Global Biohacking Market By Product Type (Wearables (Wearable Neurotech, Oura ring, Muse Headband, and Others), Implants (NFC and RFID tags, Circadia implant, Blood test Implant, and Others), Smart Drugs, Mobile Apps, Gene Modification Kits, and Others), By Application (Diagnosis & Treatment, Synthetic Biology, Genetic Engineering, Forensic Science, and Drug Testing), By End-user (Pharmaceutical & Biotechnology Companies, Research & Academic Institutes, Hospitals & Clinics, Forensic Laboratories, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 65398

- Number of Pages: 267

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

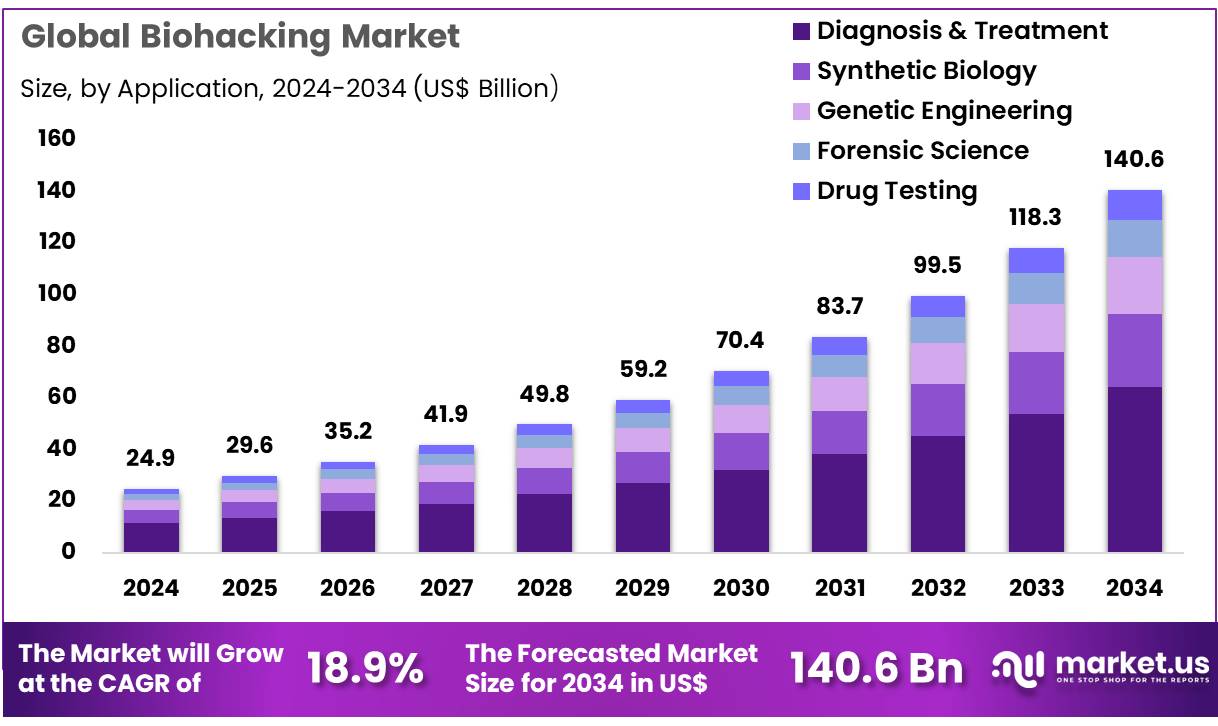

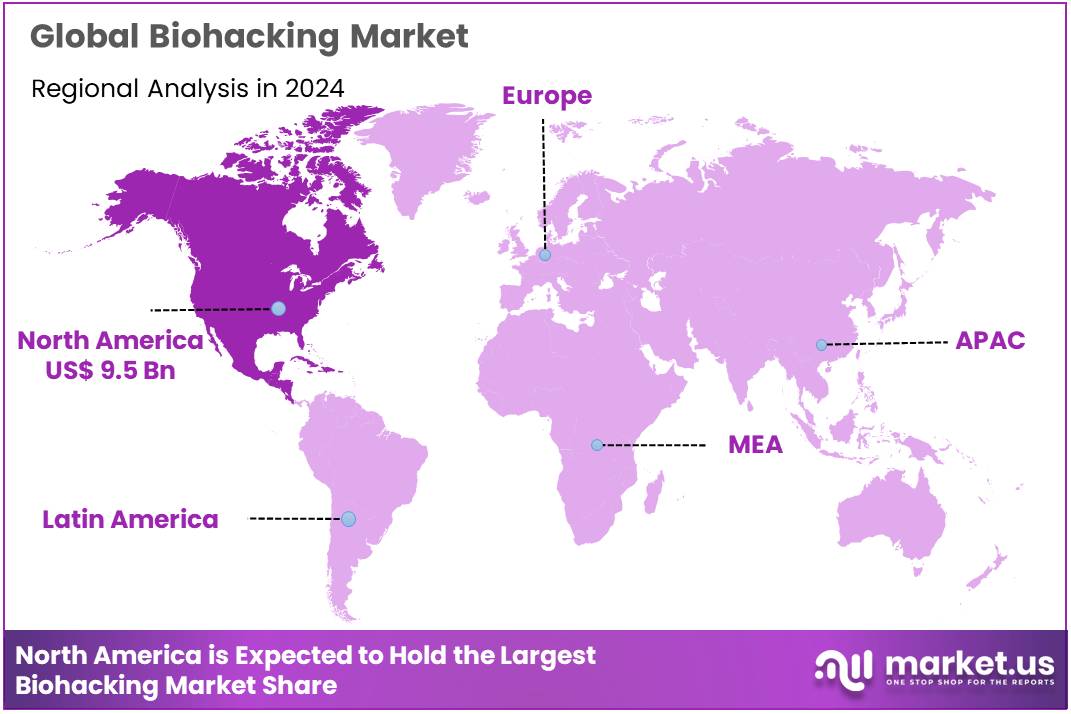

Global Biohacking Market size is expected to be worth around US$ 140.6 Billion by 2034 from US$ 24.9 Billion in 2024, growing at a CAGR of 18.9% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 38.3% share with a revenue of US$ 9.5 Billion.

Rising public interest in self-optimization and personalized health is a key driver for the biohacking market. Individuals are increasingly seeking to enhance their physical and cognitive performance, prevent disease, and extend their lifespan through a combination of lifestyle changes, nutritional supplements, and technological interventions.

This trend is fueled by a growing number of wearable devices and at-home genetic testing kits that provide users with unprecedented access to their own biological data. According to a 2024 report by the World Economic Forum, 80% of consumers are interested in using technology to manage their health, underscoring the strong demand for tools and services that enable a “do-it-yourself” approach to wellness.

