Global Biobased Disinfectant Market By Product Type(Essential oil-based disinfectants, Citric acid-based disinfectants, Biobased disinfectants, Hydrogen peroxide-based disinfectants, Others), By Category (liquid disinfectants, Gel disinfectants, spray disinfectants, Others), End-User (Healthcare, Food and beverage, Pharmaceutical, Home care, Water treatment, Other), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Oct 2023

- Report ID: 107301

- Number of Pages: 236

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Report

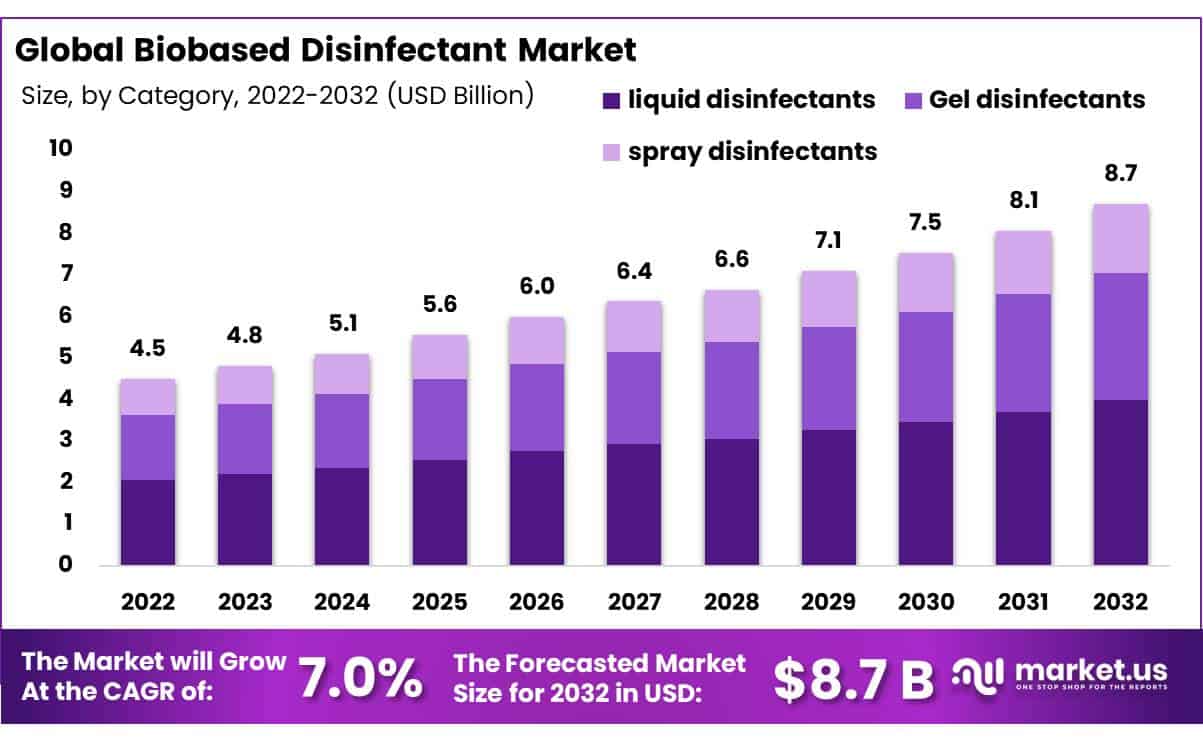

In 2022, the global biobased disinfectant market size was valued at USD 4.5 Billion and it is estimated to reach USD 8.7 billion in 2032, at a compound annual growth rate CAGR of 7% between 2023-2032.

Biobased disinfectants are environmentally friendly alternatives that use renewable biomass resources like plant material or agricultural waste in place of traditional disinfectants that typically rely on petroleum ingredients as ingredients.

Biobased disinfectants provide effective protection from various microorganisms such as bacteria, viruses, and fungi, making them suitable for disinfecting food contact surfaces, medical equipment, and public areas.

Biobased disinfectants have grown increasingly popular as consumers and businesses become aware of the environmental and health advantages provided by sustainable products. The global biobased disinfectants are expected to see rapid expansion over the coming years.

