Global Beneficial Insects Market Size, Share, And Industry Analysis Report By Type (Predators, Parasitoids, Pathogens, Pollinators), By Application (Crop Protection, Crop Production), By Crop Type (Fruits and Vegetables, Flowers and Ornamentals, Grains and Pulses, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 174854

- Number of Pages: 355

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

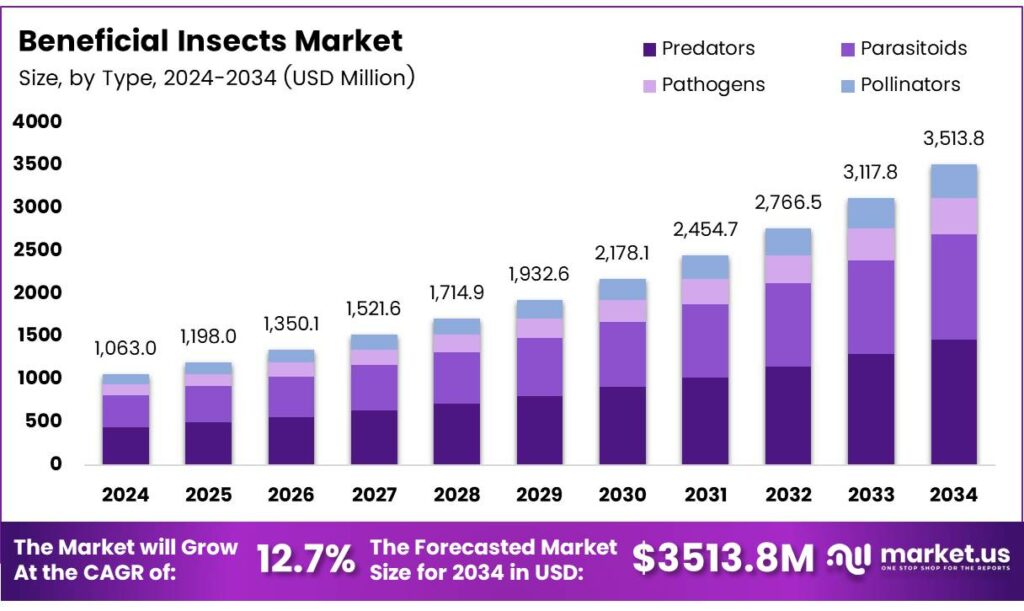

The Global Beneficial Insects Market size is expected to be worth around USD 3513.8 million by 2034, from USD 1063.0 million in 2024, growing at a CAGR of 12.7% during the forecast period from 2025 to 2034.

Beneficial insects, which serve as natural predators and pollinators, enhance crop protection, improve soil health, and promote ecosystem stability. This market includes lady beetles, lacewings, parasitoid wasps, and predatory mites used in sustainable agriculture. It supports biological control strategies that reduce chemical pesticide dependency, aligning with global efforts to enhance regenerative farming practices.

The Beneficial Insects Market is expected to show strong growth momentum as manufacturers adopt biological pest-management solutions to meet increasingly stringent residue standards. Expanding organic farming acreage and rising awareness about ecological balance accelerate the demand for beneficial insects, especially in horticulture and greenhouse cultivation, where natural pest suppression is highly valued.

- Global crop losses from pests exceed 40%, highlighting the urgent need for nature-based solutions. Meanwhile, IFOAM reports that organic farmland surpassed 96 million hectares, reinforcing demand for biological controls. Additionally, UNEP highlights that pesticide-reduction policies are expanding across multiple regions, further accelerating adoption.

Increasing climate-resilience strategies push growers to consider beneficial insects as part of sustainable crop-protection portfolios. Their ability to adapt to changing environments and reduce input costs presents measurable economic advantages. As farming systems transition toward low-chemical models, beneficial insects emerge as a practical and scalable solution.

In the broader market landscape, opportunities arise from technology-enabled breeding, large-scale insect rearing, and customized biocontrol programs. Partnerships between research institutions and farm cooperatives boost innovation, while digital monitoring tools help optimize insect release patterns. These developments strengthen long-term value creation across global agriculture.

