Global Automotive Powertrain Market By Propulsion Type (IC Engine, Gasoline, Diesel, Natural Gas Vehicle, Electric Vehicle, BEV, PHEV), By Vehicle Type (Passenger Vehicle, Commercial Vehicle), By Region And Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends And Forecast 2025-2034

- Published date: April 2025

- Report ID: 22531

- Number of Pages: 278

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

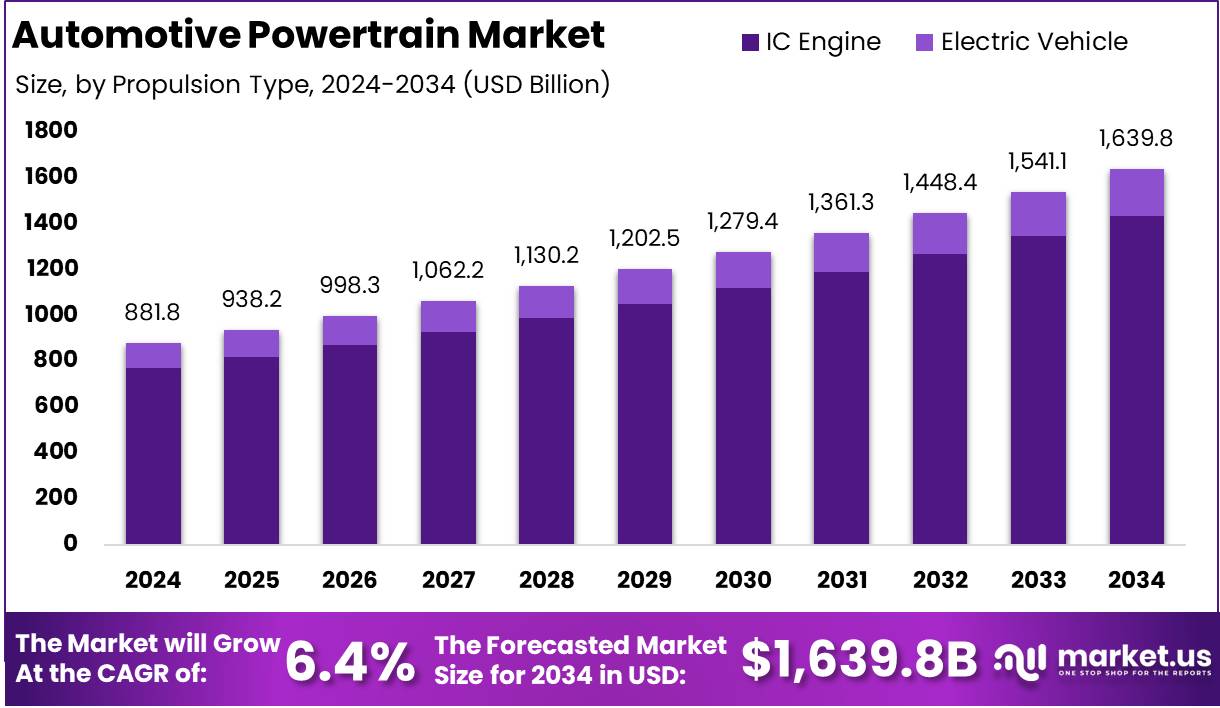

The Global Automotive Powertrain Market size is expected to be worth around USD 1,639.8 Billion by 2034 from USD 881.8 Billion in 2024, growing at a CAGR of 6.4% during the forecast period from 2025 to 2034.

The automotive powertrain refers to the complete system of components that generate power and deliver it to the road surface. It typically includes the engine, transmission, driveshafts, differentials, and final drive. Together, these components work cohesively to convert fuel or electrical energy into mechanical power, enabling vehicle motion.

Powertrains can vary based on fuel type and drivetrain configuration, encompassing internal combustion engines (ICE), hybrid systems, and fully electric drivetrains. With the rise of electrification, modern powertrains are undergoing significant evolution, integrating advanced electronics, battery management systems, and software for optimized performance and efficiency.