Key Takeaways

- Market Size: It is projected that biobased disinfectant sales will experience a compound annual compound annual growth rate (CAGR) of 7.0% from 2023-2032.

- Rising Demand: Biobased disinfectant markets have quickly established themselves as primary outlets for financing and developing naturally derived disinfectants, providing manufacturers with consistent revenue streams while mitigating price fluctuations for consumers seeking eco-friendly disinfection solutions.

- Increasing Uses: Biobased disinfectant products have quickly become essential components in various settings – healthcare facilities, households, industrial settings, and public spaces alike – thanks to disinfectant power purchase agreements (DPPAs). These agreements offer an efficient means for meeting disinfection needs sustainably.

- Rising Popularity: Biobased disinfectants and disinfectant power purchase agreements (DPPAs) have experienced rapid adoption across diverse sectors, from businesses and government institutions. Businesses use DPPAs as cost-cutting ways of meeting sustainability goals while adhering to sustainability targets while governments utilize them to develop sustainable disinfection practices that lower environmental impacts.

- Market Trend: Biobased disinfectants have seen tremendous success across industries due to their eco-friendly nature and safe applications, particularly within healthcare and cleaning.

- Drivers: Factors driving biobased disinfectant growth include growing awareness about hygiene and sanitation practices, regulations that aim to restrict chemical disinfectants’ usage, as well as their eco-friendliness as alternatives to chemical products.

- Restraints: Challenges associated with broad-spectrum efficacy, limited availability of raw materials, and consumer education regarding biobased disinfectants are impeding market expansion.

- Opportunities: Advances in biotechnology and formulation processes that increase efficiency; expanding applications within both industrial and household settings; and increased research initiatives geared at optimizing biobased disinfectants’ performance present ample avenues of growth.

- Challenges: Meeting stringent regulatory requirements, maintaining quality and efficacy standards across production facilities, and competing against well-established chemical disinfectants in terms of performance and price were major obstacles to introducing fresh disinfectant solutions into hospitals.

- Regional Analysis: Asia Pacific was an impressive leader in biobased disinfectants, boasting the largest revenue share. This success can be attributed to Asia Pacific’s emphasis on sustainability and strict environmental regulations that led to such success in 2022.

- Key Players Analysis: Key players operating within the biobased disinfectants include BASF SE, Ecolab Inc., Evonik Industries AG and Solvay SA as major competitors, along with DuPont de Nemours, Inc.’s Stepan Company, Dow Chemical Company’s Stepan plant in Georgia as well as Lonza Group Ltd, Clariant AG Sealed Air Corporation Reckitt Benckiser plc The Procter & Gamble Company as major vendors.

Driving Factors

- Environmental Sustainability and Health Consciousness: Consumers and industries have become more conscious about products that do not harm both the environment and human health, such as biobased disinfectants that offer eco-friendly alternatives to traditional chemical ones and align with health-conscious lifestyles. Biobased disinfectants offer sustainable options as an eco-friendly and health-conscious lifestyle choice, offering sustainable options like these disinfectants.

- Regulation Support and Compliance: Both regulatory agencies and governments are pushing biobased products as an environmentally friendly option in order to minimize chemical substances’ negative environmental impact. Incentive programs, subsidies, and mandates encourage manufacturers and users alike to opt for biobased disinfectants over traditional alternatives.

- Reduced Chemical Exposure and Safety: Biobased disinfectants have lower chemical contents, providing reduced exposure to potentially hazardous materials that appeal to consumers and industries searching for safer solutions, particularly within sensitive environments like healthcare settings, schools, or households.

- Growing Demand for Effective Disinfection: This also makes these biobased products attractive options when purchasing for sensitive environments such as healthcare settings or households where chemicals could pose potential threats. Biobased disinfectants with their improved efficacy and safety profiles help meet this growing need while offering more sustainable options.

