Global Bioanalytical Testing Services Market By Molecule (Small Molecule and Large Molecule), By Test (ADME (In-Vivo and In-Vitro), Pharmacokinetics, Pharmacodynamics, Bioavailability, Bioequivalence, and Others), By Workflow (Sample Preparation, Sample Analysis (Chromatographic & Electrophoretic Techniques, Mass Spectrometry & Hyphenated Techniques, and Others), and Other Workflow Processes), By Application (Oncology, Neurology, Infectious Diseases, Gastroenterology, Cardiology, and Others), By End-user (Pharma & Biotechnology Companies, CDMO, and CRO), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 142155

- Number of Pages: 203

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

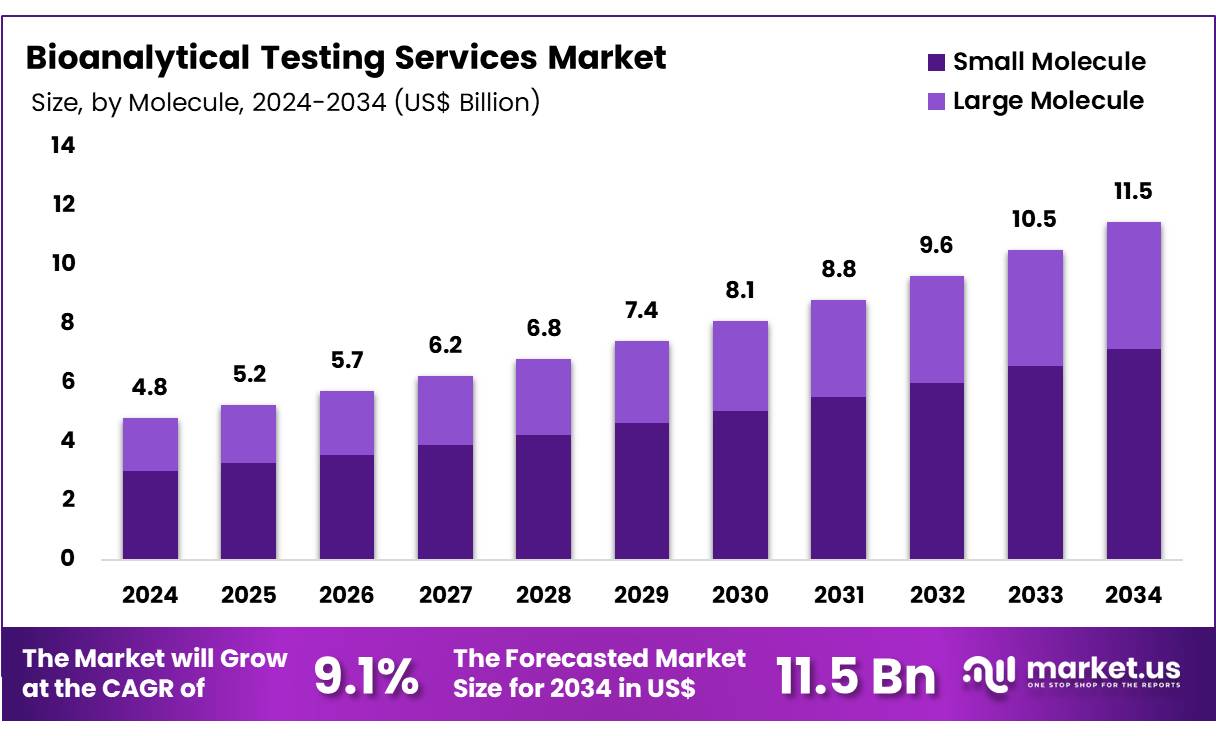

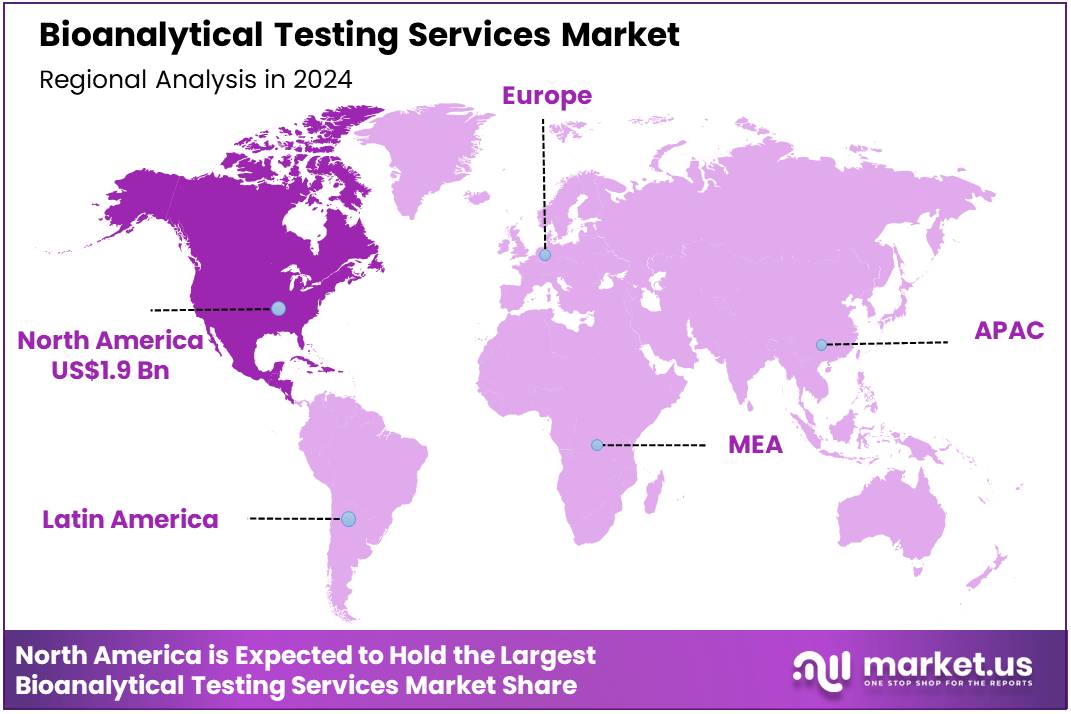

Global Bioanalytical Testing Services Market size is expected to be worth around US$ 11.5 billion by 2034 from US$ 4.8 billion in 2024, growing at a CAGR of 9.1% during the forecast period 2025 to 2034. In 2023, North America led the market, achieving over 39.6% share with a revenue of US$ 1.9 Billion.

Growing demand for accurate and efficient analytical solutions in drug development is driving expansion in the bioanalytical testing services market. The increasing focus on biosimilars, biologics, and cell and gene therapies is fueling demand for specialized bioanalytical testing to ensure drug efficacy, safety, and regulatory compliance.

In October 2022, BioFactura Inc. successfully completed a pharmacokinetic comparability clinical trial for its Ustekinumab Biosimilar (BFI-751). The study, conducted at two sites in New Zealand and Australia, aimed to evaluate the biosimilar’s efficacy and safety profile compared to the reference product. Rising investments in pharmaceutical research and clinical trials are accelerating the need for bioanalytical testing services, including pharmacokinetics, immunogenicity assessments, and biomarker analysis.

