Global Automotive Silicone Market Based on Product Type(Elastomers, Adhesives And Sealants, Resins, Fluids, Gels, Other Products), Based on Application(Interior And Exterior Parts, Engine & Drive Train System, Electrical System, Suspension Systems, Other Applications), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: October 2024

- Report ID: 13983

- Number of Pages: 274

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

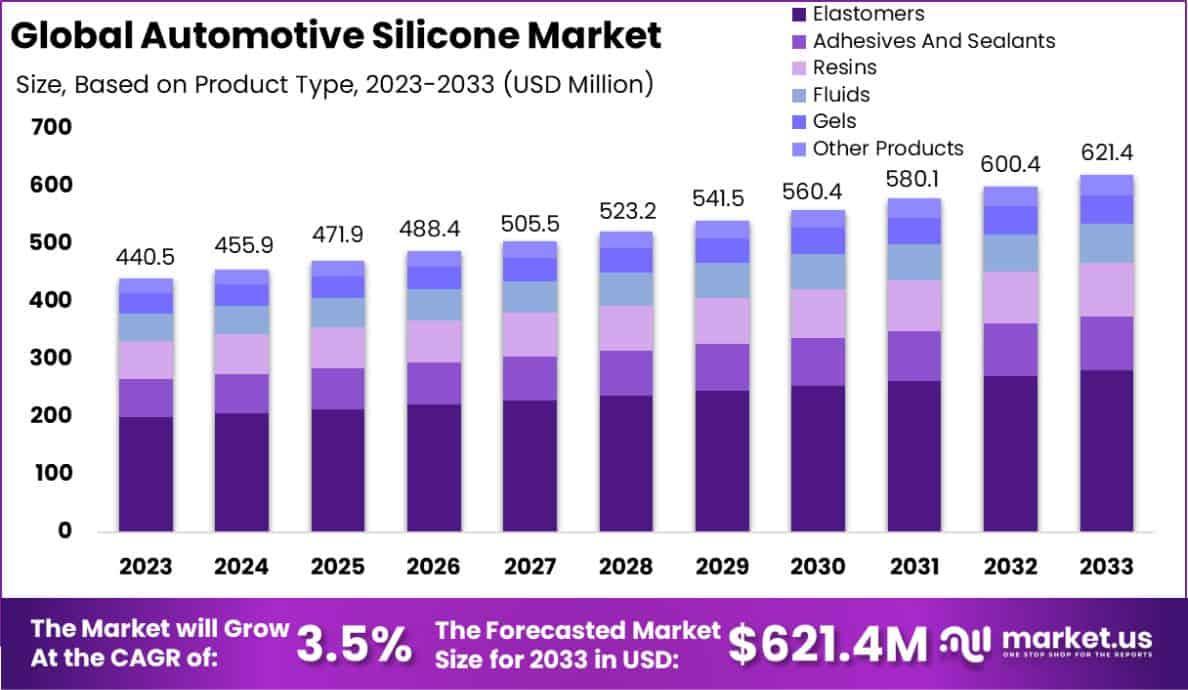

The Global Automotive Silicone Market size is expected to be worth around USD 621.4 Million by 2033, from USD 440.5 Million in 2023, growing at a CAGR of 3.5% during the forecast period from 2024 to 2033. Asia Pacific dominating a 45.3% market share in 2023 and holding USD 199.5 Million revenue of the Automotive Silicone Market.

Automotive silicone is a high-performance polymer extensively used in the automotive industry due to its superior properties such as thermal stability, flexibility, and resistance to weather, chemicals, and UV light. It is utilized in various applications, including gaskets, hoses, coatings, and sealants, to enhance durability and performance in harsh environments.

The automotive silicone market refers to the commercial landscape involving the production and sale of silicone products used in the automotive sector. This market is driven by the increasing demand for more durable and high-performance materials in automobile manufacturing, catering to the evolving standards of safety, efficiency, and environmental compliance.

The growth of the automotive silicone market can be attributed to the rising production of electric vehicles (EVs), which require advanced thermal management systems. Silicone’s superior heat resistance makes it ideal for use in battery packs and electronic components, facilitating the EV industry’s expansion.

Demand for automotive silicone is bolstered by the global automotive industry’s ongoing quest for lightweight materials. Silicone aids in reducing vehicle weight, thus improving fuel efficiency and reducing emissions, aligning with global regulatory standards for environmental sustainability.

