Global Aviation Infrastructure Market Size, Share, Statistics Analysis Report By Airport Type (Commercial Airport, Military Airport, General Aviation Airport), By Infrastructure Type (Terminal, Control Tower, Taxiway and Runway, Apron, Hangar, Other Infrastructure Types), By Platform (Domestic, International), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 145071

- Number of Pages: 392

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Analysts’ Viewpoint

- China Aviation Infrastructure Market

- Business Benefits

- Airport Type Analysis

- Infrastructure Type Analysis

- Platform Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Emerging Trends

- Key Player Analysis

- Top Opportunities for Players

- Recent Developments

- Report Scope

Report Overview

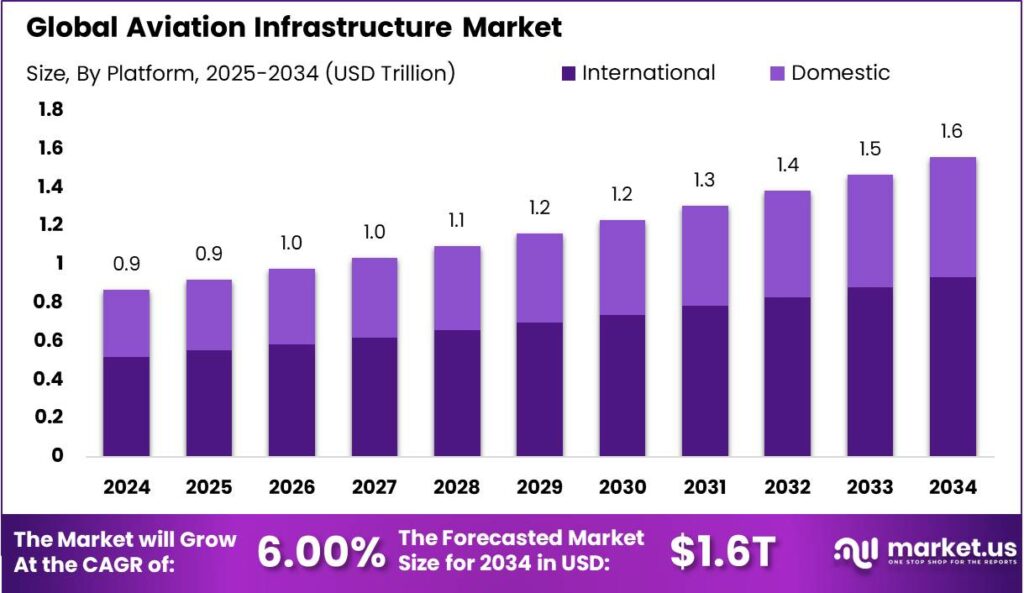

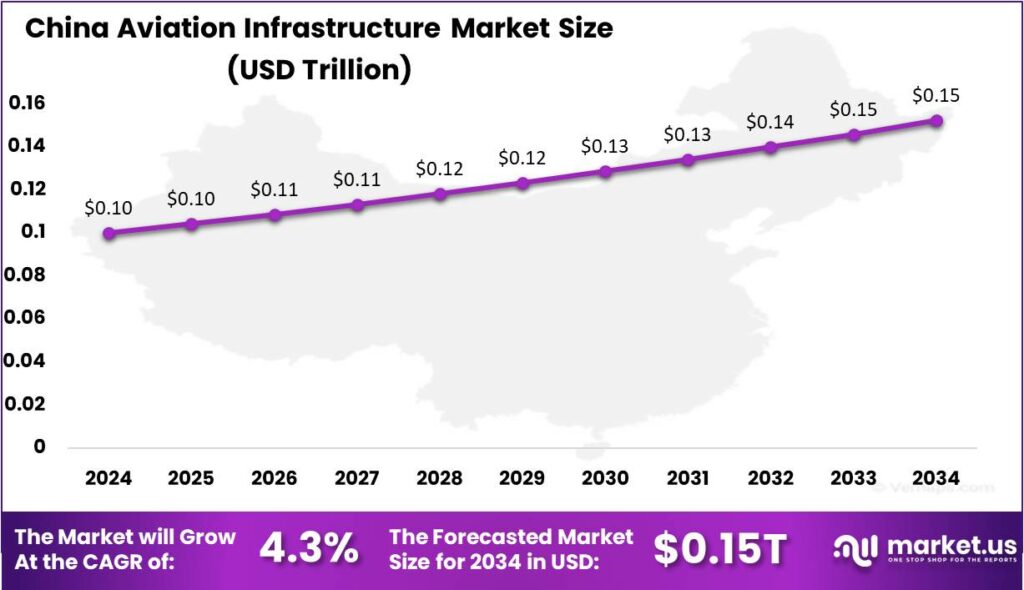

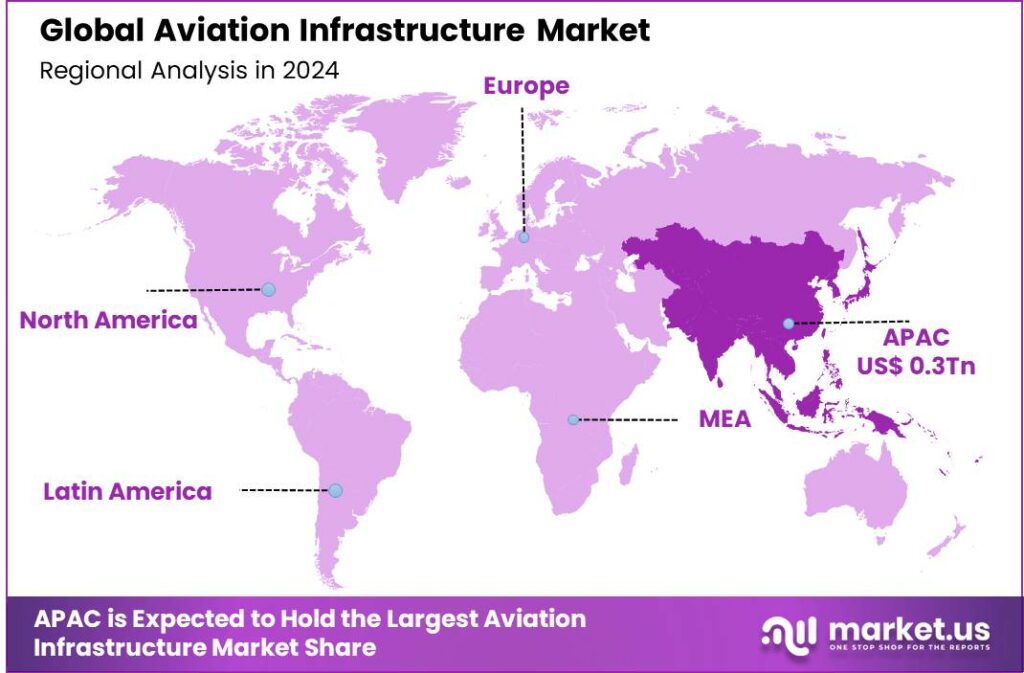

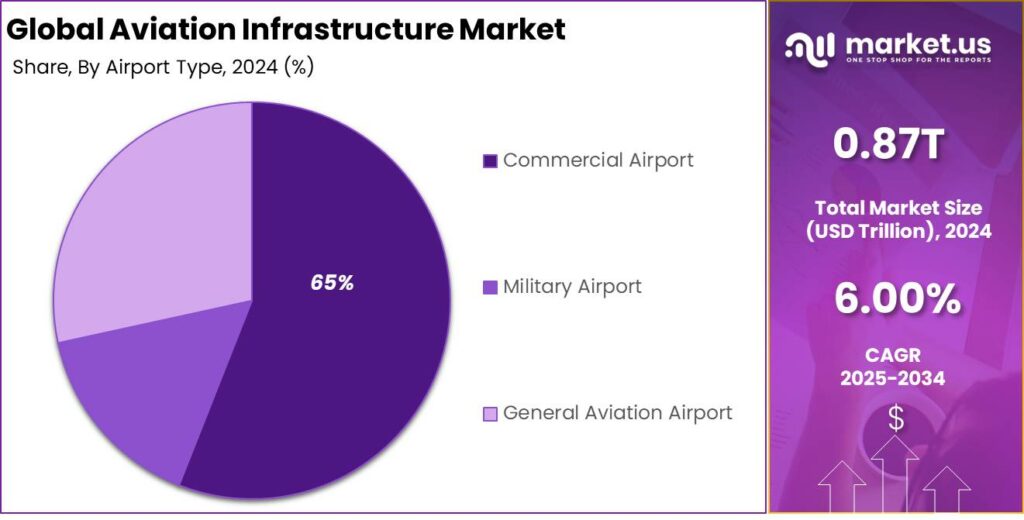

The Global Aviation Infrastructure Market size is expected to be worth around USD 1.6 Trillion By 2034, from USD 0.87 Trillion in 2024, growing at a CAGR of 6.00% during the forecast period from 2025 to 2034. In 2024, the Asia-Pacific region held over 35% of the aviation infrastructure market, with a revenue of USD 0.3 Trillion. China’s aviation infrastructure was valued at USD 0.1 trillion, growing at a CAGR of 4.3%.