The growing adoption of advanced analytical techniques, such as liquid chromatography-mass spectrometry (LC-MS) and ligand-binding assays, is enhancing the precision and reliability of bioanalytical studies. Increasing regulatory requirements for drug approval are driving pharmaceutical companies to partner with contract research organizations (CROs) for specialized bioanalytical support.

Expanding applications of bioanalytical testing in personalized medicine are strengthening its role in optimizing treatment strategies. The growing complexity of drug formulations, including nanoparticle-based therapeutics, is increasing demand for innovative bioanalytical methodologies. Rising integration of automation and artificial intelligence in bioanalytical labs is improving data accuracy, efficiency, and throughput.

Expanding use of bioanalytical testing in environmental and food safety assessments is broadening its market scope beyond pharmaceuticals. Increasing collaborations between biotechnology firms and bioanalytical service providers are fostering innovations in high-throughput screening and bioassay development.

The rising emphasis on quality assurance and Good Laboratory Practice (GLP) compliance is encouraging advancements in bioanalytical testing standards. Growing demand for real-time bioanalytical monitoring is driving the development of next-generation point-of-care analytical solutions. As pharmaceutical innovation accelerates and regulatory standards evolve, the bioanalytical testing services market is expected to witness significant growth in the coming years.

Key Takeaways

- In 2024, the market for bioanalytical testing services generated a revenue of US$ 4.8 billion, with a CAGR of 9.1%, and is expected to reach US$ 11.5 billion by the year 2033.

