Global Bacteriophage Market By Type (Virulent (Lytic), Temperate (Lysogenic), Phage Cocktails, Phage-Derived Components and Genetically Modified Phages), By Application (Therapeutic Applications, Food Safety & Biocontrol, Pest Control, Water Treatment, Aquaculture and Others), By End-User Industry (Healthcare, Food Processing Industry, Agriculture and Crop Protection, Veterinary Services and Livestock Farming and Biotechnology and Laboratory Research), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 172788

- Number of Pages: 332

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

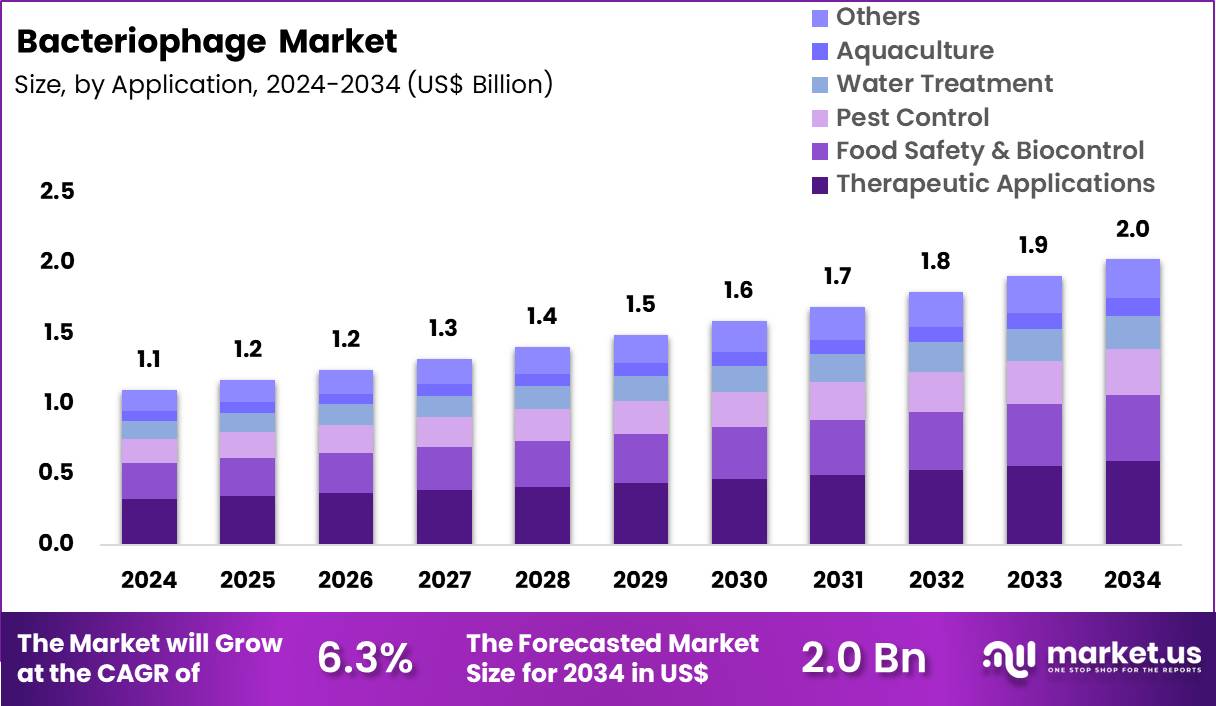

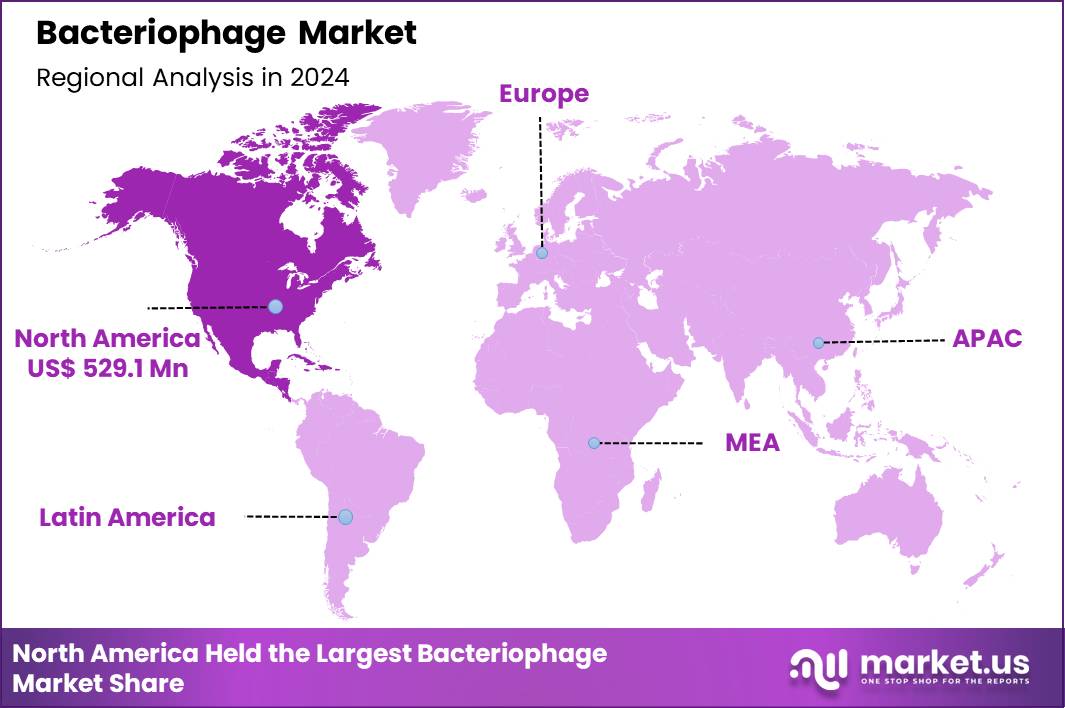

The Global Bacteriophage Market size is expected to be worth around US$ 2.0 Billion by 2034 from US$ 1.1 Billion in 2024, growing at a CAGR of 6.3% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 48.1% share with a revenue of US$ 529.1 Million.

Growing concerns over antimicrobial resistance propel pharmaceutical developers to explore bacteriophage therapies that selectively target pathogenic bacteria while preserving beneficial microbiota. Researchers increasingly apply these viruses in treating multidrug-resistant infections, lysing specific strains responsible for chronic wounds and diabetic foot ulcers. These agents support precision decolonization protocols by eliminating carrier states of pathogens like methicillin-resistant Staphylococcus aureus in preoperative patients.

Clinicians utilize engineered phages for pulmonary infections, delivering aerosolized formulations to combat Pseudomonas aeruginosa in cystic fibrosis management. These therapies address urinary tract infections through intravesical administration, targeting biofilm-forming Escherichia coli variants effectively.

In June 2025, SNIPR Biome reported that the first participant had been treated in its Phase 1b clinical study evaluating SNIPR001, a precision antimicrobial therapy that combines bacteriophages with CRISPR-Cas technology. The randomized, double-blind trial follows encouraging safety and early efficacy findings from the earlier Phase 1a study and represents the next step in advancing targeted approaches to treating bacterial infections.