The automotive powertrain market comprises the global industry engaged in the design, manufacturing, distribution, and integration of powertrain components and systems across various vehicle categories. This market spans traditional internal combustion engine-based systems and increasingly includes hybrid and electric powertrains due to shifting regulatory norms and consumer preferences.

It includes a broad range of stakeholders, from OEMs and Tier 1 suppliers to battery producers and software developers. The market is closely linked to technological advancements, environmental regulations, and the transition toward sustainable mobility solutions, making it a focal point for innovation within the broader automotive sector.

The growth of the automotive powertrain market is primarily driven by stringent global emission regulations, prompting manufacturers to invest in cleaner and more efficient powertrain technologies. The accelerated shift toward electric and hybrid vehicles, supported by government incentives, has further amplified market expansion.

Demand within the automotive powertrain market is experiencing a pronounced transition, with increasing preference for hybrid and electric vehicles reshaping traditional demand patterns. While internal combustion engines continue to hold a substantial share, the rapid proliferation of battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs) is fostering demand for electric powertrain systems.

The automotive powertrain market presents significant opportunities in the development of electric and hybrid propulsion systems. Increasing global investments in EV infrastructure, battery technologies, and energy storage solutions are paving the way for innovation in powertrain design and integration.

According to G2, the global automotive industry saw the production of 93.9 million vehicles in 2023, with 90.1 million units registered. The automotive powertrain market is witnessing steady demand, driven by the 1.47 billion cars currently in operation. Passenger cars, which account for over 60% of global vehicle sales, reached 75.9 million units in production, with 72.8 million units registered in 2023.

The sector also supports a significant workforce, including 2 million motor vehicle and parts dealers, 1.3 million car dealership employees in the U.S., and another 1 million in vehicle repair and maintenance. This robust activity underscores the expanding scope of the automotive powertrain market as it adapts to evolving industry demands.

According to Automobilgarage, the automotive powertrain market is poised for significant growth as electric vehicle sales reached 2.3 million in Q1 2023, a 25% increase from the same period in 2022. With 92% of consumers conducting online research and 60% preferring video content before purchasing, the shift toward digital buying channels is evident.

Additionally, 25% of drivers are leaning toward hybrid vehicles, driven by the growing concern over fuel costs. Notably, 53% of vehicle buyers now opt for making their purchase online, indicating a growing trend in digitalization within the automotive sector.

Key Takeaways

- The Global Automotive Powertrain Market is projected to reach USD 1,639.8 billion by 2034, up from USD 881.8 billion in 2024, growing at a CAGR of 6.4% during the forecast period from 2025 to 2034.

- The Internal Combustion (IC) Engine segment remains the dominant technology in the automotive powertrain market, holding over 87.5% of the market share.

