consumer preferences.

Local broadcasters are increasingly prioritizing cost-effective yet modern solutions to improve content quality and compete within both regional and international markets. Expansion of pay-TV services alongside digital platforms creates further opportunities for broadcasters to enhance their equipment capabilities, reinforcing steady market growth in the region.

Type Segment Analysis

In 2024, the Dish Antennas segment held a dominant market position, capturing more than a 26.7% share of the Global Broadcasting Equipment Market. This is contributed to a wide bandwidth and high directivity offered by the dish antennas, making them ideal for the broadcasting applications.

Furthermore, the dish antennas also provide reliable communication systems, over a vast distance. This makes it essential for the residential and commercial sectors. Moreover, the growth of satellite communication systems and the internet connectivity in the remote areas have increased the awareness of dish antennas.

For instance, according to PIB, 95.15% villages having access to internet with 3G/4G mobile connectivity. Additionally, dish antennas are versatile and could be used for applications such as satellite television reception, internet connectivity and weather monitoring. Advanced features such as automatic monitoring and remote management has further enhanced the usability of dish antennas.

Technology Analysis

In 2024, the Analog segment held a dominant market position, capturing more than a 58.2% share of the Global Broadcasting Equipment Market. This is primarily due to the ease of use and compatibility of the analog broadcasting.

Analog systems are simpler to operate and maintain as it requires less technical expertise and infrastructure as compared to digital systems, making it easy to use. It is also compatible with a wide range of current infrastructure and devices, thus reducing the need for extensive upgrades or replacements.

Moreover, analog systems are generally less expensive, thus making it accessible to the smaller broadcasters and the regions with restricted budgets. For instance, according to Government of UK, there are around 333 analogue commercial and BBC stations, and over 300 community stations in UK.

Application Segment Analysis

In 2024, the Radio segment held a dominant market position, capturing more than a 64.9% share of the Global Broadcasting Equipment Market. This is contributed to the easy accessibility of radios its reach in remote as well as rural areas.

Furthermore, setting and maintaining a radio broadcasting equipment is inexpensive as compared to the television or internet broadcasting, thus making it a popular choice for various broadcasters. Radios could be used for varied purposes such as entertainment, education and emergency communication. This leads to its constant demand and relevance in the market.

Moreover, the proliferation of smart devices such as smart speakers, smartphones and others with radios has made it easier for end users to access radio content anywhere and anytime. Thus has in turn increased the dominance of radio segment in the broadcasting equipment market.

Emerging Trends

The broadcasting equipment landscape is rapidly evolving toward immersive technologies such as augmented reality, virtual reality, and mixed reality, contributing to richer, more interactive viewing experiences. Cloud-native playout and IP-based content distribution are replacing traditional infrastructure, enabling flexible, scalable, and cost-efficient workflows.

Technologies like 4K and 8K broadcasting, combined with 5G networks, are becoming standard particularly in live sports and event streaming, driving demand for advanced cameras, transmitters, and encoders. There is also a noticeable shift to hybrid and multi-platform content delivery models, where broadcasters extend their reach beyond linear TV to OTT platforms, social media, and on-demand services, thus meeting consumers wherever they engage.

Meanwhile, heightened focus on content security, digital rights management via blockchain, and environmental sustainability in broadcast operations are important trends shaping equipment innovation and deployment.

Growth Factors

The broadcasting equipment market growth in 2025 is mainly driven by the global transition from analog to digital broadcasting, mandated by governments and regulatory bodies to improve broadcast quality and spectrum efficiency. The rise of internet broadcasting and streaming platforms fuels the need for high-performance encoding and transmission equipment.

Increased demand for ultra-high-definition (UHD) content and seamless live streaming formats requires broadcasters to invest in next-generation equipment capable of supporting 4K and 8K resolutions and advanced compression technologies.

Additionally, the implementation of 5G networks enables low-latency, mobile, and remote broadcasting solutions that broaden content delivery options. The sustained adoption of AI-driven automation in production and personalized advertising also contributes to market expansion. Growth is particularly pronounced in North America and parts of Europe and Asia, supported by strong media ecosystems and technology infrastructure.

Key Market Segments

By Type

- Dish Antennas

- Amplifiers

- Switches

- Encoders

- Video Servers

- Transmitters/Repeaters

- Modulators

- Others

By Technology

- Analog

- Digital

By Application

- Radio

- Amplitude Modulation

- Frequency Modulation

- Television

- Direct Broadcasting Satellite (DBS)

- Terrestrial Television

- Cable Television

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Middle East & Africa

- Latin America

Drivers

Increasing adoption of Over-The-Top (OTT) Services

The increasing adoption of OTT platforms such as Amazon Prime, Netflix, Disney Hotstar and others has driven the broadcasting equipment market as it needs a high quality video and audio content to attract and retain the subscribers.

OTT platforms also necessitates a robust content delivery networks (CDNs) and streaming infrastructure that supports efficient content distribution and minimizes the latency, thus increasing the demand for broadcasting equipments.

Furthermore, the emergence of live streaming and cloud based solutions in OTT services have also increase the need for broadcasters to invest in compatible equipments and technologies. Moreover, the increasing personalization and interactivity, as well as the global reach of OTT services have boosted the need for broadcasting equipments in the industry.

Restraint

Changing Consumer Preferences

Consumers currently, are preferring digital and on demand content over the traditional broadcasting. This has reduced the demand for conventional broadcasting equipments, thus hampering the market growth. The growing trend of cord cutting where consumers prefer the internet based streaming instead of cable of satellite television has also impacted the sales of equipments used in traditional cable and satellite broadcasting.