- The molecule segment is divided into small molecule and large molecule, with small molecule taking the lead in 2023 with a market share of 62.4%.

- Considering test, the market is divided into ADME, pharmacokinetics, pharmacodynamics, bioavailability, bioequivalence, and others. Among these, bioavailability held a significant share of 34.8%.

- Furthermore, concerning the workflow segment, the market is segregated into sample preparation, sample analysis, and other workflow processes. The sample analysis sector stands out as the dominant player, holding the largest revenue share of 49.2% in the bioanalytical testing services market.

- The application segment is segregated into oncology, neurology, infectious diseases, gastroenterology, cardiology, and others, with the oncology segment leading the market, holding a revenue share of 38.6%.

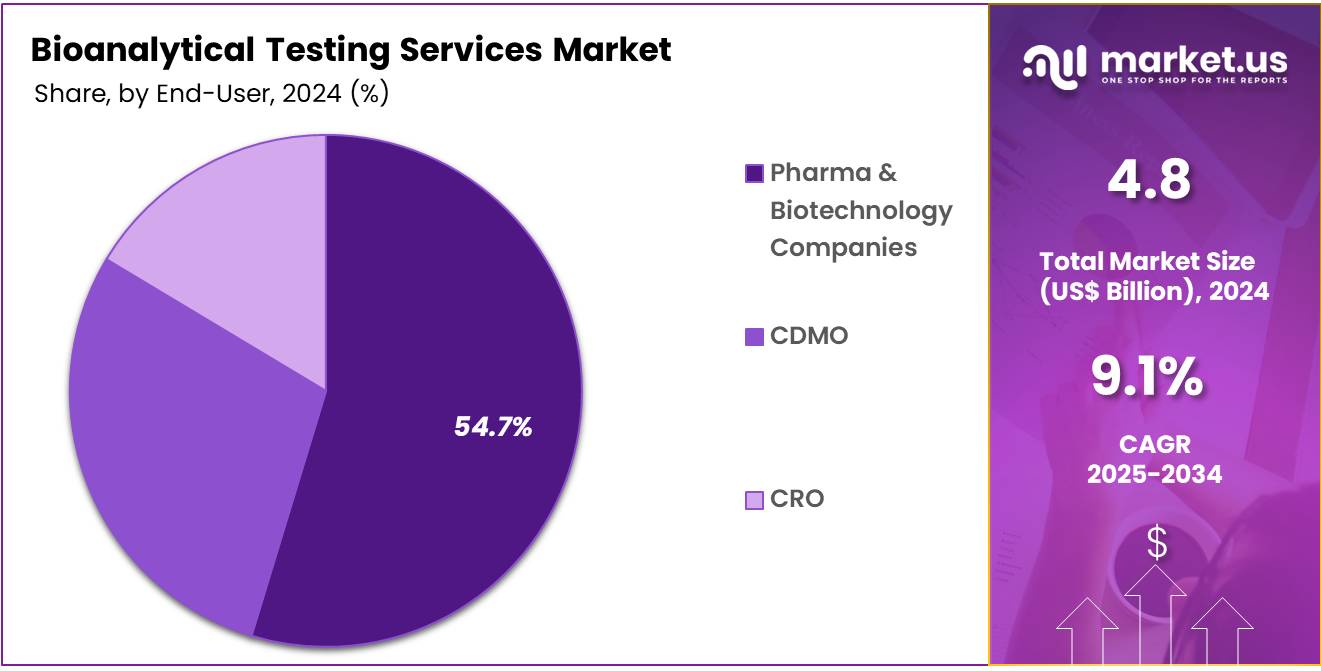

- Considering end-user, the market is divided into pharma & biotechnology companies, CDMO, and CRO. Among these, pharma & biotechnology companies held a significant share of 54.7%.

- North America led the market by securing a market share of 39.6% in 2023.

Molecule Analysis

The small molecule segment led in 2023, claiming a market share of 62.4% owing to the increasing demand for the development and testing of small molecule drugs. Small molecules are widely used in the pharmaceutical industry, particularly for their versatility in treating a wide range of diseases, including cancer, cardiovascular conditions, and infectious diseases.

The continued focus on small molecule drug discovery and development, coupled with the advancements in analytical techniques for testing such molecules, is expected to drive demand in the bioanalytical testing services market. Additionally, the growing need for efficient drug formulation and personalized therapies will further fuel the expansion of this segment.

