Global Automotive Plastic Fasteners Market Size, Share, Growth Analysis By Vehicle (Passenger cars, LCVs), By Application (Wire harnessing, Interior, Exterior, Electronics, Powertrain, Chassis, Others), By Function (Bonding, NVH), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 146502

- Number of Pages: 346

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

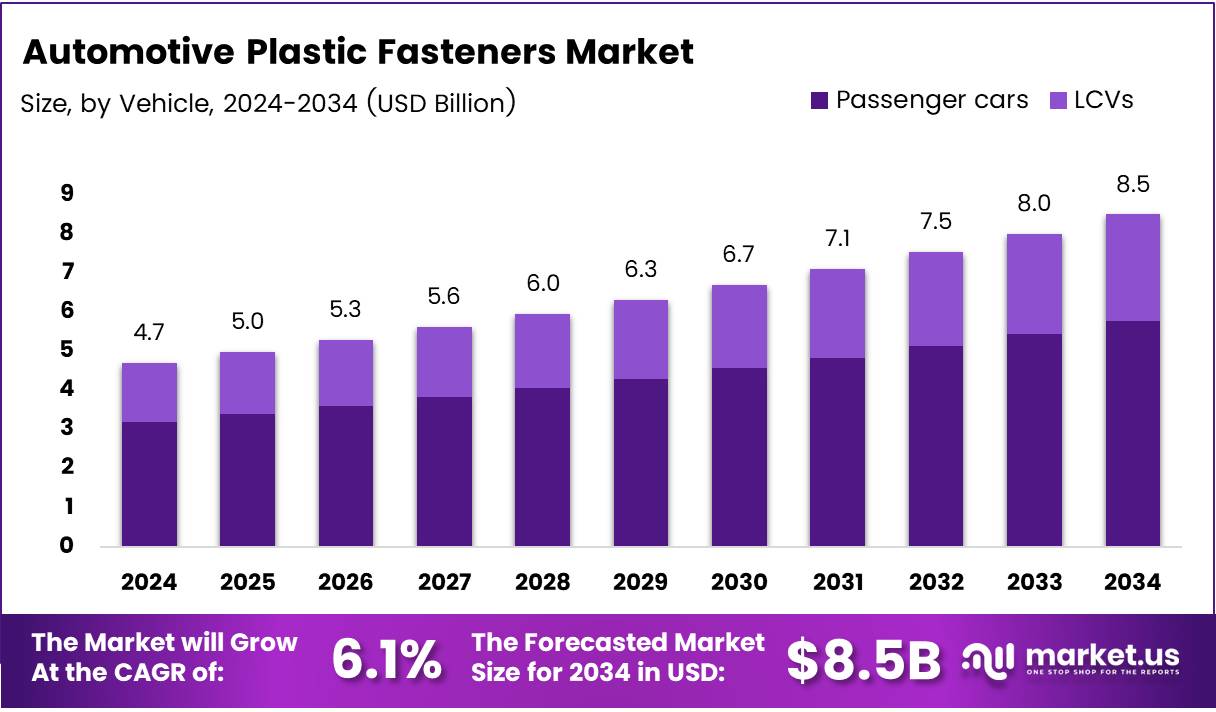

The Global Automotive Plastic Fasteners Market size is expected to be worth around USD 8.5 Billion by 2034, from USD 4.7 Billion in 2024, growing at a CAGR of 6.1% during the forecast period from 2025 to 2034.

The Automotive Plastic Fasteners Market encompasses the global production, distribution, and application of plastic-based fastening components used in vehicle assembly. These fasteners are increasingly preferred for interior trims, dashboards, bumpers, and under-hood components due to their superior resistance to corrosion, lightweight properties, and ease of installation.

The market is influenced by OEM demand for parts that support fuel efficiency, ease of assembly, and environmental compliance. The shift toward non-metallic components in automotive manufacturing has propelled the relevance of plastic fasteners, especially in applications where strength-to-weight ratio and design flexibility are key considerations.