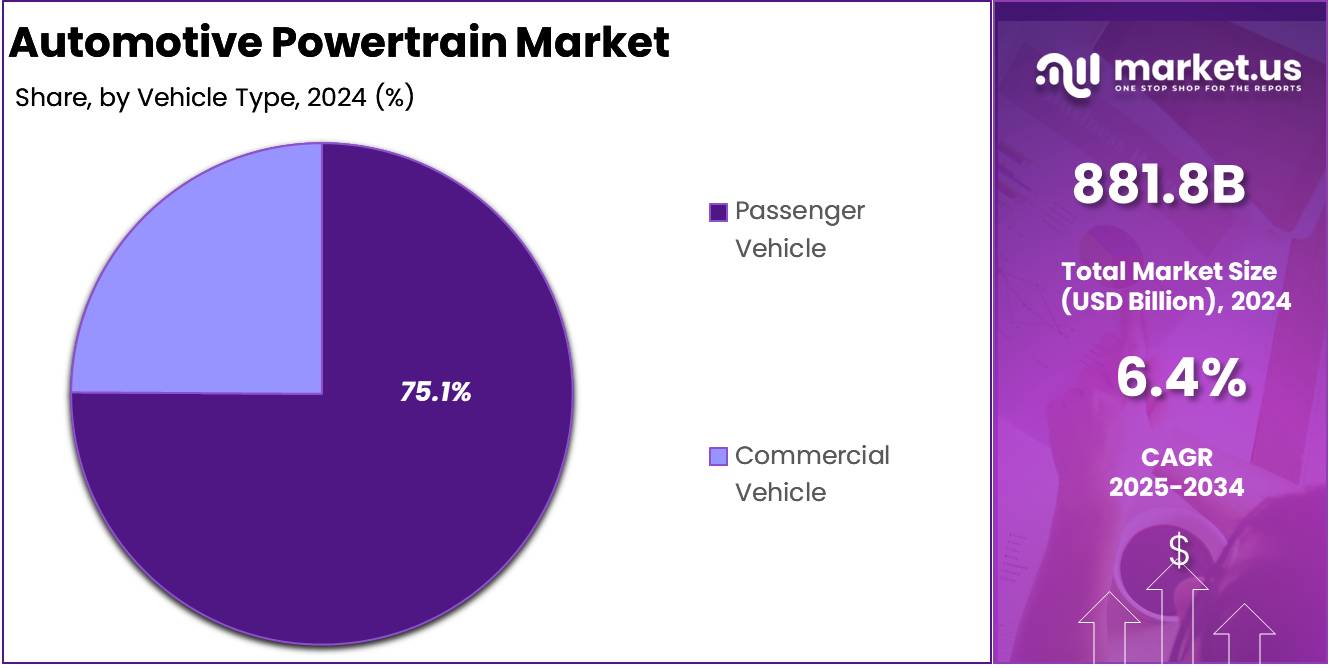

- The passenger vehicle segment continues to lead the market, accounting for over 75.1% of the overall automotive powertrain market share.

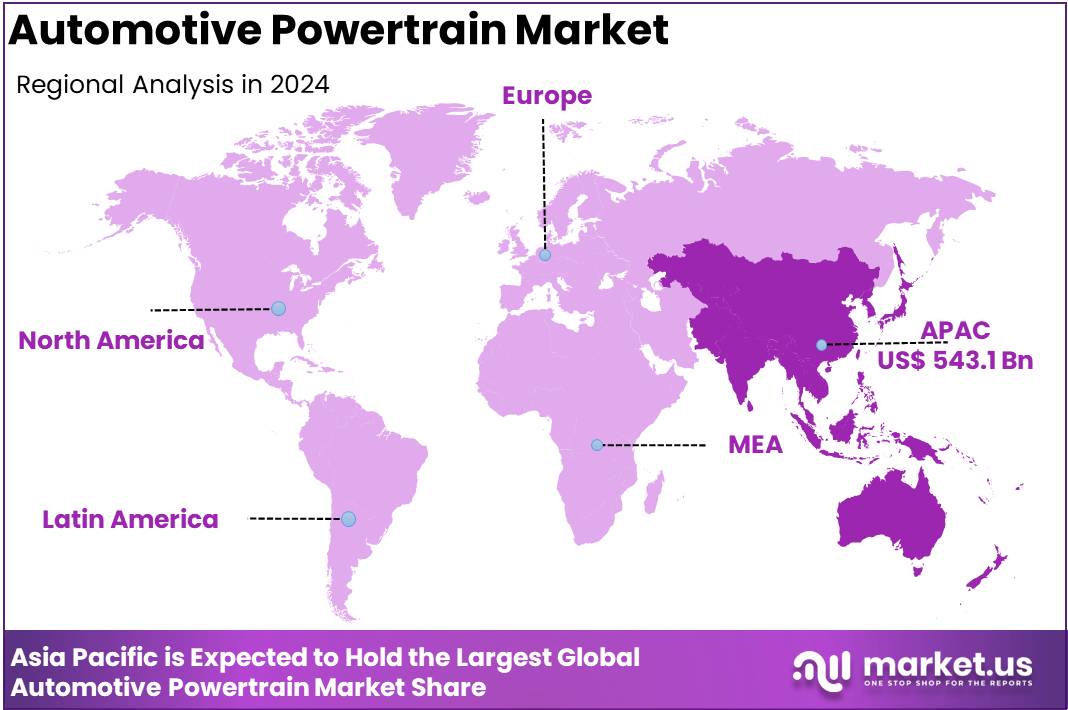

- The Asia Pacific region holds the largest market share, with a valuation of USD 543.1 billion in 2024, representing 61.6% of the global market.

