Global Bone Regeneration Market By Product Type (Bone Grafts Substitutes (Autografts, Allografts, Xenografts and Synthetic Bone Substitutes), Bone Growth Stimulators and Advanced Scaffold and Tissue Engineering Products), By Application (Trauma and Fracture Repair, Spinal Fusion, Joint Reconstruction and Revision Surgeries, Oral and Maxillofacial Surgery and Others), By Patient Type (Adult, Pediatric and Geriatric), By End-User (Hospitals, Specialty Clinics and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 172955

- Number of Pages: 282

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

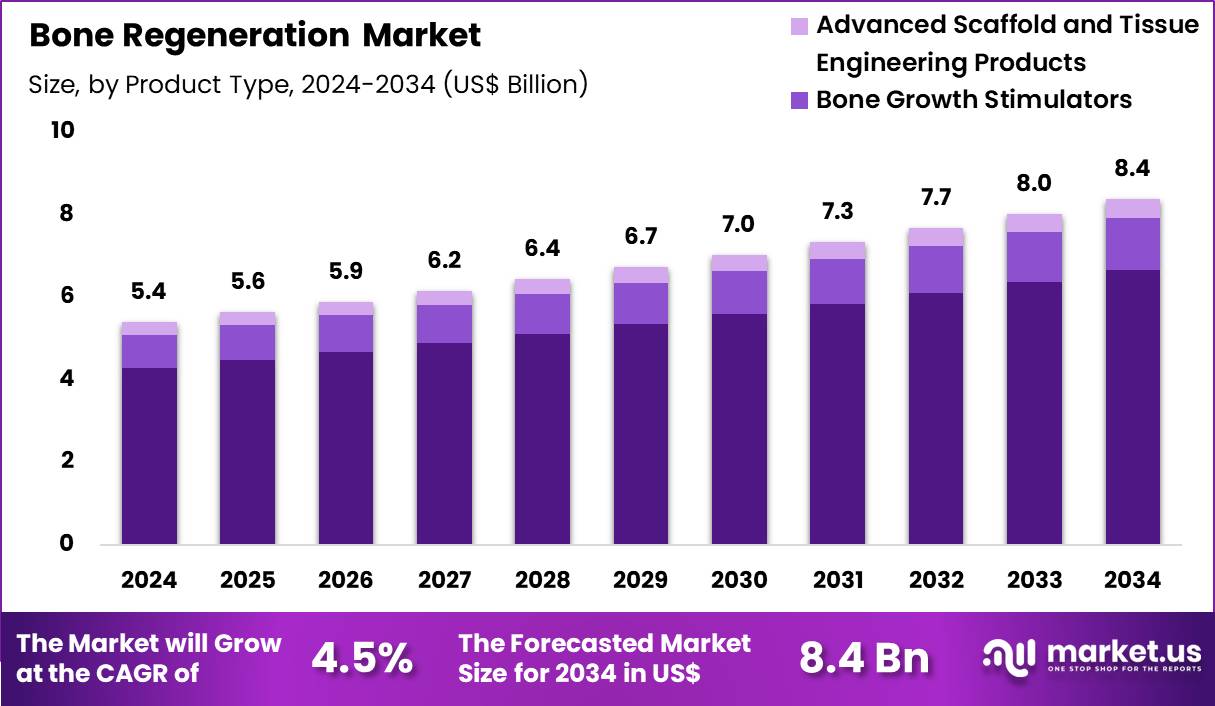

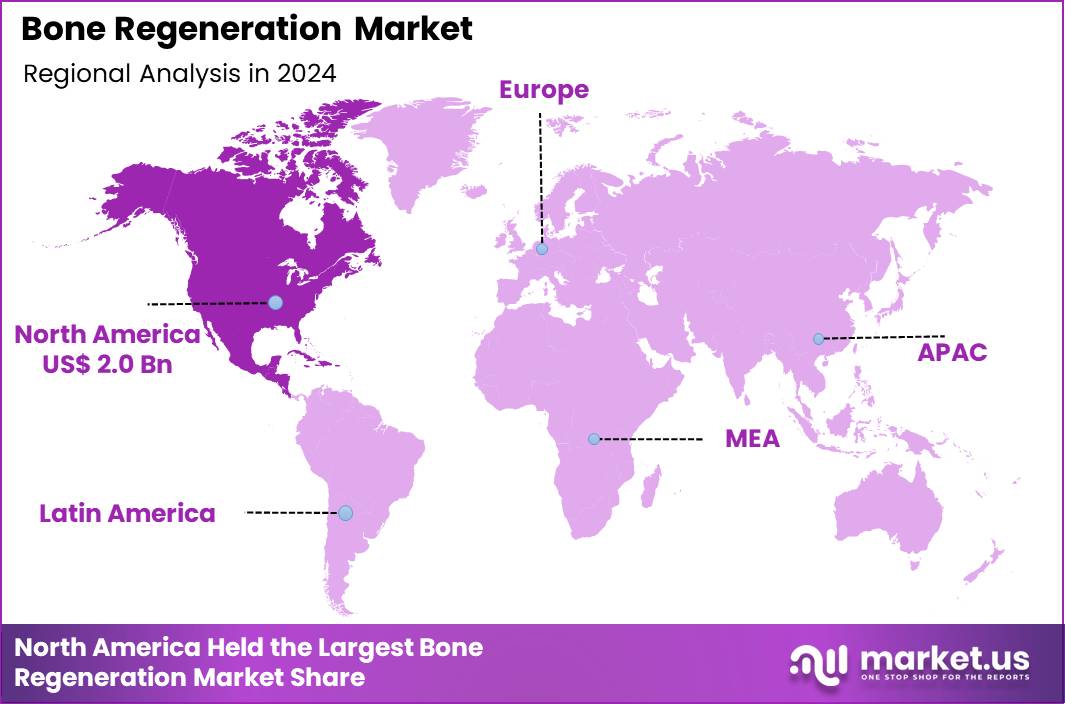

The Global Bone Regeneration Market size is expected to be worth around US$ 8.4 Billion by 2034 from US$ 5.4 billion in 2024, growing at a CAGR of 4.5% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 37.7% share with a revenue of US$ 2.0 Billion.

Rising incidence of bone defects from trauma, degenerative conditions, and surgical interventions drives demand for advanced regeneration technologies that restore skeletal integrity and function effectively. Orthopedic surgeons increasingly utilize bone graft substitutes to fill voids in fracture repairs, promoting osteoconduction and integration at defect sites. These materials support spinal fusion procedures by enhancing intervertebral stability and fusion rates in degenerative disc disease treatments.

Dentists apply regenerative solutions in alveolar ridge augmentation, preparing sites for dental implant placement with reliable bone volume restoration. Clinicians employ injectable formulations for minimally invasive filling of cystic lesions, facilitating healing in benign bone pathologies. During 2024 and extending into 2025, Stryker broadened its regenerative solutions portfolio with the introduction of Pro-Dense LoVisc, an injectable bone graft substitute.

The product holds FDA indication for filling bone voids in pediatric patients aged six years and older following cyst removal. Its low-viscosity formulation and triphasic resorption profile are designed to align material resorption with natural bone regeneration, supporting predictable healing outcomes in younger patients.

Manufacturers pursue opportunities to develop bioactive composites that combine synthetic scaffolds with growth factors, accelerating osteoinduction in large segmental defects from tumor resections. Developers engineer injectable hydrogels for trauma applications, enabling precise delivery in irregular cavities during emergency orthopedic reconstructions. These innovations expand utility in craniomaxillofacial surgery, where customized grafts restore facial symmetry after oncologic excisions or congenital corrections.