Automotive plastic fasteners are becoming integral to modern vehicle architecture due to their functional benefits beyond just weight savings. They offer advantages in terms of faster cycle times during manufacturing, better compatibility with composite materials, and improved aesthetic finish in interiors.

The growing complexity of vehicle electronics and the need for wire routing and insulation also position plastic fasteners as essential. Manufacturers are now exploring bio-based and recyclable plastics to align with environmental goals, opening new avenues for sustainable innovation in fastening solutions.

The Automotive Plastic Fasteners Market is undergoing dynamic changes due to industry-wide electrification and modular platform designs. With the rise in demand for connected and autonomous vehicles, plastic fasteners are being designed to support sensors, wiring harnesses, and control modules.

According to Fastener-World, the automotive industry is the largest consumer of fasteners, accounting for 23.2% of global usage. The growing use of plastics in structural elements also fuels market demand. In electric vehicles, plastic fasteners reduce the risk of electrical conductivity, making them preferable over metal fasteners in high-voltage environments. This niche demand is expanding the market’s scope across electric and hybrid vehicle platforms.

The Automotive Plastic Fasteners Market is witnessing significant opportunity through increasing global vehicle production, particularly in Asia-Pacific and Latin America. Government-led localization policies and subsidies for electric vehicle manufacturing are encouraging new entrants and capacity expansion.

Regulatory frameworks such as Europe’s Euro 7 and U.S. CAFE standards are indirectly promoting plastic fasteners by mandating lower vehicle emissions, which correlate with reduced weight. As per Fastener-World, each vehicle uses 3,000 to 4,000 fasteners, contributing about 4.5% to total vehicle weight. With green mobility accelerating, investments are being channeled into R&D for durable, heat-resistant plastic fasteners that meet evolving performance and compliance standards.

Key Takeaways

- Global Automotive Plastic Fasteners Market Size is projected to reach USD 8.5 Billion by 2034, growing from USD 4.7 Billion in 2024 at a CAGR of 6.1% during 2025-2034.

- Passenger Cars dominated the market with a 51.2% share in 2024, driven by the focus on fuel efficiency and vehicle weight reduction.

- Wire Harnessing led the application segment, dominating with plastic fasteners for wire management in 2024 due to their insulation, durability, and vibration resistance.