Aviation infrastructure is essential for global connectivity, supporting economic growth, international trade, and tourism. This market involves the development, expansion, and maintenance of facilities, driven by both public and private investment. As a key segment of the broader transportation infrastructure sector, it focuses on enhancing the efficiency, safety, and sustainability of air travel.

The market for aviation infrastructure is driven by increasing demands for more efficient and higher capacity airports due to growing global air traffic. This market involves significant investment in the development and modernization of airport facilities and air traffic control systems, geared towards enhancing the overall travel experience, improving safety standards, and minimizing environmental impacts.

The demand for enhanced aviation infrastructure is influenced by the continuous growth in global air traffic, which necessitates expanded and more efficient airport facilities. This demand is quantified by the investments in airport construction and expansion projects, which are crucial for accommodating the anticipated increase in passenger and cargo volumes.

Based on data from PMF IAS, India has emerged as the third-largest domestic aviation market, recording a robust 15% year-on-year growth and reaching 376.43 million total air passengers in FY24. This consistent upward trajectory reflects increasing air travel demand, rising middle-class income, and improved regional connectivity.

The India Aviation Market is projected to grow from ~$14.79 billion in 2025 to $26.09 billion by 2030, expanding at a CAGR of 12.04%, which indicates strong investor confidence and supportive policy frameworks. As of March 2025, Indian airlines operate an estimated 941 aircraft, marking a notable rise in fleet capacity.

A key milestone in infrastructure development is the doubling of operational airports, from 74 in 2014 to 149 in 2024, with a targeted capacity of 468 MPPA across metro airports. The sector has also strengthened its logistics capabilities by handling 3,365.65 MMT of freight in FY24.

India continues to lead in gender inclusivity, with 15% of its pilots being women, three times the global average. Additionally, 73 airports have adopted 100% green energy, underlining the sector’s alignment with national sustainability goals. These indicators collectively highlight India’s strategic focus on building a future-ready aviation ecosystem.

Key Takeaways

- The Global Aviation Infrastructure Market is projected to reach a value of USD 1.6 Trillion by 2034, growing from USD 0.87 Trillion in 2024, reflecting a CAGR of 6.00% during the forecast period from 2025 to 2034.

- In 2024, the Commercial Airport segment held a dominant position in the aviation infrastructure market, capturing more than a 65% share.

- In 2024, the Terminal segment held a dominant position in the aviation infrastructure market, accounting for more than a 34% share.

- In 2024, the International segment dominated the aviation infrastructure market, holding more than a 60% share.

