Global Biopharmaceutical CMO Market by Type (Biologics, Biosimilars), By Service (Manufacturing, Fill & Finish Operations, Analytical & Q.C. studies, Packaging), By Source (Mammalian and Non-mammalian), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2032

- Published date: July 2024

- Report ID: 96860

- Number of Pages: 274

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

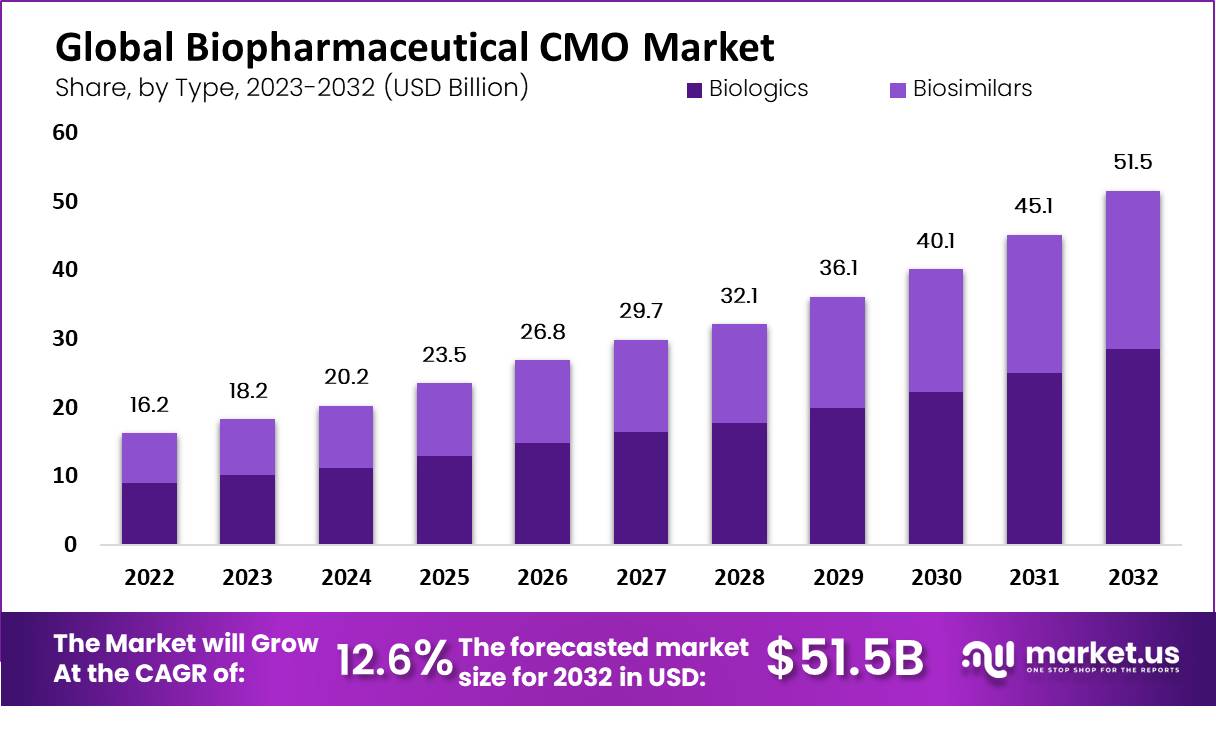

The Global Biopharmaceutical CMO Market size is expected to be worth around USD 51.5 Billion by 2032 from USD 18.2 Billion in 2023, growing at a CAGR of 12.6% during the forecast period from 2022 to 2032.

The global impact of covid-19 is unusual and staggering, with a positive demand across all regions amid the pandemic. The main types of biopharmaceutical CMO products include biologics and biosimilars. Biologics produce a wide range of products derived from human, animal, or microbial sources as biological medications.

Biologics are also known as biological drugs. They are anti-rheumatic drugs that modify the disease process. There are many products that can be included in these biologics. These include vaccines, blood, blood component, cells, genes, and tissues as well as a recombinant protein. They are derived from animals, humans, birds, insects, and plants. These products regulate the production of vital proteins and modify the cells and hormones of humans.

The biopharmaceutical CMO products come from various sources, including mammalian and non-mammalian. The biopharmaceutical CMO services include manufacturing, fill and finish operations, analytical and studies, and packaging.

The biopharmaceutical industry has seen a significant number of associations. Mergers and acquisitions help CMOs offer bioprocess combination devices to their customers, making CMOs an attractive and viable option from rapid time-to-time. These associations were mainly anticipated during the expansion and continuation of the business.