Growing strategic collaborations and research partnerships are a major trend in the market, accelerating the development of innovative biohacking applications. Biotechnology and pharmaceutical companies are increasingly collaborating with research institutions to explore new drug candidates and personalized therapies.

A prime example is the research collaboration announced in February 2022 between SEngine Precision Medicine Inc. and Oncodesign, which focused on developing personalized cancer treatments by exploring the potential of the Nanocyclix inhibitor series. This partnership highlights the industry’s shift toward using biohacking principles to create highly targeted and effective therapies, bridging the gap between individual-level experimentation and large-scale clinical application.

Increasing accessibility to advanced genetic and diagnostic tools is creating significant opportunities for market expansion. Technologies like CRISPR-based gene editing kits, once confined to academic labs, are now more accessible to the public, fostering a new wave of citizen scientists and decentralized innovation.

The National Center for Biotechnology Information (NCBI) has also noted a substantial rise in the number of publicly available genomic databases, with the NIH’s GenBank database alone containing over 278 billion base pairs of DNA data as of April 2025. This wealth of information, coupled with increasingly affordable home-testing kits for microbiome analysis and hormone levels, empowers individuals to make data-driven decisions about their health. This democratization of biotechnology is a powerful force driving market growth.

Key Takeaways

- In 2024, the market for biohacking generated a revenue of US$ 24.9 Billion, with a CAGR of 18.9%, and is expected to reach US$ 140.6 Billion by the year 2034.

- The product type segment is divided into wearables, implants, smart drugs, mobile apps, gene modification kits, and others, with wearables taking the lead in 2023 with a market share of 40.6%.