- In 2024, the Asia-Pacific region held a dominant market position in the aviation infrastructure market, capturing more than 35% share, with a revenue of USD 0.3 Trillion.

- In 2024, the market value of China’s aviation infrastructure was estimated at USD 0.1 trillion, with a CAGR of 4.3%.

Analysts’ Viewpoint

Technological advancements are critically reshaping aviation infrastructure. Modern airports are integrating technologies such as automated baggage handling systems, advanced security screening technologies, and sustainable energy solutions like solar farms. These technologies not only enhance operational efficiency but also contribute to sustainability goals.

The adoption of advanced technologies in aviation infrastructure is primarily driven by the need to enhance safety, improve passenger experience, and increase operational efficiency. For example, automated check-in kiosks and smart baggage systems reduce wait times and streamline passenger flow through airports, while green technologies help airports reduce their carbon footprint.

Government initiatives to enhance national infrastructure and promote tourism are also key drivers of growth. Additionally, the push for sustainable aviation solutions is spurring investments in green airports and innovations to reduce air travel’s environmental impact. Together, these factors are fueling the global expansion and modernization of aviation infrastructure.

China Aviation Infrastructure Market

In 2024, the market value of China’s aviation infrastructure was estimated at 0.1 trillion USD, with a compound annual growth rate (CAGR) of 4.3%. China’s aviation infrastructure market is growing rapidly due to rising air travel demand, driven by a growing middle class and urbanization. The government’s focus on improving transport infrastructure through increased funding and supportive policies further boosts airport development.

Moreover, advancements in technology and the integration of digital solutions in airport operations are contributing to the efficiency and capacity enhancement of aviation infrastructure. This includes the deployment of smart airport technologies that streamline operations and improve passenger experiences, thus supporting the market’s growth.

The market is projected to grow steadily, driven by continued investments in new airport projects and upgrades. Sustainability and the adoption of green technologies in aviation infrastructure will play a crucial role in shaping market trends, aligning with global environmental goals and enhancing operational efficiency.

In 2024, Asia-Pacific held a dominant market position in the aviation infrastructure market, capturing more than a 35% share with a revenue of USD 0.3 trillion. The region leads the market due to rapid economic growth, rising passenger traffic, and aggressive expansion policies from governments and private sector stakeholders.

The Asia-Pacific aviation infrastructure market is experiencing substantial growth, driven by urbanization, rising disposable incomes, and increased air travel demand in countries like China, India, and Southeast Asia. This has led to the modernization and expansion of airport facilities to accommodate growing passenger and cargo volumes.

Asia-Pacific is experiencing a surge in low-cost carriers, making air travel more accessible and increasing flight frequency, which demands stronger infrastructure. The region is also leading in adopting technologies like automated baggage systems, advanced security screening, and biometric verification to improve airport efficiency and capacity.

The ongoing efforts to enhance air connectivity within the region, coupled with investments in sustainability initiatives such as green airports, are likely to propel further development. These initiatives not only aim to accommodate the growing passenger numbers but also align with global environmental targets to reduce the carbon footprint of aviation operations.

Business Benefits

Investing in aviation infrastructure significantly boosts economic growth and job creation. The sector supports millions of jobs worldwide, directly and indirectly, including in airlines, air navigation, and airports, as well as in tourism and trade facilitated by air transport. A well-designed air transport network increases productivity and investment. For example, a 10% increase in connectivity can boost long-term GDP by 1.1%, as seen in European Union studies.

Quality aviation infrastructure improves global connectivity, facilitating more efficient movement of people and goods across continents. This is especially vital for industries like e-commerce, which depend on fast, reliable air transport for high-value, time-sensitive goods in both international and domestic markets.

As the aviation industry aims for carbon-neutral growth, upgraded infrastructure plays a critical role. New technologies and better-designed airports contribute to reducing the environmental impact of aviation activities. This includes more efficient layouts that reduce taxi times and fuel burn, as well as facilities that support alternative, sustainable fuels and energy sources.

