Global Bridge Construction Market Size, Share, And Industry Analysis Report By Type (Box Girder Bridges, Cable-Stayed Bridges, Arch Bridges, Truss Bridges), By Material (Concrete, Steel, Composite, Timber), By Span Length (Short-Span Bridges, Medium-Span Bridges, Long-Span Bridges), By Application (Roadways, Railways, Pipelines, Power Lines), By Construction Technique (Conventional Construction, Incremental Launching, Cable Stayed Method, Suspension Method), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 174138

- Number of Pages: 265

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

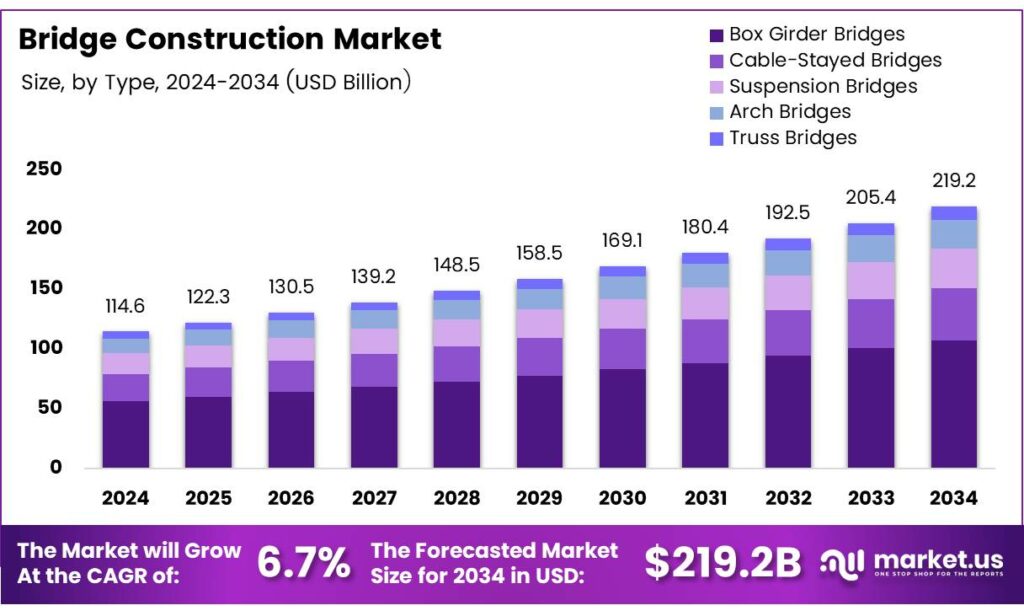

The Global Bridge Construction Market size is expected to be worth around USD 219.2 billion by 2034, from USD 114.6 billion in 2024, growing at a CAGR of 6.7% during the forecast period from 2025 to 2034.

The Bridge Construction Market represents the full lifecycle of planning, building, rehabilitating, and maintaining bridge infrastructure supporting road, rail, and multimodal transport networks. Broadly, it includes new bridge construction, structural strengthening, deck replacement, seismic retrofitting, and digital inspection services, enabling long-term mobility, safety, and economic connectivity.

Bridge construction demand is increasingly driven by aging assets, rising freight volumes, and climate resilience requirements. As urbanization accelerates, governments prioritize structurally sound crossings to reduce congestion and logistics bottlenecks. Consequently, demand expands across beam, arch, suspension, and cable-stayed designs, supported by advances in prefabrication and asset-management technologies.

- Structurally, the bridge construction market remains anchored in measurable rehabilitation demand. The U.S. National Bridge Inventory (2025) records 624,193 bridges, with 44.1% rated good, 49.1% fair, and 6.8% structurally deficient. Notably, the “one-in-three” rule persists, as nearly 35%, or over 222,000 bridges, require major repair or full reconstruction, sustaining steady near-term demand.

The U.S. bridge construction and maintenance market is valued near USD 120 billion, with about 55% of IIJA Bridge Formula Program funds committed by mid-2025, confirming live project pipelines. Internationally, India’s bridge market stands at USD 38.9 billion, while the U.K. allocates nearly GBP 1.6 billion annually to bridge and highway maintenance, reflecting continued pressure to modernize aging infrastructure.

The market shows strong opportunity potential due to persistent infrastructure backlogs. In mature economies, deferred maintenance has shifted into urgent rehabilitation programs, while emerging economies focus on capacity expansion. As a result, bridge construction aligns closely with highway expansion, smart transportation corridors, and disaster-resilient infrastructure investment strategies.