- Considering application, the market is divided into diagnosis & treatment, synthetic biology, genetic engineering, forensic science, and drug testing. Among these, diagnosis & treatment held a significant share of 45.6%.

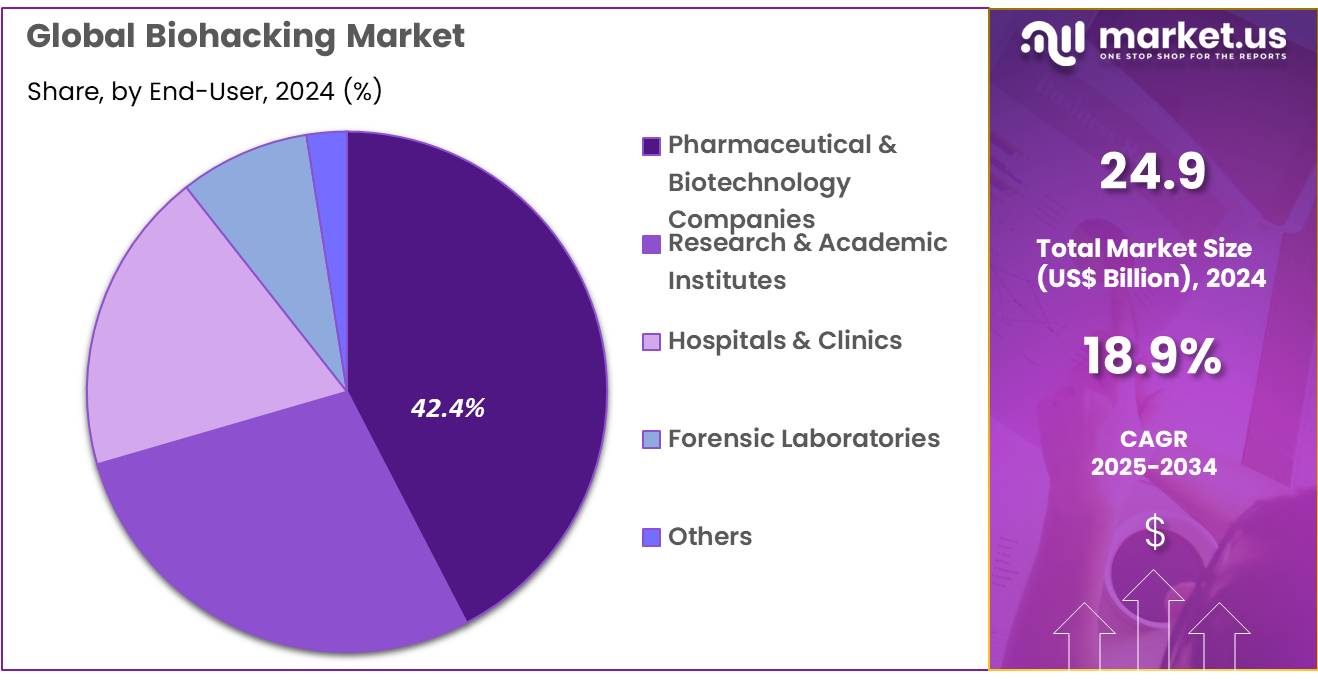

- Furthermore, concerning the end-user segment, the market is segregated into pharmaceutical & biotechnology companies, research & academic institutes, hospitals & clinics, forensic laboratories, and others. The pharmaceutical & biotechnology companies sector stands out as the dominant player, holding the largest revenue share of 42.4% in the biohacking market.

- North America led the market by securing a market share of 38.3% in 2023.

Product Type Analysis

Wearables dominate the biohacking market, holding a 40.6% share of the product type segment. The growing adoption of wearables is fueled by consumers’ increasing focus on health monitoring and fitness tracking. These devices, which range from fitness trackers to advanced health monitoring systems, allow users to monitor vital signs, sleep patterns, and physical activity, offering insights into their health in real-time.

The demand for wearables is expected to continue growing as individuals increasingly seek personalized health data and a proactive approach to wellness. Technological advancements, such as the integration of artificial intelligence (AI) and machine learning (ML) algorithms in wearables, are likely to enhance their functionality, making them even more attractive to health-conscious consumers.