By Propulsion Type Analysis

IC Engine Held a Dominant Position in the Automotive Powertrain Market, Capturing Over 87.5% Market Share

In 2024, IC Engine held a dominant market position in the By Propulsion Type segment of the Automotive Powertrain Market, capturing more than an 87.5% market share. This significant share can be attributed to the well-established global infrastructure supporting internal combustion engines, as well as the continued demand in developing regions for conventional vehicles due to affordability and widespread fuel availability.

The dominance of the IC engine segment is further reinforced by the presence of a mature supply chain, readily available service networks, and consistent technological improvements in engine performance and fuel efficiency.

Despite the rising interest in electric mobility, the internal combustion engine remains the preferred powertrain type across commercial vehicles, passenger cars, and off-road vehicles. The ease of refueling, longer driving ranges, and existing consumer trust in traditional powertrains have supported the sustained dominance of IC engines.

While governments across various regions are promoting cleaner mobility solutions, it is expected that IC engines will continue to play a significant role in the market, especially in areas with limited electric vehicle infrastructure.

In 2024, the Electric Vehicle segment emerged as a key growth area in the By Propulsion Type category of the Automotive Powertrain Market. Although it remains in an early phase when compared to internal combustion engine counterparts, the electric vehicle segment is gaining momentum due to favorable government initiatives, increasing investments in charging infrastructure, and heightened environmental awareness among consumers.

Leading automotive markets such as China, Germany, the United States, and Norway are spearheading this transition through strong regulatory support, including financial incentives and emission reduction mandates. Technological advancements in battery systems, particularly in terms of energy density and lifecycle improvements, are contributing to the enhanced feasibility of electric powertrains.

Major automobile manufacturers are accelerating their shift towards electrification, introducing new electric vehicle platforms and outlining long-term strategies to reduce dependence on conventional propulsion systems. While challenges such as higher upfront costs and the need for a more robust charging network persist, the electric vehicle powertrain is expected to expand its market footprint steadily, supported by innovation and policy-driven market dynamics.

By Vehicle Type Analysis

Passenger Vehicle Held a Dominant Position in the Automotive Powertrain Market, Capturing Over 75.1% Market Share

In 2024, Passenger Vehicle held a dominant market position in the By Vehicle Type segment of the Automotive Powertrain Market, capturing more than a 75.1% market share. This dominance is primarily driven by the global rise in passenger car ownership, fueled by increasing urbanization, improved living standards, and greater accessibility to financing options.

The high volume of passenger vehicle production, especially in emerging economies such as China, India, and Brazil, further reinforces the segment’s leading position. Additionally, the rapid evolution of powertrain technologies in compact and mid-sized cars has supported the segment’s growth across multiple propulsion systems, including both IC engines and electric variants.

Consumer preference for personal mobility solutions, especially post-pandemic, has contributed to the consistent demand for passenger vehicles. Furthermore, OEMs continue to invest in new product development and platform integration to enhance engine efficiency, lower emissions, and provide hybrid and electric alternatives.

This strategic focus has allowed the passenger vehicle segment to maintain a substantial share of the automotive powertrain market. Technological innovations, combined with regulatory compliance efforts and growing middle-class populations, are expected to sustain this segment’s prominence in the foreseeable future.

In 2024, the Commercial Vehicle segment represented a significant portion of the By Vehicle Type category in the Automotive Powertrain Market. Although its share is comparatively lower than that of passenger vehicles, commercial vehicles play a critical role in supporting logistics, freight movement, and public transportation systems.

The demand for powertrains in this segment is largely driven by expanding infrastructure projects, increasing industrial activity, and the rise of e-commerce, which has boosted the need for efficient last-mile delivery solutions. Key regions such as North America, Europe, and Asia-Pacific have shown continued investment in commercial fleets, particularly in medium and heavy-duty vehicles.

This segment is also experiencing a gradual shift toward cleaner technologies, with growing interest in electric and alternative fuel-powered commercial vehicles, especially for urban transport and logistics applications. Government policies aimed at reducing emissions and enhancing fuel efficiency are encouraging fleet modernization and powertrain innovation.

