Global Baby Drinks Market By Product Type (Baby Electrolyte, Infant Formula, Baby Juice, Other Product Types), By Age Category (Less Than 6 Months, 6 to 12 Months, 12 to 36 Months, More Than 36 Months), By Distribution Channel (Hypermarkets/Supermarkets, Pharmacy/Medical Stores, Convenience Stores, Online Channel, Other Distribution Channels), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: October 2024

- Report ID: 57853

- Number of Pages: 299

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

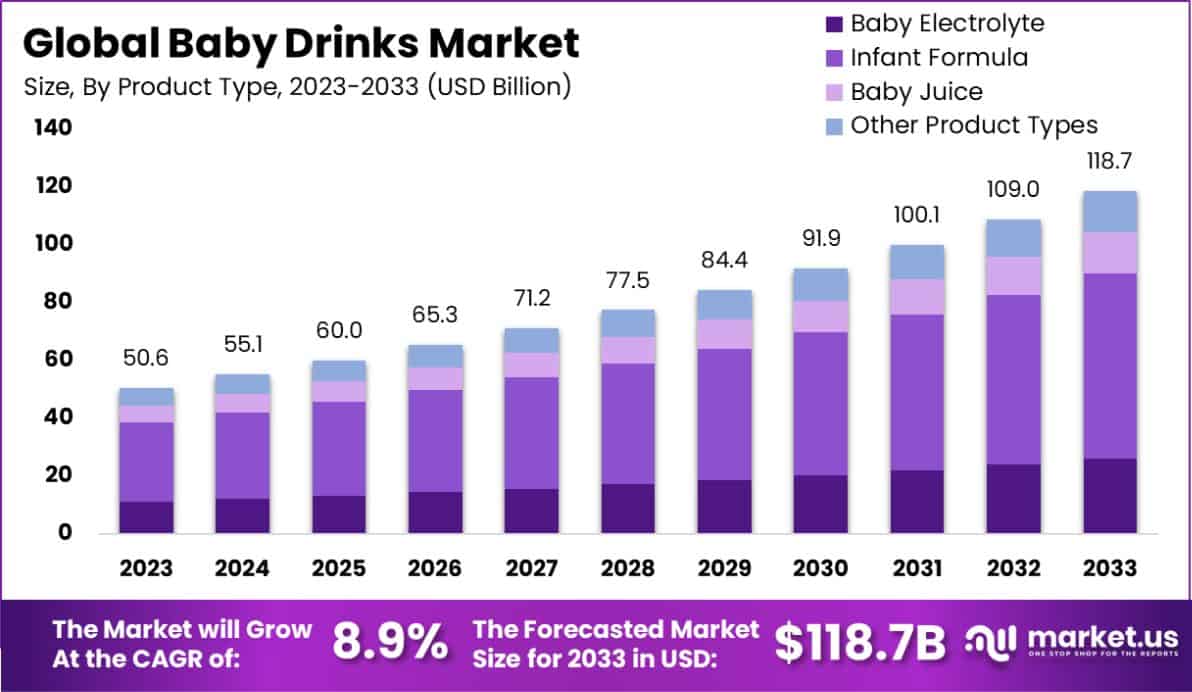

The Global Baby Drinks Market is expected to be worth around USD 118.7 billion by 2033, up from USD 50.6 billion in 2023, growing at a CAGR of 8.9% during the forecast period from 2024 to 2033.

Baby drinks are liquid consumables designed specifically for infants and toddlers. These include infant formula, baby juice, and toddler milk. They are formulated to support early childhood nutrition when breastfeeding is not an option or needs supplementation.

Baby drinks cater to the nutritional needs of babies by providing essential nutrients like vitamins, minerals, and proteins that are crucial for growth and development.

The Baby Drinks market encompasses producing, distributing, and selling beverages tailored for infants and toddlers. This market responds to the parental demand for convenient and nutritional alternatives to breast milk, catering to various health needs and dietary supplement restrictions. It is influenced by rising birth rates, increasing awareness of child nutrition, and growing economic affluence in developing regions.

The growth of the Baby Drinks market is largely driven by increasing awareness among parents about infants’ nutritional requirements and the benefits of specialized baby drinks. This awareness is bolstered by healthcare recommendations and advertising campaigns that emphasize the importance of adequate nutrition in early development.

Demand in the Baby Drinks market is sustained by the growing number of working parents seeking convenient feeding solutions for their babies. The increasing participation of women in the workforce necessitates reliable, nutritious options that support the health and development of infants, thus fueling the market demand.