Wearables’ role in disease prevention, personalized fitness, and chronic disease management is expected to drive further market growth. Additionally, the rise in the number of health-focused mobile applications that sync with wearables is anticipated to further expand the user base and drive innovation in the sector. As the wearable market diversifies into specialized devices targeting specific health conditions, its growth trajectory in the biohacking industry remains promising.

Application Analysis

Diagnosis and treatment account for 45.6% of the application segment in the biohacking market. The increasing use of biohacking techniques for diagnosing and treating various health conditions is expected to boost the growth of this segment. With advances in synthetic biology and genetic engineering, biohacking has become a critical component in the development of personalized medicine and treatments. The use of advanced diagnostic tools, including wearable devices and genetic testing kits, allows for more accurate and timely diagnoses.

As more people opt for customized treatments tailored to their genetic makeup and health conditions, the demand for biohacking solutions in diagnosis and treatment is projected to increase. Furthermore, the growing interest in alternative medicine and natural therapies, combined with technological advancements in health monitoring, is likely to further propel market expansion. With healthcare becoming more personalized and preventative, biohacking solutions in diagnosis and treatment will continue to play a vital role in addressing various chronic conditions, including obesity, diabetes, and cardiovascular diseases.

End-User Analysis

Pharmaceutical and biotechnology companies represent the largest share of 42.4% in the end-user segment of the biohacking market. The market for biohacking products and solutions in the pharmaceutical and biotechnology industries is expected to continue growing due to their increasing use in drug development and clinical trials. Biohacking techniques, such as genetic modification and personalized medicine, are being explored by pharmaceutical companies to develop more effective treatments and therapies.

Advances in gene editing tools, such as CRISPR-Cas9, and the growing focus on targeted therapies are expected to drive demand for biohacking solutions in the pharmaceutical industry. The pharmaceutical sector’s increasing investment in biotechnology and genetic research is likely to propel the growth of biohacking applications in drug discovery and development.

Moreover, with the rising need for advanced treatments tailored to individual genetic profiles, biohacking technologies will continue to play a significant role in enhancing the precision and efficiency of pharmaceutical R&D. The sector’s ability to revolutionize drug development and therapeutic interventions is anticipated to keep biohacking at the forefront of the pharmaceutical and biotechnology industries.

Key Market Segments

By Product Type

- Wearables

- Wearable Neurotech

- Oura ring

- Muse Headband

- Others

- Implants

- NFC and RFID tags

- Circadia implant

- Blood test Implant

- Others

- Smart Drugs

- Mobile Apps

- Gene Modification Kits

- Others

By Application

- Diagnosis & Treatment

- Synthetic Biology

- Genetic Engineering

- Forensic Science

- Drug Testing

By End-user

- Pharmaceutical & Biotechnology Companies

- Research & Academic Institutes

- Hospitals & Clinics

- Forensic Laboratories

- Others

Drivers

The rising consumer interest in personalized health and self-optimization is driving the market.

The biohacking market is experiencing significant growth, primarily driven by a powerful cultural shift toward personalized health, proactive wellness, and the desire for self-optimization. Consumers today are moving away from reactive, symptom-based healthcare and are seeking more control over their physical and cognitive performance. This shift is fueled by the widespread availability of consumer-grade health technology and a growing belief in the ability to improve one’s biological functions through lifestyle, diet, and technological interventions.

A key indicator of this trend is the rapid adoption of wearable devices. For instance, according to data from a 2024 analysis of consumer behavior, more than one-third of adults worldwide now use at least one health-related application or wearable device, such as a fitness tracker or a smartwatch. This surge in data-driven self-monitoring provides a foundation for biohacking practices, as individuals can track metrics like heart rate variability, sleep quality, and activity levels to inform their personal optimization strategies. This desire to quantify and improve personal health outcomes creates a robust and growing demand for the products and services within this market.

Restraints

The lack of regulatory oversight and the potential for unsafe practices are restraining the market.

