Global Brain Biomarker Market By Product Type (Test Kits and Analyzers), By Indication (Alzheimer's Disease & Other Dementias, Stroke, Parkinson's Disease, MND & ALS, and Huntington's Disease), By Application (Drug Discovery & Development, Diagnosis, and Others), By End-user (Pharma & Biotech Companies, Hospitals, and Research & Diagnostic Laboratories), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 166017

- Number of Pages: 380

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

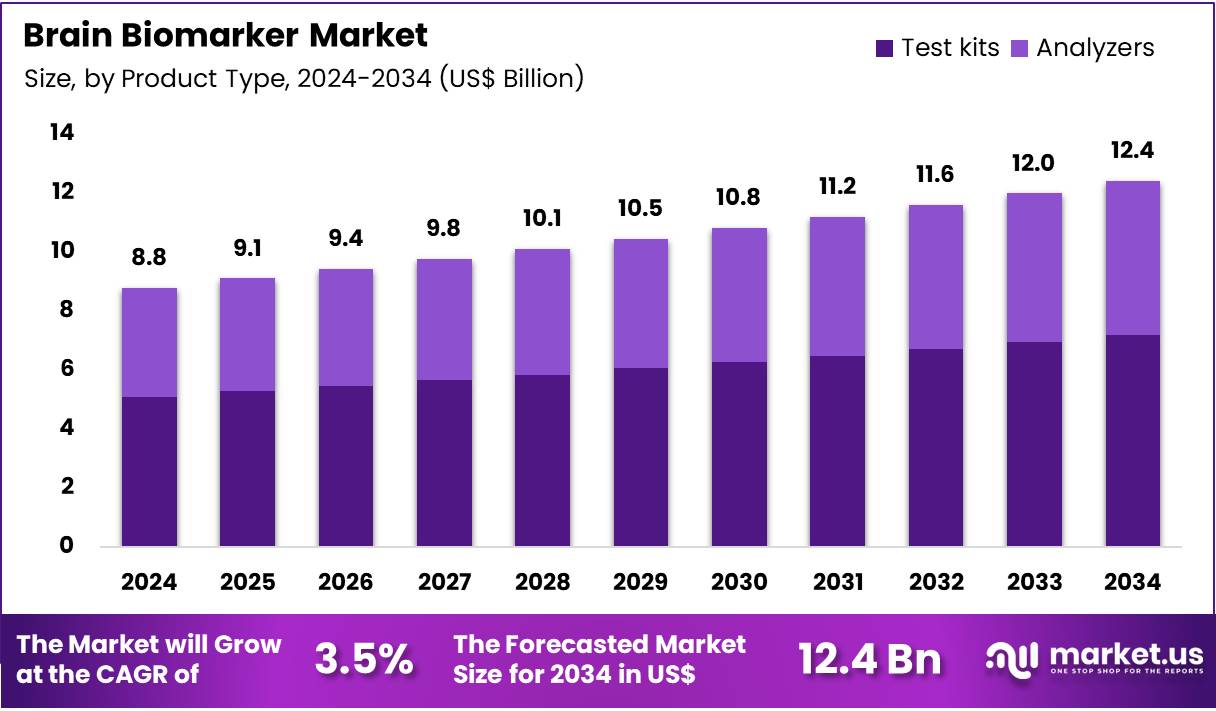

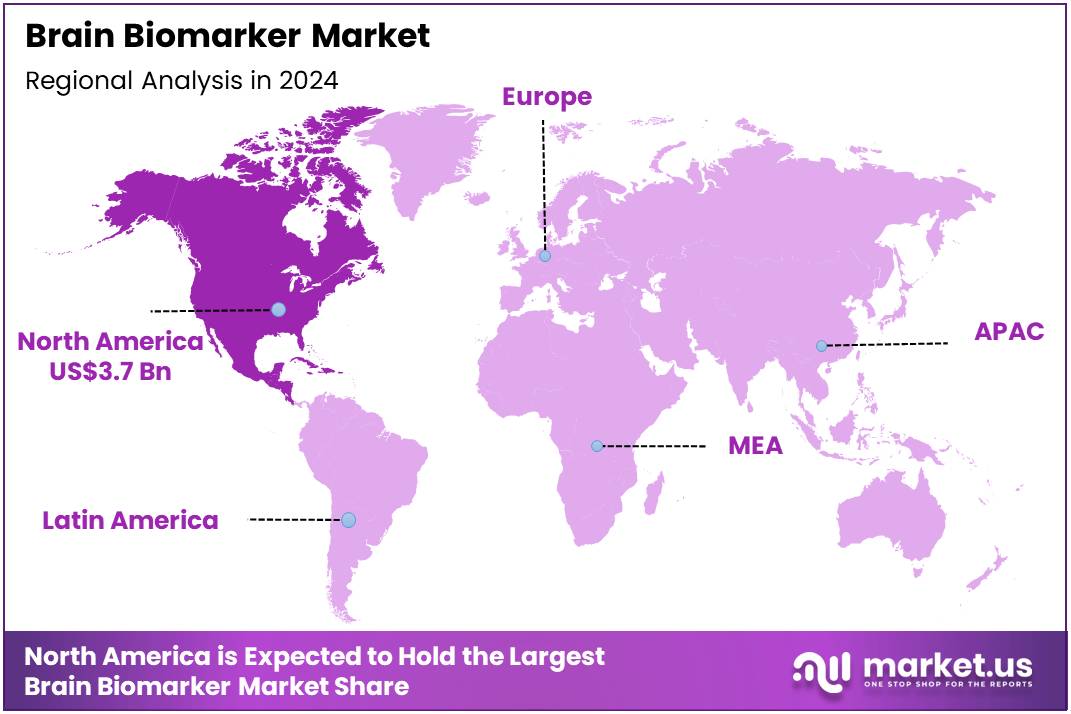

Global Brain Biomarker Market size is expected to be worth around US$ 12.4 Billion by 2034 from US$ 8.8 Billion in 2024, growing at a CAGR of 3.5% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 41.6% share with a revenue of US$ 3.7 Billion.

Increasing incidence of neurological disorders drives the Brain Biomarker market, as clinicians demand objective tools to guide diagnosis, prognosis, and therapeutic monitoring across diverse pathologies. Diagnostic companies develop multiplex assays that quantify protein aggregates, inflammatory mediators, and neuronal injury markers with high sensitivity. These biomarkers enable risk stratification in concussion protocols, progression tracking in multiple sclerosis, differential diagnosis of dementia subtypes, and efficacy evaluation in stroke rehabilitation trials.

Regulatory clearances for blood-based alternatives to imaging create opportunities to decentralize testing and reduce patient burden. Abbott Laboratories achieved this paradigm shift in March 2023 with FDA clearance of the Alinity I TBI test, introducing GFAP and UCH-L1 as reliable indicators that streamline mild trauma assessment in emergency settings. This innovation accelerates adoption of molecular diagnostics over traditional scans.