Key Takeaways

- The Global Beneficial Insects Market is expected to reach USD 3513.8 million by 2034, up from USD 1063.0 million in 2024, at a strong CAGR of 12.7% from 2025 to 2034.

- Predators lead the Type segment with a dominant 38.3% market share.

- Crop Protection is the top Application segment, accounting for 59.1% of the market.

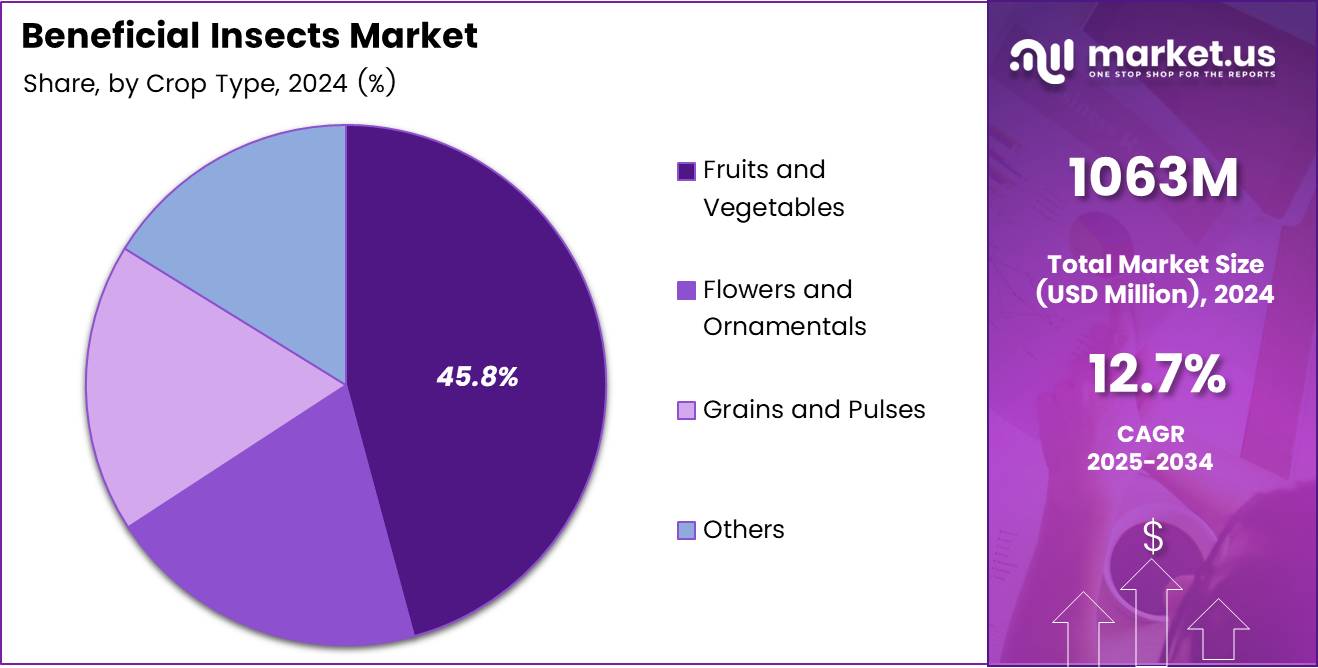

- Fruits and Vegetables dominate the Crop Type segment with 45.8% share.