A significant restraint on the market is the inherent lack of regulatory oversight for many of its products and practices, which can lead to consumer safety risks and a general distrust in the industry. Unlike pharmaceuticals or medical devices, many popular biohacking products, such as certain supplements, nootropics, and experimental therapies, are not subject to rigorous clinical trials or approval processes. This creates an environment where unproven claims can proliferate, and consumers may be exposed to products that are ineffective, contaminated, or even dangerous.

The U.S. Food and Drug Administration (FDA) has consistently issued public warnings about unproven therapies, particularly in the regenerative medicine space. In a 2024 public safety notification, the FDA warned consumers about the risks of using unapproved stem cell and exosome products marketed for a wide range of unproven conditions, highlighting the agency’s concern about products that are not backed by scientific evidence. These ongoing safety issues and the associated negative publicity can deter potential consumers and make it difficult for reputable businesses to establish credibility.

Opportunities

The proliferation of direct-to-consumer health and genetic testing is creating growth opportunities.

The market is presented with significant opportunities from the widespread availability of direct-to-consumer (DTC) health and genetic testing. These services empower individuals to gain unprecedented insight into their personal biology, from their genetic predispositions to the composition of their gut microbiome. This information serves as a personalized roadmap, allowing biohackers to tailor their interventions whether through diet, exercise, or supplementation to their unique biological makeup.

For example, a consumer might discover a genetic variant that affects nutrient absorption, prompting them to adjust their diet accordingly. According to a 2020 report from the Pew Research Center, 16% of U.S. adults had already taken a genetic test from one of these companies. This figure represents a massive consumer base that is now equipped with personal genetic data, serving as a primary driver for the development of targeted products and services. The availability of this data creates a rich ecosystem for companies to develop and market highly personalized solutions that appeal directly to the core tenets of the biohacking philosophy.

Impact of Macroeconomic / Geopolitical Factors

The biohacking market faces significant macroeconomic and geopolitical challenges that impact investment and product access. Investment in the broader longevity biotech sector, for example, reached approximately $5 billion in 2023, reflecting robust but uneven investor interest. Geopolitical factors also influence this market, with over 60 countries implementing data localization measures, as identified by the Cato Institute, which can create significant barriers to the cross-border flow of data for direct-to-consumer services like genetic testing.

Tariffs also play a role; for example, trade restrictions in the European Union now require that medical device imports from China must not have more than 50% of their components originating from that country, a measure that affects many health-related devices. Despite these headwinds, the market is poised for continued growth. Global biotech research and development investment remains strong, and consumer demand for personalized wellness solutions continues to rise, fueling innovation and strategic diversification to ensure sustained market growth.

Latest Trends

The adoption of non-invasive brain-computer interface (BCI) technologies is a recent trend.

A significant trend in 2024 is the accelerating development and commercialization of advanced, non-invasive brain-computer interface (BCI) technologies for mental wellness and cognitive enhancement. While invasive BCIs are still in the early stages of clinical research, non-invasive wearable devices are becoming more sophisticated and accessible to consumers. These devices use electroencephalography (EEG) sensors to measure brain activity and provide real-time data for purposes like improving focus, managing stress, or enhancing meditation practices.

The number of US patents for BCI technology has seen rapid growth. According to data from the US Patent and Trademark Office (USPTO), a total of 87 patents related to non-invasive brain-computer interfaces were filed in 2023, marking a significant increase from previous years. This surge in innovation and intellectual property protection underscores the growing commercial interest and technological maturity of this segment, positioning it as a key area of growth and development within the biohacking market.

Regional Analysis

North America is leading the Biohacking Market

The North American biohacking market held a substantial 38.3% share of the global market in 2024. This leadership is directly attributed to the region’s advanced healthcare infrastructure, significant investment in personalized medicine, and a high consumer interest in self-optimization and longevity. The US government, through agencies like the National Institutes of Health (NIH), has been a key driver, allocating a significant portion of its total budget to grants and research programs that drive innovation in health and wellness.

For instance, the NIH’s “All of Us” research program aims to gather health data from one million or more people to accelerate research and enable individualized prevention, treatment, and care. This type of large-scale, publicly funded research provides a strong foundation for the development of new biohacking technologies. Furthermore, the high prevalence of chronic diseases in the region, with approximately 6 in 10 Americans living with at least one chronic illness, creates a strong and consistent demand for personalized health solutions and preventative measures.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The Asia Pacific region is expected to experience significant growth, driven by a combination of government support, increasing consumer awareness, and a rise in health-conscious individuals. Several countries in the region are actively supporting biotech innovation. For example, in 2024, the United Nations Development Programme (UNDP) expanded its STEM4All platform, which promotes inclusive education and innovative solutions in science, technology, engineering, and mathematics, to include Asia and the Pacific, highlighting a push for technological development in the region.