Moreover, the change in content consumption patterns as there is an increasing demand for short form content has made the broadcasters to reform their production strategies and limited the use of traditional broadcasting equipments.

Opportunities

Adoption of 5G technology and emergence of innovative content formats

Adoption of 5G technology has been an opportunity for the market growth as it provides faster and reliable internet connectivity, higher bandwidth, seamless mobile broadcasting and enables network slicing. This allows the broadcasters to distribute content on the go and provide consistency in quality of the content.

Furthermore, the rise of different content formats like virtual reality, augmented reality, interactive contents (live polls, real time Q&A and audience participation), and customized content has also been an opportunity for the market growth. This has increased the demand for more advanced equipments such as 360 degree cameras, motion tracking systems, and VR/AR production tools.

Challenges

Market Fragmentation and Compatibility Issues

A key challenge facing the broadcasting equipment market is fragmentation due to numerous competing standards and protocols across regions and equipment types. This lack of uniformity creates compatibility issues when integrating new equipment with existing systems or when interfacing with various content delivery networks, cloud platforms, and IP infrastructure.

Broadcasters often face technical hurdles ensuring seamless interoperability between hardware and software from different vendors, which can delay deployments and increase costs. In addition, the increasing reliance on IP-based and cloud infrastructure exposes broadcasters to cybersecurity threats such as data breaches and content disruption.

Protecting against such risks requires continuous investment in security measures, specialized expertise, and timely updates. These complexities, alongside economic uncertainties affecting media spending, complicate strategic planning for broadcasters and manufacturers alike. Overcoming these challenges demands industry collaboration toward standardization, robust security frameworks, and flexible solutions that can adapt to diverse operational environments.

Key Players Analysis

In the broadcasting equipment market, Cisco Systems, Ericsson, and CommScope are leading players with strong expertise in networking, video transmission, and broadcast infrastructure. Their solutions support large-scale broadcasting networks, enabling seamless distribution of content across television, radio, and digital platforms.

With strong global presence and advanced IP-based systems, these companies drive the transition from traditional broadcasting to next-generation digital and cloud-based broadcasting models. Specialized firms such as Evertz Microsystems, Harmonic Inc., EVS Broadcast Equipment, and Grass Valley play a critical role in content production and management.

Their technologies include video servers, encoding systems, and live production tools that enhance efficiency and quality in broadcast workflows. These companies are trusted by broadcasters worldwide for their ability to deliver real-time, high-definition content, supporting both live events and on-demand services.

Other contributors including Wellav Technologies, Eletec Broadcast Telecom, and Clyde Broadcast expand the market with niche and cost-effective solutions. Their offerings address regional and specialized broadcasting needs, particularly in emerging markets. By providing tailored products and flexible deployments, these companies add diversity to the industry.

Top Key Players in the Market

- Cisco Systems Inc.

- Telefonaktiebolaget LM Ericsson

- CommScope

- Evertz Microsystems, Ltd.

- Harmonic Inc.

- EVS Broadcast Equipment

- Grass Valley

- Wellav Technologies Ltd.

- Eletec Broadcast Telecom S.A.R.L

- Clyde Broadcast

- Others

Recent Developments

- In October 2024, HFCL, a technology and next-gen communications solution provider, has introduced two innovative Unlicensed Band Radio (UBR) products at the India Mobile Congress 2024 in New Delhi. These new solutions are designed to meet the growing demand for high-speed data while prioritizing sustainability.

- In September 2024, NVIDIA AI Aerial Launches to Optimize Wireless Networks, Deliver New Generative AI Experiences on One Platform. It is a suite of accelerated computing software and hardware for designing, simulating, training and deploying AI radio access network technology (AI-RAN) for wireless networks in the AI era.

- In June 2024, Vislink Technologies, Inc., a global technology leader in the capture, delivery, and management of high-quality live video and associated data in the media and entertainment, law enforcement, and defense markets, has announced the release of its INCAM-GV RF and 5G wireless transmitters designed exclusively for Grass Valley’s new LDX 135 RF and LDX 150 RF cameras.

Report Scope

Report Features Description Market Value (2024) USD 6.3 Bn Forecast Revenue (2034) USD 11.1 Bn CAGR(2025-2034) 5.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type (Dish Antennas, Amplifiers, Switches, Encoders, Video Servers, Transmitters /Repeaters, Modulators, Others), By Technology (Analog, Digital), By Application (Radio (Amplitude Modulation, Frequency Modulation), Television (Direct Broadcasting Satellite (DBS, Terrestrial Television, Cable Television, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Cisco Systems Inc., Telefonaktiebolaget LM Ericsson , CommScope, Evertz Microsystems, Ltd., Harmonic Inc., EVS Broadcast Equipment, Grass Valley, Wellav Technologies Ltd., Eletec Broadcast Telecom S.A.R.L , Clyde Broadcast, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Broadcasting Equipment MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample

Broadcasting Equipment MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Cisco Systems Inc.

- Telefonaktiebolaget LM Ericsson

- CommScope

- Evertz Microsystems, Ltd.

- Harmonic Inc.

- EVS Broadcast Equipment

- Grass Valley

- Wellav Technologies Ltd.

- Eletec Broadcast Telecom S.A.R.L

- Clyde Broadcast

- Others