Biotechnology firms seize opportunities to design lytic phage cocktails for gastrointestinal dysbiosis, restoring microbial balance in inflammatory bowel disease through oral delivery systems. Developers engineer phage-encoded endolysins as standalone enzymes, enabling rapid bacterial cell wall degradation in sepsis caused by Gram-positive pathogens. These innovations expand applications in veterinary medicine, controlling Salmonella contamination in poultry production via feed additives.

Opportunities emerge in oncology supportive care, where phages clear opportunistic infections during chemotherapy-induced neutropenia. Companies advance topical phage preparations for acne vulgaris, targeting Cutibacterium acnes to reduce inflammatory lesions without inducing resistance. Enterprises invest in phage display libraries for antibody discovery, accelerating development of therapeutics against viral and autoimmune targets.

Industry pioneers integrate synthetic biology tools to create programmable phages that deliver payloads, enhancing antibacterial potency in implant-associated osteomyelitis. Developers refine encapsulation techniques for intravenous phage delivery, overcoming immune clearance in bloodstream infection treatments. Market participants launch combination therapies pairing phages with antibiotics, synergistically eradicating persister cells in endocarditis.

Innovators embed reporter genes into phages for diagnostic imaging, detecting active infections in prosthetic joint complications. Companies prioritize temperate phage conversions to obligate lytic forms, ensuring safety in immunocompromised host applications. Ongoing advancements emphasize regulatory pathway harmonization, facilitating broader clinical adoption of phage-based interventions across diverse infection landscapes.

Key Takeaways

- In 2024, the market generated a revenue of US$ 1.1 billion, with a CAGR of 6.3%, and is expected to reach US$ 2.0 billion by the year 2034.

