Global BB Cream Market By Skin Type (Dry, Normal, Oily, Combination, Sensitive), By End-use (Women, Men), By SPF (Below 15 SPF, Between 15-30 SPF, Between 30-50 SPF, Above 50 SPF), Distribution Channel (Offline, Online), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 63229

- Number of Pages: 316

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

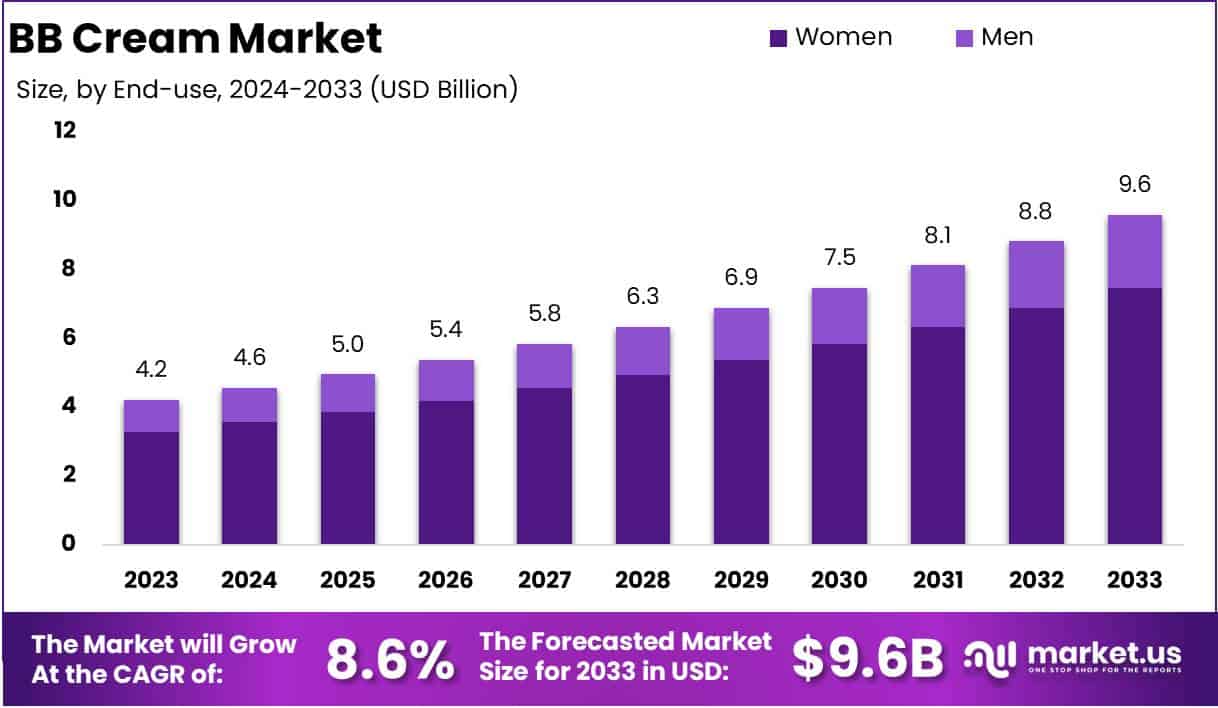

The Global BB Cream Market size is expected to be worth around USD 9.6 Billion by 2033, from USD 4.2 Billion in 2023, growing at a CAGR of 8.6% during the forecast period from 2024 to 2033.

BB Cream, short for Blemish Balm or Beauty Balm is a multifunctional skincare and cosmetic product that combines several benefits into one formulation. Typically, BB Creams serve as a moisturizer, sunscreen, primer, and foundation, offering light to medium coverage while also providing skincare benefits like hydration and anti-aging properties.

Originating in the Asian beauty market, BB Creams have gained global popularity for their convenience and efficacy, catering to consumers seeking simplified beauty routines without compromising on skin health.

The BB Cream market refers to the global industry encompassing the production, distribution, and sale of BB Cream products. This market operates within the broader cosmetics and skincare sectors and is characterized by a diverse range of offerings tailored to different skin types, tones, and specific needs such as anti-aging, acne control, or sun protection.

