Global Bioherbicides Market Size, Share Analysis Report By Source (Microbial, Biochemical, Phytotoxic Plant Residues, Others), By Crop Type (Agricultural Crops, Non-Agricultural), By Application (Seed Treatment, Foliar, Soil Application, Post-Harvest, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 155380

- Number of Pages: 312

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

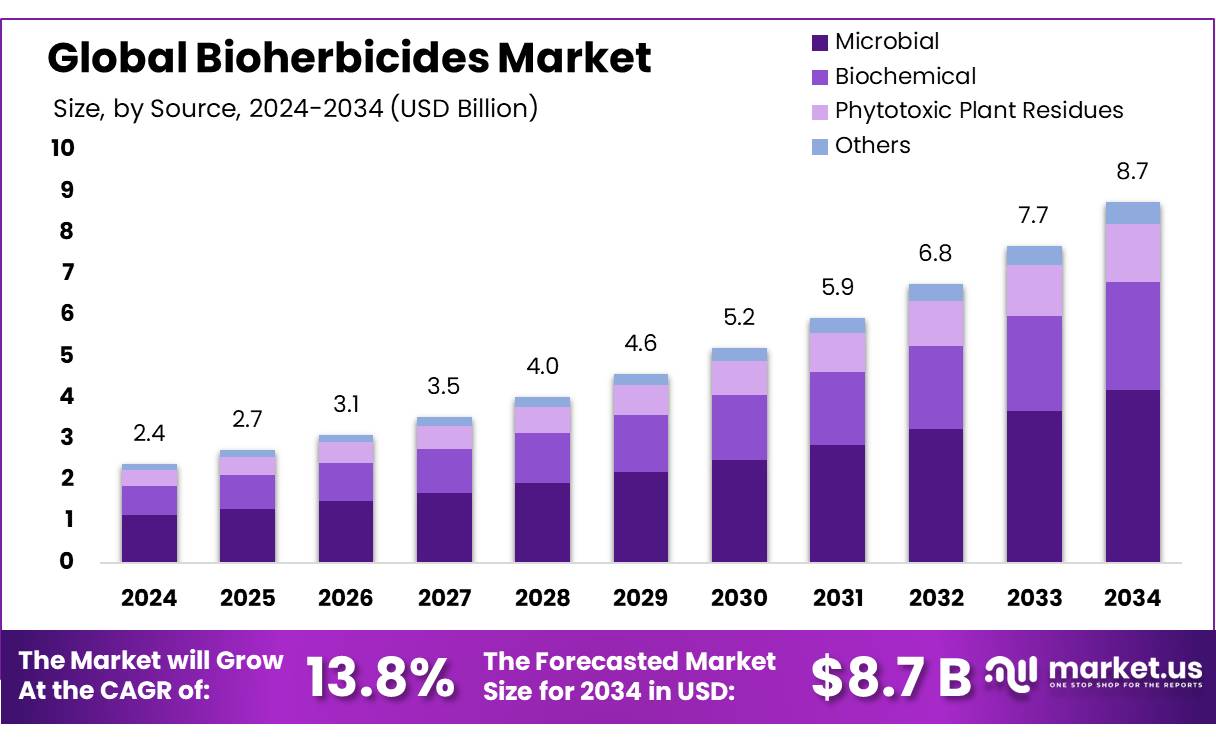

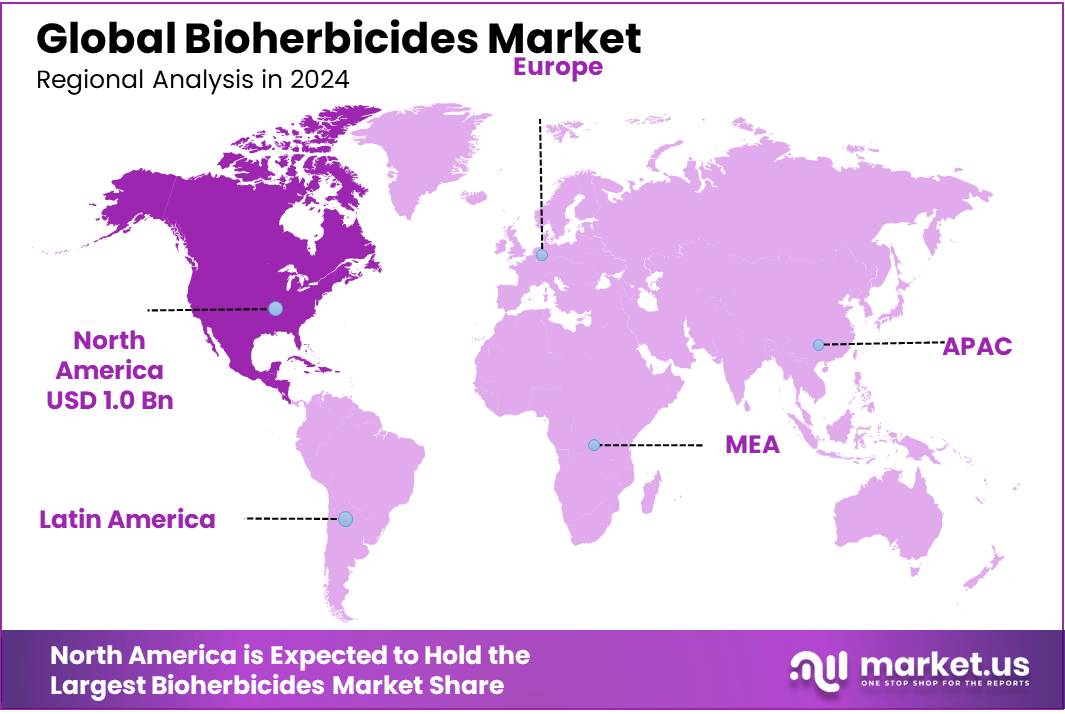

The Global Bioherbicides Market size is expected to be worth around USD 8.7 Billion by 2034, from USD 2.4 Billion in 2024, growing at a CAGR of 13.8% during the forecast period from 2025 to 2034. In 2024, Asia-Pacific held a dominant market position, capturing more than a 45.8% share, holding USD 1.0 Billion revenue.

Bioherbicides are natural or biologically derived agents used to control unwanted plants or weeds. Unlike synthetic herbicides, bioherbicides offer a more eco-friendly alternative, reducing the environmental impact associated with traditional chemical herbicides. In India, the adoption of bioherbicides is gaining momentum as farmers seek sustainable solutions to enhance crop productivity and soil health.

Government funding further supports adoption. India’s Paramparagat Krishi Vikas Yojana (PKVY) provides ₹31,500/ha over three years for organic clusters, including ₹15,000/ha direct to farmers for on-farm and off-farm organic inputs (bio-inputs), plus dedicated support for certification, marketing, and training—mechanisms that lower the cost of trying biological weed management at scale. Such incentives complement private-sector moves leading crop-science companies continue to allocate resources to biologicals even through down cycles.

Driving factors for the growth of the bioherbicides industry include stringent regulations on chemical herbicides, increasing consumer demand for organic produce, and the need for sustainable agricultural practices. The adverse effects of chemical herbicides on soil health and biodiversity have prompted a shift towards biological alternatives. Furthermore, the rising awareness among farmers about the benefits of bioherbicides, coupled with government incentives, is accelerating their adoption.

For example, BASF’s Agricultural Solutions sales were €9.8 billion in 2024 (a proxy for the scale of distribution platforms that can onboard biologicals), while Syngenta flagged plans to expand nature-inspired solutions and cited industry expectations that agricultural biologicals could exceed USD 20 billion in value by 2030. Together, public incentives and corporate channels create a practical path for bioherbicide concentrates to penetrate high-acreage crops and specialty segments.

Key Takeaways

- Bioherbicides Market size is expected to be worth around USD 8.7 Billion by 2034, from USD 2.4 Billion in 2024, growing at a CAGR of 13.8%.

- Microbial held a dominant market position, capturing more than a 48.9% share of the global bioherbicides market.