Key Takeaways

- Specialization and Expertise: Contract manufacturing organizations often specialize in particular areas or technologies, including cell therapy, gene therapy, viral vector production, complex bioprocessing or specific dosage forms for clients in these niches. By developing expertise within them specifically for these clients, CMOs provide valuable assistance.

- Emergence of Virtual CMOs: Some companies now operate as “virtual CMOs”, offering project management and oversight via an established network of manufacturing partners. This approach offers flexibility and agility during biopharmaceutical development processes.

- Niche Market Focus: Contract manufacturing organizations may specialize in catering to niche markets such as orphan diseases or rare conditions that necessitate unique production requirements at smaller scale.

- Diversifying Global Supply Chains: Businesses strive to safeguard themselves by diversifying their global supply chains through partnerships with CMOs from various regions in order to reduce risks and guarantee an uninterrupted source of supply.

- Flexible Capacity: Contract manufacturing organizations often offer clients flexible manufacturing capacity that enables them to scale up or down depending on demand fluctuations, making this an invaluable service in managing fluctuating supply.

- Emerging Markets Offer Unique Advantages: Emerging markets provide CMOs with many distinct advantages, from lower production costs and access to growing patient populations, to cost-effective solutions and unique market insights.

By Type Analysis

The Biologics segment is the most lucrative in the global biopharmaceutical CMO market.

Based on type, the market for biopharmaceutical CMO is segmented into Biologics and biosimilars. Among these types, the biologics segment is the most dominating in the global biopharmaceutical CMO market. The biologics segment is further categorized into Vaccines, monoclonal antibodies (MABs), recombinant proteins, antisense, RNAi, & molecular therapy, and others.

The use of biologics is considered to be much more effective and safer. The growing interests of the pharma developers in the biologics field and rising investment in this field have sophistically contributed to this segment’s growth.

On the other hand, biosimilars are expected to grow at a promising rate as they provide low-cost solutions and may be used as an alternative to biologics. However, the lack of reliability and safety issues associated with this segment may restrict its growth of this segment.

By Source Analysis

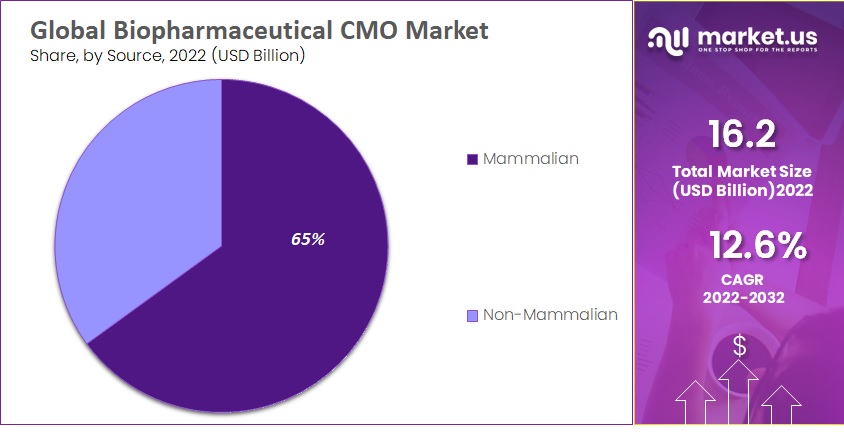

The Mammalian Segment Is Estimated To Hold a Significant Market Share

Based on the source, the market for biopharmaceutical CMO is segmented into mammalian and non-mammalian. Among these types, the mammalian segment is estimated to hold the highest market share in the forecasted period.

The mammalian cell line has been extensively used to develop viral vaccines and diagnostics in recent years, generating huge revenue for this segment. On the other hand, the non-mammalian segment is expected to gain significant adhesion owing to its increasing use in manufacturing bio-therapeutics such as enzymes, hormones, cytokines, and antibodies.

By Service Analysis

The Manufacturing Segment Is a Significant Market Shareholder

Based on the service, the market for biopharmaceutical CMO is segmented into manufacturing, fill & finish operations, analytical & Q.C. studies, and packaging. Among these types, the manufacturing segment is a significant market share holder.

The manufacturing segment is further categorized into upstream and downstream. Biopharmaceutical development, biological assay design, and commercialization CMOs produce many US-approved products. The emergence of small and midsized biopharmaceutical companies without the means to build well-furnished facilities is challenging.