Opportunities arise in combining biomaterials with stem cell therapies to enhance vascularization and remodeling in avascular necrosis treatments. Companies advance resorbable implants for joint reconstruction, supporting bone stock preservation in revision arthroplasty procedures. Firms invest in 3D-printable matrices that match patient-specific defect geometries, optimizing integration in complex pelvic and extremity reconstructions.

Industry leaders refine biphasic calcium phosphate formulations to achieve balanced resorption kinetics, minimizing inflammatory responses in long-bone defect repairs. Developers introduce nanostructured surfaces on grafts to promote cellular attachment, improving outcomes in spinal interbody fusion cages. Market participants prioritize low-viscosity injectables that reduce surgical time and enhance precision in arthroscopic-assisted cartilage and bone defect treatments.

Innovators incorporate antimicrobial agents into regenerative materials, preventing infection in open fracture management. Companies emphasize pediatric-specific solutions with controlled degradation profiles, ensuring safe growth accommodation in growing skeletons. Ongoing advancements focus on hybrid systems integrating electrical stimulation with biomaterials, accelerating consolidation in delayed union and non-union fracture cases.

Key Takeaways

- In 2024, the market generated a revenue of US$ 5.4 Billion, with a CAGR of 4.5%, and is expected to reach US$ 8.4 Billion by the year 2034.

- The product type segment is divided into bone grafts substitutes, bone growth stimulators and advanced scaffold and tissue engineering products, with bone grafts substitutes taking the lead in 2024 with a market share of 79.4%.

- Considering application, the market is divided into trauma and fracture repair, spinal fusion, joint reconstruction and revision surgeries, oral and maxillofacial surgery and others. Among these, trauma and fracture repair held a significant share of 32.6%.

- Furthermore, concerning the patient type segment, the market is segregated into adult, pediatric and geriatric. The adult sector stands out as the dominant player, holding the largest revenue share of 55.1% in the market.