- Innovations in Biotechnology and Formulations: Ongoing advancements in biotechnology and formulation techniques have given birth to biobased disinfectants with greater effectiveness, longer shelf lives, and broader antimicrobial spectrums that attract both consumers and industries searching for high-performance alternatives. These advancements offer consumers and industries reliable ways to protect themselves.

- Focus on Renewable and Biodegradable Resources: Biobased disinfectants utilize renewable resources such as plant extracts, essential oils, and microbial enzymes that align with global efforts to minimize dependence on finite resources while simultaneously decreasing waste generation. The incorporation of renewable and biodegradable materials contributes significantly towards meeting this global mandate of sustainability.

Restraining Factors

- Effectiveness and Performance Challenges: Biobased disinfectants often encounter difficulty meeting the same level of effectiveness and performance as chemical solutions; consumers and industries may hesitate to switch if they perceive biobased alternatives as less effective in controlling pathogens.

- Limited Spectrum of Antimicrobial Activity: Some biobased disinfectants tend to possess a narrower antimicrobial spectrum when compared with chemical disinfectants, and may struggle to effectively combat an array of pathogens; this may restrict their adoption when broad-spectrum disinfection is essential in certain settings.

- Raw Material Availability and Cost Fluctuations: Variations in raw material availability and costs can greatly influence production costs and ultimately product pricing in biobased disinfectant products. Reliance on specific raw materials makes the market vulnerable to supply chain disruptions or fluctuations that affect pricing decisions, leaving markets exposed.

Consumer Awareness and Education: Lack of consumer knowledge about biobased disinfectants can impede market expansion; to overcome this obstacle, education of their benefits, safety, and efficacy is imperative to their market expansion. - Compliance and Standardization: Biobased disinfectant manufacturers face unique regulatory compliance and standardization issues in each region and country they sell products into, making expansion more time-consuming than anticipated. Complying with regulations requires additional resources as they change over time – potentially impeding market expansion efforts altogether.

- Cost Competitiveness and Affordability: Biobased disinfectants may encounter difficulty competing cost-effectively with traditional chemical-based solutions, particularly if their prices are significantly higher – cost-conscious customers and companies might prefer more cost-cutting measures instead of these premium biobased options.

By Product Type Analysis

Your choice of biobased disinfectant product depends on both its intended use and your own individual preferences and needs. Essential oil-based disinfectants may be best for those seeking eco-friendly disinfectants effective against multiple microorganisms; citric acid disinfectants could work better in food and beverage industries.

Hydrogen peroxide-based disinfectants are an excellent option for healthcare settings and general household disinfection needs, while vinegar-based ones work great as general house cleaners/deodorizers. Bioenzymatic solutions may offer additional disinfecting power while specific biobased ones might meet niche applications where specific levels of disinfection may be desired.

By Category Analysis

Your choice of biobased disinfectant depends entirely upon its intended use; liquid disinfectants tend to serve multiple needs while spray disinfectants excel in reaching hard-to-reach surfaces. Gel disinfectants are often utilized in healthcare settings while other forms of biobased disinfectants make for convenient portable disinfecting solutions.

Liquid disinfectant market share dominates biobased disinfectant sales worldwide due to their versatility, as they can be used on a range of surfaces. Spray disinfectants are expected to experience rapid growth over the coming years due to their convenience; gel disinfectants have a thicker consistency than liquid or spray solutions and may be best used on hands, small surfaces, and mobile use – perfect for travel use as they offer instant disinfection on-the-go.

By End-User Industry Analysis

Biobased disinfectant market segments can be divided by end-use industry and application area; one primary area being healthcare facilities like hospitals, clinics, and nursing homes where biobased disinfectants play an essential part in maintaining a sterile and secure environment essential to patient wellbeing and infection control.

Food and beverage production facilities, restaurants, catering services, and home care sectors represent another significant segment of the industry. Biobased disinfectants are utilized here to maintain food hygiene and safety by adhering to stringent regulatory standards for surfaces such as preparation surfaces and equipment as well as packaging material used during food prep and packaging materials.

Home care also employs bio based disinfectants daily as part of daily home cleaning and sanitation routines – these safe alternatives to chemical-laden cleaners offer greater eco-friendliness for families as they provide daily sanitation without harming the planet or their inhabitants.

