Global Autonomous Agricultural Vehicle Market Size, Share, And Industry Analysis Report By Product (Tractor, Harvester, Seeders, Sprayers), By Automation (Semi Autonomous, Fully Autonomous), By Application (Harvesting, Cultivating, Plowing, Tractor Operations, Fertilizing, Planting, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 174510

- Number of Pages: 342

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

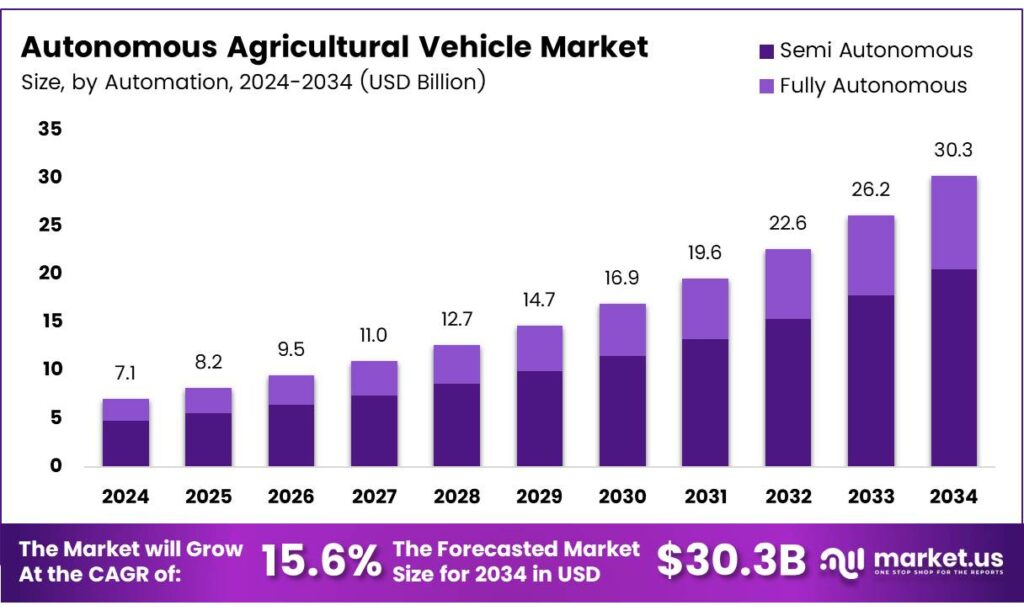

The Global Autonomous Agricultural Vehicle Market size is expected to be worth around USD 30.3 billion by 2034, from USD 7.1 billion in 2024, growing at a CAGR of 15.6% during the forecast period from 2025 to 2034.

The Autonomous Agricultural Vehicle Market covers self-driving farm equipment using artificial intelligence, sensors, and connectivity to operate with minimal human input. These machines support planting, spraying, weeding, harvesting, and livestock feeding. Consequently, the market addresses labor shortages, productivity gaps, and sustainability goals across modern agriculture value chains.

This market is shifting farming toward data-driven, precision-led operations. As farms scale and margins tighten, autonomous systems reduce manual dependency while improving operational predictability. Therefore, adoption rises among large farms first, followed by mid-scale operators through service models, leasing, and outcome-based pricing structures.

- Autonomous tractors used for plowing, planting, and harvesting are proving strong economic value for modern farms. AI-guided systems deliver nearly 15% yield improvement while reducing fuel and pesticide use by up to 30%, helping farmers lower operating costs and improve environmental performance at the same time.

Autonomous aerial sprayers and robotic systems further strengthen adoption. eVTOL sprayers increase yields by about 12% while cutting chemical use by 25%, supporting stricter runoff regulations. At the same time, robotic weeders deliver 10–14% yield gains without herbicides, and automated feeding systems reduce feed waste by nearly 20%, reinforcing long-term demand across the Autonomous Agricultural Vehicle Market.