However, challenges such as higher acquisition costs, extended payback periods, and underdeveloped charging or refueling infrastructure in certain markets remain limiting factors. Nonetheless, the commercial vehicle segment continues to be a vital component of the automotive powertrain market, with long-term growth prospects aligned with global sustainability goals and urban mobility trends.

Key Market Segments

By Propulsion Type

- IC Engine

- Gasoline

- Diesel

- Natural Gas Vehicle

- Electric Vehicle

- BEV

- PHEV

By Vehicle Type

- Passenger Vehicle

- Commercial Vehicle

Driver

Electrification and Hybridization Accelerating Powertrain Evolution

The growth of the global automotive powertrain market in 2024 is being significantly driven by the rapid adoption of electrification and hybrid technologies across the automotive sector. Governments worldwide are reinforcing stricter emission regulations and offering incentives to promote the use of electric vehicles (EVs), which is pushing automakers to invest in advanced powertrain technologies.

Electrified powertrains encompassing fully electric, plug-in hybrid, and mild hybrid systems—are increasingly replacing traditional internal combustion engines (ICEs), which is reshaping the landscape of powertrain configurations. The share of electric and hybrid powertrains in new vehicle sales has crossed 25% globally in 2024, reflecting a growing preference for environmentally sustainable mobility solutions.

In addition to regulatory pressures, consumer awareness regarding carbon emissions and fuel efficiency has surged, further contributing to the demand for advanced powertrain systems. Electrified powertrains offer superior torque delivery, reduced operating costs, and fewer mechanical complexities compared to ICE-based counterparts, leading to their strong market penetration.

Furthermore, ongoing improvements in battery energy density, power electronics, and electric motor efficiency are making EV powertrains increasingly competitive with traditional technologies. This shift is not only driving innovation but also encouraging strategic investments in R&D, ultimately fostering long-term growth in the automotive powertrain market.

Restraint

High Cost and Complexity of Advanced Powertrain Technologies

Despite promising growth trends, the global automotive powertrain market is facing notable restraints due to the high development and production costs associated with modern powertrain systems. Advanced configurations particularly those involving electrified, hybrid, or fuel-cell-based technologies require sophisticated engineering, expensive raw materials such as rare earth metals, and specialized manufacturing infrastructure.

These factors significantly increase the total cost of production, limiting the ability of original equipment manufacturers (OEMs) to price vehicles competitively, especially in emerging markets where cost sensitivity remains high.

Moreover, the integration of new-generation powertrains involves a complex interplay between hardware components and software-based control systems, which elevates the technical challenges faced by manufacturers. This complexity affects the scalability of production and leads to longer development cycles, potentially slowing down the speed at which new powertrains can be introduced to the market.

Additionally, the scarcity of skilled labor for designing and maintaining these intricate systems continues to pose logistical challenges. These combined factors hinder the widespread adoption of innovative powertrain technologies, especially in markets where infrastructure for electric or hybrid vehicles is still underdeveloped, thereby creating a considerable barrier to the global expansion of the automotive powertrain market.

Opportunity

Rising Demand in Emerging Economies with Evolving Mobility Patterns

The global automotive powertrain market is poised to benefit significantly from the increasing demand for personal and commercial vehicles in emerging economies, particularly in Asia-Pacific, Latin America, and Africa. These regions are witnessing rapid urbanization, growing middle-class populations, and increasing disposable incomes, which are collectively driving the demand for motorized transportation.

As vehicle sales grow, there is a corresponding surge in demand for diverse powertrain solutions, ranging from fuel-efficient internal combustion engines to entry-level hybrid systems that cater to varied income segments and infrastructure capabilities.

In these high-growth regions, the gradual introduction of emission regulations and government incentives for fuel-efficient or low-emission vehicles is further opening opportunities for powertrain innovation. While full electrification may face infrastructural challenges, these markets present high potential for the adoption of transitional technologies such as mild hybrids and dual-fuel engines.

This growing demand encourages global manufacturers to localize production, customize product offerings, and invest in region-specific R&D. As a result, the expansion into emerging economies not only offers volume growth but also enables technology diffusion and cost optimization strategies, contributing significantly to the sustained development of the automotive powertrain market globally.