There is a significant opportunity in the Baby Drinks market to innovate and expand the range of functional beverages that cater to specific health concerns, such as organic and non-GMO formulas. Additionally, expanding in emerging markets where urbanization and disposable incomes are rising can provide new growth avenues for market players.

The Baby Drinks market is experiencing a dynamic shift, underscored by significant investment and regulatory actions, positioning it for robust growth and innovation. Recent developments, such as the $7 million in seed funding secured by Dallas-based Harbor for its smart baby monitors, illustrate the increasing integration of technology in childcare products, a trend that is expanding the market’s reach and enhancing consumer trust and engagement.

This funding, detailed in a report by Dallas Innovates, not only reflects growing investor confidence in child-focused technologies but also signals a broader market shift towards high-tech solutions that ensure safety and health.

Moreover, the commitment of the U.S. Environmental Protection Agency (EPA) to allocate $26 million to mitigate lead exposure in drinking water at schools and childcare facilities, as reported by Waterworld.com, highlights a growing public and governmental focus on child health.

Such regulatory support not only protects vulnerable demographics but also catalyzes market growth by enforcing standards that elevate product quality and safety across the industry.

These developments suggest a market ripe with opportunities for innovation in product offerings and increased safety standards. Companies positioned at the intersection of technology and wellness may find substantial growth avenues, leveraging regulatory and financial backing to meet the sophisticated needs of today’s informed consumers.

This confluence of investment and regulation is not merely shaping current market dynamics but also setting the stage for sustained growth and innovation in the realm of baby nutrition and wellness solutions.

Key Takeaways

- The Global Baby Drinks Market is expected to be worth around USD 118.7 billion by 2033, up from USD 50.6 billion in 2023, growing at a CAGR of 8.9% during the forecast period from 2024 to 2033.

- In 2023, Infant Formula held a dominant market position in the By Product Type segment of the Baby Drinks Market.

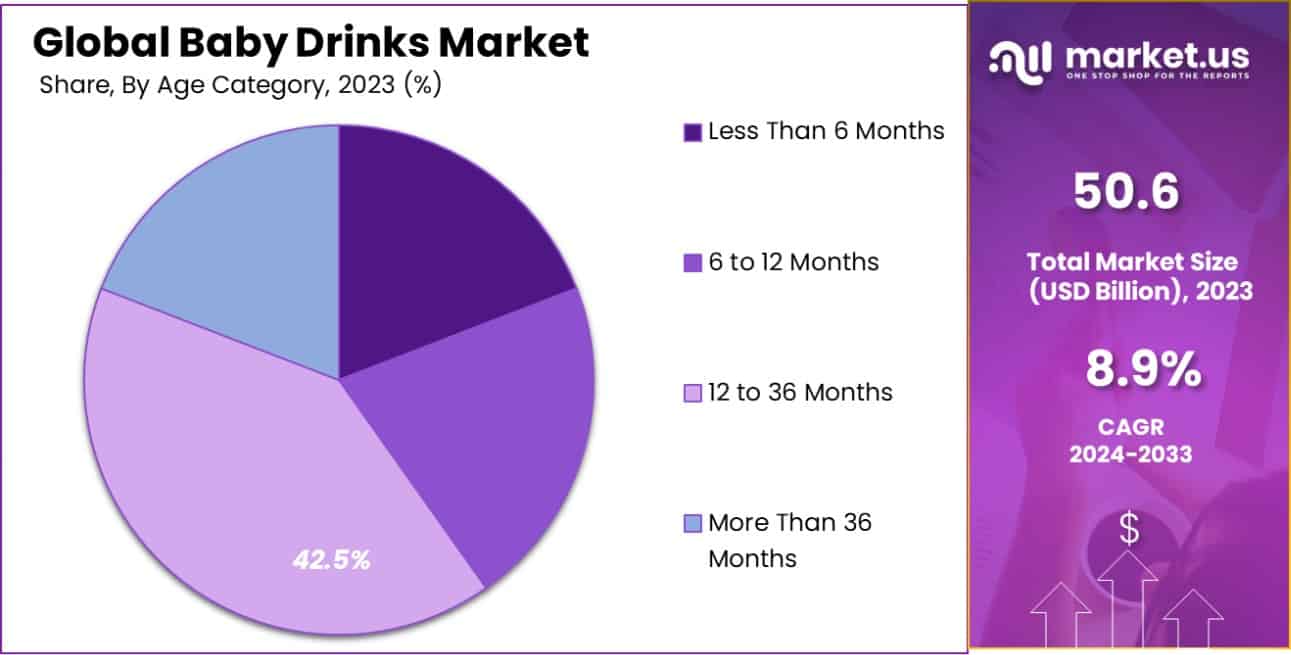

- In 2023, 12 to 36 Months held a dominant market position in the By Age Category segment of the Baby Drinks Market, with a 42.5% share.