Key Takeaways

- The Global Bridge Construction Market is projected to grow from USD 114.6 billion in 2024 to USD 219.2 billion by 2034, registering a 6.7% CAGR during 2025–2034.

- Box Girder Bridges lead the By Type segment with a dominant market share of 36.2%, supported by strong demand from highway and urban flyover projects.

- Concrete remains the most used material, accounting for a commanding 59.8% share of the By Material segment due to durability and cost efficiency.

- Short-span bridges (up to 100 m) dominate the By Span Length segment with a 49.5% share, reflecting extensive use in local and regional road networks.

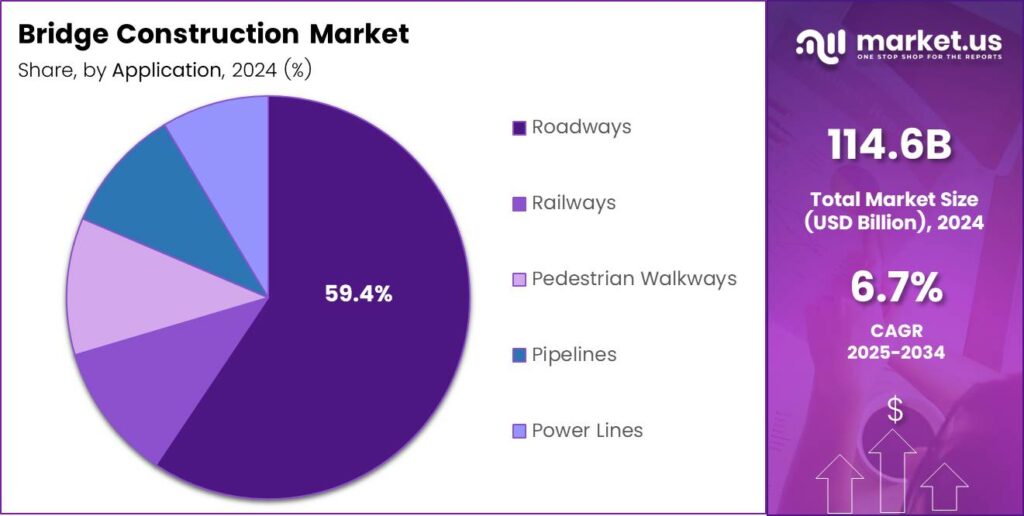

- Roadways represent the largest application area, holding a 59.4% market share, driven by continuous highway and urban road expansion.

- Conventional construction methods account for the largest share at 44.8%, supported by widespread contractor expertise and proven reliability.

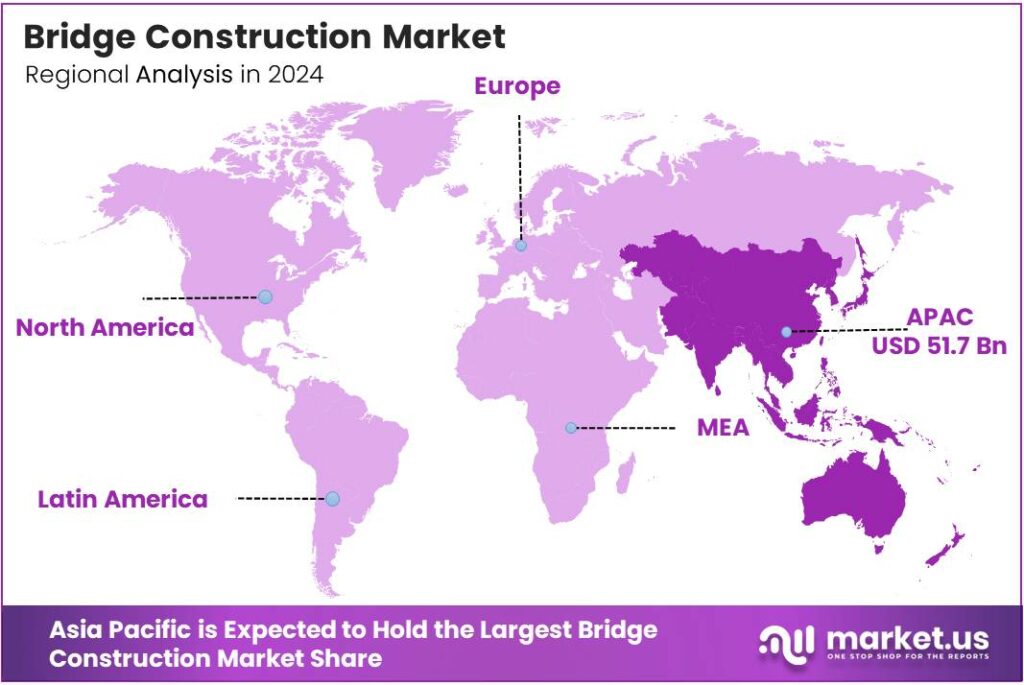

- Asia Pacific is the leading regional market with a 45.2% share, valued at USD 51.7 billion, fueled by rapid urbanization and infrastructure spending.