- The type segment is divided into virulent (lytic), temperate (lysogenic), phage cocktails, phage-derived components and genetically modified phages, with virulent (lytic) taking the lead in 2024 with a market share of 35.1%.

- Considering application, the market is divided into therapeutic applications, food safety & biocontrol, pest control, water treatment, aquaculture and others. Among these, therapeutic applications held a significant share of 29.4%.

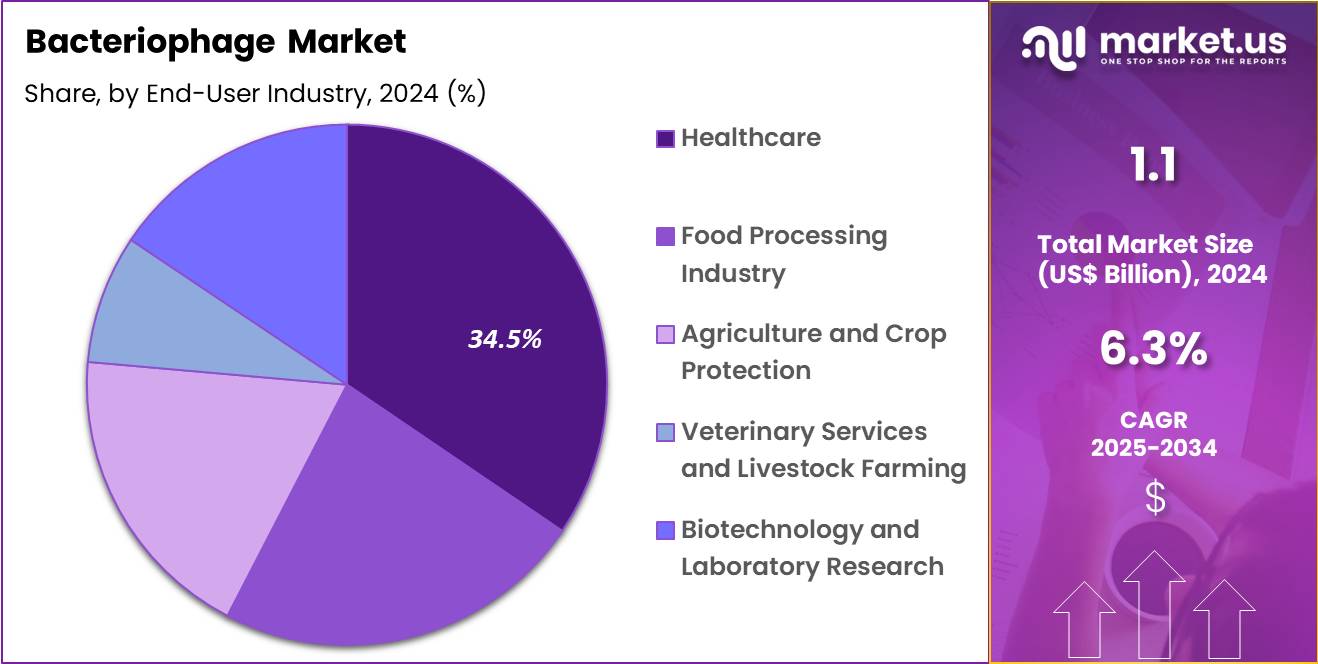

- Furthermore, concerning the end-user industry segment, the market is segregated into healthcare, food processing industry, agriculture and crop protection, veterinary services and livestock farming and biotechnology and laboratory research. The healthcare sector stands out as the dominant player, holding the largest revenue share of 34.5% in the market.

- North America led the market by securing a market share of 48.1% in 2024.

Type Analysis

Virulent or lytic bacteriophages accounted for 35.1% of the bacteriophage market, reflecting their direct and efficient mechanism of bacterial eradication. These phages immediately infect and lyse target bacteria, which positions them as highly effective against acute bacterial infections. Researchers and clinicians favor lytic phages due to their predictable activity and reduced risk of horizontal gene transfer. Rising antimicrobial resistance strengthens interest in non antibiotic bactericidal alternatives.

Lytic phages demonstrate strong specificity, which minimizes disruption to beneficial microbiota. Advancements in phage isolation and characterization improve strain selection accuracy. Regulatory bodies increasingly support controlled clinical evaluation of lytic phage therapies. Scalable production techniques enhance commercial feasibility. Growing academic and clinical validation reinforces confidence among stakeholders. This segment is projected to expand steadily due to its safety profile and therapeutic precision.