Market players include multinational cosmetic giants, regional brands, and emerging startups, all vying for a share in this competitive landscape. The market has shown resilience and adaptability, especially as consumer preferences shift towards multifunctional and time-saving beauty products.

The growth of the BB Cream market is driven by several factors, including the rising consumer preference for multi-functional skincare products and the increasing awareness of skincare regimens. Additionally, the global demand for convenient, all-in-one beauty solutions is surging, particularly among the millennial and Gen Z demographics.

Advancements in product formulations such as BB Creams with higher SPF, enhanced hydration, or natural ingredients are further fueling market growth. The expansion of e-commerce and the influence of social media have also amplified product visibility and accessibility, accelerating adoption in both developed and emerging markets.

Demand for BB Creams is bolstered by the growing emphasis on skincare, coupled with a preference for lightweight and natural-looking makeup. As consumers become more educated about skincare, there is a rising inclination towards products that provide both cosmetic and dermatological benefits.

The pandemic-induced shift towards minimal makeup looks and at-home beauty routines has further driven demand for BB Creams. Regions such as Asia-Pacific, North America, and Europe exhibit robust demand, each with unique preferences that influence product innovation and marketing strategies.

The BB Cream market presents significant opportunities for growth, particularly in emerging economies where the beauty industry is expanding rapidly. There is a rising trend toward organic and vegan formulations, creating a niche market segment for eco-conscious consumers.

Moreover, companies have the opportunity to leverage advanced technologies like AI-driven personalization to offer customized BB Creams tailored to individual skin needs.

According to The Conscious Insider, one in three beauty products in the U.S. is now labeled “clean.” This trend is reshaping the BB cream market, with 76% of Gen Z and 71% of millennials actively seeking clean beauty options. A study of 57,000 products revealed that 83% contain titanium dioxide, raising health concerns.

Social media is a powerful driver, with clean beauty hashtags garnering 6.3 million views on Instagram and 1.3 billion on TikTok in 2024. Consumer preferences focus on natural ingredients (40.2%), environmental respect (17.6%), and recyclable packaging (15.8%), highlighting sustainable demand in North America and Europe.

According to StyleSeat, the BB Cream market is poised for sustained growth, underpinned by strong consumer spending on beauty, fitness, and wellness, averaging $110 per month—$124 for women and $94 for men. Notably, 58% of Americans report they would maintain beauty expenditures even during economic downturns, highlighting resilience in demand.

Sustainability trends are also shaping the market, with 25% of consumers prioritizing eco-friendly products, and 92% indicating loyalty to brands with environmental or social commitments. Furthermore, 67% of shoppers rely on social media influencers for product insights, followed by third-party reviews (59%) and beauty professionals (55%), underscoring the importance of digital engagement.

Key Takeaways

- The BB Cream market is expected to grow from USD 4.2 billion in 2023 to USD 9.6 billion by 2033, at a CAGR of 8.6%.

- Combination skin BB creams led the market with a 27% share in 2023.

- Women dominated the end-use segment, accounting for 78% of the market.