Trends

Integration of Software and AI in Powertrain Optimization

A key trend shaping the automotive powertrain market in 2024 is the integration of software-driven intelligence and artificial intelligence (AI) to optimize performance, efficiency, and user experience. Modern powertrain systems are increasingly embedded with advanced control algorithms, predictive diagnostics, and real-time adaptive mechanisms that respond to driving conditions, terrain, and user behavior.

The deployment of AI and machine learning is enhancing the efficiency of both electric and combustion powertrains by enabling predictive maintenance, regenerative braking optimization, and adaptive power delivery, which collectively improve fuel economy and driving comfort.

Furthermore, the convergence of powertrain and vehicle electronics enabled by centralized vehicle computing platforms allows for seamless communication between drivetrain components and external data sources. This integration facilitates over-the-air (OTA) software updates, remote diagnostics, and cloud-based analytics, allowing manufacturers to continuously improve vehicle performance post-sale.

The adoption of connected powertrain systems is not only improving vehicle efficiency and reliability but also creating avenues for monetization through data-driven services. As vehicle architectures become more digitized, the powertrain is no longer a mechanical standalone unit but part of an intelligent ecosystem, marking a transformational trend in how automotive powertrains are designed, managed, and experienced in the global market.

Regional Analysis

Asia Pacific Automotive Powertrain Market with Largest Market Share of 61.6% in 2024

The global automotive powertrain market is experiencing diverse growth across regions, with Asia Pacific leading the market with the largest share of 61.6% in 2024, valued at USD 543.1 billion. This dominance is attributed to the rapid industrialization, growing automotive manufacturing, and increasing demand for electric vehicles (EVs) in the region.

The growing economies of countries like China, India, and Japan, alongside strong government initiatives to promote electric mobility and reduce carbon emissions, contribute significantly to the market’s expansion in this region.

North America follows Asia Pacific as a significant player in the automotive powertrain market. The region is expected to continue growing due to increasing vehicle production, particularly in the U.S. and Canada, where automotive innovation and adoption of advanced powertrain technologies are on the rise. Moreover, the trend towards electric vehicles, coupled with government incentives for clean energy solutions, is anticipated to drive market growth in the region. North America holds a notable share of the market and is expected to see steady growth in the coming years.

Europe, with its focus on sustainability and stringent regulations concerning emissions, stands as another key player in the automotive powertrain market. The adoption of hybrid and electric vehicles is gaining momentum due to regulatory pressure, alongside advancements in powertrain technologies aimed at reducing carbon footprints.

The region’s market is also bolstered by the presence of major automotive manufacturers and a strong commitment to sustainable transportation solutions. Europe’s market share, while significant, remains lower than that of Asia Pacific and North America but is projected to maintain growth driven by government policies and environmental initiatives.

In the Middle East & Africa, the automotive powertrain market is still in its developmental stages, with growth primarily driven by increasing demand for vehicles and infrastructure development. However, the region’s market share is comparatively smaller, as vehicle production is not as high as in other regions. Despite this, there is growing interest in the development of electric and hybrid vehicles, which is likely to fuel market growth in the coming years.

Latin America, though an emerging market, is experiencing gradual expansion in the automotive powertrain sector. The region’s automotive market is driven by increasing disposable incomes and demand for personal vehicles. However, the market share in this region is modest compared to Asia Pacific and North America, with challenges such as political instability and economic fluctuations limiting more rapid growth.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- United Arab Emirates

Key Players Analysis

The global Automotive Powertrain Market in 2024 is characterized by intense competition among leading technology providers, with major players focusing on innovation, electrification, and strategic collaborations. NIDEC CORPORATION continues to expand its footprint in the electric powertrain segment, leveraging its expertise in motor technologies to deliver high-efficiency e-drive systems.

The company’s strategic investments in EV-focused facilities position it as a crucial player in the future of electric mobility. Similarly, Mitsubishi Electric Corporation maintains a strong presence through its advanced power electronics and control systems that support the shift toward energy-efficient drivetrains, particularly in hybrid and plug-in hybrid vehicles.