Consumers in countries like China and India are increasingly adopting health optimization practices, with a noticeable rise in the use of wearable technologies. For instance, in February 2024, Samsung introduced the Galaxy Fit3, a new fitness tracker with advanced health-monitoring capabilities and a long battery life. This type of product development indicates a response to the growing demand for personal health devices.

The increasing prevalence of chronic diseases in the region also contributes to the heightened focus on preventative health and wellness solutions, which are often at the core of self-quantification practices. Therefore, the region’s expanding middle class and increasing disposable incomes will likely continue to fuel investment in health and wellness items, including personal health technologies and supplements, stimulating further growth.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the biohacking market are driving growth by leveraging technological advancements like wearable health trackers and AI-powered health monitoring tools to offer more personalized solutions. They are also heavily focused on strategic collaborations and acquisitions, partnering with biotech firms and academic institutions to accelerate research and expand their product portfolios.

Companies are further broadening their market reach by developing user-friendly, at-home kits and apps that empower individuals to take control of their biometric data, appealing to a consumer base interested in self-optimization and preventative health. This multifaceted approach, combining innovation with accessible products, is crucial for maintaining a competitive edge.

Bulletproof 360, Inc., a prominent player in the market, specializes in performance-enhancing food, beverages, and supplements. The company’s business model is centered on a science-based approach to wellness, offering products from “Upgraded Coffee” to keto-friendly snacks that are free from GMOs and artificial fillers.

Bulletproof’s strategy involves leveraging a strong brand identity and extensive content marketing, including its widely popular podcast, to build a loyal community around its “Bulletproof Diet.” The company’s focus on clean, high-quality ingredients and a holistic mind-body philosophy has solidified its position as a foundational partner for many in the wellness and personal optimization space.

Top Key Players

- TrackMyStack

- Thync Global Inc.

- Thriveport, LLC

- The ODIN

- Muse

- Moodmetric

- HVMN Inc.

- Fitbit, Inc.

- CardieX

- Apple Inc.

Recent Developments

- In October 2023, Muse became an eligible product for health savings accounts (HSA) and flexible spending accounts (FSA), offering customers both health benefits and tax savings. Through a partnership with Truemed, Muse streamlined the payment process, allowing customers to easily purchase the Muse 2 and Muse S Headbands using their HSA or FSA funds, ensuring a smooth and efficient checkout experience.

- In November 2022, CardieX Limited expanded its capabilities by acquiring Blumio, Inc., a Silicon Valley-based company known for its advanced cardiovascular sensor algorithms. This acquisition highlights CardieX’s ongoing dedication to enhancing cardiovascular health monitoring solutions, with Blumio’s innovative technology expected to significantly improve the clinical performance of their heart health products.

Report Scope

Report Features Description Market Value (2024) US$ 24.9 Billion Forecast Revenue (2034) US$ 140.6 Billion CAGR (2025-2034) 18.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Wearables (Wearable Neurotech, Oura ring, Muse Headband, and Others), Implants (NFC and RFID tags, Circadia implant, Blood test Implant, and Others), Smart Drugs, Mobile Apps, Gene Modification Kits, and Others), By Application (Diagnosis & Treatment, Synthetic Biology, Genetic Engineering, Forensic Science, and Drug Testing), By End-user (Pharmaceutical & Biotechnology Companies, Research & Academic Institutes, Hospitals & Clinics, Forensic Laboratories, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape TrackMyStack, Thync Global Inc., Thriveport, LLC, The ODIN, Muse, Moodmetric, HVMN Inc., Fitbit, Inc., CardieX, Apple Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- TrackMyStack

- Thync Global Inc.

- Thriveport, LLC

- The ODIN

- Muse

- Moodmetric

- HVMN Inc.

- Fitbit, Inc.

- CardieX

- Apple Inc.