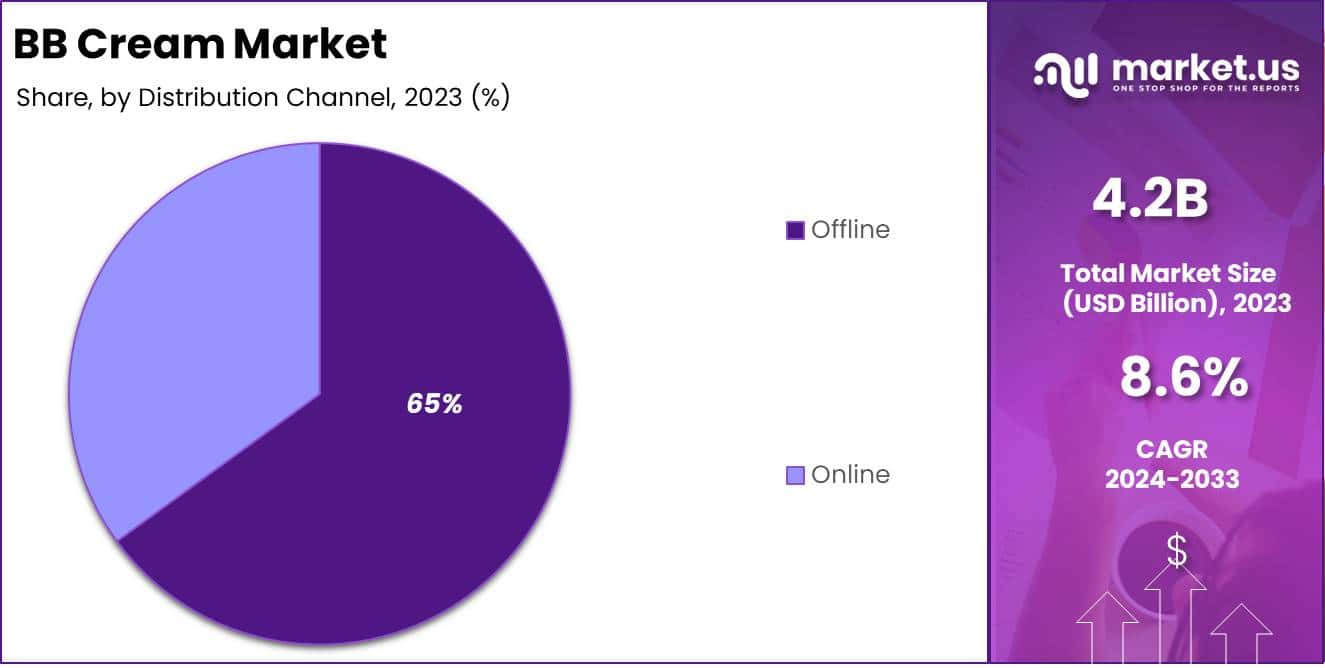

- Offline channels held a 65% market share in 2023.

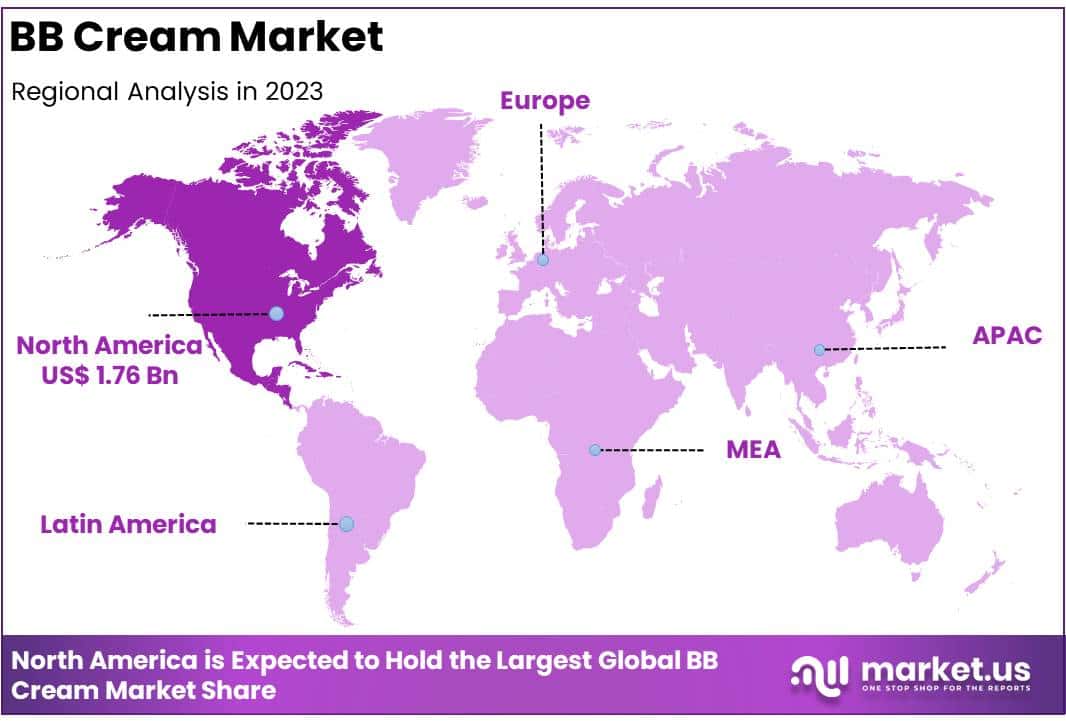

- North America led the market with a 42% share, driven by a strong beauty industry and consumer base.