Test Analysis

The bioavailability held a significant share of 34.8% as pharmaceutical companies increasingly prioritize understanding the bioavailability of new drugs. Bioavailability testing plays a critical role in determining the absorption and distribution of drugs within the body, which is essential for optimizing drug efficacy and safety.

The rise in drug development activities, especially in the fields of personalized medicine and biologics, is expected to significantly boost the demand for bioavailability testing services. Additionally, the growing regulatory requirements for drug approval, particularly in regions like the U.S. and Europe, will further support the expansion of this segment.

Workflow Analysis

The sample analysis segment had a tremendous growth rate, with a revenue share of 49.2% as the pharmaceutical and biotechnology industries continue to prioritize efficiency and accuracy in sample testing. Advancements in technology and techniques for sample analysis, such as high-throughput screening and mass spectrometry, are expected to drive the demand for sample analysis services.

These technologies offer improved precision and speed in analyzing complex biological samples, which is particularly crucial in drug discovery, clinical trials, and regulatory compliance. As drug development becomes increasingly complex, the need for robust and accurate sample analysis is anticipated to rise, driving growth in this segment.

Application Analysis

The oncology segment grew at a substantial rate, generating a revenue portion of 38.6% as the global focus on cancer research intensifies. Advances in molecular oncology and targeted therapies have led to a surge in demand for bioanalytical testing services to identify biomarkers, monitor therapeutic responses, and assess the safety of oncology drugs.

The increasing prevalence of cancer, along with the growing investment in cancer drug research and clinical trials, is expected to further drive the demand for bioanalytical testing in oncology. Additionally, the adoption of personalized medicine in oncology, which relies heavily on precise bioanalytical testing, is likely to contribute significantly to the growth of this segment.

End-User Analysis

The pharma & biotechnology companies held a significant share of 54.7% as the pharmaceutical industry increasingly relies on contract research organizations (CROs) and contract development and manufacturing organizations (CDMOs) to conduct bioanalytical testing. These companies require bioanalytical testing services to support drug discovery, development, and clinical trials, particularly for testing pharmacokinetics, bioavailability, and safety profiles.

As pharma and biotech companies continue to focus on bringing innovative treatments to market, the demand for specialized bioanalytical testing services will increase. The growing outsourcing trend and the need for compliance with stringent regulatory standards will further boost the market for bioanalytical testing services among pharma and biotechnology companies.

Key Market Segments

By Molecule

- Small Molecule

- Large Molecule

By Test

- ADME

- In-Vivo

- In-Vitro

- Pharmacokinetics

- Pharmacodynamics

- Bioavailability

- Bioequivalence

- Others

By Workflow

- Sample Preparation

- Sample Analysis

- Chromatographic & Electrophoretic Techniques

- Mass Spectrometry & Hyphenated Techniques

- Others

- Other Workflow Processes

By Application

- Oncology

- Neurology

- Infectious Diseases

- Gastroenterology

- Cardiology

- Others

By End-User

- Pharma & Biotechnology Companies

- CDMO

- CRO

Drivers

Rising Number of Drug Development and Approval Processes Driving the Bioanalytical Testing Services Market

Increasing pharmaceutical innovation is expected to drive demand for bioanalytical testing services as regulatory bodies emphasize rigorous safety and efficacy evaluations. In 2023, the US Food and Drug Administration (FDA) approved 55 novel drugs, indicating a robust pipeline in drug development and approval processes. Pharmaceutical companies continue investing in clinical research to meet the rising demand for targeted therapies, particularly in oncology, neurology, and rare diseases.

Expanding biologics and biosimilars markets require specialized bioanalytical testing to assess pharmacokinetics, immunogenicity, and biomarker validation. Advanced analytical techniques ensure compliance with evolving regulatory guidelines, strengthening drug approval success rates. The surge in personalized medicine accelerates the need for precise bioanalysis to support tailored treatment strategies. Increasing global collaborations between contract research organizations (CROs) and pharmaceutical firms contribute to market expansion.

The rise in outsourcing trends reduces operational costs for drug manufacturers, enhancing efficiency and scalability. Regulatory agencies encourage comprehensive validation studies, reinforcing the demand for bioanalytical expertise. Emerging biopharmaceutical technologies, including cell and gene therapies, require sophisticated bioanalytical solutions to assess safety and efficacy.