By Type Analysis

Box Girder Bridges dominate with a 36.2% share due to their structural efficiency and suitability for modern highway networks.

Box Girder Bridges held a dominant market position in the By Type Analysis segment of the Bridge Construction Market, with a 36.2% share. These bridges are widely preferred for urban highways and flyovers because they offer high load-bearing capacity, better torsional strength, and efficient use of concrete, supporting long-term durability.

Cable-Stayed Bridges continue to gain traction as cities expand across rivers and valleys. Their ability to span long distances with fewer piers improves navigation clearance and reduces foundation costs. As a result, they are increasingly selected for landmark projects and high-traffic corridors.

Suspension Bridges remain essential for very long spans where other designs are impractical. They are commonly used for crossings over wide water bodies and challenging terrain, supporting regional connectivity and international trade routes despite higher construction complexity.

Arch Bridges maintain steady demand due to their visual appeal and strong compression-based load transfer. They are often selected for heritage zones and medium-span crossings where aesthetics and structural stability are equally important. Truss Bridges are still relevant for rail and rural applications.

By Material Analysis

Concrete dominates with a 59.8% share due to its durability, availability, and cost efficiency.

Concrete held a dominant market position in the By Material Analysis segment of the Bridge Construction Market, with a 59.8% share. Concrete is widely used because it offers long service life, strong resistance to weathering, and compatibility with prefabrication techniques.

Steel bridges are favored for projects requiring faster construction and longer spans. Their high strength-to-weight ratio allows flexible design, making them suitable for railway bridges and complex structural requirements. Composite materials are gradually gaining attention as they combine steel and concrete.

These structures improve fatigue resistance and reduce maintenance needs, supporting lifecycle cost optimization. Timber bridges serve niche applications, especially in pedestrian and rural infrastructure. They are valued for sustainability, lower environmental impact, and suitability for short spans in low-load environments.

By Span Length Analysis

Short-span bridges dominate with a 49.5% share due to widespread use in local and regional road networks.

Short-Span Bridges (up to 100 m) held a dominant market position in the By Span Length Analysis segment of the Bridge Construction Market, with a 49.5% share. These bridges support highways, local roads, and urban crossings, driving consistent construction demand.

Medium-Span Bridges ranging from 100 to 500 meters are essential for highways and rail corridors crossing rivers and valleys. They balance structural complexity and cost, making them suitable for expanding transport infrastructure. Long-span bridges beyond 500 meters are strategically important for national connectivity.

By Application Analysis

Roadways dominate with a 59.4% share, driven by expanding highway and urban road networks.

Roadways held a dominant market position in the By Application Analysis segment of the Bridge Construction Market, with a 59.4% share. Continuous investments in expressways, bypasses, and urban mobility projects sustain strong demand. Railways rely on bridges to support heavy axle loads and high-speed corridors.

Ongoing rail modernization programs keep demand steady for both new construction and rehabilitation. Pedestrian Walkways play a growing role in urban safety and connectivity. These bridges improve mobility in dense cities and support sustainable transport planning.

Pipelines depend on bridge structures for safe crossings over rivers and valleys. These applications are critical for oil, gas, and water distribution infrastructure. Power Lines use bridge-like structures for transmission crossings, ensuring uninterrupted electricity flow across difficult terrain.

By Construction Technique Analysis

Conventional Construction dominates with a 44.8% share due to familiarity and widespread contractor expertise.

Conventional Construction held a dominant market position in the By Construction Technique Analysis segment of the Bridge Construction Market, with a 44.8% share. This method remains widely used due to proven reliability and adaptable design practices.

Prefabricated Bridge Elements and Systems (PBES) are increasingly adopted to reduce construction time and traffic disruption. They support faster project delivery and improved quality control. Incremental Launching is preferred for sites with limited access. This technique minimizes environmental impact while enabling construction over obstacles.