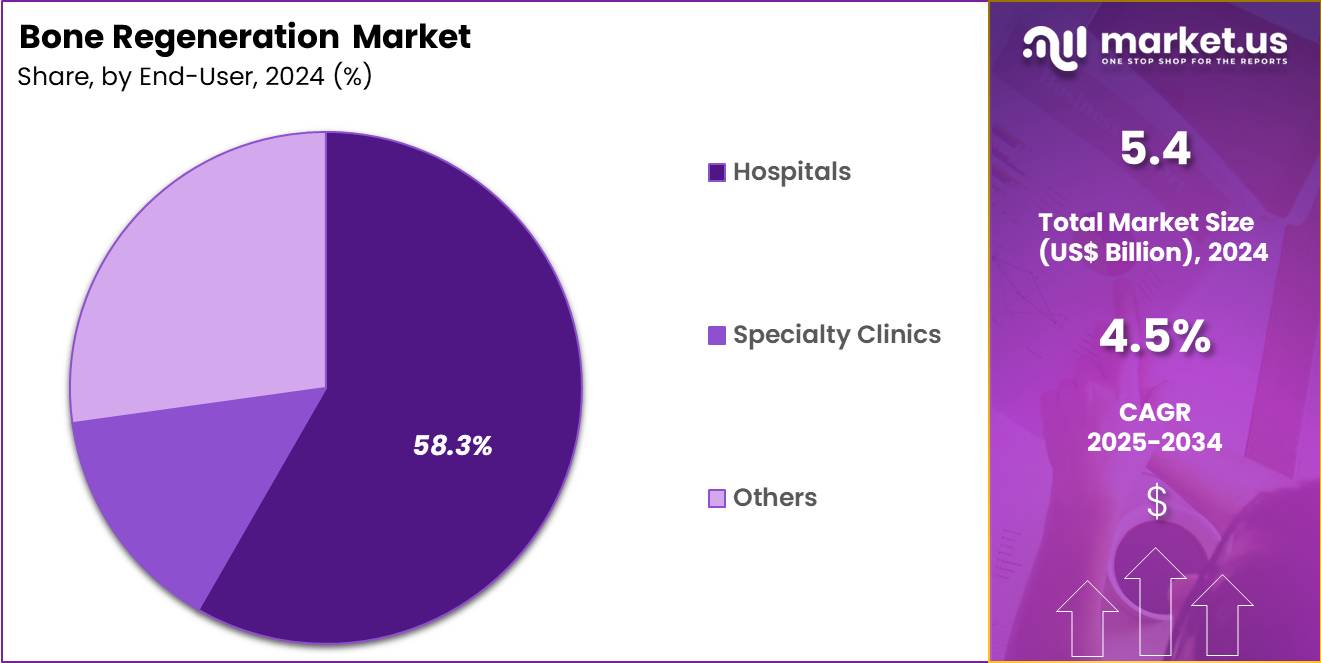

- The end-user segment is segregated into hospitals, specialty clinics and others, with the hospitals segment leading the market, holding a revenue share of 58.3%.

- North America led the market by securing a market share of 37.7% in 2024.

Product Type Analysis

Bone graft substitutes accounted for 79.4% of the bone regeneration market, reflecting their widespread adoption across orthopedic and reconstructive procedures. Surgeons increasingly select these products to avoid donor site morbidity associated with autografts. Consistent availability and standardized quality improve procedural planning and outcomes. Advancements in synthetic and demineralized matrices enhance osteoconductive and osteoinductive performance.

Rising surgical volumes in orthopedics increase routine utilization of graft substitutes. Favorable handling properties support operating room efficiency. Clinical familiarity strengthens surgeon confidence across indications. Reimbursement alignment in many regions improves hospital procurement. Ongoing product innovation expands indication coverage. This segment is projected to sustain dominance due to safety, scalability, and clinical convenience.

Application Analysis

Trauma and fracture repair represented 32.6% of the bone regeneration market, driven by increasing incidence of road accidents and sports injuries. Emergency orthopedic interventions frequently require regenerative solutions to restore bone continuity. Early stabilization strategies prioritize materials that support rapid healing. Growing urbanization and active lifestyles elevate fracture risk among working populations. Hospitals emphasize solutions that shorten recovery time and reduce complications.

Improvements in fixation techniques complement regenerative product usage. Clinical protocols increasingly integrate bone substitutes in complex fractures. Rising awareness of early intervention benefits supports adoption. Consistent outcomes reinforce surgeon preference. This application segment is anticipated to grow due to persistent trauma burden and surgical demand.

Patient Type Analysis

Adult patients accounted for 55.1% of the bone regeneration market, reflecting higher exposure to trauma, degenerative conditions, and elective orthopedic surgeries. Adults represent the largest group undergoing fracture repair and joint related procedures. Work related injuries and lifestyle factors increase musculoskeletal intervention rates. Early treatment in adults aims to restore mobility and productivity.

Surgeons favor regenerative approaches to enhance long term functional outcomes. Insurance coverage improves access for adult orthopedic care. Rising prevalence of obesity and diabetes complicates healing, increasing regenerative support needs. Elective procedures further expand treatment volumes. Follow up adherence supports therapy effectiveness. This segment is likely to remain dominant due to high procedure incidence and recovery driven priorities.

End-User Analysis

Hospitals held a 58.3% share of the bone regeneration market, reflecting their role as primary centers for complex orthopedic care. These facilities manage high volumes of trauma, fracture, and reconstructive surgeries. Access to multidisciplinary teams supports advanced regenerative interventions. Centralized procurement enables adoption of standardized graft solutions. Surgical infrastructure supports high throughput and specialized procedures.

Postoperative monitoring improves outcome consistency. Hospitals prioritize technologies that reduce revision rates and length of stay. Training and teaching environments reinforce evidence based adoption. Emergency care pathways sustain continuous demand. Consequently, hospitals are expected to maintain leadership due to procedural scale, expertise concentration, and integrated care delivery.