By Skin Type Analysis

Combination Skin Type Dominating Segment in the BB Cream Market with 27% Share

In 2023, Combination Skin Type held a dominant position in the BB cream market, accounting for over 27% of the total market share. This segment’s strong performance can be attributed to its broad appeal across diverse consumer groups.

BB creams formulated for combination skin address dual concerns of dryness and oiliness, offering balanced hydration and sebum control, making them particularly versatile and appealing.

Oily skin BB creams captured approximately 22% of the market share in 2023. These products are favored for their mattifying properties, which help consumers manage shine and reduce pore visibility, aligning well with the growing demand for oil-free, lightweight formulations.

BB creams for dry skin held an 18% market share in 2023, reflecting a growing interest in hydrating formulations. Consumers with dry skin are increasingly opting for products enriched with moisturizing agents like hyaluronic acid and glycerin to achieve a dewy, healthy complexion.

Normal skin BB creams accounted for 17% of the market in 2023. This segment benefits from consistent demand, as its products are typically designed to enhance skin tone and texture without targeting specific skin concerns, appealing to a broad consumer base.

Sensitive skin BB creams represented 16% of the market share in 2023. These formulations are specifically designed with hypoallergenic and soothing ingredients, catering to a niche but loyal consumer segment seeking gentle, non-irritating skincare solutions.

By End-use Analysis

Women: Dominating Segment in the BB Cream Market with 78% Share

In 2023, women held a commanding position in the global BB cream market by end-use, capturing more than 78% of the market share. This dominance can be attributed to growing consumer demand for multi-functional skincare products that combine hydration, coverage, and sun protection.

The rising trend of minimalist beauty routines, particularly among women aged 18-35, has further driven the adoption of BB creams as a staple in their daily skincare regimen.

Additionally, increased marketing efforts and product diversification targeting female consumers have played a pivotal role in securing this segment’s stronghold.

Although the men’s segment accounted for a smaller share of the BB cream market, its growth trajectory is noteworthy. In recent years, there has been a significant rise in male grooming awareness and a shift toward skincare products offering simplicity and convenience.

BB creams tailored for men emphasizing lightweight formulations and natural finishes are gaining traction, signaling a potential for higher market penetration in the coming years.

By SPF Analysis

Between 30-50 SPF Dominates BB Cream Market with 44% Share in 2023

In 2023, BB creams with SPF levels between 30-50 emerged as the dominant segment in the global market, capturing over 44% of total sales. This category’s strong market position reflects a growing consumer preference for products that offer comprehensive sun protection alongside skincare and cosmetic benefits.

With heightened awareness of the harmful effects of prolonged UV exposure, particularly the risk of premature aging and skin cancer, consumers are increasingly opting for higher SPF formulations. The versatility of BB creams in this range, which balance effective sun protection with lightweight application, has solidified their place as a staple in daily skincare routines.

Other SPF categories, while smaller in share, cater to specific consumer needs. BB creams with Below 15 SPF serve a niche market focused on light coverage with minimal sun protection, often favored by individuals spending limited time outdoors. The 15-30 SPF range holds a moderate market position, appealing to users seeking adequate protection for casual, everyday use.

Meanwhile, the Above 50 SPF segment, although less dominant, is gaining traction, particularly among consumers in regions with high UV exposure or those with sensitive skin requiring maximum protection. This segment shows potential for future growth as sun protection becomes an increasingly important consideration in skincare product selection.

Distribution Channel Analysis

Offline Channels Dominate BB Cream Market with 65% Share in 2023

In 2023, offline distribution channels, including supermarkets, specialty stores, and pharmacies, held a dominant position in the BB cream market, capturing over 65% of the market share. This strong performance is driven by consumers’ preference for in-store shopping, where they can personally test and evaluate products before purchase.