Cable Stayed Method is used for long-span and visually significant bridges. It allows efficient load distribution and architectural flexibility. Suspension Method remains critical for extreme spans. Despite higher complexity, it enables crossings where other techniques are not feasible.

Key Market Segments

By Type

- Box Girder Bridges

- Cable-Stayed Bridges

- Suspension Bridges

- Arch Bridges

- Truss Bridges

By Material

- Concrete

- Steel

- Composite

- Timber

By Span Length

- Short-Span Bridges (up to 100 m)

- Medium-Span Bridges (100 to 500 m)

- Long-Span Bridges (beyond 500 m)

By Application

- Roadways

- Railways

- Pedestrian Walkways

- Pipelines

- Power Lines

By Construction Technique

- Conventional Construction

- Prefabricated Bridge Elements and Systems (PBES)

- Incremental Launching

- Cable Stayed Method

- Suspension Method

Emerging Trends

Prefabrication and Digital Design Shape Bridge Construction Trends

Prefabricated bridge construction is a major trend transforming the market. Precast components are manufactured off-site and assembled quickly on location. This approach reduces construction time, limits traffic disruption, and improves quality control, making it attractive for urban projects.

- FHWA’s PBES material points to the scale of the challenge by stating that 25% of publicly owned bridges were described as structurally deficient or functionally obsolete, implying about 150,000 bridges needing to be built or rehabilitated. Sustainability is becoming a central trend. Governments are encouraging designs that reduce material use and extend bridge life spans.

Automation and advanced equipment are also shaping the market. Modern cranes, launching systems, and monitoring tools improve safety and efficiency on construction sites, allowing contractors to complete complex bridge projects with greater precision.

Drivers

Rising Government Investment in Infrastructure Drives Bridge Construction Market Growth

Government-led infrastructure spending remains the strongest driver for the bridge construction market worldwide. Many countries are shifting from delayed repairs to active bridge replacement and modernization programs. In the U.S., large federal programs are pushing states to upgrade aging bridges to improve safety and traffic flow. This steady funding reduces project uncertainty and accelerates construction timelines.

- Rapid population growth in cities increases pressure on existing transport networks. New bridges are required to reduce congestion, support public transport, and connect expanding suburbs. In the U.S., the Federal Highway Administration (FHWA) states that the Infrastructure Investment and Jobs Act (IIJA) provides approximately USD 350 billion for Federal highway programs.

Economic development and trade also support bridge construction demand. Bridges improve logistics efficiency by shortening travel times for goods and people. Governments increasingly view bridge projects as long-term economic assets rather than short-term expenses, which sustains investment even during slow economic cycles.

Restraints

High Construction Costs and Project Delays Restrain Market Expansion

Rising construction costs are a major restraint in the bridge construction market. Prices of steel, cement, and skilled labor have increased in many regions, putting pressure on project budgets. Cost overruns often lead to project delays or scope reductions, especially for publicly funded bridges.

- Environmental clearances, land acquisition challenges, and community opposition can delay projects for years. ASCE also cites the size of the problem in condition terms: 46,154 bridges, or 7.5% of the nation’s bridges, are considered structurally deficient, and it notes these structurally deficient bridges are nearly 69 years old on average.

Skilled labor shortages present another challenge. Bridge construction requires experienced engineers, designers, and technicians. In many countries, an aging workforce and limited training programs reduce labor availability, slowing project execution.

Growth Factors

Bridge Rehabilitation and Smart Infrastructure Create New Opportunities

Bridge rehabilitation and strengthening projects present major growth opportunities. Many existing bridges are structurally sound but require upgrades to meet modern safety and load standards. Rehabilitation is often faster and more cost-effective than full replacement, increasing project approvals.

- Smart bridge technologies offer another strong opportunity. Sensors, digital monitoring systems, and data analytics help track structural health in real time. Large Bridge Projects as those with eligible costs greater than USD 100 million, fit the reality that major river crossings and freight corridors can’t be solved with small maintenance contracts.

Public-private partnerships are also expanding opportunities. These models attract private capital for large bridge projects while reducing financial pressure on governments. Long-term concession models are becoming more common for toll bridges and major transport corridors.

Regional Analysis

Asia Pacific Dominates the Bridge Construction Market with a Market Share of 45.2%, Valued at USD 51.7 Billion

Asia Pacific leads the global bridge construction market, supported by large-scale highway expansion, urban transit projects, and cross-river connectivity programs. The region’s dominance is reinforced by sustained public infrastructure spending, with Asia Pacific accounting for 45.2% of global demand, translating to a market value of USD 51.7 billion. Rapid urbanization and population growth continue to push governments toward long-span and high-capacity bridge solutions.