Opportunities expand as governments promote smart agriculture and climate-resilient food systems. Many countries support autonomy through rural digitization programs, AI grants, and sustainable farming incentives. Additionally, safety regulations increasingly recognize autonomous operation standards, enabling controlled deployment while encouraging manufacturers to invest in compliant sensing, navigation, and fail-safe technologies.

Key Takeaways

- The Global Autonomous Agricultural Vehicle Market is projected to grow from USD 7.1 billion in 2024 to USD 30.3 billion by 2034, at a 15.6% CAGR.

- Autonomous tractors lead the product landscape, holding a dominant share of 47.3% due to their multi-stage farm utility.

- Semi-autonomous systems account for the majority of deployments with a market share of 87.1%, reflecting preference for supervised automation.

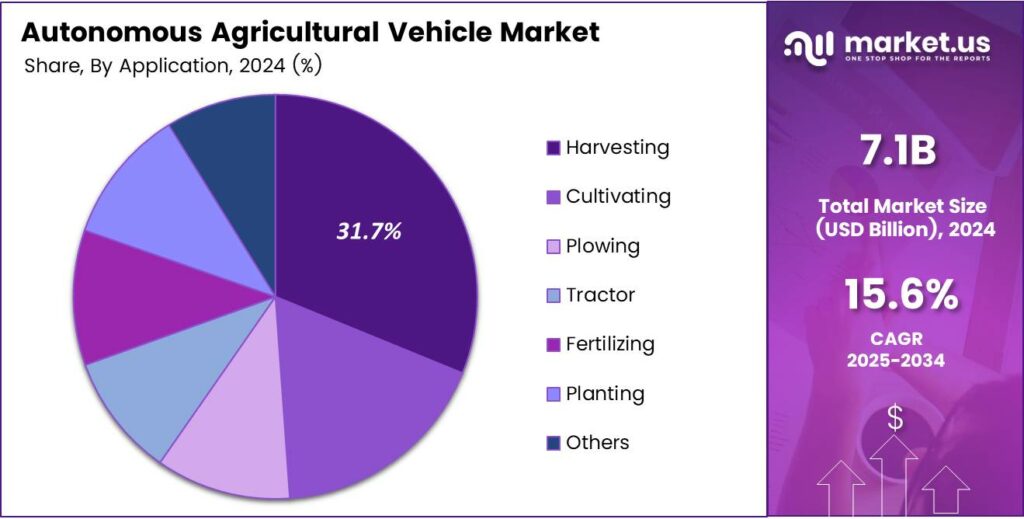

- Harvesting is the largest application segment, capturing 31.7% of total market demand.