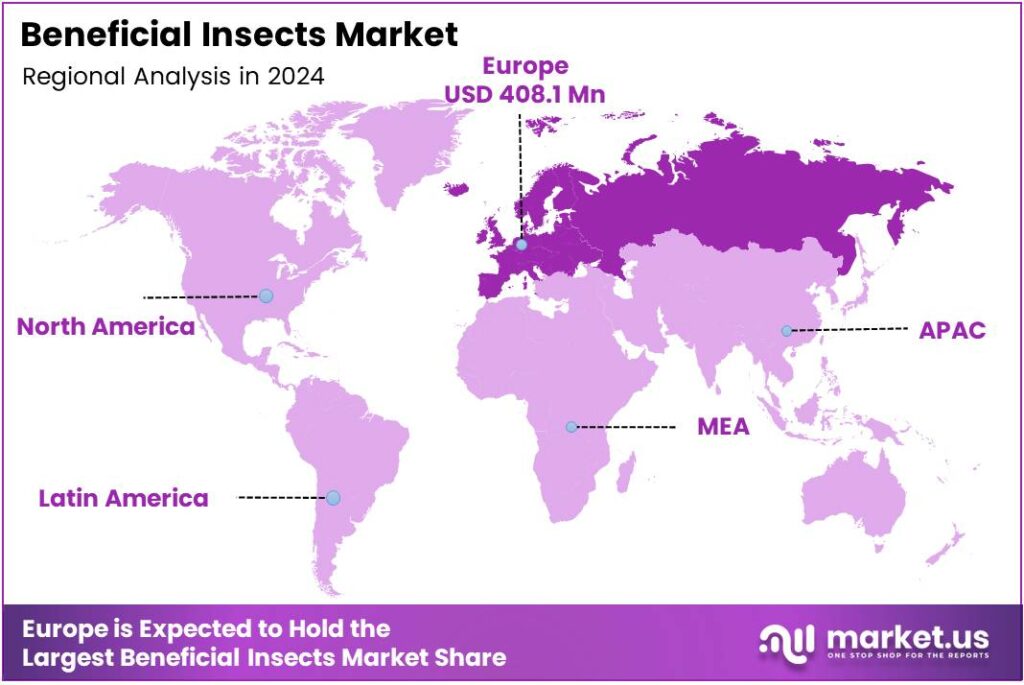

- Europe leads regionally with a 38.4% market share, valued at USD 408.1 million.

By Type Analysis

Predators dominate with 38.3% due to their strong role in natural pest control and farm-level acceptance.

In 2025, Predators held a dominant market position in the By Type analysis segment of the Beneficial Insects Market, with a 38.3% share. Farmers widely use predator insects because they directly feed on harmful pests. As a result, they reduce chemical pesticide use and improve crop safety.

Parasitoids continue to gain attention as they help manage pest populations by laying eggs inside host insects. Over time, this naturally reduces pest numbers. Moreover, parasitoids are favored in controlled farming systems where precise biological control is required.

Pathogens play a supportive role by infecting and weakening harmful insects. These include bacteria and fungi used in integrated pest management. Although adoption is gradual, pathogens are valued for their eco-friendly nature and compatibility with organic farming practices.

Pollinators remain essential for crop health and biodiversity. While not mainly used for pest control, they support overall farm productivity. Their importance is growing as farmers recognize the link between pollination, yield quality, and long-term soil sustainability.

By Application Analysis

Crop Protection leads with 59.1%, driven by rising demand for sustainable pest management solutions.

In 2025, Crop Protection held a dominant market position in the By Application analysis segment of the Beneficial Insects Market, with a 59.1% share. Farmers rely on beneficial insects to control pests naturally. This approach reduces chemical residue and supports regulatory compliance.

Crop Production also benefits from beneficial insects through improved plant health and yield stability. Insects such as pollinators enhance flowering and fruit development. As a result, farmers see better output quality, especially in high-value crops.

By Crop Type Analysis

Fruits and Vegetables dominate with 45.8% due to high pest pressure and quality-focused farming.

In 2025, Fruits and Vegetables held a dominant market position in the By Crop Type analysis segment of the Beneficial Insects Market, with a 45.8% share. These crops face frequent pest attacks, making biological solutions essential for maintaining appearance and freshness.

Flowers and Ornamentals rely on beneficial insects to maintain visual quality and plant health. Even minor pest damage can reduce market value. Therefore, growers prefer gentle biological control methods that protect delicate plants without chemical stress.

Grains and Pulses use beneficial insects mainly in integrated farming systems. While pest pressure is moderate, natural control helps improve soil balance. Adoption is steady, especially where sustainable farming practices are encouraged. Others include specialty and mixed crops, where beneficial insects support ecosystem balance.