Growing focus on preclinical detection propels the Brain Biomarker market, as healthcare systems invest in screening programs that identify at-risk individuals before irreversible damage occurs. Biotechnology firms engineer ultrasensitive platforms capable of detecting femtogram-level analytes in peripheral fluids. Applications now include prodromal Alzheimer’s identification via phosphorylated tau isoforms, Parkinson’s staging through alpha-synuclein seeding, amyotrophic lateral sclerosis monitoring with neurofilament light chain, and epilepsy seizure prediction using glial activation markers.

Minimally invasive blood tests open avenues for population-scale studies and companion diagnostic development. Quanterix advanced this frontier in July 2023 by commercializing LucentAD, a plasma assay that facilitates early Alzheimer’s confirmation and positions blood biomarkers as viable substitutes for costly neuroimaging. Such solutions catalyze the transition to proactive neurological care.

Rising regulatory support for innovative assays invigorates the Brain Biomarker market, as accelerated pathways validate novel ratios and combinations that enhance diagnostic specificity. Manufacturers prioritize plasma-based panels that correlate tightly with neuropathological hallmarks. These tools support therapeutic trial enrichment for Huntington’s disease, outcome prediction in traumatic brain injury recovery, subtype classification in frontotemporal dementia, and response assessment in glioblastoma immunotherapy.

Breakthrough designations expedite integration into clinical guidelines and reimbursement frameworks. Beckman Coulter Diagnostics secured this advantage in January 2025 with FDA Breakthrough Device Designation for its Access p-Tau217/β-Amyloid 1-42 ratio test, affirming plasma biomarkers’ role in precise early Alzheimer’s detection. This milestone propels standardized, routine deployment of advanced neurodiagnostics.