- In 2023, Hypermarkets/Supermarkets held a dominant market position in the distribution Channel segment of the Baby Drinks Market.

- Asia Pacific dominated a 37.5% market share in 2023 and held USD 18.9 Billion revenue of the Baby Drinks Market.

By Product Type Analysis

In 2023, Infant Formula held a dominant market position in the “By Product Type” segment of the Baby Drinks Market. This category, which also includes Baby Electrolyte, Baby Juice, and Other Product Types, has witnessed substantial growth, primarily driven by increasing consumer awareness regarding the nutritional requirements of infants.

Infant Formula is specifically designed to mimic the nutritional profile of human milk, making it an essential choice for parents seeking optimal dietary options for their infants. The market dominance of Infant Formula can be attributed to its widespread acceptance as a reliable substitute for breast milk, coupled with significant investments in product development and marketing by key industry players.

Moreover, shifting demographics, such as higher birth rates in developing regions and growing economic prosperity, have contributed to the increased demand for packaged baby drinks. The market’s expansion is further supported by the rise in the number of working mothers, propelling the need for convenient and ready-to-feed solutions.

Infant Formula’s enriched formulations, which often include added vitamins and minerals to support healthy infant development, have solidified its position as the go-to option within the Baby Drinks sector.

As parents increasingly prioritize health and nutrition, the segment is expected to maintain its leading status, driven by continuous product innovation and enhanced distribution channels that make these vital nutritional products more accessible worldwide.

By Age Category Analysis

In 2023, the “12 to 36 Months” category held a dominant market position in the “By Age Category” segment of the Baby Drinks Market, capturing a substantial 42.5% market share.

This segment, which also includes “Less Than 6 Months,” “6 to 12 Months,” and “More Than 36 Months,” reflects a critical phase in a toddler’s developmental stage where the transition from formula to solid food begins, yet supplementary liquid nutrition remains crucial.

The significant market share of this age category is driven by the high nutritional demands of toddlers, which compels parents to seek specialized drink formulations that support growth and development.

The preference for fortified baby drinks that include vitamins, minerals, and sometimes probiotics to aid digestion, has catalyzed the growth of this segment. Manufacturers have responded by expanding their product lines to include a variety of flavors and formulations that cater to the nutritional needs of toddlers, thereby supporting cognitive and physical development.

The strong position of the “12 to 36 Months” category is further reinforced by increasing parental awareness about the importance of balanced nutrition during these formative years, coupled with a rise in global birth rates and enhanced product availability.

As the market evolves, this age segment is likely to continue leading, supported by ongoing product innovation and targeted marketing strategies that resonate with health-conscious parents.

By Distribution Channel Analysis

In 2023, Hypermarkets/Supermarkets held a dominant market position in the “By Distribution Channel” segment of the Baby Drinks Market. This category, which also includes Pharmacy/Medical Stores, Convenience Stores, Online Channels, and Other Distribution Channels, secured its leadership due to the extensive variety and accessibility it offers to consumers.

Hypermarkets and supermarkets provide a one-stop shopping experience where consumers can compare multiple brands and product types, including baby drinks, under one roof. This convenience, coupled with the trust and reliability associated with purchasing from established retail formats, has greatly influenced consumer preferences.

The dominant position of hypermarkets/supermarkets is supported by their widespread geographic footprint, which ensures that a wide array of baby drink options are readily available to a large customer base. Additionally, these outlets frequently host promotional activities and discounts, further attracting consumers seeking value in their purchases.

As parents increasingly prioritize convenience along with quality, hypermarkets, and supermarkets have adapted by offering more organic and health-oriented baby drink products, responding to growing consumer demand for healthier choices for infants and toddlers. This strategy has not only reinforced their market dominance but also positioned them well for continued growth in the sector.

Key Market Segments

By Product Type

- Baby Electrolyte

- Infant Formula

- Baby Juice

- Other Product Types

By Age Category

- Less Than 6 Months

- 6 to 12 Months

- 12 to 36 Months

- More Than 36 Months

By Distribution Channel

- Hypermarkets/Supermarkets -dom

- Pharmacy/Medical Stores

- Convenience Stores

- Online Channel

- Other Distribution Channels

Drivers

Key Growth Drivers for Baby Drinks

The Baby Drinks Market is experiencing significant growth primarily due to the increasing awareness among parents about the nutritional needs of infants and toddlers. With rising disposable incomes, more families are opting for convenient and healthy baby drink options, such as formula and organic juice, which promise enhanced development benefits for young children.