Key Market Segments

By Type

- Predators

- Parasitoids

- Pathogens

- Pollinators

By Application

- Crop Protection

- Crop Production

By Crop Type

- Fruits and Vegetables

- Flowers and Ornamentals

- Grains and Pulses

- Others

Emerging Trends

Rising Use of Precision Agriculture Boosts Adoption of Beneficial Insects

A major trend shaping the beneficial insects market is the increasing use of precision agriculture tools. Farmers are using digital sensors, drones, and data analytics to monitor pest populations more accurately. This allows them to release beneficial insects only when needed, improving efficiency and reducing costs. Precision farming makes biological pest control more predictable and easier to manage.

- The growing interest in pollinator-friendly farming. Many crops depend on bees and other pollinating insects, and farmers are becoming more aware of their importance. The EU’s Farm to Fork direction sets two headline targets for 2030: a 50% reduction in the use and risk of chemical pesticides, and a 50% reduction in the use of more hazardous pesticides.

Greenhouse farming is also expanding globally, and it often relies heavily on beneficial insects for pest management. Controlled environments help these insects perform better, making them a preferred choice for greenhouse vegetable and ornamental growers. The rise of vertical farms and protected cultivation further strengthens this trend.

Drivers

Rising Shift Toward Sustainable and Chemical-Free Farming Practices

The demand for beneficial insects is increasing as farmers look for safer and more natural ways to protect crops. Many growers are moving away from chemical pesticides because they can harm soil health and pollinators. Beneficial insects provide a natural solution by controlling pests without damaging the environment. This shift fits well with the growing global interest in sustainable agriculture.

- Governments are also promoting biological pest control through subsidy programs and awareness campaigns. These initiatives make it easier for farmers to adopt natural pest management tools. The EU recorded an overall 27% decrease in the use of more hazardous pesticides compared with its baseline period.

Organic farms rely heavily on biological control methods because chemical pesticides are restricted. As organic farming continues to expand worldwide, the demand for beneficial insects also grows. Farmers appreciate that these insects help reduce long-term pest pressure and support healthier ecosystems.

Restraints

High Production Costs and Limited Awareness Restrict Market Adoption

One major restraint in the beneficial insects market is the high cost of production and maintenance. Breeding beneficial insects requires controlled environments, skilled technicians, and continuous monitoring. These factors make them more expensive compared to conventional pesticides, especially for small farmers who operate with limited budgets.

- A global assessment from IPBES (an intergovernmental science body) puts hard numbers on this. It estimates that the annual market value of global crop output directly linked to pollination services is US$235 billion to US$577 billion. The same assessment also notes that 75% of food crop types depend at least partly on animal pollination.

The lack of awareness among farmers. Many growers are still unfamiliar with biological pest control or unsure how to use beneficial insects correctly. Without proper training, farmers may hesitate to adopt these solutions because they fear lower effectiveness or slower pest control results compared to chemicals.

Growth Factors

Expanding Organic Farming Creates Strong Market Opportunities

The rapid expansion of organic farming worldwide offers major opportunities for the beneficial insects market. As more countries promote organic agriculture, farmers need natural pest control methods that meet certification standards. Beneficial insects perfectly fit these requirements, making them an attractive long-term solution for pest management on organic farms.

There is also growing interest in integrated pest management (IPM), which combines biological, cultural, and mechanical methods. Beneficial insects play an important role in IPM programs, giving companies new avenues to supply products and advisory services. As governments continue encouraging IPM adoption, demand for natural predators is expected to rise.

Increasing consumer demand for chemical-free fruits and vegetables also supports market expansion. Retailers and food brands are beginning to highlight pesticide-free production, which further motivates farmers to use beneficial insects. This shift opens new sales channels and strengthens business potential for biological control companies.

Regional Analysis

Europe Dominates the Beneficial Insects Market with a Market Share of 38.4%, Valued at USD 408.1 Million

Europe leads the global beneficial insects market, holding a 38.4% share and generating a market value of USD 408.1 million. The region’s dominance is driven by strict EU pesticide regulations, rapid adoption of biological control agents, and strong government support for sustainable agriculture. Countries such as Germany, France, and the Netherlands have significantly increased the use of natural pest-management solutions.