Key Takeaways

- In 2024, the market generated a revenue of US$ 8.8 Billion, with a CAGR of 3.5%, and is expected to reach US$ 12.4 Billion by the year 2034.

- The product type segment is divided into test kits and analyzers, with test kits taking the lead in 2024 with a market share of 57.9%.

- Considering indication, the market is divided into Alzheimer’s disease & other dementias, stroke, Parkinson’s disease, MND & ALS, and Huntington’s disease. Among these, Alzheimer’s disease & other dementias held a significant share of 44.6%.

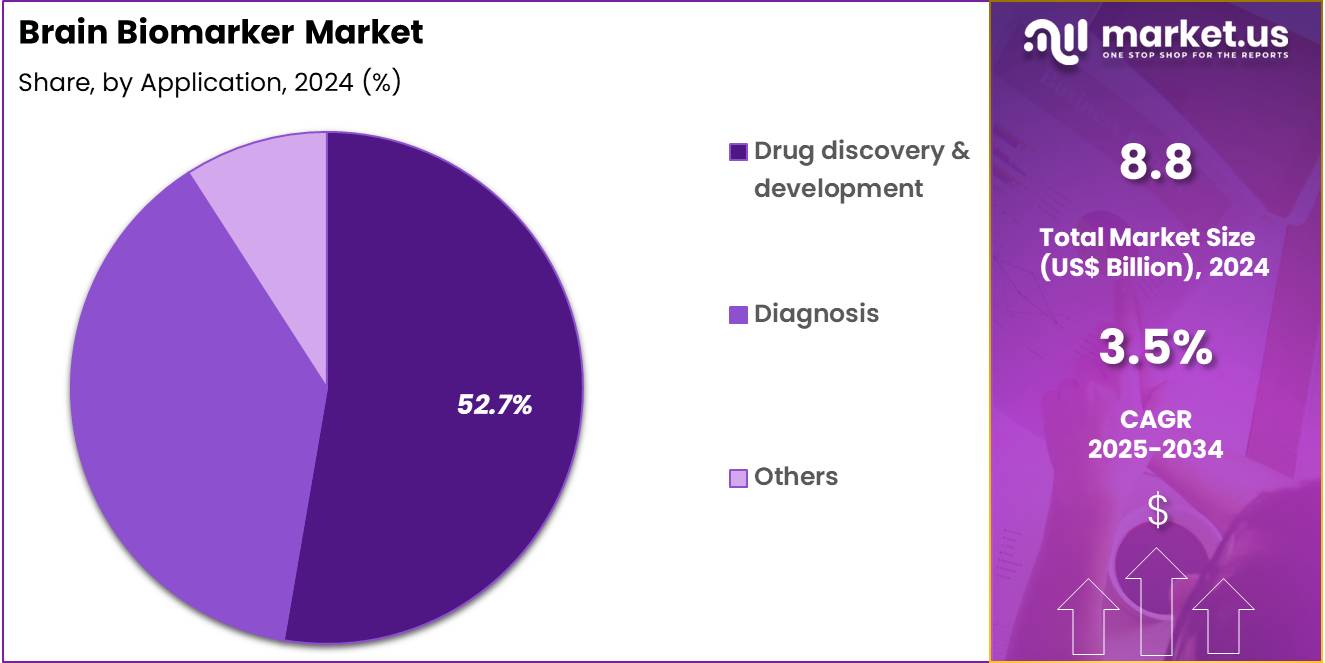

- Furthermore, concerning the application segment, the market is segregated into drug discovery & development, diagnosis, and others. The drug discovery & development sector stands out as the dominant player, holding the largest revenue share of 52.7% in the market.

- The end-user segment is segregated into pharma & biotech companies, hospitals, and research & diagnostic laboratories, with the pharma & biotech companies segment leading the market, holding a revenue share of 48.5%.

- North America led the market by securing a market share of 41.6% in 2024.

Product Type Analysis

Test kits account for 57.9% of the Brain Biomarker market and are anticipated to dominate due to their scalability, convenience, and rapid turnaround time in biomarker detection. These kits enable early and precise measurement of neurological biomarkers such as amyloid-beta, tau proteins, and neurofilament light chain, driving adoption in both clinical and research settings. The shift toward non-invasive diagnostic techniques using blood and cerebrospinal fluid has significantly increased demand for biomarker-based test kits.