There is a significant opportunity in the development of bio-based silicones, which offer an eco-friendly alternative to conventional materials. As the automotive industry shifts towards more sustainable practices, the adoption of green silicones in vehicle manufacturing processes is set to increase, opening new avenues for market growth.

The Automotive Silicone market is poised for robust growth, buoyed by strategic governmental investments in the broader semiconductor and silicone manufacturing sectors. In India, the government’s approval of approximately ₹1.52 lakh crores (around USD 18.3 billion) for semiconductor projects catalyzes advancements in automotive technologies, indirectly benefiting the silicone market.

Concurrently, Ontario’s recent announcement of a $100 million investment in Siltech Corporation, a key player in silicone manufacturing for automotive applications, underscores regional commitments to enhancing automotive manufacturing capabilities. These developments are expected to drive significant demand for automotive silicone, reflecting a favorable outlook for market expansion and technological integration in the automotive sector.

Key Takeaways

- The Global Automotive Silicone Market size is expected to be worth around USD 621.4 Million by 2033, from USD 440.5 Million in 2023, growing at a CAGR of 3.5% during the forecast period from 2024 to 2033.

- In 2023, Elastomers held a dominant market position in Based on Product Type segment of Automotive Silicone Market, with a 45.3% share.

- In 2023, Interior And Exterior Parts held a dominant market position in Based on Application segment of Automotive Silicone Market, with a 38.3% share.

- Asia Pacific dominating a 45.3% market share in 2023 and holding USD 199.5 Million revenue of the Automotive Silicone Market.

Based on Product Type Analysis

In 2023, Elastomers held a dominant market position in the “Based on Product Type” segment of the Automotive Silicone Market, with a 45.3% share. This prominence is largely due to elastomers’ crucial role in enhancing vehicle performance by improving durability and heat resistance essential for harsh automotive environments.

Adhesives and sealants followed, capturing a 20.2% market share, prized for their robust bonding properties that contribute to vehicle safety and longevity. Resins, with a 14.5% share, are integral for their protective coatings that guard against environmental damage and corrosion.

Fluids and gels, holding shares of 10.1% and 6.4% respectively, are essential for their lubrication and damping properties, which are critical in maintaining the operational efficiency of vehicle components. The remaining segment, labeled as Other Products, accounted for 3.5% of the market, encompassing a variety of niche applications that leverage silicone’s unique properties to meet specific automotive needs.

Collectively, these segments underscore the diverse applications of automotive silicones in meeting the evolving demands of the automotive industry, driven by trends towards sustainability and efficiency.

Based on Application Analysis

In 2023, Interior and Exterior Parts held a dominant market position in the “Based on Application” segment of the Automotive Silicone Market, with a 38.3% share. This significant share is attributed to the critical role silicone plays in enhancing the durability and aesthetic appeal of both interior and exterior automotive components.

Engine & Drive Train Systems followed with a 25.7% share, leveraging silicone’s thermal stability and chemical resistance to improve performance and extend the lifespan of critical engine components.

The Electrical System segment captured 18.9% of the market, benefitting from silicone’s excellent insulation properties which are essential for reliable electrical connections and performance. Suspension Systems, with a 12.2% share, utilize silicone for its damping qualities that contribute to smoother rides and enhanced vehicle control.

The remaining market share, labeled as Other Applications, accounted for 4.9%, covering varied uses of silicone in areas not categorized under standard segments, such as fluid transport and safety features. This diverse application across various automotive subsystems underscores silicone’s versatility and its pivotal role in advancing automotive technology and consumer safety.

Key Market Segments

Based on Product Type

- Elastomers

- Adhesives And Sealants

- Resins

- Fluids

- Gels

- Other Products

Based on Application

- Interior And Exterior Parts

- Engine & Drive Train System

- Electrical System

- Suspension Systems

- Other Applications

Drivers

Automotive Silicone Market Growth Drivers

The Automotive Silicone Market is experiencing robust growth driven by several key factors. First, the automotive industry’s push towards lighter vehicles necessitates materials that can reduce weight without compromising performance or safety, a niche that silicone fills effectively.