Continental AG remains at the forefront with its integrated powertrain solutions that combine software, electronics, and mechanical components, aligning with the global shift to cleaner propulsion technologies. ZF Friedrichshafen AG, another dominant player, is enhancing its e-mobility portfolio through continuous development of electric axle drives and hybrid modules, focusing on modular and scalable solutions to meet diverse OEM demands.

BorgWarner Inc. continues to strengthen its market share by offering comprehensive propulsion system solutions, including electric drive modules and power electronics, reflecting its commitment to carbon neutrality and electrified transport.

Magna International Inc. plays a pivotal role through its systems integration capabilities and strong partnerships with global automakers, especially in the development of electrified powertrains. VALEO, with its emphasis on innovation, is accelerating the adoption of 48V systems and thermal solutions essential for EV efficiency.

Schaeffler AG enhances its position with precision-engineered hybrid modules and transmission systems. Meanwhile, Marelli Holdings Co., Ltd. is expanding in the EV segment with inverters and e-motors, and Robert Bosch GmbH leads with comprehensive powertrain electrification offerings and intelligent control units, reinforcing its role as a market innovation leader.

Top Key Players in the Market

- NIDEC CORPORATION

- Mitsubishi Electric Corporation

- Continental AG

- ZF Friedrichshafen AG

- BorgWarner Inc.

- Magna International Inc.

- VALEO

- Schaeffler AG

- Marelli Holdings Co., Ltd.

- Robert Bosch GmbH

Recent Developments

- In January 9, 2024, Hyzon Motors Inc. (NASDAQ: HYZN), a leader in high-power hydrogen fuel cell technology, announced the achievement of significant operational and commercial milestones throughout 2023. These achievements mark a key moment in their journey towards advancing zero-emission heavy-duty fuel cell electric vehicles (FCEVs) and reinforcing their commitment to sustainability in the transport sector.

- On January 17, 2024, Eatron Technologies, known for its innovative AI-driven battery management software for the automotive sector, successfully secured funding in its Series A2 round. LG Technology Ventures led the investment, with additional backing from MMC Ventures, further strengthening Eatron’s position as a frontrunner in the development of cutting-edge automotive technologies.

- In 2024, Mazda Motor Corporation reaffirmed its commitment to advancing rotary engine (RE) technology. As part of its efforts to contribute to a carbon-neutral society, Mazda will expand its R&D activities into rotary engines designed for modern applications. This will include their adaptation for use in generators and further research into compliance with regulatory standards in major markets, marking a new chapter in the rotary engine’s legacy.

- In 2024, Honda Motorcycle & Scooter India (HMSI) introduced its first flex-fuel motorcycle at the Bharat Mobility Expo 2024. The motorcycle, powered by a 293.52cc single-cylinder engine, is capable of running on E85 fuel, comprising 85% ethanol and 15% gasoline. The launch of this new model marks a milestone in Honda’s push to offer sustainable fuel options in India, with the bike set to hit the market by late 2024.

- In 2024, Honda announced the upcoming release of a hybrid-electric version of the iconic Prelude sports coupe in the U.S. market. This vehicle, set for launch in late 2025, will feature the brand-new Honda S+ Shift, a drive mode designed to elevate driver engagement while retaining the Prelude’s legacy of performance and style.

Report Scope

Report Features Description Market Value (2024) USD 881.8 Billion Forecast Revenue (2034) USD 1,639.8 Billion CAGR (2025-2034) 6.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Propulsion Type(IC Engine, Gasoline, Diesel, Natural Gas Vehicle, Electric Vehicle, BEV, PHEV), By Vehicle Type(Passenger Vehicle, Commercial Vehicle) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape NIDEC CORPORATION, Mitsubishi Electric Corporation, Continental AG, ZF Friedrichshafen AG, BorgWarner Inc., Magna International Inc., VALEO, Schaeffler AG, Marelli Holdings Co., Ltd., Robert Bosch GmbH Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automotive Powertrain MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

Automotive Powertrain MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- NIDEC CORPORATION

- Mitsubishi Electric Corporation

- Continental AG

- ZF Friedrichshafen AG

- BorgWarner Inc.

- Magna International Inc.

- VALEO

- Schaeffler AG

- Marelli Holdings Co., Ltd.

- Robert Bosch GmbH