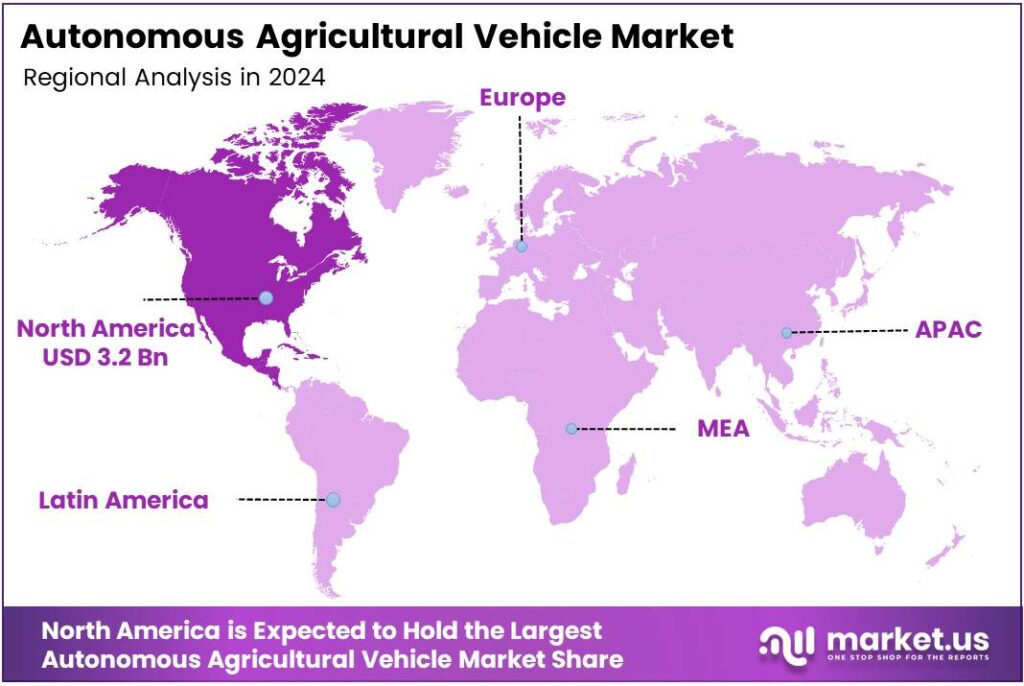

- North America dominates the global market with a share of 46.2%, valued at USD 3.2 billion.

By Product Analysis

Tractor dominates with 47.3% due to its central role in multi-stage autonomous farming operations.

In 2025, Tractor held a dominant market position in the By Product analysis segment of the Autonomous Agricultural Vehicle Market, with a 47.3% share. Autonomous tractors are widely used across plowing, planting, hauling, and basic harvesting tasks. As a result, farmers prioritize tractors because they deliver year-round utility and faster return on automation investments.

Harvester adoption continues to expand as growers focus on reducing labor dependency during peak harvest seasons. Autonomous harvesters help manage timing risks and crop losses. Moreover, automation improves operational consistency during long harvesting windows, especially for large farms facing seasonal workforce shortages.

Seeders play a growing role in precision agriculture by supporting accurate seed placement and uniform crop spacing. Automated seeding improves input efficiency and supports yield stability. Consequently, seeders are gaining attention among farms adopting data-driven planting strategies.

Sprayers are increasingly automated to support precise input application and reduce chemical waste. Autonomous sprayers improve coverage accuracy and minimize operator exposure. Therefore, they are becoming important tools for sustainable and regulation-compliant farming practices.

By Automation Analysis

Semi-Autonomous dominates with 87.1% as farmers prefer gradual automation with human oversight.

In 2025, Semi Autonomous held a dominant market position in the By Automation analysis segment of the Autonomous Agricultural Vehicle Market, with an 87.1% share. Farmers widely adopt semi-autonomous systems because they balance automation benefits with operator control. This approach reduces risk while allowing faster skill adaptation.

Fully Autonomous systems represent an emerging transition toward hands-free farming operations. Although adoption remains limited, interest is rising as technology reliability improves. Over time, fully autonomous vehicles are expected to support continuous operations in labor-constrained and large-scale farming environments.

By Application Analysis

Harvesting dominates with 31.7% as automation addresses labor shortages during critical crop cycles.

In 2025, Harvesting held a dominant market position in the By Application analysis segment of the Autonomous Agricultural Vehicle Market, with a 31.7% share. Automation helps farmers complete time-sensitive harvests efficiently. As a result, growers reduce crop losses and dependency on seasonal labor availability.

Cultivating applications benefit from autonomous guidance systems that ensure consistent soil preparation. Automated cultivation improves field uniformity while lowering fuel consumption. Therefore, adoption supports both productivity and cost control.

Plowing automation improves depth accuracy and soil turnover consistency. Autonomous plowing also enables extended working hours. Consequently, farmers can prepare the land faster ahead of planting seasons. Tractor applications span multiple field activities, making autonomous tractors highly versatile.