Clinical trial complexities necessitate high-throughput bioanalytical platforms to streamline sample analysis. Strengthening regulatory frameworks worldwide further fuels the adoption of bioanalytical testing services in preclinical and clinical drug development.

Restraints

Regulatory Complexities as a Restraint in the Bioanalytical Testing Services Market

Growing regulatory challenges are expected to limit market growth as evolving compliance requirements increase operational burdens for bioanalytical service providers. Agencies such as the FDA, the European Medicines Agency (EMA), and the International Council for Harmonisation (ICH) impose stringent validation protocols for bioanalytical methods.

Frequent updates in regulatory guidelines require laboratories to continuously adapt, leading to increased costs and resource allocation. Standardization across different jurisdictions remains a challenge, as regional regulatory variations complicate international drug development. Strict data integrity requirements mandate robust documentation practices, further extending approval timelines.

Complex bioanalytical validation processes often delay clinical trials, affecting pharmaceutical companies’ commercialization strategies. Inconsistent regulatory expectations for biosimilars and novel biologics introduce additional hurdles for analytical method development. Despite technological advancements, meeting evolving compliance standards continues to be a significant challenge for bioanalytical testing laboratories.

Opportunities

Advances in Biomarkers and Diagnostics as an Opportunity in the Bioanalytical Testing Services Market

Rising biomarker-driven drug development is expected to create growth opportunities for bioanalytical testing services as precision medicine gains traction in clinical research. A 2023 study highlighted that only 20.3% of patients had all core biomarker results available at the first consultation, underscoring the need for improved biomarker turnaround times to enhance diagnostic efficiency. The increasing role of companion diagnostics in targeted therapies drives demand for biomarker validation and bioanalytical assays.

Advanced mass spectrometry and liquid chromatography techniques enhance biomarker quantification, improving diagnostic accuracy. Expanding cancer immunotherapy research necessitates precise biomarker analysis to guide treatment decisions. Pharmaceutical companies prioritize biomarker-driven clinical trials, further integrating bioanalytical solutions into early-stage drug development.

Growing emphasis on early disease detection accelerates the need for reliable biomarker-based screening tools. Digital pathology and AI-powered diagnostics complement bioanalytical methodologies, optimizing sample analysis workflows. The development of multiplex assays enables simultaneous biomarker detection, improving laboratory efficiency.

Personalized medicine initiatives propel demand for bioanalytical platforms capable of high-throughput biomarker screening. Collaborative efforts between diagnostic firms and bioanalytical service providers support the expansion of precision medicine programs. Ongoing innovations in non-invasive biomarker testing, such as liquid biopsies, enhance the accessibility and feasibility of advanced bioanalytical applications.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly influence the bioanalytical testing services market. On the positive side, growing global healthcare investments, particularly in emerging markets, drive demand for testing services as countries seek to strengthen their pharmaceutical and biotechnology sectors.

Increased research activities and the need for regulatory compliance across borders fuel the market, as companies worldwide rely on accurate and efficient bioanalytical testing to meet global standards. On the other hand, trade barriers, economic downturns, and regulatory challenges can limit the expansion of testing services in certain regions, affecting market growth.

Moreover, the ongoing geopolitical tensions and shifting healthcare policies may create challenges in the cross-border flow of research data and testing materials. Despite these challenges, the market is likely to continue its growth trajectory due to increasing investments in advanced technologies and the rising demand for high-quality testing services to support drug development, regulatory approvals, and patient safety.

Latest Trends

Growing Outsourcing of Testing Services Driving the Bioanalytical Testing Services Market:

The growing outsourcing of testing services is a rising trend that is significantly driving the bioanalytical testing services market. High demand for cost-effective and time-efficient solutions has led pharmaceutical companies, biotechnology firms, and academic institutions to increasingly rely on third-party providers for bioanalytical testing.

This shift is expected to improve operational efficiency and allow companies to focus more on core research activities, reducing the need for substantial investment in in-house testing facilities. The trend is likely to intensify as companies look for specialized expertise in areas such as drug development, clinical trials, and regulatory compliance.

Between June 2021 and January 2024, the FDA participated in seven Generic Drug Cluster videoconferences, focusing on collaborative data assessment to potentially widen the pool of test volunteers and expedite drug approval timelines. This demonstrates the increasing reliance on outsourcing and global collaboration in testing services, highlighting the growing importance of bioanalytical testing providers in the global healthcare ecosystem.