Retailers also provide expert consultations and immediate product availability, enhancing the shopping experience. Additionally, promotional activities such as in-store discounts and product bundling further bolster offline sales, particularly in emerging markets where e-commerce infrastructure remains underdeveloped.

While offline channels maintain a significant lead, the online segment is steadily growing, fueled by the increasing penetration of e-commerce platforms and the convenience of home delivery.

The online market benefits from wider product availability, competitive pricing, and detailed customer reviews, making it an attractive option for tech-savvy consumers. As digital adoption accelerates, especially in urban areas, this segment is poised for robust growth in the coming years.

Key Market Segments

By Skin Type

- Dry

- Normal

- Oily

- Combination

- Sensitive

By End-use

- Women

- Men

By SPF

- Below 15 SPF

- Between 15-30 SPF

- Between 30-50 SPF

- Above 50 SPF

Distribution Channel

- Offline

- Online

Driver

Rising Consumer Demand for Multifunctional Beauty Products

In 2024, the global BB cream market is experiencing significant growth, primarily driven by consumers’ increasing preference for multifunctional beauty products. Modern consumers, particularly millennials and Gen Z, seek efficiency and simplicity in their skincare routines.

BB creams, which combine moisturizing, sun protection, and light coverage, align perfectly with this demand.

The convenience of having multiple benefits in a single product appeals to busy lifestyles, reducing the need for separate skincare and makeup items. This trend is further amplified by the growing awareness of skincare health, as consumers opt for products that offer both aesthetic and protective benefits.

Additionally, the rise of the “no-makeup” makeup trend has bolstered BB cream sales. Consumers are gravitating towards products that provide a natural look while enhancing skin appearance. BB creams offer a lightweight alternative to traditional foundations, catering to this preference.

The integration of skincare ingredients such as antioxidants and hyaluronic acid in BB creams also attracts health-conscious consumers. This convergence of skincare and makeup in a single product not only meets consumer expectations but also drives market expansion, as brands innovate to meet the evolving demands for multifunctionality and convenience.

Restraint

Market Saturation and Intense Competition

Despite the positive growth trajectory, the BB cream market faces challenges due to market saturation and intense competition. The proliferation of BB cream products from numerous brands has led to a crowded marketplace, making it difficult for new entrants to establish a foothold.

Established brands are continuously innovating and launching new variants, intensifying the competitive landscape.

This saturation can lead to price wars, reducing profit margins and potentially compromising product quality as companies strive to maintain market share.

Moreover, consumer loyalty becomes fragmented in such a saturated market. With a plethora of options available, consumers may frequently switch brands in search of better formulations or pricing, leading to instability in brand-customer relationships. This volatility necessitates increased marketing expenditures to retain customer loyalty, further straining company resources.

Additionally, the rapid pace of product launches can overwhelm consumers, leading to decision fatigue and potentially hindering purchase decisions. Therefore, while the demand for BB creams remains robust, market saturation and fierce competition pose significant challenges that could impede sustained growth.

Opportunity

Expansion into Male Grooming Segment

An emerging opportunity within the BB cream market is the expansion into the male grooming segment. Societal perceptions of male grooming are evolving, with an increasing number of men incorporating skincare and cosmetic products into their daily routines.

This shift presents a substantial market opportunity for BB cream manufacturers to develop products tailored specifically for men, addressing unique skin concerns such as oiliness, larger pores, and the effects of shaving. By formulating BB creams that cater to these needs, companies can tap into a previously underexplored demographic, driving market growth.

Furthermore, targeted marketing strategies that challenge traditional gender norms and promote skincare as a universal concern can enhance product acceptance among male consumers.

Collaborations with male influencers and endorsements from public figures can also play a pivotal role in normalizing the use of BB creams among men. By capitalizing on this opportunity, brands can diversify their consumer base, increase market penetration, and achieve a competitive advantage in the evolving beauty and personal care industry.

Trends

Shift Towards Natural and Organic Ingredients

A significant trend influencing the BB cream market in 2024 is the consumer shift towards natural and organic ingredients. Health-conscious consumers are increasingly scrutinizing product formulations, favoring BB creams that are free from synthetic chemicals, parabens, and artificial fragrances.