Application Analysis

Therapeutic applications represented 29.4% of the bacteriophage market, driven by escalating global concern over antibiotic resistant infections. Healthcare systems actively seek alternative treatments for multidrug resistant bacterial pathogens. Phage therapy offers targeted bacterial elimination without systemic toxicity. Increasing clinical case studies demonstrate positive outcomes in compassionate use settings. Personalized medicine trends align well with patient specific phage treatment strategies.

Research funding increasingly prioritizes bacteriophage based therapeutics. Hospitals explore phage therapy for chronic and recurrent infections where antibiotics fail. Advances in formulation and delivery improve therapeutic consistency. Regulatory frameworks gradually adapt to accommodate biological antimicrobials. As a result, therapeutic applications are anticipated to grow due to urgent unmet medical needs.

End-User Industry Analysis

Healthcare accounted for 34.5% of the bacteriophage market, reflecting its central role in managing infectious disease burdens. Hospitals and clinical centers treat high volumes of resistant bacterial infections that require innovative interventions. Clinicians increasingly recognize bacteriophages as adjunct or alternative therapeutic options. Integration of phage therapy into specialized infectious disease units supports structured adoption.

Academic medical centers drive translational research and clinical trials. Diagnostic advancements enable precise bacterial identification, which improves phage matching. Healthcare institutions benefit from controlled treatment environments that support biological therapies. Public health initiatives emphasize antimicrobial stewardship, strengthening interest in phages.

Collaboration between hospitals and biotech firms accelerates clinical development. Consequently, the healthcare end user segment is likely to remain dominant due to clinical demand concentration and research driven implementation.

Key Market Segments

By Type

- Virulent (Lytic)

- Temperate (Lysogenic)

- Phage Cocktails

- Phage-Derived Components

- Genetically Modified Phages

By Application

- Therapeutic Applications

- Food Safety & Biocontrol

- Pest Control

- Water Treatment

- Aquaculture

- Others

By End-User Industry

- Healthcare

- Food Processing Industry

- Agriculture and Crop Protection

- Veterinary Services and Livestock Farming

- Biotechnology and Laboratory Research

Drivers

Increasing antimicrobial resistance is driving the market

The bacteriophage market is substantially driven by the escalating challenge of antimicrobial resistance, which necessitates alternative therapies like phage treatments to combat bacterial infections unresponsive to conventional antibiotics. Healthcare providers increasingly turn to bacteriophages for their ability to target specific pathogens without broadly disrupting microbial ecosystems. Global health authorities recognize the urgent need for phage-based solutions amid rising resistance rates in clinical settings.

Pharmaceutical developers invest in phage libraries to address multidrug-resistant organisms prevalent in hospitals. Regulatory bodies encourage research into phages as a complementary strategy to preserve antibiotic efficacy. Patient outcomes in resistant infections improve with phage interventions under compassionate use protocols. Academic collaborations accelerate phage isolation and characterization for therapeutic applications.

Economic burdens from resistance-related healthcare costs further justify phage development. According to a Centers for Disease Control and Prevention report, antimicrobial-resistant infections accounted for over 2.8 million cases and 35,000 deaths annually in the United States during recent years. This persistent threat sustains momentum for bacteriophage innovations in infection management.

Restraints

Regulatory hurdles and lack of approvals are restraining the market

The bacteriophage market faces significant restraints due to stringent regulatory hurdles and the absence of commercial approvals, which delay widespread clinical implementation. Developers must navigate complex validation requirements for phage safety, efficacy, and manufacturing consistency. Health agencies demand extensive preclinical data to address variability in phage-host interactions.

Manufacturers encounter challenges in standardizing production processes to meet good manufacturing practice standards. Investors hesitate amid uncertain approval timelines for phage products. Clinical laboratories struggle with adoption due to limited guidance on diagnostic integration. International differences in regulatory frameworks complicate global market entry. Patient access remains limited to compassionate use cases rather than routine prescriptions.

According to the National Institute of Dental and Craniofacial Research, no bacteriophage therapies received Food and Drug Administration approval for commercialization in the United States as of 2024. These barriers collectively impede scalability and commercialization efforts in the sector.

Opportunities

Growing government funding for phage research is creating growth opportunities

The bacteriophage market presents notable growth opportunities through expanding government funding dedicated to phage research, enabling advancements in therapeutic development and clinical evaluation. Funding agencies prioritize grants for investigating phage applications against resistant pathogens in various healthcare contexts.