Airport Type Analysis

In 2024, the Commercial Airport segment held a dominant position in the aviation infrastructure market, capturing more than a 65% share. This segment’s leadership is primarily due to the high volume of passenger and cargo traffic handled by commercial airports, which are crucial nodes in the global travel and trade networks.

The robust growth of the commercial airport segment can also be attributed to substantial investments in airport expansion and modernization projects. Governments and private sector players are increasingly focused on enhancing airport capacity and efficiency to accommodate growing passenger numbers and meet the heightened expectations for traveler convenience and safety.

The growth of airline alliances and expanded routes has boosted the commercial airport segment, increasing flight frequencies and destinations from major airports, solidifying their role as global hubs. Their strategic location in key metropolitan areas boosts market dominance and supports regional and international economic activities.

The trend towards airport commercialization has accelerated growth, with airports transforming into comprehensive travel centers offering retail, dining, and entertainment. This enhances the passenger experience and generates additional revenue, strengthening their position in the aviation infrastructure market.

Infrastructure Type Analysis

In 2024, the Terminal segment held a dominant market position in the aviation infrastructure market, capturing more than a 34% share. This segment leads primarily due to the critical role terminals play in passenger and cargo processing, which directly impacts an airport’s capacity and efficiency.

Terminals are the most visible part of airport infrastructure to travelers, and improvements in this area significantly enhance the passenger experience. Investments in terminal infrastructure not only facilitate smoother operations but also allow airports to handle increased passenger volumes, which is essential in today’s rapidly growing air travel industry.

The superiority of the Terminal segment is further cemented by the increasing demand for more sophisticated and passenger-friendly terminals. These facilities are integrating advanced technologies such as automated check-in systems, self-service kiosks, and biometric verification processes to streamline passenger flow and increase throughput.

The expansion of luxury and retail services in terminals has turned them into key revenue generators for airports. Modern terminals enhance commercial appeal with dining, shopping, and relaxation options, increasing passenger spending. This economic benefit drives investment and development, particularly in the terminal segment.

Platform Analysis

In 2024, the international segment held a dominant market position in the aviation infrastructure market, capturing more than a 60% share. This segment’s leadership is largely driven by the increasing globalization of business and tourism, which necessitates extensive and efficient international air connectivity.

The growth of the international segment is driven by rising international trade and expanding global supply chains. Airports serving international routes are upgrading their facilities, including runways, terminals, and cargo capacities, while enhancing security and technology to efficiently manage the complexities of global air travel.

The rise in strategic alliances and partnerships among international airlines has improved route efficiency and service quality. These collaborations necessitate enhanced infrastructure to accommodate increased traffic, more frequent flights, and seamless integration across carriers, further driving the growth of the international segment.

The international segment is set to keep growing, fueled by the post-pandemic recovery of travel and stronger global economic ties. Advancements in aircraft technology, making long flights more efficient and comfortable, will also drive continued demand for international air travel and upgraded aviation infrastructure.

Key Market Segments

By Airport Type

- Commercial Airport

- Military Airport

- General Aviation Airport

By Infrastructure Type

- Terminal

- Control Tower

- Taxiway and Runway

- Apron

- Hangar

- Other Infrastructure Types

By Platform

- Domestic

- International

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Rising global demand for air travel

One significant driver of aviation infrastructure growth is the increasing global demand for air travel, influenced by economic growth in emerging markets. As economies expand, especially in Asia and other developing regions, there is a notable rise in the middle class with disposable income, which boosts air travel demand.

This trend necessitates expanded and improved aviation infrastructure to handle increased passenger and cargo volumes. In addition to the need for expanded aviation infrastructure and technological advancements, sustainability is becoming an increasingly important factor.

The aviation industry is under growing pressure to reduce its environmental footprint, leading to the adoption of greener technologies, such as more fuel-efficient aircraft, the use of sustainable aviation fuel (SAF), and eco-friendly airport designs.