Key Market Segments

Product Type Analysis

- Essential oil-based disinfectants

- Citric acid-based disinfectants

- Biobased disinfectants

- Hydrogen peroxide-based disinfectants

- Others

By Category Analysis

- liquid disinfectants

- Gel disinfectants

- spray disinfectants

- Others

End-User Industry

- Healthcare

- Food and beverage

- Pharmaceutical

- Home care

- Water treatment

- Other

Growth Opportunity

- Increasing demand for sustainable and eco-friendly disinfectants: Consumer and business awareness of eco-friendly disinfectants has grown, prompting an upswing in demand for eco-friendly alternatives such as biobased disinfectants. Made from renewable resources and biodegradable, biobased disinfectants provide more sustainable options.

- Increased Awareness of Hygiene: With COVID-19’s pandemic being so widespread and infectious diseases spreading so easily, awareness about hygiene has grown significantly, prompting an uptick in demand for disinfectants across various industries such as healthcare, food & beverage, and education.

- Expanding applications of biobased disinfectants: Biobased disinfectants have expanded in scope significantly in recent years. Their uses now encompass everything from disinfecting personal protective equipment (PPE), air conditioning systems, and clothing – even down to household surfaces like countertops.

- Government Support of Biobased Products: Governments across the globe are offering financial incentives and tax breaks to encourage biobased product use, making decontaminants more cost-effective and accessible to a broader range of users.

Latest Trends

- Integration of Technology: Technology integration is becoming an increasing trend, with smart dispensing systems and IoT-enabled devices becoming essential components in efficient biobased disinfectant application processes. Dosage accuracy, reduced wastage costs, and real-time monitoring make these features invaluable tools in improving biobased disinfection procedures.

- Partnerships and Collaborations: Partnerships between biotech firms, manufacturers, and research institutions have gained increasing traction recently, as their collaboration aims to combine expertise and resources for bio-based disinfectant product development as well as market expansion.

- Consumer Education and Awareness: Education efforts regarding the benefits of biobased disinfectants such as their lower environmental impact, enhanced safety, and efficacy have become more prominent over time. Awareness campaigns highlighting this shift toward switching to bio-based solutions play a pivotal role.

- Market Expansion and Global Reach: Biobased disinfectant manufacturers have expanded their market presence by entering into new geographical markets. Their global expansion strategies consist of partnerships, acquisitions, and distribution networks designed to meet international demands for eco-friendly disinfection solutions.

- Multi-Functional Products: Manufacturers have begun creating biobased disinfectants with multifunctional capabilities that include acting as a sanitizer, cleaner, and deodorizer simultaneously – driven by consumer preference for products providing comprehensive cleaning and disinfection properties. This trend continues today.

Regional Analysis

Asia Pacific is the largest market for biobased disinfectants, in the global market share in 2023. The growth of the market in this region is attributed to the increasing awareness of environmental sustainability and the implementation of stringent environmental regulations. The growth of the healthcare and food processing sectors in the region is also boosting the market growth.

North America is the second-largest market for biobased disinfectants. The growth of the market in this region is attributed to the increasing demand for sustainable and environmentally friendly cleaning products. The presence of key players in the region is also driving the market growth.

Europe is another major market for biobased disinfectants. The growth of the market in this region is attributed to the increasing government support for the development and use of biobased products. The growing awareness about the benefits of biobased disinfectants among consumers and businesses is also driving the market growth.

Latin America and the Middle East & Africa are relatively smaller markets for biobased disinfectants. However, these markets are expected to grow at a significant pace in the coming years, driven by the increasing demand for sustainable and environmentally friendly cleaning products.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

These companies are all investing heavily in research and development efforts to develop more effective biobased disinfectants, like those developed by BASF SE that target bacteria, viruses, and fungi; Ecolab Inc. is creating one that is biodegradable and food grade; Evonik Industries AG’s disinfection products can protect hospital-acquired infections while Solvay SA creates one which combats waterborne pathogens.