- Agricultural Crops held a dominant market position, capturing more than a 78.3% share of the global bioherbicides market.

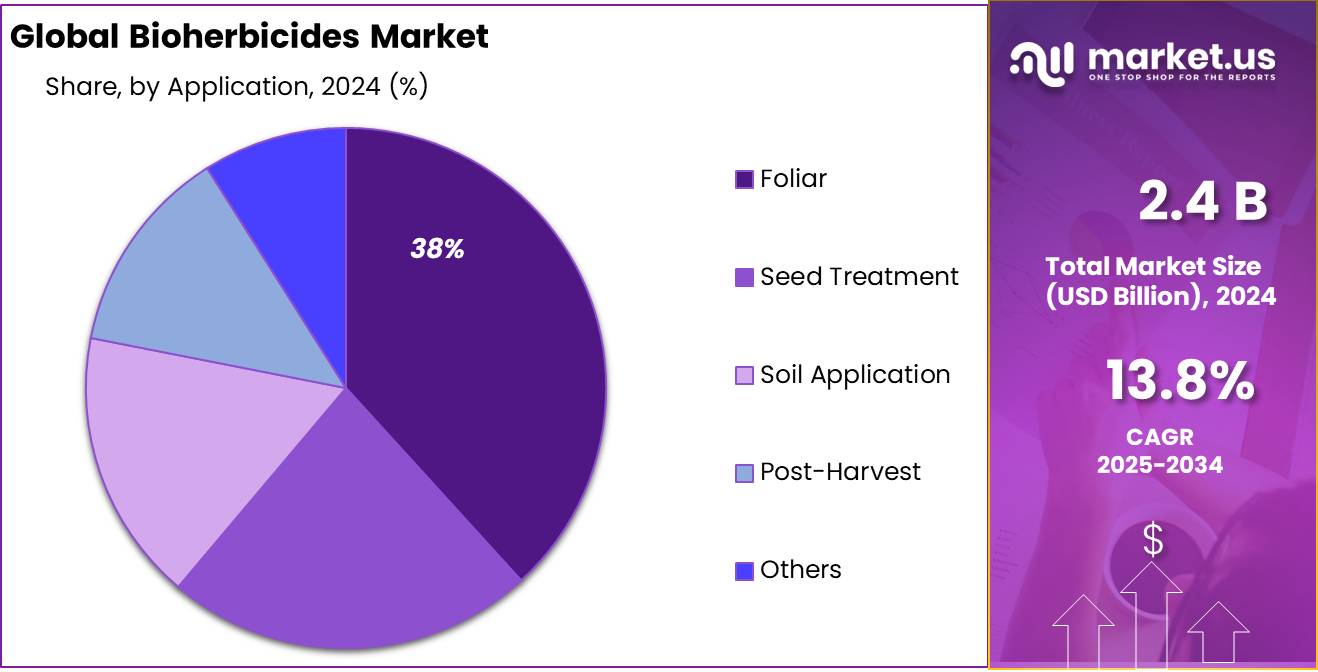

- Foliar held a dominant market position, capturing more than a 38.4% share of the global bioherbicides market.

- North America emerged as the leading region in the global bioherbicides market, commanding a 45.8% share with an estimated value of USD 1.0 billion.

By Source Analysis

Microbial Bioherbicides lead with 48.9% share thanks to their proven efficacy and eco-friendly profile

In 2024, Microbial held a dominant market position, capturing more than a 48.9% share of the global bioherbicides market. This leadership stems from their strong performance in controlling a wide spectrum of weeds while aligning with global regulations aimed at reducing chemical pesticide use. Microbial concentrates—derived from living organisms such as bacteria, fungi, and viruses—are increasingly favored in integrated weed management due to their selectivity, biodegradability, and low environmental footprint.

In 2025, early indications show sustained growth momentum for microbial sources, supported by tightening maximum residue limit (MRL) requirements in export markets and the U.S. EPA’s continued approval of microbial actives. With these regulatory, environmental, and performance advantages, microbial bioherbicides are expected to maintain their market dominance while expanding into new crop categories and geographies in the coming years.