Continuous advancements in immunoassay and multiplexing technologies are enhancing assay sensitivity and specificity, improving early disease detection rates. Growing investment by biotech firms in biomarker validation and test-kit development accelerates product innovation. Additionally, regulatory clearances for diagnostic kits targeting Alzheimer’s disease and stroke biomarkers strengthen market penetration.

The expansion of point-of-care testing solutions and automation-enabled diagnostic workflows further contribute to adoption. As global neurological disorder incidence rises, test kits are expected to remain a key growth engine for rapid, scalable neurodiagnostic testing solutions.

Indication Analysis

Alzheimer’s disease and other dementias dominate the indication segment with 44.6% share and are projected to continue leading due to increasing global prevalence and urgent need for early diagnosis. The growing elderly population drives the clinical demand for biomarkers that identify cognitive decline before irreversible neuronal damage occurs. Research advances in blood-based and imaging biomarkers such as phosphorylated tau, beta-amyloid, and neurogranin have transformed diagnostic strategies.

Pharmaceutical companies are prioritizing Alzheimer’s biomarker validation to accelerate drug discovery and patient stratification. Collaborations between academic research centers and diagnostic firms are producing biomarker panels capable of differentiating Alzheimer’s from other neurodegenerative disorders. Government funding initiatives in the US, EU, and Japan are strengthening translational research in dementia biomarker development.

Furthermore, the emergence of companion diagnostics integrated with digital cognitive assessments supports precise disease tracking. With rising R&D investment and awareness among clinicians, Alzheimer’s-related biomarker applications are anticipated to expand substantially over the forecast period.

Application Analysis

Drug discovery and development comprise 52.7% of the Brain Biomarker market and are expected to remain dominant due to their critical role in accelerating neurological therapeutic pipelines. Biomarkers facilitate patient selection, dose optimization, and early efficacy assessment in neurodegenerative drug trials. Pharmaceutical and biotech firms increasingly depend on biomarker validation to improve trial success rates and regulatory approval outcomes.

The adoption of surrogate biomarkers in clinical phases reduces timelines and costs associated with lengthy neurological studies. Integration of artificial intelligence and omics-based biomarker profiling is enhancing precision drug development. Recent advancements in liquid biopsy and proteomic technologies enable real-time monitoring of neuronal degeneration and therapeutic response.

Strategic collaborations between biopharma companies and academic institutions are driving innovation in biomarker-guided CNS drug development. The growing focus on disease-modifying therapies for Alzheimer’s and Parkinson’s is likely to sustain biomarker utilization growth. As personalized neurology progresses, biomarker-driven R&D is projected to define the future of neurotherapeutic innovation.

End-User Analysis

Pharma and biotech companies dominate the end-user segment with 48.5% of the Brain Biomarker market and are projected to sustain leadership due to their pivotal role in translational research and therapeutic innovation. These companies rely on biomarker-based screening to design precision therapies targeting neurodegenerative and psychiatric conditions. The expansion of large-scale clinical trials utilizing digital biomarker platforms reinforces demand for standardized testing protocols.

Major firms are investing in multiplex biomarker assays to monitor disease progression and treatment efficacy in real-time. Strategic mergers and partnerships with diagnostic developers are enabling the co-development of companion diagnostics for CNS drugs. Furthermore, increased funding for neuroimaging and biofluid biomarker validation supports preclinical and clinical-stage programs.

The emphasis on precision medicine has positioned biomarkers as essential tools in regulatory submissions and market approvals. As biotech innovation converges with advanced analytics and omics research, pharma and biotech players are expected to remain key drivers of biomarker commercialization and adoption.

Key Market Segments

By Product Type

- Test Kits

- Analyzers

By Indication

- Alzheimer’s Disease & Other Dementias

- Stroke

- Parkinson’s Disease

- MND & ALS

- Huntington’s Disease

By Application

- Drug Discovery & Development

- Diagnosis

- Others

By End-user

- Pharma & Biotech Companies

- Hospitals

- Research & Diagnostic Laboratories

Drivers

Escalating Mortality from Dementia is Driving the Market

The growing mortality associated with dementia has positioned it as a critical driver for the brain biomarker market, underscoring the urgent need for early detection tools to mitigate disease progression. As populations age, the burden of Alzheimer’s and related disorders intensifies, prompting healthcare systems to prioritize biomarker development for timely interventions. This trend compels investments in research and diagnostic infrastructure, enhancing the accuracy of cerebrospinal fluid and imaging assays. Professional societies advocate for routine screening, integrating biomarkers into clinical guidelines to facilitate proactive management.