Additionally, the rise in electric vehicle production has escalated the demand for silicone due to its superior heat resistance and electrical insulation properties, essential for managing battery and electronic systems safely.

The increasing stringency of environmental regulations across the globe also propels the market forward, as silicone helps in meeting these standards by enhancing vehicle efficiency and durability.

Furthermore, ongoing advancements in silicone technology continue to expand its applications within the automotive sector, ensuring its relevance and driving market growth.

Restraint

Challenges in Automotive Silicone Market

A significant restraint in the Automotive Silicone Market is the high cost of silicone materials compared to other polymers and metals used in automotive manufacturing. This cost factor can be a barrier for widespread adoption, particularly in cost-sensitive markets where manufacturers aim to keep production expenses low.

Additionally, the processing of silicone requires specialized equipment and techniques, which can further elevate production costs and complexity. Environmental concerns also play a role, as the production and disposal of silicone materials pose challenges in terms of sustainability and environmental impact.

These factors combined can slow down market growth and limit the penetration of silicone-based products in the global automotive industry, despite their advanced properties and benefits.

Opportunities

Expanding Opportunities in Automotive Silicone Market

The Automotive Silicone Market is ripe with opportunities, particularly from the emerging demand for electric vehicles (EVs), where silicone is crucial for battery safety and longevity due to its excellent thermal stability and insulating properties. This market segment is expected to grow as global interest in sustainable transportation increases.

Another opportunity lies in the innovation of high-performance silicone blends that can offer enhanced properties such as improved durability and resistance to extreme temperatures and chemicals. The development of eco-friendly silicones, which align with increasing environmental regulations, also presents a significant growth avenue.

Furthermore, expanding markets in developing regions, where automotive production is on the rise, provide new opportunities for the application of silicone in various automotive parts.

Challenges

Navigating Challenges in Automotive Silicone Market

The Automotive Silicone Market faces several challenges that could impede its growth. One of the primary issues is the fluctuating prices of raw materials, which can lead to inconsistent production costs and affect profitability.

Additionally, the global supply chain for these materials is often vulnerable to disruptions from geopolitical tensions, trade disputes, or pandemics, impacting the timely delivery and cost-effectiveness of silicone products.

Regulatory challenges also pose a significant hurdle as stricter environmental and safety regulations may limit the use of certain silicone types or require costly compliance measures.

Moreover, competition from alternative materials that offer similar benefits at a lower cost or with enhanced performance could divert market share from silicone-based solutions.

Growth Factors

Growth Drivers in Automotive Silicone Market

The Automotive Silicone Market is set for substantial growth driven by several influential factors. The surge in electric vehicle (EV) production is a major catalyst, as silicone’s thermal resistance is crucial for managing heat in EV batteries and electronics.

Additionally, the global push towards lighter and more fuel-efficient vehicles elevates the demand for silicone, which contributes to weight reduction without compromising vehicle integrity. The versatility of silicone in automotive applications, from engine components to sealants and adhesives, ensures its continued adoption.

Furthermore, technological advancements in silicone formulations are expanding its utility in high-performance automotive parts, aligning with industry demands for durability and longevity in harsh operating conditions.

Emerging Trends

Emerging Trends in Automotive Silicone Market

Emerging trends in the Automotive Silicone Market are shaping its future, particularly the integration of silicone with cutting-edge technologies. A notable trend is the development of smart silicones that can adapt their properties in response to environmental changes, enhancing vehicle performance and safety.

Additionally, the increasing use of silicone in autonomous vehicle systems, such as industrial sensors and insulation for electronic components, underscores its growing importance. The trend towards sustainability is also influencing the market, with a shift towards green silicones that are more environmentally friendly in production and disposal.

These innovations are making silicone an even more indispensable component in modern automotive design, driving its adoption across new and evolving automotive technologies.

Regional Analysis

In the Automotive Silicone Market, Asia Pacific emerges as the dominating region, commanding a significant 45.3% market share, valued at USD 199.5 million. This substantial share is attributed to the robust automotive manufacturing sectors in countries like China, Japan, and South Korea, where there is a high demand for innovative materials that enhance vehicle efficiency and performance.

North America follows, leveraging advanced automotive technologies and a growing preference for electric vehicles that utilize high-performance silicone components. Europe remains a key player due to stringent environmental regulations driving the need for sustainable and high-quality automotive materials.