By Crop Type Analysis

Agricultural Crops dominate with 78.3% share driven by large-scale adoption in farming

In 2024, Agricultural Crops held a dominant market position, capturing more than a 78.3% share of the global bioherbicides market. This strong lead comes from the vast cultivated area dedicated to cereals, oilseeds, pulses, and cash crops, where weed pressure significantly impacts yields and profitability. Farmers are increasingly turning to bioherbicide solutions to manage resistant weed species, reduce chemical residues, and meet export quality standards.

Government-led sustainability programs—such as the EU’s Farm-to-Fork target of reducing chemical pesticide use by 50% by 2030 and India’s PKVY subsidy of ₹31,500/ha for organic and bio-inputs—are directly encouraging bioherbicide use in large-scale agriculture. In 2025, this segment is expected to see further growth as climate-resilient farming and integrated weed management practices gain traction, particularly in regions where regulatory limits on synthetic herbicides are tightening. With high demand from staple crop cultivation and expanding adoption in export-oriented farming, agricultural crops will continue to anchor bioherbicide market demand in the years ahead.

By Application Analysis

Foliar application leads with 38.4% share due to quick action and broad weed coverage

In 2024, Foliar held a dominant market position, capturing more than a 38.4% share of the global bioherbicides market. This dominance is linked to the method’s ability to deliver active ingredients directly to the plant’s surface, ensuring faster absorption and visible results in weed control. Foliar application is widely preferred in both large-scale farming and horticulture because it allows precise targeting, reduces wastage, and works effectively even against mature weeds.

Supportive regulatory trends, such as the EU’s pesticide reduction goals and India’s subsidies for bio-based inputs under the PKVY program, are boosting adoption across diverse crops. In 2025, foliar bioherbicides are expected to expand further, driven by advancements in microbial and plant-based formulations that improve rainfastness and leaf penetration. This segment’s efficiency, ease of use, and adaptability across different crop types ensure it will remain a major application method for bioherbicides in the coming years.

Key Market Segments

By Source

- Microbial

- Fungi

- Bacteria

- Protozoa

- Biochemical

- Phytotoxic Plant Residues

- Others

By Crop Type

- Agricultural Crops

- Grains & Cereals

- Oilseeds

- Fruits & Vegetables

- Others

- Non-Agricultural

- Turf & Ornamental

- Plantation Crops

By Application

- Foliar

- Seed Treatment

- Soil Application

- Post-Harvest

- Others

Emerging Trends

Integration of Bioherbicides with Precision Agriculture

A significant trend shaping the future of bioherbicides is their integration with precision agriculture technologies. This approach combines advanced tools like GPS, remote sensing, and data analytics to optimize the application of bioherbicides, ensuring targeted and efficient weed control. By leveraging these technologies, farmers can apply bioherbicides more precisely, reducing waste and enhancing their effectiveness.

In India, the adoption of precision agriculture is gaining momentum, particularly among large-scale farmers and progressive cooperatives. The government’s support for digital agriculture initiatives further accelerates this trend. For instance, the Prime Minister Dhan-Dhaanya Krishi Yojana, launched in July 2025, aims to boost crop yields and farmers’ income through the convergence of 36 existing schemes, focusing on sustainable practices and improved access to technology. While specific data on the adoption of precision agriculture in India is limited, the increasing interest and government backing indicate a positive trajectory for its growth.

The integration of bioherbicides with precision agriculture not only enhances weed management but also aligns with the broader goals of sustainable farming. By reducing chemical inputs and minimizing environmental impact, this approach supports the transition towards more eco-friendly agricultural practices. As technology continues to evolve and government initiatives provide further support, the synergy between bioherbicides and precision agriculture is poised to play a pivotal role in the future of Indian agriculture.

Drivers

Government Support and Policy Initiatives

One of the most significant driving forces behind the growth of bioherbicides in India is the robust support from government policies and initiatives aimed at promoting sustainable and organic farming practices. The Indian government has recognized the importance of reducing chemical pesticide usage and has introduced several schemes to encourage the adoption of bio-based alternatives.