The market is also propelled by the growing number of working mothers, which boosts the demand for ready-to-drink baby formulas that offer a practical feeding solution. Additionally, innovations in product offerings, including added health benefits like fortified vitamins and minerals, are attracting health-conscious parents seeking the best for their children’s early growth and immune system support. These factors collectively drive the expansion of the baby drinks market.

Restraint

Challenges Hindering the Baby Drinks Market

The Baby Drinks Market faces significant challenges, primarily due to concerns over safety and health risks associated with processed baby drinks. Many parents are cautious about artificial additives, preservatives, and potential contaminants in formula and other baby beverages, which can deter them from purchasing these products.

This apprehension is further fueled by frequent product recalls due to contamination or incorrect labeling, leading to a trust deficit in the market. Additionally, the increasing advocacy for breastfeeding by health organizations worldwide advocates that breast milk is the most beneficial for infants, posing a direct challenge to the demand for baby drinks.

These factors combine to restrain the growth of the baby drinks market, as more parents prefer natural feeding options for their infants’ health and safety.

Opportunities

Expanding Opportunities in Baby Drinks

The Baby Drinks Market presents vast opportunities, particularly through the increasing demand for organic and natural products. Parents are actively seeking healthier alternatives for their children, favoring baby drinks that are free from synthetic additives and made with organic ingredients.

This shift is driving manufacturers to innovate and expand their product lines to include organic formulas, natural juices, and vitamin-enriched drinks. Additionally, the global expansion of retail distribution channels, including online platforms, offers easy accessibility to these products, further boosting market growth.

Emerging markets in Asia and Latin America, characterized by rising urbanization and income levels, also provide new growth avenues for baby drink manufacturers. By capitalizing on these trends, companies can tap into a growing consumer base seeking premium, health-focused products for their children.

Challenges

Navigating Challenges in Baby Drinks

The Baby Drinks Market encounters several challenges that impact its growth potential. Key among these is the stringent regulatory environment governing the safety and nutritional content of baby food and drinks. Manufacturers must navigate complex compliance requirements, which can vary significantly across different regions, adding to production costs and operational complexities.

Moreover, the intense competition in this sector pressures companies to continuously innovate while keeping prices competitive, which can strain profit margins. Another significant hurdle is the shifting consumer preferences towards natural breastfeeding, supported by numerous health campaigns that emphasize breast milk as the ideal nutrition for infants.

This cultural and informed shift reduces the demand for packaged baby drinks, compelling companies to adapt their marketing strategies and product offerings to stay relevant in a rapidly evolving market.

Growth Factors

Driving Growth in Baby Drinks

The Baby Drinks Market is experiencing robust growth, driven by several pivotal factors. The rise in the global infant population fuels the demand for baby drinks, as more parents seek convenient feeding solutions.

Increased participation of women in the workforce necessitates easy-to-prepare, nutritious options for infant feeding, boosting the sales of formula and ready-to-drink baby beverages. Health-focused trends are also significant, with parents increasingly preferring products that support developmental benefits, such as drinks enriched with vitamins, minerals, and organic ingredients.

Additionally, advancements in product packaging that enhance convenience—like ready-to-use bottles and improved safety features—also contribute to market growth. Moreover, expanding distribution channels, particularly online retail, make it easier for parents to access a variety of baby drink options, supporting the market’s expansion further.

Emerging Trends

Emerging Trends in Baby Drinks

Emerging trends in the Baby Drinks Market are shaping its future trajectory. A notable trend is the increasing consumer preference for organic and non-GMO ingredients, reflecting a broader demand for natural and safer baby food products. This shift is prompting manufacturers to innovate and expand their organic offerings.

Additionally, the integration of functional ingredients such as probiotics and prebiotics, which support infant gut health and immunity, is gaining traction among health-conscious parents. There’s also a growing trend towards personalization and premiumization, where parents seek products tailored to specific dietary needs and developmental stages of their babies.

Furthermore, digital marketing and e-commerce platforms are becoming crucial for reaching young, tech-savvy parents who prefer online shopping for convenience. These trends are driving significant changes in product development and marketing strategies within the baby drinks sector.

Regional Analysis

The global Baby Drinks Market exhibits diverse dynamics across various regions, with Asia Pacific leading at 37.5% of the market share, translating to USD 18.9 billion. This region’s dominance is driven by a large infant population and increasing urbanization that enhances access to baby nutrition products.

North America and Europe also hold significant shares, driven by high consumer awareness and strong regulatory frameworks ensuring product quality and safety.