Using single-use bioreactors, continuous purification processing, disposable plastic containers, and real-time quality analysis has effectively allowed the CMOs to meet the increasing service demand for biologics production. Several companies are investing in biosimilar development to outperform earlier in-class innovator drugs’ safety, efficacy, disposition, or cost. It has increased the competition amongst innovator manufacturers, which will likely benefit the CMO.

Market Segmentation

Based on Type

- Biologics

- Biosimilars

Based on Service

- Manufacturing

- Fill & Finish Operations

- Analytical & C. studies

- Packaging

Based on Source

- Mammalian

- Non-Mammalian

Drivers

Enhanced Production Capacity for Biologics Production by Several Biopharmaceutical CMOs to Support Market Expansion

The Biopharmaceutical CMO is driving the market growth of synthetic biology’s multiple applications. A growing number of presentations about biologics simultaneously increases the demand for fill & finish services regional.

High growth is majorly due to the growing number of biologics pipelines anticipated to be launched during the forecast period. CMOS has been investing and acquiring facilities ready for high-production units. The data can be analyzed for understanding and opportunities to increase production efficiency, industrialize monitoring and allow adaptable manufacturing systems to rise.

The demand for tests in their diagnosis and treatment is also growing significantly. Owing to the high number of applications of Biopharmaceutical CMO in healthcare industries, the rising investment in this industry is criticized for offering growth opportunities in the market.

The CMOs are participating in automation and innovative technologies at their plants to improve their project throughput and product quality capabilities. It has driven large molecule manufacturers’ interest in the CMOs to meet the growing demand for biologics.

Restraints

Market Growth Is Impended by High Initial Investments and Limited Outsourcing

Investments in manufacturing facilities and new equipment to increase biomanufacturing at a faster resolution are the significant factors limiting the market’s growth.

The market expansion is further hampered by the restricted use of contracting by well-established biopharmaceutical companies. The market will witness considerable growth due to the presence of many CMO manufacturing facilities and multiple small-scale CMOs entering the market.

Opportunity

Business Expansion Opportunities in Developing Countries

The biopharmaceutical CMO industry is also boosted due to growing healthcare industries in several emerging economies such as Brazil, India, South Africa, and China.

The biopharmaceutical CMOs are implementing innovative growth prospects. Expanding R&D efforts and investment is critical to developing market growth. The rapidly increasing geriatric population, rising per capita incomes, high patient volumes, and spiking awareness among individuals are driving the need for enhancing the healthcare industries in these nations.

Therefore, the governments in these economies are increasing their investments aimed at improving healthcare facilities & infrastructure. Regional extensions, new product improvement, industry cooperation, assignment development, and consolidations and acquisitions are other development strategies to acquire a competitive advantage in the worldwide market.

Owing to the high number of applications of biopharmaceutical CMOs in healthcare industries, the rising investment in this industry is slated to offer growth opportunities in the market.

Trends

Microbial Fermentation and Mammalian Cell Culture Outsourced Services to Gain Adhesion

Ongoing trends in the market are the demand for mammalian cell culture and microbial fermentation outsourcing facilities. The high demand for microbial fermentation and mammalian cell culture outsourcing service is due to the increasing number of companies focusing on biologics development based on a procedure such as recombinant protein and monoclonal antibodies. This strategic development will foster market growth by introducing new drugs and encourage innovation in biopharmaceutical manufacturing.

Biopharmaceutical CMO are increasingly focused on product innovation and differentiation as they are steadily moving toward union through mergers & acquisitions, joint ventures, and collaborative partnerships. Such trends are currently being witnessed in this market, boosting the demand for these products.

The market price contains associated properties sold by the facility supplier or within the service offering. Only properties and services traded between entities or sold to end consumers are included.