Pharmaceutical companies collaborate with diagnostic firms to align biomarker panels with therapeutic targets, accelerating approval pathways. Public health campaigns raise awareness, encouraging higher utilization rates in primary care settings. The economic implications of delayed diagnosis further incentivize adoption, as early identification reduces long-term care expenditures. Global consortia standardize protocols, ensuring interoperability across laboratories worldwide. This driver not only expands market demand but also fosters innovation in multiplex testing formats.

The Centers for Disease Control and Prevention reported that in 2022, 288,436 deaths among U.S. adults aged 65 and older were attributed to dementia as the underlying cause. Such data reflect the escalating public health crisis, compelling sustained advancements in biomarker technologies. Ultimately, this momentum reinforces the market’s essential role in addressing neurodegenerative threats.

Restraints

Persistent Challenges in Biomarker Validation are Restraining the Market

Ongoing difficulties in validating brain biomarkers for consistent clinical performance continue to limit the market’s expansion, as discrepancies in assay sensitivity hinder reliable adoption across diverse populations. Inter-laboratory variations and the complexity of biological matrices complicate reproducibility, delaying integration into standard workflows. Regulatory agencies require extensive longitudinal data, extending timelines for commercialization and increasing development expenses. This restraint affects smaller innovators, who struggle with resource demands for multi-site trials.

Ethical concerns over sample sourcing and equity in access further slow progress, particularly in underrepresented demographics. Collaborative initiatives seek to harmonize cut-off values, yet implementation gaps persist in global settings. The resultant uncertainty discourages payer reimbursements, confining utilization to specialized centers. Manufacturers must navigate evolving evidence thresholds, diverting focus from innovation to compliance. These barriers collectively cap market penetration, perpetuating reliance on invasive diagnostics.

A 2024 review published through the National Institutes of Health emphasized that, despite technological advances, significant challenges remain in effectively integrating biomarker data and developing reliable predictive models for neurodegenerative diseases. Addressing these validation hurdles is imperative for unlocking broader therapeutic potential.

Opportunities

Advancements in Blood-Based Diagnostic Tools are Creating Growth Opportunities

The evolution of non-invasive blood-based assays for brain pathology detection is opening expansive avenues for market growth, transforming accessibility from specialized clinics to routine primary care. These tools offer high specificity for amyloid and tau proteins, enabling earlier staging without lumbar punctures or imaging. Developers are pursuing companion diagnostics, linking biomarkers to emerging disease-modifying agents for personalized regimens. This synergy attracts cross-sector partnerships, streamlining regulatory submissions and market entry.

Cost reductions from scalable production enhance affordability, appealing to emerging economies with rising dementia burdens. Educational programs equip clinicians with interpretation skills, boosting confidence in frontline deployment. Reimbursement expansions for validated assays incentivize provider uptake, diversifying revenue models. International validations facilitate global harmonization, mitigating regional disparities. These opportunities position blood-based solutions as pivotal enablers of precision neurology.

In 2024, the U.S. Food and Drug Administration cleared the Lumipulse G pTau 217/β-Amyloid 1-42 Plasma Ratio assay to aid healthcare providers in identifying patients with amyloid pathology associated with Alzheimer’s disease. Such clearances exemplify the pathway to widespread clinical utility.

Impact of Macroeconomic / Geopolitical Factors

Inflationary trends and reduced government funding for neuroscience programs restrict clinical labs from adopting cutting-edge brain biomarker technologies, curbing routine screenings in overburdened facilities. Private equity inflows and heightened focus on early dementia detection, however, energize biotech firms to refine sensitive assays, expanding access for at-risk populations.

Trade embargoes on high-precision lab instruments from conflict zones like Ukraine disrupt calibration processes, extending validation periods and hiking setup expenses for global developers. These constraints, in contrast, stimulate cross-continental tech transfers and homegrown engineering solutions that enhance assay accuracy and scalability.