Key Market Segments

By Product Type

- Bone Grafts Substitutes

- Autografts, Allografts, Xenografts

- Synthetic bone substitutes

- Bone Growth Stimulators

- Advanced Scaffold and Tissue Engineering Products

By Application

- Trauma and fracture repair

- Spinal fusion

- Joint reconstruction and revision surgeries

- Oral and Maxillofacial surgery

- Others

By Patient Type

- Adult

- Pediatric

- Geriatric

By End-User

- Hospitals

- Specialty Clinics

- Others

Drivers

Increasing number of bone graft procedures is driving the market

The bone regeneration market is significantly driven by the escalating number of bone graft procedures, which address defects arising from trauma, tumors, infections, and degenerative conditions. Healthcare providers increasingly utilize bone regeneration techniques to facilitate healing in cases of fractures and non-unions, thereby enhancing patient mobility and quality of life. Manufacturers develop advanced biomaterials to support these procedures, ensuring compatibility with host tissues for optimal integration.

Regulatory bodies emphasize safety in graft applications, promoting standardized protocols across orthopedic practices. Clinical research focuses on improving graft efficacy to reduce revision surgeries in high-volume settings. Global demographic trends, including rising trauma incidents, contribute to sustained procedural demand in emergency care. Academic collaborations advance regenerative strategies to meet the needs of diverse patient populations.

Patient outcomes benefit from innovative grafts that accelerate bone formation and minimize complications. Economic considerations highlight the cost-effectiveness of regeneration over repeated interventions. According to a comprehensive review published by the National Institutes of Health, over 2.2 million bone grafts are performed each year worldwide to treat various bone-related diseases.

Restraints

High costs associated with advanced regeneration therapies are restraining the market

The bone regeneration market faces notable restraints due to the high costs of advanced therapies, encompassing specialized biomaterials, surgical procedures, and postoperative care. Developers incur substantial expenses in research and production of scaffolds and growth factors, which elevate prices for end-users. Healthcare facilities in resource-limited regions struggle to adopt these therapies, limiting market penetration.

Regulatory requirements for clinical validation add to financial burdens through extensive testing phases. Insurance providers often restrict reimbursement for innovative regeneration methods, deterring widespread utilization. Manufacturers contend with supply chain complexities that contribute to pricing volatility. Clinical adoption slows as providers weigh costs against benefits in elective cases.

Academic studies underscore disparities in access, exacerbating inequities in orthopedic care. Patient affordability issues persist, particularly for long-term regeneration protocols. These economic factors collectively hinder market expansion and innovation accessibility.

Opportunities

Advancements in stem cell-based approaches are creating growth opportunities

The bone regeneration market presents growth opportunities through advancements in stem cell-based approaches, which enhance tissue repair and integration in orthopedic applications. Researchers explore mesenchymal stem cells to promote osteogenesis in defect sites, offering alternatives to traditional grafts. Pharmaceutical entities invest in stem cell therapies to address non-healing fractures and congenital anomalies.

Regulatory frameworks support accelerated pathways for stem cell products demonstrating safety and efficacy. Clinical trials evaluate combinations of stem cells with scaffolds for improved bone formation outcomes. Healthcare systems integrate these approaches into multidisciplinary protocols for complex reconstructions. Academic partnerships refine cell sourcing and delivery methods to optimize therapeutic potential.

Patient-specific strategies emerge, tailoring stem cell applications to individual healing profiles. Global initiatives target degenerative diseases, expanding the scope of stem cell interventions. These developments position the market for diversified regenerative solutions in trauma and maxillofacial surgery.

Impact of Macroeconomic / Geopolitical Factors

Increasing global healthcare expenditures and demographic shifts toward aging populations propel the bone regeneration market, as medical firms intensify investments in biomaterials and scaffolds to address rising orthopedic needs and surgical demands. Industry executives strategically prioritize innovative grafts and stem cell therapies, harnessing economic booms in developing regions to expand patient access and revenue potential.