In North America, the market is bolstered by advanced distribution channels and high spending power, while Europe benefits from stringent organic certification standards, which boost the demand for organic baby drinks.

Latin America and the Middle East & Africa, though smaller in market size, are experiencing rapid growth due to increasing disposable incomes and the gradual shift towards modern retail structures. In these regions, the growing middle class and the expansion of local and international manufacturers into these markets are key growth drivers.

Each region’s market dynamics are shaped by distinct cultural attitudes towards infant nutrition, economic conditions, and changing parental preferences towards packaged baby drinks, influencing the strategies of market players across these geographies.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the global Baby Drinks Market for 2023, key players such as Abbott Laboratories, Arla Foods amba, and Beingmate Group Co. Ltd. are strategically positioned to leverage their market dominance and drive industry trends.

Abbott Laboratories, renowned for its innovative and scientifically-backed baby nutrition products, continues to lead with a robust portfolio that includes popular infant formula and toddler drinks.

The company’s commitment to research and development ensures that its products meet the highest safety and nutritional standards, appealing to health-conscious parents globally.

Arla Foods Amba, a leader in organic baby drinks, capitalizes on the growing demand for organic and natural products. With its strong dairy-based heritage, Arla has successfully expanded its offerings to include a range of organic milk formulas and baby drinks that cater to the nutritional needs of infants and toddlers. This strategy not only aligns with current health trends but also strengthens its market share in Europe and extends its reach into other regions.

Beingmate Group Co. Ltd., primarily focused on the Chinese market, has made significant strides in expanding its presence in the Asia Pacific region. With China being a major market for baby drinks due to its large population and increasing parental spending on baby care, Beingmate’s deep understanding of local consumer preferences and regulatory landscapes gives it a competitive edge.

The company’s focus on product quality and safety, coupled with aggressive marketing strategies, has helped it to sustain its position as a leading player in the region.

Together, these companies are shaping the competitive landscape of the Baby Drinks Market by focusing on quality, innovation, and strategic market expansion, ensuring their continued relevance and dominance in a highly competitive industry.

Top Key Players in the Market

- Abbott Laboratories

- Arla Foods amba

- Beingmate Group Co. Ltd.

- BOBBIE

- CAMPBELL SOUP COMPANY

- Danone S.A.

- Sign Softech Private Limited

- Dana Dairy

- Royal Friesl and Campina N.V.

- Freed Foods, Inc.

- Hain Celestial Group, Inc.

- Holle Baby Food AG

- HIPP GmbH

- Mead Johnson & Company, LLC.

- Nestlé

- Nature’s One

- NANNYcare Ltd.

- Other Key Players

Recent Developments

- In May 2023, Michelle Obama cofounded PLEZi Nutrition, launching a low-calorie, sugar-free children’s drink to combat obesity, available at select Target and Sprouts stores, with plans for future product expansions.

- In October 2022, Abbott Nutrition announced plans to construct a $500 million facility for specialty and metabolic infant formulas to address the ongoing U.S. formula shortage and enhance domestic production diversity.

Report Scope

Report Features Description Market Value (2023) USD 50.6 Billion Forecast Revenue (2033) USD 118.7 Billion CAGR (2024-2033) 8.9% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type(Baby Electrolyte, Infant Formula, Baby Juice, Other Product Types), By Age Category(Less Than 6 Months, 6 to 12 Months, 12 to 36 Months, More Than 36 Months), By Distribution Channel(Hypermarkets/Supermarkets, Pharmacy/Medical Stores, Convenience Stores, Online Channel, Other Distribution Channels) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Abbott Laboratories, Arla Foods amba, Beingmate Group Co. Ltd., BOBBIE, CAMPBELL SOUP COMPANY, Danone S.A., Sign Softech Private Limited, Dana Dairy, Royal Friesl and Campina N.V., Freed Foods, Inc., Hain Celestial Group, Inc., Holle Baby Food AG, HIPP GmbH, Mead Johnson & Company, LLC., Nestlé, Nature’s One, NANNYcare Ltd., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Abbott Laboratories

- Arla Foods amba

- Beingmate Group Co. Ltd.

- BOBBIE

- CAMPBELL SOUP COMPANY

- Danone S.A.

- Sign Softech Private Limited

- Dana Dairy

- Royal Friesl and Campina N.V.

- Freed Foods, Inc.

- Hain Celestial Group, Inc.

- Holle Baby Food AG

- HIPP GmbH

- Mead Johnson & Company, LLC.

- Nestlé

- Nature’s One

- NANNYcare Ltd.

- Other Key Players