Restraint

Heavy financial costs tied to facility development and upgrades

A primary restraint in the aviation infrastructure market is the significant financial burden associated with developing and upgrading facilities. Infrastructure projects, such as airport construction and expansion, require substantial capital investment, which can be a barrier, particularly in less economically developed regions.

The high costs are exacerbated by stringent regulatory requirements and the need for advanced technology, which further strain financial resources. This financial requirement can delay or scale down projects, hindering the pace at which necessary developments might otherwise proceed.

The lengthy approval processes, coupled with stringent environmental and safety regulations, can delay projects and increase costs. These hurdles are especially challenging in regions with less developed regulatory frameworks or political instability, further hindering the timely development of necessary infrastructure.

Opportunity

Developing greenfield airports and upgrading brownfield sites

There is a substantial opportunity in the development of greenfield airports and the modernization of brownfield sites. With air travel demand surging, new airports and the expansion of existing ones can cater to this growth, especially in under-served regions.

Furthermore, the shift towards sustainability in aviation drives opportunities for incorporating green technologies and practices in airport design and operations. These initiatives not only help reduce the environmental impact but also improve efficiency and reduce operational costs over time, making sustainable practices an appealing investment for the future of aviation infrastructure.

Challenge

Integrating new technologies smoothly without disrupting operations

One of the main challenges in the aviation infrastructure sector is managing the integration of new technologies while maintaining uninterrupted operations. As airports adopt innovative solutions like smart airport technologies, they must also navigate the complexities of implementing these systems without disrupting ongoing airport activities.

Additionally, the sector faces challenges related to labor shortages and supply chain disruptions, which can delay projects and increase costs. Ensuring timely and budget-compliant completion of infrastructure projects remains a critical challenge for the industry, impacted by these operational hurdles.

As airports implement digital systems like biometric screening and automated check-ins, the volume of sensitive data grows, making cybersecurity a critical concern. Continuous investment in robust security measures is essential to protect against cyber threats, ensure data privacy, and maintain passenger trust while enabling technological innovation.

Emerging Trends

The aviation industry is undergoing major transformations in infrastructure, fueled by technological advancements and sustainability efforts. A key development is the use of AI and machine learning in airport operations, which optimize flight schedules, manage air traffic, and enhance predictive maintenance, resulting in fewer delays and lower operational costs.

Another important development is the adoption of sustainable aviation fuels (SAFs). Projects such as the Ethanol to Jet (EtJ) facility in Charters Towers, Australia, aim to convert bioethanol from locally grown sugarcane into SAF. This initiative highlights the aviation industry’s dedication to reducing carbon emissions and advancing environmental sustainability.

The ‘aerotropolis’ concept is gaining traction, with airports serving as central hubs for integrated urban development, boosting connectivity and economic growth. Additionally, air traffic management is modernizing, exemplified by the U.S. NextGen system, which uses advanced technologies like satellite-based navigation and automated tools to improve safety, efficiency, and capacity.

Key Player Analysis

The construction and maintenance of airports, runways, terminals, and air traffic control systems require the expertise of key industry players.

Hensel Phelps is a major player in aviation infrastructure, renowned for its vast experience in the design and construction of airports and aviation-related projects. With a strong track record in large-scale infrastructure, the company specializes in building state-of-the-art terminals, air traffic control towers, and baggage handling systems.

Turner Construction is one of the largest construction management companies in the world and has a robust portfolio in the aviation sector. The company’s work includes building and upgrading airport terminals, runways, and airfields, with a strong emphasis on safety and efficiency. Turner is known for its innovative approach to project management and its ability to adapt to complex and dynamic airport environments.

Austin Industries is a well-established construction firm that has been involved in several high-profile aviation infrastructure projects. The company excels in constructing both the large-scale terminal facilities and smaller support structures needed to keep airports running smoothly. Austin’s dedication to quality, cost-effectiveness, and timely delivery has made it a trusted partner in the aviation industry.