North America shows steady growth driven by the rehabilitation of aging bridge assets and capacity upgrades on major freight routes. A large share of spending is directed toward structural repairs, deck replacements, and seismic retrofitting. The region benefits from long-term infrastructure programs that prioritize safety, resilience, and climate adaptation, keeping bridge construction activity stable across federal and state levels.

Europe’s bridge construction market is shaped by the modernization of transport networks and strict safety regulations. Investments focus on replacing aging structures, improving load capacity, and supporting cross-border transport corridors. Sustainability requirements are also influencing material selection and construction techniques, supporting demand for advanced engineering solutions across both Western and Eastern Europe.

The U.S. bridge construction market is driven by ongoing replacement and rehabilitation of structurally aging bridges. Investment is largely focused on improving safety ratings, increasing load-bearing capacity, and reducing long-term maintenance costs. The emphasis on asset management and lifecycle-based planning supports consistent demand for both new construction and major refurbishment projects.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

ACS Group remained a steady force in 2024 because it combines large-scale civil engineering delivery with disciplined project management across complex bridge packages. Its strength lies in executing multi-asset transport corridors where bridges are only one part of a wider mobility upgrade. This positioning helps it win work tied to long-term public infrastructure budgets and resilience programs.

AECOM continued to stand out in 2024 for its advisory-to-delivery role, especially where owners need early-stage planning, design leadership, and risk controls before shovels hit the ground. AECOM is a “de-risking partner” for bridge programs, bringing technical depth in lifecycle planning, climate adaptation, and constructability reviews that support faster approvals and fewer change orders.

Balfour Beatty showed strong relevance in 2024 as clients pushed for safer execution and less disruption on live road and rail networks. Its value proposition is practical delivery—phased construction, traffic management, and refurbishment capability—making it well-suited to replacement and upgrade cycles in mature markets. That balance of new-build and maintenance work can support resilience when greenfield awards slow.

China Communications Construction Co. (CCCC) stayed influential in 2024 through its scale, equipment access, and ability to deliver large bridge and transport links at speed. It leverages integrated capabilities—design, marine works, foundations, and complex structures—to compete on mega-projects. Its presence is most visible where governments prioritize connectivity, ports, and economic corridor expansion under tight timelines.

Top Key Players in the Market

- ACS Group

- AECOM

- Balfour Beatty

- China Communications Construction Co. (CCCC)

- China Railway Group

- Bechtel

- HOCHTIEF

- Skanska

- Bouygues Construction

- Fluor

- Kiewit

Recent Developments

- In 2025, AECOM will be involved in the Mississippi River Bridge at Vicksburg (I-20) project, which is a critical connection between Louisiana and Mississippi. A contract was awarded for design and construction services, focusing on a new bridge structure to enhance regional transportation.

- In 2025, Balfour Beatty Infrastructure Inc. was awarded a contract in North Carolina for roadway, culvert, and bridge construction in Nash and Halifax counties, with progress expected across. Balfour Beatty VINCI progressed on HS2 viaducts in the UK, including complex bridge work over the Christmas 2025 period.

Report Scope

Report Features Description Market Value (2024) USD 114.6 Billion Forecast Revenue (2034) USD 219.2 Billion CAGR (2025-2034) 6.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Box Girder Bridges, Cable-Stayed Bridges, Suspension Bridges, Arch Bridges, Truss Bridges), By Material (Concrete, Steel, Composite, Timber), By Span Length (Short-Span Bridges up to 100 m, Medium-Span Bridges 100 to 500 m, Long-Span Bridges beyond 500 m), By Application (Roadways, Railways, Pedestrian Walkways, Pipelines, Power Lines), By Construction Technique (Conventional Construction, Prefabricated Bridge Elements and Systems (PBES), Incremental Launching, Cable Stayed Method, Suspension Method) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape ACS Group, AECOM, Balfour Beatty, China Communications Construction Co. (CCCC), China Railway Group, Bechtel, HOCHTIEF, Skanska, Bouygues Construction, Fluor, Kiewit Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Bridge Construction MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample

Bridge Construction MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- ACS Group

- AECOM

- Balfour Beatty

- China Communications Construction Co. (CCCC)

- China Railway Group

- Bechtel

- HOCHTIEF

- Skanska

- Bouygues Construction

- Fluor

- Kiewit