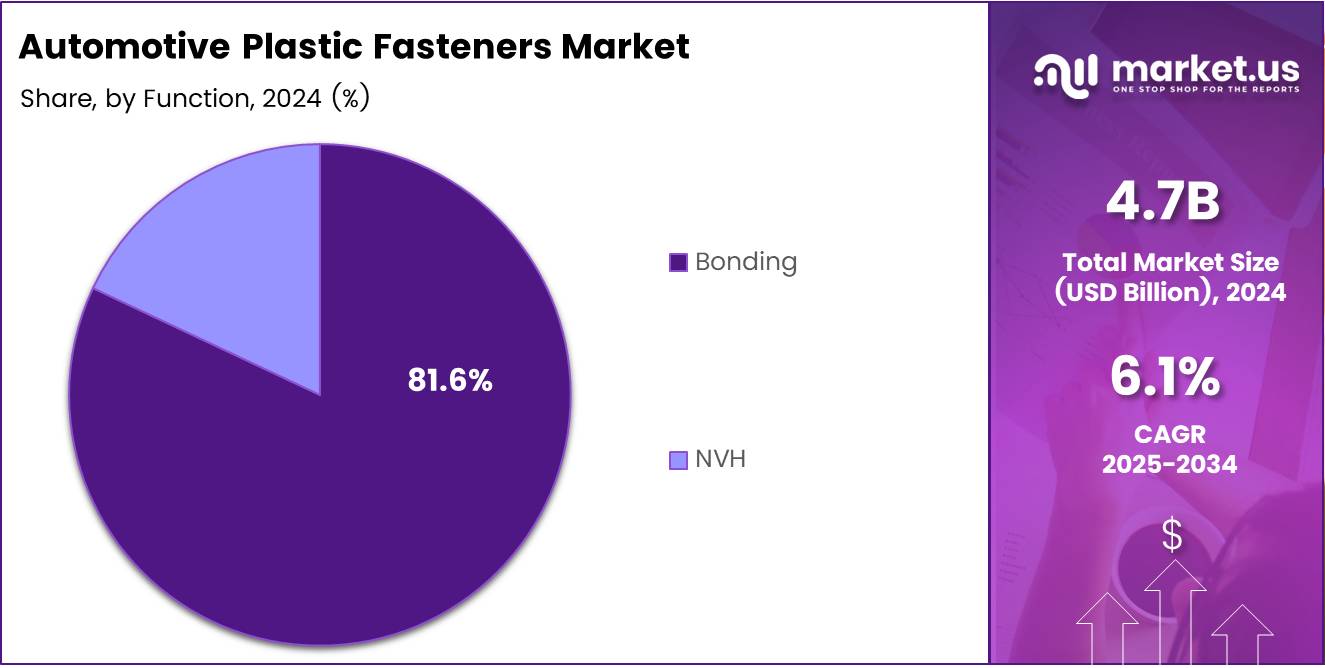

- Bonding Fasteners held the largest share of 81.6% in 2024, offering structural integrity, better design, and improved aerodynamics.

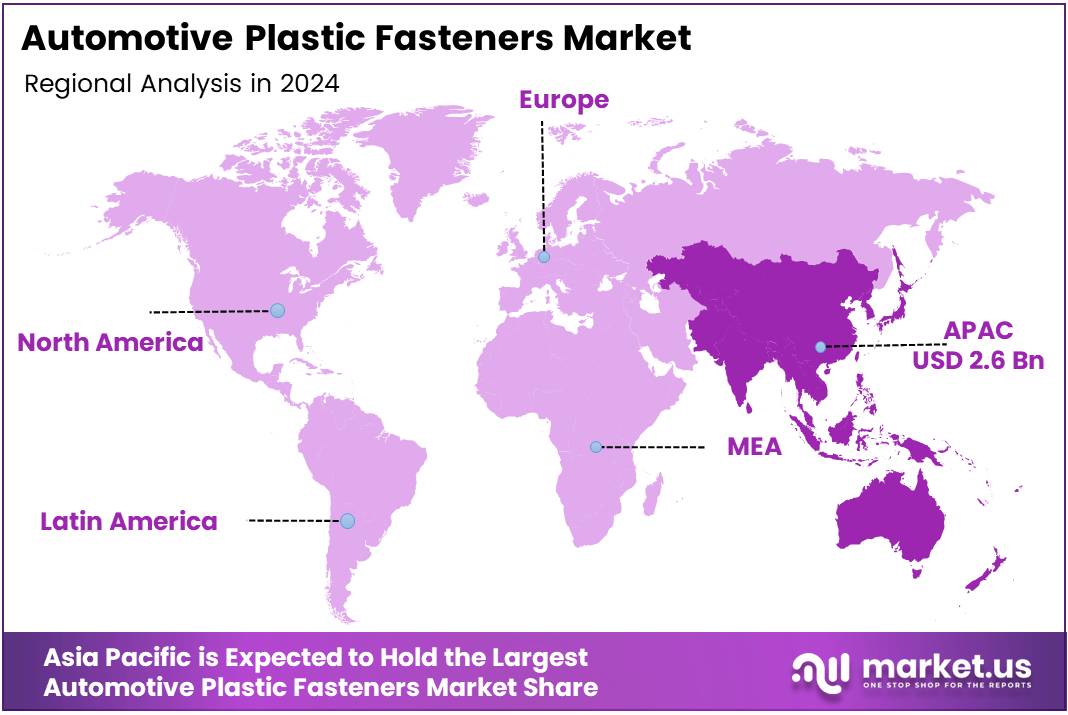

- Asia Pacific is the leading region, holding 55.1% of the market share, valued at USD 2.6 billion in 2024, fueled by automotive manufacturing in China, India, and Japan.