A notable example is the Paramparagat Krishi Vikas Yojana (PKVY), launched by the Ministry of Agriculture and Farmers Welfare. This scheme promotes organic farming through the adoption of organic practices, including the use of bioherbicides. Under PKVY, financial assistance is provided to farmers for organic farming activities, which indirectly supports the use of bioherbicides as part of integrated pest management strategies. The scheme has led to the establishment of numerous organic clusters across the country, fostering a conducive environment for the growth of bioherbicide usage.

Additionally, the National Mission on Sustainable Agriculture (NMSA) focuses on promoting sustainable agricultural practices, including the use of bio-based inputs like bioherbicides. The mission provides financial support for the adoption of such practices, thereby encouraging farmers to shift towards eco-friendly alternatives. These initiatives have been instrumental in increasing awareness and adoption of bioherbicides among Indian farmers.

Restraints

Regulatory and Commercialization Challenges

Despite the growing interest in bioherbicides as a sustainable alternative to chemical herbicides, several significant barriers hinder their widespread adoption in India. One of the primary challenges is the complex and lengthy regulatory approval process. Bioherbicides, which often contain live microorganisms, must undergo rigorous testing to ensure their safety and efficacy. This process can be both time-consuming and costly, deterring many companies from investing in their development.

For instance, obtaining formal registration with the Environmental Protection Agency can be prohibitively expensive, and the procedures vary across different countries, adding to the uncertainty and hesitation in using biologically active agents in agricultural settings.

In India, the situation is compounded by the limited number of bioherbicide formulations available on the market. As of recent reports, only 14 bioherbicidal formulations have been registered under the 1968 Insecticide Act, which primarily catalogs the criteria for determining pesticide bio-safety. This limited availability restricts farmers’ access to effective bioherbicide options, forcing them to rely on traditional chemical herbicides.

Furthermore, the environmental conditions in India present additional challenges for the application of bioherbicides. Factors such as humidity, soil type, temperature, and UV light can significantly influence the success of bioherbicides. For example, UV light can degrade the bioherbicide, and inadequate water availability can affect its efficacy. These environmental variables make it difficult to achieve consistent results, which is crucial for farmers seeking reliable weed control solutions.

The high costs associated with the formulation and commercialization of bioherbicides also pose a significant barrier. The production of bioherbicides often involves complex processes and the use of specialized equipment, leading to higher costs compared to traditional chemical herbicides. These increased costs can make bioherbicides less attractive to farmers, especially those operating on small margins.

Opportunity

Expansion of Organic Farming and Government Support

A significant growth opportunity for bioherbicides in India lies in the expanding organic farming sector, bolstered by supportive government initiatives. India is witnessing a notable shift towards organic agriculture, driven by increasing consumer demand for chemical-free produce and a growing awareness of the environmental and health impacts of synthetic pesticides. This transition presents a fertile ground for the adoption of bioherbicides as effective, eco-friendly alternatives to traditional chemical herbicides.

The Indian government has been proactive in promoting organic farming through various schemes and programs. For instance, the Paramparagat Krishi Vikas Yojana (PKVY) encourages farmers to adopt organic farming practices by providing financial assistance for certification and input costs. Under PKVY, farmers are supported in forming clusters and adopting organic farming methods, which include the use of bioherbicides.

Additionally, the Mission Organic Value Chain Development for the North Eastern Region (MOVCDNER) focuses on promoting organic farming in the northeastern states, further expanding the reach of organic agriculture. These initiatives are part of the broader National Mission for Sustainable Agriculture, which aims to promote sustainable agricultural practices, including the use of bio-based inputs like bioherbicides.

The government’s emphasis on organic farming is reflected in the increasing area under organic cultivation. As of recent reports, India has over 6,50,000 organic producers and approximately 4 million hectares of certified organic land, making it one of the leading countries in organic agriculture. This growth in organic farming directly correlates with the rising demand for bioherbicides, as farmers seek sustainable and effective solutions for weed management.