This preference is driven by concerns over potential skin irritations and long-term health effects associated with synthetic ingredients. As a result, brands are reformulating products to include natural extracts, plant-based oils, and organic compounds, aligning with consumer expectations and enhancing product appeal.

Additionally, the demand for cruelty-free and environmentally sustainable products is shaping the BB cream market. Consumers are seeking products that not only benefit their skin but also have a minimal environmental footprint. This trend has led to the adoption of eco-friendly packaging and sustainable sourcing of ingredients.

Brands that transparently communicate their commitment to ethical practices and sustainability are gaining favor among consumers. This shift towards natural and organic products is not only meeting consumer demands but also driving innovation and differentiation in the BB cream market, contributing to its growth and evolution.

Regional Analysis

North America Leads BB Cream Market with 42% Share

In 2023, North America emerged as the dominant region in the global BB cream market, capturing a substantial 42% share, equivalent to approximately USD 1.76 billion. This leadership is attributed to the region’s advanced beauty industry, high consumer awareness, and a strong preference for multifunctional skincare products.

The United States, in particular, has been a significant contributor, driven by a robust economy and a consumer base that values innovative beauty solutions. The market’s growth is further supported by the increasing adoption of BB creams among diverse demographics, including men and older adults, reflecting a broadening appeal of these products.

Europe stands as a significant player in the BB cream market, holding a considerable share due to its rich history in cosmetics and skincare innovation. Countries such as Germany, France, and the United Kingdom have been at the forefront, with consumers exhibiting a strong inclination towards products that combine skincare benefits with cosmetic appeal.

The region’s market is characterized by a growing demand for natural and organic formulations, aligning with the broader European trend towards sustainability and clean beauty. Additionally, the presence of numerous established beauty brands and a high level of disposable income among consumers contribute to the market’s robust performance.

The Asia Pacific region is experiencing rapid growth in the BB cream market, driven by countries like South Korea, Japan, and China. This surge is largely due to the region’s deep-rooted beauty culture and the origin of BB creams in South Korea. Consumers in this region prioritize skincare, leading to a high adoption rate of products that offer multiple benefits, such as BB creams.

The market is further propelled by the rising middle-class population, increasing urbanization, and a growing number of working women seeking convenient beauty solutions. The influence of K-beauty trends and the proliferation of e-commerce platforms have also played pivotal roles in expanding the market’s reach.

The Middle East & Africa region presents emerging opportunities in the BB cream market, with a growing consumer base becoming more conscious of skincare and beauty products. Urbanization and increasing disposable incomes are key factors contributing to the market’s expansion.

In the Middle East, particularly in countries like the United Arab Emirates and Saudi Arabia, there is a noticeable shift towards premium beauty products, including BB creams that offer sun protection a crucial feature given the region’s climate.

In Africa, markets such as South Africa and Nigeria are witnessing a rise in demand, driven by a youthful population and increasing awareness of skincare routines.

Latin America is experiencing steady growth in the BB cream market, with countries like Brazil, Mexico, and Argentina leading the charge. The region’s beauty industry is characterized by a strong cultural emphasis on appearance and grooming, which fuels the demand for innovative skincare products.

The market benefits from a young and dynamic population, increasing urbanization, and a growing middle class with higher disposable incomes.

Consumers in this region are showing a preference for products that offer multiple benefits, such as hydration, sun protection, and coverage, making BB creams an attractive choice. The expansion of retail networks and the rise of e-commerce platforms have further facilitated market growth by improving product accessibility.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- United Arab Emirates

Key Players Analysis

In the global BB cream market of 2024, several key players are shaping the competitive landscape through strategic initiatives and product innovations.

Procter & Gamble (P&G) continues to leverage its extensive portfolio and global reach to maintain a strong presence in the BB cream segment. By focusing on research and development, P&G introduces formulations that cater to diverse skin types and consumer preferences, thereby enhancing its market share.