Inflationary pressures, however, amplify costs for raw titanium and biological agents, forcing manufacturers to cut R&D budgets and delay product rollouts during downturns. Geopolitical rivalries, including U.S.-China trade frictions and supply disruptions from Middle Eastern conflicts, often obstruct shipments of essential implants and growth factors, complicating timelines for companies reliant on international vendors.

Current U.S. tariffs under Section 301 enforce duties up to 25 percent on Chinese-origin medical devices as of December 2025, heightening import expenses for American distributors and squeezing operational margins amid ongoing investigations. These tariffs further elicit retaliatory moves from global partners, curbing U.S. exports of advanced regeneration technologies and straining joint development efforts.

Despite such obstacles, the tariff regime fuels targeted expansions in domestic fabrication plants and nearshoring to allies like Canada, bolstering supply security. This strategic realignment nurtures greater autonomy, accelerates local breakthroughs, and sets the stage for resilient, profitable growth in the sector over time.

Latest Trends

Integration of bioprinting technologies in bone scaffolds is a recent trend

In 2025, the bone regeneration market has demonstrated a prominent trend toward the integration of bioprinting technologies in scaffold development, enabling precise fabrication of structures mimicking native bone architecture. Engineers utilize 3D bioprinting to incorporate cells and growth factors directly into scaffolds, enhancing vascularization and mechanical properties. Clinicians anticipate improved outcomes in defect repair through customized bioprinted implants for patient-specific needs.

Developers focus on bioinks derived from natural polymers to ensure biocompatibility and degradation rates aligned with regeneration timelines. Research evaluates bioprinted constructs in preclinical models for load-bearing applications in orthopedics. Regulatory discussions address standardization of bioprinting processes for clinical translation. Academic reviews highlight the potential of hybrid bioprinting with nanomaterials to accelerate osteointegration.

Industry collaborations advance printer resolutions for intricate pore structures essential to bone ingrowth. Ethical considerations guide the use of patient-derived cells in bioprinted therapies. A 2025 review from the National Institutes of Health detailed the impact of bioprinting in advancing bone tissue engineering, emphasizing MSC-based therapies and scaffold innovations.

Regional Analysis

North America is leading the Bone Regeneration Market

In 2024, North America secured a 37.7% share of the global bone regeneration market, fueled by surging demands for advanced biomaterials and scaffolds amid escalating orthopedic procedures and regenerative therapies for age-related skeletal deteriorations. Surgeons increasingly integrate bone morphogenetic proteins and synthetic grafts into spinal fusions and joint reconstructions, optimizing healing outcomes for patients with degenerative disc diseases and traumatic fractures.

Federal programs emphasize stem cell-infused matrices for non-union repairs, accelerating clinical trials and approvals through streamlined pathways that prioritize biocompatibility. Pharmaceutical innovators collaborate on hydroxyapatite composites tailored for dental implants, addressing edentulism in expanding senior populations. Heightened sports medicine applications drive allograft adoptions for ligament reconstructions, supported by insurance expansions covering minimally invasive techniques.

Research consortia validate peptide-enhanced hydrogels for critical-sized defects, bridging gaps in pediatric congenital anomalies. Supply networks fortify sterile, ready-to-use kits, ensuring compliance with biosafety norms in high-volume trauma centers. In the United States, 2 million osteoporotic fractures occur annually.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Experts anticipate vigorous expansion in bone regeneration technologies across Asia Pacific over the forecast period, as nations confront mounting skeletal morbidities through strategic healthcare investments. Orthopedists deploy allograft substitutes in hip replacements, tailoring formulations to combat osteoarthritis burdens in rapidly aging societies.

Authorities channel funds into bioceramic scaffolds for maxillofacial reconstructions, equipping urban hospitals to manage industrial trauma cases efficiently. Biotech firms engineer growth factor-loaded carriers, customizing them for ethnic bone densities vulnerable to nutritional deficits. Regional alliances accelerate trials on autologous platelet concentrates, optimizing applications for delayed unions in diabetic extremities.