Key Market Segments

By Product

- Tractor

- Below 20 HP

- 21–45 HP

- 46–60 HP

- 61–75 HP

- Above 75 HP

- Harvester

- Self-propelled Combine Harvesters

- Control Combine Harvester

- Seeders

- Broadcast Seeder

- Drop Seeder

- Pneumatic Seeder

- Precision Seeder

- Others

- Sprayers

- Handheld Sprayers

- Backpack Sprayers

- Airless Sprayers

- Compression Sprayers

- Mist Sprayers

By Automation

- Semi Autonomous

- Fully Autonomous

By Application

- Harvesting

- Cultivating

- Plowing

- Tractor Operations

- Fertilizing

- Planting

- Others

Emerging Trends

AI and Sensor Integration Emerges as a Key Market Trend

Advanced AI and sensor fusion are shaping current market trends. Modern autonomous vehicles combine cameras, LiDAR, and GPS to navigate complex farm environments accurately. This improves safety and operational precision. Machine learning allows vehicles to adapt to changing soil, crop, and weather conditions.

- In 2025, John Deere introduced its second-generation autonomous tractor system with 16 cameras providing a full 360-degree field view. This system allows tractors to operate continuously without an onboard driver, relying on computer vision to detect obstacles and stop safely when needed.

Connectivity is another rising trend. Integration with cloud platforms enables real-time monitoring and performance optimization. These technology-driven trends push the market toward smarter, more autonomous, and data-focused farming systems.

Drivers

Rising Farm Labor Shortages Drive Autonomous Agricultural Vehicle Adoption

Farm labor availability continues to decline across many agricultural regions, creating strong demand for automation. Fewer skilled workers are willing to take up repetitive and physically demanding farm tasks. As a result, farmers look for reliable alternatives that ensure timely field operations.

- Autonomous tractors, harvesters, and sprayers reduce this risk by working longer hours with consistent performance. The Association of Equipment Manufacturers, U.S. farms purchased about 217,200 tractors and 5,564 combines in 2024, showing the large installed base where autonomous retrofits can be added without replacing entire fleets.

Rising wages also increase operating costs for farmers. Automated vehicles lower long-term labor expenses by reducing dependency on manual operators. Over time, these savings improve farm profitability. Consequently, labor scarcity combined with cost pressure remains a major driver for market growth.

Restraints

High Initial Investment Costs Limit Market Expansion

One of the main restraints for the autonomous agricultural vehicle market is the high upfront cost. Advanced sensors, AI systems, GPS modules, and control software significantly raise equipment prices. Many small and medium farmers struggle to afford these investments.

In developing regions, access to financing remains limited. Even when long-term savings are clear, short-term capital constraints delay adoption. Farmers often prioritize basic machinery over advanced autonomous solutions. Autonomous agricultural vehicles help address this gap by operating with minimal human involvement.

Technical complexity is another concern. Autonomous systems require regular software updates, calibration, and skilled maintenance. Limited technical support in rural areas increases operational risk. These cost and capability challenges slow market penetration, especially in price-sensitive agricultural economies.

Growth Factors

Government Support for Smart Farming Creates New Growth Opportunities

Governments worldwide increasingly promote smart agriculture to improve food security and sustainability. Subsidies, pilot programs, and digital farming initiatives encourage farmers to adopt autonomous technologies. These policies lower financial barriers and accelerate acceptance.

- Precision farming goals also create opportunities. Autonomous vehicles enable accurate seeding, spraying, and harvesting, reducing waste and improving yields. In the UK, the Department for Environment, Food & Rural Affairs allocated £12.5 million to robotics and automation projects that include autonomous field vehicles aimed at improving farm productivity and lowering labor dependency.

Integration with farm management software opens new value streams. Data-driven decision-making improves productivity and resource use. As policy support and digital agriculture expand, growth opportunities for autonomous agricultural vehicles continue to strengthen.

Regional Analysis

North America Dominates the Autonomous Agricultural Vehicle Market with a Market Share of 46.2%, Valued at USD 3.2 Billion

North America holds the leading position due to the rapid adoption of precision farming and a strong focus on labor efficiency. The region benefits from large-scale commercial farms that actively deploy AI-driven and GPS-enabled agricultural vehicles. In the U.S., rising labor shortages and high operational costs accelerate automation investments, reinforcing North America’s dominant 46.2% share and market value of USD 3.2 billion. Supportive digital agriculture initiatives further strengthen long-term deployment.