Vehicle Analysis

Passenger cars lead with 51.2% share driven by rising light weighting needs in mass production.

In 2024, Passenger cars held a dominant market position in By Vehicle Analysis segment of the Automotive Plastic Fasteners Market, with a 51.2% share. The growing emphasis on fuel efficiency and vehicle weight reduction in the passenger car category has significantly contributed to the increased adoption of plastic fasteners. These components offer a balance of durability and reduced weight, making them ideal for widespread usage in passenger vehicles.

Light commercial vehicles (LCVs) are also showing notable uptake of plastic fasteners owing to the rising demand for last-mile delivery and commercial logistics. The increasing focus on cost-efficiency, combined with the ease of assembly that plastic fasteners offer, has led to their growing integration in LCV designs. Moreover, as LCV manufacturers aim for modular vehicle architecture, plastic fasteners support the shift toward more flexible and serviceable assemblies.

Application Analysis

Wire harnessing stands out due to its widespread usage in automotive assemblies.

In 2024, Wire harnessing held a dominant market position in By Application Analysis segment of the Automotive Plastic Fasteners Market. Plastic fasteners are critical in managing wire bundles within vehicles, offering insulation, durability, and resistance to vibration, which are key for both safety and performance. The surge in electric vehicles has further fueled demand as these models require extensive and organized cabling solutions.

Interior applications have increasingly relied on plastic fasteners for dashboards, trims, and seating systems, due to their lightweight and aesthetic advantages. The material compatibility and ease of removal make them ideal for modular interior assemblies.

Exterior components also benefit from plastic fasteners that withstand varying environmental conditions, providing a corrosion-resistant alternative to metal. Similarly, electronics and powertrain segments utilize these fasteners to secure components and reduce wear caused by vibrations, ensuring reliability and longer life cycles.

Chassis and other auxiliary systems are adopting plastic fasteners gradually, with OEMs shifting towards standardization and weight reduction in vehicle frames and underbody systems.

Function Analysis

Bonding leads with 81.6% share due to superior structural efficiency.

In 2024, Bonding held a dominant market position in By Function Analysis segment of the Automotive Plastic Fasteners Market, with a 81.6% share. The dominance is driven by the need for long-lasting structural integrity in modern vehicles. Bonding fasteners ensure a more streamlined and integrated design approach, reducing the number of mechanical joints and promoting better aesthetics and aerodynamics.

NVH (Noise, Vibration, and Harshness) functionalities are also gaining momentum, especially in premium and electric vehicle segments. Plastic fasteners tailored for NVH help minimize cabin noise and enhance driving comfort, which is increasingly becoming a differentiator in consumer preferences. While currently a smaller segment, its relevance is growing with the industry’s shift towards silent, vibration-free electric drivetrains.

Key Market Segments

By Vehicle

- Passenger cars

- LCVs

By Application

- Wire harnessing

- Interior

- Exterior

- Electronics

- Powertrain

- Chassis

- Others

By Function

- Bonding

- NVH

Drivers

Lightweight Vehicles are Pushing the Demand for Plastic Fasteners

One of the main drivers of the automotive plastic fasteners market is the growing demand for lightweight vehicles. Automakers are under pressure to improve fuel efficiency and meet strict emission regulations. As a result, manufacturers are shifting from traditional metal parts to lighter alternatives—like plastic fasteners. These plastic components help reduce the overall weight of a vehicle without compromising on basic performance, especially in non-load-bearing areas.

Additionally, the global rise in automobile production, especially in Asia-Pacific and North America, is creating a steady demand for plastic fasteners as essential parts in vehicle assembly. Another major boost comes from the electric vehicle (EV) sector.