Furthermore, the government’s support extends to research and development in the field of bioherbicides. Institutions like the Department of Biotechnology (DBT) and the Ministry of Agriculture and Farmers Welfare are actively involved in promoting the development and commercialization of bio-based pesticides, including bioherbicides. These efforts aim to enhance the efficacy and availability of bioherbicides, making them more accessible to farmers across the country.

Regional Insights

North America leads the bioherbicides market with 45.8% share, valued at USD 1.0 billion

In 2024, North America emerged as the leading region in the global bioherbicides market, commanding a 45.8% share with an estimated value of USD 1.0 billion. This dominance is driven by a combination of large-scale adoption in commercial agriculture, stringent regulatory frameworks, and a strong push toward sustainable weed management practices. The United States and Canada are at the forefront, benefiting from extensive research and development, advanced agricultural technology adoption, and well-established supply chains for biological crop protection products.

The U.S. Environmental Protection Agency (EPA) maintains an active biopesticide registration program, which includes numerous microbial and biochemical herbicide actives, facilitating faster market entry for innovative products. Additionally, U.S. Department of Agriculture (USDA) funding for integrated pest management (IPM) programs and the expansion of organic farming—covering over 4.9 million acres in the U.S. as of 2023—are further fueling bioherbicide uptake.

In 2025, North America is expected to sustain its leadership position, supported by continued government incentives, increasing herbicide resistance challenges in conventional chemistry, and expanding adoption of regenerative agriculture. With robust infrastructure, regulatory support, and high farmer awareness, the region is set to remain a key driver in global bioherbicide market growth over the next decade.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Emery Oleochemicals is a global leader in natural-based specialty chemicals, focusing on sustainable solutions for various industries, including agriculture. Their Agro Green division offers EMERION® herbicide, a USDA-certified 100% biobased product derived from pelargonic acid, effective for non-selective weed control. With over 185 years of innovation, Emery combines oleochemical expertise with environmental responsibility to provide high-performance, eco-friendly agricultural solutions.

FMC Corporation is a global agricultural sciences company offering innovative crop protection solutions. Their portfolio includes biological products, crop nutrition, and precision agriculture technologies. FMC’s commitment to sustainability and innovation enables growers to address challenges economically while protecting the environment. The company focuses on developing new active ingredients and formulations to meet the evolving needs of agriculture.

Seipasa is a Spanish company dedicated to developing natural-based solutions for agriculture, including biopesticides, biostimulants, and fertilizers. With over 26 years of experience, Seipasa formulates and registers high-quality products applied in demanding agricultural systems worldwide. Their commitment to research and development ensures sustainable and effective crop protection, contributing to the production of high-value fruits, vegetables, and cereals.

Top Key Players Outlook

- Emery Oleochemicals

- Harpe Bio

- Seipasa

- FMC Corp

- Bioherbicides Australia PTY Ltd

- Certis Biologicals

Recent Industry Developments

In 2024 Emery Oleochemicals, expanded its USDA BioPreferred certified portfolio by introducing three new pelargonic acid-based bioherbicides: EMERION W 90 PA, W 90 PA TG, and W 90 PA MUP.

In 2024 Harpe Bioherbicide Solutions, advanced its research with over 1,000 field and greenhouse trials demonstrating the efficacy of its formulations against a broad spectrum of resistant weeds, including pigweed and kochia.

Report Scope

Report Features Description Market Value (2024) USD 2.4 Bn Forecast Revenue (2034) USD 8.7 Bn CAGR (2025-2034) 13.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Microbial, Biochemical, Phytotoxic Plant Residues, Others), By Crop Type (Agricultural Crops, Non-Agricultural), By Application (Seed Treatment, Foliar, Soil Application, Post-Harvest, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Emery Oleochemicals, Harpe Bio, Seipasa, FMC Corp, Bioherbicides Australia PTY Ltd, Certis Biologicals Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Emery Oleochemicals

- Harpe Bio

- Seipasa

- FMC Corp

- Bioherbicides Australia PTY Ltd

- Certis Biologicals