Researchers leverage these resources to conduct trials assessing phage cocktails for specific infections. Institutions collaborate on projects to refine phage engineering for enhanced stability and specificity. Regulatory pathways benefit from funded studies providing evidence for future approvals. Pharmaceutical partnerships emerge to translate funded discoveries into viable products. Global initiatives align funding with public health priorities to combat resistance crises.

Patient cohorts in high-burden areas gain from expanded access through supported programs. The National Institute of Allergy and Infectious Diseases awarded $2.5 million in grants to 12 institutes worldwide to advance bacteriophage therapy research, as announced in early 2025 reflecting 2024 activities. These investments foster innovation and position the market for diversified therapeutic applications.

Impact of Macroeconomic / Geopolitical Factors

Rising global healthcare budgets and heightened focus on antibiotic resistance accelerate the bacteriophage market, compelling biotech firms to scale up phage therapies for treating bacterial infections effectively. Industry leaders actively invest in clinical trials and production facilities, leveraging economic expansions in emerging regions to capture new opportunities and boost revenue streams.

Stubborn inflation, however, escalates costs for raw materials and research inputs, forcing smaller companies to trim budgets and delay innovative projects amid slower growth periods. Geopolitical tensions, including U.S.-China trade frictions and regulatory barriers in Eastern Europe where many phages originate, disrupt supply chains and hinder international collaborations essential for product development.

Current U.S. tariffs on biotechnology imports, paused in October 2025 following negotiations that secured price reductions from major drugmakers, still impose compliance burdens and elevate indirect costs for non-exempt suppliers. These tariffs prompt retaliatory actions from trading partners, complicating exports of U.S.-developed phage solutions and straining global partnerships.

Nevertheless, the tariff framework drives aggressive onshoring efforts and domestic manufacturing investments, fortifying supply resilience and positioning the market for accelerated innovation and long-term prosperity.

Latest Trends

Revitalization through increased investments and trials is a recent trend

In 2024, the bacteriophage market has exhibited a prominent trend toward revitalization, characterized by substantial investments and an upsurge in clinical trials to advance phage therapies. Developers secure funding to progress phage candidates through phase II evaluations for resistant infections. Health authorities facilitate compassionate use expansions amid growing trial initiations. Researchers focus on engineered phages to enhance host range and therapeutic efficacy.

Manufacturers scale production capabilities to support trial demands and future commercialization. Academic publications highlight successful case studies informing trial designs. Collaborative networks between governments and industry accelerate translational efforts. Patient advocacy drives interest in phage alternatives for chronic conditions.

Ethical considerations guide trial protocols to ensure safety in diverse populations. According to a review in the Proceedings of the National Academy of Sciences, investments exceeded $9 million in key companies, complemented by $24 million from the Biomedical Advanced Research and Development Authority in 2024.

Regional Analysis

North America is leading the Bacteriophage Market

In 2024, North America achieved a 48.1% share of the global bacteriophage market, bolstered by escalating antimicrobial resistance pressures and favorable regulatory mechanisms promoting phage therapies in medical and food safety applications. Clinicians expand deployment of precisely formulated phage mixtures to tackle healthcare-associated infections from resilient organisms, supported by expedited approval pathways for individualized treatments in urgent scenarios.

Producers in the food industry incorporate phage solutions to suppress bacterial pathogens on processing surfaces, adhering to rigorous federal guidelines that favor sustainable biocontrol methods. Scientific teams advance studies on modified phages for improved targeting efficiency, securing governmental support to explore options for managing persistent infections in at-risk individuals. Growing numbers of patients with suppressed immunity, particularly those receiving immunosuppressive treatments, necessitate supplementary approaches to avert severe bloodstream invasions.

Partnerships among research entities and manufacturers enhance phage isolation and amplification processes, facilitating broader deployment in animal health sectors. Logistics improvements guarantee consistent delivery of viable, climate-controlled products to diverse clinical locations. According to the Centers for Disease Control and Prevention, hospital-onset infections from six key antimicrobial-resistant bacteria collectively rose 20% during the COVID-19 pandemic relative to pre-pandemic benchmarks, with the highest levels in 2021 and continued elevation into 2022.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Experts predict notable escalation in bacteriophage applications across Asia Pacific during the forecast period, propelled by acute antimicrobial resistance crises and strategic health policy reinforcements. Clinicians incorporate phage preparations into treatment regimens for respiratory and urinary tract infections, targeting prevalent carbapenem-resistant Enterobacteriaceae in overcrowded hospitals.