Regional Analysis

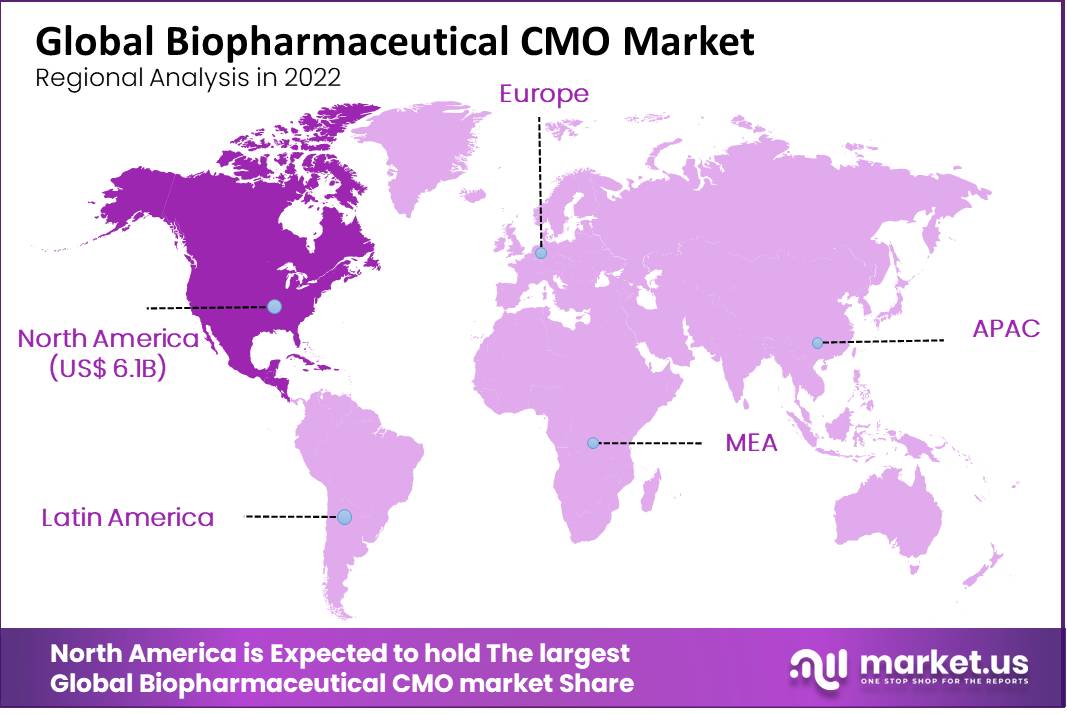

North America held the largest revenue share of 34.2% in 2022

It can be attributed to the local presence of several service providers in the region. Also, many approved products in the U.S. are manufactured by CMOs. Asia is driving the surge in outsourcing due to lower labor and operations expenses. The countries covered in the biopharmaceutical CMO market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, the U.K., and the USA are also the major players in the market.

Latin America and Middle East & Africa held minimal market share. The regional market will witness significant growth due to the presence of many CMO manufacturing facilities, coupled with multiple small-scale CMOS entering the market. India is anticipated to exhibit significant progress owing to the high volume of large molecule production in this country. India’s large-molecule manufacturing is also expected to boost its economy.

The U.S. dominates the biopharmaceutical industry due to numerous contract manufacturers. The various small and medium-sized pharma developers are contracting the manufacturing of pharmaceuticals to the CMOs due to a lack of investments. The rapidly increasing geriatric population, rising per capita incomes, high patient volumes, and spiking awareness among individuals are driving the need for enhancing the healthcare industries in these nations.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Emerging key players are focused on various strategic policies to develop their respective businesses in foreign markets. Several biopharmaceutical CMO market companies are concentrating on expanding their existing operations and R&D facilities.

Furthermore, businesses in the biopharmaceutical CMO market are developing new products and portfolio expansion strategies through investments, mergers, and acquisitions. One of the major factors supporting the biopharmaceutical CMO market growth is the robust pipeline of biologics.

Samsung Biologics announced plans to expand its production capacity by developing the largest biologics manufacturing plant. The Russia-Ukraine confrontation disturbed the probability of worldwide financial recovery from the COVID-19 epidemic, at least for a small duration.

In addition, several key players are now focusing on marketing strategies, such as spreading awareness about natural ingredients and boosting the target products’ growth. Market players focus on various business strategies, including mergers, acquisitions, and product launches.

Asia Pacific is expected to increase rapidly during the projected period. The company of several small and mid-size biopharmaceutical entities lacks the resources and market PRA Health Sciences; ICON plc. LabCorp; and Paraxial International Corporation are engaged in offering contract research services for large molecule production. Lonza and Samsung Biologics held the highest share of the global market. Lonza is the leader in the worldwide market.

Market Key Players

With the presence of many local and regional players, the market for Biopharmaceutical CMO is fragmented. Market players are subject to intense competition from top market players, particularly those with strong brand recognition and high distribution networks. To stay on top of the market, companies have gained various expansion strategies such as partnerships and product launches.

Listed below are some of the most prominent Biopharmaceutical CMO Market players.

- Lonza

- JRS Pharma

- Samsung Biologics

- CMC Biologics

- TOYOBO Co. Ltd.