U.S. tariffs at 25% on Chinese-origin diagnostic reagents, enforced under Section 301 since mid-2025, burden American neuro labs with steeper input prices and complicate budget allocations for large-scale studies. Labs respond shrewdly by qualifying for exemptions through domestic blending operations and partnering with Canadian suppliers to steady costs.

Latest Trends

Integration of Artificial Intelligence in Biomarker Analysis is a Recent Trend

The incorporation of artificial intelligence algorithms into brain biomarker interpretation has gained prominence in 2024, enhancing predictive accuracy through pattern recognition in complex datasets. Machine learning models process multimodal inputs, from plasma proteomics to neuroimaging, to forecast disease trajectories with unprecedented precision. This trend supports real-time analytics, reducing diagnostic delays in high-volume environments.

Regulatory frameworks are adapting to validate AI-enhanced tools, emphasizing explainability for clinical trust. Collaborative platforms enable federated learning, preserving data privacy while aggregating insights across institutions. The approach refines risk stratification, tailoring interventions to individual molecular profiles. Pharmaceutical entities leverage AI for trial enrichment, optimizing biomarker selection in study cohorts.

Ethical guidelines address bias mitigation, ensuring equitable outcomes across demographics. This innovation bridges gaps in traditional analytics, accelerating biomarker discovery pipelines. In 2024, the National Institutes of Health funded the “Federated Deep Learning to Accelerate Alzheimer’s Disease Biomarker Discovery” project to enable distributed AI computations on global biobanks for advancing neurodegenerative diagnostics. Such initiatives highlight the trend’s transformative influence on neurological care paradigms.

Regional Analysis

North America is leading the Brain Biomarker Market

The Brain Biomarker market in North America captured 41.6% of the global share in 2024, fueled by surging investments in precision diagnostics for neurodegenerative conditions like Alzheimer’s and Parkinson’s. Biotechnology leaders such as Quanterix and C2N Diagnostics pioneered ultrasensitive assays for neurofilament light chain and amyloid-beta detection, enabling earlier intervention through minimally invasive blood tests. The National Institute on Aging amplified grants for biomarker validation studies, prioritizing longitudinal cohorts to correlate imaging with proteomic signatures for prognostic accuracy.

Academic consortia, including those at Mayo Clinic, integrated multi-omics platforms to refine tau protein profiling, accelerating translation from bench to bedside. Private equity infusions exceeded traditional thresholds, supporting scalable point-of-care devices that democratize access in community clinics. Reimbursement expansions under the Centers for Medicare & Medicaid Services covered novel plasma-based panels, spurring adoption among primary care providers.

Interdisciplinary hubs in Boston and San Diego fostered real-world evidence generation, linking biomarkers to therapeutic response monitoring. Ethical frameworks from the FDA guided equitable trial designs, incorporating diverse ethnic representations to mitigate biases in reference ranges. Export of validated kits to global partners reinforced North America’s leadership in standardization efforts. The National Institute on Aging reports that NIH was funding 495 clinical trials for Alzheimer’s and related dementias as of the end of fiscal year 2024, illustrating the depth of ongoing biomarker-driven investigations.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Forecasters project the neurological diagnostic tools sector in Asia Pacific to expand vigorously during the forecast period, as nations intensify commitments to combat rising dementia incidences through innovative detection methods. China deploys national funds under the Healthy China 2030 initiative to develop cerebrospinal fluid-independent assays for early-onset variants, partnering with tech firms for AI-enhanced interpretations.

Japan channels resources via the Japan Agency for Medical Research and Development toward positron emission tomography ligands for synaptic density mapping, yielding breakthroughs in mild cognitive impairment staging. India harnesses the Indian Council of Medical Research to validate affordable salivary biomarkers for rural screening programs, bridging gaps in underserved populations.

South Korea advances Korea Health Technology R&D Project allocations for exosomal RNA profiling in stroke-related neurodegeneration, cultivating local manufacturing hubs. Governments enact fast-track certifications, like Australia’s Therapeutic Goods Administration streamlined reviews, to hasten market entry of home-based kits.