Top Key Players in the Market

- Hensel Phelps

- Turner Construction Company

- Austin Industries

- AECOM

- The Walsh Group

- McCarthy Building Companies Inc.

- J.E. Dunn Construction Company

- PCL Constructors Inc.

- Skanska

- TAV Construction

- Royal BAM Group NV

- BIC Contracting LLC

- ALEC Engineering and Contracting

- Manhattan Construction Group Inc.

- Hill International Inc.

- The Sundt Companies Inc.

- Other Key Players

Top Opportunities for Players

The aviation infrastructure market is poised for significant growth, driven by a convergence of technological, economic, and demographic factors.

- Expansion of Air Traffic Management Systems: With air passenger traffic on the rise, there is a crucial need for the expansion of air traffic management systems to accommodate increased flight volumes. This includes enhancing the efficiency and capacity of runways and terminals, as highlighted by the growth in infrastructure projects aimed at modernizing existing airports and building new ones.

- Technological Advancements in Airport Infrastructure: Technological innovations such as biometrics, smart airport solutions, and sustainable infrastructure technologies are reshaping airport operations. Players in the aviation infrastructure market can leverage these technologies to improve operational efficiencies, enhance security, and optimize passenger experiences.

- Government Investments in Infrastructure: Governments worldwide are investing heavily in airport infrastructure to support economic growth and meet the rising demand for air travel. This trend is particularly strong in developing regions, where urbanization is accelerating. These investments present significant opportunities for infrastructure development companies to engage in new projects.

- Adoption of Sustainable Practices: There is a growing focus on sustainability within the aviation sector, with increased adoption of green building practices and sustainable aviation fuels. This shift not only helps in reducing environmental impact but also aligns with global regulatory requirements and consumer preferences for more sustainable travel options.

- Public-Private Partnerships (PPPs): As the complexity and cost of aviation infrastructure projects increase, public-private partnerships are becoming more prevalent. These collaborations allow for sharing of expertise and financial resources between government entities and private firms, facilitating large-scale infrastructure projects that might otherwise be challenging to fund.

Recent Developments

- In February 2024, The Innovation Next+ design-build team, including Turner Construction, was selected for the $855 million Dallas Fort Worth International Airport Terminal F Concourse and Skylink Station Project. This project encompasses a new concourse building and associated infrastructure.

- In July 2024, Hill International was selected by Los Angeles World Airports to provide program services for various improvements at Los Angeles International Airport, Van Nuys Airport, and LAWA’s landholdings in Palmdale.

- In December 2024, Skanska secured a $450 million contract with the Massachusetts Port Authority for construction improvements at Boston’s Logan Airport Terminal E. The project includes building a new parking garage and implementing various modernization enhancements.

Report Scope

Report Features Description Market Value (2024) USD 0.87 Trillion Forecast Revenue (2034) USD 1.6 Trillion CAGR (2025-2034) 6.00% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Airport Type (Commercial Airport, Military Airport, General Aviation Airport), By Infrastructure Type (Terminal, Control Tower, Taxiway and Runway, Apron, Hangar, Other Infrastructure Types), By Platform (Domestic, International) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Hensel Phelps, Turner Construction Company, Austin Industries, AECOM, The Walsh Group, McCarthy Building Companies Inc., J.E. Dunn Construction Company, PCL Constructors Inc., Skanska, TAV Construction, Royal BAM Group NV, BIC Contracting LLC, ALEC Engineering and Contracting, Manhattan Construction Group Inc., Hill International Inc., The Sundt Companies Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Aviation Infrastructure MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

Aviation Infrastructure MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Hensel Phelps

- Turner Construction Company

- Austin Industries

- AECOM

- The Walsh Group

- McCarthy Building Companies Inc.

- J.E. Dunn Construction Company

- PCL Constructors Inc.

- Skanska

- TAV Construction

- Royal BAM Group NV

- BIC Contracting LLC

- ALEC Engineering and Contracting

- Manhattan Construction Group Inc.

- Hill International Inc.

- The Sundt Companies Inc.

- Other Key Players