EVs require lightweight materials to enhance battery life and energy efficiency, making plastic fasteners an ideal fit. Since EVs are rapidly gaining traction worldwide, especially in Europe and China, this trend is likely to further drive market growth. The combination of weight-saving, cost-effectiveness, and increasing global vehicle output is strengthening the position of plastic fasteners in automotive applications.

Restraints

High Raw Material Prices are Slowing Market Growth

Despite the growing demand, the automotive plastic fasteners market faces some roadblocks. One of the key restraints is the high cost and price fluctuation of raw materials such as engineered plastics and polymers. These materials are derived from petroleum-based sources, which means their prices are tied to volatile oil markets. This can significantly increase manufacturing costs, especially for smaller companies. Another concern is performance.

While plastic fasteners are great for reducing weight, they may not match the durability and strength of metal fasteners—particularly in high-stress or heat-intensive applications like engines or undercarriage systems. This limits their use in certain critical vehicle components.

As automakers prioritize both safety and reliability, the restricted use of plastic fasteners in specific areas may slow down broader adoption. Therefore, the industry must find a balance between performance, cost-efficiency, and material innovation to overcome these limitations.

Growth Factors

Growth in Emerging Markets and Green Materials Open New Doors

The automotive plastic fasteners market is poised for significant growth, especially in emerging economies. Countries like India, China, Brazil, and Mexico are seeing rapid growth in vehicle production, which translates into higher demand for automotive components like plastic fasteners. Local manufacturing initiatives and increasing investments in automotive infrastructure are further supporting this trend.

Another major opportunity lies in innovation—particularly in sustainable materials. With growing awareness of environmental concerns, there’s a rising interest in biodegradable or recyclable plastic fasteners. These eco-friendly options not only reduce environmental impact but also help manufacturers comply with global sustainability regulations.

Additionally, the integration of advanced manufacturing technologies like 3D printing is opening up new design possibilities. These methods allow for the quick and cost-effective production of customized fasteners, increasing their appeal among automakers. All these factors combined create a promising outlook for players looking to expand their footprint in this market.

Emerging Trends

3D Printing and Green Materials are Changing the Game

A number of exciting trends are shaping the future of the automotive plastic fasteners market. One of the most prominent is the increasing use of 3D printing in vehicle manufacturing. This technology enables the rapid production of customized, lightweight plastic fasteners tailored to specific design requirements, offering automakers more flexibility in both form and function. In addition, there’s a clear shift toward sustainability.

Car manufacturers are now more focused on using recyclable and biodegradable materials in their production lines. This eco-conscious shift is driving demand for plastic fasteners made from sustainable polymers, which help reduce the vehicle’s carbon footprint.

Aesthetic appeal is also becoming a key factor. Consumers today value the look and feel of vehicle interiors more than ever before. This has prompted automakers to use designer plastic fasteners that not only serve functional purposes but also enhance visual appeal. These fasteners can be color-matched, textured, or even hidden, contributing to a cleaner, more refined finish. Together, these trends are not just influencing current market dynamics—they’re paving the way for future innovation.

Regional Analysis

Asia Pacific Leads Automotive Plastic Fasteners Market with 55.1% Share, Valued at USD 2.6 Billion

Asia Pacific stands as the dominating region in the automotive plastic fasteners market, holding a substantial 55.1% share and valued at USD 2.6 billion. This dominance is driven by significant automotive manufacturing growth in countries like China, India, and Japan. The region’s advantages include lower production costs, an expanding middle class, and increasing vehicle ownership, which collectively spur demand for automotive plastic fasteners.

Regional Mentions:

In North America, the market’s growth is fueled by stringent regulatory standards that promote the use of lightweight materials to enhance fuel efficiency and reduce emissions. The presence of a sophisticated automotive industry with advanced manufacturing capabilities also supports the market.