Meanwhile, the Middle East & Africa and Latin America are experiencing gradual growth. In these regions, expanding automotive production and increasing economic stability are beginning to fuel the demand for silicone solutions, although they still lag behind the major markets.

This geographic segmentation highlights the diverse applications and continuing expansion of silicone in the global automotive industry.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the global Automotive Silicone Market, the 3M Company, Henkel AG & Co. KGaA, and Permatex Canada Inc. are pivotal players, each bringing distinct strengths and strategic focuses that shape their market positions in 2023.

3M Company has leveraged its vast R&D capabilities to innovate within the automotive silicone sector, focusing on developing high-performance silicones that meet the evolving needs of modern vehicles, including electric and hybrid models.

Their products are crucial in enhancing vehicle longevity and performance, particularly in extreme conditions. 3M’s strong global distribution network and brand reputation allow it to maintain a leading position by consistently meeting the diverse demands of automotive manufacturers worldwide.

Henkel AG & Co. KGaA stands out with its specialized adhesive technologies and sealants that are integral to vehicle assembly and maintenance. Henkel’s commitment to sustainability is evident in their development of eco-friendly silicone solutions that reduce environmental impact without compromising quality.

Their strategic partnerships with automotive OEMs and continuous investment in technology innovation ensure they remain at the forefront of the market, particularly in Europe, where regulatory pressures drive demand for sustainable automotive materials.

Permatex Canada Inc. focuses on the niche segment of automotive maintenance and repair, offering a range of silicone-based gasket makers, sealants, and adhesives. Their products are renowned for reliability and ease of use, catering primarily to the aftermarket sector.

Permatex’s strategy includes deep market penetration in North America and a growing presence in emerging markets, where rising vehicle ownership levels fuel demand for maintenance products.

These companies, through strategic innovation and market adaptation, significantly influence the dynamics of the Automotive Silicone Market, ensuring robust growth and the continuous evolution of automotive material technologies in 2023.

Top Key Players in the Market

- 3M Company

- Henkel AG & Co. KGaA

- Permatex Canada Inc.

- Elkem ASA

- Basildon Chemicals

- Specialty Silicone Products Inc.

- Dow Inc.

- ACC Silicones Ltd.

- Wacker Chemical AG

- Shin-Etsu Chemical Co.

- Laur Silicone Inc.

- CSL Silicones Inc.

- Other Key Players

Recent Developments

- In October 2023, Specialty Silicone Products Inc. announced in October 2023 a strategic partnership with a major automotive OEM to supply specialized silicone gaskets, aiming to improve engine efficiency and reduce emissions in new vehicle models.

- In August 2023, Basildon Chemicals,launched a new line of silicone emulsions designed specifically for automotive interiors, enhancing durability and resistance to wear and tear, which is essential for vehicle longevity.

- In May 2023, Elkem ASA expanded its production capabilities by opening a new, state-of-the-art automotive silicone manufacturing facility in Europe, aiming to meet the rising demand for high-performance silicones in automotive applications.

Report Scope

Report Features Description Market Value (2023) USD 440.5 Million Forecast Revenue (2033) USD 621.4 Million CAGR (2024-2033) 3.5% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered Based on Product Type(Elastomers, Adhesives And Sealants, Resins, Fluids, Gels, Other Products), Based on Application(Interior And Exterior Parts, Engine & Drive Train System, Electrical System, Suspension Systems, Other Applications) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape 3M Company, Henkel AG & Co. KGaA, Permatex Canada Inc., Elkem ASA, Basildon Chemicals, Specialty Silicone Products Inc., Dow Inc., ACC Silicones Ltd., Wacker Chemical AG, Shin-Etsu Chemical Co., Laur Silicone Inc., CSL Silicones Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automotive Silicone MarketPublished date: October 2024add_shopping_cartBuy Now get_appDownload Sample

Automotive Silicone MarketPublished date: October 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- 3M Company

- Henkel AG & Co. KGaA

- Permatex Canada Inc.

- Elkem ASA

- Basildon Chemicals

- Specialty Silicone Products Inc.

- Dow Inc.

- ACC Silicones Ltd.

- Wacker Chemical AG

- Shin-Etsu Chemical Co.

- Laur Silicone Inc.

- CSL Silicones Inc.

- Other Key Players