The biobased disinfectant market is projected to experience exponential growth over the coming years due to growing consumer interest in environmentally friendly disinfectants that meet sustainability criteria. Key players within this market are well-positioned to take advantage of this surge by continuing investments in research & development, product design & market expansion efforts.

Market Key Players

- BASF SE

- Ecolab Inc.

- Evonik Industries AG

- Solvay SA

- DuPont de Nemours, Inc.

- Stepan Company

- Dow Chemical Company

- Lonza Group Ltd.

- Clariant AG

- Sealed Air Corporation

- Reckitt Benckiser Group plc

- The Procter & Gamble Company

Recent Developments

- In 2023, Solvay announced a partnership to develop and commercialize new biobased disinfectant products. The partnership will combine Ecolab’s expertise in infection prevention and Solvay’s expertise in biobased chemistry to develop new disinfectants that are effective, safe, and sustainable.

- In 2023, Ecolab: Ecolab launched a new biobased disinfectant called Xeris PureClean Disinfectant. Xeris PureClean Disinfectant is a ready-to-use disinfectant made from plant-based ingredients that is effective against a wide range of pathogens.

- In 2023, Evonik Industries AG: Evonik launched a new line of biobased disinfectants called TEGO DISINFECTANT. TEGO DISINFECTANT products are made from renewable ingredients and are effective against a wide range of pathogens. Evonik is also working to develop new biobased disinfectant ingredients and formulations.

Report Scope

Report Features Description Market Value (2022) USD 4.5 Bn Forecast Revenue (2032) USD 8.7 Bn CAGR (2023-2032) 7% Base Year for Estimation 2022 Historic Period 2017-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Essential oil-based disinfectants, Citric acid-based disinfectants, Biobased disinfectants, Hydrogen peroxide-based disinfectants, Others), By Category (liquid disinfectants, Gel disinfectants, spray disinfectants, Others), End-User (Healthcare, Food and beverage, Pharmaceutical, Home care, Water treatment, Other) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC- China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- GCC, South Africa, &Rest of MEA Competitive Landscape BASF SE, Ecolab Inc., Evonik Industries AG, Solvay SA, DuPont de Nemours, Inc., Stepan Company, Dow Chemical Company, Lonza Group Ltd., Clariant AG, Sealed Air Corporation, Reckitt Benckiser Group plc, The Procter & Gamble Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What are bio based disinfectants market?Biobased disinfectants are cleaning and disinfection products made from natural, renewable resources such as plants, bacteria, fungi, or enzymes. These disinfectants are formulated to kill or inhibit the growth of harmful microorganisms on various surfaces, providing an eco-friendly alternative to traditional chemical-based disinfectants.

How do bio based disinfectants market work?Biobased disinfectants work by utilizing naturally derived active ingredients that have antimicrobial properties. These ingredients disrupt the cell membranes or metabolic processes of microorganisms, effectively eliminating them. Common biobased ingredients include citric acid, lactic acid, hydrogen peroxide, and essential oils.

Are biobased disinfectant market certified or regulated?Yes, many biobased disinfectants undergo certification processes to validate their efficacy and safety. Regulatory bodies, such as the Environmental Protection Agency (EPA) in the United States, provide guidelines and approvals for biobased disinfectants to ensure they meet established standards for performance and environmental impact.

Are biobased disinfectant market as effective as chemical-based disinfectants?Yes, biobased disinfectants can be as effective as chemical-based disinfectants in killing bacteria, viruses, and other pathogens. Advances in biotechnology have led to the development of biobased disinfectants with comparable efficacy while being safer for human health and the environment.

Biobased Disinfectant MarketPublished date: Oct 2023add_shopping_cartBuy Now get_appDownload Sample

Biobased Disinfectant MarketPublished date: Oct 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- BASF SE

- Ecolab Inc.

- Evonik Industries AG

- Solvay SA

- DuPont de Nemours, Inc.

- Stepan Company

- Dow Chemical Company

- Lonza Group Ltd.

- Clariant AG

- Sealed Air Corporation

- Reckitt Benckiser Group plc

- The Procter & Gamble Company