North America shows steady growth in the beneficial insects market, supported by rising demand for residue-free produce and expanding indoor farming operations. The U.S. and Canada are increasingly adopting biological pest-control solutions due to stricter environmental norms and the shift toward sustainable farming systems. The region also benefits from active research initiatives and large-scale greenhouse cultivation, driving consistent adoption of natural enemies and pollinators.

Asia Pacific is experiencing rapid expansion in the beneficial insects market, primarily driven by growing agricultural intensification and rising awareness of eco-friendly pest management among growers. Countries such as China, India, and Japan are incorporating biological control solutions to reduce chemical pesticide dependency. Supportive government programs promoting integrated pest management (IPM) and organic farming further strengthen market adoption across the region.

The U.S. market is expanding due to the rapid transition toward precision agriculture and increasing demand for organic and pesticide-free crops. Greenhouse vegetable production and commercial pollination services are strengthening the adoption of beneficial insects across key states. Supportive federal initiatives promoting sustainable agricultural practices further enhance the country’s market growth.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Applied Bionomics Ltd sits in the “precision biocontrol” lane, where consistent quality, cold-chain discipline, and dependable field performance matter as much as the insect itself. In 2025, its edge is likely to come from tight production control and fit-for-purpose programs for greenhouse and high-value crops, where growers pay for reliability and measurable pest suppression rather than novelty.

Biobest Group NV looks like a scale-and-systems player: broad beneficial portfolios, strong technical advisory, and a commercial footprint that supports rapid adoption. From an analyst viewpoint, 2025 is about converting IPM intent into repeat purchasing—Biobest benefits when retailers and growers want one supplier that can bundle insects, monitoring tools, and crop guidance into a single operating routine.

Bioline AgroSciences Ltd typically competes on practical deployment—making beneficials easier to use across different farm sizes and crop cycles. In 2025, its performance will be judged by how well it supports transitions away from residue-sensitive chemistries, especially where growers need “plug-and-play” biological solutions with clear instructions, predictable lead times, and responsive agronomy support.

Fargro Limited is positioned less as a single-product bet and more as a distribution-and-solutions platform for biologicals. The 2025 opportunity is in being the trusted route-to-market: educating growers, managing product choice, and improving on-farm confidence. If adoption accelerates, Fargro benefits from breadth—helping customers choose, trial, and scale beneficial insects within a wider crop input strategy.

Top Key Players in the Market

- Applied Bionomics Ltd

- Biobest Group NV

- Bioline AgroSciences Ltd

- Fargro Limited

- Andermatt Group AG

- ARBICO Organics

- BioBee Ltd

- BIONEMA

- Koppert

- Tip Top Bio-Control

Recent Developments

- In 2024, Applied Bionomics Ltd began construction on a new large greenhouse at 799 Wain Road in North Saanich to expand operations, with completion expected. This project is confined to the southeast corner of the property and aims to enhance the production of beneficial insects and mites.

- In 2025, Biobest Group NV, a Belgian leader in biological crop protection and pollination, rebranded under BioFirst Group following acquisitions and restructuring. Introduced enhanced detection methods for four major moth pests to help growers improve pest management.

Report Scope

Report Features Description Market Value (2024) USD 1063 Million Forecast Revenue (2034) USD 3513.8 Million CAGR (2025-2034) 12.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Predators, Parasitoids, Pathogens, Pollinators), By Application (Crop Protection, Crop Production), By Crop Type (Fruits and Vegetables, Flowers and Ornamentals, Grains and Pulses, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Applied Bionomics Ltd, Biobest Group NV, Bioline AgroSciences Ltd, Fargro Limited, Andermatt Group AG, ARBICO Organics, BioBee Ltd, BIONEMA, Koppert, Tip Top Bio-Control Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Beneficial Insects MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample

Beneficial Insects MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Applied Bionomics Ltd

- Biobest Group NV

- Bioline AgroSciences Ltd

- Fargro Limited

- Andermatt Group AG

- ARBICO Organics

- BioBee Ltd

- BIONEMA

- Koppert

- Tip Top Bio-Control