- FUJIFILM Biosynth Biotechnologies

- Wuxi Biologics

- Pantheon

- PRA Health Science

- LabCorp

- Other key players

Recent Development

- Lonza: In April 2024, Lonza announced the acquisition of a small-scale biomanufacturing facility in Switzerland. This acquisition aims to enhance Lonza’s production capabilities and expand its global footprint in the biopharmaceutical market.

- JRS Pharma: In May 2024, JRS Pharma launched a new excipient product designed to improve the stability and solubility of biologic drugs. This product aims to address formulation challenges in biopharmaceutical development.

- Samsung Biologics: In June 2024, Samsung Biologics merged with Samsung Bioepis, creating a unified entity to strengthen their biosimilar and biologics manufacturing capabilities. The merger is expected to streamline operations and enhance production efficiency.

- CMC Biologics: In March 2024, CMC Biologics expanded its Seattle facility, adding new bioreactors to increase its production capacity. This expansion supports the growing demand for contract manufacturing services in the biopharmaceutical sector.

- FUJIFILM Biosynth Biotechnologies: In May 2024, FUJIFILM Biosynth Biotechnologies announced the acquisition of a state-of-the-art biomanufacturing plant in Denmark. This acquisition is set to enhance FUJIFILM’s production capabilities and support its global biopharmaceutical operations.

- Wuxi Biologics: In April 2024, Wuxi Biologics entered into a strategic partnership with a leading pharmaceutical company to co-develop and manufacture biologic drugs. This partnership aims to accelerate the development and commercialization of innovative biologics.

Report Scope

Report Features Description Market Value (2023) USD 18.2 Billion Forecast Revenue (2032) USD 51.5 Billion CAGR (2023-2032) 12.6% Base Year for Estimation 2022 Historic Period 2016-2021 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Company Profiles, Recent Developments Segments Covered Based on Type, (Biologics, Biosimilars), Based on Service, (Manufacturing, Fill & Finish Operations, Analytical & C. studies, Packaging), Based on Source, (Mammalian, Non-Mammalian) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Lonza, JRS Pharma, Samsung Biologics, CMC biologics, TOYOBO Co. Ltd., FUJIFILM Bio smith Biotechnologies, Wuxi Biologics, Pantheon, PRA Health Sciences, LabCorp, and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Mode We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is a Biopharmaceutical CMO?A Biopharmaceutical Contract Manufacturing Organization (CMO) provides services to biotechnology and pharmaceutical companies for the production of biopharmaceuticals. These services include cell line development, process development, and commercial manufacturing.

Why are Biopharmaceutical CMOs important?CMOs are crucial for biotech and pharma companies as they offer expertise, advanced technologies, and capacity for large-scale production, helping companies bring their products to market faster and more efficiently.

How big is the Biopharmaceutical CMO Market?The global Biopharmaceutical CMO Market size was estimated at USD 18.2 Billion in 2023 and is expected to reach USD 51.5 Billion in 2033.

What is the Biopharmaceutical CMO Market growth?The global Biopharmaceutical CMO Market is expected to grow at a compound annual growth rate of 12.6%. From 2024 To 2033

Who are the key companies/players in the Biopharmaceutical CMO Market?Some of the key players in the Biopharmaceutical CMO Markets are Lonza, JRS Pharma, Samsung Biologics, CMC biologics, TOYOBO Co. Ltd., FUJIFILM Bio smith Biotechnologies, Wuxi Biologics, Pantheon, PRA Health Sciences, LabCorp, and Other Key Players.

What services do Biopharmaceutical CMOs offer?Biopharmaceutical CMOs provide a range of services including cell line development, process development, analytical services, and manufacturing of clinical and commercial-scale biopharmaceuticals.

What recent trends are observed in the Biopharmaceutical CMO market?Recent trends include increased mergers and acquisitions, expansion of manufacturing facilities, and the launch of innovative biomanufacturing services to meet growing market demands.

How does the Biopharmaceutical CMO market impact drug development?CMOs help reduce the time and cost of drug development by providing specialized services and scalable manufacturing solutions, enabling biotech and pharma companies to focus on innovation and development.

Biopharmaceutical CMO MarketPublished date: July 2024add_shopping_cartBuy Now get_appDownload Sample

Biopharmaceutical CMO MarketPublished date: July 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Lonza

- JRS Pharma

- Samsung Biologics

- CMC Biologics

- TOYOBO Co. Ltd.

- FUJIFILM Biosynth Biotechnologies

- Wuxi Biologics

- Pantheon

- PRA Health Science

- LabCorp

- Other key players