Authorities subsidize local production of phage libraries, equipping public laboratories to customize solutions against endemic typhoid strains in subtropical zones. Biotech firms engineer host-specific viruses for aquaculture, curbing Vibrio outbreaks in shrimp farms vital to export economies. Regional consortia conduct multicenter trials on phage-antibiotic synergies, optimizing efficacy for diabetic foot ulcer management among expanding middle-aged demographics.

Pharmaceutical leaders license Western technologies, adapting them to genetic diversities for gastrointestinal pathogen control. Community programs train practitioners on administration protocols, extending reach to rural clinics grappling with limited antibiotic alternatives. A systematic analysis for the global burden of disease study documented 711,852 deaths associated with bacterial antimicrobial resistance in China in 2021.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Bacteriophage market drive growth by advancing targeted antibacterial therapies that address antibiotic-resistant infections across human health, veterinary use, and food safety. Companies expand pipelines through genomic screening and phage-engineering platforms that improve specificity, stability, and manufacturing consistency.

Commercial strategies emphasize partnerships with hospitals, biotech firms, and regulators to accelerate clinical validation and navigate evolving approval pathways. Market leaders invest in scalable production and formulation technologies to support repeat dosing and shelf stability for real-world use. Geographic expansion focuses on regions with high antimicrobial resistance burden and supportive innovation policies.

PhageGuard Group represents a notable participant in the Bacteriophage market as a biotechnology company specializing in phage-based solutions for food safety and health applications, leveraging proprietary phage libraries, regulatory experience, and commercial deployments to build sustainable growth.

Top Key Players

- Intralytix, Inc.

- Micreos BV

- Locus Biosciences

- Armata Pharmaceuticals, Inc.

- BiomX

- Proteon Pharmaceuticals S.A.

- Phagelux AgriHealth, Inc.

- Pherecydes Pharma

- APS Biocontrol Ltd.

- Qingdao Phagepharm Biotech

- Fixed-Phage Ltd.

- Zeptometrix

- Phage International, Inc.

- Nextbiotics

- InnoPhage, Ltd.

- TechnoPhage

Recent Developments

- In September 2024, Locus Biosciences reported favorable outcomes from the first part of its Phase 2 ELIMINATE trial assessing LBP-EC01. The investigational treatment uses a CRISPR-enhanced phage approach to target Escherichia coli–driven urinary tract infections, demonstrating clinical potential in addressing antibiotic-resistant bacterial infections.

- In March 2024, BiomX finalized a merger with Adaptive Phage Therapeutics, bringing together complementary phage technology platforms under a single organization. The combined pipeline focuses on developing bacteriophage-based therapies for widespread infectious diseases, including difficult-to-treat conditions such as diabetic foot osteomyelitis, with the goal of accelerating clinical progress and commercialization.

Report Scope

Report Features Description Market Value (2024) US$ 1.1 Billion Forecast Revenue (2034) US$ 2.0 Billion CAGR (2025-2034) 6.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Virulent (Lytic), Temperate (Lysogenic), Phage Cocktails, Phage-Derived Components and Genetically Modified Phages), By Application (Therapeutic Applications, Food Safety & Biocontrol, Pest Control, Water Treatment, Aquaculture and Others), By End-User Industry (Healthcare, Food Processing Industry, Agriculture and Crop Protection, Veterinary Services and Livestock Farming and Biotechnology and Laboratory Research) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Intralytix, Inc., Micreos BV, Locus Biosciences, Armata Pharmaceuticals, Inc., BiomX, Proteon Pharmaceuticals S.A., Phagelux AgriHealth, Inc., Pherecydes Pharma, APS Biocontrol Ltd., Qingdao Phagepharm Biotech, Fixed-Phage Ltd., Zeptometrix, Phage International, Inc., Nextbiotics, InnoPhage, Ltd., TechnoPhage Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Intralytix, Inc.

- Micreos BV

- Locus Biosciences

- Armata Pharmaceuticals, Inc.

- BiomX

- Proteon Pharmaceuticals S.A.

- Phagelux AgriHealth, Inc.

- Pherecydes Pharma

- APS Biocontrol Ltd.

- Qingdao Phagepharm Biotech

- Fixed-Phage Ltd.

- Zeptometrix

- Phage International, Inc.

- Nextbiotics

- InnoPhage, Ltd.

- TechnoPhage