Europe shows steady growth supported by sustainability-driven farming practices and strict environmental regulations. Farmers increasingly adopt autonomous vehicles to reduce fuel use, chemical inputs, and emissions. Precision seeding, automated harvesting, and robotic cultivation align well with Europe’s climate-resilient agriculture goals, making the region an important contributor to global demand despite diverse farm sizes.

Asia Pacific represents a high-growth region driven by rising food demand, mechanization of small-to-mid-sized farms, and government-backed smart farming programs. Countries in the region focus on yield optimization and water-efficient farming. Autonomous tractors, drones, and robotic planters gain traction as labor availability declines and rural digitization expands.

Latin America benefits from large agricultural land holdings and export-oriented crop production. Autonomous vehicles assist in improving operational efficiency across large farms while reducing dependency on seasonal labor. Increasing use of digital farming tools and mechanized harvesting supports gradual but consistent market expansion across the region.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

AGCO is strengthening its autonomy roadmap by blending precision hardware with software-led farm workflows. Its strategy leans on scalable automation—starting with assisted guidance and moving toward supervised autonomy—so growers can adopt step-by-step without disrupting seasonal operations.

John Deere remains a pace-setter by productizing autonomy at scale and pairing it with a mature precision ecosystem. The key advantage is end-to-end integration—machines, sensors, and decision tools working together—so autonomy is not a “feature,” but a repeatable productivity system on large farms.

CNH Industrial focuses on practical autonomy that fits mixed fleets and varied field conditions. Its direction signals “automation for real-world variability,” prioritizing safety layers, retrofit-friendly pathways, and data-enabled efficiency gains that can appeal to both mid-sized and large operators.

Kubota Corporation is well-positioned in compact and mid-power segments where labor gaps are acute, and farm sizes are smaller. Its approach emphasizes reliable, easy-to-operate automation and tight implementation compatibility, helping autonomy reach specialty crops and diversified farms where simplicity and uptime matter most.

Top Key Players in the Market

- AGCO

- John Deere

- CNH Industrial

- Kubota Corporation

- Dutch Power Company

- Yanmar Co. Ltd

- AutoNext Automation

- Argo Tractors

- Monarch Tractors

- Case IH

- New Holland

Recent Developments

- In 2025, AGCO will focus on advancing autonomous retrofit solutions, AI-integrated precision agriculture, and mixed-fleet autonomy. AGCO showcased full-line innovations at AGRITECHNICA, highlighting autonomous systems, advanced machinery, and mixed-fleet management platforms.

- In 2025, John Deere emphasized autonomous tractors, electric prototypes, and upgrades for existing equipment. John Deere revealed the autonomous 9RX tractor at CES, featuring 16 cameras for depth calculations and efficiency. E-Power electric tractor prototypes, offering 130 HP and configurable batteries, are in testing throughout.

Report Scope

Report Features Description Market Value (2024) USD 7.1 Billion Forecast Revenue (2034) USD 30.3 Billion CAGR (2025-2034) 15.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Tractor [Below 20 HP, 21–45 HP, 46–60 HP, 61–75 HP, Above 75 HP], Harvester [Self-propelled Combine Harvesters, Control Combine Harvester], Seeders [Broadcast, Drop, Pneumatic, Precision, Others], Sprayers [Handheld, Backpack, Airless, Compression, Mist]), By Automation (Semi Autonomous, Fully Autonomous), By Application (Harvesting, Cultivating, Plowing, Tractor Operations, Fertilizing, Planting, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape AGCO, John Deere, CNH Industrial, Kubota Corporation, Dutch Power Company, Yanmar Co. Ltd, AutoNext Automation, Argo Tractors, Monarch Tractors, Case IH, New Holland Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Autonomous Agricultural Vehicle MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample

Autonomous Agricultural Vehicle MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- AGCO

- John Deere

- CNH Industrial

- Kubota Corporation

- Dutch Power Company

- Yanmar Co. Ltd

- AutoNext Automation

- Argo Tractors

- Monarch Tractors

- Case IH

- New Holland