Regional Analysis

North America is leading the Bioanalytical testing services Market

North America dominated the market with the highest revenue share of 39.6% owing to rising demand for advanced analytical solutions in pharmaceuticals, environmental sciences, and biotechnology. Pace Analytical Services’ acquisition of Alpha Analytical in April 2023 expanded its presence in the Northeastern U.S., increasing capacity for environmental and life sciences testing across 39 locations. The growing number of clinical trials and drug development programs fueled the need for high-quality bioanalytical testing, ensuring compliance with regulatory standards.

Advances in biologics, biosimilars, and gene therapies further accelerated demand for specialized analytical techniques. The adoption of automation and AI-driven data analysis improved efficiency and accuracy in bioanalysis. Additionally, the expansion of government-funded research initiatives and increasing investments from pharmaceutical companies strengthened market growth. The rising focus on quality control and contamination testing in the food and beverage sector also contributed to the expansion of bioanalytical services across North America.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to increasing pharmaceutical manufacturing and expanding regulatory compliance requirements. The launch of SGS’s state-of-the-art testing laboratory in Pudong, Shanghai, in February 2023 highlighted the region’s growing commitment to quality control and regulatory testing. Rising investments in drug discovery and clinical research are expected to drive demand for advanced analytical solutions.

Government initiatives promoting biosimilar development and biologics manufacturing are anticipated to accelerate market expansion. Collaborations between global contract research organizations (CROs) and regional biotech firms are likely to enhance service availability and affordability. The increasing adoption of digitalized laboratory solutions and AI-powered data processing is projected to improve testing efficiency.

Additionally, the rapid growth of personalized medicine and cell-based therapies is expected to create new opportunities for bioanalytical services, positioning Asia Pacific as a key hub for scientific advancements in analytical testing.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the anatomic pathology market focus on advancing digital pathology solutions and integrating artificial intelligence to improve diagnostic accuracy. Companies invest in research and development to enhance imaging technologies, automate workflows, and streamline sample processing. Strategic collaborations with hospitals and laboratories help expand service accessibility and drive adoption of advanced diagnostic tools.

Emphasis on regulatory compliance and high-throughput testing strengthens market position and supports growth in personalized medicine. Many players also prioritize geographic expansion and product innovation to meet the rising demand for efficient disease diagnostics.

Leica Biosystems is a leading company in this market, offering advanced anatomic pathology solutions such as digital imaging and tissue processing systems. The company focuses on technological advancements, strong industry partnerships, and continuous innovation to enhance diagnostic capabilities. Leica Biosystems’ commitment to precision and efficiency establishes it as a key player in pathology diagnostics.

Top Key Players

- Syneos Health

- SGS SA

- Resolian

- Labcorp

- IQVIA

- ICON Plc

- Charles River Laboratories International

- Cerba HealthCare

Recent Developments

- In September 2023, Cerba HealthCare strengthened its bioanalytical expertise by acquiring CIRION BioPharma Research, a leading Canadian contract research laboratory. This acquisition supports the company’s mission to optimize clinical trial operations and expand its presence in North America.

- In November 2023, Resolian bolstered its global laboratory network by acquiring Denali Medpharma, a China-based bioanalytical contract research organization. This strategic move extends Resolian’s capabilities across the US, UK, Australia, and China, reinforcing its position in bioanalysis services.

Report Scope

Report Features Description Market Value (2024) US$ 4.8 billion Forecast Revenue (2034) US$ 11.5 billion CAGR (2025-2034) 9.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Molecule (Small Molecule and Large Molecule), By Test (ADME (In-Vivo and In-Vitro), Pharmacokinetics, Pharmacodynamics, Bioavailability, Bioequivalence, and Others), By Workflow (Sample Preparation, Sample Analysis (Chromatographic & Electrophoretic Techniques, Mass Spectrometry & Hyphenated Techniques, and Others), and Other Workflow Processes), By Application (Oncology, Neurology, Infectious Diseases, Gastroenterology, Cardiology, and Others), By End-user (Pharma & Biotechnology Companies, CDMO, and CRO) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Syneos Health, SGS SA, Resolian, Labcorp, IQVIA, ICON Plc, Charles River Laboratories International, Cerba HealthCare. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Bioanalytical Testing Services MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Bioanalytical Testing Services MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Syneos Health

- SGS SA

- Resolian

- Labcorp

- IQVIA

- ICON Plc

- Charles River Laboratories International

- Cerba HealthCare