Shiseido Company, Limited, a leader in the Asian beauty market, capitalizes on its deep understanding of skincare to offer BB creams that blend traditional Japanese beauty principles with modern technology. Shiseido’s emphasis on high-quality ingredients and innovative formulations appeals to consumers seeking premium skincare solutions.

LVMH, through its luxury brand portfolio, positions its BB creams as high-end products that combine skincare benefits with cosmetic appeal. By targeting affluent consumers, LVMH maintains a niche yet influential market segment, reinforcing its status in the luxury beauty industry.

L’Oréal Groupe utilizes its extensive research capabilities and diverse brand offerings to cater to a broad consumer base. By integrating advanced skincare technologies into its BB creams, L’Oréal addresses various skin concerns, thereby strengthening its competitive position globally.

Coty Inc. focuses on expanding its BB cream offerings through strategic acquisitions and partnerships. By diversifying its product range and enhancing distribution channels, Coty aims to increase its market penetration and appeal to a wider audience.

Unilever emphasizes sustainability and natural ingredients in its BB cream formulations. By aligning with the growing consumer demand for eco-friendly products, Unilever differentiates itself in the market and attracts environmentally conscious consumers.

Estée Lauder Companies leverages its prestige brand image to offer BB creams that promise luxury and efficacy. By investing in cutting-edge research and personalized beauty solutions, Estée Lauder caters to consumers seeking premium skincare experiences.

Avon Products utilizes its direct-selling model to reach a vast network of consumers, particularly in emerging markets. By offering affordable BB cream options, Avon appeals to price-sensitive customers while maintaining product quality.

CHANEL positions its BB creams as part of a holistic beauty regimen, emphasizing elegance and sophistication. By integrating skincare benefits with cosmetic allure, CHANEL attracts consumers seeking a seamless blend of luxury and functionality.

Revlon focuses on innovation and affordability, offering BB creams that cater to mass-market consumers. By continuously updating its product formulations and engaging in dynamic marketing strategies, Revlon maintains its relevance in a competitive market.

Top Key Players in the Market

- Procter & Gamble

- Shiseido Company, Limited

- LVMH

- L’ORÉAL GROUPE

- Coty Inc.

- Unilever

- Estée Lauder Companies

- Avon Products

- CHANEL

- Revlon

Recent Developments

- On August 30, 2023, L’Oréal finalized its acquisition of Aesop, a luxury beauty brand. CEO Nicolas Hieronimus expressed excitement, emphasizing Aesop’s unique blend of urban sophistication and luxury. The acquisition aims to accelerate Aesop’s growth, especially in China.

- In 2023, Oddity, the company behind Il Makiage and Spoiled Child, completed its largest acquisition in 2023, purchasing biotech startup Revela for $76 million. The deal includes establishing a Boston-based lab, reinforcing Oddity’s commitment to innovation in beauty and biotech.

- In 2023, Famille C Participations, the investment arm of the Clarins-owning Courtin family, became the majority shareholder of Pai Skincare. Following a £14 million Series C funding round, the British brand plans to expand its presence in the UK and Europe while strengthening partnerships with retailers like John Lewis and Sephora.

- On July 1, 2024, Givaudan acquired the remaining 75% of b.kolormakeup & skincare. This move aligns with Givaudan’s 2025 strategy to grow in the beauty sector. The acquisition enhances its capabilities in makeup and skincare, complementing its leadership in fragrances and haircare.

Report Scope

Report Features Description Market Value (2023) USD 4.2 Billion Forecast Revenue (2033) USD 9.6 Billion CAGR (2024-2033) 8.6% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered Skin Type (Dry, Normal, Oily, Combination, Sensitive), By End-use (Women, Men), By SPF (Below 15 SPF, Between 15-30 SPF, Between 30-50 SPF, Above 50 SPF), Distribution Channel (Offline, Online) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Procter & Gamble, Shiseido Company, Limited, LVMH, L’ORÉAL GROUPE, Coty Inc., Unilever, Estée Lauder Companies, Avon Products, CHANEL, Revlon Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Procter & Gamble

- Shiseido Company, Limited

- LVMH

- L'ORÉAL GROUPE

- Coty Inc.

- Unilever

- Estée Lauder Companies

- Avon Products

- CHANEL

- Revlon