Pharmaceutical leaders localize production of demineralized bone matrices, aligning with pharmacopeial standards to sustain export-driven orthobiologics. Community initiatives train surgeons on minimally invasive grafting techniques, extending reach to rural enclaves facing pollution-exacerbated fragility. Asia exhibits the highest osteoporosis prevalence at 24.3% among global regions.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the bone regeneration market drive growth by expanding portfolios across bone graft substitutes, biologics, and scaffold materials that support orthopedic, dental, and spinal repair procedures. Companies accelerate adoption by generating clinical evidence that demonstrates fusion rates, healing speed, and reduced revision risk, which influences surgeon preference and hospital procurement.

Commercial teams strengthen scale through partnerships with hospitals, ambulatory surgery centers, and dental chains, supported by surgeon training and procedure-specific support programs. Innovation strategies focus on bioactive ceramics, collagen composites, and growth factor delivery approaches that improve osteointegration and handling characteristics in the operating room.

Market expansion targets regions with rising trauma cases, aging populations, and higher elective procedure volumes that increase demand for bone repair solutions. Zimmer Biomet represents a key participant through its global orthopedic footprint, broad reconstructive and biologics portfolio, and deep surgeon relationships that support consistent adoption of advanced bone regeneration products.

Top Key Players

- Stryker Corporation

- Orthofix

- Nuvasive

- Medtronic plc

- Johnson & Johnson

- Zimmer Biomet Holdings, Inc.

- Enovis

- Bioventus

- Dentsply Sirona

- Straumann Group

- ZimVie, Inc.

- Tissue Regenix Group

- Xtant Medical

- Henry Schein, Inc.

- botiss biomaterials GmbH

- Geistlich Pharma AG

- NovaBone

Recent Developments

- In April 2024, the FDA awarded Breakthrough Device Designation to Medtronic’s Infuse Bone Graft for use in transforaminal lumbar interbody fusion procedures. Building on this milestone, Medtronic reported in July 2025 that its pivotal clinical study achieved predefined safety and effectiveness benchmarks for spinal fusion applications using rhBMP-2. These results support progression toward a formal Premarket Approval submission, signaling regulatory momentum for biologic-assisted spine fusion approaches.

- In April 2024, Xstim, Inc. received FDA clearance to commercially market its Xstim Spine Fusion Stimulator. The wearable, non-invasive device applies a low-energy electric field through capacitive coupling to encourage bone-forming cell activity at the fusion site. It is intended for patients at elevated risk of fusion failure, offering an adjunctive option to support bone healing without surgical intervention.

Report Scope

Report Features Description Market Value (2024) US$ 5.4 Billion Forecast Revenue (2034) US$ 8.4 Billion CAGR (2025-2034) 4.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Bone Grafts Substitutes (Autografts, Allografts, Xenografts and Synthetic Bone Substitutes), Bone Growth Stimulators and Advanced Scaffold and Tissue Engineering Products), By Application (Trauma and Fracture Repair, Spinal Fusion, Joint Reconstruction and Revision Surgeries, Oral and Maxillofacial Surgery and Others), By Patient Type (Adult, Pediatric and Geriatric), By End-User (Hospitals, Specialty Clinics and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Stryker Corporation, Orthofix, Nuvasive, Medtronic plc, Johnson & Johnson, Zimmer Biomet Holdings, Inc., Enovis, Bioventus, Dentsply Sirona, Straumann Group, ZimVie, Inc., Tissue Regenix Group, Xtant Medical, Henry Schein, Inc., botiss biomaterials GmbH, Geistlich Pharma AG, NovaBone Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Stryker Corporation

- Orthofix

- Nuvasive

- Medtronic plc

- Johnson & Johnson

- Zimmer Biomet Holdings, Inc.

- Enovis

- Bioventus

- Dentsply Sirona

- Straumann Group

- ZimVie, Inc.

- Tissue Regenix Group

- Xtant Medical

- Henry Schein, Inc.

- botiss biomaterials GmbH

- Geistlich Pharma AG

- NovaBone