Europe’s market is similarly influenced by environmental regulations, which encourage the adoption of eco-friendly and lightweight materials. The rise in electric vehicle production, particularly in Germany, France, and the UK, drives demand for plastic fasteners that are non-conductive and corrosion-resistant.

Middle East & Africa and Latin America are developing at a steadier pace, bolstered by the growing automotive sectors within these regions. Urbanization and economic growth, especially in countries like Brazil and South Africa, support a gradual transition towards improved standards in vehicle production and assembly.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2024, key players in the global Automotive Plastic Fasteners Market are poised to drive significant growth through innovations in material science, manufacturing processes, and strategic partnerships.

PennEngineering, with its strong global footprint and advanced fastening solutions, remains a leader in offering highly specialized fasteners tailored for automotive applications. Their focus on innovation and quality positions them as a key player in meeting the growing demand for lightweight and durable components in the automotive sector.

Avery Dennison is making substantial strides in the market by combining its expertise in adhesives and fasteners to develop solutions that enhance vehicle assembly processes. Their sustainable product offerings are increasingly gaining traction in response to the automotive industry’s shift toward eco-friendly materials and processes.

MW Industries is well-positioned as a major supplier of precision fasteners. Their products are vital for automotive OEMs and tier suppliers who demand high-performance solutions for critical components. Their strong commitment to R&D and customization of fasteners for specific automotive needs ensures that they remain an integral part of the market’s supply chain.

Nifco Inc., a leader in the production of plastic fasteners, is tapping into the expanding automotive sector by emphasizing the benefits of cost-effective and lightweight solutions. Their growth in emerging markets highlights the shift towards plastic over traditional metal fasteners in an effort to reduce vehicle weight and improve fuel efficiency.

DuPont and SABIC are significant players providing high-performance polymers that are increasingly being utilized in automotive plastic fasteners. These materials offer enhanced durability, temperature resistance, and chemical resistance, making them ideal for the rigorous demands of the automotive industry.

Top Key Players in the Market

- PennEngineering

- Avery Dennison

- MW Industries

- Nifco Inc.

- DuPont

- SABIC

- Panduit

- ITW

- Bossard Group

- Essentra Components

- Stanley Black & Decker

- BAND-IT

Recent Developments

- In March 2025, Italy’s Fontana is set to acquire a majority stake in auto parts maker Right Tight Fasteners, strengthening its presence in the automotive sector and enhancing its supply chain capabilities for global markets. This strategic acquisition is expected to drive innovation and expansion within Fontana’s manufacturing operations.

- In May 2024, the U.S. Department of Energy announced a $100 million investment aimed at retooling automotive manufacturing to produce electric vehicle (EV) parts, boosting the transition to cleaner technologies. This funding initiative will support automakers in adapting their facilities for EV production, enhancing sustainability and efficiency in the industry.

- In May 2025, Kuwaiti startup Motery Application secured $8 million in seed funding, marking a significant milestone in its effort to transform automotive financing in Kuwait. The company plans to leverage this investment to develop innovative solutions that make car financing more accessible and user-friendly for local consumers.

Report Scope

Report Features Description Market Value (2024) USD 4.7 Billion Forecast Revenue (2034) USD 8.5 Billion CAGR (2025-2034) 6.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Vehicle (Passenger cars, LCVs), By Application (Wire harnessing, Interior, Exterior, Electronics, Powertrain, Chassis, Others), By Function (Bonding, NVH) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape PennEngineering, Avery Dennison, MW Industries, Nifco Inc., DuPont, SABIC, Panduit, ITW, Bossard Group, Essentra Components, Stanley Black & Decker, BAND-IT Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automotive Plastic Fasteners MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

Automotive Plastic Fasteners MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- PennEngineering

- Avery Dennison

- MW Industries

- Nifco Inc.

- DuPont

- SABIC

- Panduit

- ITW

- Bossard Group

- Essentra Components

- Stanley Black & Decker

- BAND-IT