Innovation parks in Singapore integrate wearable sensors with biomarker analytics, attracting venture capital for scalable prototypes. Regional alliances under the Asia-Pacific Economic Cooperation framework exchange datasets, refining algorithms for cross-ethnic applicability. Pharmaceutical developers localize production chains, reducing import dependencies while elevating trial enrollment rates.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Leading firms in the neurodiagnostic marker sector accelerate growth by embedding ultra-sensitive digital immunoassays into emergency protocols for concussion evaluation, securing rapid adoption in sports medicine and military triage. They forge exclusive data-sharing pacts with biobanks to validate plasma-based panels against longitudinal imaging cohorts, derisking pivotal trials for Alzheimer’s stratification. Innovators miniaturize benchtop analyzers into point-of-care cartridges that deliver sub-femtomolar detection of neurofilament light within minutes.

Companies acquire complementary AI interpretation startups to layer predictive algorithms atop raw analyte readouts, enhancing prognostic granularity for multiple sclerosis flares. Executives pursue harmonized regulatory filings across FDA and EMA to synchronize global launches of companion diagnostics tied to disease-modifying agents. This precision orchestration captures escalating demand for minimally invasive, serial monitoring in aging populations.

BioMérieux SA, headquartered in Marcy-l’Étoile, France, commands a cornerstone position through its VIDAS platform, which quantifies core neuronal injury markers with automated, high-throughput workflows trusted in over 160 countries. The company integrates its assays into centralized lab networks, supporting real-time decision-making in stroke centers and neurology wards.

BioMérieux expands its neurology portfolio via targeted R&D in multiplexed panels that correlate blood proxies with PET-validated pathology. Leadership channels resources into seamless LIS connectivity and clinician training portals to drive protocol adherence. The firm sustains dominance by aligning innovations with reimbursement frameworks, positioning itself as the gold standard for objective, scalable brain health assessment worldwide.

Top Key Players

- Thermo Fisher Scientific Inc.

- Siemens Healthineers AG

- Quanterix Corporation

- PerkinElmer Inc.

- Fujirebio Holdings, Inc.

- Hoffmann‑La Roche Ltd

- Danaher Corporation

- Bio‑Techne Corporation

- Bio‑Rad Laboratories, Inc.

- Abbott Laboratories

Recent Developments

- In May 2025, the FDA granted approval for the Lumipulse blood test, marking a significant advancement in non-invasive Alzheimer’s disease (AD) diagnostics. By quantifying tau protein variants associated with amyloid plaque buildup, this test enables earlier and more accessible identification of AD pathology in adults aged 50 and older with cognitive decline. Its clinical integration reduces dependence on invasive cerebrospinal fluid testing and PET imaging, directly boosting demand for blood-based biomarker solutions and expanding the Brain Biomarker Market’s reach across hospital and outpatient diagnostic settings.

- In October 2025, the FDA cleared Roche and Eli Lilly’s Elecsys pTau181 plasma test for clinical use in primary care environments for patients aged 55 and above. Designed as a screening tool to rule out amyloid pathology before advanced testing, this approval brings biomarker-based Alzheimer’s screening into general practice for the first time. The accessibility of such plasma-based tests at the primary care level democratizes early cognitive assessment, supporting a scalable diagnostic pathway that is expected to significantly accelerate adoption across the Brain Biomarker Market.

Report Scope

Report Features Description Market Value (2024) US$ 8.8 Billion Forecast Revenue (2034) US$ 12.4 Billion CAGR (2025-2034) 3.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Test Kits and Analyzers), By Indication (Alzheimer’s Disease & Other Dementias, Stroke, Parkinson’s Disease, MND & ALS, and Huntington’s Disease), By Application (Drug Discovery & Development, Diagnosis, and Others), By End-user (Pharma & Biotech Companies, Hospitals, and Research & Diagnostic Laboratories) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Thermo Fisher Scientific Inc., Siemens Healthineers AG, Quanterix Corporation, PerkinElmer Inc., Fujirebio Holdings, Inc., F. Hoffmann‑La Roche Ltd, Danaher Corporation, Bio‑Techne Corporation, Bio‑Rad Laboratories, Inc., Abbott Laboratories. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Thermo Fisher Scientific Inc.

- Siemens Healthineers AG

- Quanterix Corporation

- PerkinElmer Inc.

- Fujirebio Holdings, Inc.

- Hoffmann‑La Roche Ltd

- Danaher Corporation

- Bio‑Techne Corporation

- Bio‑Rad Laboratories, Inc.

- Abbott Laboratories